- Insurance 150

- Posts

- How the Insurance Industry Is Adapting to Climate Change: Insights from Our Latest Microsurvey

How the Insurance Industry Is Adapting to Climate Change: Insights from Our Latest Microsurvey

Climate change continues to reshape the insurance landscape—altering risk models, underwriting approaches, and even the products offered to clients.

In our latest Insurance150 Microsurvey, we asked readers how their organizations are adapting to the realities of climate change and which strategies are proving most effective in strengthening resilience.

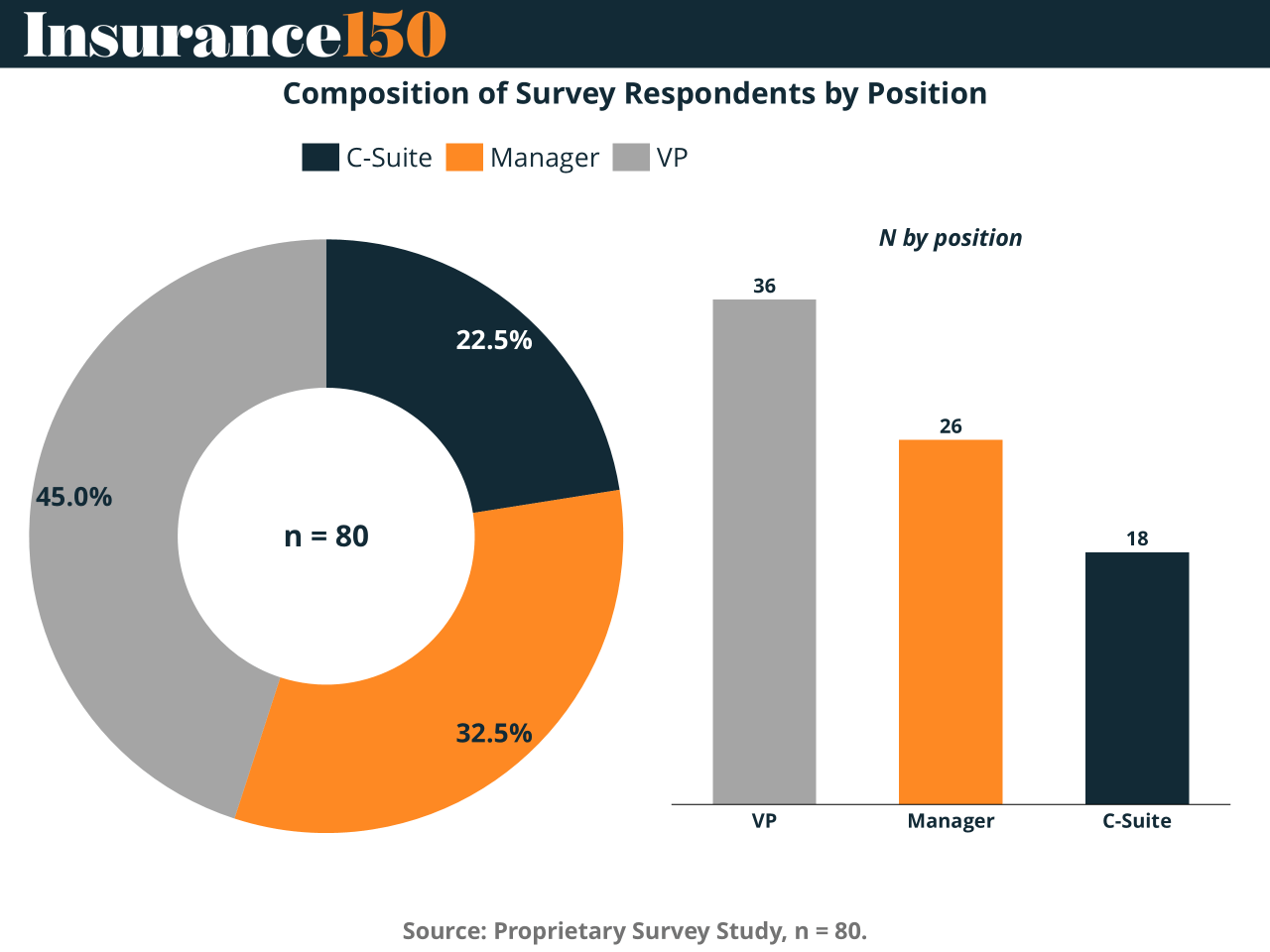

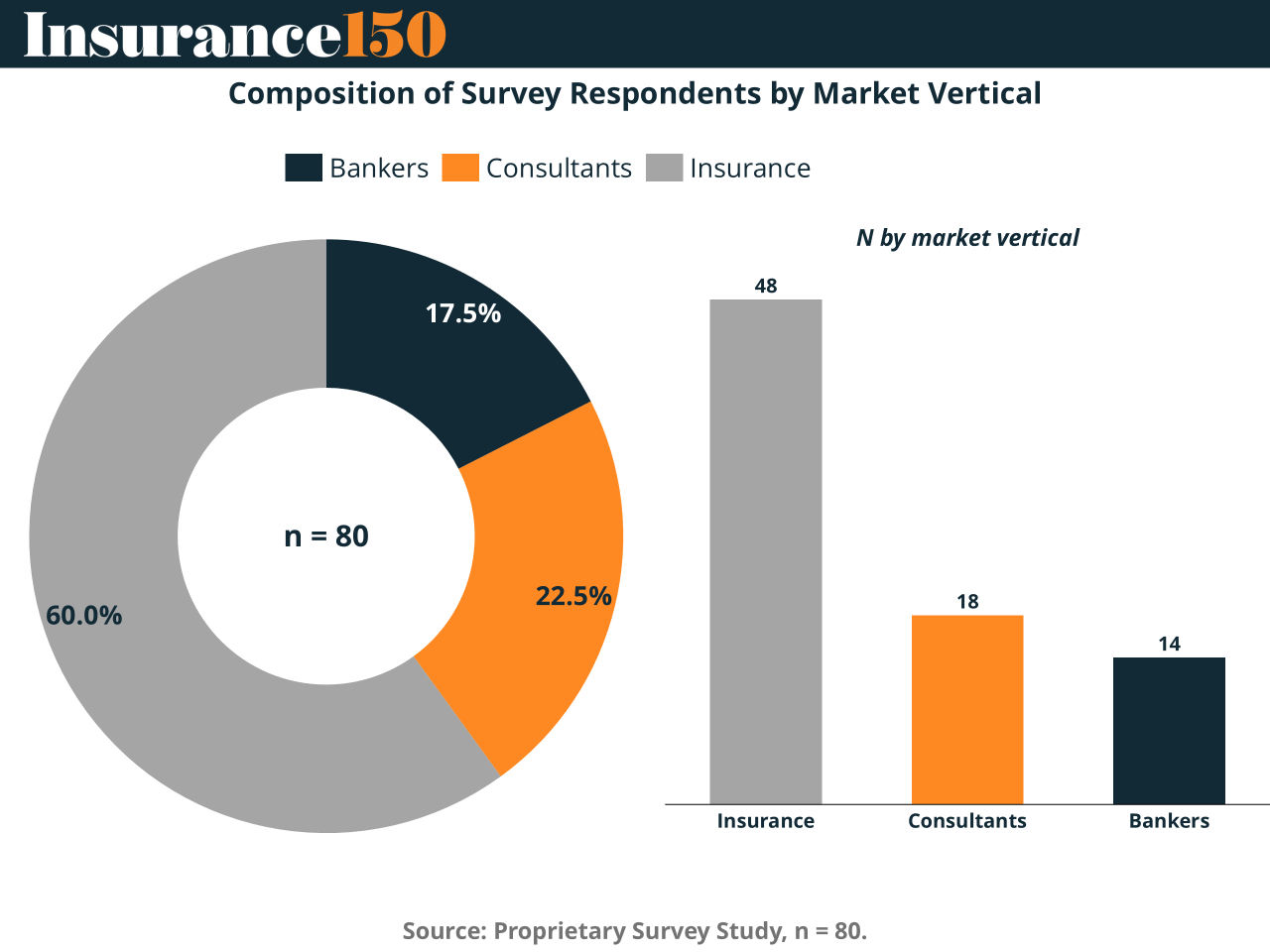

A total of 80 respondents participated, representing a broad cross-section of the insurance value chain—from C-suite executives to managers and vice presidents, as well as professionals in consulting and banking. Their responses shed light on how different roles and sectors are prioritizing adaptation strategies in today’s climate-challenged market.

1. Survey Demographics

Our respondent base was diverse across organizational levels. Nearly half of all participants (45%) were vice presidents (VPs), followed by managers (33%) and C-suite leaders (23%). This mix ensures that the insights reflect both strategic leadership perspectives and on-the-ground operational realities.

By industry segment, a strong majority (60%) of respondents work in insurance, while consultants (23%) and bankers (18%) round out the sample. This balance allows us to see how insights from adjacent financial sectors complement the insurance industry’s approach to managing climate risks.

The survey’s cross-sectional design offers a valuable snapshot of how climate resilience is being prioritized across different decision-making levels and market contexts.

2. Answers: How Organizations Are Adapting

When asked, “Which strategies are proving most effective in strengthening resilience?”, four major approaches emerged:

Advanced modeling and analytics – such as catastrophe (cat) modeling and climate scenario analysis.

Portfolio rebalancing and underwriting restrictions – particularly in high-risk areas.

Pricing and product innovation – including parametric and usage-based insurance products.

Reinsurance and capital-market instruments – like catastrophe bonds and insurance-linked securities (ILS).

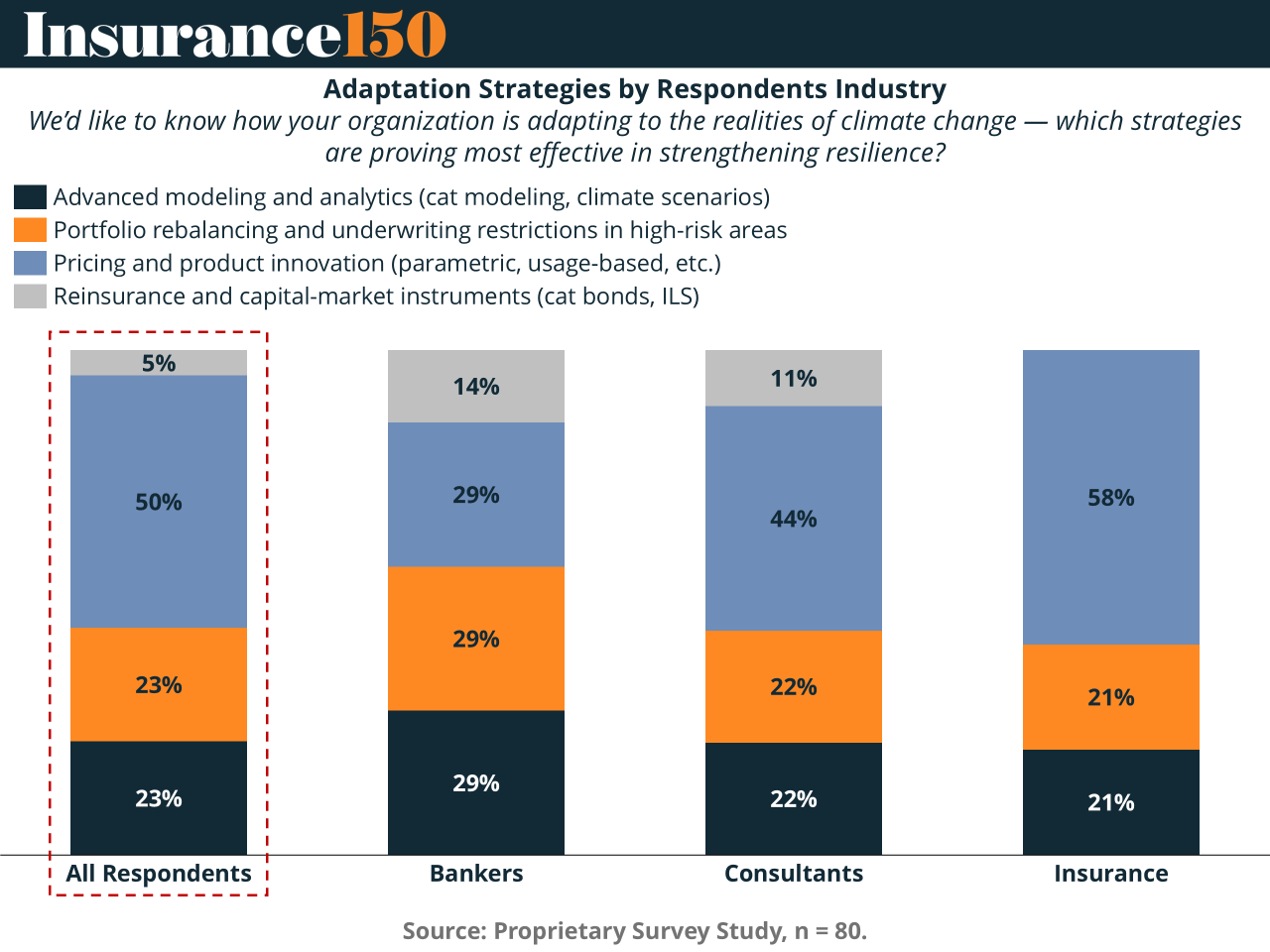

Overall Trends

Across all respondents, two strategies stood out as the top approaches to climate adaptation:

Pricing and product innovation (50%)

Portfolio rebalancing (23%)

Advanced modeling and analytics (23%)

Reinsurance and capital-market instruments (5%)

This suggests that the industry is focusing most heavily on product-level innovation, with pricing mechanisms seen as the most tangible way to manage new forms of risk. Meanwhile, fewer respondents view reinsurance as a leading resilience tool—possibly reflecting the limited accessibility of capital-market instruments outside large organizations.

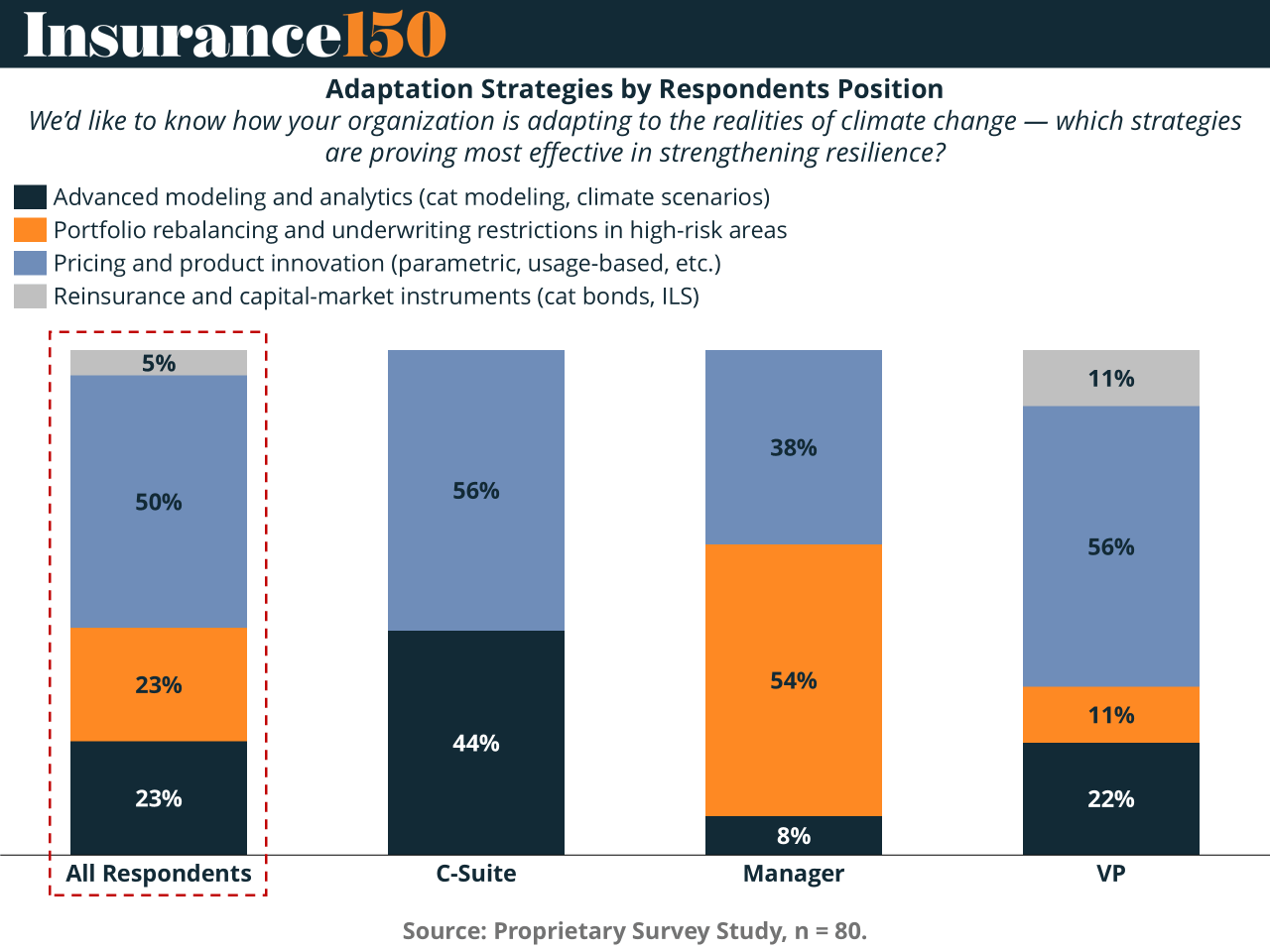

Differences by Organizational Role

C-Suite Executives:

Among executive leaders, the emphasis shifts toward data-driven decision-making.

44% of C-suite respondents highlight advanced modeling and analytics as their primary strategy.

56% focus on pricing and product innovation.

This indicates that senior leaders are prioritizing analytical tools to inform high-level strategy and risk allocation decisions, but still recognize innovation in product design as essential for long-term competitiveness.

Managers:

The managerial cohort tells a different story. For 54% of managers, portfolio rebalancing—including underwriting restrictions in high-risk zones—is the top adaptation strategy. Only 8% cited analytics as their leading approach.

This likely reflects their operational proximity to underwriting decisions, where the realities of risk selection and exposure management are most immediate. Managers appear to be applying tangible mitigation measures, often through adjustments to coverage in vulnerable regions or segments.

Vice Presidents:

VPs seem to straddle both strategic and operational considerations.

56% cited pricing and product innovation, aligning closely with C-suite priorities.

22% emphasized advanced modeling, and

11% each identified portfolio rebalancing and reinsurance tools.

This balanced view may reflect their dual responsibilities: interpreting executive direction while overseeing teams that implement those risk management and pricing changes.

Sector-Level Implications

While the survey primarily focused on roles, responses across verticals offer additional context.

Insurers are leading the charge in developing parametric and usage-based products, aligning with the growing role of technology and real-time risk monitoring.

Consultants tend to highlight modeling and analytics, reflecting their advisory role in helping clients quantify and mitigate exposure.

Bankers—though a smaller share of respondents—see capital-market instruments as an emerging opportunity for diversification and resilience.

These differences illustrate that climate adaptation in financial services is not a one-size-fits-all challenge. Each vertical contributes uniquely—through innovation, data, or capital—to the broader goal of market resilience.

3. Conclusion: A Shift Toward Innovation and Data-Driven Resilience

The results of this week’s survey make one thing clear: the insurance industry’s response to climate change is evolving from reactive risk avoidance to proactive resilience building.

While traditional approaches like portfolio rebalancing remain vital, especially among operational teams, the strategic emphasis is increasingly on innovation and data. The majority of respondents—particularly at the executive level—view analytics and product innovation as the twin pillars of climate adaptation.

This represents a critical shift. As models become more sophisticated and data sources expand—from satellite imagery to IoT-driven risk signals—insurers are rethinking how they price, structure, and transfer risk. At the same time, the growing popularity of parametric insurance and climate-linked products points toward a future where flexibility and responsiveness define resilience.

The relatively lower emphasis on reinsurance and capital-market tools suggests there’s still room for growth in integrating these mechanisms more broadly across the market. As climate volatility continues to increase, they may become an even more critical part of the resilience toolkit.

Ultimately, the data tells an encouraging story: across roles and sectors, the insurance ecosystem is not standing still. Whether through data analytics, innovative pricing, or portfolio management, organizations are actively reshaping how they confront the challenges of a changing climate—turning risk into opportunity and uncertainty into insight.