- Insurance 150

- Posts

- Insurance M&A 2025: Scale, Capital Optimization, and Strategic Repositioning Define the Cycle

Insurance M&A 2025: Scale, Capital Optimization, and Strategic Repositioning Define the Cycle

The global insurance M&A market in 2025 reflects an industry in strategic transition rather than cyclical exuberance.

Introduction

After several years of valuation dislocation, interest rate volatility, and underwriting recalibration, dealmaking has re-emerged with clearer pricing signals, disciplined capital deployment, and a pronounced tilt toward high-impact transactions. Unlike prior cycles driven by volume, the current market is defined by selectivity, megadeal concentration, and strategic clarity, particularly across insurance distribution, specialty underwriting, life and annuity platforms, and technology-enabled intermediaries.

Across regions and subsectors, insurers, brokers, and financial sponsors are deploying M&A as a tool to restore top-line momentum, optimize capital structures, and reposition portfolios for a structurally different risk environment. The data from 2025 confirms that consolidation is no longer about accumulation—it is about control of distribution, access to specialty risk, long-duration assets, and scalable fee-based economics.

Insurance M&A Within the Broader Global Deal Landscape

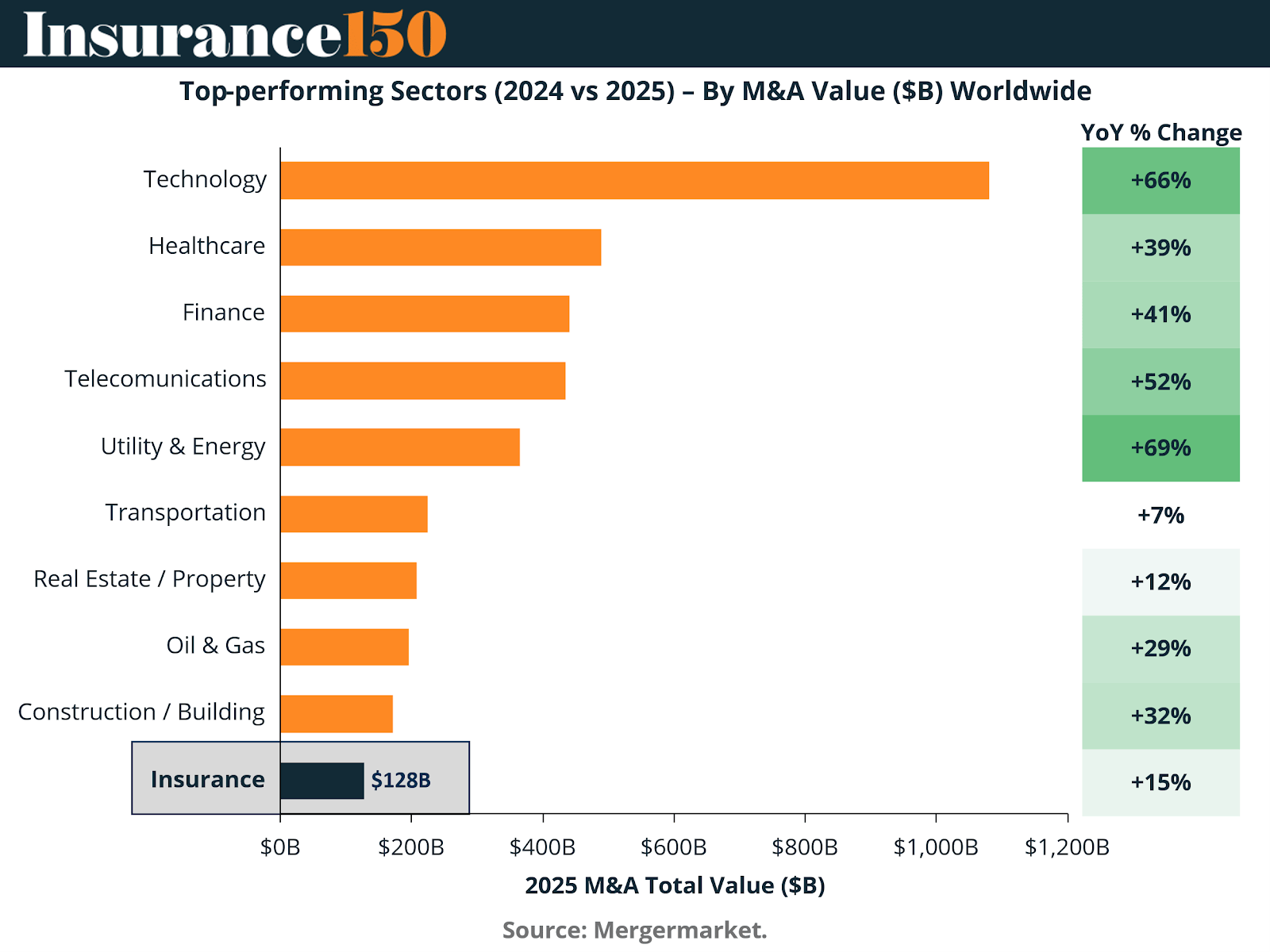

Insurance M&A in 2025 must be understood within the broader global deal environment, where sectoral divergence has become pronounced. Technology leads global M&A value at approximately $1.1 trillion, reflecting a +66% year-over-year increase, driven by AI infrastructure, data platforms, and digital ecosystems. While insurance does not match technology in absolute value, its relative growth profile is notable, particularly when compared with traditionally capital-intensive sectors.

Financial services M&A—including insurance—registered solid growth, with finance-related transactions expanding approximately +41% year over year, while telecommunications (+52%) and utilities & energy (+69%) also posted strong rebounds. These trends highlight a macro environment in which regulated, cash-generative, and capital-efficient sectors have regained strategic appeal as financing conditions normalized and valuation expectations converged.

Within this context, insurance’s performance is particularly compelling. Despite representing a smaller absolute share of total global M&A value, insurance transactions benefit from defensive earnings profiles, recurring revenue, and strong private capital sponsorship, positioning the sector as a durable allocation within financial services M&A.

US Insurance M&A: Value Concentration Amid Volume Volatility

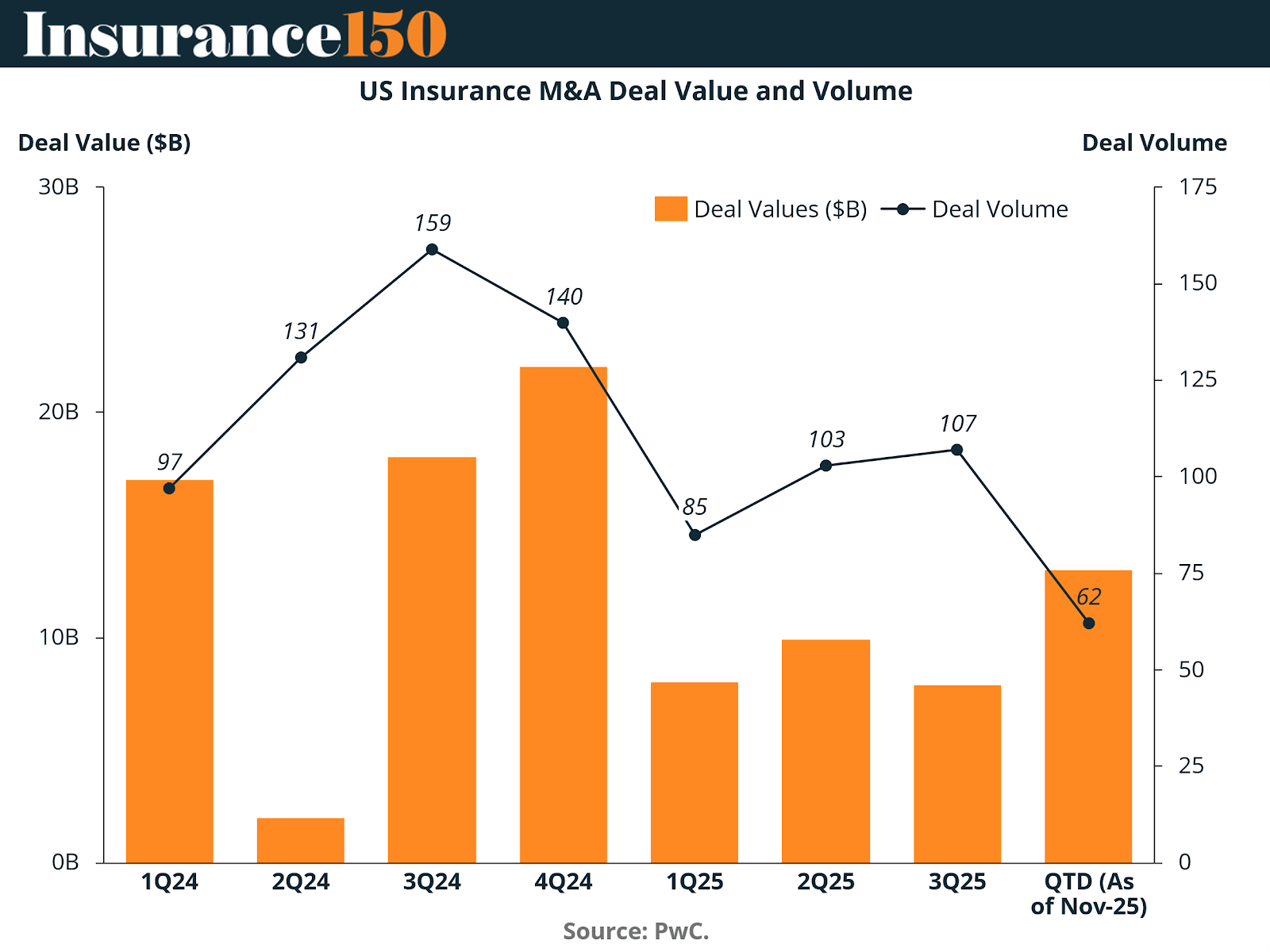

US insurance M&A activity in 2024–2025 demonstrates a clear decoupling between deal value and transaction volume, underscoring the increasing dominance of large, strategic transactions. In 4Q24, US insurance deal value peaked at approximately $22 billion, supported by 140 transactions, reflecting robust year-end execution as valuation gaps narrowed.

By contrast, 2025 shows a moderation in volume alongside persistent value creation. Deal values in 1Q25 ($8B) and 2Q25 ($10B) were materially lower than late-2024 levels, yet volumes remained resilient at 85 and 103 deals, respectively. This dynamic indicates a market prioritizing fewer, higher-conviction transactions rather than broad-based consolidation.

Notably, year-to-date 2025 deal value of approximately $13 billion, despite a reduced deal count of 62 transactions, reinforces the outsized role of megadeals. The data confirms that capital is concentrating around scaled platforms, specialty capabilities, and fee-based distribution, rather than being dispersed across smaller tuck-ins.

This concentration is further validated by the fact that over 90% of announced insurance deal value in the second half of 2025 was driven by megadeals, even though these transactions represented only a small fraction of total deal volume.

Megadeals as the Primary Value Engine

The defining characteristic of insurance M&A in 2025 is the dominance of billion-dollar transactions. Strategic buyers and sponsors alike have demonstrated a willingness to deploy capital at scale where transactions offer control of distribution, access to specialty underwriting, or long-duration balance sheet assets.

High-profile transactions—spanning brokerage consolidation, specialty P&C expansion, life and annuity platforms, and tech-enabled intermediaries—illustrate how acquirers are targeting structural earnings durability rather than cyclical growth.

These megadeals are not opportunistic; they are deliberate portfolio reshaping exercises designed to optimize capital efficiency, enhance fee income, and reduce earnings volatility.

The implication for the broader market is clear: insurance M&A is increasingly a game of scale and strategic relevance, where sub-scale platforms face mounting pressure to consolidate, divest, or align with larger sponsors.

Regional Differentiation in Insurance M&A Economics

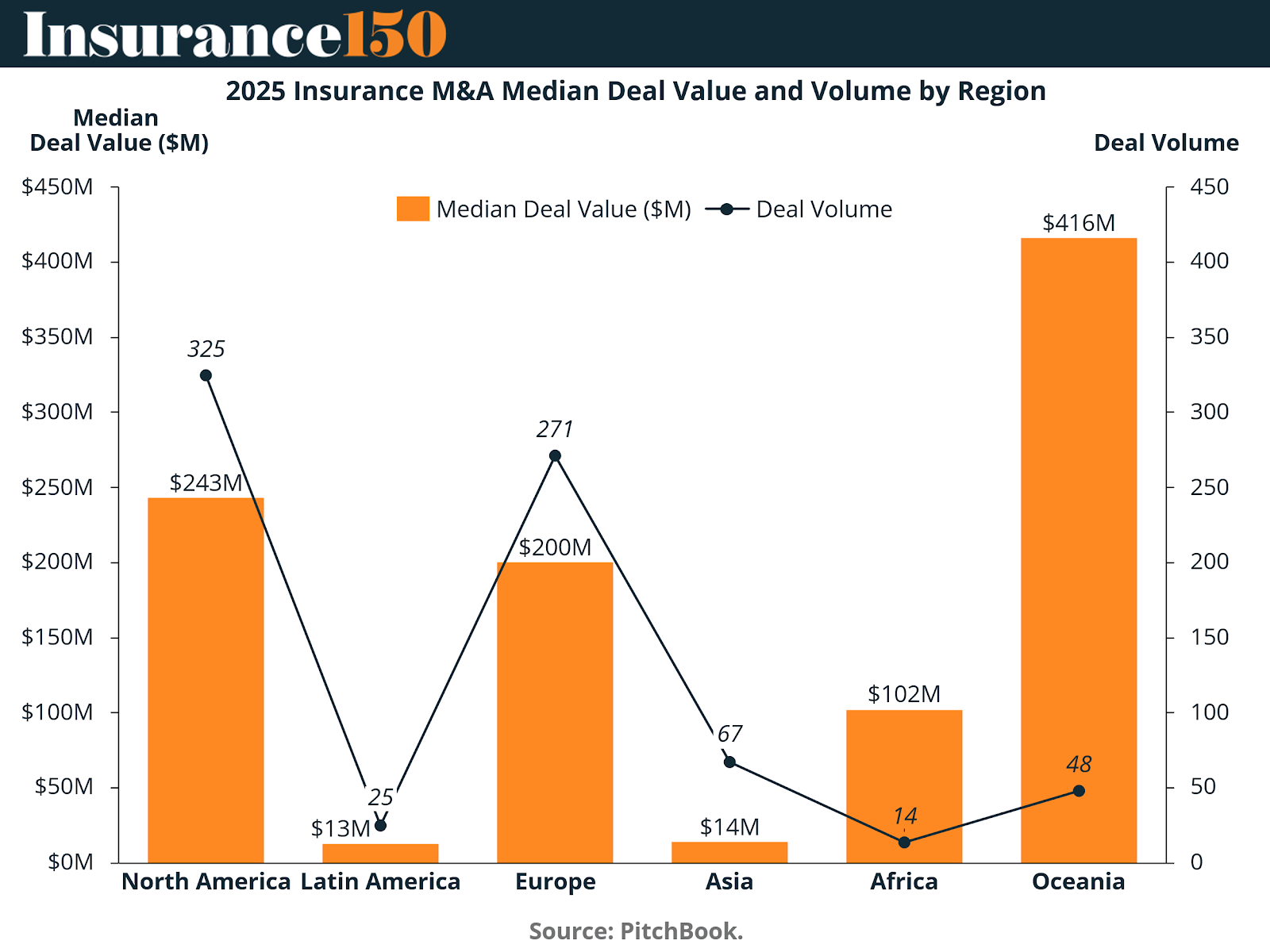

Regional data highlights stark differences in deal economics and strategic intent. North America remains the most active insurance M&A market by volume, with approximately 325 transactions and a median deal value of $243 million, reflecting deep sponsor participation, robust broker consolidation, and strong appetite for specialty platforms.

Europe, by comparison, recorded 271 deals with a median value of $200 million, underscoring a more fragmented but increasingly active market. European activity is shaped by uneven national dynamics, with the UK, France, Southern Europe, and the Nordics showing momentum, while Germany remains more integration-focused.

Emerging regions display markedly different profiles. Asia, despite a meaningful deal count (67 transactions), posted a median deal value of just $14 million, highlighting early-stage consolidation and regulatory fragmentation. Africa, with 14 transactions and a median value of $102 million, reflects selective cross-border interest rather than broad-based consolidation.

Most striking is Oceania, where a limited deal count (48 transactions) coincides with a median deal value of $416 million, signaling highly concentrated, sponsor-led platform transactions, particularly in life insurance and asset-intensive structures.

These regional differences reinforce that insurance M&A is not monolithic. Deal size, structure, and rationale vary significantly depending on regulatory regimes, capital markets depth, and growth trajectories.

Corporate and Strategic Buyers Regain Momentum in 2025

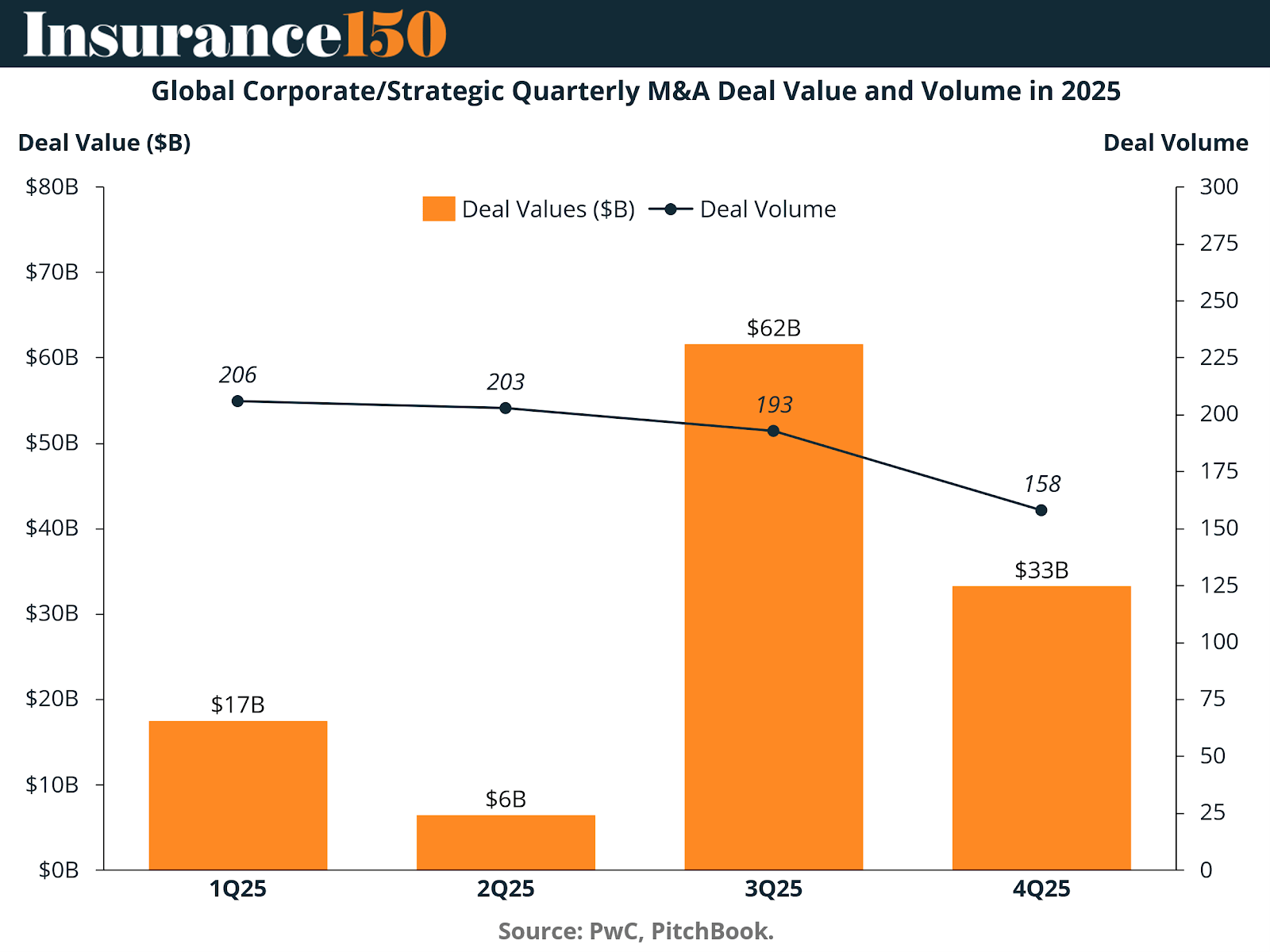

Corporate and strategic buyers played an increasingly decisive role in 2025, particularly in the second half of the year. After a muted 2Q25, where global corporate deal value dipped to approximately $6 billion, activity rebounded sharply in 3Q25, reaching $62 billion, the highest quarterly level of the year.

Deal volumes remained relatively stable throughout the year—ranging from 206 transactions in 1Q25 to 158 in 4Q25—but the surge in 3Q value highlights renewed confidence among strategics to pursue transformational acquisitions.

This resurgence reflects several converging factors:

Greater certainty around interest rate trajectories

Improved underwriting profitability, particularly in P&C

Strong balance sheets following years of capital discipline

Regulatory environments increasingly supportive of consolidation

Strategic buyers are no longer deferring decisions; they are actively deploying capital to secure distribution, expand specialty capabilities, and defend competitive moats.

Thematic Drivers Reshaping Insurance M&A

Across subsectors, several persistent themes are shaping deal flow:

Insurance Distribution as a Growth Engine

With organic premium growth moderating, brokers continue to rely on M&A to sustain top-line expansion. Large corporates dominate activity, leveraging balance sheet strength and integration capabilities to outpace smaller consolidators.

Private Equity’s Strategic Persistence

Despite volume fluctuations, private equity remains deeply embedded in insurance M&A. Improved financing conditions and the sector’s recurring cash flows are reigniting sponsor interest, particularly in broker platforms and capital-light businesses.

Life and Annuity Platform Consolidation

Life and annuity assets remain attractive to alternative asset managers seeking long-duration capital and international expansion. Cross-border transactions underscore the global nature of this capital flow.

Portfolio Optimization and Divestitures

Carriers are increasingly divesting fee-based or non-core operations to unlock capital while retaining strategic underwriting relationships. These transactions reflect a shift toward capital-efficient operating models.

Insurtech and Technology Enablement

Rather than standalone disruption, insurtech is being absorbed into larger ecosystems. Acquirers are targeting capabilities—data, automation, embedded distribution—rather than speculative growth.

Outlook: Insurance M&A Entering a Sustained Strategic Phase

Looking ahead, insurance M&A is expected to remain active but disciplined into 2026. Activity is likely to mirror 2025 levels, with continued emphasis on:

Strategic megadeals over volume-driven consolidation

Cross-border expansion, particularly involving Europe and Asia

Private capital partnerships and alternative financing structures

Capital optimization through reinsurance, sidecars, and structured solutions

The insurance sector’s ability to withstand macroeconomic uncertainty, combined with its essential role in risk transfer, positions it as a core allocation for strategic and financial buyers alike.

Ultimately, insurance M&A in 2025 is best understood not as a cyclical rebound, but as a structural realignment—one in which scale, specialization, and capital efficiency determine long-term winners.

Sources & References

Clifford Chance. (2025). Global M&A in 2026. https://www.globalbankingandfinance.com/the-global-insurance-m-a-surge-what-s-fueling-consolidation-across-sectors/

Global Banking Finance. (2025). The Global Insurance M&A Surge: What’s Fueling Consolidation Across Sectors. https://www.globalbankingandfinance.com/the-global-insurance-m-a-surge-what-s-fueling-consolidation-across-sectors/

Insurance Business. (2025). Uneven insurance M&A momentum emerges across Europe in Q3 2025. https://www.insurancebusinessmag.com/uk/news/mergers-acquisitions/uneven-insurance-manda-momentum-emerges-across-europe-in-q3-2025-557252.aspx

ION Analytics. Mergermarket. (2025). Year of the Megadeals – M&A Highlights FY25. https://ionanalytics.com/insights/mergermarket/ma-highlights-fy25/?utm_source=google&utm_medium=cpc&utm_campaign=23341937737&utm_content=189802435877&utm_term=m%26a%20insights&gad_source=1&gad_campaignid=23341937737&gbraid=0AAAAAoQU0jUQHC8tibHJ1gZRBP2GaN7Pb&gclid=CjwKCAiAvaLLBhBFEiwAYCNTfzBPdWloNyzMrJ-t2msjrL76WQ1WpeRIHfhYYBvTsodNqFQ9wQvxqxoCoUsQAvD_BwE

Risk & Insurance. (2025). Insurance Agency M&A Market Settles Into New Normal as Consolidation Accelerates. https://riskandinsurance.com/insurance-agency-ma-market-settles-into-new-normal-as-consolidation-accelerates/

PwC. (2025). Megadeals remain key insurance M&A value driver. https://www.pwc.com/us/en/industries/financial-services/library/insurance-deals-outlook.html