- The Deal Brief - Insurance

- Posts

- Electric Vehicles Charging Stations Insurance Market: Opportunities for Insurers

Electric Vehicles Charging Stations Insurance Market: Opportunities for Insurers

The electrification of transport is one of the defining trends of the coming decades.

Introduction

In 2024 alone, more than 17 million electric vehicles (EVs) were sold worldwide, representing a 25 percent increase from the prior year. This rapid adoption underscores the urgency of developing a robust charging network capable of supporting the transition. Charging stations are therefore becoming critical infrastructure — as important to the EV ecosystem as refineries and gas stations were to the internal combustion era.

The expansion of this market not only benefits equipment providers, utilities, and real estate operators, but also opens a new frontier for insurers. Charging stations carry unique risks — property damage, liability exposure, cyber threats, and business interruption — which demand specialized insurance solutions. The following report evaluates the opportunity for insurance companies in this market, using data from global EV adoption trends, proprietary indices, and detailed regional analyses.

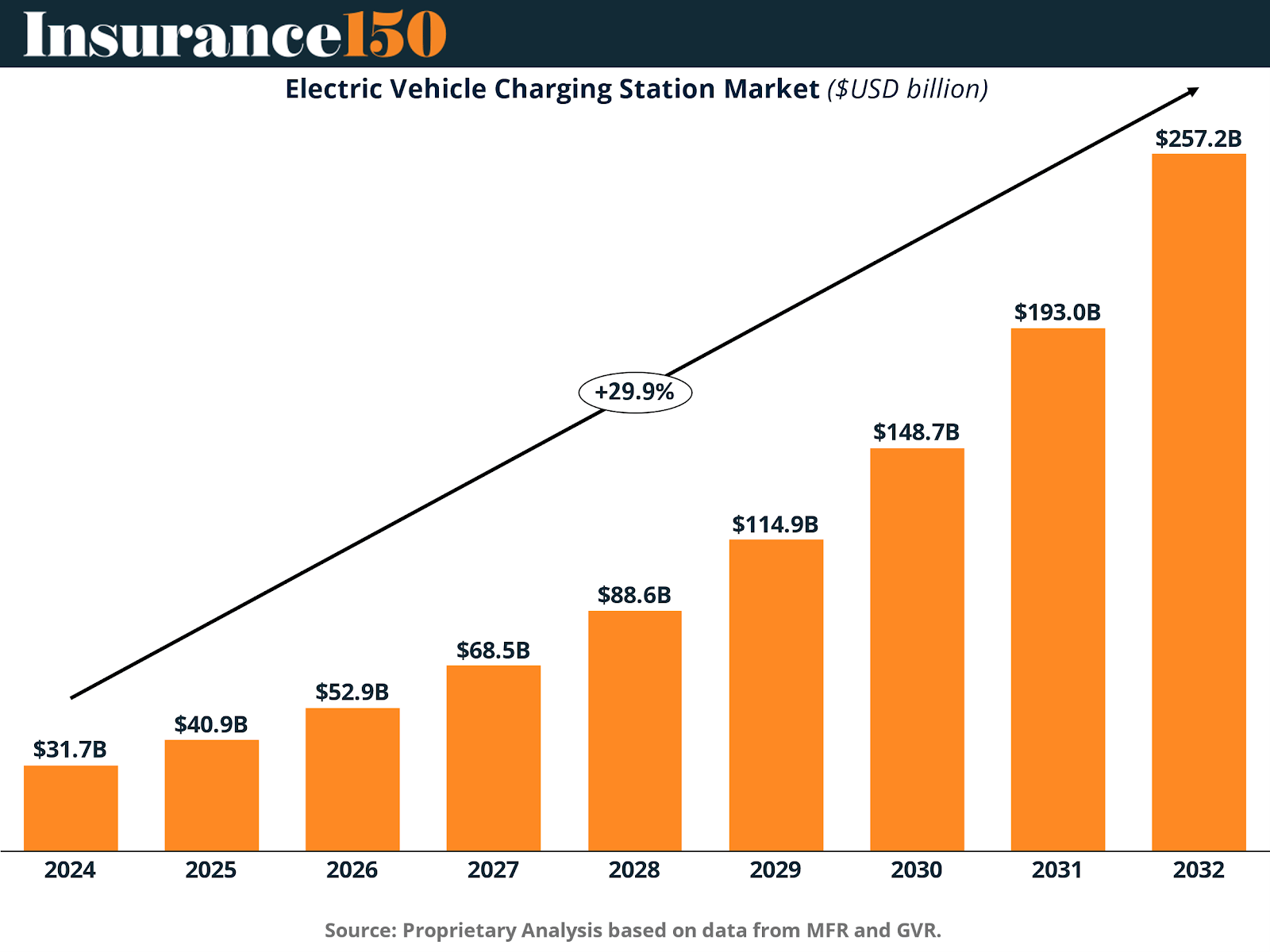

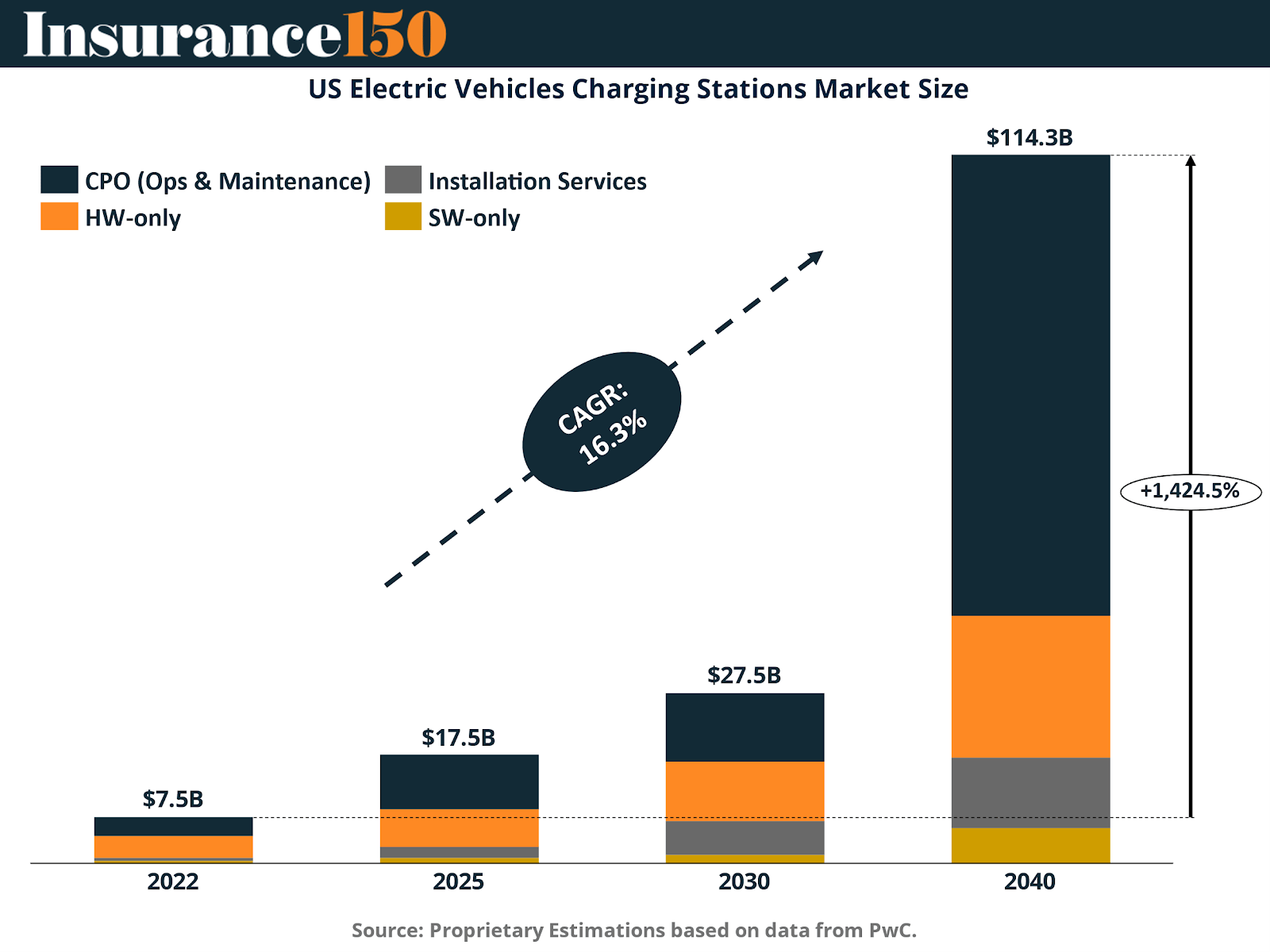

The first chart illustrates the global market size of EV charging stations, already in the tens of billions of dollars and forecast to expand rapidly. For insurers, this signifies that the volume of physical and operational assets requiring coverage will increase exponentially. Each billion invested into charging infrastructure represents billions more in insurable exposure across property, liability, and cyber domains.

EV Growth Dynamics

The demand for charging infrastructure stems directly from the rise of electric vehicles. Global EV sales have increased at double-digit rates annually, and the market is shifting from niche adoption to mass penetration.

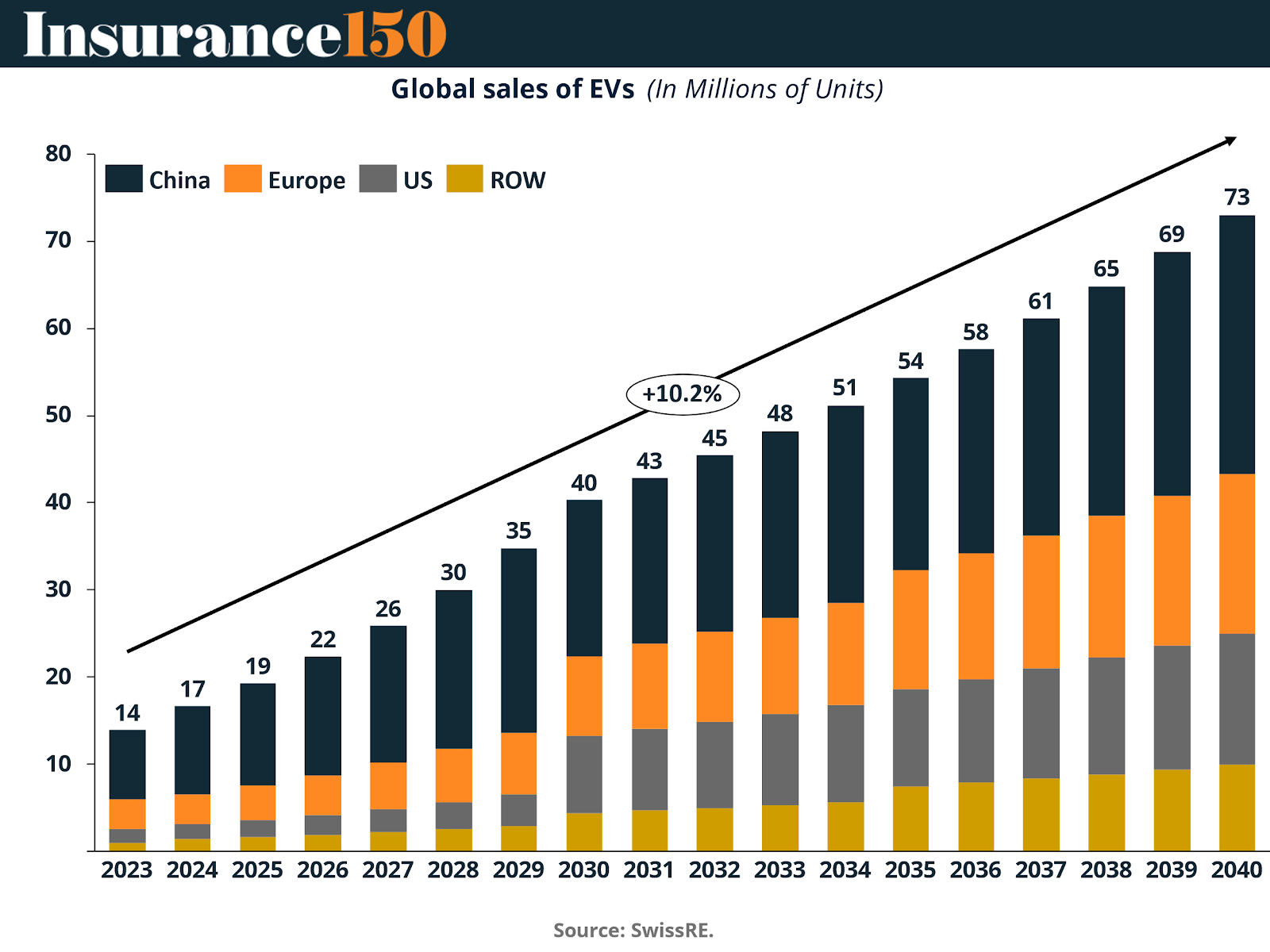

This chart highlights the sharp upward trajectory of EV sales, growing from less than one million units a decade ago to more than 17 million annually by 2024.

For insurers, each vehicle sold translates into additional strain on charging networks and greater need for reliable, insured infrastructure. As EV adoption grows, the liability exposure of charging station operators also rises, because more users mean higher risk of accidents, malfunctions, and claims.

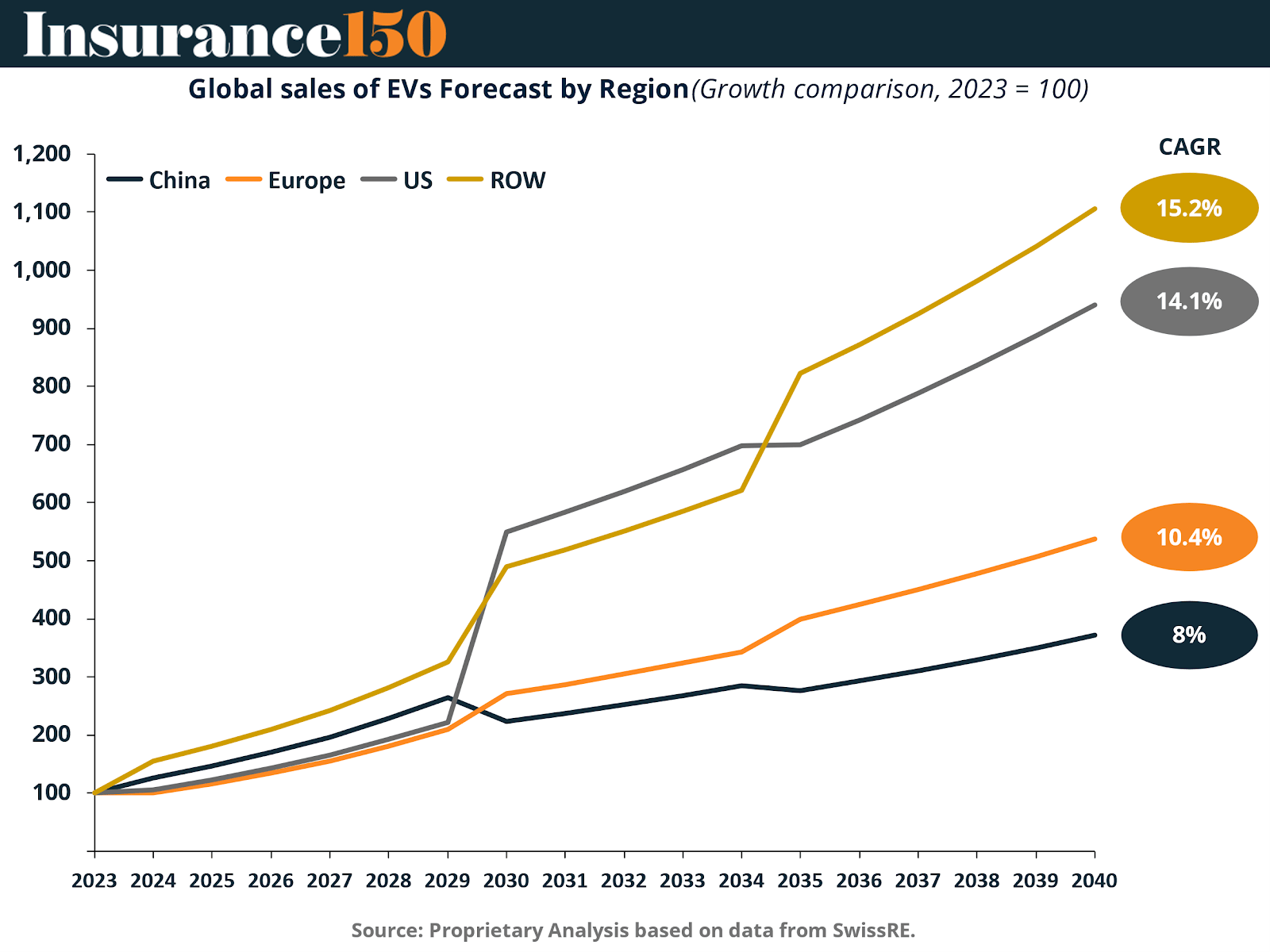

The forecast by region shows how adoption differs geographically. Europe and China currently lead, while the United States is catching up quickly under federal and state incentives.

From an insurance standpoint, this variation means that product design and underwriting strategies must be localized. In Europe, policies may focus on managing mature risks in dense networks, whereas in the U.S. and emerging markets the focus is on underwriting growth and early-stage infrastructure resilience.

Risk Environment for Charging Stations

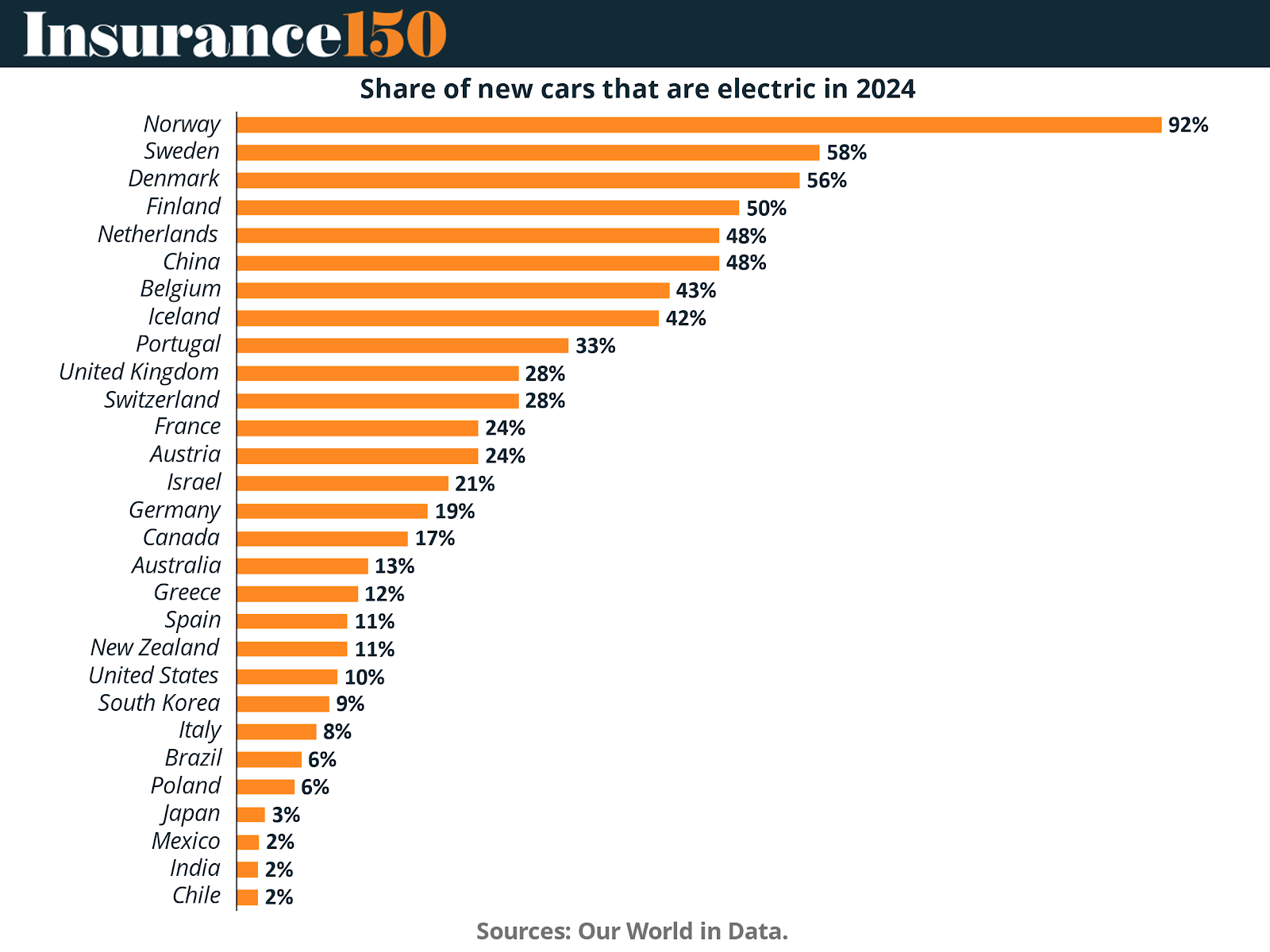

One of the most critical indicators for insurance potential is the share of new cars that are electric.

This chart demonstrates how different markets are advancing in EV penetration. Countries like Norway already see EVs as the majority of new sales, while others such as the U.S. remain in earlier stages of adoption.

For insurers, higher EV penetration correlates with accelerated demand for charging networks, which in turn means a faster-growing book of business in infrastructure coverage.

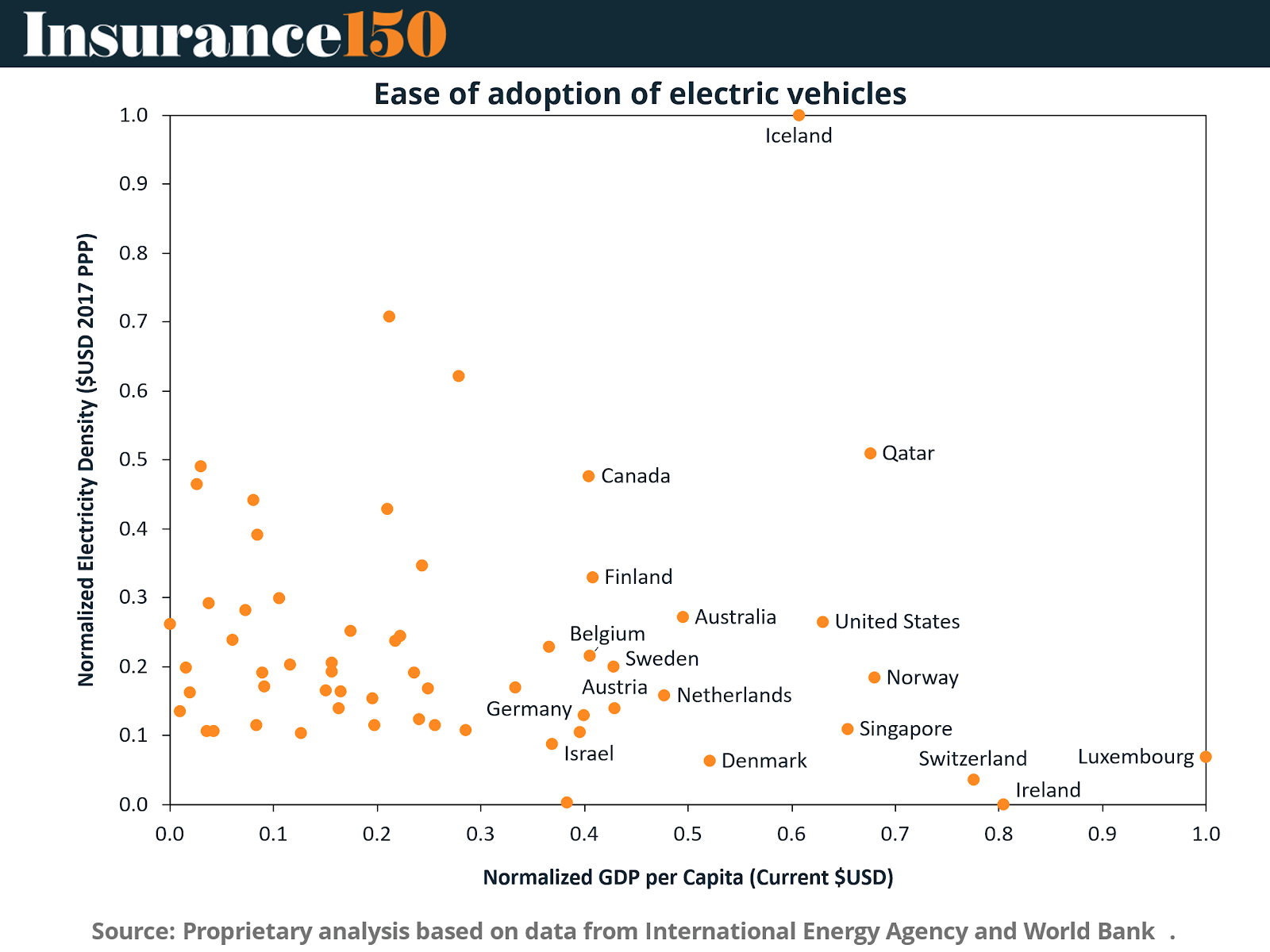

The ease of adoption index provides an additional layer of analysis, capturing how well a country’s infrastructure, grid density, and socioeconomic factors support EV uptake. Nations that score high here are likely to build extensive charging networks quickly, creating concentrated insurance opportunities.

Conversely, countries with low scores may face implementation risks, leading insurers to price higher premiums or introduce exclusions.

Insurance Market Scaling

The next set of charts illustrates how the overall EV fleet and its growth trajectory generate a sustained demand for charging station insurance.

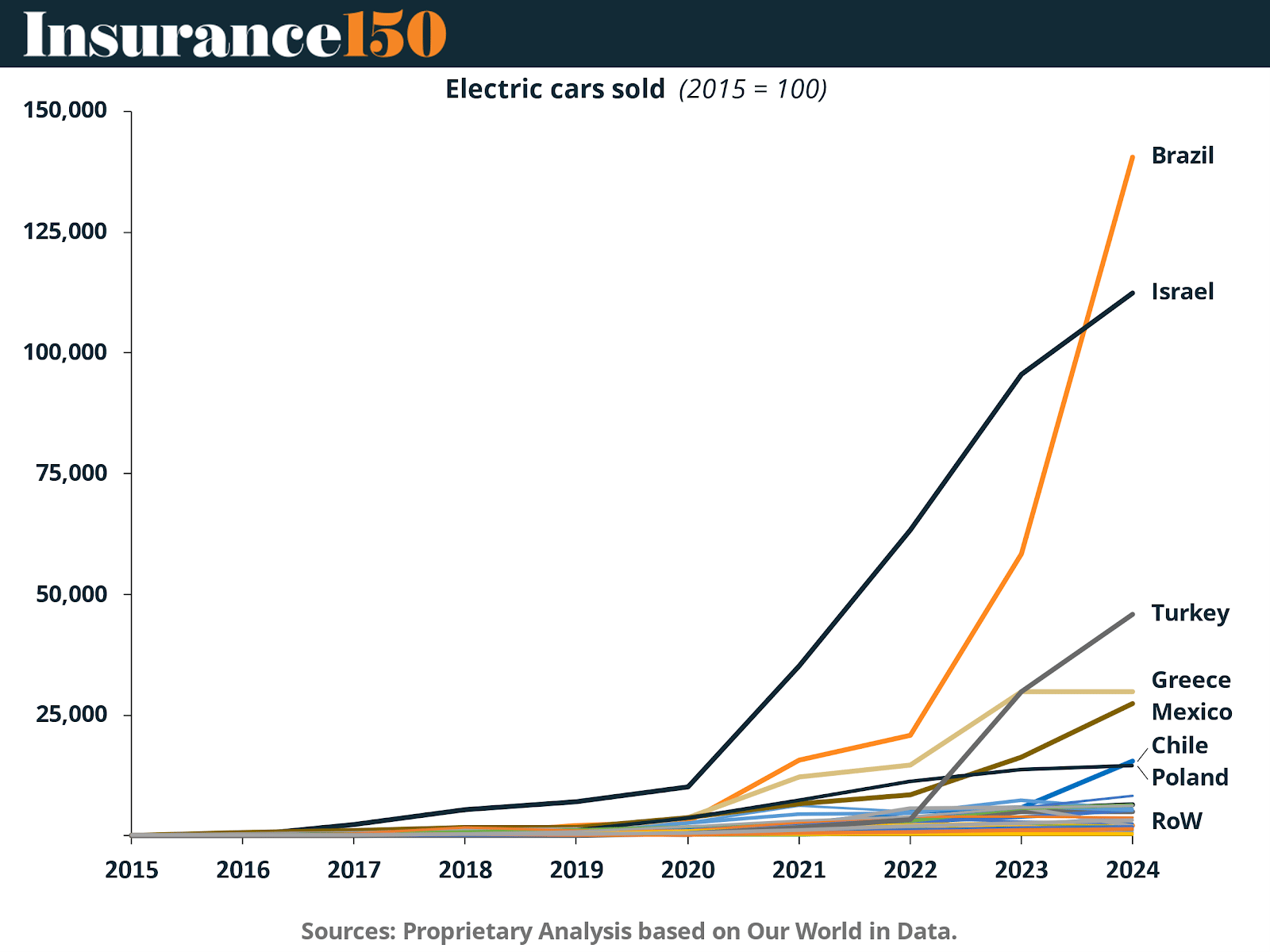

This chart indexes sales since 2015, revealing the acceleration of EV adoption globally. The trend suggests that charging demand will not plateau soon. Insurers must therefore prepare for long-term exposure growth, rather than viewing this as a temporary spike.

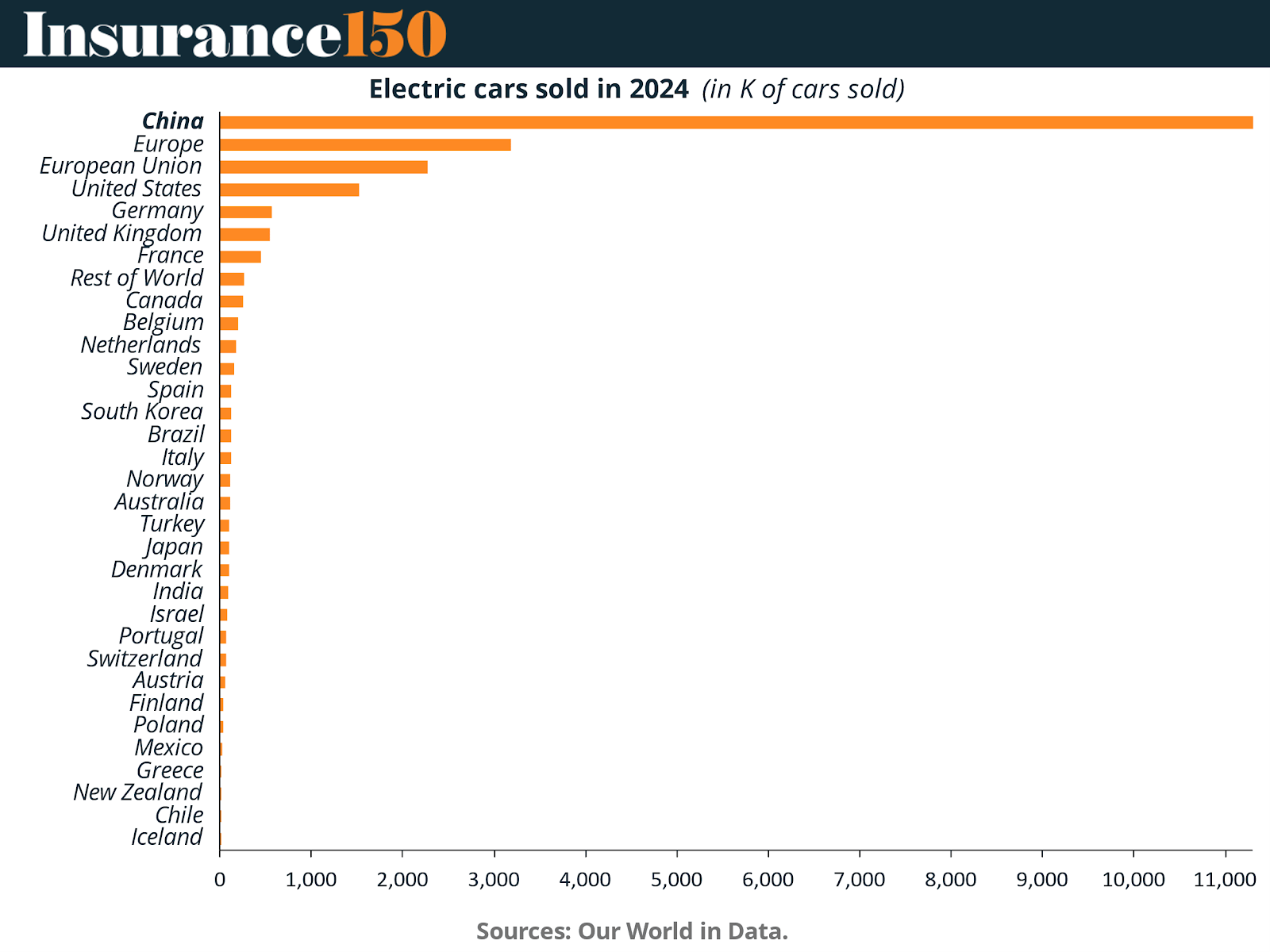

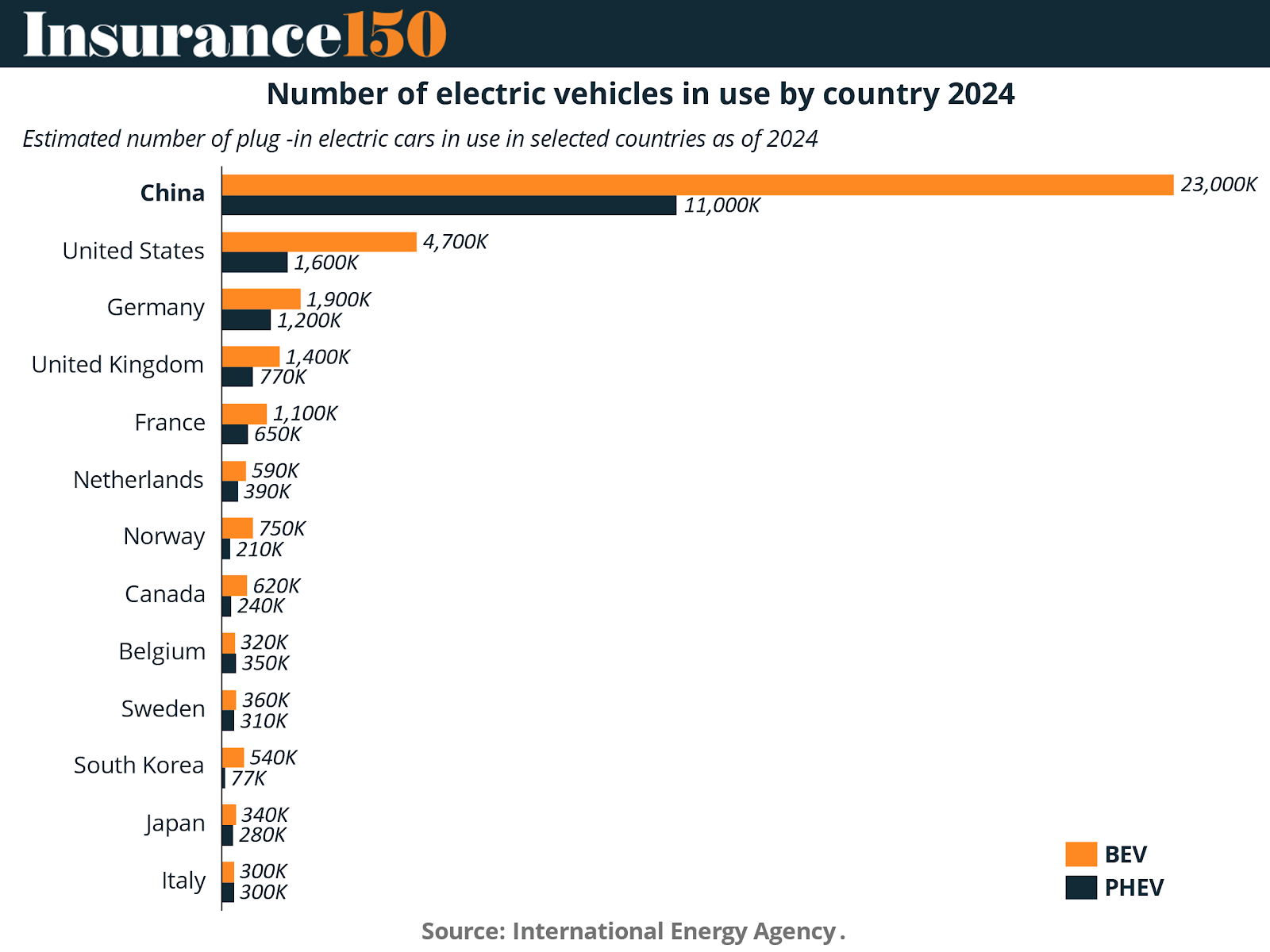

Looking at absolute figures for 2024, the data shows immediate pressure on infrastructure, particularly in China, the U.S., and Europe. Each car sold requires a network capable of safe charging, and every installed station becomes an insurable asset. For insurers, these sales numbers are effectively leading indicators of premium growth.

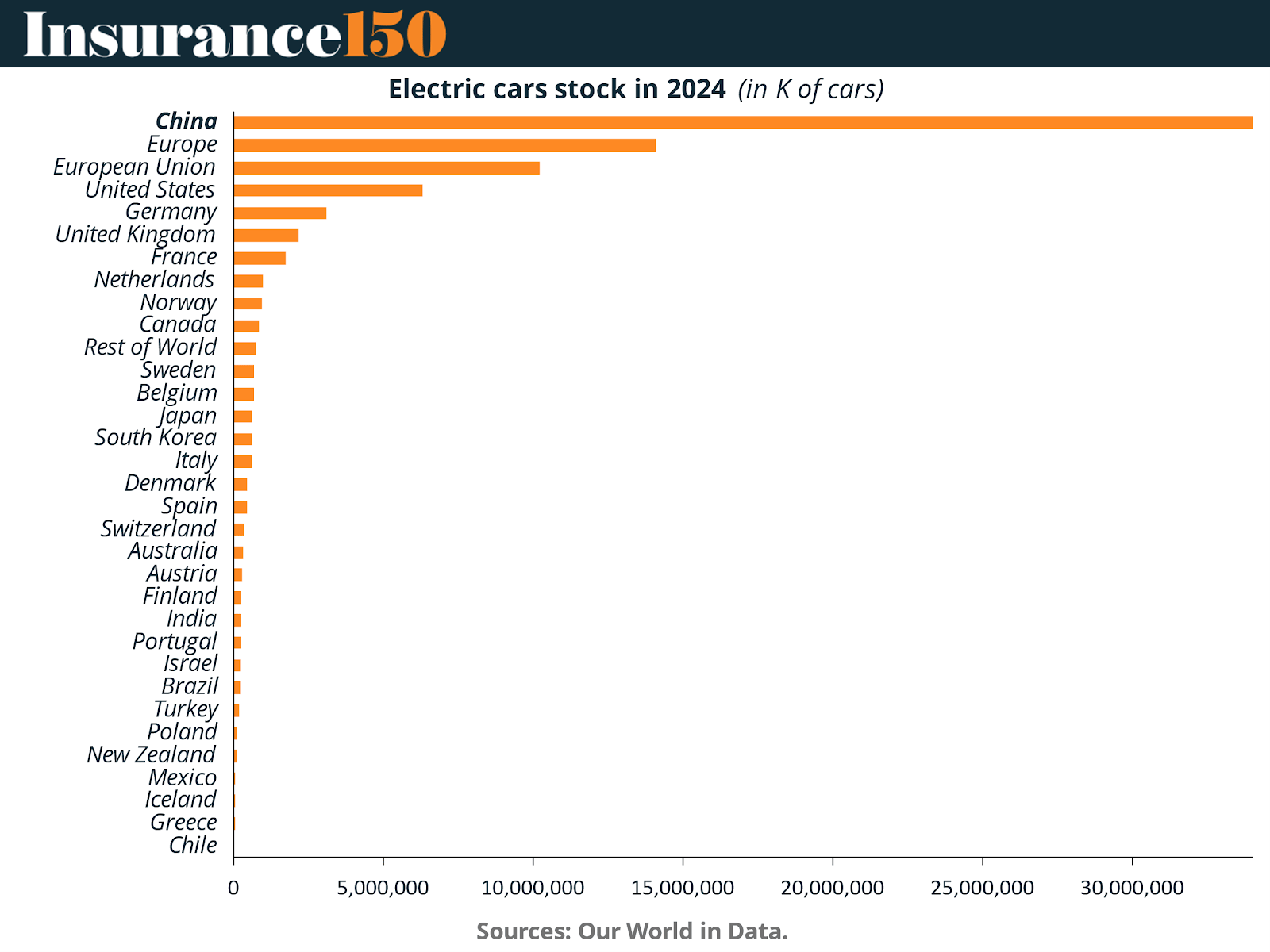

The stock of EVs, as opposed to annual sales, represents cumulative exposure. For insurers, this is perhaps the most important figure, because installed infrastructure must serve the entire fleet on the road. As stock grows, the baseline liability and property risk rises accordingly.

Charging Stations Insurance Market Potential

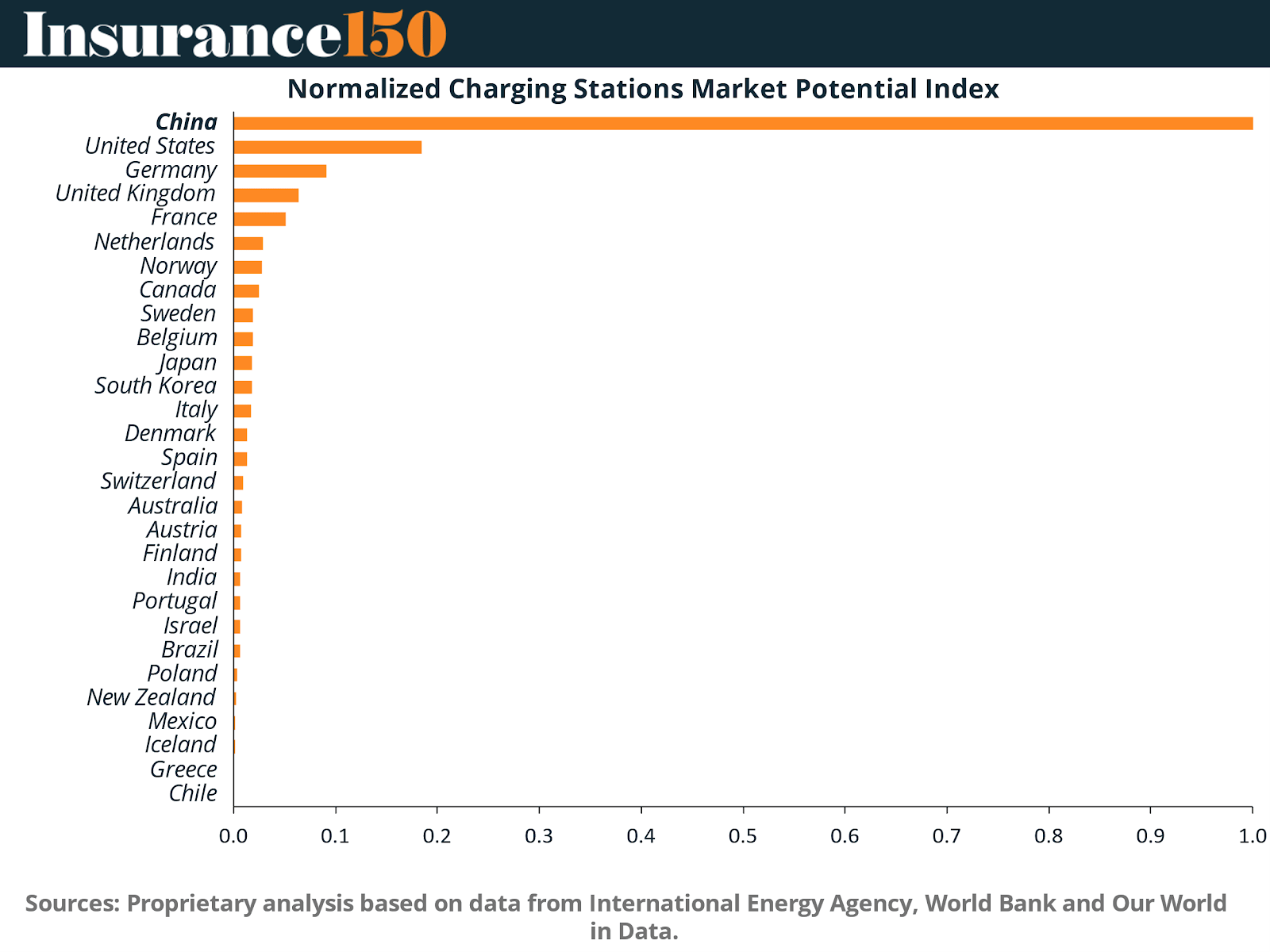

To prioritize markets, we developed our Normalized Charging Stations Market Potential Index.

This chart combines adoption rates, stock, and readiness to identify where charging stations represent the greatest infrastructure potential. For insurers, it is a proxy for where demand for specialized policies will accelerate fastest.

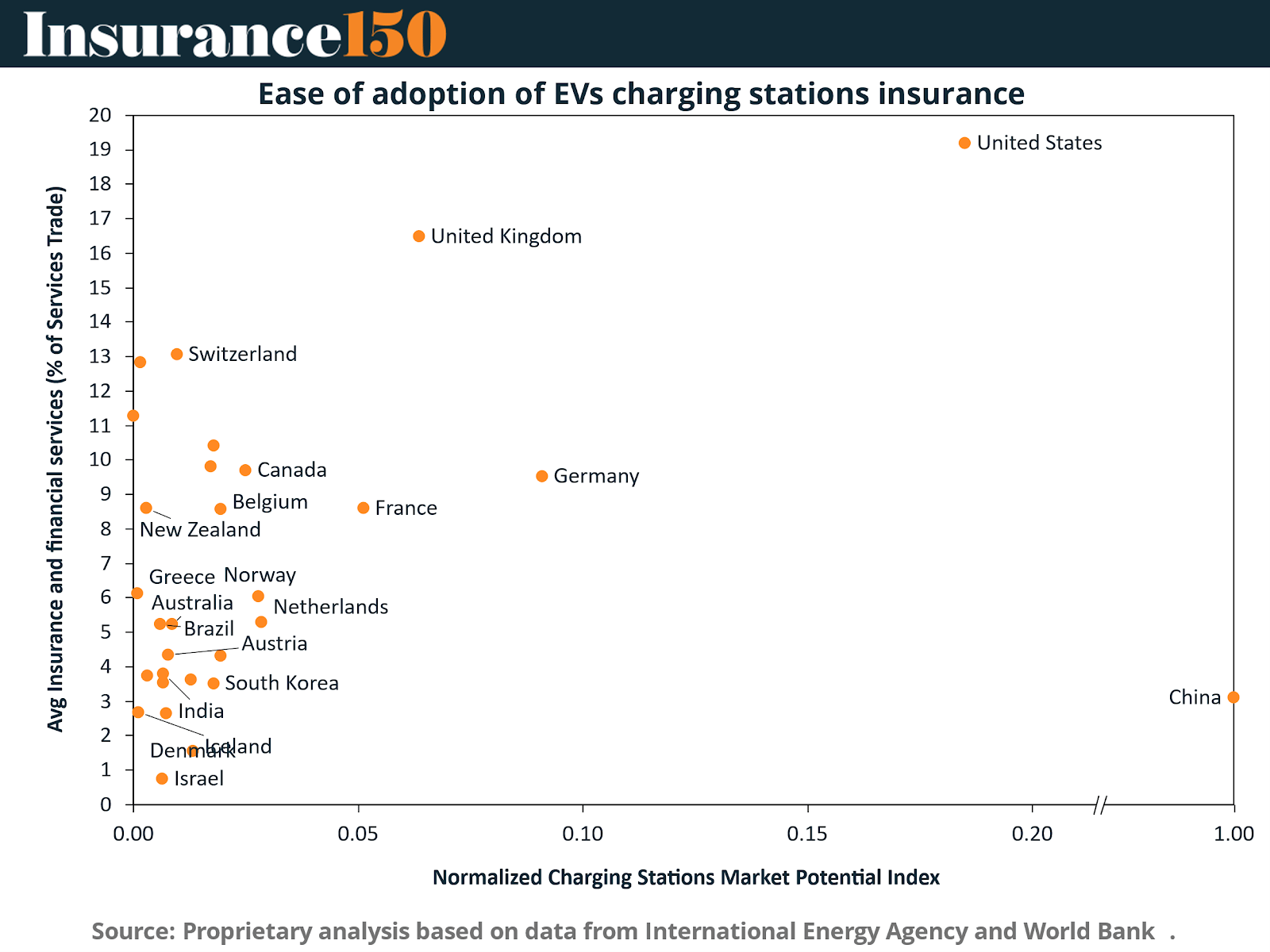

The insurance adaptation of the ease-of-adoption measure highlights countries where not only EV penetration but also insurance and financial infrastructure are mature enough to support specialized coverage. Markets such as the U.S., Germany, and Japan score highly, indicating near-term opportunities.

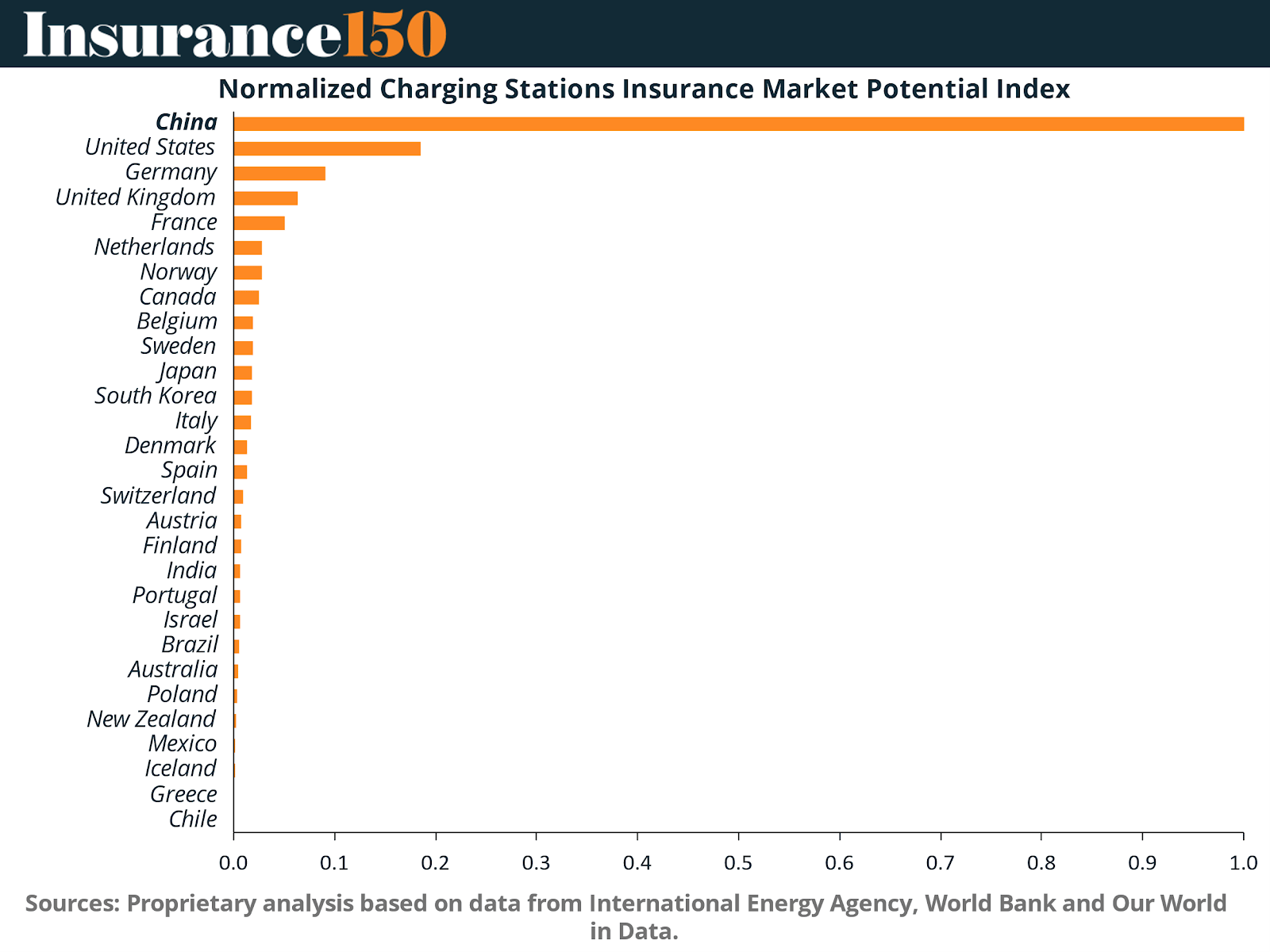

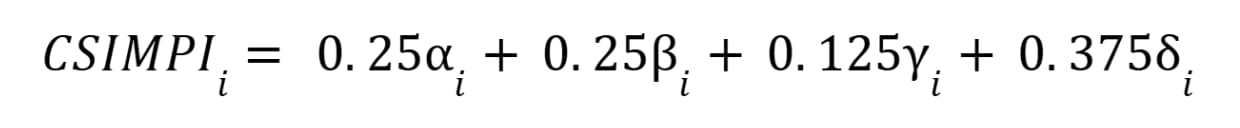

Our insurance-specific index is built as follows:

Where:

αᵢ = Share of new cars that are electric

βᵢ = Our ease of adoption of electric vehicles index that weighs country`s electricity density and GDP per capita.

γᵢ = Electric car stock

δᵢ = Average insurance and financial services as % of services foreign trade (our proxy for country`s maturity insurance).

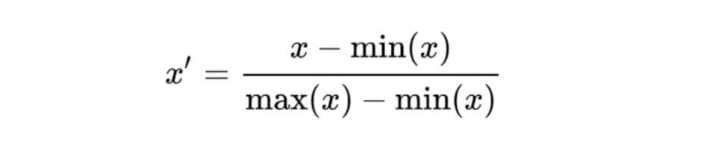

Normalization is then applied to the Index:

This formula ensures comparability across countries, scaling scores between 0 and 1. High-scoring countries represent prime opportunities for insurers, as they combine rising EV adoption with mature insurance markets and financial services penetration.

Regional Breakdown

Scale and growth differ sharply by region.

The distribution of EVs shows China, the U.S., and Europe leading in absolute numbers. For insurers, these represent the largest immediate markets for charging station coverage. However, scale also brings higher aggregated risk, requiring reinsurance strategies and capital buffers.

This chart underscores the presence of secondary but fast-growing markets such as South Korea, Canada, and Brazil. For insurers, these are attractive frontier opportunities — less saturated than China and Europe, but with strong growth potential.

U.S. Deep Dive

The United States deserves special attention due to its size, regulatory backing, and infrastructure deficit.

The forecast shows extraordinary growth, from $7.5 billion in 2022 to more than $114 billion by 2040. For insurers, this represents a massive expansion of premiums tied to property, liability, and cyber coverage.

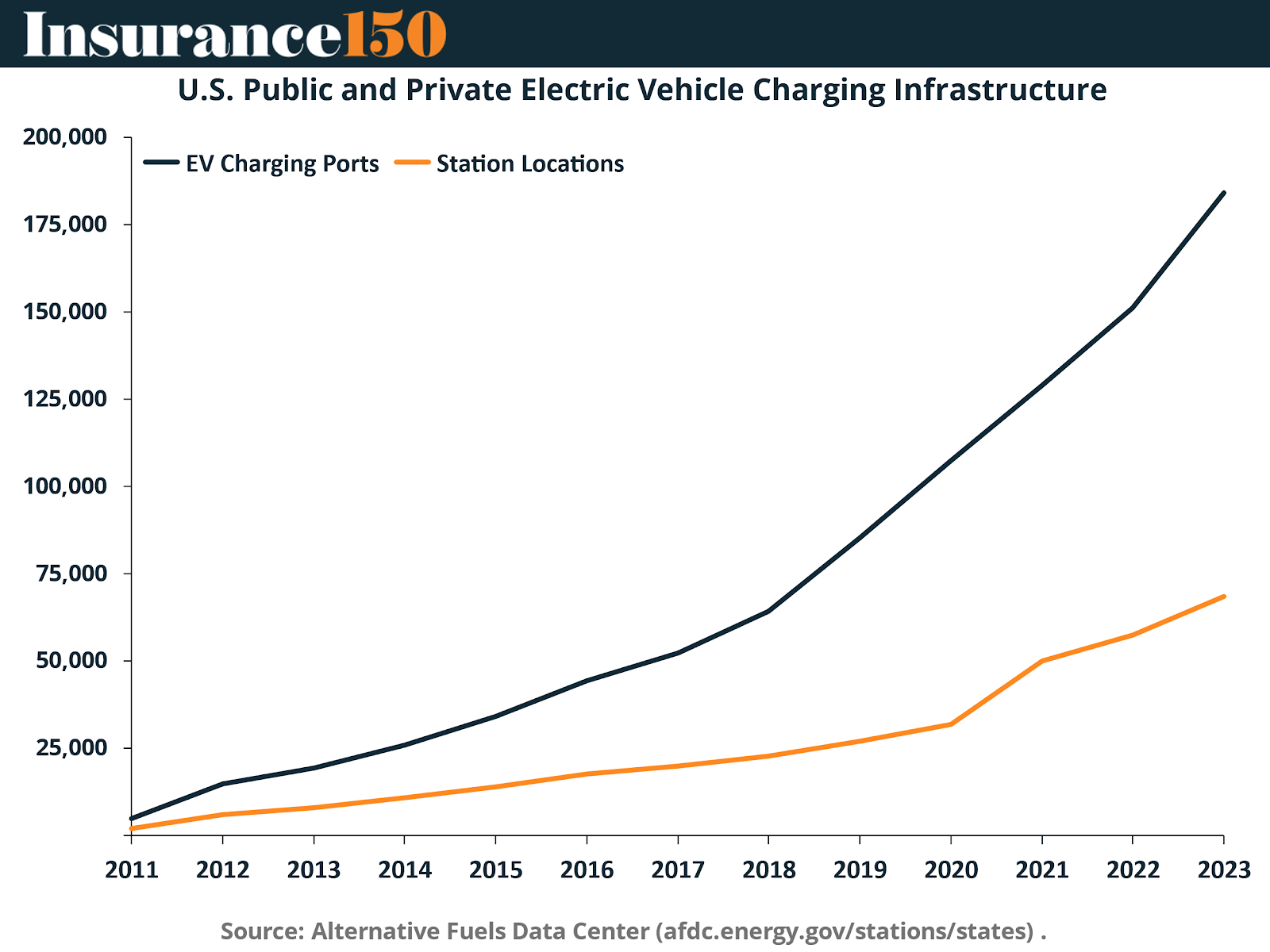

This breakdown between public and private infrastructure highlights differing insurance needs. Public stations face greater liability and cyber risks due to high traffic and exposure, whereas private fleet depots emphasize property and business interruption coverage.

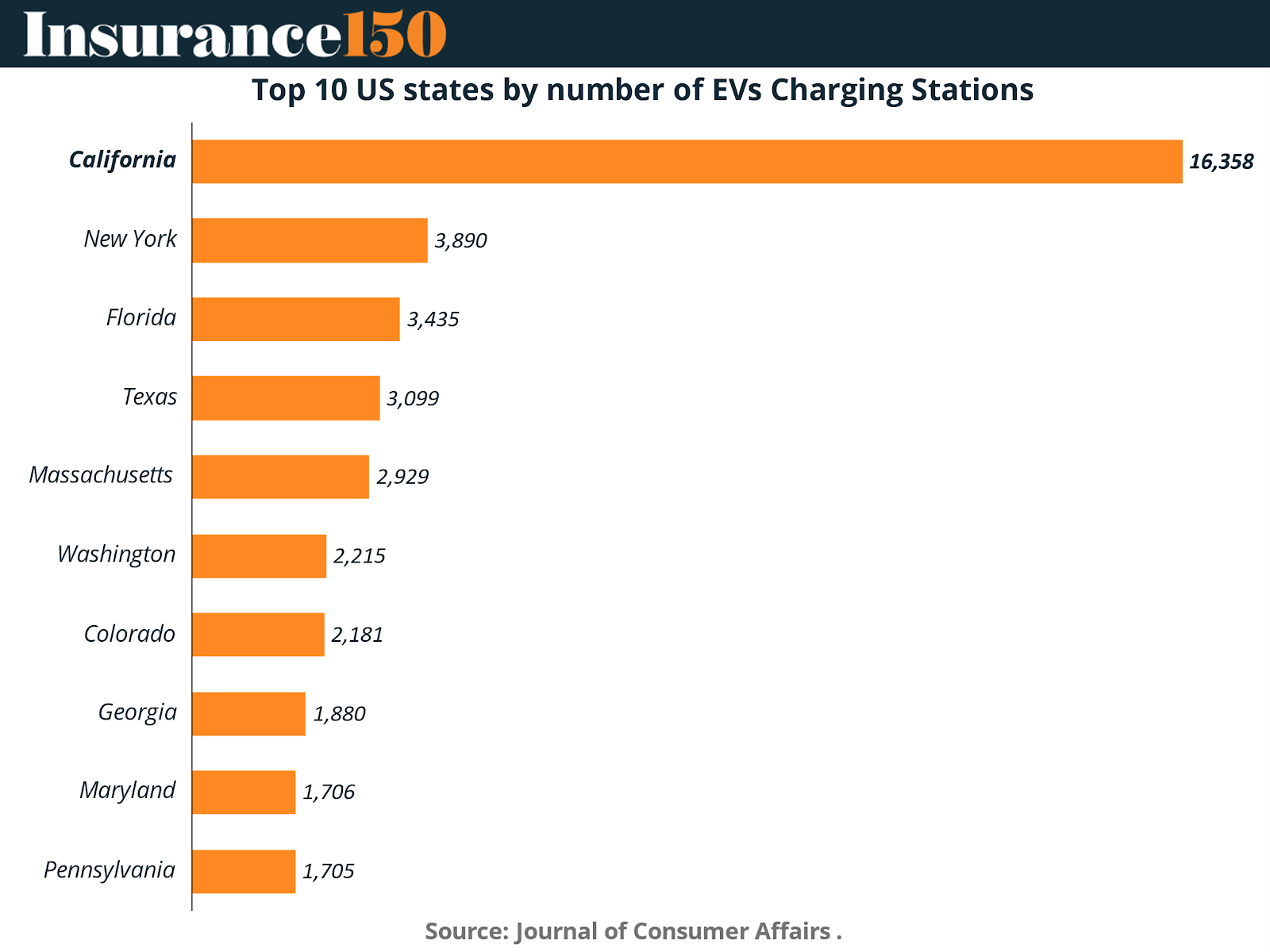

Geographically, charging infrastructure is concentrated in a handful of states. California alone accounts for over a quarter of all stations. Insurers must therefore manage concentration risk while developing tailored approaches for high-growth states like Florida, Texas, and Illinois.

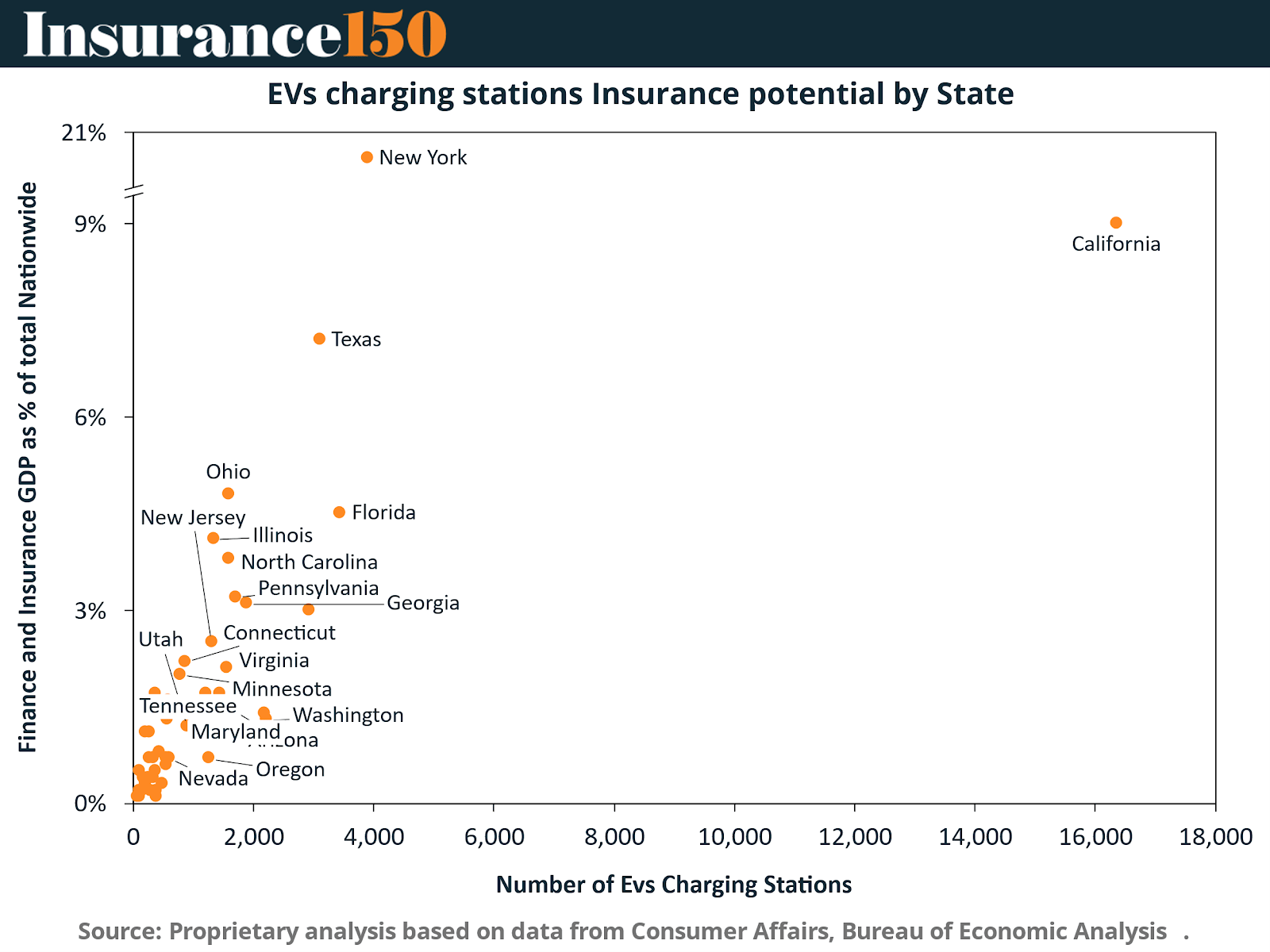

This chart identifies state-level insurance potential, combining adoption rates with station density. For insurers, it provides a roadmap to prioritize states with both rapid growth and insufficient current infrastructure. These areas present the highest near-term underwriting opportunities.

Conclusion

Electric vehicle charging stations are the backbone of the decarbonized mobility ecosystem. Their rapid deployment creates not only new infrastructure markets but also an entirely new class of insurable risks. Property damage, liability claims, cyber threats, and business interruption will increasingly shape the risk landscape of the EV era.

For insurance companies, this is a once-in-a-generation opportunity. By developing specialized products, aligning underwriting with the Normalized Charging Stations Insurance Market Potential Index, and focusing on high-growth regions and states, insurers can position themselves at the core of the EV revolution. Those that move early, innovate in coverage, and build expertise in this emerging risk class will secure long-term leadership in a market that is set to expand exponentially.

Sources & References

Bureau of Economic Analysis. (2025). Gross domestic product (GDP) by state: Finance and insurance. https://apps.bea.gov/itable/?ReqID=70&step=1&utm_source=chatgpt.com#eyJhcHBpZCI6NzAsInN0ZXBzIjpbMSwyOSwyNSwzMSwyNiwyNywzMF0sImRhdGEiOltbIlRhYmxlSWQiLCI1MDUiXSxbIk1ham9yX0FyZWEiLCIwIl0sWyJTdGF0ZSIsWyIwIl1dLFsiQXJlYSIsWyJYWCJdXSxbIlN0YXRpc3RpYyIsWyI1MSJdXSxbIlVuaXRfb2ZfbWVhc3VyZSIsIlBlcmNlbnRPZlVzIl0sWyJZZWFyIixbIjIwMjQiXV0sWyJZZWFyQmVnaW4iLCItMSJdLFsiWWVhcl9FbmQiLCItMSJdXX0=

Consumer Affairs, Journal of Consumer Research. (2024). How many EV charging stations are in the U.S.? 2025. https://www.consumeraffairs.com/automotive/how-many-ev-charging-stations-are-in-the-us.html#general-statistics

Driivz. (2025). 2025 State of Network Charging Operators. https://hs-5013832.f.hubspotemail.net/hubfs/5013832/Survey%20-%20State%20of%20EV%20Charging%20Network%20Op%2025/SoEVChargingNWOperators2025-FINAL.pdf

Evpost. (2025). EV Charging Station Insurance in USA: Complete Guide to Coverage, Cost & Benefits. https://evpost.in/ev-charging-station-insurance-in-usa-complete-guide-to-coverage-cost-benefits/

Grand View Research. (2025). Electric Vehicle Charging Infrastructure Market Size. https://www.grandviewresearch.com/industry-analysis/electric-vehicle-charger-and-charging-station-market#:~:text=The%20global%20electric%20vehicle%20charging,25.5%25%20from%202025%20to%202030

Insurance Business. (2024). EV charging stations – what are the risks and insurance implications? https://www.insurancebusinessmag.com/au/news/breaking-news/ev-charging-stations--what-are-the-risks-and-insurance-implications-477557.aspx

International Energy Agency. (2025). SDG7 Database. Historical time series on access to electricity and clean cooking (SDG 7.1) and progress towards SDG targets on renewables (SDG 7.2) and energy efficiency (SDG 7.3). https://www.iea.org/data-and-statistics/data-product/sdg7-database#energy-intensity

International Energy Agency. (2025). Global EV Data Explorer. https://www.iea.org/data-and-statistics/data-tools/global-ev-data-explorer

Lectron. (2024). Number of EV Charging Stations by State: 2024 Overview. https://ev-lectron.com/blogs/blog/number-of-ev-charging-stations-by-state-2024-overview?srsltid=AfmBOopw0c7MmCVOXY72sDnZN1skAEyLsYdOTk8cRYpFXj4LyNEYFNON

Market Research Future. (2025). Electric Vehicle Charging Station Market. https://www.marketresearchfuture.com/reports/electric-vehicle-charging-station-market-5401

NREL. (2024). Electric Vehicle Charging Infrastructure Trends from the Alternative Fueling Station Locator: Second Quarter 2024. https://afdc.energy.gov/files/u/publication/electric_vehicle_charging_infrastructure_trends_second_quarter_2024.pdf

Risk Strategies. (2024). EV Charging Stations: Risk Management and Insurance Planning. https://www.risk-strategies.com/blog/ev-charging-stations-risk-management-and-insurance-planning#:~:text=What%20are%20the%20insurance%20considerations,station%20fire%20causes%20environmental%20contamination

PE150. (2025). Electric Vehicle Charging Stations Market: A Private Equity Investment Thesis. https://www.pe150.com/p/electric-vehicle-charging-stations-market

PwC. (2025). The US electric vehicle charging market could grow nearly tenfold by 2030: How will we get there? https://www.pwc.com/us/en/industries/industrial-products/library/electric-vehicle-charging-market-growth.html

SwissRE. (2023). Gearing up for the electric vehicles ecosystem. https://www.swissre.com/dam/jcr:af04aa03-0d21-4b8d-afd2-8a2f2f9f614e/2023-01-sri-electric-vehicles-ecosystem-risks-value-chain-part-1.pdf

USI. (2024). Electric Vehicles: How to Navigate Heightened Risks and Insurance Challenges. https://www.usi.com/executive-insights/executive-series-articles/supplemental/property-casualty/q3-2024/electric-vehicles-how-to-navigate-heightened-risks-and-insurance-challenges/