- The Deal Brief - Insurance

- Posts

- Embedded Insurance

Embedded Insurance

The Business Case for Seamless Coverage.

Introduction

In recent years, embedded insurance has rapidly gained traction as a powerful tool for both insurers and non-insurance businesses to unlock new value. By integrating insurance products directly into the purchase journey of goods and services, whether it is a flight booking, a retail checkout, a ride-hailing app, or a SaaS subscription—companies are transforming a once tedious, fragmented process into a seamless part of the customer experience.

This evolution marks a shift in how insurance is not only distributed but also perceived. Instead of being sold separately through agents or complex portals, policies are now delivered at the moment of relevance, in just a few clicks—or sometimes with no clicks at all. As a result, embedded insurance is being hailed as a win-win: consumers receive protection when and where they need it, while businesses tap into a high-margin revenue stream that enhances customer trust and retention.

What is emerging now is Embedded Insurance 2.0—a more mature, flexible, and scalable version of the original model. Today, we are seeing insurance integrated not only into ecommerce and travel, but across creator platforms, vertical SaaS tools, gig economy apps, and buy-now-pay-later providers. These are not just product tie-ins, they are full-blown partnerships designed to provide contextual protection, deliver data-driven pricing, and expand access to underserved segments.

For platform companies, this trend represents a significant monetization opportunity. Insurance can be added without building underwriting capabilities or absorbing risk, allowing businesses to expand offerings while outsourcing complexity. For insurers, meanwhile, embedded models help lower distribution costs and reach new digital-native customers at scale—often in geographies or demographics that traditional models struggle to serve.

Yet success in this space depends on more than just adding a policy to the checkout page. Executing embedded insurance well requires sophisticated infrastructure, API integration, regulatory awareness, and user-centric design. There is also a growing emphasis on balancing automation with transparency: ensuring customers understand what they are buying without reintroducing friction that negates the value of embedding in the first place.

As competition intensifies and more sectors adopt this model, embedded insurance is increasingly becoming a strategic differentiator—a way for platforms to offer more comprehensive experiences and for insurers to future-proof their distribution. What was once seen as a novelty is now becoming the norm in how insurance is bought, sold, and experienced.

Market Size & Growth Outlook

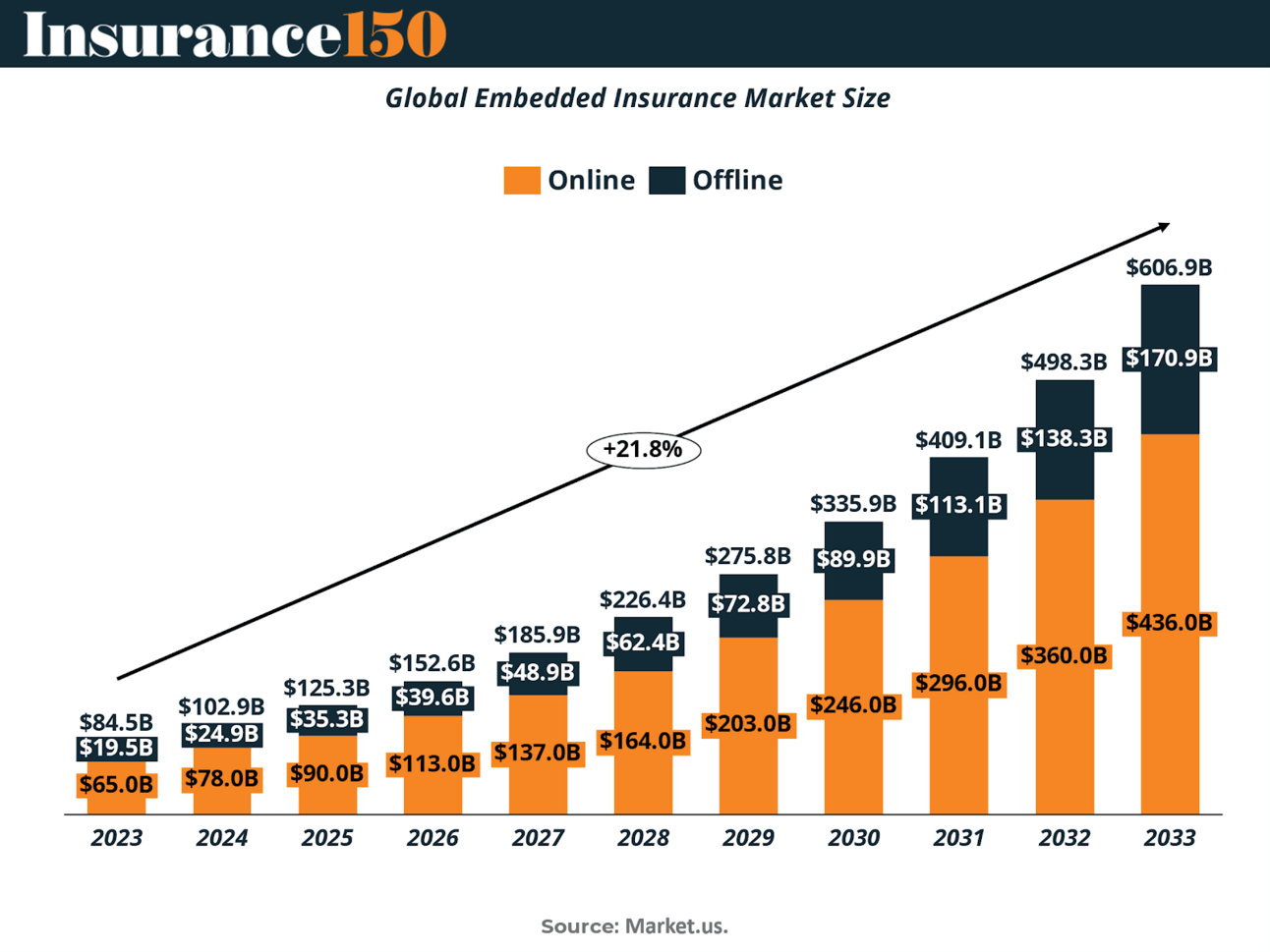

The embedded insurance market is undergoing a paradigm shift—transforming from a nascent distribution experiment into a mainstream commercial model reshaping the insurance landscape. According to Market.us, the global market size is projected to grow from $84.5 billion in 2023 to an estimated $606.9 billion by 2033, expanding at a compound annual growth rate (CAGR) of 21.8% over the forecast period.

The chart clearly illustrates the shift from early-stage adoption to large-scale integration, with online distribution leading the charge, supported by rising mobile penetration, API connectivity, and digital-first consumer expectations.

This growth is driven by a fundamental rethinking of how insurance is sold. Rather than pushing policies through traditional agents or clunky digital portals, embedded insurance integrates protection directly into the purchasing journey—whether that is at the point of sale in ecommerce, during a loan application, or as part of a ride-sharing experience. The result is a contextual, frictionless offering that aligns with what consumers increasingly expect: relevant coverage delivered instantly, with minimal effort.

In 2023, Asia-Pacific held a dominant position, capturing over 35.7% of global embedded insurance revenue, or approximately $30.2 billion. The region’s rapid adoption is fueled by mobile-first economies, government support for digital financial infrastructure, and widespread platform usage—from superapps in Southeast Asia to fintech ecosystems in India. According to TCS, India alone accounted for 35% of insurtech venture investments in Asia-Pacific, signaling deep market momentum.

At the same time, Western markets are seeing major structural change. In the United States, EY predicts that embedded channels will account for over 30% of all insurance transactions by 2028, with $70 billion in U.S. property & casualty premiums expected to flow through embedded models by 2030. This trend reflects the growing alignment between consumer convenience and commercial opportunity—especially in sectors like travel, retail, mobility, and BNPL lending.

From a supply-side perspective, insurers and technology firms are doubling down. According to Openkoda, a remarkable 94% of insurance executives now view embedded insurance as critical to their future strategy. Meanwhile, global insurtech investment hit $8.1 billion in the first three quarters of 2023 alone, a staggering increase from just $140 million a decade ago. The sector is quickly becoming a battleground for innovation and distribution advantage.

Technological advancement is central to this evolution. Innovations in machine learning, predictive analytics, and IoT are enhancing insurers’ ability to deliver personalized, real-time coverage. For example, smartphone sensors can now trigger automatic claims or instant replacements—streamlining the customer experience while reducing administrative costs. These capabilities are turning insurance from a post-sale afterthought into a proactive, value-added layer within broader product ecosystems.

Embedded insurance also offers businesses outside the insurance industry a unique opportunity to strengthen their value proposition. Whether it is a retailer offering theft protection, a travel app bundling cancellation insurance, or a SaaS platform embedding cyber coverage, companies are using embedded models to boost customer loyalty, increase revenue per transaction, and differentiate in crowded markets.

What began as a convenience play is now reshaping insurance economics, unlocking new distribution channels and enabling risk coverage to become an integrated part of everyday life. As the decade unfolds, embedded insurance will increasingly be judged not just by premiums sold, but by how well it creates value for platforms, users, and insurers alike.

Insurance Line Segment Analysis

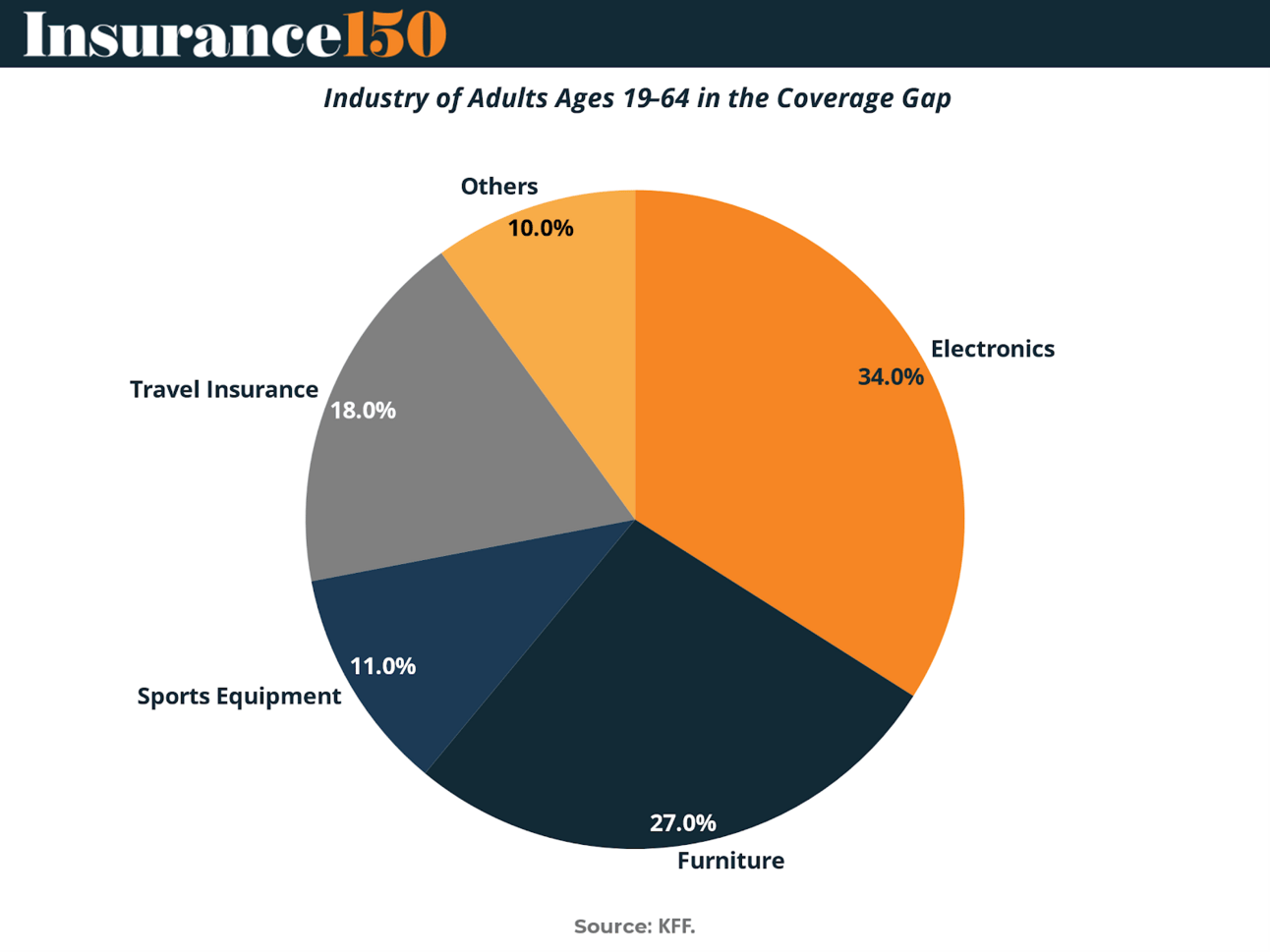

In 2023, the Electronics Insurance segment held a dominant position in the embedded insurance market, accounting for approximately 34% of total market share. This leadership reflects the growing consumer dependence on electronic devices and the rising cost of replacing them, which makes insurance an attractive option for consumers seeking financial protection against damage, loss, or theft.

This segment’s growth is driven by several factors. The ubiquity of personal electronics—such as smartphones, laptops, and tablets—has greatly expanded the potential customer base. As these gadgets become integral to daily life, the likelihood of accidental damage or malfunction increases, fueling demand for insurance coverage. Additionally, technological advancements have enhanced the value and price of these devices, further encouraging consumers to protect their investment.

Another factor supporting this growth is increased consumer awareness, driven by retail partnerships and aggressive marketing from insurers. By offering protection plans at the point of sale, embedded insurance eliminates friction in the buying process and boosts adoption rates.

As highlighted in the accompanying chart, Electronics Insurance leads the market, followed by Furniture and Travel Insurance. Looking ahead, the electronics segment is poised for further expansion, underpinned by the continued evolution of tech products, increasing internet penetration, and a broader push toward digitally integrated insurance experiences.

Growth Drivers: What’s Powering Embedded Insurance Adoption

Despite its growing pains, embedded insurance is rapidly gaining ground—driven by a convergence of technological innovation, shifting consumer behavior, and strategic alignment between insurers and digital platforms. These key forces are accelerating adoption across industries and geographies:

• Seamless Digital Checkout Is Now the Norm

Post-pandemic consumer behavior has shifted decisively toward frictionless, embedded experiences. Rather than navigating standalone portals, customers increasingly expect protection to be offered contextually—within the purchase flow. Recent surveys show that 31.6% of personal-lines buyers prefer embedded offers, particularly for high-frequency, low-consideration purchases like travel or electronics. As digital expectations rise, insurers are being pressured to adopt instant-bind APIs or risk exclusion from dominant platforms.

• Lower Customer Acquisition Costs for Insurers

With digital ad prices soaring, traditional direct-to-consumer strategies are becoming less sustainable. Embedded insurance sidesteps expensive lead-gen channels by tapping into ecosystems that already own customer attention. For example, Cover Genius generated over $500M in gross written premium in 2024 through embedded partnerships. This model also enables more precise underwriting through access to behavioral and transactional data.

• Regulatory Tailwinds for Inclusive Coverage

Global regulators increasingly see embedded insurance as a mechanism to close the protection gap—especially for underserved or underinsured populations. The U.S. NAIC’s 2024 strategic priorities explicitly endorse simpler, bundled products distributed through embedded channels. Similarly, the EU’s evolving insurance distribution rules encourage micro-policies with transparent disclosures.

• API-Driven Distribution Through BigTech and Fintech Partnerships

Tech-first ecosystems are becoming fertile ground for embedded insurance. In Japan, Smartpay and Chubb are embedding purchase protection into BNPL transactions—seamlessly offering coverage at the point of payment. These partnerships give insurers access to real-time, high-quality data for dynamic pricing and claims automation—creating a cycle of personalization and platform loyalty.

Challenges and Risks: What Could Derail Embedded Insurance’s Momentum

While embedded insurance offers transformational potential for insurers and platforms alike, its expansion is not without friction. As the model scales across industries and geographies, a range of operational, regulatory, and structural challenges have emerged—threatening to slow progress or introduce unintended complexity.

1. Regulatory Fragmentation and Compliance Burden

Embedded insurance must adhere to insurance regulations in every jurisdiction where it is sold—often down to the state or provincial level. Licensing requirements, disclosure rules, and capital adequacy standards vary widely, posing significant operational challenges for platforms that operate globally or across U.S. states. Smaller insurtechs may find it difficult to navigate this complexity without robust legal and compliance infrastructure, raising barriers to entry and potentially favoring incumbents.

2. Data Privacy and Consent Management

The real-time, data-driven nature of embedded insurance raises significant concerns around user privacy, consent, and data governance. Regulations like the EU’s GDPR and California’s CCPA impose strict standards on how customer data is collected, processed, and stored. With some embedded products relying on continuous data streams (e.g., from IoT devices or mobility apps), maintaining up-to-date consent and securing user trust is an ongoing—and resource-intensive—challenge.

3. Lack of Actuarial Depth for New Products

Many embedded offerings focus on micro-coverage or contextual, short-term policies—such as per-ride accident protection or short-stay travel insurance. These niche products often lack the historical actuarial data needed to build reliable underwriting models, making pricing and risk assessment difficult. The absence of benchmark loss ratios, fraud indicators, and usage patterns can inhibit both product development and profitability.

4. Channel Conflict with Traditional Distributors

As embedded insurance sidesteps brokers and comparison platforms, it introduces disintermediation risk that can alienate existing distribution partners. In markets where broker networks remain strong, such as parts of Europe and Latin America, this tension may lead to regulatory scrutiny or reduced market access. Traditional agents may also view embedded offerings as a threat to their commission-based models, creating resistance to innovation.

5. Risk of Oversimplification and Customer Misunderstanding

The core value of embedded insurance lies in its simplicity and speed—but there is a fine line between frictionless UX and lack of transparency. Consumers may not fully understand what they are buying if disclosures are compressed or overly streamlined. This can lead to dissatisfaction at claims time, eroding trust in both the platform and the insurer. Balancing ease of purchase with informed consent remains a design and regulatory challenge.

6. Misalignment with Customer Perceptions of Value

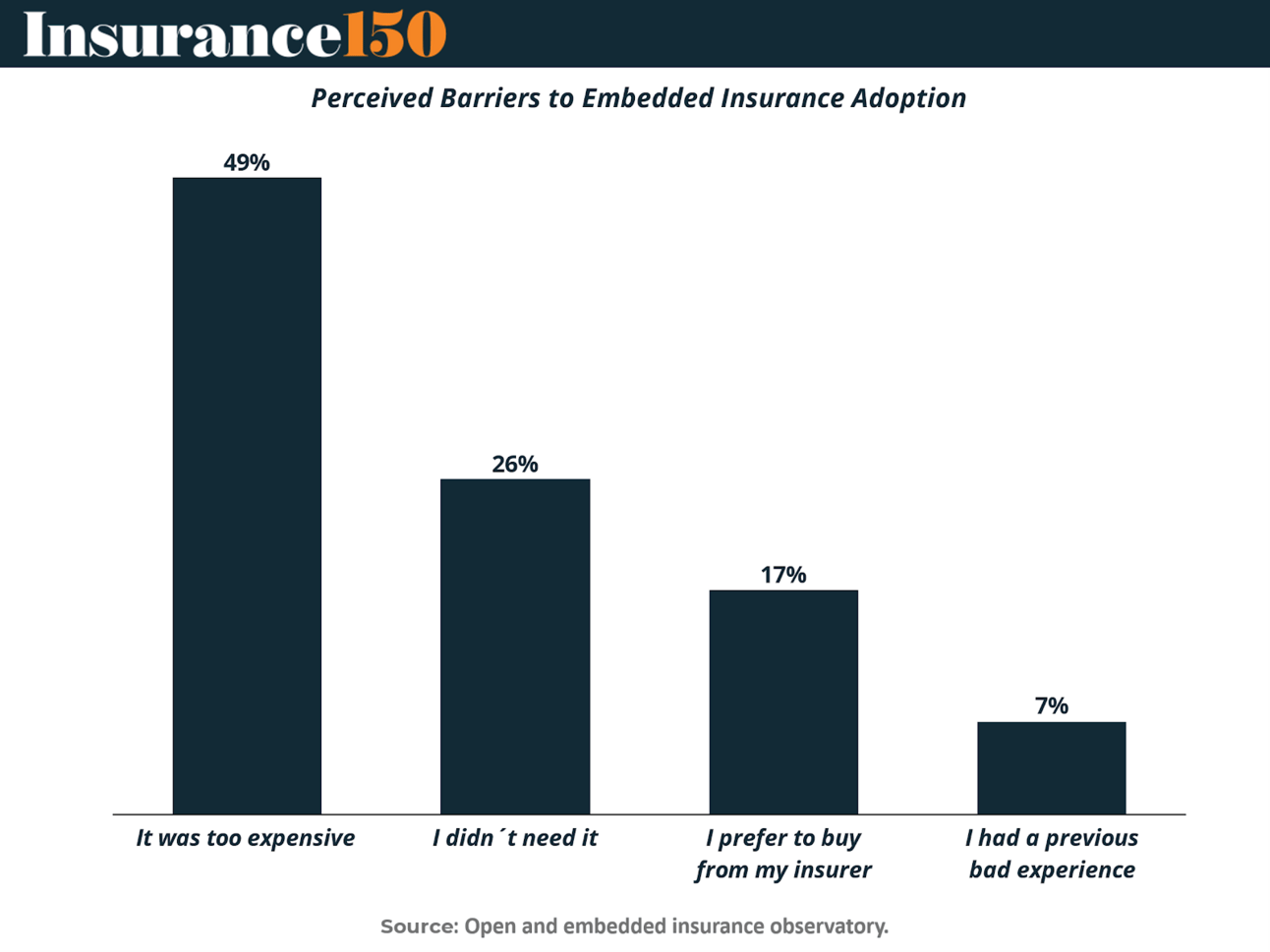

A 2022 survey by ReMark found that nearly half of respondents (49.4%) refused embedded insurance because they perceived it as too expensive. Another 26% said they simply did not need it, while 17.4% preferred to buy directly from their insurer. These results highlight a fundamental issue: convenience alone is not enough. For embedded insurance to succeed, it must feel relevant, personalized, and priced appropriately at the moment of offer. Without perceived value, even the most seamless integration can fall flat. Past bad experiences—cited by 7.2% of respondents—also underscore the long-term reputational risk of poor claims handling or unclear coverage.

Outlook: Embedded Insurance Moves from Innovation to Infrastructure

Embedded insurance is quickly transitioning from an experimental sales channel to a foundational growth engine for insurers, platforms, and fintech ecosystems. Adoption is accelerating across sectors—from travel and electronics to SaaS and the gig economy—driven by rising digital expectations, API maturity, and the proven ability to boost conversion and retention. As more platforms integrate insurance into their core user flows, embedded coverage is evolving from a convenience feature to an expected part of the digital experience.

Financially, the model is gaining traction not just because it improves unit economics—lower CAC, higher LTV—but because it unlocks new monetization layers for non-insurance businesses. Platforms can now generate recurring, high-margin revenue without taking on underwriting risk, while insurers gain scalable access to hard-to-reach customer segments. Investment is following suit: embedded-first insurtechs are attracting outsized funding relative to traditional players.

Looking ahead, the winners in this space will be those that treat embedded insurance not as an add-on but as strategic infrastructure—deeply integrated, data-enriched, and responsive to evolving user needs. As personalization improves and partnerships deepen, embedded insurance will become a critical lever for financial inclusion, customer loyalty, and risk mitigation at scale—marking a durable shift in how protection is delivered and monetized in the digital economy.

Conclusion

Embedded insurance has evolved from a convenience feature into a foundational component of modern digital commerce. As insurance products are increasingly integrated into ecommerce checkouts, SaaS subscriptions, BNPL flows, and gig platforms, the model is transforming how risk coverage is bought, delivered, and perceived.

What we are witnessing is not just an innovation in distribution, but a structural shift in the insurance value chain. Insurers gain lower customer acquisition costs and access to hard-to-reach, digital-first segments. At the same time, platform companies unlock high-margin, recurring revenue streams without the complexity of underwriting or claims management.

However, the promise of Embedded Insurance 2.0 comes with executional demands. Success hinges on strong infrastructure, API connectivity, regulatory awareness, and thoughtful user experience design. Trust, transparency, and perceived value must be preserved even as coverage becomes more seamless and automated.

Despite regulatory hurdles, data privacy concerns, and the lack of actuarial depth in niche products, momentum continues to build. As more sectors adopt embedded models and investment accelerates, embedded insurance is poised to move from a differentiator to an industry standard—reshaping how protection is delivered in the digital economy.

In the decade ahead, the winners will be those that treat embedded insurance not as an add-on, but as a core strategic capability—built for scale, powered by data, and designed around customer needs.

Sources & References

Embedded Insurance Market Overview

https://www.mordorintelligence.com/industry-reports/embedded-insurance-market

Global Embedded Insurance Market Report

https://market.us/report/embedded-insurance-market/

What Is Embedded Insurance 2.0?

https://fintech.global/2025/04/22/what-is-embedded-insurance-2-0-the-future-of-effortless-coverage/