- The Deal Brief - Insurance

- Posts

- $38.7B Oil Risk, AI Crackdowns, and PE’s Next Insurance Play

$38.7B Oil Risk, AI Crackdowns, and PE’s Next Insurance Play

This week we’re tracking where insurance risk, regulation, and capital are converging—from the $38.7B oil insurance market growing at a 5.6% CAGR, to regulators tightening scrutiny on AI-led underwriting, and brokers scaling into high-margin deal insurance as PE demand rebounds.

Good morning, ! This week we’re tracking where insurance risk, regulation, and capital are converging—from the $38.7B oil insurance market growing at a 5.6% CAGR, to regulators tightening scrutiny on AI-led underwriting, and brokers scaling into high-margin deal insurance as PE demand rebounds.

Sponsor spotlight: Affinity helps deal teams capture relationship signals automatically and map firm-wide connections—so you can source and move faster. Book a demo →

DATA DIVE

Insuring the Uninsurable: Venezuela’s Oil Sector Meets Political Risk Coverage

The arrest of Nicolás Maduro has cracked open a door that’s been bolted shut for two decades: foreign reinvestment in Venezuela’s oil infrastructure, home to the world’s largest proven reserves. But don't mistake this for an oil story—it’s an insurance one.

To rebuild, Venezuela needs tens of billions in long-duration foreign capital, but no investor will touch the country without credible guardrails against expropriation, contract repudiation, and capital controls. That’s where Political Risk Insurance (PRI) steps in—not as a bolt-on product, but as a capital enabler. PRI has become central to any credible underwriting stack for frontier energy plays.

The global oil insurance market, already on a growth path from $23.7B in 2024 to $38.7B by 2033 (5.6% CAGR), is pricing in not just physical asset risks but sovereign ones. Venezuela, with its obsolete refineries and corroded pipelines, sits at the riskiest end of the spectrum. But as the report notes, "once insurers withdraw, capital markets follow"—and the reverse may now be true.

Bottom line: For energy underwriters and PE firms with appetite for risk, PRI is no longer optional—it’s the ticket to participate in one of the last great oil arbitrages left on the planet. (More)

TREND OF THE WEEK

AI in Insurance: From Pilots to Playbooks

2026 may be remembered as the year AI in insurance stopped being a headline and started being a handbook. According to Xceedance, insurers are decisively shifting from AI experimentation to operationalization—with real-time data, human-AI collaboration, and embedded governance shaping the next wave of underwriting and customer interaction.

Core themes: streaming risk data from IoT and telematics, AI agents trained by humans (not the other way around), explainability as a compliance requirement, and “DIY policyholders” who generate and share their own risk data.

Why this matters: the winners won't just be tech adopters, but integrators—combining judgment and machine learning to create more dynamic, participatory models of insurance. Pricing is becoming behavioral. Underwriting is becoming real-time. And compliance is moving upstream into design.

The result? Insurance is shifting from a one-time decision to a continuous process. Risk is no longer just evaluated—it’s interpreted, monitored, and refined in real time. (More)

PRESENTED BY AFFINITY

Affinity is the CRM built for private equity teams. Emails and calendar activity are captured automatically, with firm-wide relationships mapped to target companies and intermediaries so deal teams can see existing connections without manual data entry.

A firm's network is its edge. Relationship intelligence turns that network into action with purpose-built AI that maps firm-wide connections to accelerate deal sourcing, strengthen diligence, and deepen portfolio oversight.

By centralizing relationship context across the deal lifecycle, firms can act earlier, stay aligned, and avoid paying fees for connections they already have.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

When Roles Only Exist on Paper (Value Creation)

What breaks teams before it shows up on a dashboard? According to Shiv Narayanan, Founder of leading PE growth consultancy, How To SaaS, dysfunction rarely starts with a blowup, it creeps in through misaligned incentives, ghost roles, and busyness masquerading as strategy.

In this week's featured episode, Narayanan outlines familiar yet dangerous failure modes:

Marketing and sales running parallel instead of together, “leaders” without true ownership, and teams producing at full tilt without knowing why. The diagnosis is blunt: these aren’t tool problems, they’re structural ones. And AI? It just accelerates the direction you’re already going.

The conversation is worth a listen for anyone scaling a firm, running GTM at a portco, or trying to make cross-functional teams actually function. One key quote stuck with us: “Tools don’t fix lack of clarity. They make confusion scale.”

MICROSURVEY

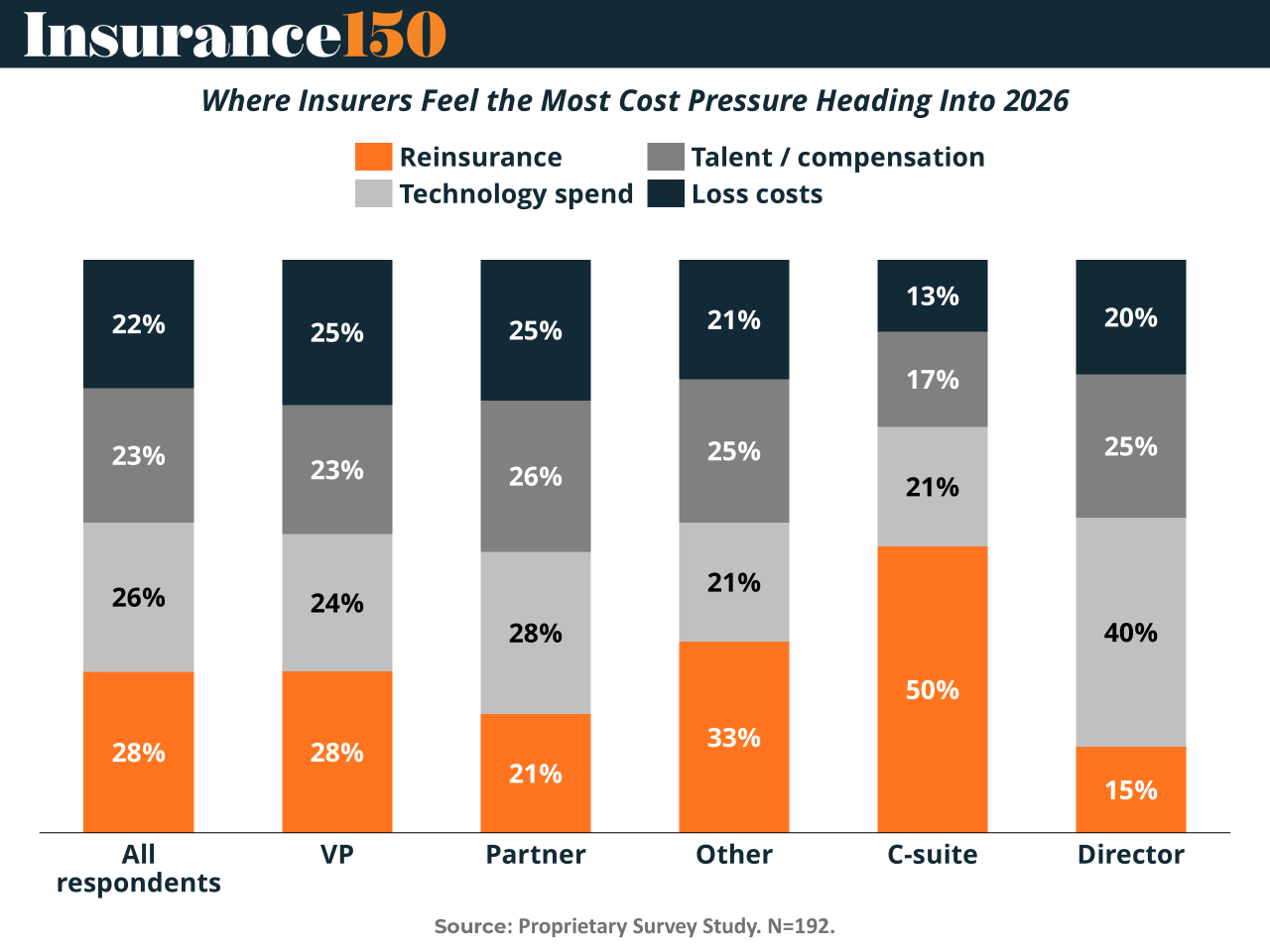

Cost Pressures Are Splintering Across Insurance Leadership

As insurers rebalance expense ratios heading into 2026, cost pressure is no longer uniform across the organization. Results from our latest Insurance 150 proprietary microsurvey (N=192) show reinsurance (28%) as the top concern overall—but priorities diverge sharply by seniority.

At the C-suite level, 50% of executives cite reinsurance as their biggest cost pressure, reflecting heightened focus on capacity, pricing volatility, and capital efficiency. Directors, by contrast, point to technology spend (40%) as the primary constraint, signaling growing scrutiny around core systems, AI investments, and vendor ROI.

Meanwhile, VPs and Partners report a more balanced mix across loss costs, talent, and technology, underscoring the operational challenge of controlling costs while still funding growth.

Bottom line: managing 2026 margins will require alignment across leadership—because cost pressure depends on where you sit. (More)

DEAL OF THE WEEK

Howden Builds a US Transactional Powerhouse

UK-based Howden is making a decisive move in the US market with its acquisition of Atlantic Global Risk, a top-five transaction liability broker in North America. The deal, expected to close in Q1 2026, strengthens Howden’s transactional liability bench with 110+ specialists and expands its footprint into a PE-heavy US market hungry for risk-transfer solutions.

Atlantic operates across R&W, tax, contingent, and credit risk lines, with a stronghold in private equity-backed deals. Howden, already dominant outside the US in this space, gains not just talent and clients—but a strategic foothold in the world’s largest M&A insurance market.

Why it matters: As deal insurance becomes table stakes in complex transactions, this acquisition signals a continued shift toward global specialization. It’s a clear bet on the resilience of PE activity and the rising demand for tailored coverage in the upper-middle and large-cap deal tiers. The founders' reinvestment and integration into Howden’s leadership also underscore long-term strategic alignment. This isn't just a scale play—it's a blueprint for broking consolidation in high-margin verticals. (More)

INSURTECH CORNER

GenAI: Fast Starts, Slow Trust

GenAI adoption in insurance is picking up—but with the parking brake still on. While insurers have long used traditional AI, supervisors see GenAI largely confined to limited deployments, not yet scaled across markets. The reason is simple: broader use cases come with broader risk exposure, from hallucinations and bias to governance complexity.

The most active use cases today cluster where stakes are manageable and efficiency gains are visible: claims handling, external chatbots, fraud detection, process optimisation, complaints handling, and information retrieval. These are areas where cost reduction and analytical benefits show up quickly.

By contrast, adoption remains lighter in pricing, underwriting, compliance, and especially capital planning, ALM, and risk management—functions where errors are expensive and regulatory tolerance is thin.

Bottom line: insurers are experimenting aggressively but scaling cautiously. GenAI is moving fast—but only where controls, oversight, and consumer risk can keep up. (More)

MACROECONOMICS

From Dictators to Discounted Barrels

Private equity just got a geopolitical gift. The capture of Nicolás Maduro and potential reboot of Venezuela’s oil sector marks a generational re-entry point for U.S. capital. Despite holding the world’s largest proven oil reserves, Venezuela currently produces less than 1.3% of global supply—a massive delta driven not by geology but by decades of state mismanagement. With oil majors sidelined (thanks to PTSD from past nationalizations), PE sponsors can be uniquely positioned to underwrite the long game: from pipeline triage to refinery rebuilds, and even LNG integration, by providing long term cash via equity investments or private lines of credit.

Forget quick trades—this is a 15-year CAPEX thesis with regime risk built in. And while oil prices barely budged post-capture, that’s the tell: the market’s not pricing the upside yet. PE should be. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Do not be embarrassed by your failures, learn from them and start again."

Richard Branson