- The Deal Brief - Insurance

- Posts

- Cyber Insurance

Cyber Insurance

Navigating the Digital Wild West – Unlocking Billions in the New Frontier of Risk

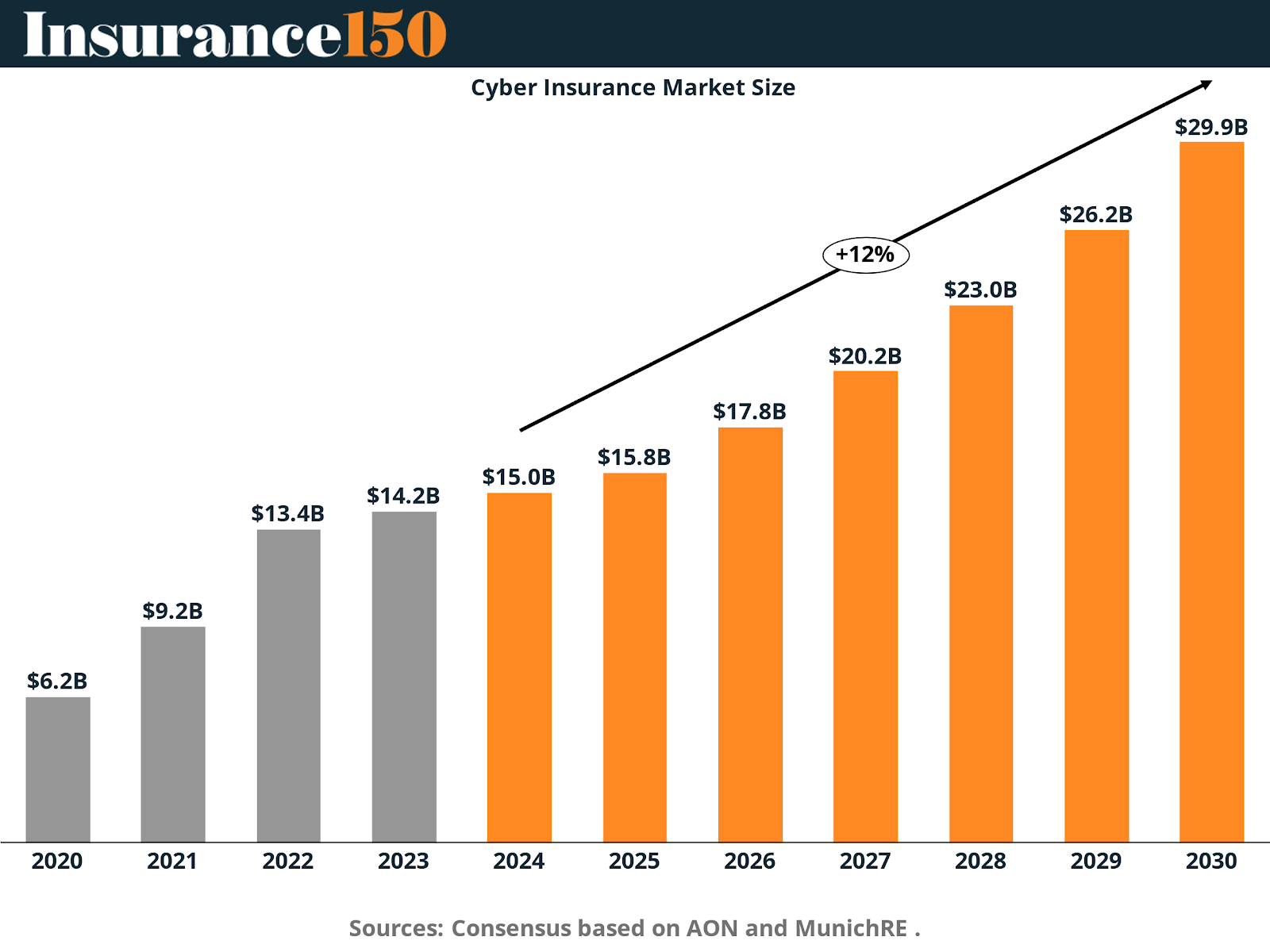

Cyber Insurance Market Size and Growth Outlook

The global cyber insurance market is on a robust growth trajectory, expanding from $15.0 billion in 2024 to a projected $26.2 billion by 2029. This represents a compound annual growth rate (CAGR) of approximately 12% over the five-year forecast period. By 2030, the market is expected to reach $29.9 billion, nearly doubling from its 2024 value.

This sustained growth is driven by a confluence of factors:

Rising Cyber Threats: The frequency and sophistication of cyberattacks continue to grow, pushing organizations across all sectors to seek financial protection against data breaches, ransomware, and business interruption losses.

Increased Regulatory Pressure: Governments and regulatory bodies are introducing stricter cybersecurity and data privacy laws (such as GDPR, CCPA, and others globally), prompting organizations to adopt insurance as a compliance and risk mitigation tool.

Digital Transformation: As companies accelerate their digital operations, including cloud adoption, remote work infrastructure, and IoT deployment, their exposure to cyber risks increases, further driving demand for coverage.

Growing Awareness and Risk Perception: Executives and boards are increasingly aware of the financial impact of cyber incidents, leading to greater prioritization of cyber risk management and insurance.

Expansion of Coverages and Offerings: Insurers are innovating with more tailored and comprehensive cyber products, making policies more accessible and attractive to small and medium enterprises (SMEs), not just large corporations.

With these drivers firmly in place, the cyber insurance market is poised for strong, sustained growth, establishing itself as a critical component of modern enterprise risk management.

The Driving Force: A Digital Ecosystem Under Siege

The accelerating pace of digital transformation has ushered in unprecedented efficiency, connectivity, and innovation—but it has also opened the door to a parallel surge in cyber threats, both in volume and sophistication. What was once a domain-specific risk for tech-heavy or multinational corporations has evolved into a pervasive, enterprise-wide concern affecting organizations of all sizes and across every sector. Small and medium-sized businesses, previously considered lower-priority targets, are now increasingly in the crosshairs of cybercriminals due to often limited security infrastructure and lower overall resilience.

Modern cyberattacks are not only more frequent, but also more complex and damaging. From large-scale ransomware operations and business email compromise (BEC) schemes to highly targeted phishing campaigns and zero-day exploits, threat actors are continuously innovating—often outpacing the speed at which organizations can defend against them. The increasing use of AI and automation by cybercriminals has further intensified this risk, enabling faster and more adaptive attacks that are harder to detect and mitigate.

This rapidly evolving threat landscape has exposed the shortcomings of traditional insurance policies, which typically fall short in covering the multifaceted risks associated with cyber incidents. Legacy coverage models were not designed to account for the cascading effects of a cyber event, such as prolonged business interruption, reputational harm, regulatory penalties, or third-party liabilities. As a result, organizations are turning to purpose-built cyber insurance products that offer specialized protections tailored to today’s digital threats.

Beyond risk transfer, cyber insurance is also playing a more proactive role in overall cybersecurity strategy. Many policies now include value-added services such as incident response planning, threat intelligence, vulnerability assessments, and access to expert forensics teams. This shift signals a broader evolution of cyber insurance—from a reactive safety net to an integrated component of a holistic cyber resilience framework.

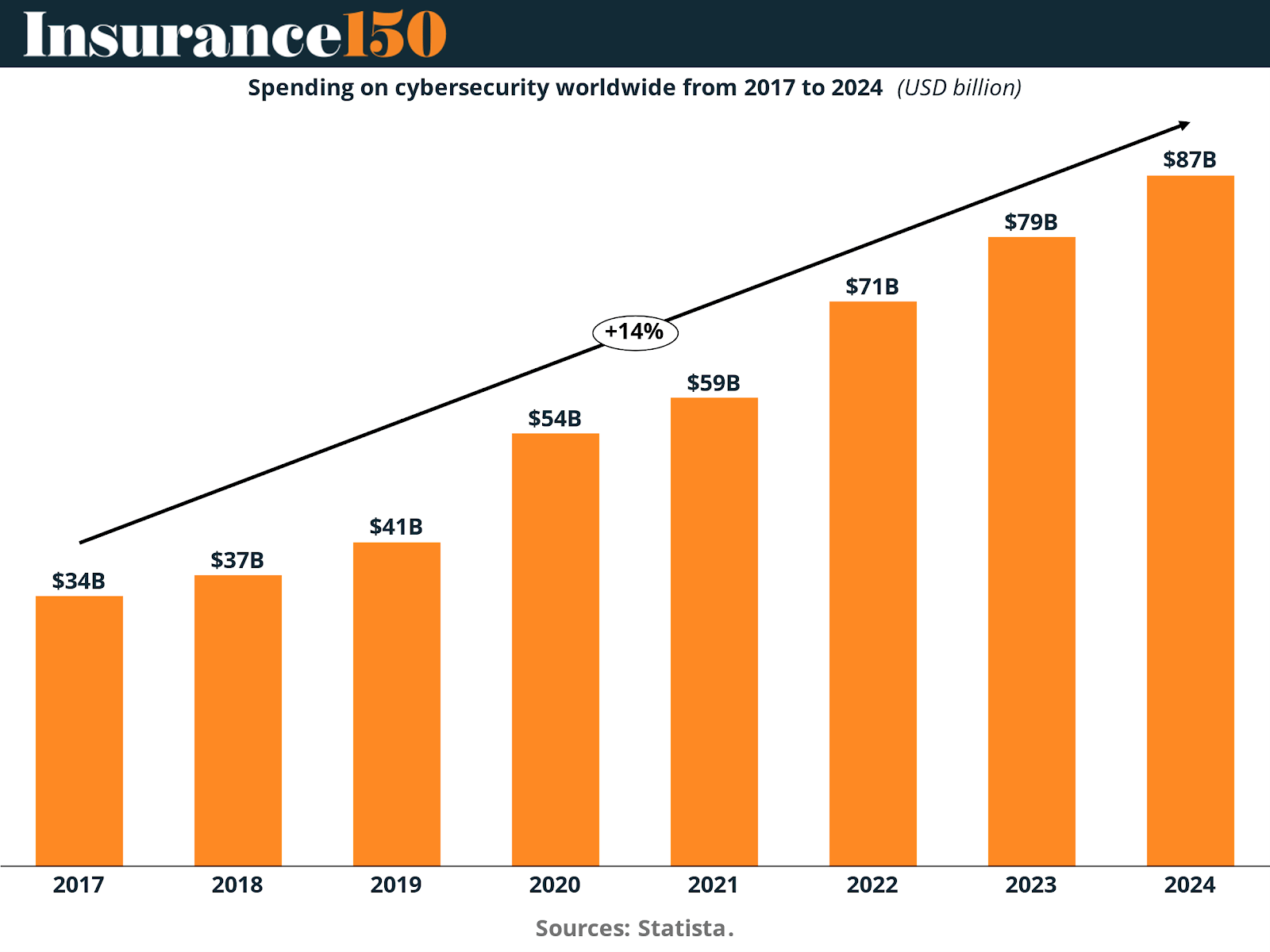

The urgency to adopt these solutions is echoed in global investment trends. According to Statista, worldwide cybersecurity spending surged from $34 billion in 2017 to an estimated $87 billion in 2024, reflecting a compound annual growth rate (CAGR) of 14.4%. This substantial increase underscores the growing recognition among businesses and governments alike that cybersecurity is no longer optional—it is foundational.

In this high-stakes environment, cyber insurance is emerging as more than just financial protection; it is becoming an operational imperative. As digital ecosystems grow in complexity and interconnectivity, the ability to anticipate, absorb, and recover from cyber disruptions will define the resilience—and ultimately, the survival—of modern enterprises.

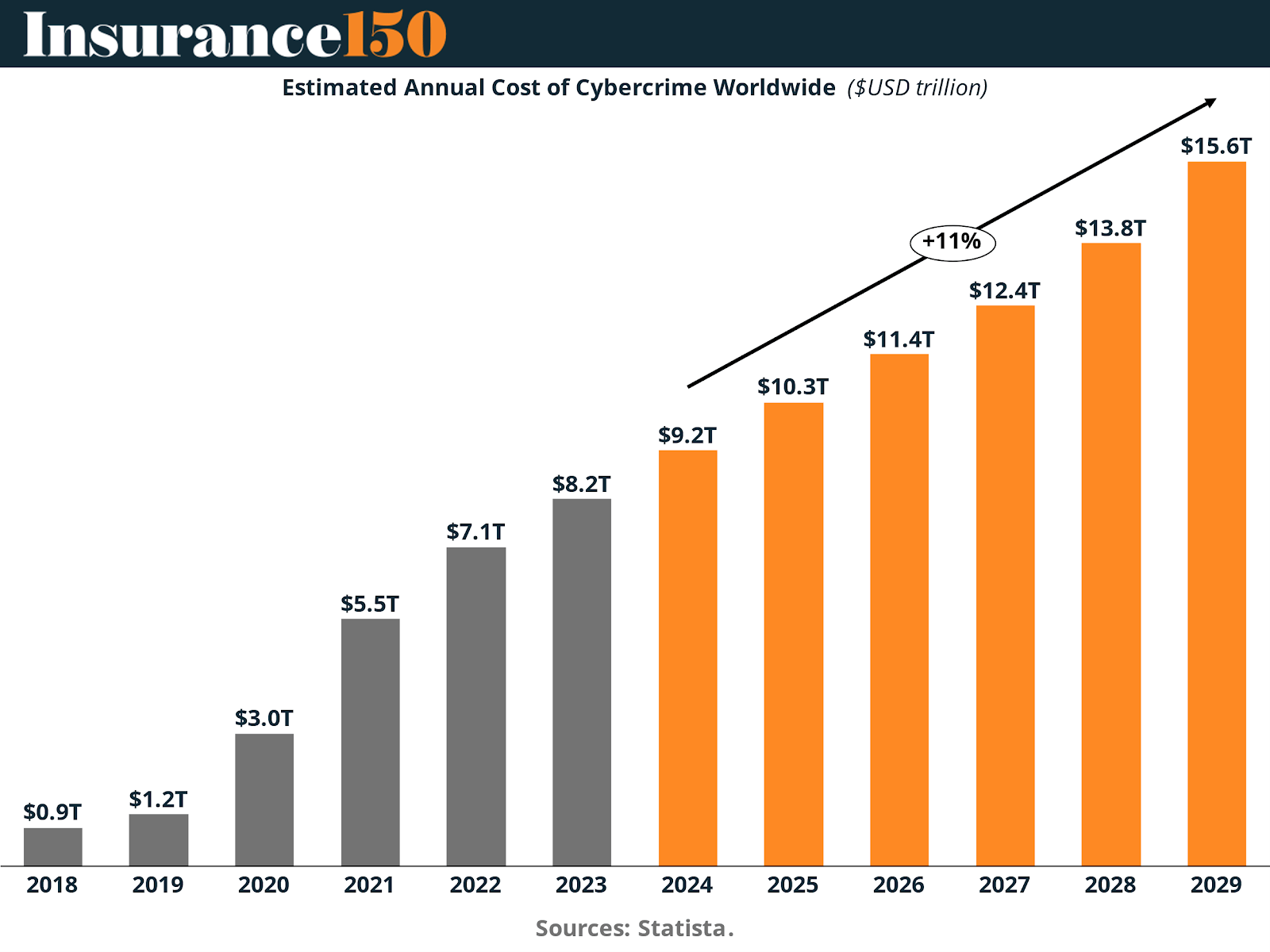

The Soaring Cost of Cybercrime

As the digital landscape grows increasingly hazardous and cyberattacks become more prevalent, the financial impact of cybercrime is rising at an alarming rate. According to Statista, the global cost of cybercrime is expected to surge from $9.22 trillion in 2024 to a staggering $15.63 trillion by 2029, representing a 91.78% increase and a compound annual growth rate (CAGR) of 11.46%.

Cybercrime costs encompass a wide array of damages that extend far beyond immediate financial losses. As outlined by Cyber Crime Magazine, these costs include the destruction or theft of data, financial theft, loss of productivity, intellectual property theft, personal and financial data breaches, embezzlement, fraud, operational disruptions, forensic investigations, system restoration, and reputational damage.

This dramatic rise in the economic burden of cybercrime underscores the critical need for robust cyber risk management strategies. As organizations face mounting pressure to protect both digital and financial assets, cyber insurance is rapidly emerging as a strategic necessity rather than a discretionary expense.

This trend highlights an untapped future potential and anticipated costs for companies and governments, underscoring the necessity for financial protection against potential future incidents. As a result, demand for cyber insurance is expected to continue growing across various industries and regions.

According to Bio-Key, as cyberattacks hit record highs in 2022, organizations are increasingly pressured to reassess their cybersecurity budgets. Despite rising threats, small and medium-sized enterprises (SMEs) currently allocate only 10% of their IT budget to cybersecurity, raising concerns about whether this is sufficient to combat the growing risks. Most cybersecurity spending is directed toward data protection, governance compliance, and identity management, but the question remains whether these efforts are enough to counteract sophisticated threats like AI-driven attacks and geo-phishing.

Different industries face unique cybersecurity challenges and must tailor their spending accordingly. For example, the banking and financial services sector struggles to balance modern customer experiences with robust data protection, while state and local governments, dealing with a 95% increase in cyber-attacks, must prioritize employee cyber training and leverage available resources like CISA's tools and the Department of Defense's Zero Trust Strategy. Across industries, the key to cyber resilience lies in both preventative security measures and appropriate cybersecurity insurance coverage.

High-Risk Sectors: Where Cyber Insurance Demand Is Most Acute

Most affected Industries

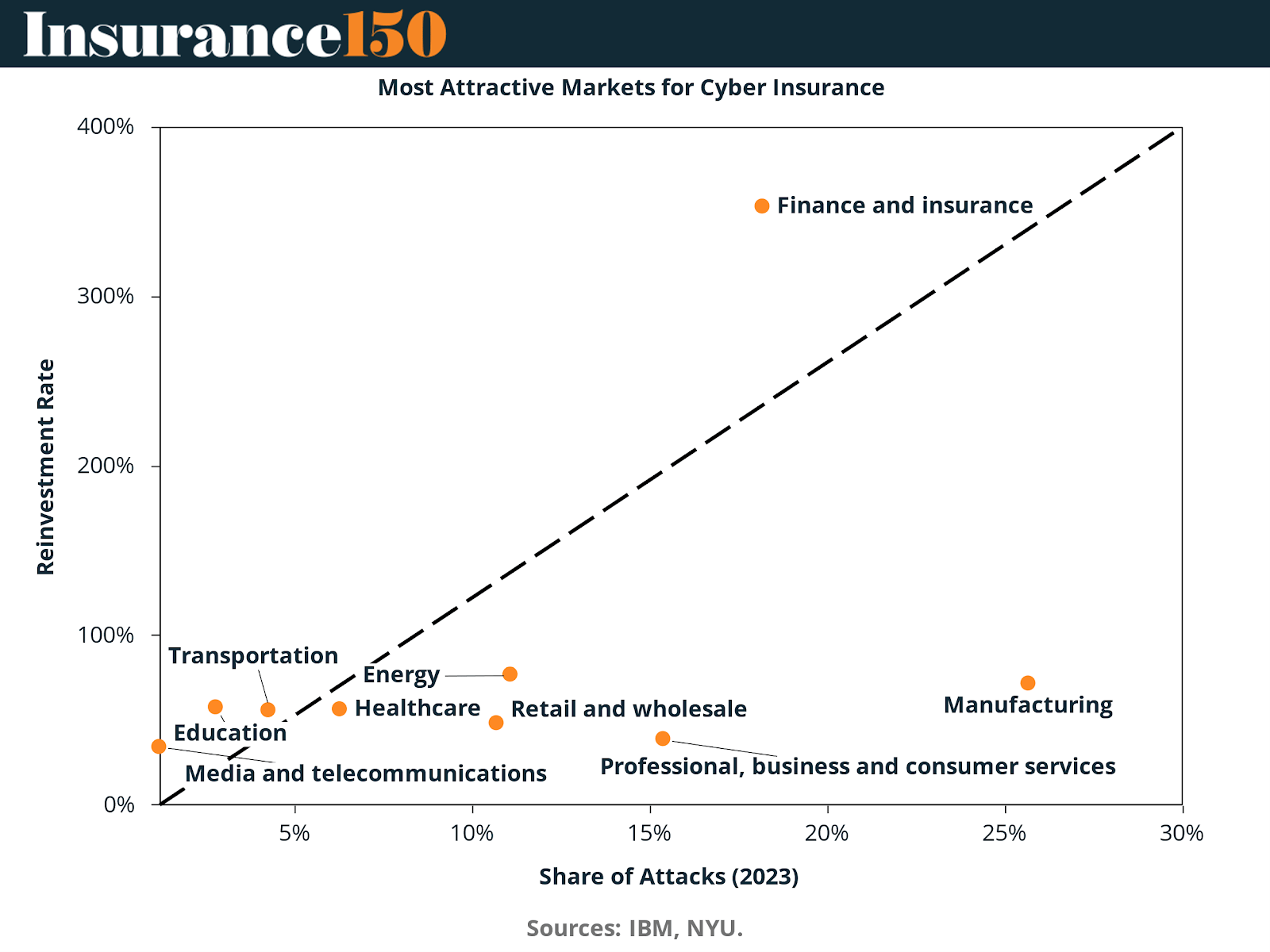

According to IBM, the industries most frequently targeted by cyberattacks include Manufacturing, Financial Services, and Professional, Business, and Consumer Services. These sectors, due to their critical infrastructure, complex operations, and high-value data, face an elevated risk profile—making them prime candidates for robust cyber insurance solutions.

The 2023 IBM X-Force Threat Intelligence Index highlights that manufacturing held its position as the most attacked industry for the third consecutive year, accounting for 25.7% of all incidents among the top 10 sectors. Attack methods continue to evolve, with malware representing the most common technique at 45%, followed by ransomware at 17%. Notably, attackers increasingly use legitimate tools for malicious purposes, a tactic present in 31% of incidents, with credential theft being the leading technique in this category, also at 17%.

Other notable trends include a rise in server access incidents, which climbed to 21% in 2023, up from 17% the year prior. The primary impacts of these attacks were credential harvesting and data theft, each affecting 36% of reported cases. Secondary but still significant outcomes included data destruction and extortion, each seen in 16% of incidents.

When examining initial access vectors, phishing remains the most common point of entry at 39%, followed closely by the exploitation of public-facing applications (33%) and the abuse of external remote services (22%).

From an insurance strategy perspective, analyzing the intersection between cyberattack frequency and reinvestment rates in cybersecurity reveals key insights. Industries that are frequently targeted yet underinvested in cybersecurity present both a heightened risk and a substantial opportunity for cyber insurers. Conversely, sectors that are highly targeted and already heavily reinvesting in defenses may represent a more mature, competitive market—but also one in need of specialized and advanced coverage options.

The manufacturing sector, which accounts for 25.7% of all cyberattacks, continues to be a high-risk industry. Despite this, it maintains a moderate reinvestment rate of 71.52%, suggesting that while companies are making efforts to balance operational resilience with growth initiatives, many still lack comprehensive risk mitigation strategies. This positions manufacturing as a key market for cyber insurance products that can reinforce and expand upon existing security frameworks.

In contrast, the finance and insurance sector, responsible for 18.2% of cyberattacks, demonstrates a remarkably high reinvestment rate of 352.89%. This indicates a proactive stance in fortifying digital infrastructure, likely driven by regulatory pressures and the critical nature of data security in this space. Cyber insurance providers have a valuable opportunity to deliver advanced, integrated solutions that align with these investments and address the increasingly complex threat landscape.

The professional, business, and consumer services sector reports 15.4% of total cyber incidents, yet its reinvestment rate sits at just 38.84%. This disparity points to a potential underinvestment in cyber defense, leaving many organizations vulnerable. For insurers, this presents an opportunity to introduce accessible, targeted coverage that not only addresses immediate risk but also supports broader risk management education and preparedness.

Similarly, the energy sector, which faces 11.1% of cyberattacks, has a reinvestment rate of 76.74%. As operators of critical infrastructure, energy companies are actively working to enhance cybersecurity posture. Cyber insurance offerings tailored to the sector’s unique risk exposure—particularly regarding operational technologies (OT) and industrial control systems (ICS)—can play a key role in strengthening resilience.

In the retail and wholesale industry, which sees 10.7% of attacks and a reinvestment rate of 48.16%, the data suggests notable exposure with relatively limited reinforcement. The combination of high transaction volumes, sensitive consumer data, and increasingly digital operations makes this sector especially vulnerable. Cyber insurance can fill an essential gap here, offering protection against both financial loss and reputational damage.

Most Affected Geographies: Mapping Global Exposure to Cybercrime

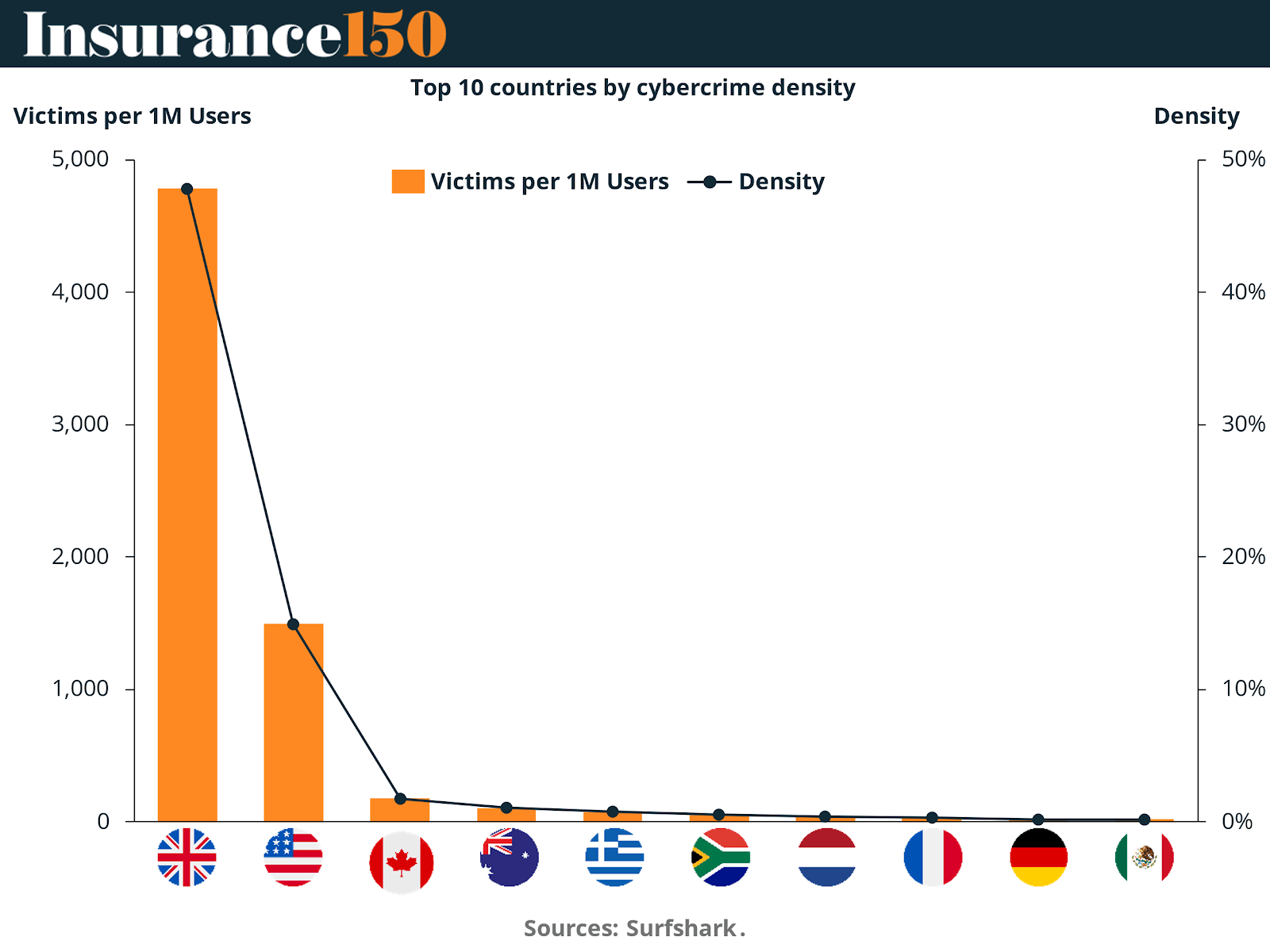

Cyber threats are not evenly distributed across the globe—different regions experience varying levels of cybercrime intensity, shaped by digital maturity, regulatory environments, and investment activity. According to Surfshark, the United Kingdom emerges as the most affected country, with 4,783 victims per million users, accounting for 47.8% of global incidents. This staggering rate underscores the UK as a top-priority market for cyber insurance providers.

In comparison, the United States, while experiencing fewer incidents per capita—1,494 victims per million users—still represents 14.9% of global cyberattacks, reflecting its large digital economy and high-value targets. Other developed economies such as Canada, Australia, and Greece show considerably lower rates of victimization, indicating varying degrees of exposure and preparedness.

Countries like South Africa (52 victims per million) and the Netherlands (41 victims per million) also report notable figures, while France, Germany, and Mexico register lower rates, though they still face meaningful threats. These ten countries collectively represent the geographies most impacted by cybercrime, offering clear guidance for insurers seeking high-impact markets.

As the global digital footprint expands, understanding these geographic disparities is crucial for effective risk management. It highlights the importance of localized cyber insurance strategies, where solutions are tailored to the specific threat landscapes, legal frameworks, and economic conditions of each region.

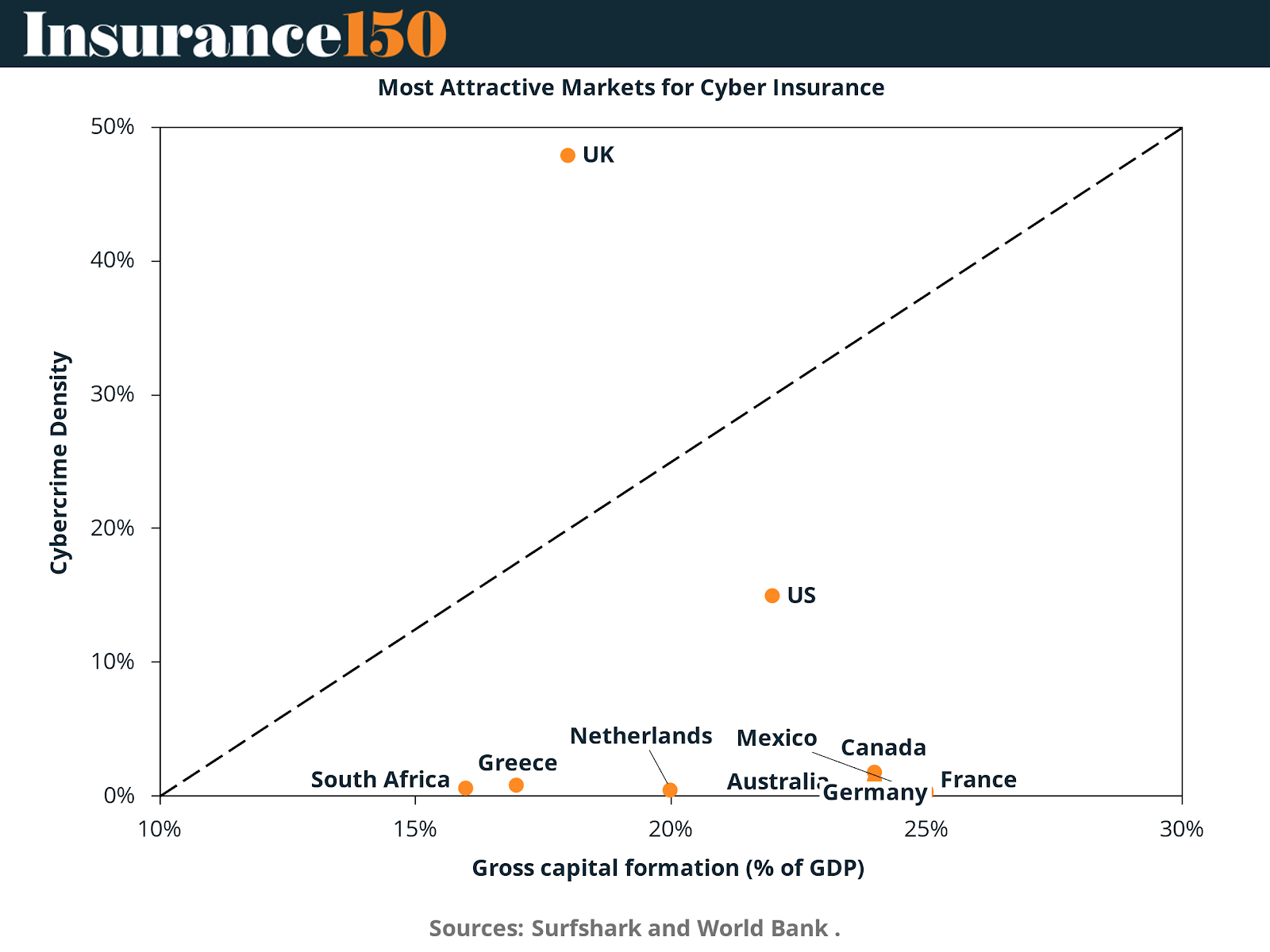

Economic Context: Cyber Risk in High-Investment Markets

An analysis of cybercrime density alongside gross capital formation (a key economic indicator of national investment) reveals compelling insights for cyber insurers. Countries like the UK and the US not only experience high cybercrime rates but also command massive capital investment—most notably, the U.S. at $5.63 trillion. This convergence of high digital exposure and economic activity creates fertile ground for cyber insurance growth, as organizations in these economies face heightened stakes and increasing pressure to secure digital assets.

In contrast, countries such as Germany and Mexico, while investing significantly in their economies—$1.05 trillion and $442.92 billion in gross capital formation respectively—report much lower cybercrime densities (approximately 0.2%). This suggests a less immediate demand for cyber insurance in comparison to higher-risk regions, although growing digitization could shift these dynamics in the near future.

For cyber insurers, this intersection of cyber risk exposure and economic investment is a key strategic lens. Markets like the UK and the US, where cyber threats are both frequent and costly, offer a strong case for expanded and sophisticated coverage offerings. These regions represent not only critical hotspots of vulnerability but also substantial opportunities for insurers to deliver value through proactive, tailored protection.

Global Cybercrime Hubs: Insights from the World Cybercrime Index

A recent study published in PLOS ONE introduces the World Cybercrime Index (WCI), a groundbreaking metric that maps the global geography of cybercrime offenders. Unlike traditional analyses that focus on where cyberattacks land, the WCI identifies where cybercriminals are based, offering a more accurate view of the origins of cybercrime.

The WCI was developed through a survey of global cybercrime experts, who evaluated countries based on their involvement in five key categories of cybercrime:

Technical products and services (e.g., malware development, botnet operations)

Attacks and extortion (e.g., DDoS attacks, ransomware)

Data and identity theft (e.g., phishing, account compromises)

Scams (e.g., advance-fee fraud, business email compromise)

Cashing out and money laundering (e.g., illicit virtual currency platforms)

Each country was assessed on the impact, professionalism, and technical skill of its cybercriminal activity. These evaluations were combined into an overall WCI score, highlighting the top sources of cybercrime globally.

According to the WCI, Russia ranks highest with a score of 58, followed by Ukraine (36), China (28), and the United States (25). Other notable countries include Nigeria (21), Romania (15), and North Korea (11). The United Kingdom, despite being one of the most attacked nations per capita, ranks 9th in terms of cybercrime origin.

This data paints a clear picture: cybercrime is concentrated, with a relatively small number of countries serving as global hubs. These nations often specialize in specific types of cybercrime—some excel in technical sophistication, while others are known for scam-based operations. This specialization underscores the need for targeted cybersecurity and insurance strategies.

For cyber insurers, understanding the source of threats, not just the victims, is essential. This intelligence enables the development of risk-adjusted products, more precise underwriting models, and region-specific solutions that reflect the nature of threats emerging from particular geographies.

By aligning cyber insurance offerings with these insights, providers can better support clients in managing exposure and building resilience in the face of an increasingly complex and globally networked cyber threat landscape.

Conclusion

The escalating scale and complexity of cyber threats, combined with the rapid digitalization of economies worldwide, have solidified cyber insurance as a non-negotiable pillar of modern risk management. No longer a niche product, cyber insurance is now a strategic asset for enterprises—and a growth engine for insurers and investors alike.

For insurance providers, the road ahead offers significant opportunity—but also demands strategic precision. As the threat landscape continues to evolve, insurers must go beyond traditional models. They will need to invest in advanced analytics, dynamic underwriting, and proactive service offerings that include risk assessments, breach response, and real-time threat intelligence. The ability to design sector-specific, geography-informed, and risk-adjusted products will be the differentiator in a market that is both expanding and becoming more sophisticated.

From an investor perspective, the cyber insurance sector represents one of the most compelling growth stories in the global insurance market. With the industry expected to nearly double by 2029, the combination of high demand, structural under-penetration, and increasing regulatory pressures creates a unique window for capital deployment. Investment in underwriting technology, security partnerships, and distribution innovation can unlock both margin expansion and long-term resilience.

Moreover, the intersection of cybercrime density and economic investment, as well as insights from the World Cybercrime Index, provides a roadmap for smart capital allocation. Markets with high cyber exposure and significant economic activity—such as the US, UK, and parts of Europe—are primed for deeper penetration. Meanwhile, emerging markets with rising digital adoption represent a longer-term play with significant upside.

In sum, the cyber insurance market is no longer optional—it's inevitable. For insurers, it’s a call to innovate. For investors, it’s an invitation to lead. Those who act now, with clarity and conviction, will define the next frontier of insurance in the digital age.

Sources & References

Bruce M, Lusthaus J, Kashyap R, Phair N, Varese F (2024) Mapping the global geography of cybercrime with the World Cybercrime Index. PLoS ONE 19(4): e0297312. https://doi.org/10.1371/journal.pone.0297312

DBR. (2024). 2024 Data Breach Report. https://www.idtheftcenter.org/wp-content/uploads/2025/02/ITRC_2024DataBreachReport.pdf

IBM. (2025). IBM X-Force 2025 Threat Intelligence Index. https://www.ibm.com/thought-leadership/institute-business-value/report/2025-threat-intelligence-index

MunichRE (2025). Cyber Insurance Risks and Trends 2025. https://www.munichre.com/en/insights/cyber/cyber-insurance-risks-and-trends-2025.html

NYU. Damodaran. (2024). https://pages.stern.nyu.edu/~adamodar/New_Home_Page/data.html

Oxford University. (2024). World-first “Cybercrime Index” ranks countries by cybercrime threat level. https://www.ox.ac.uk/news/2024-04-10-world-first-cybercrime-index-ranks-countries-cybercrime-threat-level

Statista. (2024). Cybercrime Expected To Skyrocket in Coming Years. https://www.statista.com/chart/28878/expected-cost-of-cybercrime-until-2027/

Statista. (2024). Spending on cybersecurity worldwide from 2017 to 2024. https://www.statista.com/statistics/991304/worldwide-cybersecurity-spending/#:~:text=In%202023%2C%20spending%20in%20the,has%20been%20increasing%20since%202021.

The Insurer. (2025). Cyber Market Growth estimates are moderating. https://www.theinsurer.com/ti/viewpoint/cyber-market-growth-estimates-are-moderating-2025-02-21/#:~:text=Aon%20has%20moderated%20its%20long,targets%20in%202023%20and%202024.

WTW. (2025). Cyber liability: A recap of 2024 and look ahead to 2025. https://www.wtwco.com/en-us/insights/2025/01/cyber-liability-a-recap-of-2024-and-look-ahead-to-2025