- Insurance 150

- Posts

- Niche Over Scale: How Insurance M&A Preferences Are Splitting by Role

Niche Over Scale: How Insurance M&A Preferences Are Splitting by Role

The insurance M&A market is showing signs of internal divergence—not across firms, but within them.

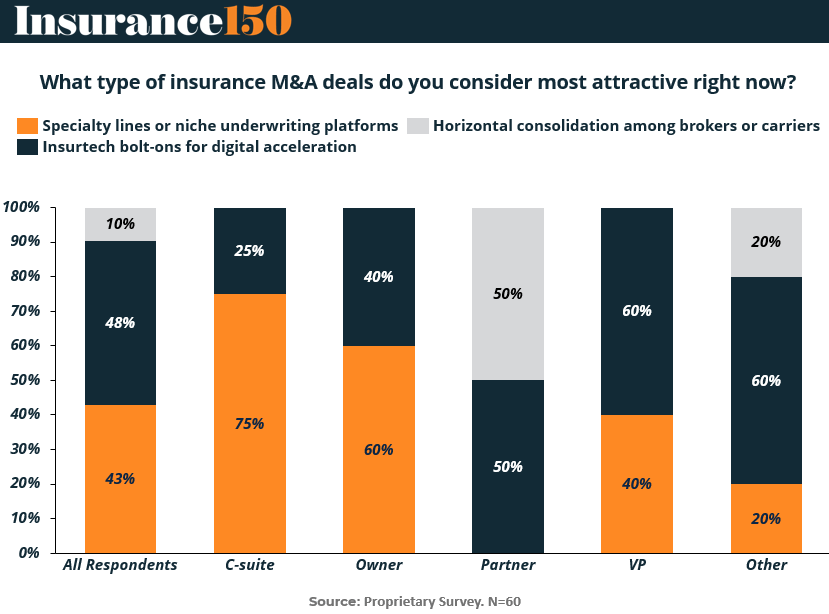

According to a proprietary Insurance150 survey of 60 senior industry professionals, executives are far from aligned on what type of M&A deals they find most attractive. The data suggests a strategic split: while C-suites are doubling down on underwriting specialization, mid-level leaders are prioritizing tech-forward growth. Meanwhile, enthusiasm for traditional roll-ups appears to be fading.

Here’s what the survey revealed:

43% of all respondents favor specialty lines or niche underwriting platforms

48% lean toward Insurtech bolt-ons for digital acceleration

Only 10% selected horizontal consolidation as their top M&A focus

But those top-line numbers mask striking differences by title.

C-Suite is All-In on Specialization

Among executives, the message is loud and clear: 75% of C-suite respondents prefer deals in specialty or niche underwriting. That’s a full 32 percentage points above the average across all respondents.

This overwhelming preference signals a shift in how leaders view long-term value creation in the space. With P&C lines increasingly commoditized and personal lines suffering margin compression, the appeal of underwriting platforms with expertise in underserved verticals—cyber, pet, fine art, aviation—is obvious. Specialty carriers often command higher margins, better retention, and pricing power, especially if distribution is tightly integrated.

From a corporate development lens, these businesses are also more likely to be under-optimized, founder-led, and ripe for operational leverage post-acquisition.

VPs and “Other” Roles Are Betting on Insurtech

While execs chase earnings-accretive assets, VPs are playing a different game. 60% of VPs (and 60% of “Other” roles) chose Insurtech bolt-ons as the most attractive type of M&A deal.

This likely reflects a frontline focus on process transformation and digital enablement. For operational leaders tasked with improving workflow efficiency and customer experience, adding a low-code claims platform or embedded API capability may feel more impactful than acquiring another monoline book.

The digital M&A thesis is clear: bolt-ons that enhance speed, automation, and data flows can generate rapid returns—without the cultural upheaval of full-stack integrations. And with the Insurtech sector still trading at relatively compressed multiples, the timing may be ideal.

Horizontal Consolidation Has Lost Its Shine

Once the cornerstone of insurance M&A strategy, horizontal consolidation now ranks dead last across most seniority levels. Only 10% of all respondents view it as the most attractive strategy, with just one group—Partners—showing parity between this and other approaches.

This is a notable shift. Broker roll-ups and regional carrier combinations were once the dominant play, driven by economies of scale, cross-selling synergies, and margin expansion. But today, those benefits are harder to extract. Integration fatigue, cultural mismatches, and a crowded field of aggregators have dulled the appeal.

Moreover, regulatory scrutiny around market concentration is increasing, particularly in distribution-heavy verticals.

Strategic Implications: Know Your Audience

For M&A advisors, corp dev leads, and founders eyeing exits, this data carries clear implications:

If you’re a niche underwriting platform, go straight to the C-suite.

If you're offering digital tooling, target operational leaders—those dealing with systems pain daily.

If your pitch involves scale or consolidation, prepare for skepticism.

More broadly, the divergence in preferences suggests that insurance M&A is entering a multi-track era. No single strategy dominates; instead, buyers are aligning deals to their functional pain points, not just their financial goals.

That shift could fragment the M&A market—but it also opens room for specialization, speed, and sharper deal positioning.