- Insights 150

- Posts

- Mobile Phone Insurance: Valuing Cell Phone Anti-Theft Protection, the Private Equity Opportunity

Mobile Phone Insurance: Valuing Cell Phone Anti-Theft Protection, the Private Equity Opportunity

Increasing Mobile Phone costs and thefts are diving Mobile Phone Insurance adoption. Billions to capture.

In this article

Market Size

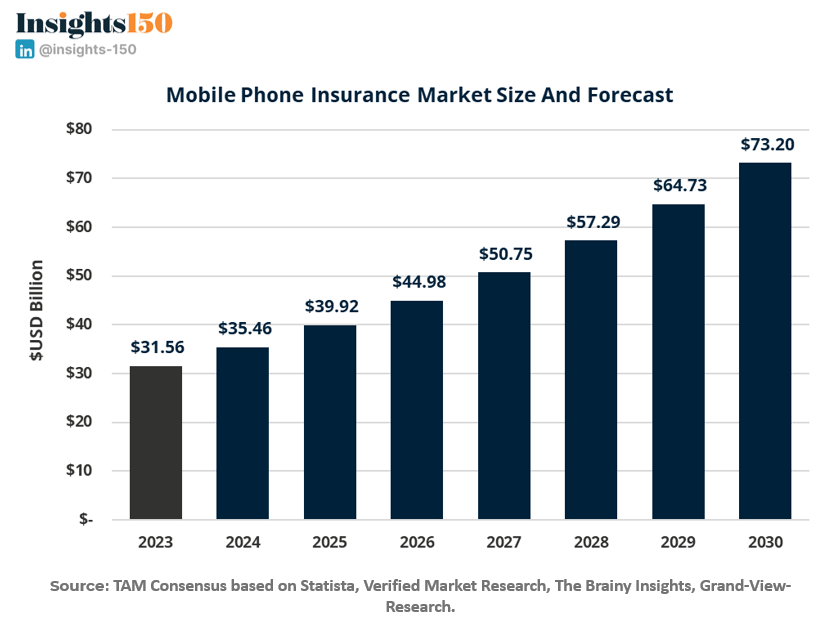

Mobile Phone Insurance Market Size was valued at $31.56 billion in 2023, and it is expected to reach a total Market value of $73.2 billion by 2030, growing at a CAGR of ~12.77%, mostly driven by the increasing number of mobile phones, rising costs of insurance and the growing theft trend across different geographies.

Market Drivers

Growing Smartphone Penetration: Increased smartphone adoption globally, especially in emerging markets, drives the demand for mobile insurance as more people own expensive devices.

Rising Incidence of Phone Theft and Damage: The high rate of mobile theft, accidental damage, and loss has made users more inclined to insure their devices to protect themselves from unexpected repair or replacement costs.

Cost of Smartphone Repairs: High repair costs for advanced smartphones, especially models with premium features like glass bodies, foldable screens, and high-end cameras, make mobile insurance an attractive option for users.

Growing Consumer Awareness: Increasing consumer awareness about the benefits of mobile insurance, including protection against theft, accidental damage, and loss, has spurred market demand.

Rise in Premium Smartphone Sales: The increasing sales of high-end smartphones like iPhones, Samsung Galaxy, and other premium devices lead to higher demand for mobile insurance as these are costlier to repair or replace.

Bundling of Insurance with Mobile Phones: Telecom operators and mobile retailers often bundle mobile insurance with the sale of new smartphones, which increases penetration and drives the market growth.

Emergence of Digital Insurance Platforms: The availability of digital and app-based insurance solutions makes purchasing, claiming, and managing mobile insurance more convenient, attracting tech-savvy users.

Increase in Mobile Usage for Financial Transactions: As mobile phones become central to digital payments, banking, and other financial activities, the need to protect these devices becomes more critical, further encouraging insurance adoption.

Rise in Subscription-based Services: The increasing popularity of subscription-based services for smartphones, including extended warranties, maintenance plans, and insurance, has fueled consistent growth in the mobile insurance market.