- The Deal Brief - Insurance

- Posts

- How Insurance Leaders Are Adapting to Climate Change: Insights From Our Latest Microsurvey

How Insurance Leaders Are Adapting to Climate Change: Insights From Our Latest Microsurvey

Last week, we asked readers of Insurance150 how their organizations are adapting to the accelerating realities of climate change. Specifically, we posed the question:

“Which strategies are proving most effective in strengthening resilience?”

Respondents were asked to select among four leading approaches currently shaping climate-risk strategy across the insurance value chain:

Incentives for green underwriting and investment

Mandatory climate-risk disclosure and stress testing

Public-private partnerships to expand catastrophe coverage

Harmonized international standards for climate-risk data

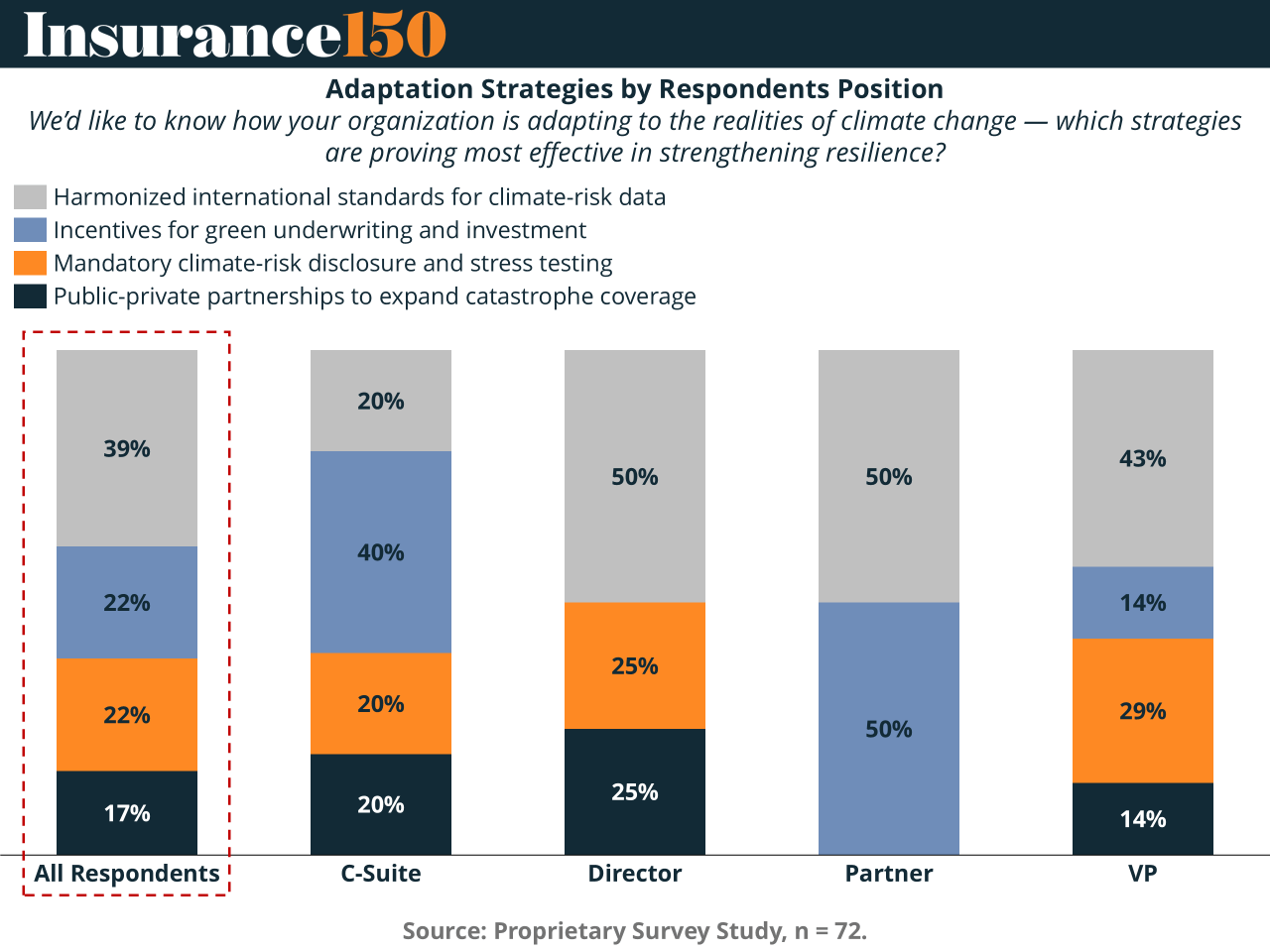

This week, we share the insights gathered from 72 respondents, analyzed by organizational role and industry segment.

Consensus on the Need for Better Climate-Risk Data

Across all respondents, the most favored adaptation strategy was Harmonized international standards for climate-risk data, selected by 39%. The need for consistent data standards has been a recurring theme in industry dialogue, reflecting growing frustration with fragmented data sources, evolving regulatory frameworks, and difficulty comparing climate exposures across markets.

Among executive roles, alignment around data consistency remains strong. Directors and Partners each recorded 50% support for harmonized data standards, signaling urgent expectations for clearer guidance and integrated datasets to support decision-making. C-Suite respondents also recognized its importance (20%), but showed more even distribution across multiple strategies—possibly indicating more diversified priorities at the enterprise planning level.

Growing Emphasis on Mandatory Climate-Risk Disclosure

The second most cited strategy among all participants was Mandatory climate-risk disclosure and stress testing, tied at 22% overall. This reflects growing regulatory pressure globally, including initiatives like TCFD, IFRS-S2, and NAIC requirements in the U.S.

Interestingly, support varies significantly by seniority:

VPs were the most likely group to favor enhanced disclosure (29%), perhaps reflecting accountability for operational implementation.

Directors allocated 25% of their support to disclosure, suggesting a practical focus on transparency and measurable risk controls.

Role-Dependent Views on Green Incentives & Public-Private Partnerships

Public-private partnerships to expand catastrophe coverage received 17% overall, with strongest support from Directors (25%) and the C-Suite (20%). As catastrophe losses continue to rise and withdrawal from distressed markets accelerates, collaborative risk-sharing structures appear increasingly attractive.

Meanwhile, Incentives for green underwriting and investment received 22% overall, but gained significant traction among Partners (50%). This may reflect advisory and consulting roles where sustainable investment strategies and ESG-aligned product design are emerging competitive differentiators.

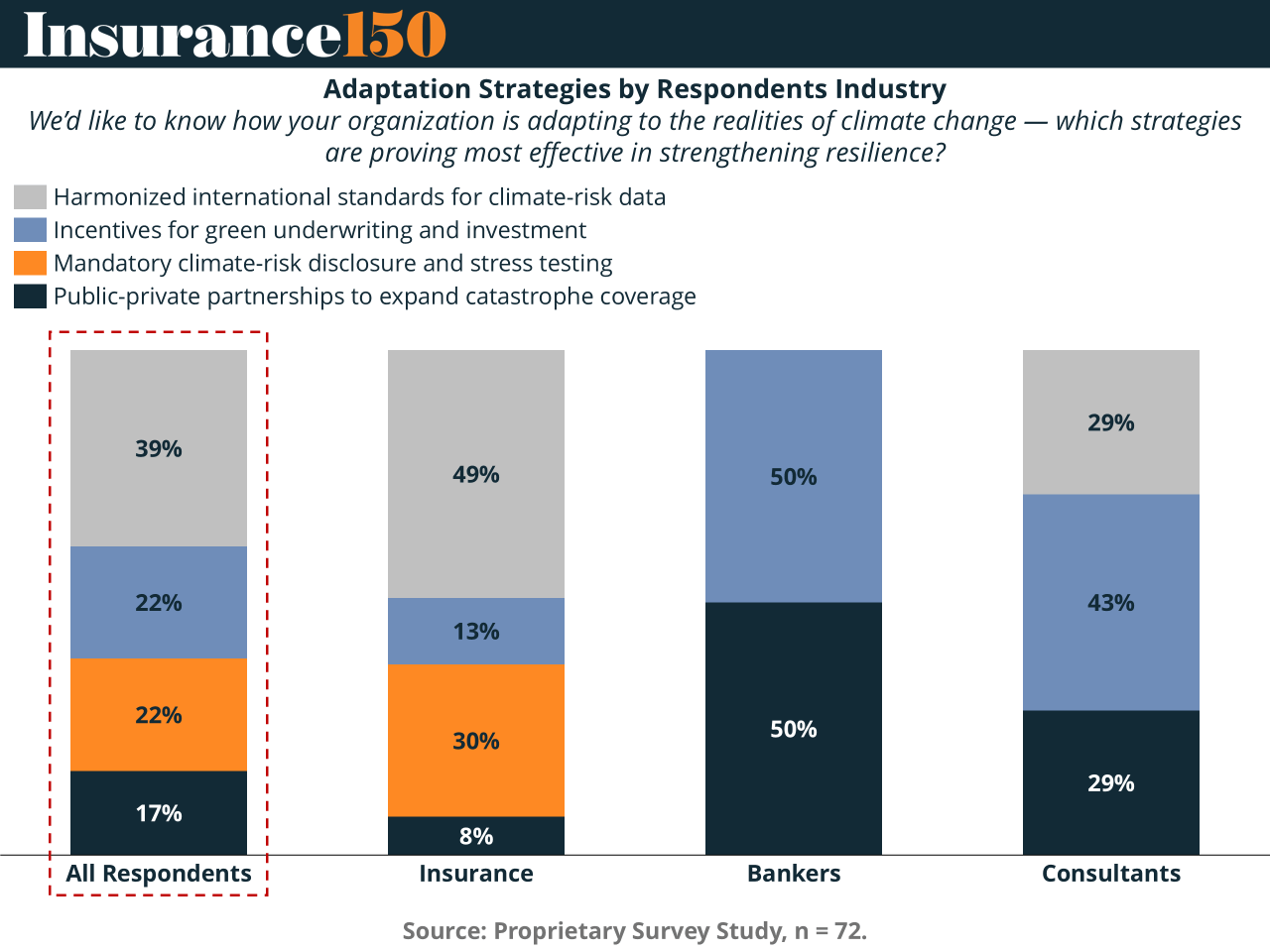

Industry Perspectives Show Even Greater Variation

When broken down by industry category, responses diverged more sharply.

Insurance-sector respondents prioritized disclosure and data transparency, with 49% citing harmonized data standards and 30% supporting mandatory disclosure.

Bankers demonstrated the strongest support for public-private partnerships (50%), positioning capital-market collaboration as essential for future risk capacity.

Consultants emphasized incentives for green underwriting (43%), reflecting broader trends in ESG advisory and innovation.

Key Takeaways

Data standardization is the top priority across the industry, signaling an urgent need for clearer, comparable climate-risk information.

Regulatory pressure is reshaping risk governance, with rising support for mandatory climate disclosures.

Industry-specific strategies vary, influenced by exposure, client needs, and capital structures.

Collaboration and sustainable product innovation are gaining momentum, particularly as catastrophic losses challenge traditional insurance models.

Climate adaptation is no longer a future strategy—it is a competitive imperative. As organizations experiment with diverse resilience approaches, convergence around transparency, shared data, and coordinated risk frameworks may define the next phase of climate-risk transformation.