- The Deal Brief - Insurance

- Posts

- Insurers Face a Triple Threat: Cyber, Climate, and Macro Volatility

Insurers Face a Triple Threat: Cyber, Climate, and Macro Volatility

Global supervisors flag 3 key risks, while cyber premiums lag ransomware reality and the labor market enters a "low-hire" limbo.

Good morning, ! This week we’re covering how cyber risks are growing faster than the protection instruments and the coverage gap in cybersecurity. Another gap is in the labor market which entered a bottleneck while valuations keep growing pushed by AI. According to global supervisors, the industry’s most enduring weaknesses are concentrated in macroeconomic volatility, disaster risk, and cyber exposure.

Sponsor spotlight: Affinity’s report breaks down 7 best practices top PE firms use to turn relationship intelligence into better sourcing—finding warm paths early, tightening banker coverage, and building firm-wide visibility. Download Report →

TREND OF THE WEEK

Insurance’s Risk Stack Gets Thicker

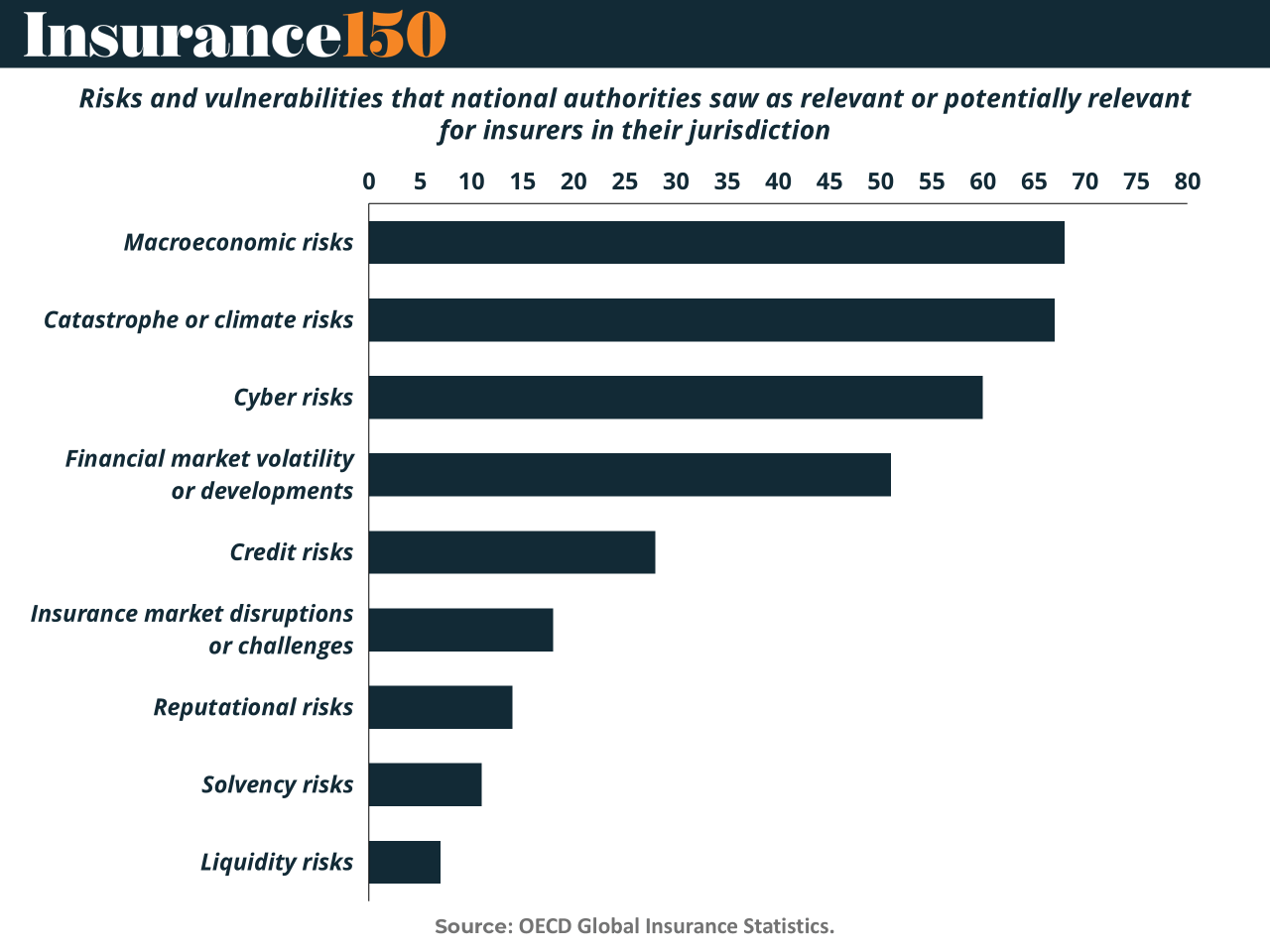

If insurers feel like they’re juggling more risks than usual, it’s because they are. According to global supervisors, the industry’s most persistent vulnerabilities cluster around macroeconomic volatility, disaster risk, and cyber exposure—with financial market swings close behind.

Inflation and interest rate volatility top the list. Regulators from Australia to France warn that higher rates are driving policy lapses, underinsurance, and valuation pressure on bond-heavy balance sheets. Add in rising claims severity—from auto to health—and underwriting margins get squeezed fast.

Meanwhile, catastrophe risk isn’t theoretical. Earthquakes, floods, wildfires, and windstorms are already straining non-life portfolios, particularly in disaster-prone regions. Layer on escalating cyber risk, amplified by digitization and third-party dependencies, and insurers face a wider attack surface than ever.

Bottom line: risk isn’t spiking—it’s stacking. (More)

PRESENTED BY AFFINITY

Private equity firms face rising competition as auctions drive valuations higher and differentiation lower. The firms that consistently outperform are not simply deploying more capital. They are managing networks more strategically, uncovering warm paths into targets before processes begin, maintaining disciplined banker coverage, and creating visibility across every relationship.

This best practices guide highlights seven proven strategies used by leading firms to source proprietary deals, streamline execution, and position portfolio companies for stronger exits. Built around real-world examples, it shows how relationship intelligence is reshaping private equity deal making from origination through exit.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

PUBLISHERS PODCAST

Introducing No Off Button: Conversations with founders/investors

Relentless builders don’t wait for permission, and they don’t hit pause. No Off Button goes inside the minds of operators who keep compounding when others tap out.

This week, our Publisher sits down with Walker Deibel, WSJ bestselling author of Buy Then Build and founder of Acquisition Lab. Walker makes a PE-relevant case that hits close to home: building from zero is often the worst risk-adjusted bet, while buying profitable, owner-operated businesses offers immediate cash flow, control, and asymmetric upside.

The conversation dives into acquisition entrepreneurship, the Silver Tsunami of baby boomer exits, and why “boring” industries deliver better downside protection than most venture-backed plays.

Why PE should care: this is roll-up logic, applied at the individual-operator level, capital discipline, cash yield, and buying earnings instead of narratives.

MICROSURVEY

Where do you expect the fastest ROI from new investments? |

DEAL OF THE WEEK

The Great Indian Insurance Unbundling

Bajaj Group just cut the cord on its 24-year joint venture with Allianz, shelling out $2.4B to take near-full control of their life and general insurance arms. The breakup marks one of India’s largest insurance buyouts, ending a partnership that helped build two top-tier franchises in the country. For Bajaj, this is a bet on India’s next insurance boom, driven by rising incomes and digital adoption.

For Allianz, it’s a strategic retreat to redeploy capital elsewhere—think fewer joint ventures, more capital-light plays. Also worth noting: this deal isn’t just a big check. It’s a sign of foreign players stepping back as local firms double down. (More)

INSURTECH CORNER

Cyber Premiums Lag Ransomware Reality

Cyber risk is growing faster than the products meant to protect against it. Ransomware accounts for 60% of all cyber insurance claims, yet cyber insurance premiums are only growing at 15% annually. Meanwhile, 66% of organizations report increasing their cybersecurity spend, a sign of escalating perceived risk.

The gap between premium growth and claim activity points to a potential repricing wave ahead. As underwriting models catch up to threat velocity, especially with ransomware now a dominant claim driver, expect hardening in cyber lines, tighter terms, and more demand for parametric and tech-assisted solutions.

Why it matters: For carriers and cyber-focused insurtechs, this is a pricing and product design moment. Insurers underestimating ransomware exposure risk loss ratios blowing out. The winners will be those who embed advanced threat intelligence into underwriting and align pricing more closely to actual incident frequency. (More)

MACROECONOMICS

Jobs, Not Profits, Are the Missing KPI

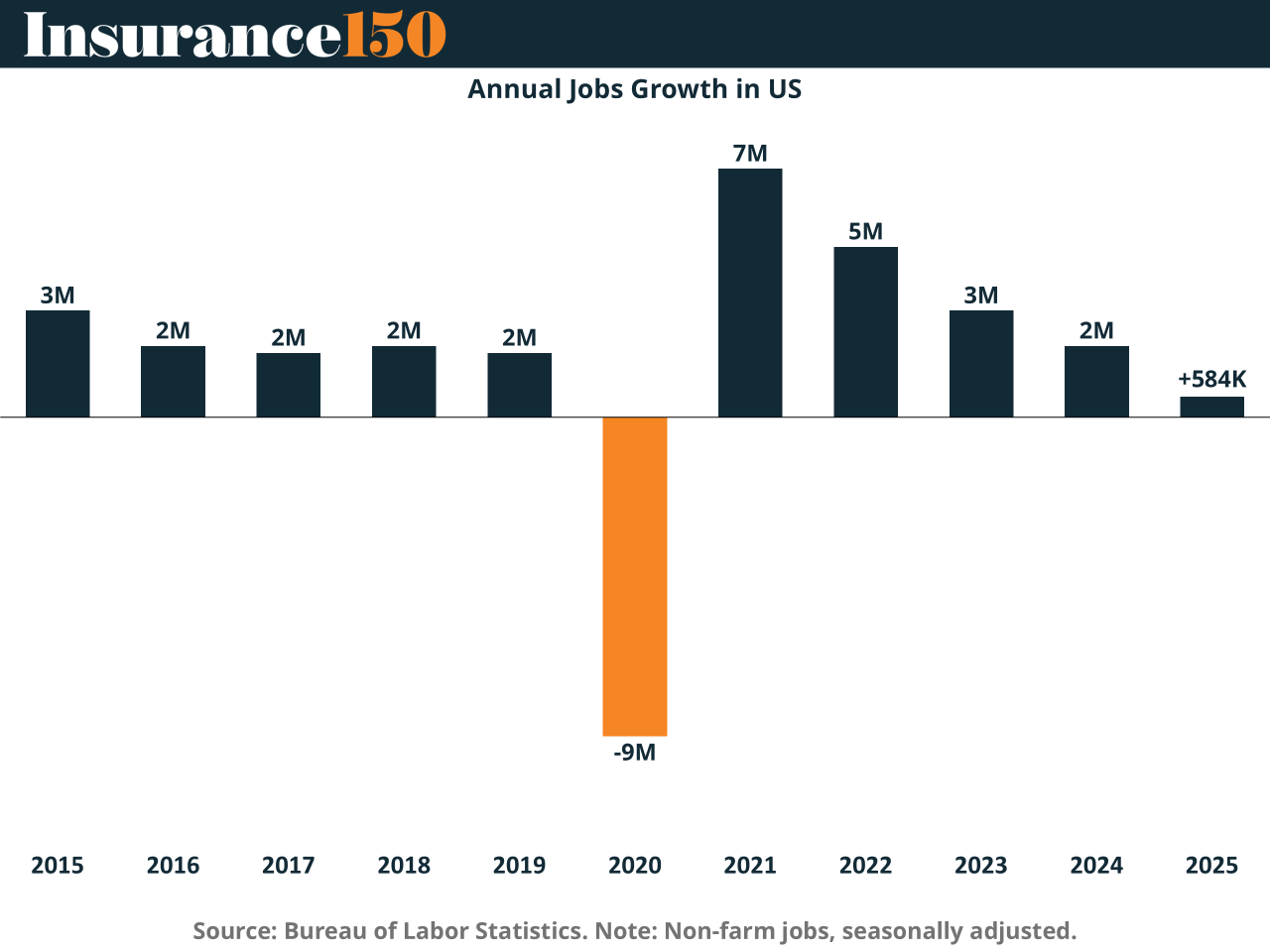

The U.S. labor market has entered a “low-hire, low-fire” limbo. Job growth in 2025 was the weakest in a decade (outside the pandemic), yet the unemployment rate barely budged. Why? Companies are dodging both hiring and firing while quietly betting on automation over labor. Despite this stagnation, equity markets are ripping, pricing in an AI-fueled productivity boom that may never trickle down.

The paradox? Rising valuations with flat labor income. For PE and corporate strategists, this is a macro backdrop where capital beats labor—until consumer demand becomes the constraint.

COMPLIANCE CORNER

Solvency Spotlight: U.S. Tightens Grip on Capital Soundness

In 2025, U.S. regulators are sharpening solvency oversight with a push beyond traditional Risk-Based Capital (RBC). The key shift? Asset concentration risk—long overlooked in RBC formulas—is now under the microscope, prompting calls for more granular Own Risk and Solvency Assessments (ORSA).

On the global front, the adoption of the Insurance Capital Standard (ICS) brings U.S. insurers into alignment with international risk metrics, especially for IAIGs. But U.S. regulators are insisting on tailored implementation to reflect domestic market realities, including PE involvement.

Expect tougher group-wide supervision, tighter investment and reinsurance restrictions, and more rigorous financial exams.

Why it matters: Insurers must elevate enterprise-wide capital discipline now—integrating concentration analytics, refining reserving practices, and preparing for ICS-level reporting. Solvency isn't just a compliance issue in 2025—it's a strategic imperative. (More)

INTERESTING ARTICLES

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"Our greatest weakness lies in giving up. The most certain way to succeed is always to try just one more time."

Thomas Edison