- Insurance 150

- Posts

- From Barns to Blockchain: What’s Moving the Insurance Needle

From Barns to Blockchain: What’s Moving the Insurance Needle

Farmer land insurance fuels steady growth, emissions hit an inflection point, and insurtech reshapes global markets while compliance tightens the screws.

Good morning, ! This week we’re diving into the global farm and ranch insurance market size,greenhouse gas emissions forecasted to fall for the first time, the Insurtech market share by region, and PWC’s third party risk framework.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

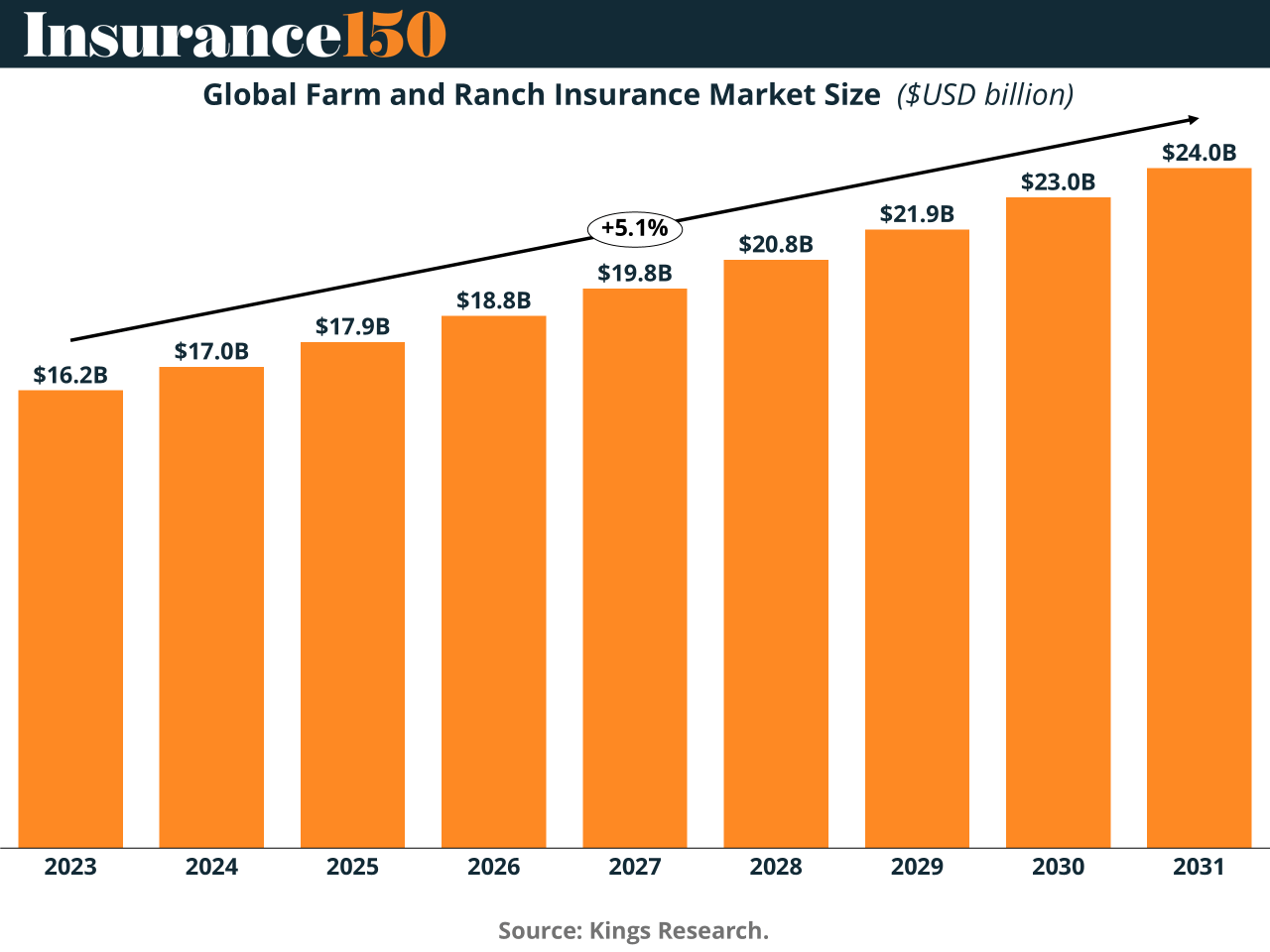

Ground Game: Insuring the Farm Floor

Call it the real asset class hiding in plain sight: farmer land insurance is quietly becoming a mid-single-digit growth engine, and the math behind it is compelling. As per-acre land values appreciate, insured limits rise by default. But it’s not just inflation—it’s productivity, climate volatility, and capital intensity.

The kicker? Even though agricultural acreage is shrinking, output keeps climbing. That creates a scarcity premium on high-quality land and feeds demand for more comprehensive, tech-driven coverage—from hoop houses to frost fans.

Region matters: specialty-crop zones in the U.S., EU, and Japan need blanket limits and parametric overlays; emerging markets like Brazil and Indonesia lean on hybrid packages and credit-linked placement.

Bottom line: as farms become more like factories, the property & liability footprint expands, making this segment one of the most durable premium drivers in insurance today.

TREND OF THE WEEK

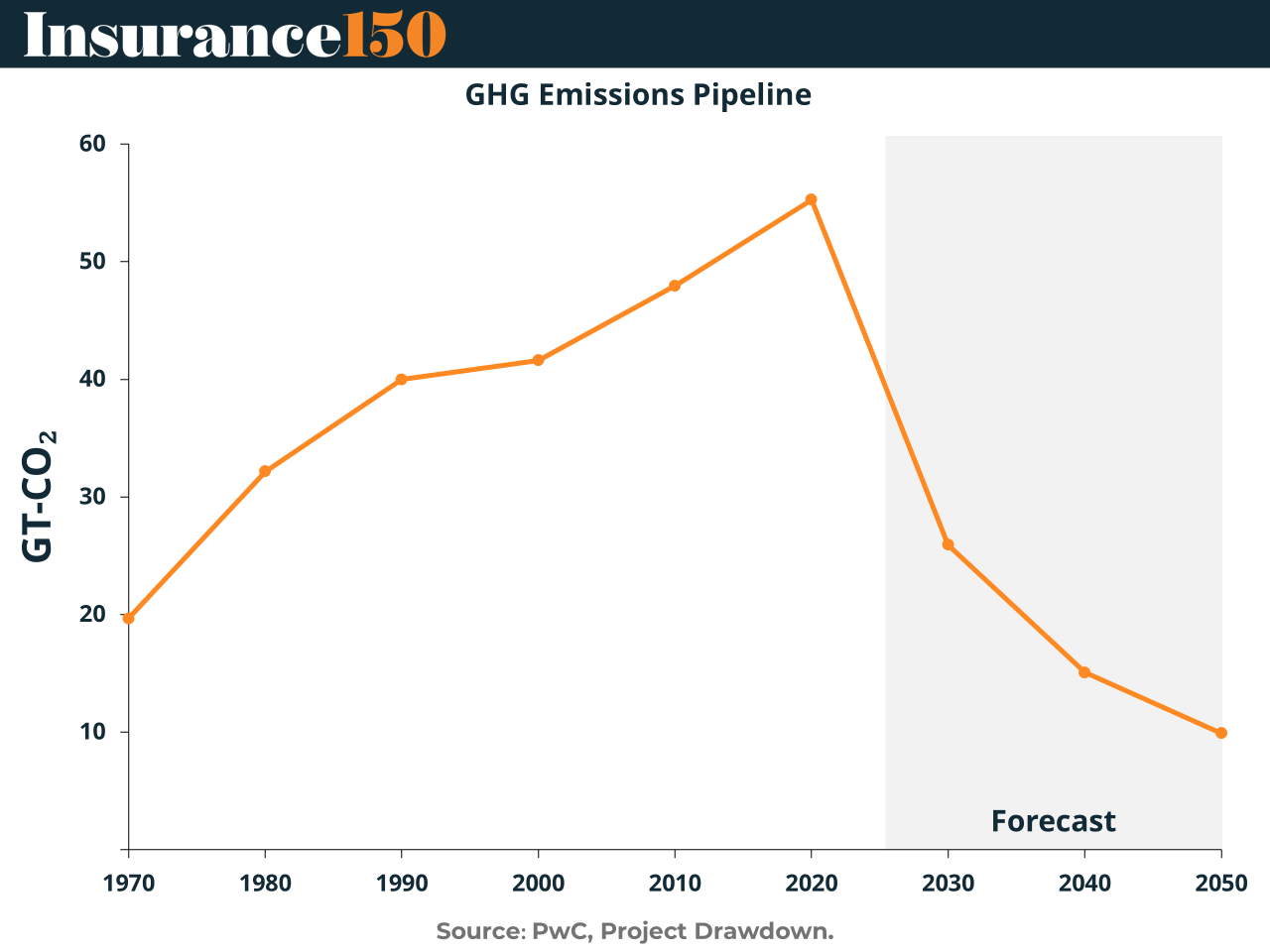

The Carbon Curveball: Underwriting in a Burning World

Greenhouse gas emissions are finally forecast to fall, but the insurance industry won’t be catching a break anytime soon. Catastrophe claims hit $118B in 2023, and climate models predict continued spikes in severity and frequency of perils. The real issue? Risk transfer is breaking down. Insurers are pulling out of markets, regulators are hamstrung, and underwriting is becoming a slow retreat from volatility.

The PwC chart tells the story: emissions are peaking now, but damage is just getting started. Climate resilience isn’t just a moral imperative—it’s the only path to a functional insurance market. Net-zero underwriting, embedded green tech, and climate-linked parametric products are no longer niche ideas—they’re survival tools. And without them, we’re headed straight for insurance deserts. (More)

PRESENTED BY BEEHIIV

This newsletter you couldn’t wait to open? It runs on beehiiv — the absolute best platform for email newsletters.

Our editor makes your content look like Picasso in the inbox. Your website? Beautiful and ready to capture subscribers on day one.

And when it’s time to monetize, you don’t need to duct-tape a dozen tools together. Paid subscriptions, referrals, and a (super easy-to-use) global ad network — it’s all built in.

beehiiv isn’t just the best choice. It’s the only choice that makes sense.

MICROSURVEY

What’s the biggest barrier to closing deals today? |

DEAL OF THE WEEK

DB Insurance Makes a $1.65B U.S. Bet

South Korea’s DB Insurance is acquiring Fortegra Group for $1.65 billion, marking the first-ever U.S. insurer purchase by a Korean non-life carrier. The Jacksonville-based specialty insurer, backed by Tiptree since 2014, has grown its revenue from $179M to nearly $1B over the past decade—a 5.5x jump.

Why it matters: Fortegra is a niche underwriter with deep roots in admitted and surplus lines, known for underwriting consistency and high-agent loyalty. DB Insurance gains immediate U.S. market access and a springboard into Europe, supercharging its ambition to become a global insurance leader by 2033.

The deal ensures operational independence for Fortegra but comes with DB’s A+ financial backing, $45B in assets, and a mandate to scale. For DB, it’s a bet on growth through specialty underwriting. For Fortegra, it’s the war chest and global reach to expand faster—without the IPO headache.

Target close: mid-2026.

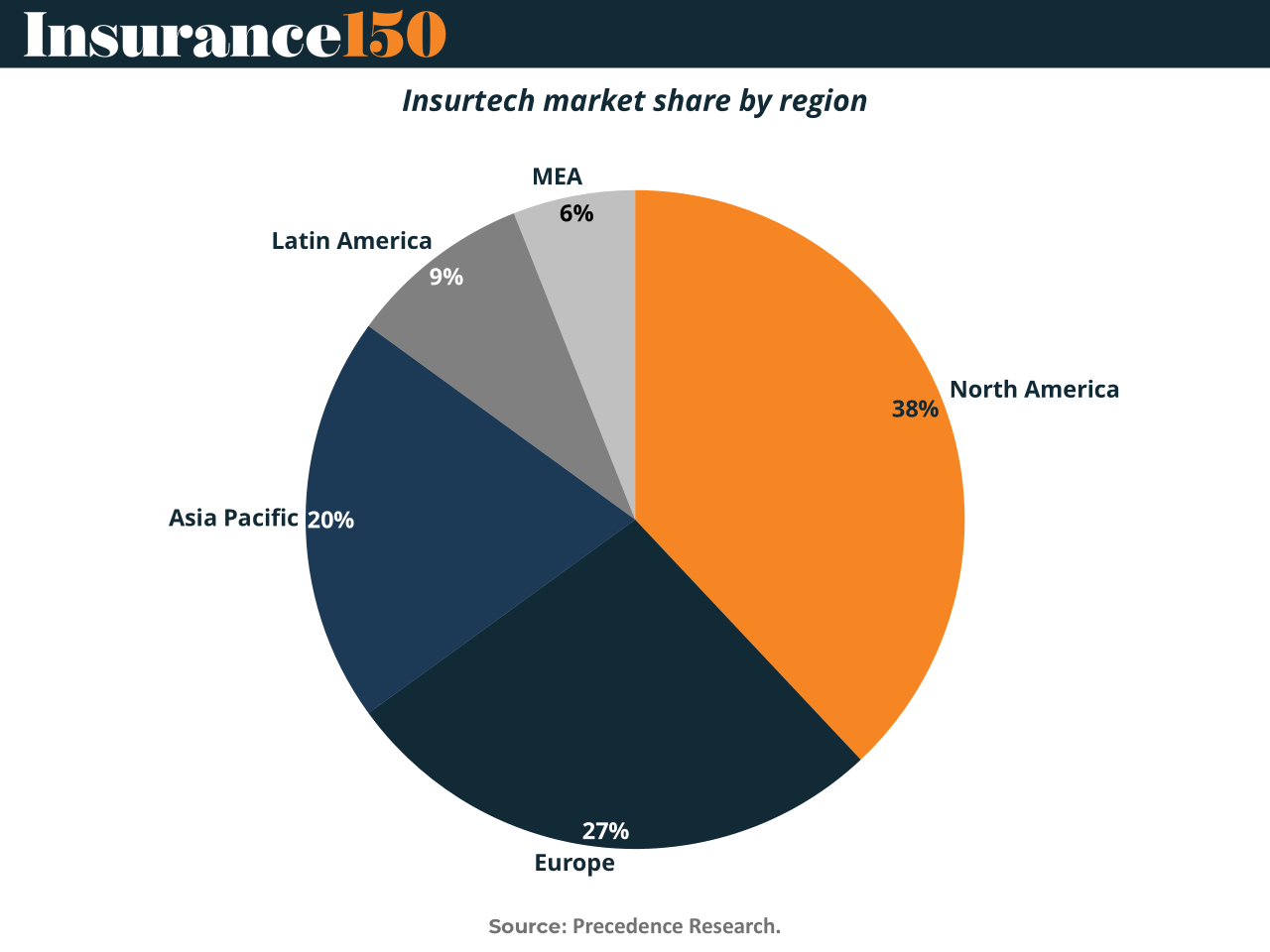

INSURTECH CORNER

North America Leads, Asia Pacific Surges

The global insurtech market isn’t growing evenly. North America (38%) remains the innovation hub, powered by venture capital and a mature insurance ecosystem. Europe (27%) follows, with regulators nudging carriers toward digital-first models and embedded insurance. But the real growth story is Asia Pacific (20%), where smartphone adoption and AI-driven underwriting are fueling a wave of startups in China and India. Latin America (9%) and MEA (6%) are still early-stage, but microinsurance and financial inclusion are widening protection gaps—and opportunities. The bottom line: insurtech is global, but scaling requires a local playbook. (More)

TOGETHER WITH BEEHIIV

beehiiv is the one platform that does everything for your newsletter. And they do mean everything:

A newsletter editor that makes your words shine like they belong on a bestseller list

A no-code website builder that doubles as your 24/7 subscriber magnet

Revenue tools that make earning money so easy it feels like cheating: ads, referrals, and paid subs

If you’ve got a newsletter (or even just the idea for one), beehiiv is the ultimate no-brainer.

Start for free on the absolute best platform for newsletters. No credit card required.

MACROECONOMICS

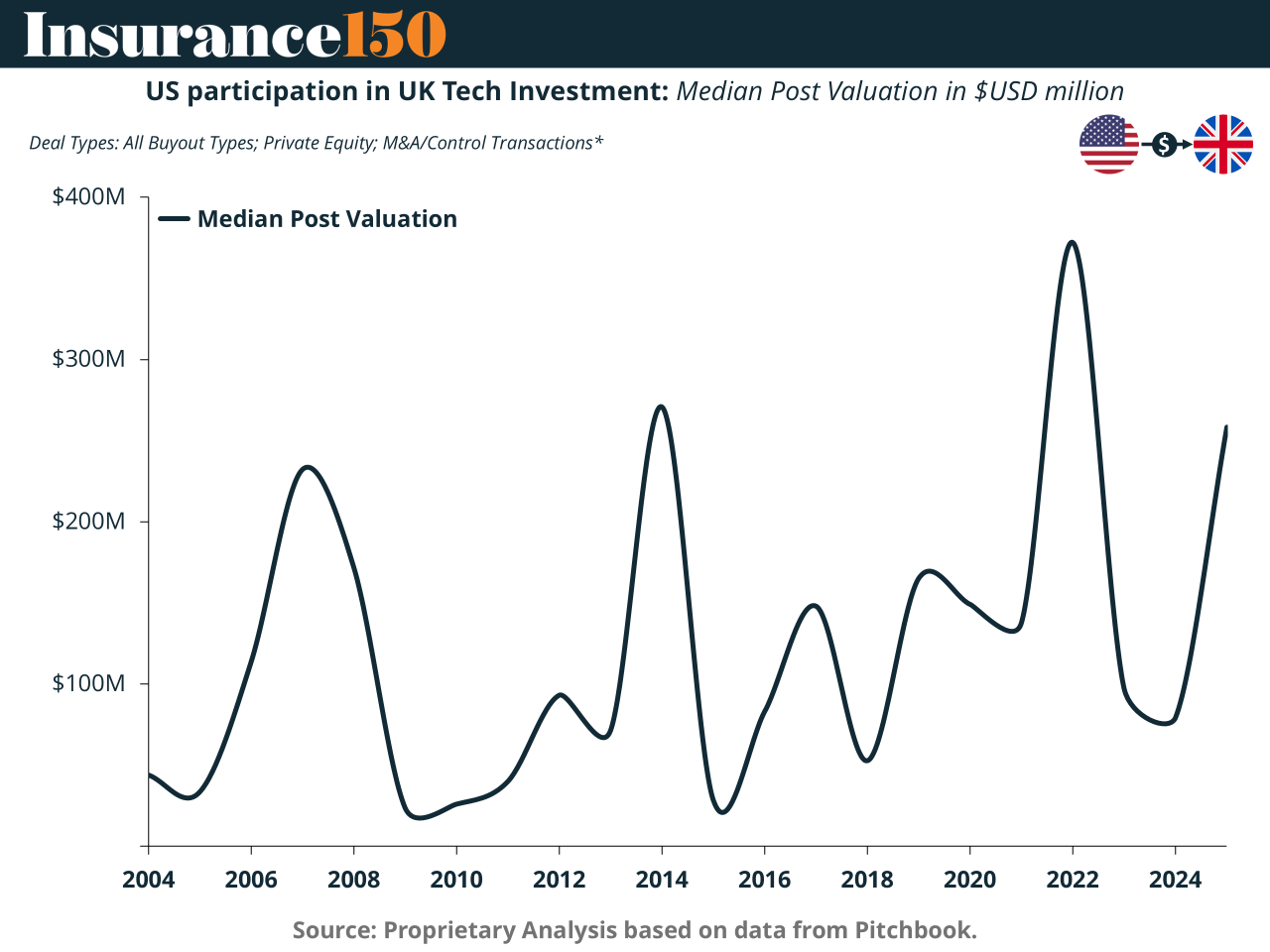

US-UK Deal: Techno-Soft Landing

The $42B US-UK “Tech Prosperity Deal” is less about AI supercomputers and more about macroeconomic tailwinds. With central banks easing rates, this mega-pact arrives just as the cost of capital drops—a rare alignment of geopolitics and monetary policy. Think of it as QE for quantum infrastructure. If the Fed and BoE stay dovish, expect cross-border M&A to accelerate, especially in AI, biotech, and civil nuclear energy. A “soft landing” used to be a macroeconomic pipedream. Now? It’s the potential launchpad for transatlantic PE expansion. (More)

COMPLIANCE CORNER

Compliance Grows Teeth: No One Insures Reputations

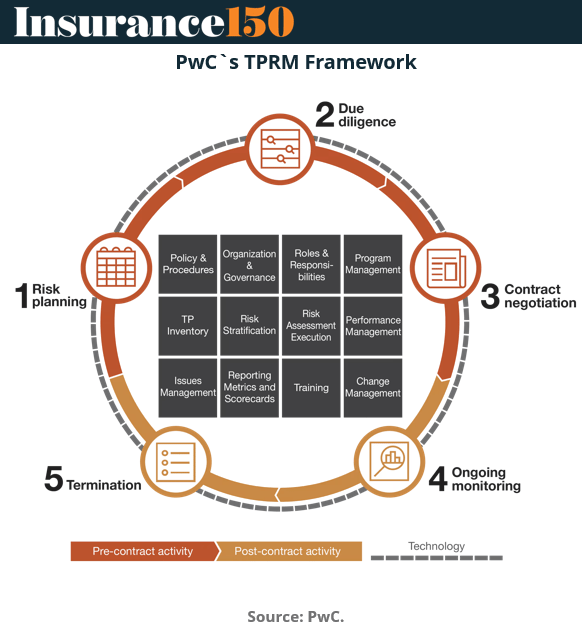

Third-party risk has officially outgrown the compliance basement. As insurers lean harder on outsourcing, governance is shifting from fragmented functions to centralized teams, often reporting directly to the CRO or COO. These teams are embedding risk frameworks into onboarding, procurement, and even real-time incident monitoring. Why? Because reputational damage isn’t insurable, and in a world where misinformation spreads faster than premiums rise, brand trust can unravel overnight. Some firms are even deploying AI tools to flag supplier threats before they escalate. The takeaway: third-party risk management is now a boardroom issue, not a back-office checklist. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

$LMND is aiming to disrupt the $7.5T insurance market.

With a current market cap of just $4B, it’s easy to see why a 10x from here isn’t just possible — it’s conservative: 🧵

— Daniel (@danielisdizzy)

1:19 PM • Sep 30, 2025

"You don't need to be a genius or a visionary or even a college graduate to be successful. You just need a framework and a dream."

Michael Dell