- The Deal Brief - Insurance

- Posts

- Gross Capital Formation: Your New Favorite KPI That Actually Predicts Winners

Gross Capital Formation: Your New Favorite KPI That Actually Predicts Winners

Economic growth does not happen by accident.

The Investment Engine: Gross Capital Formation and the Path to Prosperity

At the heart of this transformation lies Gross Capital Formation (GCF) — the share of national output (GDP) invested into productive assets like infrastructure, factories, housing, machinery, and technology.

When we look at the world’s most successful economies, a consistent pattern emerges: sustained investment rates fuel income growth, innovation, and improved living standards. This article explores how GCF as a percentage of GDP is a foundational lever for economic development, using global data and the impressive stories of the Asian Tigers to illustrate the point.

I. The Golden Equation: Savings → Investment → Growth

The basic engine of wealth creation in any country follows a simple, intuitive chain:

People save — setting aside part of their income instead of consuming it.

Savings are transformed into investment, either by entrepreneurs, corporations, or the government.

Investment expands the productive capacity of the economy, leading to job creation, innovation, and higher incomes.

This chain breaks down if a country fails at any of these stages. If people do not trust financial institutions, they won't save. If savings can't be directed into productive investments due to corruption, bureaucracy, or a weak legal system, growth stalls.

Therefore, nations must build systems that make saving worthwhile and investing easy. That includes:

Property rights protection

Ease of doing business

Efficient regulation

Open trade policies

Political stability

These ingredients attract both domestic and foreign investors, increasing the GCF ratio — the percentage of GDP that is reinvested into the economy.

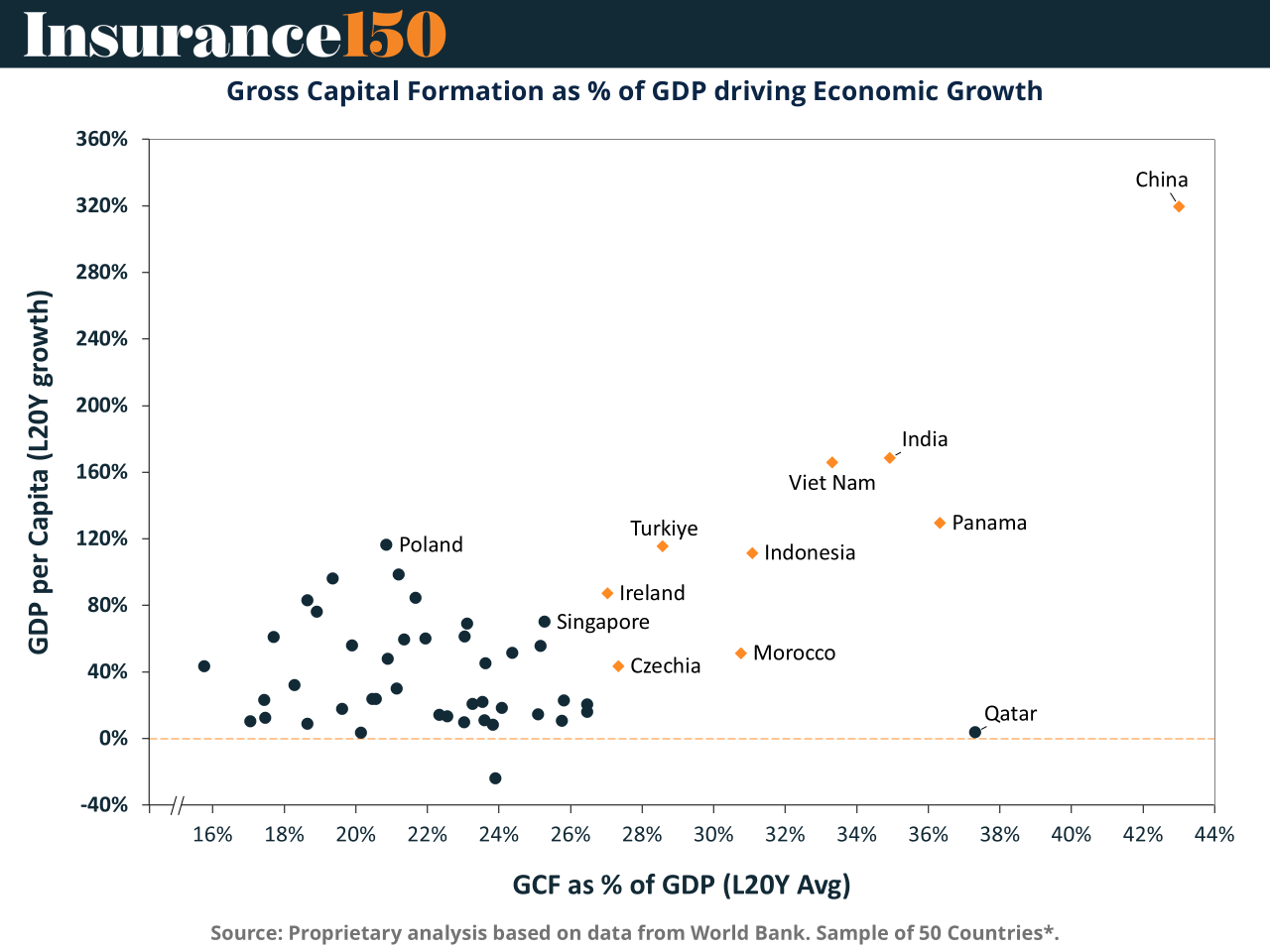

The previous chart reveals a strong relationship between high GCF and long-term GDP per capita growth. China, India, and Vietnam — countries with sustained high investment rates — have seen outsized economic expansion.

II. The Asian Tigers: A Case Study in Investment-Led Transformation

Few regions exemplify the power of investment-driven growth like the Asian Tigers — Hong Kong SAR, Singapore, South Korea, and Taiwan. In 1960, these economies were largely poor, agrarian, and recovering from war or colonial rule. Today, they are high-income, global leaders in innovation and manufacturing.

How did they do it?

1. High Investment Rates

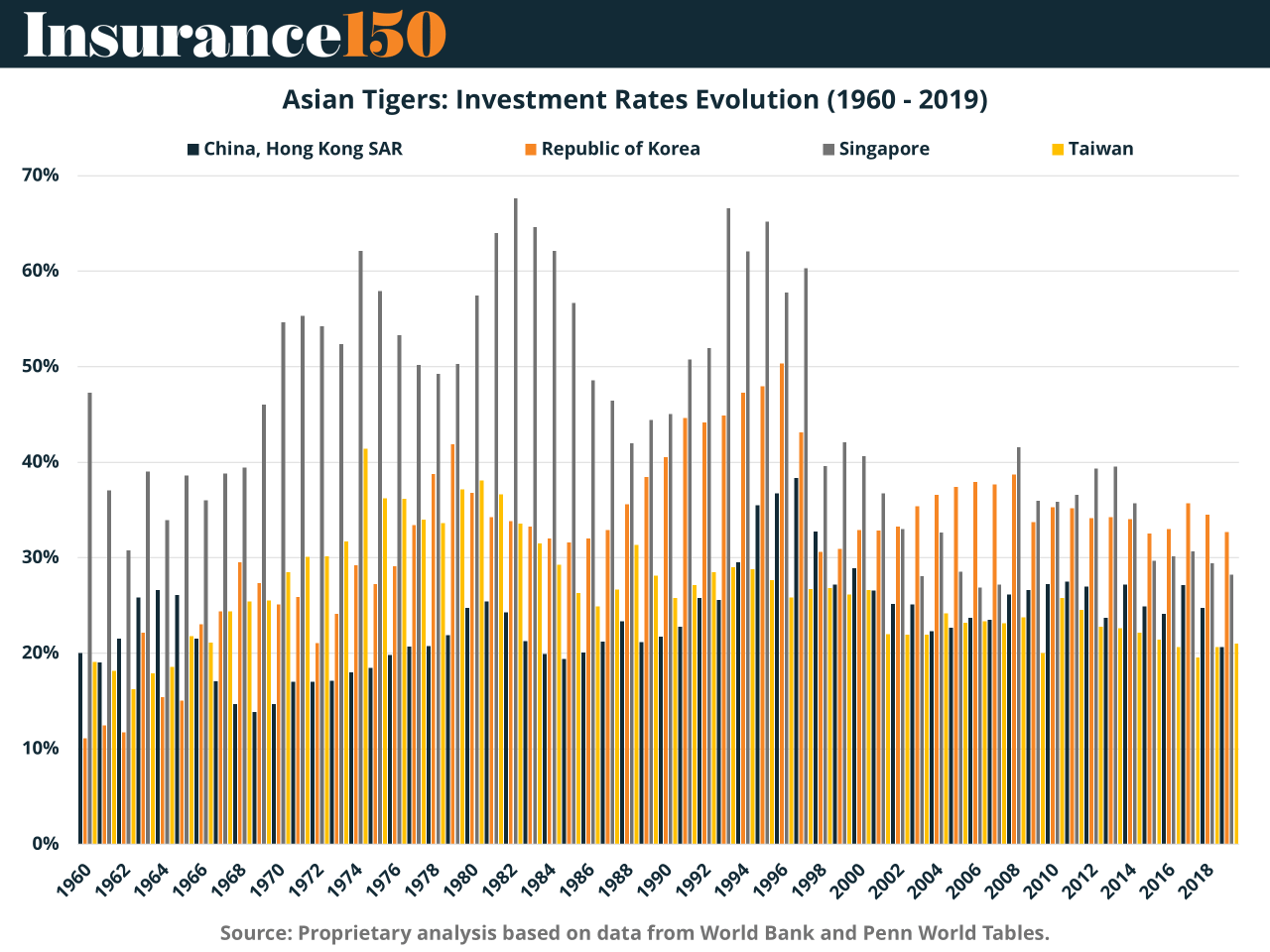

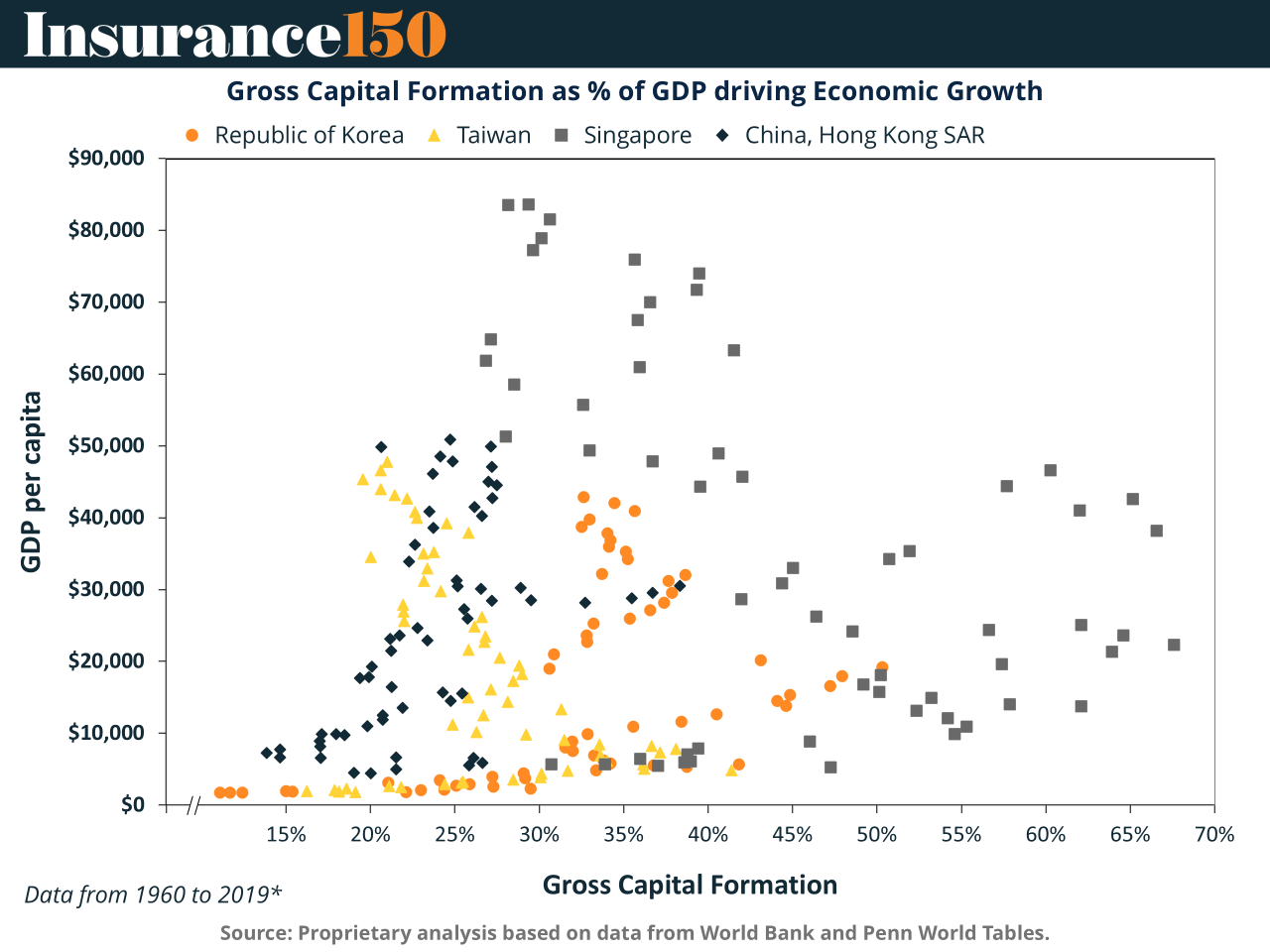

As seen in the chart above, all four countries consistently invested 25% to 40% of their GDP back into the economy for several decades — a level far above the global average. This capital formation built roads, ports, schools, factories, and power grids, laying the foundation for economic takeoff.

2. Business-Friendly Environments

Governments in these countries:

Respected contracts and property rights

Streamlined bureaucracy

Encouraged exports

Invested heavily in education and technology

Welcomed foreign direct investment (FDI)

This approach unlocked not just domestic savings, but attracted billions in foreign capital, enabling rapid industrialization and technological upgrading.

3. Spectacular GDP Growth

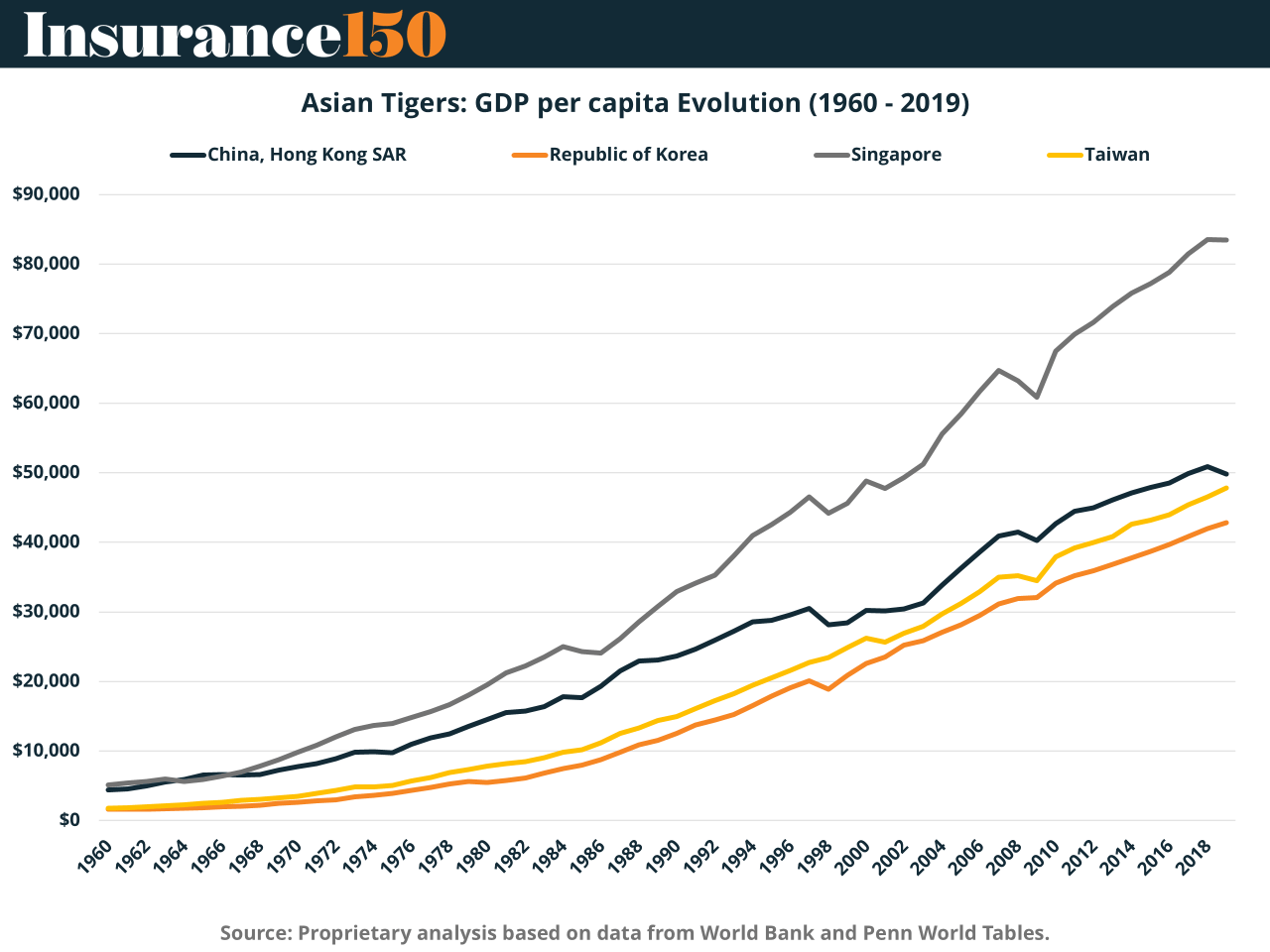

From just a few hundred dollars in the 1960s, per capita income in Singapore now exceeds $80,000, and Taiwan, Korea, and Hong Kong are not far behind. This wasn’t random — it was engineered through consistent investment and pro-growth policy.

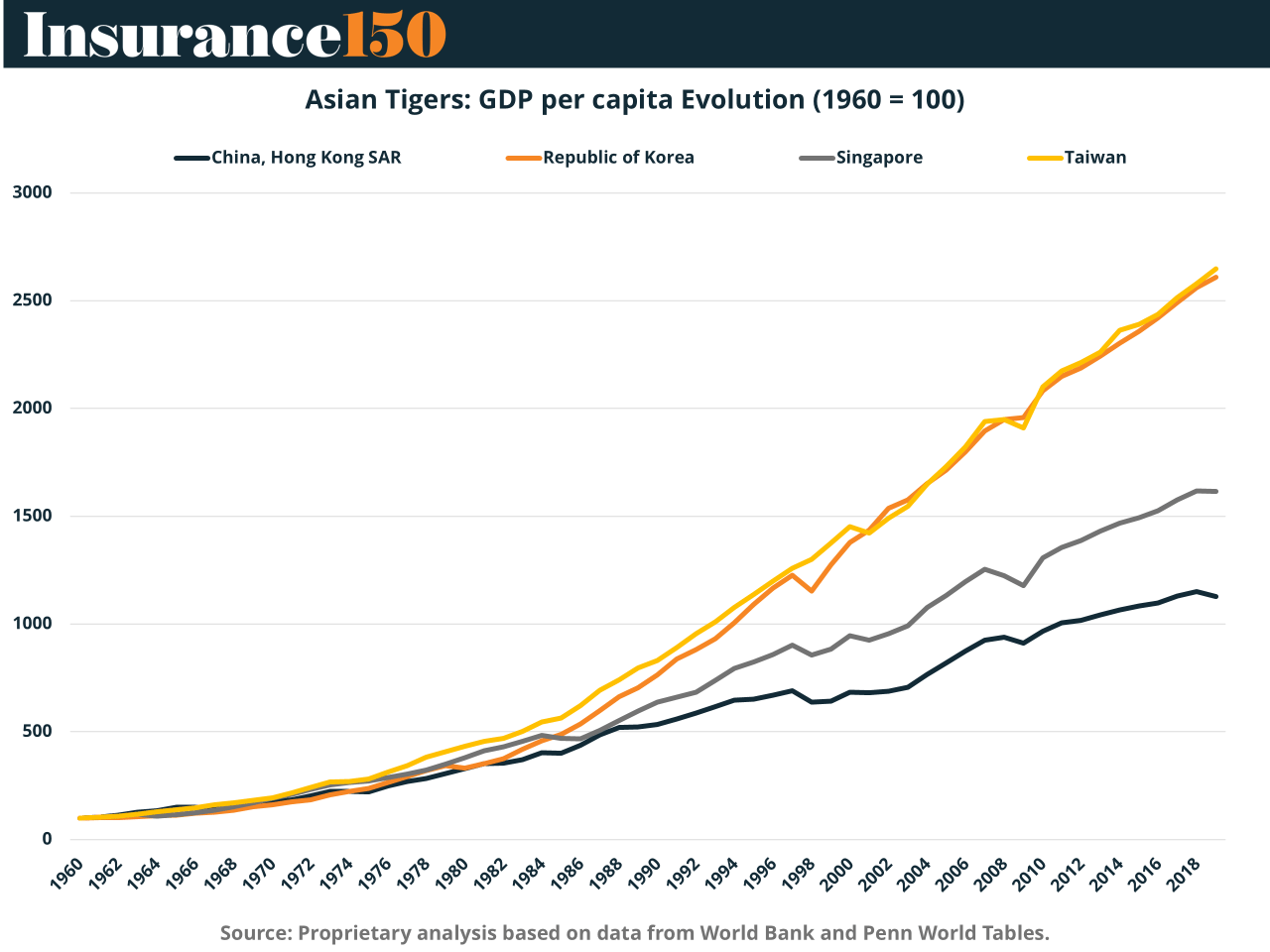

This chart reinforces this story by showing the relative rise of these economies: from a baseline of 100 in 1960, Taiwan and Korea have grown their GDP per capita over 2,500%, surpassing even advanced economies that started far richer.

4. Investment and Wealth: The Correlation

This last chart connects the dots by showing how higher GCF consistently translates into higher levels of income per person. Singapore, which has combined very high investment rates with a stellar business environment, clearly outpaces others — a signal that investment isn’t enough on its own; how and where you invest matters.

III. Lessons for Emerging Economies

While every country’s context is different, the formula for long-term prosperity is remarkably similar:

Encourage savings: through financial inclusion, macroeconomic stability, and low inflation.

Channel savings into productive investment: make it easy to start businesses, access credit, and build infrastructure.

Create investor confidence: by eliminating red tape, fighting corruption, and maintaining political stability.

Most importantly, government policy must be aligned with capital formation, not consumption. When a nation uses its income to build future productive capacity instead of short-term spending, it plants the seeds for growth.

IV. Conclusion: Investment is the Bridge to the Future

Gross Capital Formation is not just a statistic — it’s a reflection of a nation’s ability to convert today's resources into tomorrow’s prosperity. Countries that foster investment, protect property, and enable entrepreneurship are rewarded with high growth, rising incomes, and global competitiveness.

The Asian Tigers are not mythical creatures. They are proof that with the right policies, even the poorest nations can become rich. And the road runs through investment.

Sources & References

UC Davis. (2025). Penn World Tables. https://cid.ucdavis.edu/pwt

World bank. (2025). GDP per capita, PPP (constant 2021 international $). https://data.worldbank.org/indicator/NY.GDP.PCAP.PP.KD

World Bank. (2025). Gross capital formation (% of GDP). https://data.worldbank.org/indicator/NE.GDI.TOTL.ZS