- Insurance 150

- Posts

- Insurance Liquidity in Times of Economic Stress

Insurance Liquidity in Times of Economic Stress

Liquidity management is increasingly vital for insurers amid rising illiquid investments, tighter regulations, and macroeconomic uncertainties.

Introduction

Liquidity management in the insurance sector has never been more critical. With the growing prevalence of illiquid investments, heightened regulatory scrutiny, and mounting macroeconomic uncertainties, insurers are being forced to reevaluate their liquidity strategies.

This report brings together perspectives from regulatory updates, industry commentary, and select research to outline practical considerations for how insurers might approach liquidity risk during periods of stress.

I. Understanding Liquidity Risk in Insurance

Liquidity risk refers to the potential inability of an insurer to meet its financial obligations as they come due, without incurring unacceptable losses. This risk manifests on both the liability and asset sides of the balance sheet. On the liability side, insurers may face sudden demands for payouts due to claims or policyholder surrenders. On the asset side, liquidity risk arises when assets are difficult to liquidate quickly, particularly under distressed market conditions.

The unique structure of insurer balance sheets—comprising a mix of long-duration liabilities and yield-seeking assets—requires a nuanced understanding of liquidity positioning. For many insurers, particularly those in life insurance, liabilities are relatively illiquid due to long-term policy horizons. However, the increasing allocation to alternative assets such as private equity and real estate has elevated asset-side liquidity concerns.

II. Macroeconomic Triggers of Liquidity Stress

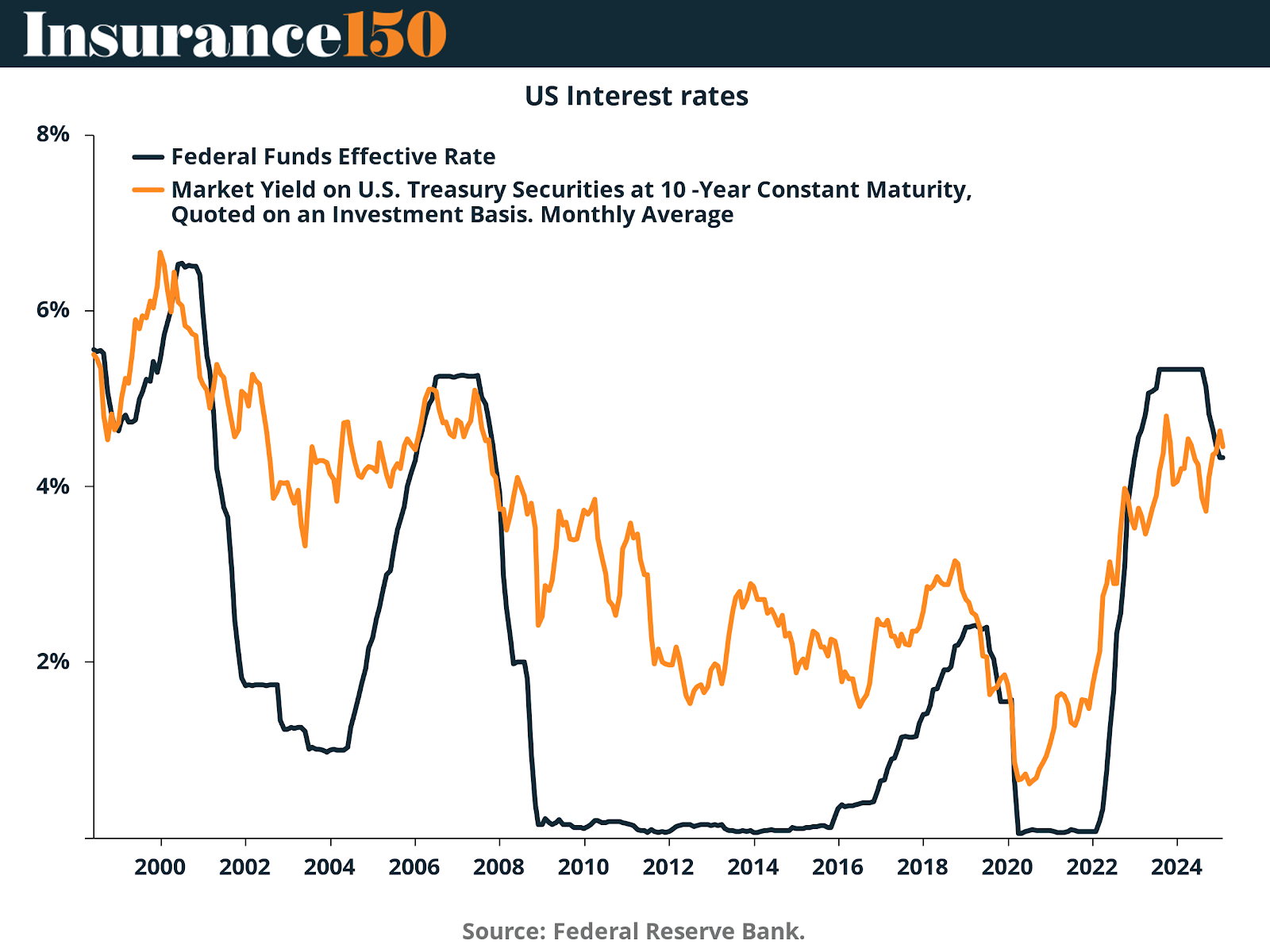

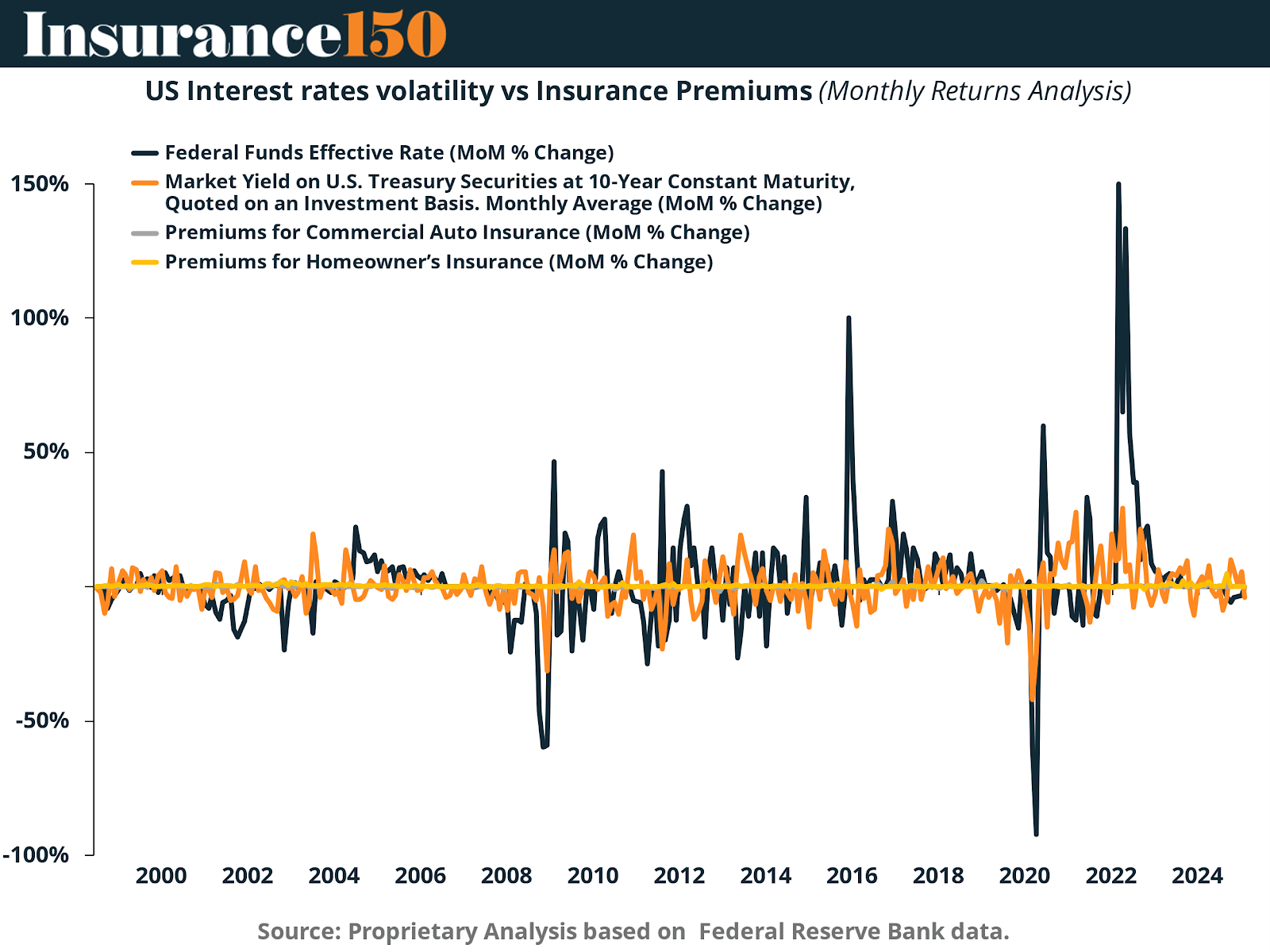

The macroeconomic environment plays a substantial role in shaping liquidity dynamics for insurers. One of the most significant triggers is a sharp increase in interest rates. As rates rise, policyholders may be incentivized to surrender existing contracts in search of better yields elsewhere, leading to significant liquidity outflows. This is particularly acute in products with low surrender penalties or embedded guarantees.

High inflation also poses a challenge by eroding the real value of investment returns and increasing the cost of claims. Insurers holding large fixed-income portfolios may find their real returns suppressed, tightening liquidity cushions. In parallel, broader financial market disruptions—such as the regional banking crisis in the U.S. or the collapse of Credit Suisse—can further destabilize liquidity by undermining market confidence and creating sudden shifts in investor or policyholder behavior.

III. Liability-Side Liquidity Risk

Life insurers face particularly complex challenges on the liability side. Investment-oriented policies, especially those linked to interest rates, can see elevated surrender activity in a rising rate environment. Moreover, large-scale mortality events, such as pandemics, can result in unexpected claim spikes. These dynamics demand that life insurers design products with surrender penalties or lock-in periods to deter early withdrawals.

Property and casualty (P&C) insurers, while less exposed to policyholder surrender, must contend with liquidity spikes driven by catastrophic (CAT) events. When natural disasters strike, the resulting claims can require immediate liquidity, which must be met despite potential disruptions in capital markets.

Reinsurers are exposed to even broader risks, often facing simultaneous cash calls from multiple ceding companies. For all these segments, product diversification and strong claims forecasting are critical components of managing liability-driven liquidity stress.

IV. Asset-Side Liquidity Risk

In recent years, insurers have aggressively shifted towards alternative asset classes to enhance returns in a low-yield environment. While private equity, real assets, and private credit offer yield premiums, they are also notably illiquid. These holdings can be difficult to sell quickly and may require deep discounts in distressed conditions, compounding liquidity stress.

Asset-liability management (ALM) frameworks are central to mitigating these risks. Effective ALM ensures that asset maturities are aligned with expected liability cash flows. Additionally, insurers must maintain liquid buffers—typically in cash or highly liquid government securities—to absorb shocks. Scenario-based stress testing, incorporating asset sale haircuts, further enhances preparedness by modeling potential outflow and market shock scenarios.

V. Streesting and Liquidity Metrics

To evaluate their resilience, insurers are increasingly adopting rigorous liquidity stress testing protocols. Key tools include the Liquidity Coverage Ratio (LCR), which compares liquid assets to expected net cash outflows, and liquidity gap analysis, which identifies mismatches across various time horizons. The Liquidity Coverage Ratio (LCR), while a cornerstone metric for banks under Basel III, is not universally standardized or mandated for insurance companies in the same way. However, many insurers—and particularly their regulators—use similar LCR-like internal metrics to assess liquidity resilience.

More soticated firms integrate these metrics into enterprise risk management platforms. Stress scenarios often simulate a range of adverse conditions—mass policyholder surrenders, CAT events, derivative margin calls, and regulatory ring-fencing of group entities. These scenarios help insurers plan their responses and identify vulnerabilities. A well-constructed contingency funding plan (CFP) then outlines operational steps for responding to liquidity events, including accessing credit lines, internal fund transfers, or prioritized asset sales.

VI. Regulatory Framework and Supervisory Expectations

Global and national regulators are intensifying their focus on liquidity management. The International Association of Insurance Supervisors (IAIS) has embedded liquidity monitoring into its Common Framework (ComFrame) and the Holistic Framework for Systemic Risk. In Europe, Solvency II requires that liquidity be addressed in the Own Risk and Solvency Assessment (ORSA).

In the U.S., the National Association of Insurance Commissioners (NAIC) has developed a Liquidity Stress Testing (LST) Framework, targeting large life insurers. This framework incorporates macroprudential considerations and emphasizes market-wide impacts of insurer asset sales. Similar efforts are unfolding in the UK, where the Prudential Regulation Authority (PRA) has enhanced liquidity reporting, and in South Africa, which has issued new liquidity return guidance for life insurers.

VII. Governance and Operational Response

Effective liquidity management demands strong governance. Insurers must clearly define their liquidity risk appetite and embed it within their broader enterprise risk management structure. This requires delineation of roles across the three lines of defense, with front-line managers responsible for day-to-day oversight, risk teams validating frameworks, and internal audit ensuring compliance.

Operational readiness is equally critical. Contingency responses should include internal fund reallocation mechanisms, pre-arranged repo facilities, access to committed credit lines, and predetermined liquidity windows for asset sales. These tools should be regularly reviewed, tested, and embedded into liquidity management protocols to ensure real-time execution when stress emerges.

VIII. Strategic Opportunities in Liquidity Management

While liquidity risk is a challenge, it can also be a source of strategic advantage. Insurers with excess liquidity can monetize it through short-term lending or repo transactions. Maturity transformation—investing in longer-dated assets while maintaining adequate short-term liquidity—is another strategy that can enhance yield, provided it's supported by robust ALM.

Advanced scenario modeling allows insurers to optimize portfolios under a range of stress conditions. Tools such as Monte Carlo simulations, regime-switching models, and dynamic cash flow projections enable deeper insight into liquidity exposures and opportunities. These strategies should be pursued with caution, balancing return aspirations with regulatory compliance and reputational considerations.

Conclusion

Navigating liquidity risk during periods of stress is not merely about regulatory compliance—it is about building a resilient, forward-looking financial structure. Successful insurers will be those who can integrate strategic foresight, robust governance, and operational agility into their liquidity frameworks. As capital markets evolve and macroeconomic volatility persists, proactive liquidity management will be a defining factor of long-term viability in the insurance sector.

Sources & References

European Insurance and Occupational Pensions Authority. (2024). 2024 Insurance Stress Test. https://www.eiopa.europa.eu/document/download/f8a234b0-a84a-49ff-975e-c47f8849bfc0_en?filename=Report+-+Insurance+Stress+Test+2024.pdf

Deloitte. (2021). Liquidity within the Life Insurance Industry. https://www.deloitte.com/za/en/Industries/financial-services/analysis/liquidity-within-the-life-insurance-industry.html

Federal Reserve. (2025). Financial Accounts of the United States - Z.1. https://www.federalreserve.gov/releases/z1/20240307/html/l116.htm

Federal Reserve. (2022). How Do U.S. Life Insurers Manage Liquidity in Times of Stress? https://www.federalreserve.gov/econres/notes/feds-notes/how-do-us-life-insurers-manage-liquidity-in-times-of-stress-20220823.html?utm_source=chatgpt.com

Fitch Ratings. (2023). Shift to Illiquid Assets Raises Risks for Some U.S. Life Insurers. https://www.fitchratings.com/research/insurance/shift-to-illiquid-assets-raises-risks-for-some-us-life-insurers-27-11-2023

International Association of Insurance Supervisors. (2025). Financial Stability. https://www.iais.org/activities-topics/financial-stability/

International Association of Insurance Supervisors. (2021). Development of Liquidity Metrics. https://www.iais.org/uploads/2022/01/211118-PCD-on-the-Development-of-Liquidity-Metrics-Phase-2-PUBLIC.pdf

International Association of Insurance Supervisors. (2022). Liquidity metrics as an ancillary

International Monetary Fund. (2025). Global Financial Stability Report. https://www.imf.org/en/Publications/Global-Financial-Stability-Report?page=3#:~:text=Description:%20The%20April%202014%20Global,received%20by%20systemically%20important%20banks

Milliman. (2023). Liquidity, capital, and ALM. https://www.milliman.com/en/insight/liquidity-capital-alm-insurers-liquidity-score

National Association of Insurance Companies. (2022). NAIC 2022 LIQUIDITY STRESS TEST FRAMEWORK. https://content.naic.org/sites/default/files/inline-files/Final%202022%20LST%20Framework.pdf

The Geneva Association. (2024). LIQUIDITY RISK IN INSURANCE. https://www.genevaassociation.org/sites/default/files/2024-07/liquidity_risk_report_0709_digital_web_final.pdf

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|