- Insurance 150

- Posts

- Insuring the Plate: The Strategic Role of Insurance in the Global Food Economy

Insuring the Plate: The Strategic Role of Insurance in the Global Food Economy

The global food industry is undergoing rapid expansion, technological transformation, and structural risk accumulation.

Executive Summary

Despite its size and essential nature, food remains a low-margin, high-volume business riddled with volatility. Insurance has emerged as a financial backbone in this landscape, absorbing shocks ranging from spoilage and contamination to cyberattacks and climate impacts.

As food demand continues to rise and logistical complexity scales, insurance is no longer just a cost of doing business. It is a margin-preservation strategy, a risk transfer mechanism, and increasingly, a prerequisite for resilience. This report explores market sizing, regional growth, structural waste, and the economic necessity of food insurance in a sector that cannot afford disruption.

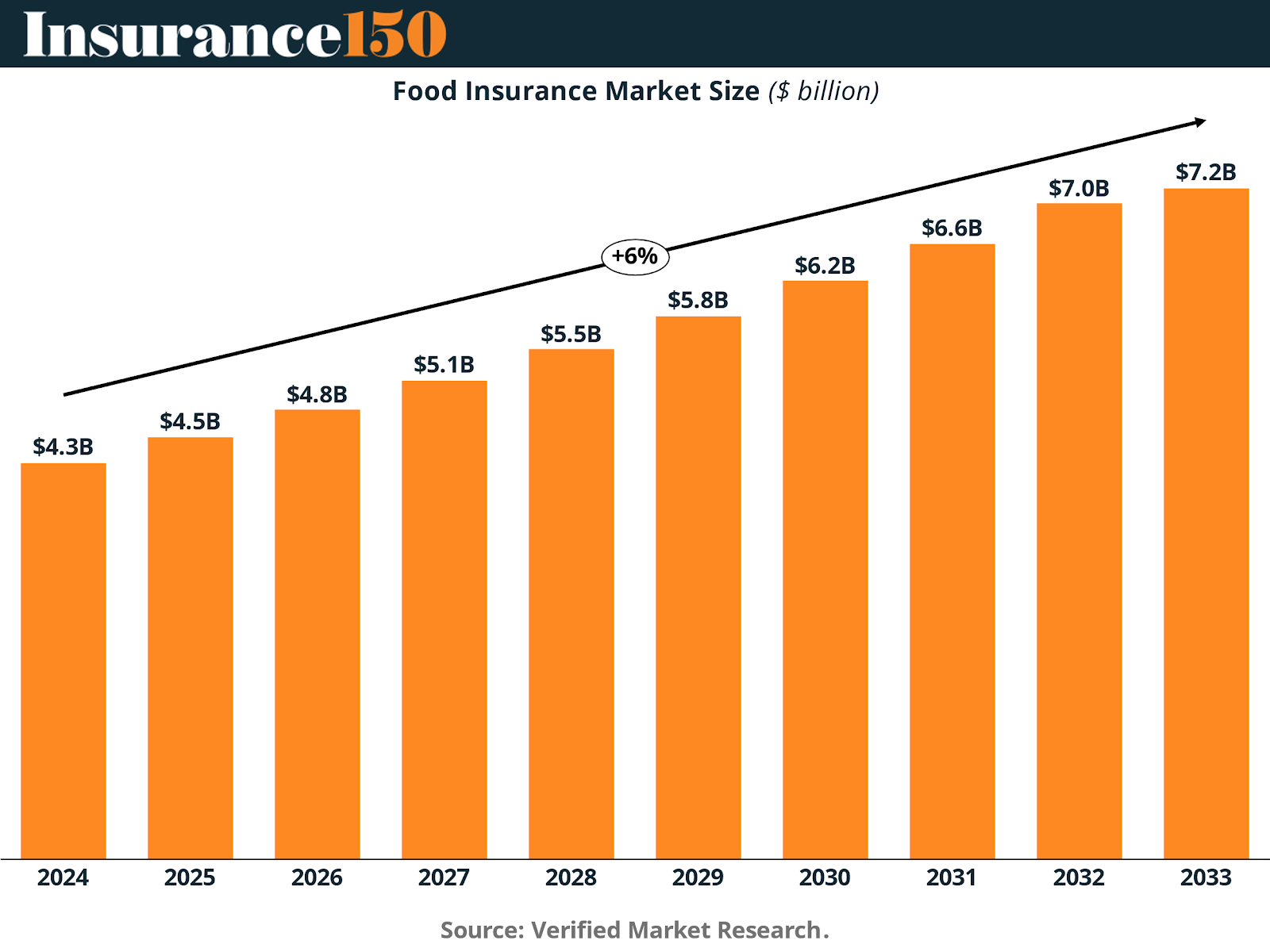

Food Insurance Market Size: A $7.2B Industry by 2033

The food insurance market is projected to grow from $4.3 billion in 2024 to $7.2 billion by 2033, representing a compound annual growth rate of ~6%. This steady rise is not occurring in isolation. It reflects a larger transformation within the food value chain where risks—once tolerated—are now actively hedged.

As food systems become increasingly global and interconnected, insurance demand has been pushed higher by regulatory changes, more frequent recalls, and the expansion of food logistics. Events like cargo contamination, cyber breaches in distribution systems, and supply chain delays have made insurers key partners, not just vendors. The growth in premiums signals a deeper truth: risk is becoming uninsurable unless proactively priced and managed.

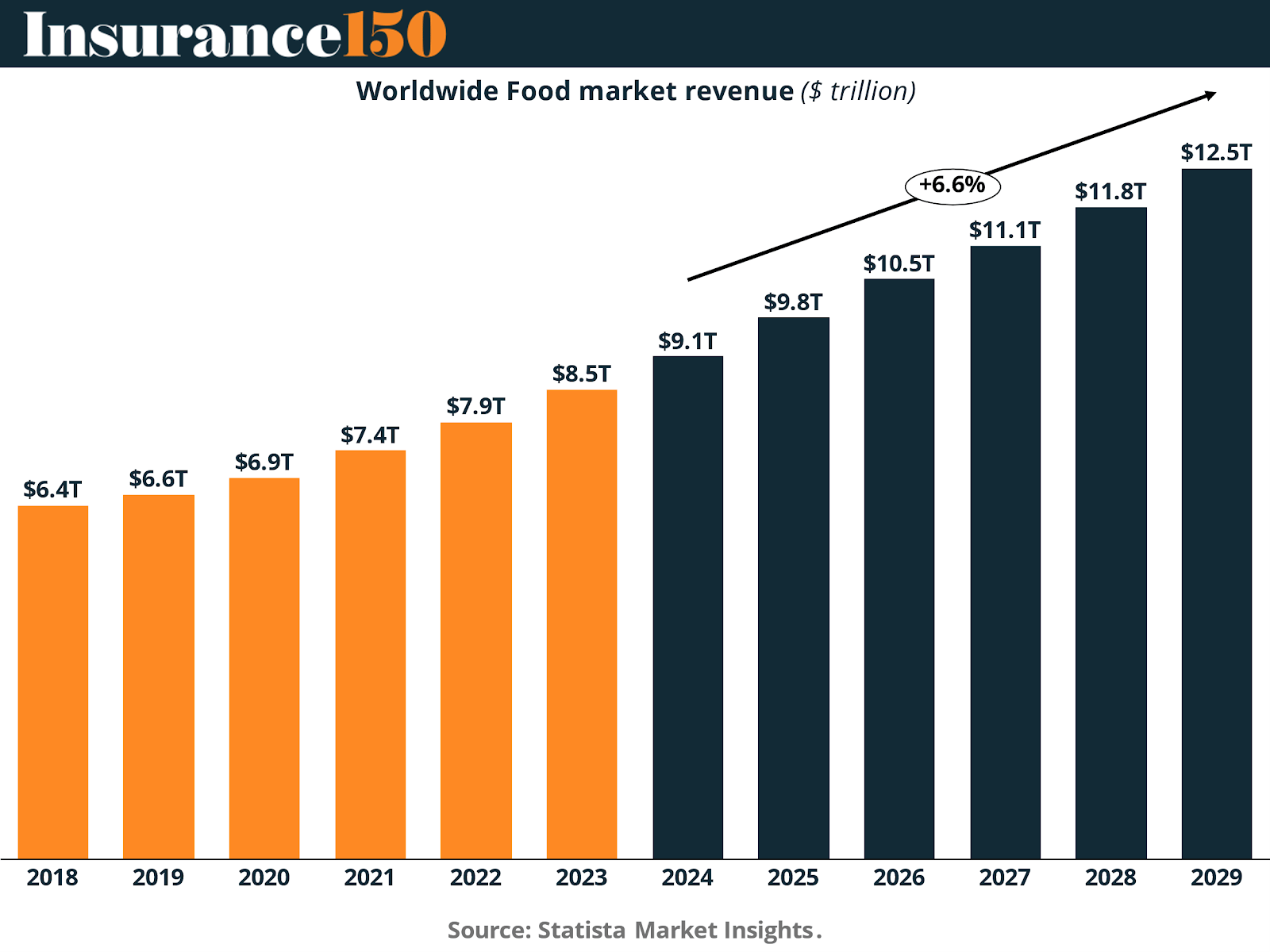

A $12.5 Trillion Global Market That Can’t Afford Disruption

The broader food economy is on track to grow from $8.5 trillion in 2023 to $12.5 trillion by 2029, driven by population growth, rising incomes, and evolving consumption in emerging markets. This growth rate of 6.6% annually may seem familiar—it closely mirrors the rise of insurance demand.

As volumes increase, however, so does fragility. Global food supply chains are more extended than ever, with products crossing multiple borders and regulatory zones. This complexity, while efficient, is also vulnerable to disruption from cyber incidents, weather shocks, and geopolitical events. A container stuck at a port is not just a delay—it’s a spoilage event, a margin loss, a reputational risk.

This economic expansion thus increases the need for food insurance not just as protection, but as a structural enabler of trade and logistics.

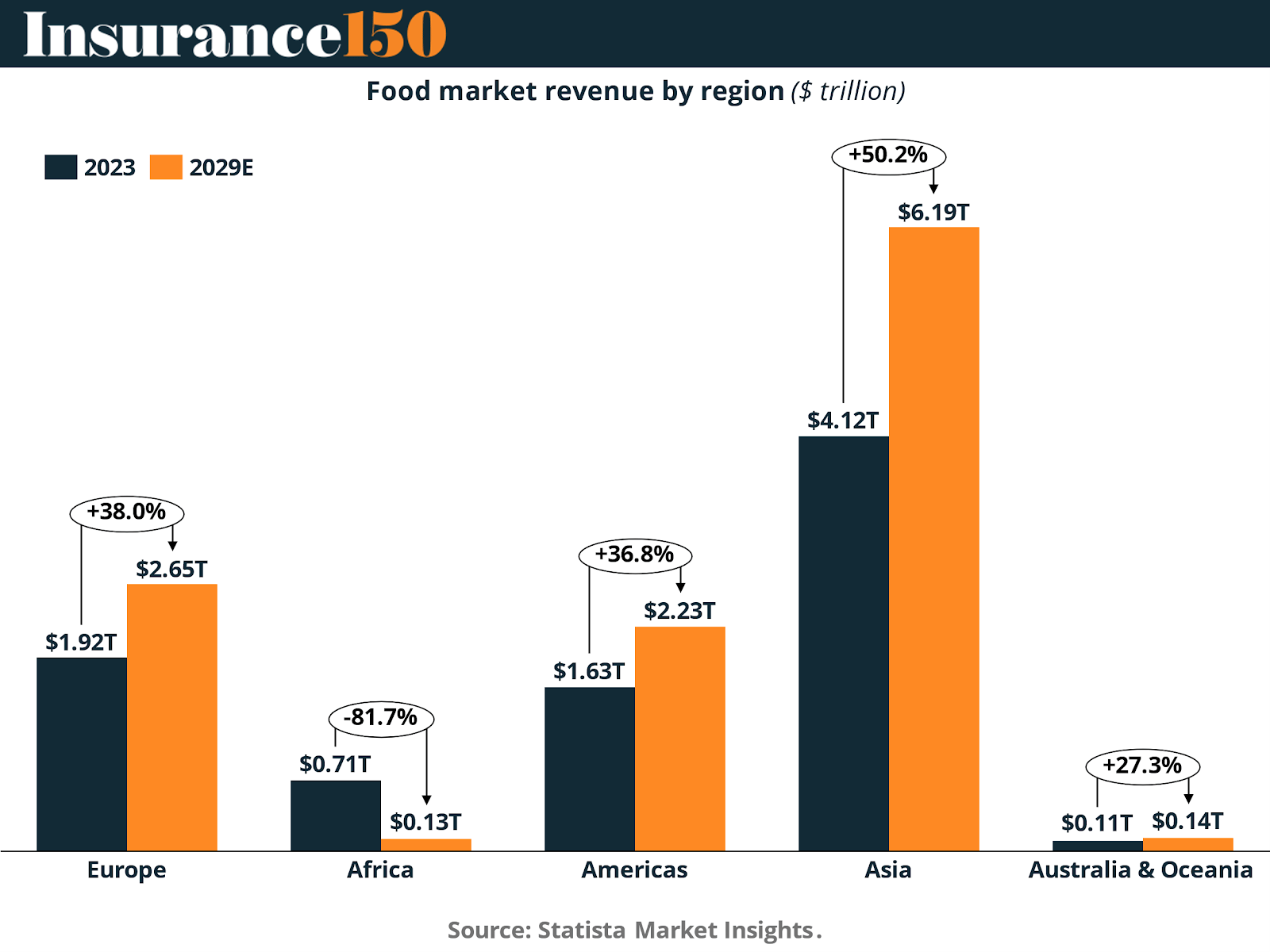

Regional Exposure: Asia Leads, Africa Stalls

Global growth is not evenly distributed. Between 2023 and 2029, Asia’s food market is projected to grow by over 50%, from $4.1T to $6.2T. Europe and the Americas follow with strong gains as well, while Africa’s market is expected to shrink dramatically by over 80%—a decline attributed to logistical limitations and systemic underinvestment.

This divergence has direct implications for the insurance industry. In regions like Asia and Latin America, the rise in consumer demand and industrial-scale production means a growing need for comprehensive policies that cover contamination, temperature sensitivity, and trade credit risk. In developed regions, coverage is evolving to include cyber threats, directors’ liability, and digital fraud. Africa’s situation, though contracting in economic terms, may still pose significant underwriting challenges due to political instability and physical infrastructure risk.

Insurers will need to tailor regional portfolios to match risk intensity, not just revenue potential.

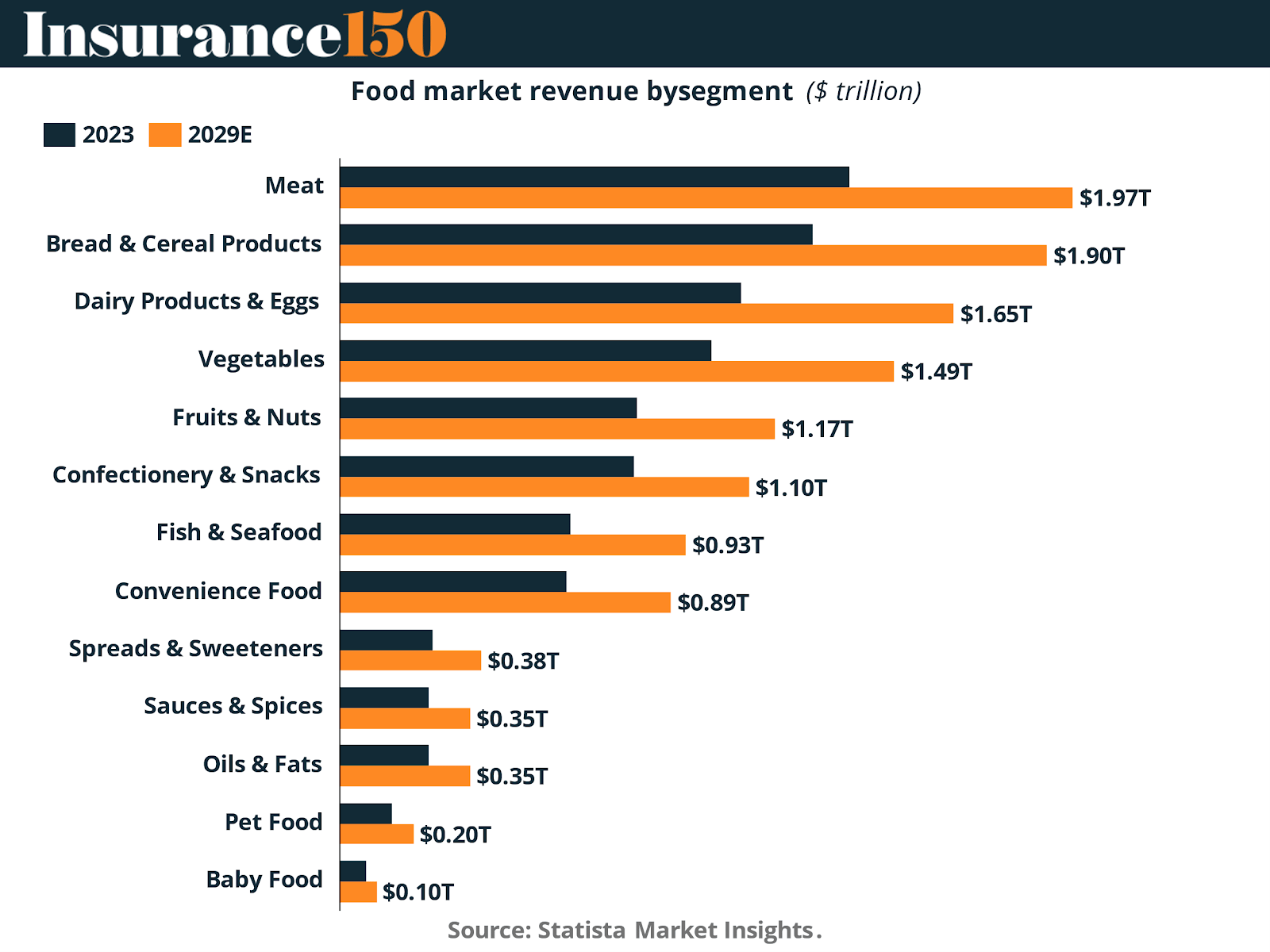

Breakdown by Segment: Volume over Margin

Segment-level data highlights the essential structural truth of the food industry: it is high in turnover and low in margin. By 2029, the largest food segments will be meat ($1.97T), bread and cereals ($1.90T), and dairy ($1.65T). Vegetables and fruits also contribute significantly, but none of these sectors are immune to spoilage, compliance pressures, or price volatility.

These sectors face rising risks across the board. For instance, meat processing is highly sensitive to health inspections and recalls. Dairy producers contend with cold chain dependence and livestock disease outbreaks. Even bread and cereal producers navigate volatile input costs and labor shortages. Insurance, in this environment, plays a vital role as a buffer between operational execution and financial exposure.

With such thin margins, even minor disruptions can decimate quarterly performance. Insurance turns these unpredictable variables into managed costs.

Structural Waste: $940B in Losses Per Year

Globally, the food system loses over ~$940 billion in associated economic losses. Food waste is not just a sustainability concern—it’s a bottom-line killer, and one of the biggest silent risks to operators in the space.

The causes range from poor storage conditions to retail overstocking and consumer-level disposal. Yet at every stage of the supply chain, waste compounds loss and accelerates liability. For producers and distributors, spoilage leads to inventory write-downs, contract penalties, and in some cases, recalls. For retailers, it invites regulatory scrutiny and damages consumer trust.

Insurers are increasingly stepping into this gap with offerings like spoilage coverage, business interruption policies, and recall-specific underwriting. What’s emerging is a new kind of insurance model: one that supports ESG compliance while protecting financial health.

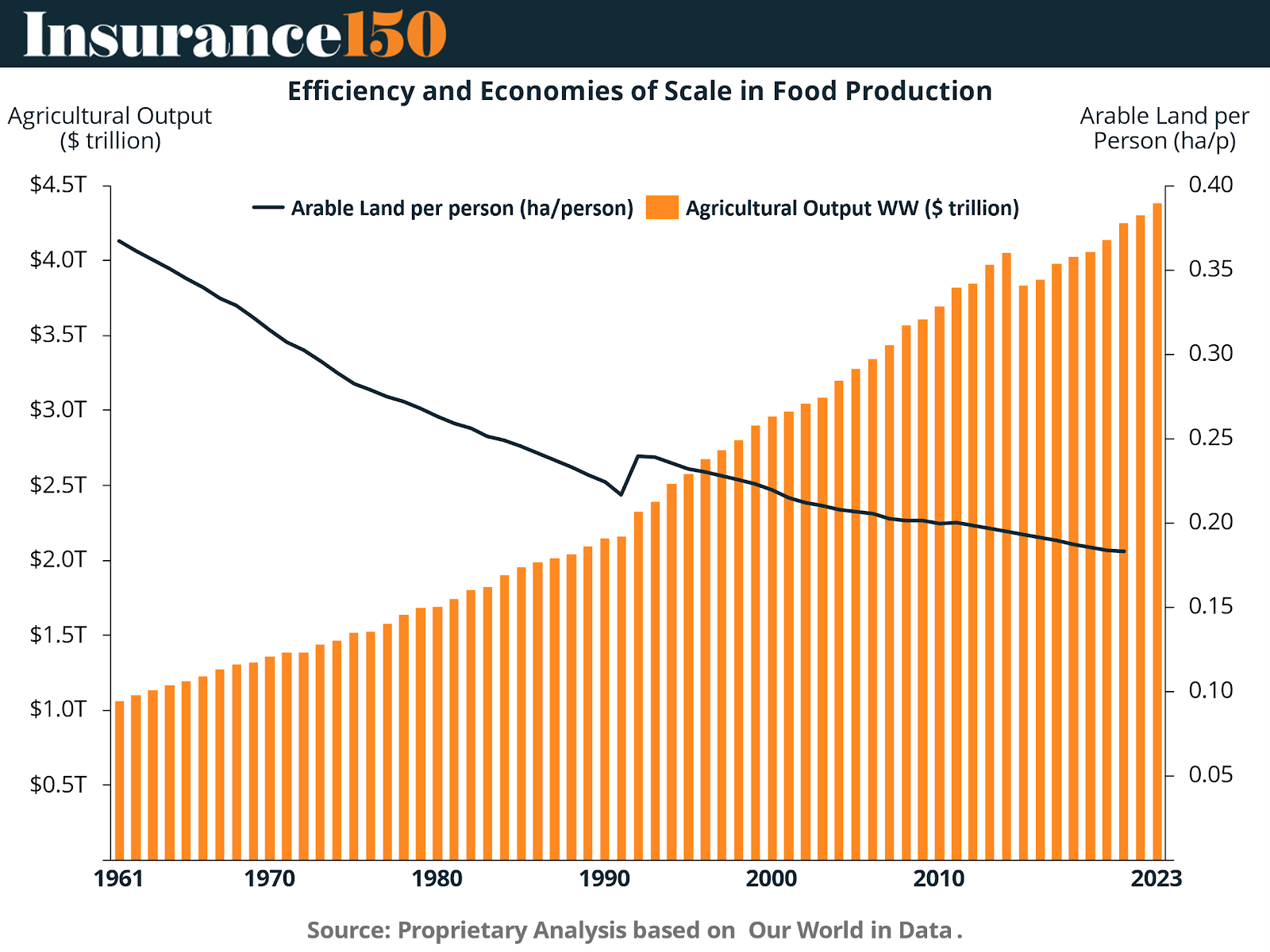

Economies of Scale: Why Malthus Was Wrong

Contrary to longstanding fears of population outpacing food production, the last sixty years have shown the opposite. Since 1961, agricultural output has grown dramatically, even as arable land per person has steadily declined. The food system is not constrained by finite land, but rather empowered by technology, logistics, and scale.

This improved efficiency results from a combination of factors: advanced irrigation, genetically improved crops, automation in harvesting, and supply chain digitization. These developments allow food businesses to achieve more with less—but also make them more reliant on infrastructure.

Here, insurance plays a hidden yet pivotal role. When the inputs to efficiency—like water access, precision farming software, or cold storage networks—fail, insurance provides the capital cushion to recover and rebuild. Malthus may have predicted scarcity, but the real threat today is systemic failure, not natural limits.

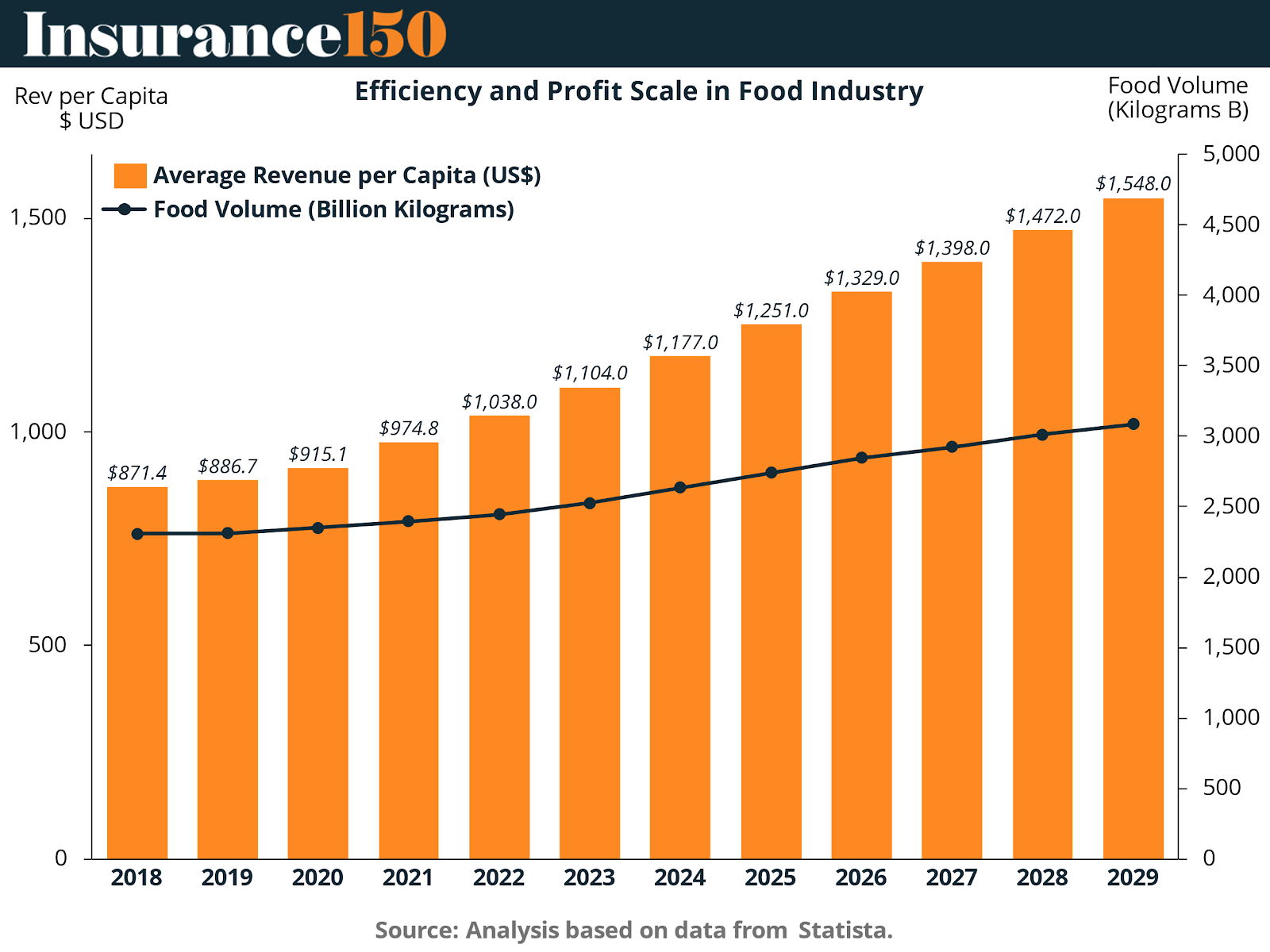

Profit Scale: More Food, Slimmer Margins

Between 2018 and 2029, average food revenue per capita is expected to rise from $871 to over $1,548, while global food volume surges beyond 3,000 billion kilograms. The result is a business model that generates massive turnover but retains little margin—especially as input costs increase.

To survive in this low-margin environment, food businesses must aggressively manage risk. The cost of a single contaminated shipment or production halt can erase months of profit. Here, insurance serves not just to reimburse losses, but to ensure operational continuity and preserve working capital.

As businesses scale, so do their exposures. Without appropriate insurance frameworks, growth becomes a liability instead of an asset.

Insurance Product Evolution in Food

The structure of food insurance is evolving just as rapidly as the sector it supports. Traditional property and casualty coverage is giving way to newer forms like parametric policies, which pay out based on defined environmental triggers (e.g., temperature deviations, crop failure). Digital transformation is also ushering in demand for cyber coverage, especially as logistics and retail platforms move online.

Innovative insurers are bundling coverage with IoT sensors, allowing for real-time tracking of perishables. Others are offering ESG-integrated pricing models, rewarding sustainable practices with reduced premiums. And as cross-border trade increases, political risk and credit default protection are becoming essential to exporters.

This evolution reflects a deeper trend: food insurance is no longer reactive. It is proactive, predictive, and increasingly baked into operational planning.

Strategic Implications for Investors, Operators, and Underwriters

For private equity firms, insurance diligence is becoming standard in acquisition checklists—particularly for logistics-heavy or compliance-sensitive assets. For operators, the cost of being underinsured or poorly insured can result in unplanned expenses that reduce EBITDA and stall expansion.

Underwriters, in turn, must rethink how they assess and price risk in food. Traditional models based on static property values fall short in a world of global logistics, just-in-time delivery, and digital storefronts. The food economy is dynamic—and so too must be the insurance products that protect it.

In this context, insurance is no longer a back-office cost. It is a front-line defense mechanism, a credit enabler, and a strategic asset.

Conclusion

Food will always be essential. But in today’s climate—economic, geopolitical, and environmental—its production and distribution have become mission-critical systems riddled with fragile links. Insurance doesn't just protect food businesses; it stabilizes the infrastructure that feeds the world.

And as the food market scales to $12.5 trillion and beyond, food insurance will grow not as a product line, but as a strategic imperative.

Sources & References

AON. Food and Drink: Insurance Market Update. https://www.aon.com/unitedkingdom/insights/food-and-drink-insurance-market-update.jsp

Coughlin. (2024). Insurance for Food Business Stability in an Unpredictable Market. https://coughlinis.com/insurance-for-food-business-stability/

Our World in Data. (2025). Agricultural Production. https://ourworldindata.org/agricultural-production

Our World in Data. (2025). Arable land use per person. https://ourworldindata.org/grapher/arable-land-use-per-person?tab=table

Statista. (2024). Food: market data & analysis. https://www.statista.com/study/55496/food-market-data-and-analysis/#:~:text=Revenue%20in%20the%20Food%20market,discussed%20from%20an%20international%20perspective

SwissRE. (2017). Trends in the food industry and what they mean for insurance. https://www.swissre.com/institute/research/topics-and-risk-dialogues/health-and-longevity/trends-in-the-food-industry-and-what-they-mean-for-insurance.html

United Nations. (2024). UNEP Food Waste Index Report 2024. https://unstats.un.org/unsd/envstats/fdes/EGES11/9UNEP_Food%20Waste%20Index.pdf

Verified Market Research. (2025). Global Food and Beverage Insurance Market Size. https://www.verifiedmarketreports.com/product/food-and-beverage-insurance-market/

World Bank. (2025). Agricultural land (% of land area). https://data.worldbank.org/indicator/AG.LND.AGRI.ZS?view=chart

WTW. (2024). Food and beverage insurance market update – H1 2024. https://www.wtwco.com/en-gb/insights/2024/10/food-and-beverage-insurance-market-update-h1-2024