- The Deal Brief - Insurance

- Posts

- Holiday Spending Resilience Amid Inflation Pressures: What Black Friday 2025 Reveals About the U.S. Economy

Holiday Spending Resilience Amid Inflation Pressures: What Black Friday 2025 Reveals About the U.S. Economy

The 2025 holiday shopping season has opened with a striking paradox that underscores the complex state of the U.S. economy:

Consumers are spending aggressively, even as confidence remains weak and household budgets are under strain. Black Friday 2025 produced record-setting online sales, yet many shoppers report financial anxiety, and macroeconomic indicators suggest persistent inflation pressures and uneven labor market performance.

Inflation Expectations and Consumer Psychology

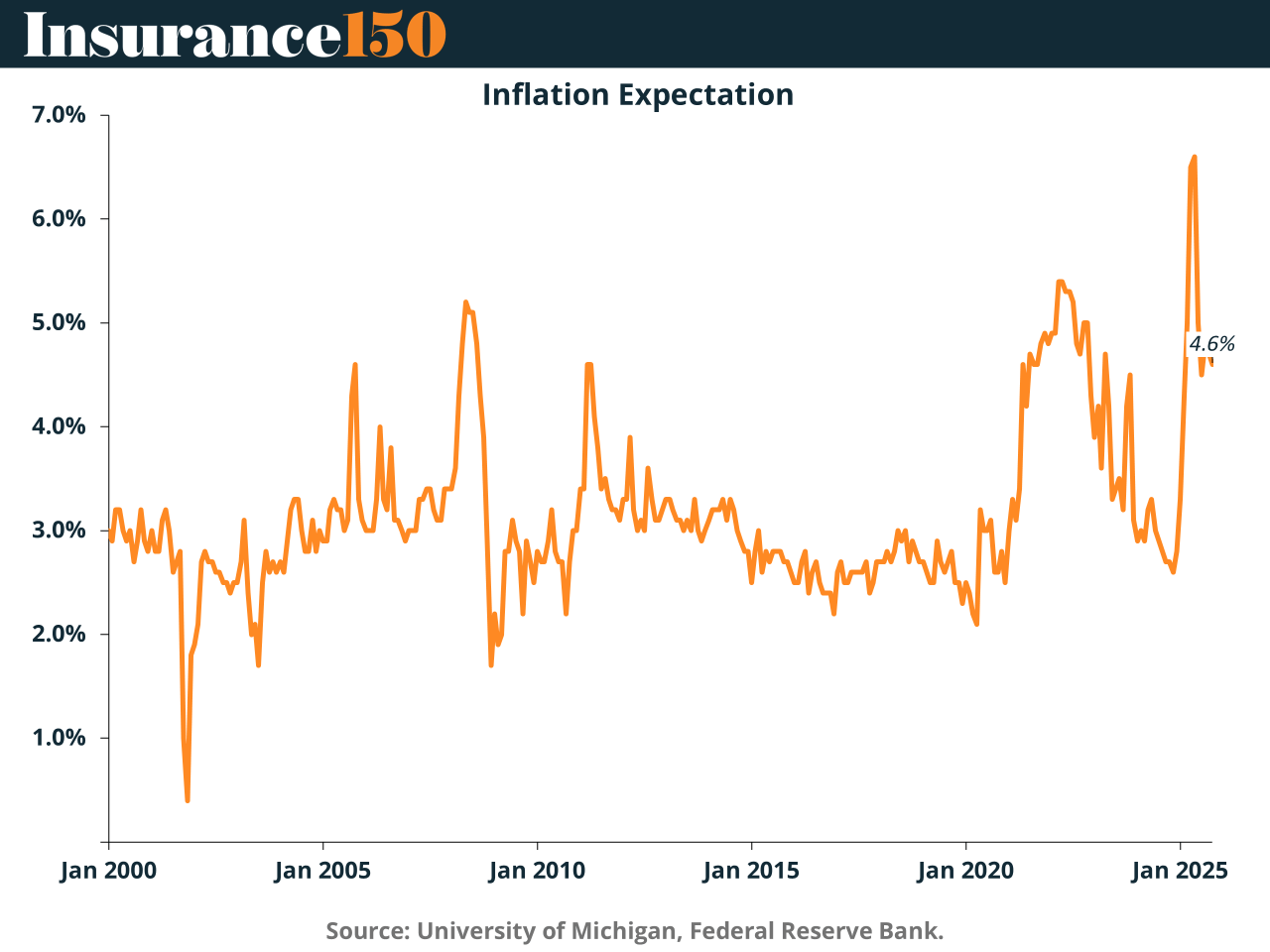

Inflation expectations remain volatile, with the latest University of Michigan survey showing a sharp rebound near 4.6%. Historically, consumer expectations are a powerful forward-looking indicator, influencing spending, saving, wage demands and interest rate expectations. While below the peak levels seen during the 2021–2022 surge, today’s expectations remain significantly above the Federal Reserve’s 2% target.

This elevated expectation environment casts an important backdrop for holiday spending: households may be spending rapidly not because they feel confident, but because they fear prices will continue to rise. Behavioral economists refer to this as intertemporal substitution — buy now, because it will cost more later.

Actual Inflation Trends

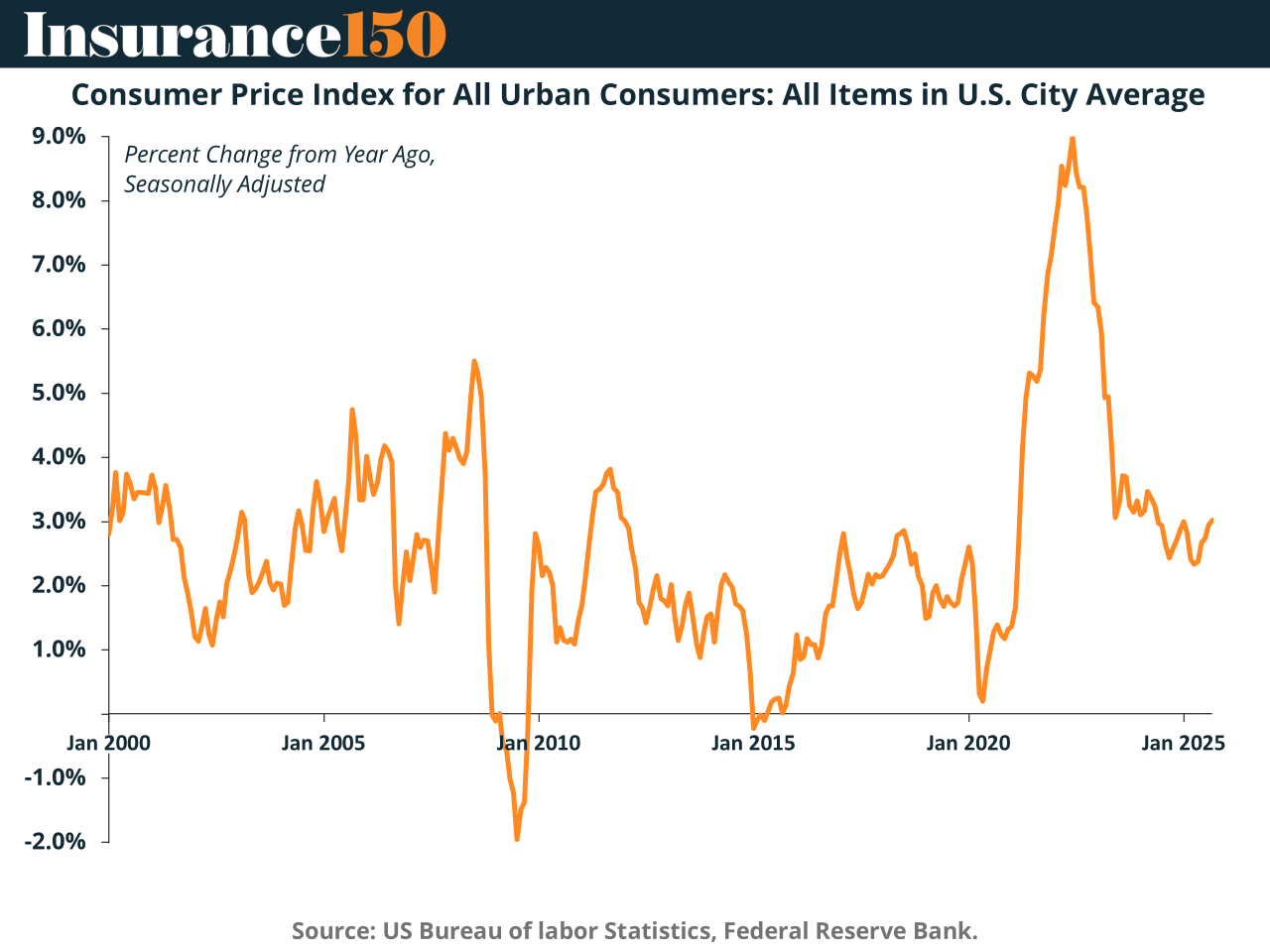

The CPI for all urban consumers shows a cooling trend from the peaks of 2022, but inflation is still more than double pre-pandemic norms, fluctuating around the 3% to 3.5% range. While headline inflation has moderated, price levels remain historically high, especially in essential categories like food, where grocery prices are still 18% higher than in early 2022.

The combination of high price levels + slowing wages + elevated expectations is straining middle- and low-income households even as wealthier consumers sustain aggregate spending totals.

Black Friday Spending Surges — But Not for the Reasons Headlines Suggest

U.S. consumers spent a record $11.8 billion online on Black Friday, up 9.1% from 2024. Thanksgiving Day itself reached $6.4 billion in online spending. A surge in e-commerce is evident:

E-commerce sales +10.4%

In-store sales +1.7%

Foot traffic modestly up 1–2% depending on the source

Average selling prices up 7%, order volume down 1%

In other words, Americans spent more money but bought fewer units — confirming that inflation, not volume, is driving revenue growth.

The in-store shopping experience remains culturally symbolic, but no longer dominant. Article 1 documents lively scenes in malls across the country, from New Orleans to Minnesota, with champagne toasts and crowds waiting overnight. Yet Article 2 highlights that the mass-hysteria version of Black Friday has faded. Foot traffic is flat and urgency is gone as retailers stretch promotions over weeks and consumers increasingly buy online.

AI and BNPL Transform Spending Behavior

One of the most dramatic structural shifts is the use of AI-powered shopping assistants, which Adobe reports increased website traffic influenced by AI by 800% year-over-year. From Walmart’s Sparky to Amazon’s Rufus, AI tools compress search time, compare prices across retailers, and personalize recommendations — reducing friction and helping consumers feel more strategic.

Simultaneously, the rapid growth of Buy Now, Pay Later (BNPL) financing suggests households are using credit-adjacent tools to maintain consumption. BNPL spending is expected to reach $20 billion this holiday season, up 11% from 2024, with $747 million in BNPL purchases on Black Friday alone. While interest-free installment options can help smooth cash-flow, nearly 40% of BNPL users reported at least one late payment, introducing new systemic risk heading into 2026.

Income Stratification and the Uneven Consumer

Data from Deloitte and major banks show widening divergence in consumer ability:

Affluent households are driving growth, particularly in luxury and travel-related goods.

Lower- and middle-income households are trading down, chasing discounts and relying more heavily on credit.

This bifurcation explains why consumer sentiment surveys remain weak, even as spending indicators appear strong. GDP calculations treat a $100 transaction the same whether it buys a single sweater or three sweaters — but households do not feel the same when they walk away with less.

The Macro Outlook

The strong nominal spending numbers offer support for a soft-landing narrative, but they do not resolve persistent structural risks. For the Federal Reserve, resilient consumption could delay the timeline for interest-rate cuts if inflation risks reaccelerate. For retailers, profitability will depend on inventory control and return patterns, particularly around Super Saturday and early January.

The bigger question for 2026 is whether today’s consumption levels are sustainable without job growth or renewed wage momentum — or whether the holiday season is being propped up by price inflation and short-term borrowing rather than real purchasing power.

Conclusion

Black Friday 2025 shows an American consumer that refuses to give up holiday tradition, even through economic uncertainty. The season is being carried by technology-enabled spending, higher prices, and widening inequality, rather than broad-based economic strength. As the inflation expectations chart demonstrates, psychological forces are now as important as fundamentals. The risk is a January “bill hangover,” in both literal credit payments and broader consumer retrenchment.

For now, the holiday machine hums on — but the macro story beneath it is far more complex than the record sales headlines suggest.

Sources & References

AP. (2025). Shoppers hit Black Friday sales with celebratory mood despite economic strain. https://apnews.com/article/black-friday-deals-holiday-shopping-2d85fcbab82d71ecd930b6fe1060f3c1

CNBC. (2025). How Black Friday became a retail letdown: ‘To sustain the ride, they started to dilute it’. https://www.cnbc.com/2025/11/28/black-friday-shopping-retail-letdown.html

TechStock. (2025). Black Friday 2025: U.S. Shoppers Spend Record $11.8 Billion Online as AI and BNPL Reshape Holiday Spending. https://ts2.tech/en/black-friday-2025-u-s-shoppers-spend-record-11-8-billion-online-as-ai-and-bnpl-reshape-holiday-spending/

University of Michigan, University of Michigan: Inflation Expectation [MICH], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/MICH, December 1, 2025.

U.S. Bureau of Labor Statistics, Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/CPIAUCSL, December 1, 2025.