- Insurance 150

- Posts

- Insuring Oil Giants, Australia’s Insurtech Surge, and the 5-Year Outlook

Insuring Oil Giants, Australia’s Insurtech Surge, and the 5-Year Outlook

Oil insurance demand targets $38.7B and White Mountains exits Bamboo at a $1.75B valuation, while Australia’s insurtech sector jumps to a 31% CAGR.

Good morning, ! This week we’re diving into the main targets for oil insurance, Australia’s insurtech market size, and where insurance leaders are betting in the next 3-5 years.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Coverage at Crude Scale

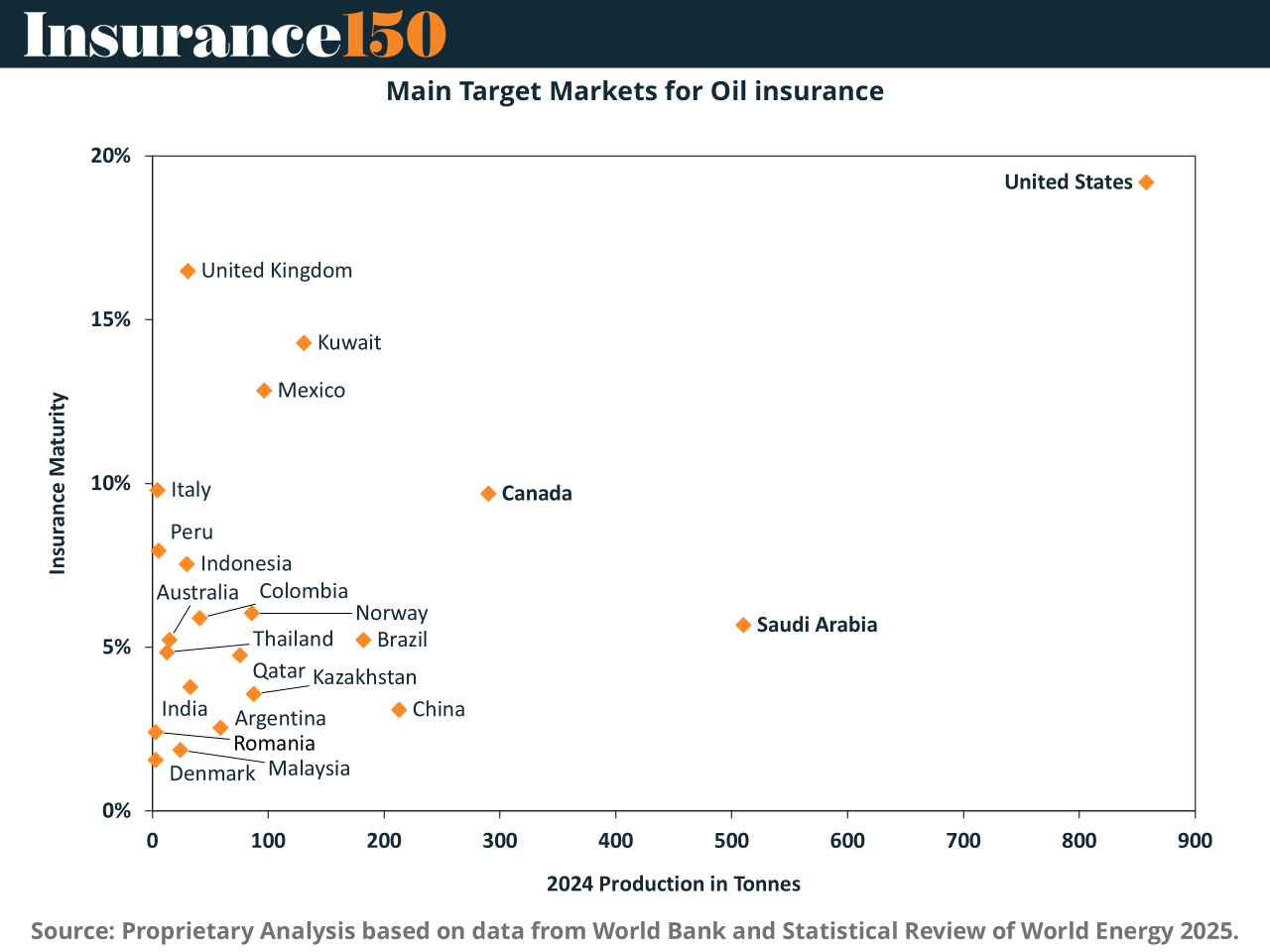

The oil insurance market is having a moment—whether it wants to or not. With asset values climbing and U.S. crude output topping 857M metric tons, demand for coverage across upstream, midstream, and downstream operations is rising fast. Market size is projected to hit $38.7B by 2033, fueled by complex geopolitics, ESG pressure, and a steady stream of catastrophic risk. Upstream capacity is at a record $10B, while downstream insurers obsess over business interruption and wildfire exposure. Insurers now find themselves underwrite-and-pray mode: pricing in climate chaos, cyber breaches, and regulatory whiplash in the same policies. Welcome to modern energy risk.

TREND OF THE WEEK

The Loyalty Arms Race

Insurance leaders are making one bet with outsized conviction: customer loyalty and retention. With 65% naming it their top strategic priority, the industry is effectively declaring that growth over the next 3–5 years will come from keeping existing policyholders, not chasing new ones. Close behind is the push to enhance data analytics capabilities (60%), a clear signal that underwriting precision and behavioral insight are becoming competitive necessities rather than innovation buzzwords. This data push also fuels the broader march toward digital transformation (56%), where real-time servicing and personalized experiences are no longer aspirational. Meanwhile, product diversification (21%) and new-market expansion (19%) take a back seat. Depth over breadth is the new playbook — and the insurers that best understand their current customers will own the next growth cycle. (More)

PRESENTED BY RAD INTEL

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

MICROSURVEY

Which area will see the biggest increase in your insurance budget next year? |

DEAL OF THE WEEK

White Mountains’ $1.75B Bamboo Exit

White Mountains Insurance Group just locked in a major win with its sale of a controlling stake in Bamboo Insurance to CVC Capital Partners. The deal values the California-based insurtech at $1.75 billion, nearly 6x White Mountains’ original investment of $285 million in 2023 for ~70% of the company.

White Mountains walks away with $840 million in net proceeds and books a tidy $310 per share in book value gains—while retaining a 15% stake valued around $250 million. Not bad for a two-year hold.

Why it matters: Bamboo’s hybrid model—a tech-enabled MGA with in-house reinsurance and distribution—has proven resilient amid California’s volatile homeowners’ market. The deal signals strong investor appetite for scaled, capital-light insurance platforms with embedded growth and underwriting control.

CVC’s entry also underscores private equity’s ongoing pivot toward mature insurtech assets that actually make money. For execs in Insurance and FIG, it’s a case study in building, scaling, and monetizing platforms—fast. (More)

INSURTECH CORNER

Kangaroo Jumping CAGR: Australia’s InsurTech Takes a 31% Leap Forward

Australia’s InsurTech market is sprinting toward a $4.2B valuation by 2034, growing at a blistering 31% CAGR. That’s not a typo—it’s a tech play unfolding inside a legacy industry. AI, IoT, cloud, and real-time analytics are reshaping how insurers price, underwrite, and settle claims. Meanwhile, embedded insurance is sneaking coverage into checkout flows and gig work apps. Incumbents? They’re partnering fast—or bracing for irrelevance. And with staffing cuts of up to 20% forecasted due to automation, this isn’t just tech disruption—it’s an operating model overhaul. From Sydney to Perth, the back office is turning into backend code. (More)

TOGETHER WITH YOU.COM

AI is all the rage, but are you using it to your advantage?

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities. Learn more with this AI Use Case Discovery Guide.

MACROECONOMICS

A World of Debt: Global Debt Surpasses $100T

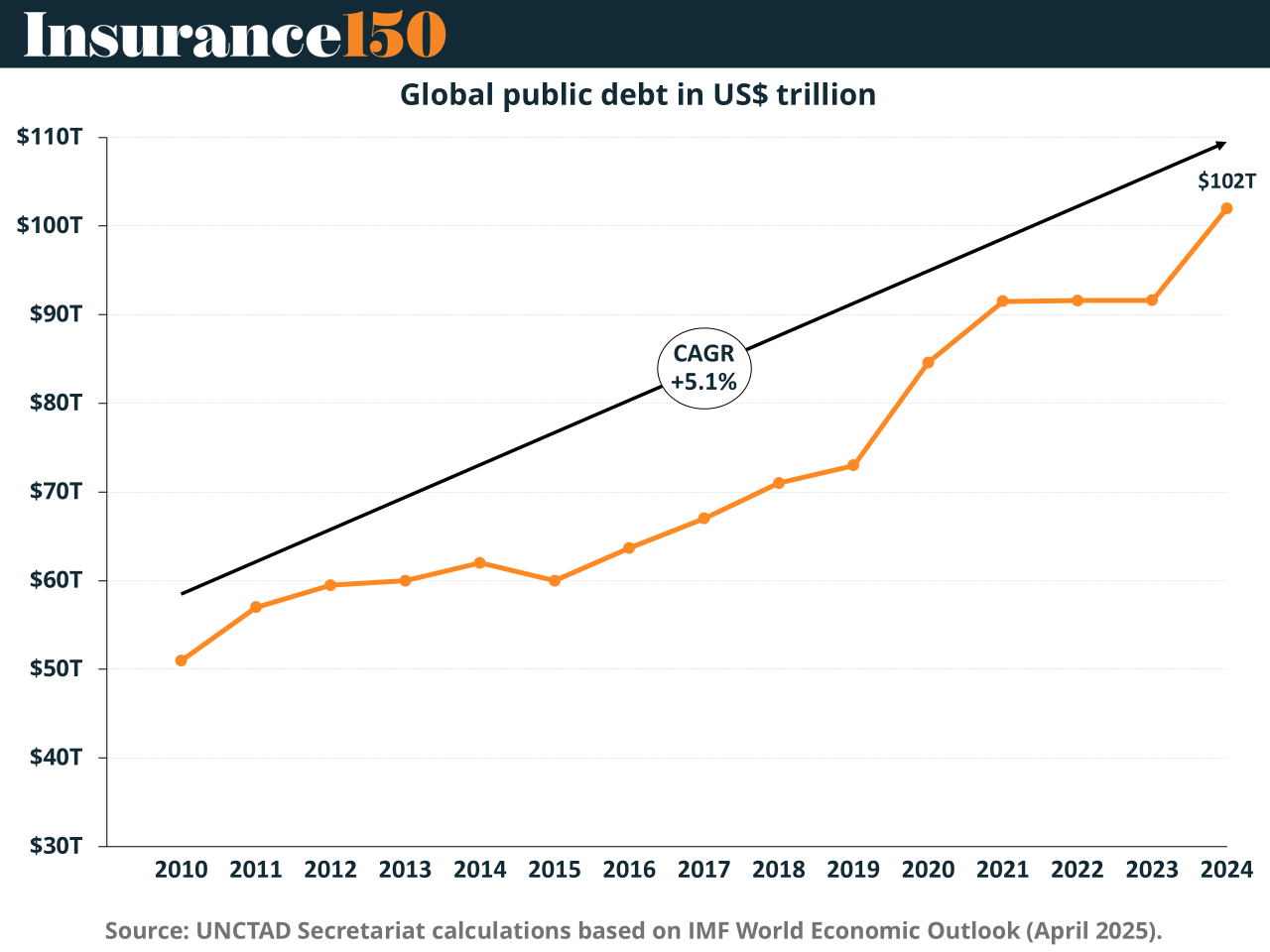

Global public debt has topped $100 trillion, but the real headline? It's not just ballooning—it's suffocating. Developing economies now carry twice the debt growth of advanced nations since 2010, with little to show in GDP or revenue. As interest payments outpace human development budgets, more countries are falling into the 60% debt-to-GDP club—58 and counting. Structurally, this isn’t just bad luck—it’s a broken financial system where the math doesn’t pencil. PE folks eyeing growth markets? Watch for mounting refinancing risks and FX exposures that could flip sovereigns from borrower to basket case overnight. (More)

COMPLIANCE CORNER

I, Captives, and Capital: What’s Next in Regulatory Scrutiny?

Deloitte’s 2026 Insurance Outlook is clear: innovation is non-negotiable, but so is compliance. As insurers race to deploy GenAI across claims triage, underwriting, and fraud detection, regulators are sharpening their focus on data quality, system modernization, and cyber resilience. With fragmented data systems still prevalent, supervisory pressure will likely rise on data governance standards and AI model transparency, especially in fraud-sensitive markets like the U.S.

Another hotspot? Captive insurance expansion. Asia-Pacific, particularly Hong Kong, is seeing a resurgence in captives as large corporates respond to tightening reinsurance terms and elevated loss ratios. But as captives proliferate, expect closer scrutiny from regulators on solvency, risk transfer structures, and abuse risks—especially as capital models grow more complex and interconnected.

For compliance officers, the rising use of agile capital vehicles like cat bonds and sidecars means more oversight responsibilities around counterparty risk and transparency. Pair that with shifting expectations on customer-centricity—driven by behavioral analytics and hyper-personalized products—and the compliance playbook for 2026 is getting thicker.

Bottom line: Tech deployment without governance is a regulatory trap. As insurers modernize, compliance teams must scale with equal agility—or risk becoming the next chokepoint. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Action is the foundational key to all success."

Pablo Picasso