- Insurance 150

- Posts

- Insurance Under Pressure: Navigating Structural Shifts and Margin Realities Across the Healthcare Landscape

Insurance Under Pressure: Navigating Structural Shifts and Margin Realities Across the Healthcare Landscape

The 2024–2027 outlook for the insurance and healthcare financing ecosystem reveals a market caught between structural transition and cyclical normalization.

Across health, non-life, and group segments, insurers are confronting the twin challenge of slowing growth and intensifying cost dynamics.

While macroeconomic conditions have broadly stabilized since the pandemic, underlying system pressures — from Medicaid redeterminations to medical inflation and evolving employer demand — continue to reshape the profitability contours of the industry. The result is a marketplace where agility, pricing precision, and capital discipline increasingly define strategic advantage.

From the U.S. coverage gap to global non-life premium deceleration, the signals point to a recalibration rather than retreat. Health coverage erosion underscores persistent inequities in access and affordability, while softening non-life and group insurance growth mark the shift from expansion to optimization.

At the same time, emerging markets and ACA-compliant segments demonstrate that premium expansion persists where regulation, unmet need, and population dynamics still support structural tailwinds. These patterns highlight the growing divergence between volume-led and margin-led growth — a distinction investors must now integrate into long-term allocation strategies.

For investment professionals, the narrative is clear: insurance markets are entering a phase where resilience, not reach, will determine outperformance. Capital is likely to migrate toward platforms with scalable technology, diversified exposure, and sophisticated risk analytics capable of balancing pricing power against regulatory and affordability constraints. The winners of this cycle will be those that treat uncertainty not as a drag but as a design feature — using data, discipline, and differentiated underwriting to turn systemic volatility into sustainable return.

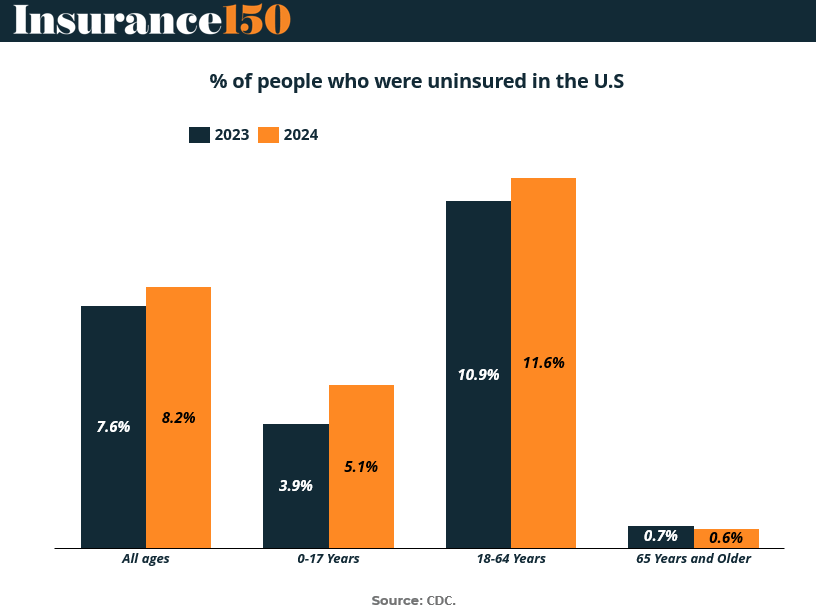

Coverage Slippage: The Rising Tide of the Uninsured in the U.S.

The percentage of Americans lacking health insurance edged upward across nearly all age groups in 2024, reflecting persistent structural and policy challenges within the U.S. healthcare ecosystem. Despite steady economic growth and record Medicaid enrollment during prior years, recent policy rollbacks and eligibility redeterminations have reversed some of those gains. This shift underscores growing concerns over coverage sustainability, affordability, and accessibility — factors that remain central to the investment outlook for managed care organizations and healthcare service providers.

For investors, this data signals a recalibration period. The uninsured rate serves as a barometer for payer mix dynamics, influencing everything from hospital uncompensated care burdens to payer pricing leverage and premium growth. The uptick in uninsured adults — particularly among working-age populations — could also reshape near-term utilization patterns, driving deferred care and downstream cost surges once coverage is reestablished. Meanwhile, the marginal decline in uninsured seniors reinforces Medicare’s role as a stabilizing anchor amid broader market volatility.

As health insurers, providers, and policymakers navigate these coverage headwinds, capital deployment and portfolio strategy will hinge on identifying resilient subsectors. Medicaid-focused MCOs, retail health entrants, and care-financing innovators may capture share in bridging this coverage gap. Conversely, providers with high self-pay exposure or thin operating margins face renewed risk as payer composition tilts unfavorably.

Key takeaways from chart

Broad-Based Increase in Uninsured Rates:

The overall uninsured rate rose from 7.6% in 2023 to 8.2% in 2024, reversing prior-year improvements and reflecting the post-pandemic Medicaid redetermination cycle.Child Coverage Erosion:

Among 0–17-year-olds, uninsured levels increased from 3.9% to 5.1%, marking a concerning trend given that pediatric coverage is typically a policy priority. This rise likely stems from administrative churn and reduced continuity in Medicaid/CHIP renewals.Adult Segment Drives the Surge:

The 18–64-year-old cohort remains the key pressure point, climbing from 10.9% to 11.6% uninsured. As employer-sponsored insurance growth plateaus, affordability and job-based plan turnover continue to limit retention rates.Elderly Segment Stable to Slightly Improved:

Coverage among 65+ adults remains near-universal, with a marginal decline from 0.7% to 0.6% uninsured, reaffirming Medicare’s stabilizing influence.Investor Implication:

These shifts favor insurers with exposure to Medicaid redetermination recovery and Affordable Care Act (ACA) exchange enrollment, while heightening risk for providers reliant on commercial or self-pay volumes. Strategic positioning toward value-based, cost-containment, and retail-oriented coverage solutions appears increasingly prudent.

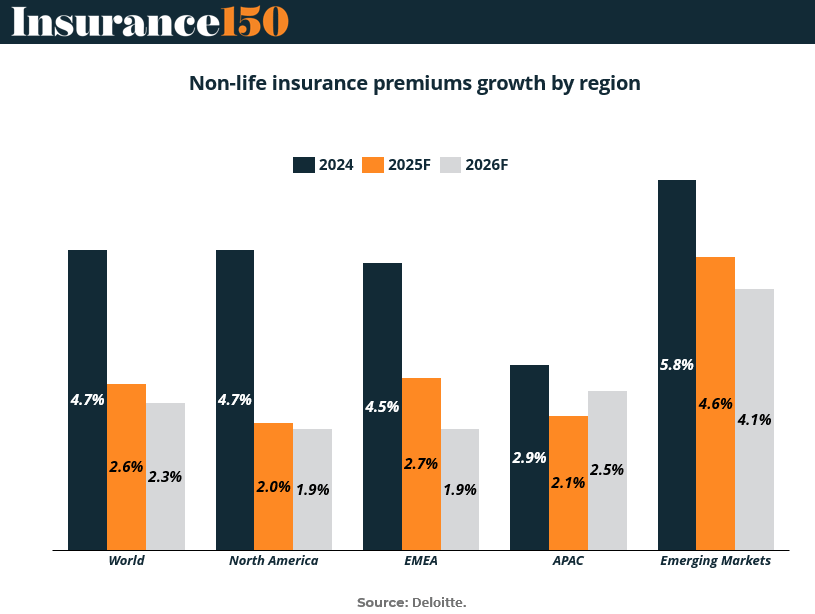

Cooling Momentum: Global Non-Life Premiums Enter a Downshift

After a period of robust post-pandemic expansion, the global non-life insurance sector is moving into a slower growth phase. As shown in the chart, premium growth decelerates markedly from 2024 through 2026 across nearly all regions. Inflation normalization, tighter underwriting cycles, and macroeconomic moderation are converging to temper rate expansion and limit premium uplift. The slowdown reflects a reversion toward long-term structural trends rather than an outright contraction — but it signals a strategic pivot point for carriers and investors alike.

In mature markets such as North America and EMEA, pricing discipline and capital efficiency will increasingly drive returns as volume growth plateaus. Reinsurance cost pressures and claims inflation — previously catalysts for rate hardening — are gradually easing, compressing underwriting margins unless offset by operational efficiency gains or data-driven risk segmentation. Meanwhile, policy retention remains stable but new business formation has softened, particularly in commercial lines, where economic uncertainty continues to dampen exposure growth.

Conversely, emerging markets maintain their role as the engine of global non-life expansion, albeit with moderating momentum. Rapid urbanization, regulatory modernization, and low penetration rates continue to underpin structural growth, though currency volatility and rising capital costs introduce new constraints. For investors, the message is clear: growth is slowing, but not stalling — shifting from a cycle of price-led expansion toward one emphasizing profitability, digital distribution, and capital optimization.

Key insights from chart

Global Slowdown Underway:

Worldwide non-life premium growth is projected to slow from 4.7% in 2024 to 2.6% in 2025, and further to 2.3% in 2026, reflecting weaker pricing momentum and softer economic activity.North America: Flatlining Growth:

Premium growth declines from 4.7% (2024) to 2.0% (2025) and 1.9% (2026) — the steepest deceleration among developed markets. Elevated claims costs and stable but saturated demand constrain expansion.EMEA: Gradual Cooling, Not Collapse:

Growth moderates from 4.5% to 2.7%, then 1.9%. Persistently high repair costs and reinsurance pricing stabilize the market but limit margin upside.APAC: Resilient but Slowing:

Asia-Pacific premiums slow from 2.9% to 2.1%, then 2.5%, maintaining a steadier trajectory due to strong motor and property lines in key economies like China and India.Emerging Markets: Still the Growth Frontier:

Despite moderation from 5.8% to 4.6%, and 4.1%, emerging economies continue to outpace developed peers. Rising risk awareness and infrastructure investment sustain momentum even amid tighter capital markets.Investor Implication:

The premium deceleration underscores the shift from volume to margin. Investors should look for insurers leveraging advanced analytics, embedded distribution, and capital-light partnerships to preserve earnings growth. Underwriting discipline and risk-based pricing will differentiate outperformers in this maturing global cycle.

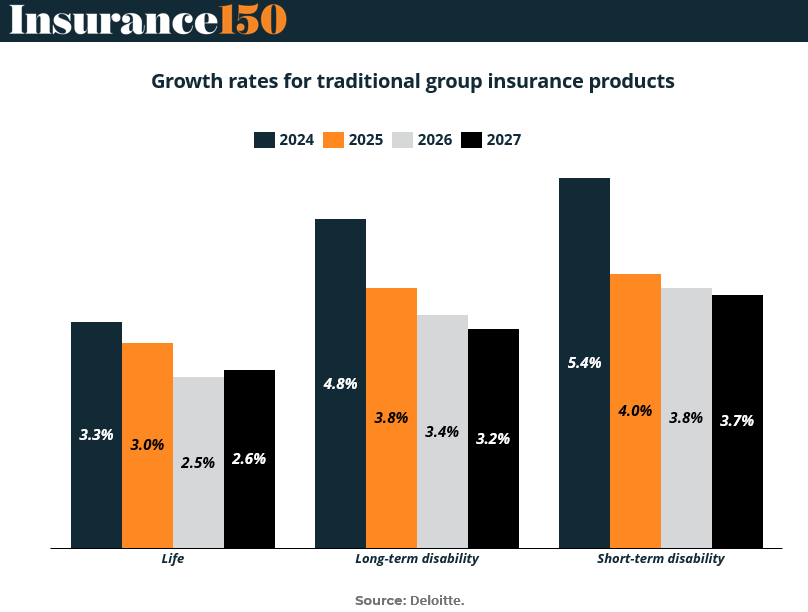

Plateau Ahead: Slowing Growth in Group Insurance Demand

The traditional group insurance segment—long considered a stable pillar of employer-sponsored benefits—is entering a phase of moderated expansion. The chart reveals a consistent deceleration across life, long-term disability, and short-term disability products through 2027. After years of steady wage growth and post-pandemic benefit recalibration, the group market is reaching saturation, particularly among large employers. With macroeconomic uncertainty weighing on workforce expansion and benefit budgets, growth is tilting toward maintenance rather than momentum.

Yet this cooling does not imply a weakening market. Rather, it signals a maturing cycle where pricing discipline, product differentiation, and integration with voluntary benefits will define the next frontier of competitiveness. Carriers are recalibrating toward hybrid coverage models—blending core protection products with well-being and income security features that appeal to evolving employee preferences. As workforce demographics shift, the value proposition of group protection is being reframed from “coverage as benefit” to “resilience as service.”

For investors, the signal is one of endurance, not decline. The slowdown creates openings for players capable of scaling through distribution efficiency and technology-led underwriting. Group insurers with digital enrollment platforms, adaptive risk analytics, and employer partnership depth will capture share even as aggregate growth normalizes. The emphasis shifts from expansion to profitability and stickiness in client relationships—a hallmark of institutional stability amid cyclical moderation.

Key takeaways from chart

General Downtrend in Growth:

Across all three product lines, growth decelerates from 2024 through 2027, highlighting a gradual normalization of demand post-COVID benefit expansions.Life Insurance: Steady Softening:

Growth eases from 3.3% in 2024 to 3.0% (2025), 2.5% (2026), and 2.6% (2027)—a reflection of plateauing workforce participation and limited benefit redesign in mature employer markets.Long-Term Disability: Moderate Compression:

Rates decline from 4.8% to 3.8%, 3.4%, and 3.2%, driven by slower wage inflation and stabilization of claims volumes. Employers continue to prioritize cost control, curbing premium expansion.Short-Term Disability: Most Pronounced Decline:

Growth falls from 5.4% to 4.0%, 3.8%, and 3.7%, though remaining relatively higher due to continued focus on absentee management and employee well-being programs.Structural Interpretation:

The softening reflects a mature cycle rather than market erosion. As voluntary and supplemental benefits gain traction, traditional group insurance faces incremental, not exponential, growth potential.Investor Implication:

Expect a margin-led rather than volume-led cycle ahead. Consolidation, cross-selling to midmarket employers, and digital onboarding efficiency will define the outperformers. Carriers prioritizing embedded analytics and personalized coverage extensions will sustain profitability despite macro deceleration.

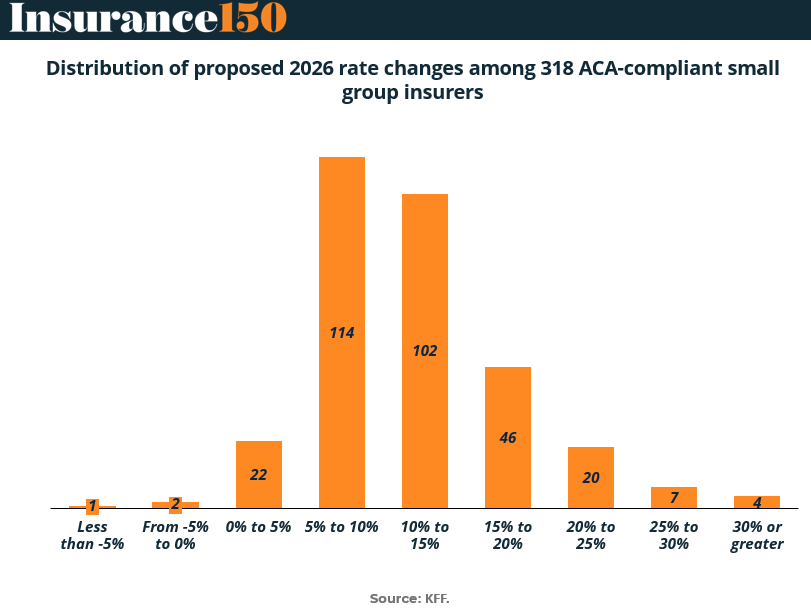

Pricing Pressure Mounts: ACA Small Group Insurers Brace for Double-Digit Rate Hikes

As the Affordable Care Act (ACA) small group insurance market looks toward 2026, proposed rate filings signal a wave of premium escalation across the board. According to filings from 318 ACA-compliant small group insurers, most carriers anticipate rate increases in the 5% to 15% range, marking one of the broadest upward adjustments since the pandemic. This reflects intensifying cost drivers — including medical inflation, rising pharmaceutical expenditures, and higher administrative overhead — all converging against a backdrop of constrained underwriting margins.

The distribution of proposals reveals that nearly three-quarters of insurers are positioning for mid- to high-single-digit increases, suggesting that cost normalization remains elusive despite moderation in utilization growth. Small group insurers, in particular, face disproportionate exposure to claims volatility and reduced pricing flexibility, heightening the tension between affordability and solvency. While the majority of filings remain within actuarially justifiable bands, the clustering around 5–15% increases underscores the persistence of inflationary inertia within the sector.

For investors, these proposed rate hikes signal both risk and resilience. On one hand, premium expansion will likely buoy top-line growth for smaller carriers and regional players in 2026. On the other, higher pricing could pressure enrollment and renewals among small employers still recovering from wage cost inflation. The competitive equilibrium in the small group market will increasingly hinge on pricing agility, risk management sophistication, and regulatory navigation — core differentiators that will shape investor outlooks across publicly traded and private health insurers alike.

Key insights from chart

Majority Expect Mid-Single to Low-Double-Digit Increases:

The largest concentration of insurers — 114 carriers (5–10%) and 102 carriers (10–15%) — indicates a broad consensus around meaningful premium inflation.Outliers at Both Ends:

Only 3 insurers project rate reductions, while a small group (11 insurers total) expect increases above 25%, reflecting market-specific claims spikes or adverse selection pressures.Moderate Hikes Dominate:

Roughly 85% of insurers fall within the 5%–20% increase range, suggesting systemic cost adjustments rather than isolated market shocks.Key Drivers:

Rising medical utilization, high-cost specialty drugs, and elevated labor costs in provider networks remain the primary catalysts behind these filings.Investor Implication:

Persistent premium growth reinforces the earnings outlook for underwriters with disciplined pricing and diversified product portfolios. However, elevated rate actions could attract regulatory scrutiny and limit enrollment elasticity in the small group segment. Long-term performance will depend on execution in cost containment, risk pooling, and benefit design innovation.

Sources & References

CDC. Health insurance Fastats. https://www.cdc.gov/nchs/fastats/health-insurance.htm

KFF. Health care costs and affordability. https://www.kff.org/health-costs/health-policy-101-health-care-costs-and-affordability/

CMS. NHL expenditure data. https://www.cms.gov/data-research/statistics-trends-and-reports/national-health-expenditure-data

Deloitte. Insurance industry outlook. https://www.deloitte.com/us/en/insights/industry/financial-services/financial-services-industry-outlooks/insurance-industry-outlook.html