- Insurance 150

- Posts

- AI in Insurance

AI in Insurance

The rise, trends and impact of Artificial Intelligence in the Insurance Industry.

Introduction

Artificial Intelligence (AI) is no longer on the periphery of the insurance industry — it is at the core of its transformation. Over the past few years, AI has moved from experimental pilot projects to real-world deployments across the insurance value chain. Insurers are increasingly relying on machine learning, computer vision, and large language models to streamline operations, reduce fraud, accelerate underwriting, and personalize customer interactions.

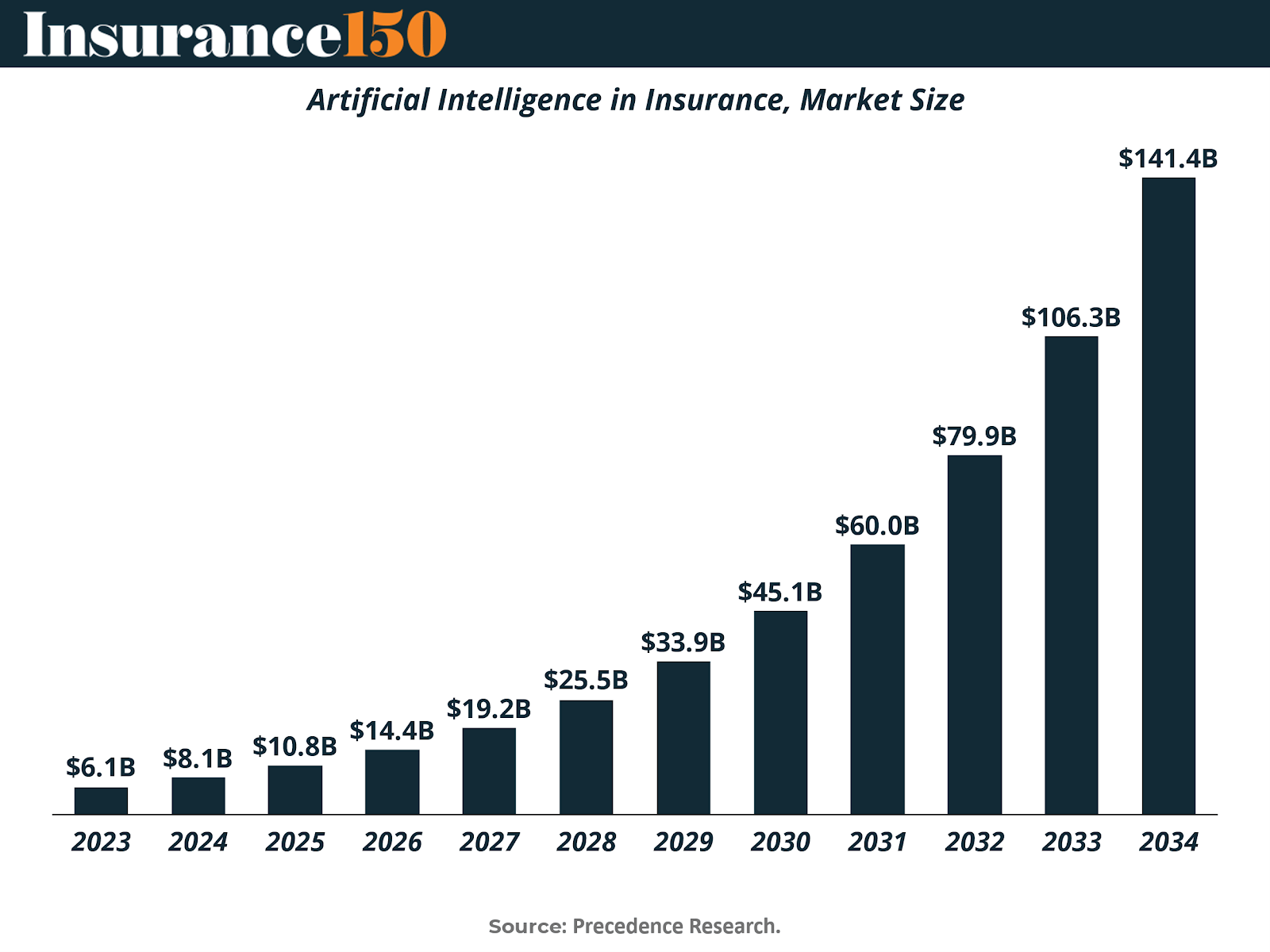

The economic rationale is clear: AI delivers cost savings, boosts speed and unlocks new revenue streams. But what is more telling is the scale of investment and adoption. According to Precedence Research, the AI in insurance market was valued at $6.11 billion in 2023 and is forecast to reach $141.44 billion by 2034 — representing a compound annual growth rate (CAGR) of over 30%.

This explosive growth is being fueled by a convergence of powerful forces:

Rising operating costs and thin margins are forcing insurers to automate wherever possible — from document processing to fraud flagging.

Customer expectations are changing rapidly. Policyholders now demand instant decisions, personalized offers, and seamless digital service — all of which AI enables at scale.

Data availability has expanded exponentially, with insurers now able to tap into behavioral data, satellite imagery, connected devices, and even voice inputs — allowing for more accurate and dynamic risk assessments.

Regulatory environments are also evolving. While concerns about algorithmic bias and transparency persist, regulators are increasingly offering guidance rather than outright restrictions, encouraging responsible AI use rather than stifling innovation.

Competitive dynamics are shifting, with tech-savvy insurtechs setting new standards for agility and customer-centricity, forcing traditional insurers to adopt AI or risk irrelevance.

AI is no longer just a tool — it is a strategic asset. For carriers, reinsurers, and brokers alike, the next decade will be defined by how effectively they integrate AI into the heart of their business models. Whether it is underwriting a policy in seconds, flagging fraudulent claims in real time, or deploying conversational bots to reduce call center loads, AI is rapidly becoming the default mode of operation in modern insurance.

The age of reactive insurance is fading. What is emerging is a new paradigm — one where insurers can predict, prevent, and personalize risk at unprecedented scale and speed.

Global AI Adoption in Insurance: Regional Breakdown

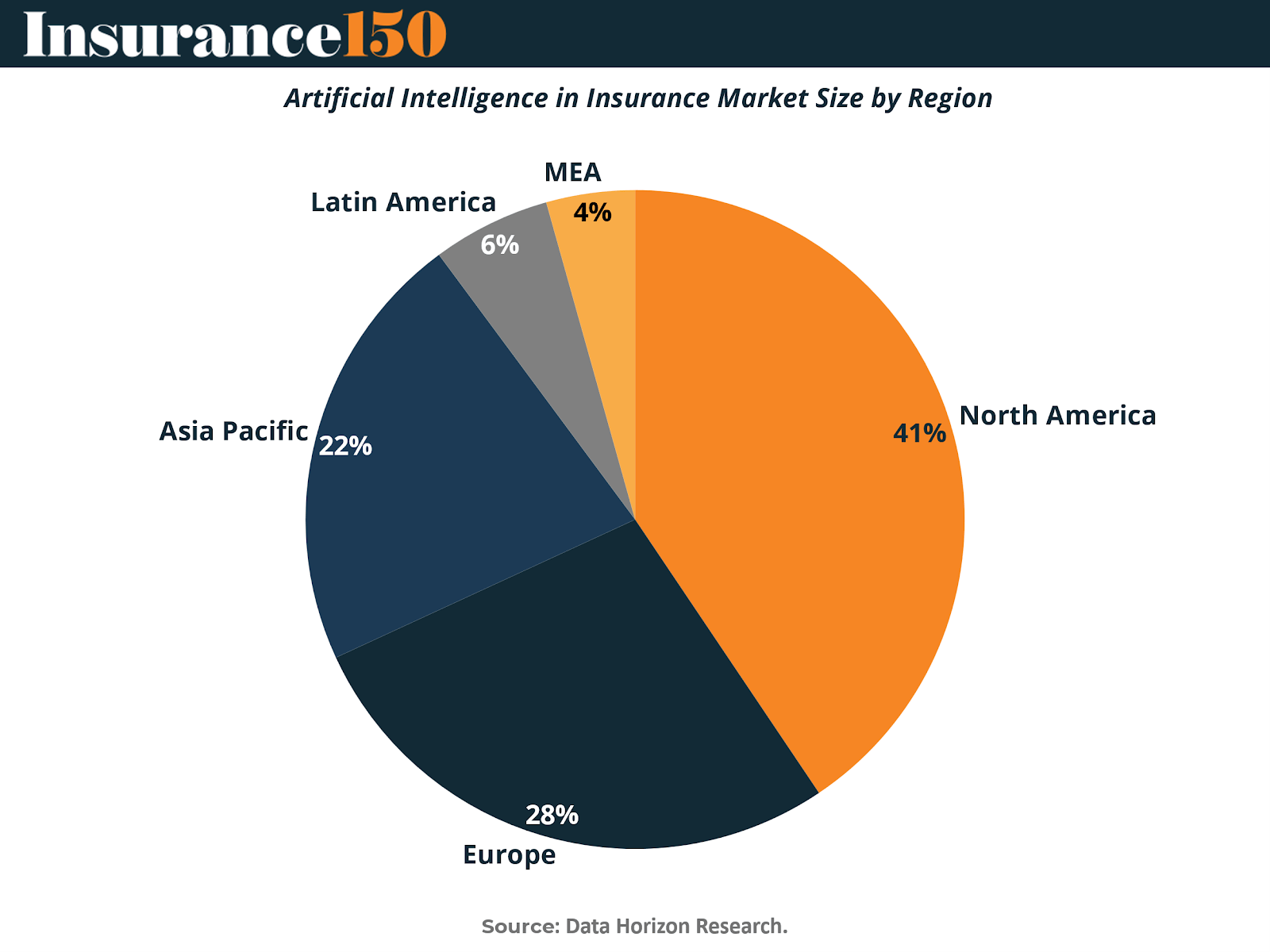

As artificial intelligence transforms the insurance industry, North America leads the global market, accounting for 41% of total AI-driven insurance spending. This dominance is fueled by early adoption of advanced analytics, machine learning in underwriting, and automated claims processing across U.S. and Canadian insurers.

Europe follows with 28%, where regulatory alignment and growing insurtech ecosystems are accelerating AI integration, particularly in the U.K., Germany, and the Nordics.

Asia Pacific holds a 22% share, driven by fast-growing digital insurance platforms in countries like China, Japan, and India. The region is quickly closing the gap with innovations in customer engagement and fraud detection.

Latin America and MEA (Middle East & Africa) trail with 6% and 4%, respectively. While these markets are still in early stages, there is rising interest in AI-powered distribution models and mobile-first insurance offerings that could unlock future growth.

As insurers worldwide invest in intelligent automation, predictive modeling, and generative AI, regional disparities are narrowing—but North America remains the innovation hub, for now.

Adoption Trends: AI Moves from Consideration to Core Capability

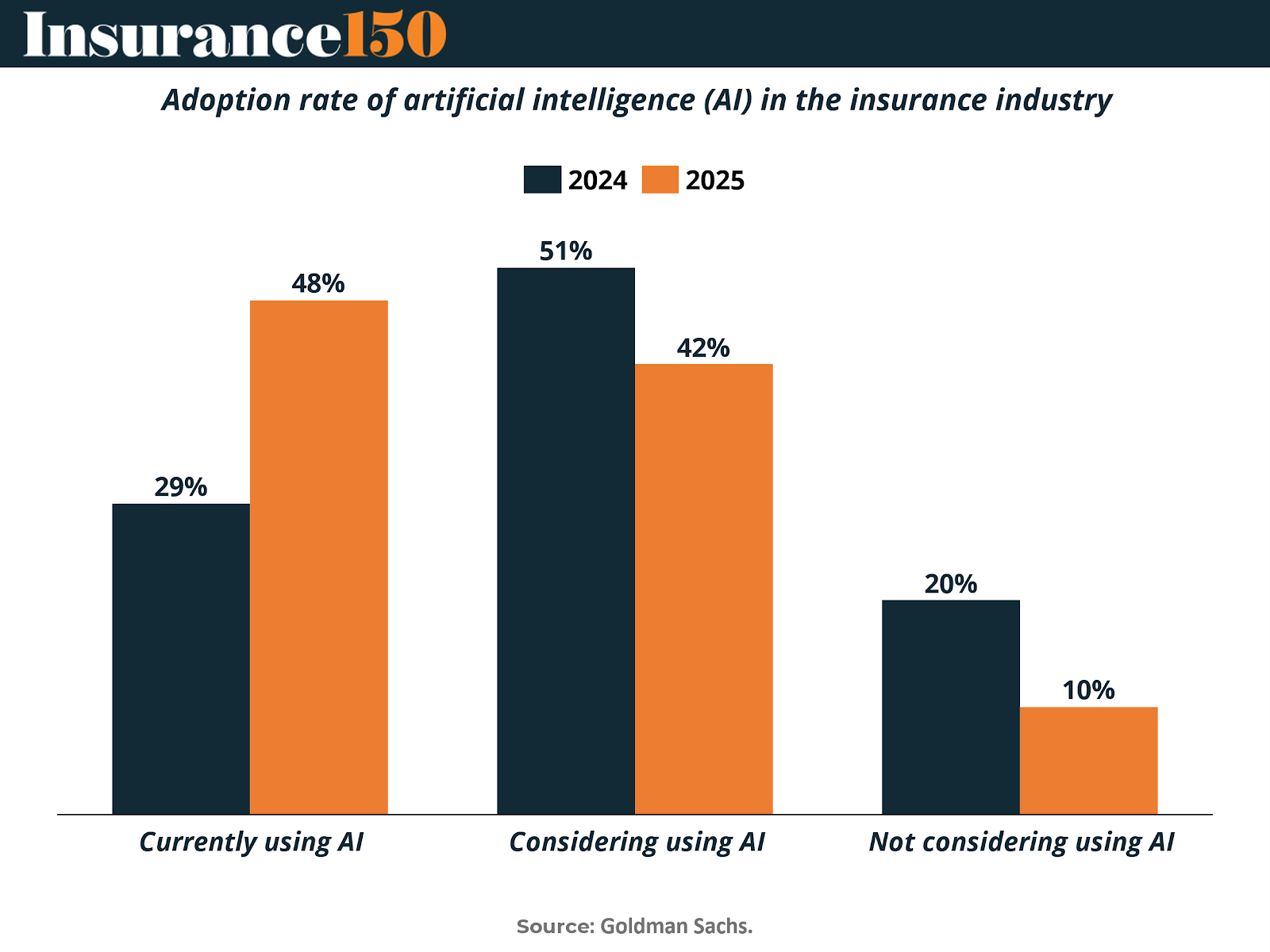

AI is transitioning from a strategic consideration to a day-to-day operational tool for insurers. According to Goldman Sachs' 2025 Global Insurance Survey, the share of insurance organizations actively using AI is projected to surge from 29% in 2024 to 48% in 2025 — marking a 65% year-over-year increase. This sharp rise underscores the urgency with which insurers are embedding AI across underwriting, claims, and customer service workflows.

Meanwhile, the percentage of firms still considering AI implementation is expected to decline from 51% to 42%, indicating that deliberation is giving way to execution. Perhaps most notably, the share of insurers not considering AI at all will be halved — dropping from 20% in 2024 to just 10% by 2025.

These adoption shifts signal several key dynamics:

AI is no longer viewed as experimental or optional. It is becoming foundational to how insurers remain competitive and responsive.

Decision timelines are compressing. Firms that spent recent years in exploration mode are now deploying full-scale implementations.

The laggards are being left behind. With only 1 in 10 insurers planning to stay AI-free in 2025, the cost of inaction is rising — in both efficiency and customer experience.

From a strategic standpoint, this acceleration reflects a broader transformation: AI is becoming table stakes. It is not just about early adopters gaining an edge — it is about survival in a sector where speed, accuracy, and personalization are rapidly becoming non-negotiable.

For insurance leaders, the message is clear: the window for AI experimentation is closing. The focus now must shift to execution, integration, and governance — ensuring that AI systems are not just in place but are adding measurable value across business lines.

Strategic Priorities: Where Insurers Are Applying AI Today

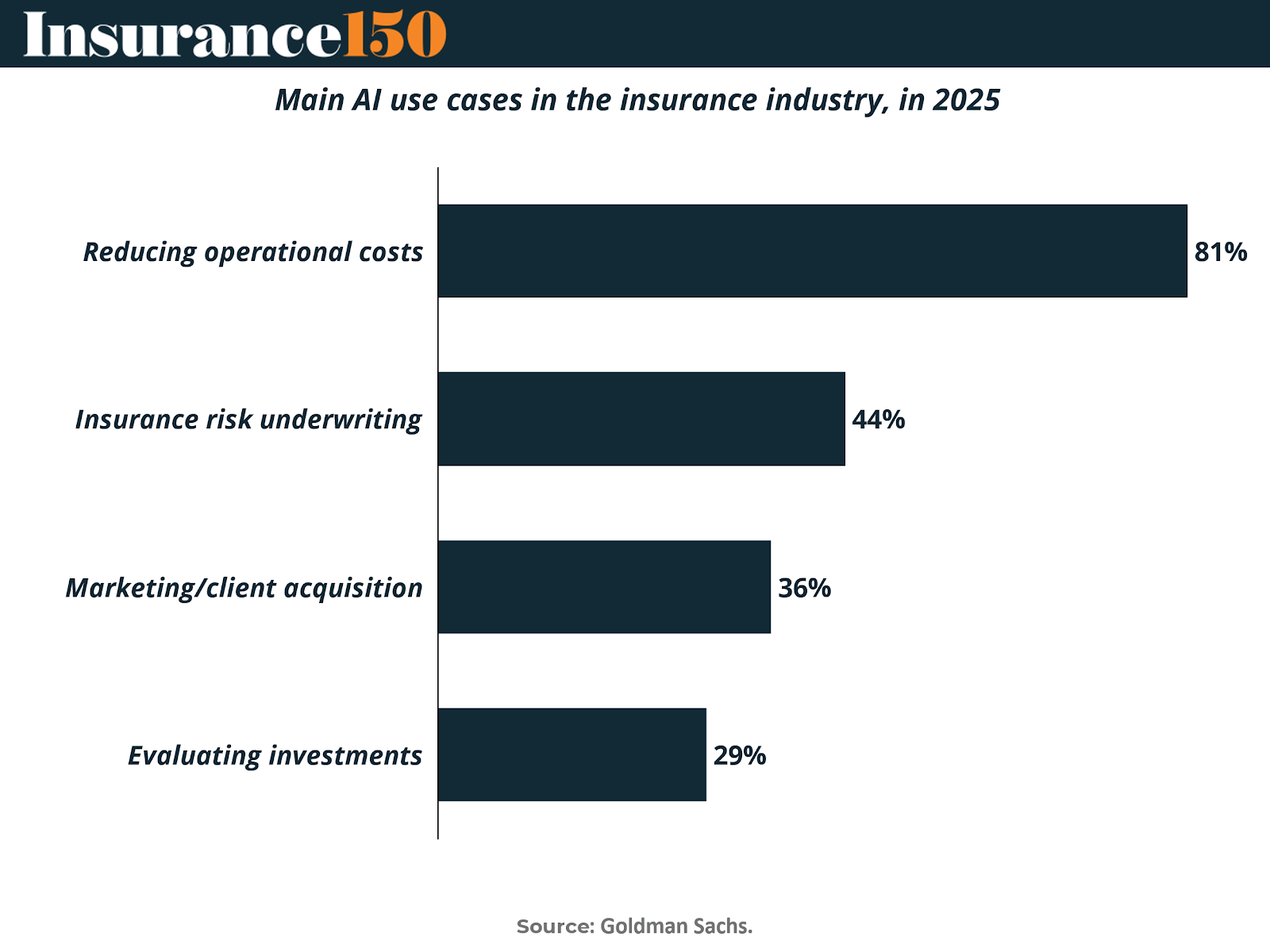

As artificial intelligence adoption accelerates across the insurance industry, the focus is quickly shifting from if insurers should adopt AI to where it can deliver the greatest impact. New survey data shows that the most immediate applications of AI are driven by economic efficiency, core operational needs, and the evolving expectations of policyholders.

According to recent global data, 81% of insurers currently using or considering AI are deploying it to reduce operational costs — by far the most common application. From automating claims processing to managing high volumes of documentation through natural language processing (NLP), AI is now being viewed as a critical tool for boosting productivity and driving down expenses across the board.

Beyond cost containment, 44% of insurers are applying AI to risk underwriting, an area where machine learning models are enabling deeper, more dynamic risk assessments. This marks a 5-percentage-point increase from 2024, highlighting AI’s growing role in enhancing pricing accuracy and expanding underwriting capabilities through alternative data sources (e.g., telematics, wearable devices, satellite imagery).

Other prominent areas of application include:

Marketing and client acquisition (36%): AI is powering advanced segmentation models, personalized messaging, and predictive targeting to improve conversion and retention.

Evaluating investments (29%): Particularly relevant for insurers with large asset management divisions, AI is being used to assess credit risk, model asset behavior, and inform strategic allocation.

These use cases reflect a broader trend: AI is not just a technology upgrade — it is a fundamental enabler of strategic agility. Insurers are using it to compress decision-making cycles, personalize customer interactions, and expand into adjacent areas like wealth and wellness. As use cases multiply, organizations that can tightly align AI capabilities with business objectives will gain a meaningful edge.

Looking ahead, operational efficiency may remain the primary driver in the short term — but the next wave of differentiation will likely come from how well firms use AI to underwrite smarter, sell better, and invest more strategically.

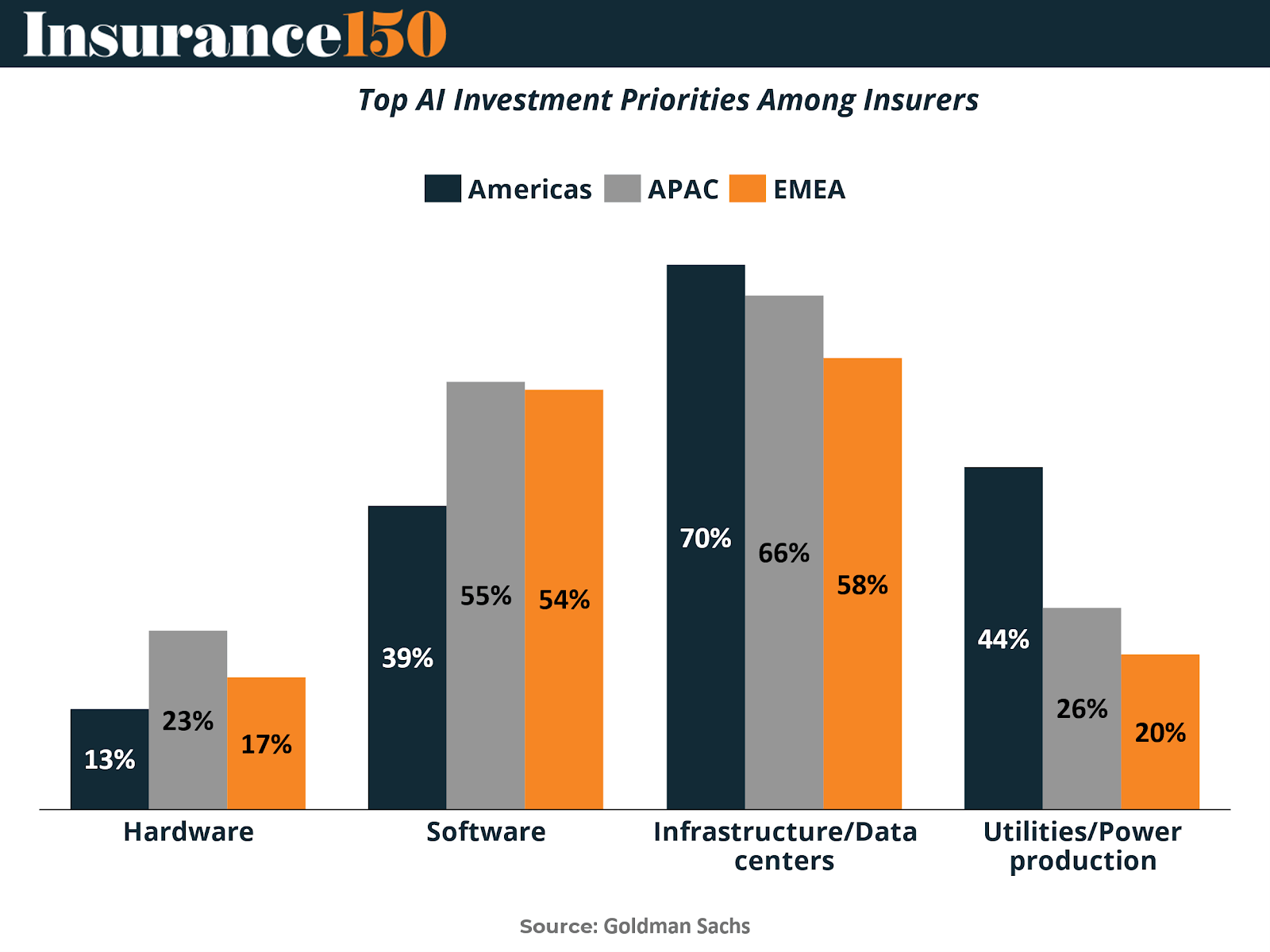

AI Investment Priorities: Infrastructure First, But Software Close Behind

As insurers deepen their commitment to AI, investment strategies are becoming more structured and sector specific. The majority of firms are prioritizing infrastructure and data centers, with 70% of insurers in the Americas, 66% in APAC, and 58% in EMEA citing this as the most promising area for returns. This signals a clear recognition that scalable, secure, and high-performance computing environments are essential to support next-generation AI workloads — particularly in underwriting, fraud detection, and customer service.

Software comes in as a close second, especially in APAC (55%) and EMEA (54%), where firms are increasingly turning to specialized applications for pricing models, claims automation, and conversational AI interfaces. In contrast, investment in hardware remains relatively modest across all regions — a sign that many insurers are favoring cloud-based solutions over large capital outlays in physical infrastructure.

Interestingly, 44% of insurers in the Americas also see meaningful returns in utilities and power production, reflecting growing awareness of AI’s energy demands and the importance of energy-efficient infrastructure.

As Marco Argenti, Chief Information Officer at Goldman Sachs, puts it:

"Artificial Intelligence has rapidly become a transformative force, creating new opportunities for investors across various industries... Generative AI is anticipated to drive innovative solutions for both new and existing businesses, enhancing efficiency and fostering growth."

For insurance stakeholders, this emerging investment landscape underscores a key shift: AI is no longer a siloed initiative. It is an enterprise-wide priority, backed by infrastructure spending and increasingly tied to broader investment theses. Whether through infrastructure, software, or energy resilience, insurers are positioning themselves for long-term AI readiness — not just operational efficiency, but future-proofed innovation.

Challenges and Risks in AI Adoption

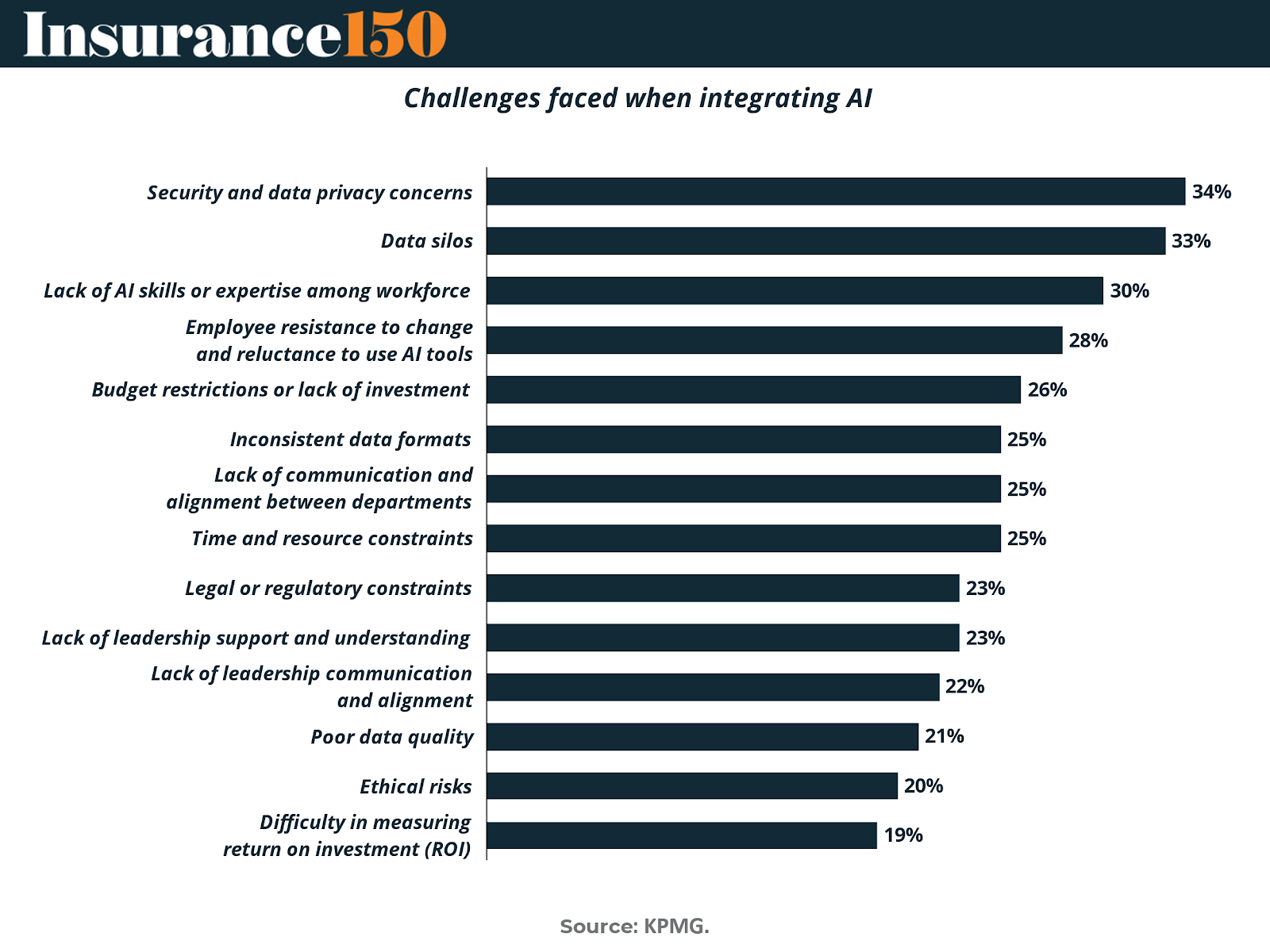

While the insurance sector is rapidly embracing artificial intelligence, the path to enterprise-level integration is far from frictionless. As the data reveals, organizations are encountering a range of structural, technical, and human barriers that threaten to slow momentum and dilute ROI.

Data-related concerns top the list of challenges. A full 34% of insurers cite security and data privacy as their most pressing issue, closely followed by data silos (33%) and inconsistent data formats (25%). These issues not only compromise the integrity of AI outputs but also hinder the development of scalable, cross-functional models.

Another critical constraint is the lack of AI expertise, with 30% of respondents highlighting gaps in workforce capabilities. Beyond skills, cultural hurdles persist: nearly 28% of insurers point to employee resistance to change and reluctance to adopt AI tools as a substantial barrier. This underscores the need for robust change management and clear internal communication strategies.

Budget limitations (26%), resource constraints (25%), and limited leadership support (23%) also pose significant risks. These challenges highlight the difficulty of aligning AI ambitions with operational realities — particularly in legacy-driven organizations where technology investment cycles are slower.

On the regulatory front, legal and compliance constraints (23%) continue to create uncertainty, especially around data use, model governance, and explainability. Meanwhile, concerns around ethical risks (20%) and difficulty in measuring return on investment (19%) suggest that many insurers still struggle to connect AI initiatives to clear business value.

Taken together, these risks underscore a key truth: success with AI in insurance is not just about model performance — it is about organizational readiness. The insurers who lead this transformation will be those who invest early in data infrastructure, workforce upskilling, and internal governance to support responsible, scalable AI adoption.

Conclusion: AI as the New Competitive Core in Insurance

Artificial Intelligence is no longer a distant promise for the insurance industry — it is the defining catalyst of its next chapter. As this report illustrates, insurers are not merely experimenting with AI; they are institutionalizing it across functions, workflows, and investment strategies. From underwriting and claims to marketing and asset management, AI is transforming how insurers operate, compete, and deliver value.

The data speaks for itself. Adoption rates are accelerating, with nearly half of insurers expected to be actively using AI by 2025. The drivers are both economic and strategic: cost pressures, evolving customer demands, and the rapid rise of insurtechs are leaving little room for complacency. Operational efficiency remains the dominant entry point, but the most forward-looking insurers are already moving beyond cost-saving toward differentiated capabilities in risk prediction, personalization, and intelligent automation.

AI’s impact, however, extends beyond internal processes. As insurers invest in infrastructure and software, they are laying the foundation for enterprise-wide AI readiness. Increasing attention to areas like energy efficiency, generative AI, and dynamic pricing signals that AI is becoming tightly woven into broader business strategy and capital allocation decisions.

Still, the path forward is not without friction. Challenges around data integrity, regulatory clarity, model governance, and workforce alignment must be addressed head-on. The winners in this next phase will not simply be those who deploy AI — but those who do so responsibly, transparently, and in ways that compound competitive advantage over time.

Sources & References

Artificial Intelligence in Insurance Market

Goldman Sachs – Global Insurance Survey 2025

Intelligent Insurance Report (2025)