- Insurance 150

- Posts

- Insuring the Game

Insuring the Game

Analysis of the Global Sports Insurance Market

Introduction

In the realm of professional sports, athletes are not just players—they are valuable assets whose health and performance are tied directly to multimillion-dollar contracts, brand endorsements, and team valuations. Given the high stakes involved, it’s no surprise that the sports insurance industry has grown into a complex and vital sector, protecting athletes, teams, events, and even sponsors against an array of financial risks. From covering career-threatening injuries to safeguarding events from unexpected disruptions, insurance has become the financial backbone of modern sports.

1. The Global Sports Insurance Market – Current Landscape and Projections

The sports insurance market has experienced steady growth over the past decade, bolstered by the rise in global sports participation and heightened awareness of injury-related risks.

According to our consensus based on data from Global Growth Insights, Data Intelo and Verified Market Reports, the sector was valued at approximately USD 6.6 billion in 2024, and it is expected to expand to USD 11.9 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.7%.

This growth trajectory is influenced by several factors, including increasing commercialization of sports, expansion of media coverage, and growing financial stakes in both amateur and professional events.

A significant proportion of this growth is attributed to professional sports, where clubs and organizations invest in comprehensive insurance packages to protect their high-value players. For instance, high-profile athletes like Lionel Messi and Cristiano Ronaldo are often covered under multi-million-dollar personal injury insurance policies that compensate clubs in case of long-term injuries. Event organizers also seek coverage for cancellation or liability.

The global demand for such insurance products is expected to rise in tandem with the expansion of the sports ecosystem. Countries investing in sports infrastructure, talent development, and international events will likely see higher adoption rates of sports insurance in the coming years.

2. Athlete Coverage – From Grassroots to Elite Levels

Sports insurance coverage is multifaceted and varies depending on the level at which the sport is played. Amateur athletes often rely on basic insurance plans that cover participant accidents and general liability. These plans are essential in school leagues, recreational clubs, and local tournaments, where budgets are limited and risks are still substantial.

In contrast, insurance for professional athletes is significantly more complex and costly. These policies typically cover a wide range of scenarios including injuries, long-term disability, and career-ending incidents. For instance, when footballer Neymar Jr. sustained an injury before a critical Champions League match, his club’s insurance covered a substantial portion of his salary and potential lost value. Policies can be tailored to individual needs, and premiums are often determined based on medical history, playing position, and prior injury records.

Moreover, collegiate athletes in countries like the United States also have access to structured insurance systems. The NCAA provides injury insurance options for players during and after their college careers. In some cases, these policies can be supplemented with loss-of-value insurance that protects a player’s future earnings potential should an injury decrease their draft status or marketability.

3. Risk Management and Claims in Sports Insurance

Risk management lies at the core of sports insurance. Effective management and prompt claims processing ensure the sustainability of insurance operations and the financial well-being of insured parties. Insurers often employ risk analysts to assess the potential exposure associated with each policy, especially in high-contact sports like American football, rugby, and mixed martial arts.

Common claims in sports insurance include medical expense coverage for on-field injuries, liability claims related to spectator incidents, and coverage for damaged or stolen equipment. Accident insurance policies are particularly important in youth and amateur sports. As noted by Sadler Sports & Recreation Insurance, these plans typically pay for covered medical expenses and may include supplemental policies that reimburse out-of-pocket costs up to $5,000.

In addition to physical injuries, psychological health and wellness are increasingly being factored into comprehensive insurance coverage. Some advanced policies now include mental health support, reflecting the growing recognition of mental strain in competitive sports. This shift aligns with broader societal changes and could mark a significant turning point in how sports insurance is structured.

Accident insurance represents the largest share of claims in the sports insurance sector, accounting for approximately 50% of all reported cases, as illustrated in the 2023 breakdown. This dominance highlights the inherently high risk of physical injury in athletic environments, especially in contact and high-impact sports. Athletes at every level—from youth leagues to professionals—are susceptible to acute injuries like fractures, sprains, and concussions, which often require immediate medical attention and can result in significant medical expenses. As such, accident coverage serves as the financial backbone of most sports insurance policies, ensuring that both individuals and organizations are protected against the economic burden of these frequent incidents.

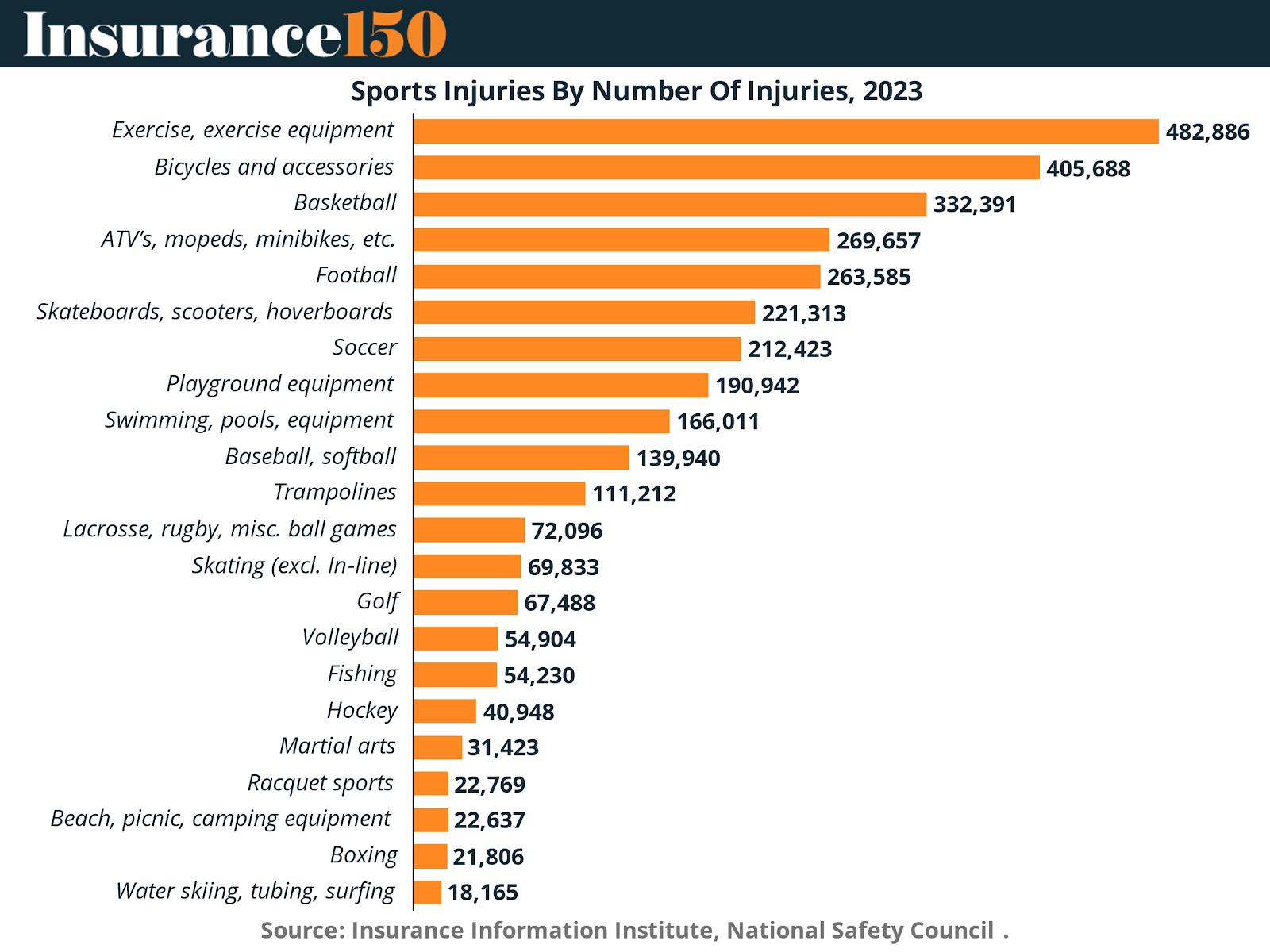

This chart reinforces the central role of accident-related injuries as the primary driver of sports insurance claims. In 2023 alone, a total of 3,272,347 sports-related injuries were reported across various activities, underscoring the significant exposure faced by insurers. Leading the list are seemingly routine activities like exercise with equipment (482,886 injuries) and bicycling (405,688 injuries), which together account for more than a quarter of all reported injuries. Traditional team sports such as basketball, football, and soccer also contribute heavily, collectively exceeding 800,000 cases.

These figures illustrate why accident insurance consistently represents about 50% of all sports insurance claims. Whether from contact sports, equipment misuse, or recreational activities, the frequency and severity of injuries demand comprehensive coverage. For insurers, this data validates the need for robust accident protection policies, especially in high-participation or youth sports markets. For policyholders, it highlights the value of accident insurance as not just a safety net, but a critical component of responsible sports management and planning.

This age-distribution chart of sports injuries in 2023 offers critical insight into where insurance coverage is most essential — particularly in the competitive age brackets. The highest number of injuries occurred in the 25 to 64 age group (1,037,740), closely followed by ages 5 to 14 (1,030,389) and 15 to 24 (812,335). These three segments together account for over 85% of all reported sports injuries.

The data emphasizes that the majority of injury incidents happen during the most active and competitive stages of life — from youth leagues and school sports to collegiate athletics and adult amateur or semi-professional competitions. These are the age groups where performance pressure, training intensity, and organized play converge, raising the risk of accidents.

From an insurance perspective, this reinforces the need for tailored accident and liability coverage in youth and adult leagues, educational institutions, and training academies. Insurers and investors should focus on these age brackets when designing products, as they represent both the highest claim volumes and the greatest demand for protective coverage. For policyholders, especially institutions managing competitive sports programs, these numbers validate why robust, age-specific coverage is not optional — it’s a necessity.

4. Case Study in professional sports: Lionel Messi’s €750 Million Legs

Lionel Messi, reportedly had his legs insured for an astounding €750 million (approximately $900 million USD), when playing for Barcelona (until 2021). This insurance policy, taken out during his tenure at FC Barcelona, underscores the immense value placed on his physical assets, particularly his legs, which have been instrumental in his illustrious career.

Such a substantial insurance policy reflects the high stakes involved in professional sports, where an athlete's physical well-being is directly tied to their performance and, by extension, the financial interests of their clubs and sponsors. In Messi's case, his exceptional dribbling, precise passing, and goal-scoring abilities have not only brought success to his teams but have also made him a global icon, attracting significant commercial endorsements. By insuring his legs for such a significant amount, FC Barcelona aimed to mitigate the financial risks associated with potential injuries that could sideline their star player. This move is indicative of a broader trend in sports insurance, where clubs and athletes seek to protect their investments and earning potential through comprehensive coverage.

For insurance M&A developers and investors, Messi's case highlights the lucrative opportunities within the sports insurance sector, particularly in offering specialized policies tailored to the unique needs of elite athletes. As the commercialization of sports continues to grow, the demand for such high-value insurance products is likely to increase, presenting a promising avenue for investment and innovation in the industry.

5. Conclusion

The sports insurance sector is no longer a niche back-office offering—it has evolved into a critical financial instrument in a multibillion-dollar industry. With more than 3.2 million sports-related injuries reported in the US in 2023 alone, and the majority occurring in high-participation, competitive age groups (5–14, 15-24 and 25-64 years), the financial risk profile in global sports has never been higher. This makes accident and liability insurance one of the most significant and consistent sources of premium revenue but also claims volume for insurers.

Sports insurance, in its truest and most impactful form, is a product built for the professional tier. While schools, amateur leagues, and recreational athletes may rely on generalized health and accident coverage, the financial exposure and performance risk in professional sports demand specialized policies—covering everything from career-ending injuries to loss-of-value scenarios. It is at this elite level where insurance becomes deeply integrated into contract negotiations, club asset management, and sponsorship guarantees. These are not optional coverages—they are risk transfer instruments critical to protecting multi-million-dollar investments in talent.

The case of Lionel Messi's €750 million leg insurance stands as a symbol of the market’s potential. When an athlete's physical assets are insured at such magnitude, it reflects a broader trend: performance and health are insurable capital. Clubs, sponsors, and athletes are increasingly proactive in transferring this risk through insurance, creating substantial underwriting opportunities at the high end of the market.

For M&A developers and insurance investors, the implication is strategic and urgent. The sports insurance vertical is poised for consolidation, innovation, and international expansion. Acquiring specialty underwriters, investing in digital claims platforms, or entering emerging regional markets (like Latin America or Southeast Asia) offer pathways to create scalable value. With risk frequency high, payout predictability maturing, and customer demand rising, sports insurance is not just a necessary product—it’s a high-growth play for the next decade.

Sources & References

Abbeyautoline. (n/d). The top 10 most expensive athlete insurance policies of all time. https://www.datalibraryresearch.com/reports/sports-insurance-market-91

AG Specialty Insurance. (2023). Announcing the 2024 College Sports Medical Expense and Sports Insurance Study. https://agspecialtyinsurance.com/news/sports-injury-statistics-insurance-study/

Data Intelo. (2025). Sports Insurance Market. https://dataintelo.com/report/global-sports-insurance-market

DLR. (2024). Global Sports Insurance Market Opportunities and Forecast 2023-2030. https://www.datalibraryresearch.com/reports/sports-insurance-market-91?utm_source=chatgpt.com

eSports Insurance. (2024). Essential Guide to General Liability Insurance for Your Sports League. https://esportsinsurance.com/general-liability-insurance-for-sports-league/

eSports Insurance. (2024). The Essentials of Sports Accident Insurance: Protecting Athletes. https://esportsinsurance.com/sports-accident-insurance/

Global Growth Insights. (2025). Sports Insurance Market. https://www.globalgrowthinsights.com/market-reports/sports-insurance-market-105266

Insurance Information Institute. (2023). Facts + Statistics: Sports injuries. https://www.iii.org/fact-statistic/facts-statistics-sports-injuries#Sports%20Injuries%20By%20Number%20Of%20Injuries,%202023

NSC injury Facts. (2023). Sports and Recreational Injuries. https://injuryfacts.nsc.org/home-and-community/safety-topics/sports-and-recreational-injuries/

O2 Sports Insurance. (n/d). Types of Coverage Needed for Sporting Events: A Comprehensive Guide. https://www.o2sportsinsurance.com/types-of-coverage-needed-for-sporting-events/

Sports 150. (2025). Scoring Money: The Economics of Sports. https://www.sport150.com/p/scoring-money-the-economics-of-sports

Verified Market Reports. (2025). Global Sports Insurance Market. https://www.verifiedmarketreports.com/product/sports-insurance-market/