- Insurance 150

- Posts

- Moody's Downgrades U.S. Credit Rating Amid Rising Fiscal Concerns

Moody's Downgrades U.S. Credit Rating Amid Rising Fiscal Concerns

Moody’s Downgrades U.S. Credit Rating Amid Deficit, Political Instability, and Debt Concerns.

In a significant blow to U.S. fiscal credibility, Moody`s Ratings has downgraded the United States’ long-term credit rating, citing a growing deficit, political instability, and weakening governance. This move follows earlier warnings from Fitch and S&P, and reinforces mounting concerns over America’s fiscal trajectory. Moody`s downgrade reflects deepening unease in global markets over the sustainability of U.S. debt, which has surged in recent years amidst pandemic spending, tax cuts, and limited fiscal reform.

While the U.S. retains its safe-haven status in global finance, this rating shift carries symbolic and practical implications. As The Guardian noted, the downgrade underscores the failure of U.S. policymakers to address structural budgetary weaknesses and avoid brinkmanship over debt ceilings. The Peterson Foundation echoed this, warning that recent policy decisions are likely to deteriorate the fiscal outlook further. Meanwhile, investors are grappling with whether the downgrade is already priced in, or if more volatility lies ahead.

U.S. Macro Fundamentals: A Closer Look

a) Inflation and Stagflation Risk

The U.S. consumer price index (CPI) surged dramatically after the pandemic, peaking in mid-2022 with year-over-year inflation reaching nearly 9%. Although inflation has since cooled, as of early 2025, CPI still hovers around 3%, with core inflation (excluding food and energy) proving more persistent.

This inflationary persistence is worrisome, especially amid geopolitical tensions and renewed tariff threats. As global supply chains face renewed stress and protectionist policies gain traction, stagflation—a toxic mix of slow growth and high inflation—looms as a credible threat. The monthly CPI data, which briefly turned negative in early 2024, has since rebounded, showing choppy month-to-month increases, reinforcing fears of inflation becoming entrenched.

b) Interest Rates: High for Longer

In response to the inflation spike, the Federal Reserve enacted one of the most aggressive tightening cycles in modern history. The Federal Funds Effective Rate rose sharply from near zero in 2021 to over 5% by late 2023, remaining elevated into 2025 (4.33%).

Despite some moderation in inflation, the Fed has shown no rush to ease, signaling a “high-for-longer” stance. Meanwhile, 10-year Treasury yields, though off their peak, continue to reflect tighter financial conditions. The yield curve remains relatively flat, occasionally inverting—often a precursor to recession.

This sustained monetary tightening has broad implications. Elevated borrowing costs dampen investment and consumer demand, weighing on growth. Yet, with inflation stubbornly above the Fed's 2% target, premature easing could reignite price pressures.

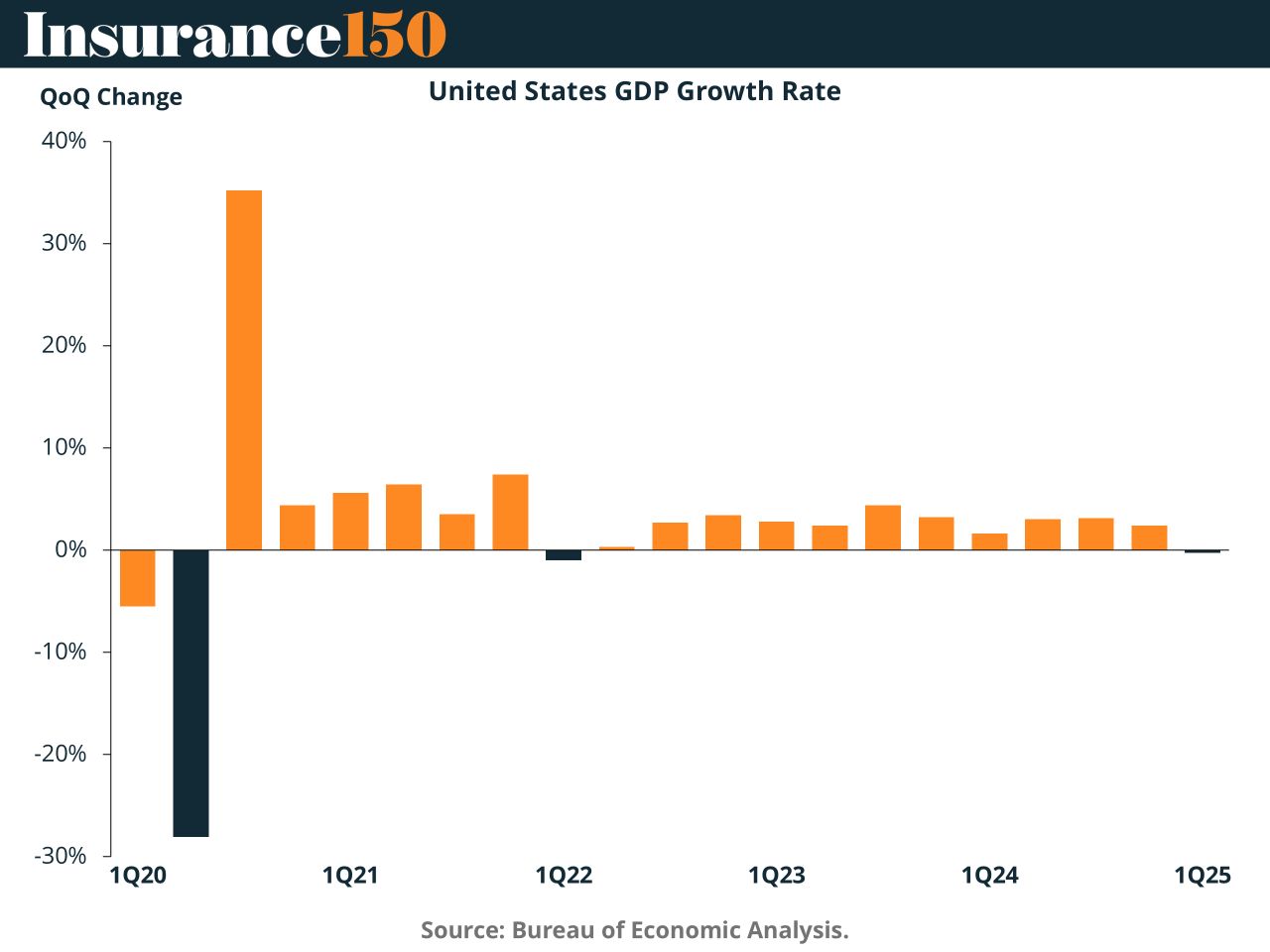

c) GDP Growth: Resilient, But Tepid

U.S. GDP growth has moderated significantly after the post-COVID rebound. Following a dramatic contraction in early 2020 and a record-setting rebound in late 2020, quarterly growth has settled into a more subdued range.

From 2022 to 2024, quarterly GDP changes have hovered around 1-2%, with signs of deceleration emerging in early 2025 and stagflation risk. While the economy has avoided a recession, growth has remained below trend, raising questions about the sustainability of demand amid tightening credit conditions.

Resilience in consumer spending and employment has helped avert a hard landing, but underlying fragilities—particularly high corporate and government debt—persist. The Fed’s policy path and fiscal uncertainty will be key determinants of future growth dynamics.

d) Budget Deficit: Structural and Worsening

Perhaps the most compelling argument behind Moody`s downgrade lies in the fiscal domain. After ballooning to $3.1 trillion in 2020 (14.7% of GDP), the U.S. budget deficit narrowed temporarily but has begun widening again, reaching an estimated $1.8 trillion in 2024 (6.3% of GDP).

This trend reflects a structural mismatch between revenue and spending. Despite economic recovery, expenditures remain elevated, driven by entitlements, interest payments, and defense outlays. Meanwhile, revenue has plateaued amid tax resistance and sluggish economic growth.

Moody`s and other rating agencies have stressed that without significant fiscal reform—either through spending restraint or revenue enhancement—the debt trajectory is unsustainable. The longer fiscal inaction persists, the greater the risk of a funding crisis.

Sudden Stop Risk for Emerging Markets?

Beyond U.S. borders, Moody`s downgrade carries implications for global capital flows—particularly for emerging markets. The U.S. remains the world’s benchmark borrower, and its Treasuries underpin global financial systems. A downgrade, even if symbolic, may spur repricing of risk globally.

Emerging markets (EMs) could face a “sudden stop” scenario if investor sentiment shifts. Higher U.S. yields could prompt capital outflows from EMs, driving currency depreciation, rising bond yields, and refinancing challenges. Countries with twin deficits or dollar-denominated debt would be especially vulnerable.

While markets have arguably priced in much of the U.S. fiscal concern, as Fidelity notes, the Moody`s downgrade adds another layer of uncertainty. Investors may now reassess risk premiums globally, especially as volatility in U.S. fiscal policy becomes a recurring theme.

This risk is vividly illustrated in the chart titled “Capital outflows from Emerging Markets”, which tracks the trajectory of EMs capital flight following different shock moments. Each line represents a separate event, and the pattern is clear: sharp, sustained outflows can materialize rapidly—within days of a major financial or geopolitical trigger. In the most severe instance shown (COVID-19), capital outflows exceeded $35 billion within 84 days of the shock.

If the Moody`s downgrade is perceived as the beginning of a broader loss of confidence in U.S. fiscal stewardship, it could trigger a comparable reaction. The sheer scale and speed of past outflows highlight how vulnerable EMs remain to sudden shifts in global sentiment. Whether this moment proves to be such a trigger—or if policymakers and markets can stabilize expectations—will be crucial in the weeks ahead.

The question remains whether the downgrade will catalyze a repricing of U.S. debt or serve as a wake-up call for Washington. Regardless, it has reignited debate over the fragility of global financial interdependence—and what happens when the world's anchor starts to drift.

Sources & References

Bureau of the Fiscal Service. (2025). Financial Report of the United States Government. https://www.fiscal.treasury.gov/files/reports-statements/financial-report/2024/01-16-2025-FR-(Final).pdf

Fidelity. (2025). Does the US debt downgrade matter for investors? https://www.fidelity.com/learning-center/trading-investing/us-debt-downgrade

Moody`s Ratings. (2025). Moody's Ratings downgrades United States ratings to Aa1 from Aaa; changes outlook to stable. https://ratings.moodys.com/ratings-news/443154

Peter G. Peterson Foundation. (2025). Moody’s Downgrade of U.S. Credit Rating Highlights Risks of Rising National Debt. https://www.pgpf.org/article/moodys-downgraded-its-us-credit-rating-and-warns-that-recent-policy-decisions-will-worsen-fiscal-outlook/

The Guardian. (2025). The US credit rating has been downgraded. But there’s an easy fix for our debt. https://www.theguardian.com/commentisfree/2025/may/21/us-credit-rating-debt-fix

U.S. Bureau of Economic Analysis, Gross Domestic Product [GDP], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/GDP May 23, 2025.