- The Deal Brief - Insurance

- Posts

- Parametric Insurance: Driving Resilience and Innovation in Risk Management

Parametric Insurance: Driving Resilience and Innovation in Risk Management

How emerging models and technology are reshaping the insurance landscape for a climate-volatile and rapidly evolving world

Introduction

The insurance industry is at a turning point. Long reliant on indemnity-based models, it now faces unprecedented pressures that challenge the adequacy of traditional coverage. Climate change is driving more frequent and severe catastrophes, from hurricanes to wildfires, pushing losses to record highs. At the same time, the protection gap—the difference between insured and actual economic losses—continues to widen, leaving governments, businesses, and individuals without sufficient safety nets. In parallel, policyholders are demanding faster, fairer, and more transparent coverage, while insurers themselves are seeking new ways to manage volatility and deploy capital efficiently.

These forces are accelerating the search for innovative approaches, and parametric insurance has emerged as one of the most compelling solutions. Unlike indemnity insurance, which requires time-consuming damage assessments, parametric models rely on predefined triggers tied to measurable events: rainfall levels, wind speed, earthquake magnitude, or even flight delays. When the trigger is met, the payout is automatic, regardless of the actual financial loss incurred.

This mechanism provides clear advantages: speed, with payouts often within days; simplicity, as claims disputes are minimized; and accessibility, since coverage can be extended to risks or geographies where traditional insurance is impractical. Of course, trade-offs exist—particularly basis risk, the possibility that payouts may not fully align with real losses. Yet the benefits are proving powerful enough that parametric solutions are moving rapidly from niche pilots in agriculture and sovereign risk pools to broader adoption across sectors such as energy, tourism, and supply chain.

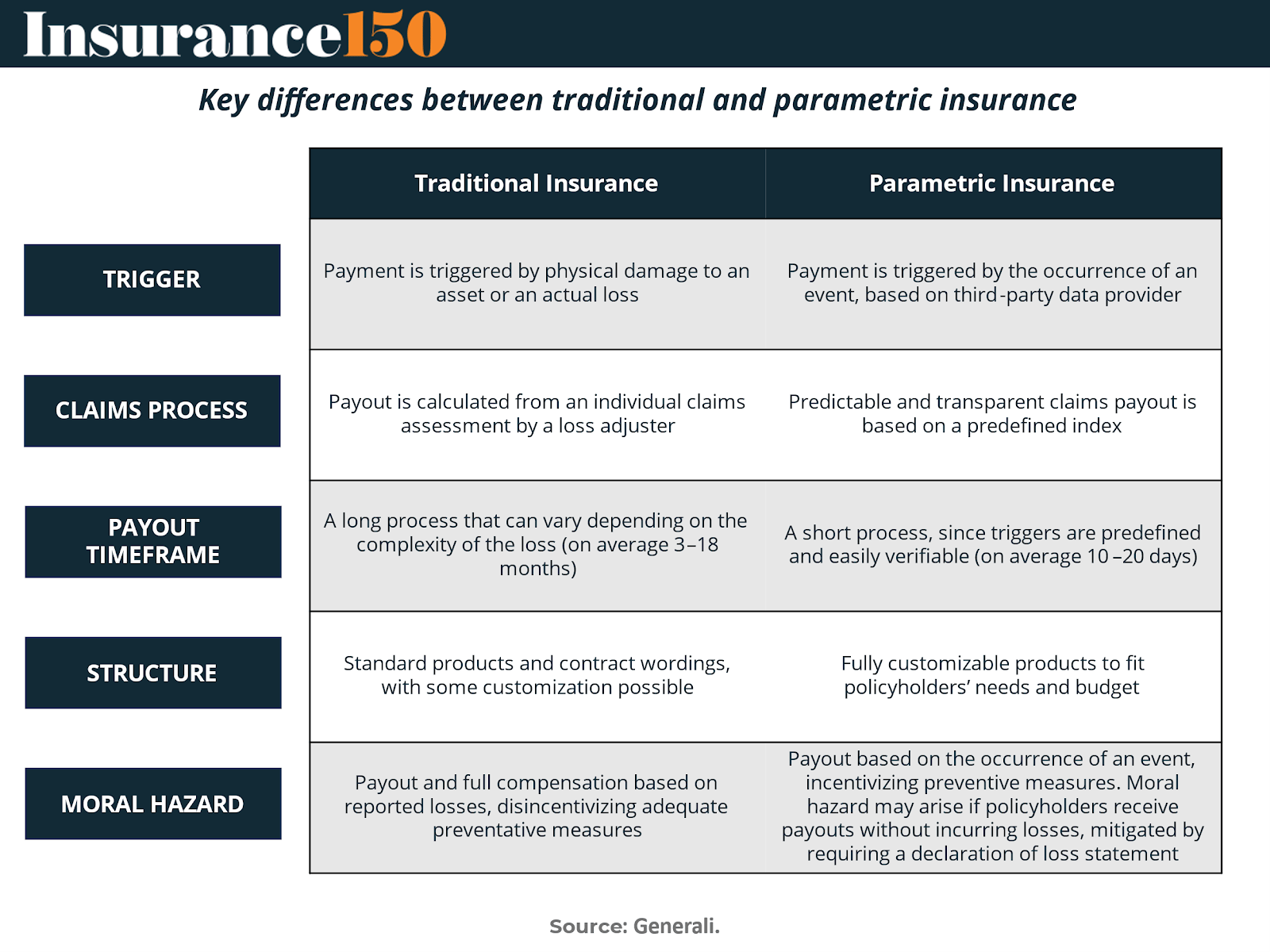

As the industry rethinks product models to close protection gaps and adapt to climate realities, parametric insurance is no longer just an experiment—it is becoming a mainstream tool that reshapes how risk is measured, transferred, and managed. To better understand this shift, it is useful to compare how parametric insurance differs from traditional indemnity-based policies in terms of triggers, claims process, payout timeframe, structure, and moral hazard—as summarized in the table below.

Market Size & Growth Outlook

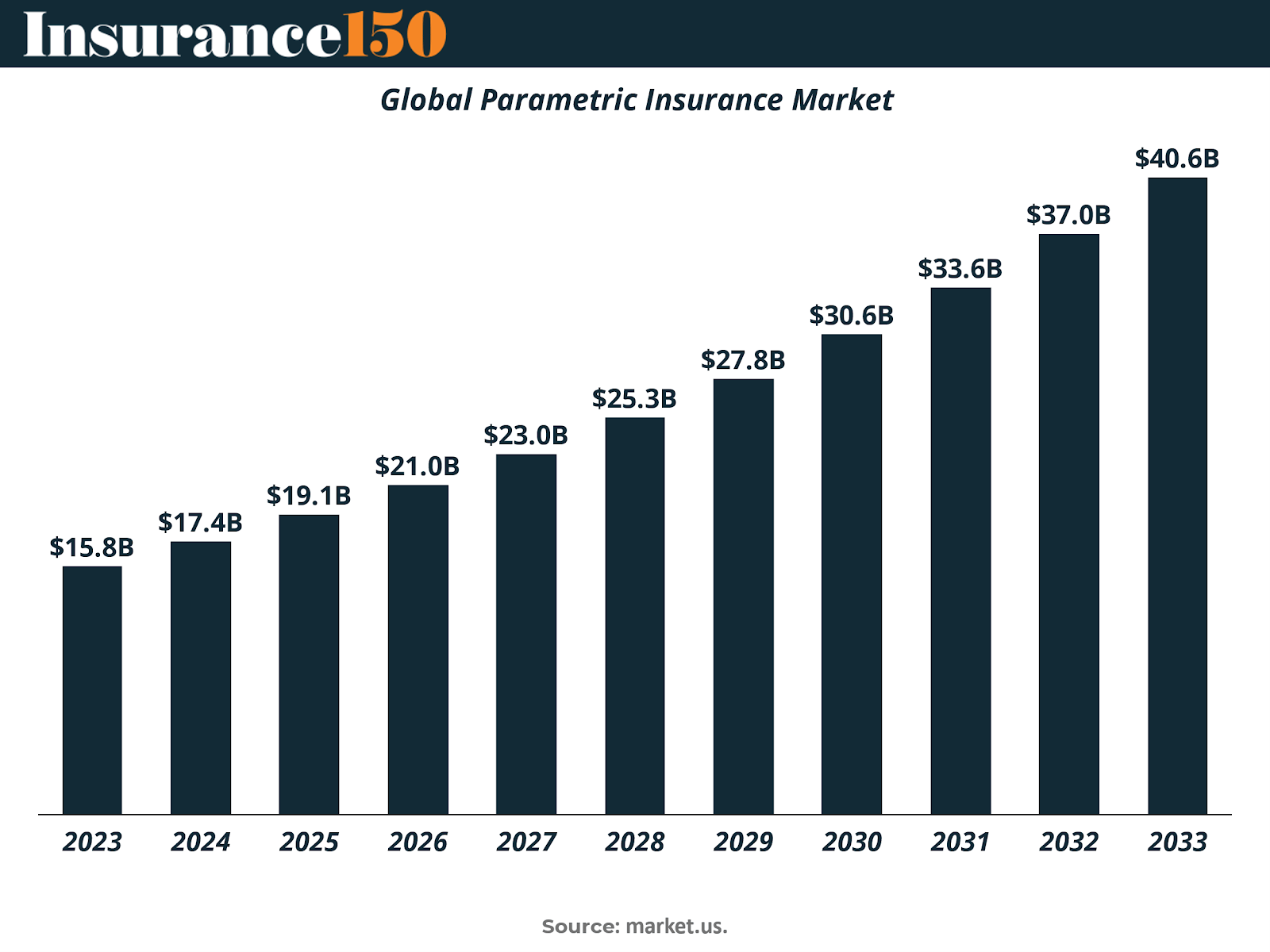

The global parametric insurance market is on a strong growth trajectory, projected to reach USD 40.6 billion by 2033, up from USD 15.8 billion in 2023. This represents a robust compound annual growth rate (CAGR) of 9.9% over the forecast period (2024–2033). The steady upward curve highlights the growing recognition of parametric solutions as a reliable alternative to traditional indemnity-based products.

In 2023, North America emerged as the leading region, accounting for more than 35% of global revenues (USD 5.5 billion). Its dominance is supported by a high concentration of insured assets, advanced insurance markets, and strong adoption of innovative risk-transfer mechanisms. However, significant growth opportunities also exist in emerging economies—particularly in areas exposed to climate-related risks such as hurricanes, droughts, and floods—where traditional insurance penetration remains low.

The expansion of this market is fueled by the increasing demand for faster payouts, transparent coverage, and tailored risk transfer. By tying claims to measurable event parameters (e.g., wind speeds, rainfall levels, or seismic activity), parametric insurance eliminates lengthy claims assessments and delivers immediate liquidity when it is needed most. This speed, combined with scalability across sectors, is making parametric insurance an attractive proposition for governments, businesses, and individuals alike.

The growth outlook suggests that parametric insurance will continue to evolve from a niche offering to a mainstream risk management tool, reshaping how insurers and policyholders approach protection in an era defined by climate volatility and economic uncertainty.

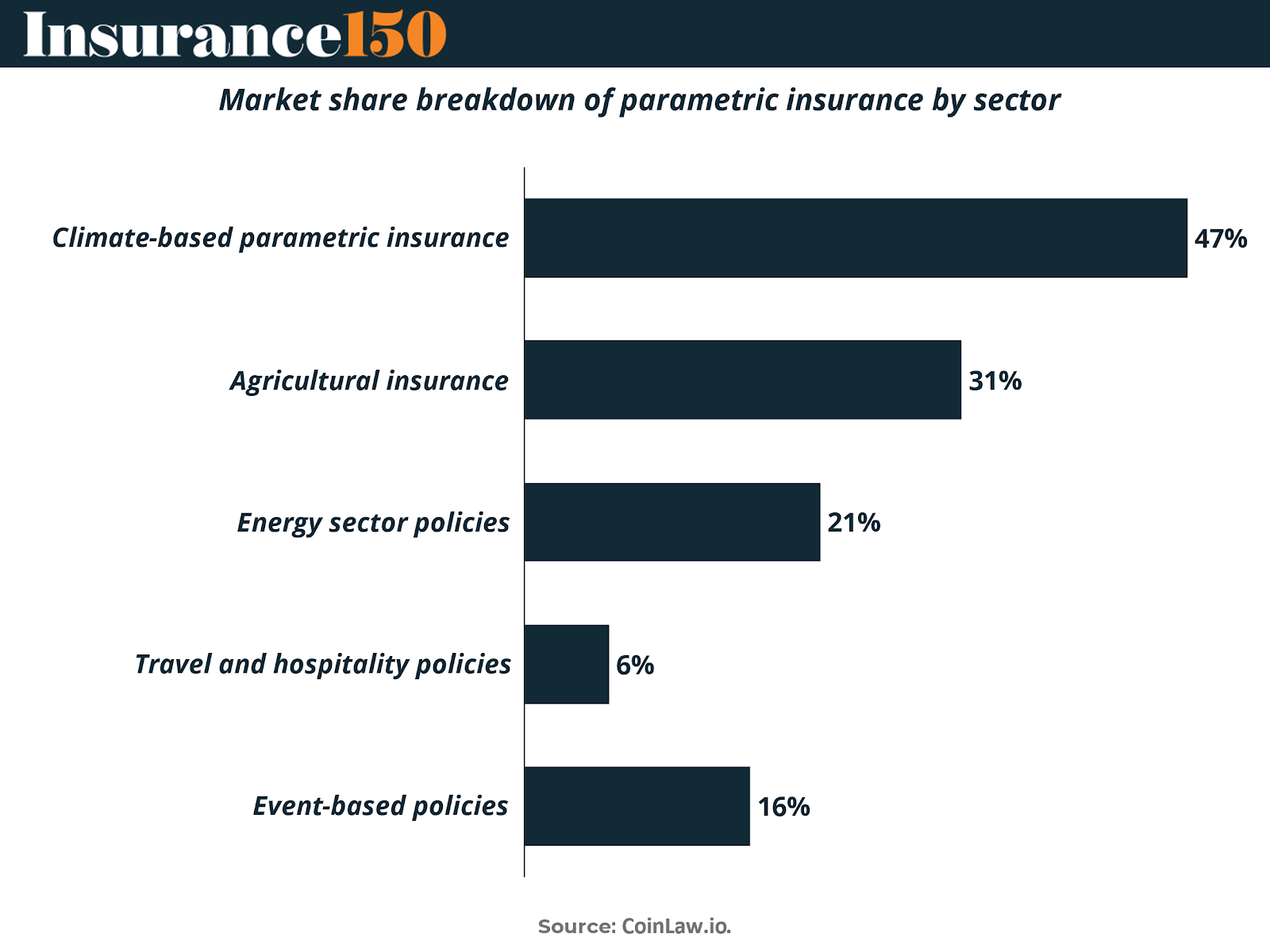

Parametric insurance adoption varies widely across industries, with climate-related risks emerging as the clear driver of growth. Climate-based parametric insurance holds the largest share at 47%, reflecting the urgent demand for solutions that address natural catastrophes such as floods, hurricanes, and wildfires. Agricultural insurance follows at 31%, highlighting the sector’s exposure to weather variability and the increasing reliance on rapid, index-based payouts to protect crop yields and farmer livelihoods.

Beyond these two dominant segments, energy sector policies account for 21%, supporting utilities and renewable operators facing high exposure to environmental volatility. Event-based policies (16%) and travel and hospitality policies (6%) represent smaller but growing areas, where parametric models offer faster claims resolution compared to traditional coverage.

This distribution underscores how parametric insurance is concentrated in climate-sensitive industries, while diversification into events, travel, and hospitality signals a broader market evolution.

Parametric Insurance Market by End Use

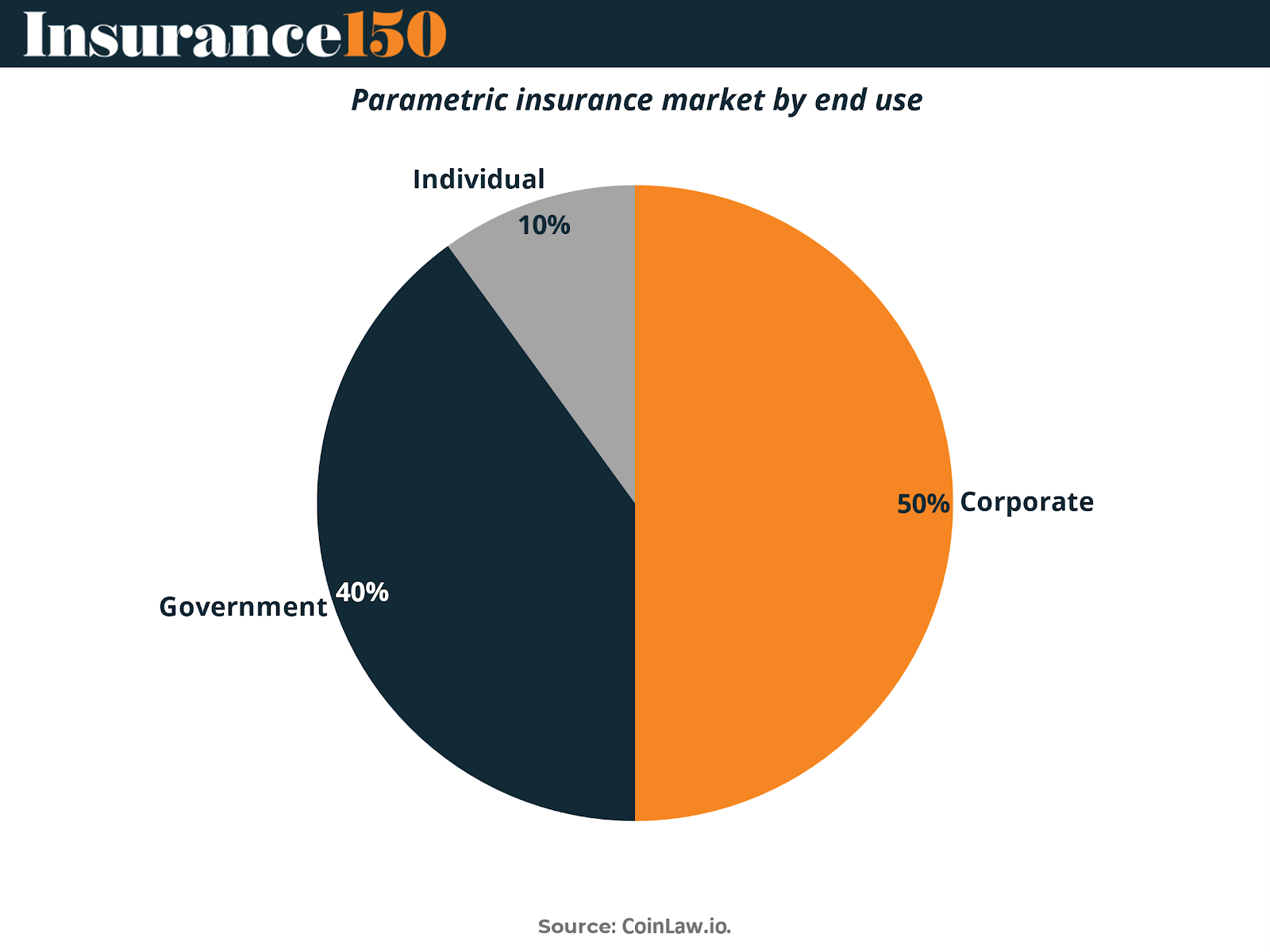

The adoption of parametric insurance is being driven primarily by corporate clients, who account for 50% of the market. Businesses in sectors such as energy, agriculture, and logistics face high exposure to climate risks and operational disruptions, making rapid and transparent payouts critical to maintaining continuity. For these organizations, parametric models are increasingly seen as a complement—or even an alternative—to traditional indemnity-based coverage.

Governments represent 40% of the market, reflecting the use of parametric schemes in disaster risk financing and resilience programs. Sovereign parametric covers have been deployed in regions highly exposed to hurricanes, floods, and earthquakes, offering governments immediate liquidity to support relief efforts and infrastructure recovery.

Meanwhile, the individual segment accounts for just 10%, underscoring both the untapped potential and the challenges of scaling consumer-facing parametric products. Awareness, affordability, and trust remain barriers, but as digital distribution and microinsurance models expand, this segment could become a key growth frontier.

This breakdown highlights the current balance of demand: strong institutional adoption paired with early but promising consumer opportunities.

Benefits and Challenges of Parametric Insurance

The rapid rise of parametric insurance is closely tied to the distinct advantages it offers compared to traditional indemnity models. One of the most significant benefits is efficiency and speed. Because payouts are triggered automatically by predefined parameters, funds can be released within days of a qualifying event. This streamlined process reduces bureaucratic delays and eliminates the need for lengthy on-site assessments, ensuring that businesses, governments, and individuals have access to liquidity precisely when they need it most.

Another key advantage lies in versatility. Parametric solutions are designed to address a broad range of risks, from hurricanes and floods to crop damage and freeze events. Their flexibility allows organizations to tailor coverage to specific operational needs, helping to reduce overhead costs, recoup lost revenue, and manage financial disruptions more effectively.

Equally important is clarity and transparency. Because payouts are tied to objective, measurable triggers, policyholders have a clear understanding of when and how compensation will occur. This reduces ambiguity, builds trust between insurers and insureds, and minimizes disputes over claims. Coupled with a comprehensive safety net, parametric policies safeguard against climate-related risks and ensure operational continuity by delivering customized solutions that align with unique business needs and geographical exposures.

Yet, despite these benefits, parametric insurance also faces critical challenges that need to be addressed for the market to scale effectively. Chief among them is basis risk—the potential misalignment between the actual losses experienced by the policyholder and the payout defined by the trigger. This gap can undermine confidence if not carefully managed. Additionally, data dependency presents a structural hurdle: effective execution requires accurate, reliable data from weather stations, satellites, or IoT devices, and coverage may be limited in regions where such infrastructure is weak.

There is also customization complexity. Designing policies that account for the nuances of specific industries and client needs can be intricate, often requiring significant education and collaboration with buyers. Finally, regulatory and market acceptance remains uneven. Many jurisdictions lack clear frameworks for parametric products, and market participants must navigate diverse rules while simultaneously working to build broader understanding and trust.

By weighing these benefits against the challenges, businesses, governments, and insurers can better evaluate how parametric solutions fit within their risk management strategies. A balanced approach ensures that the advantages of speed, transparency, and flexibility are maximized, while potential hurdles around data, basis risk, and regulation are addressed proactively.

The Rise of Smart Contracts in Parametric Insurance

Alongside the broad expansion of parametric insurance, the adoption of smart contracts is emerging as a key driver of market innovation. Smart contracts leverage blockchain technology to automate policy execution and payout processes, further enhancing the speed, transparency, and reliability that parametric models are known for.

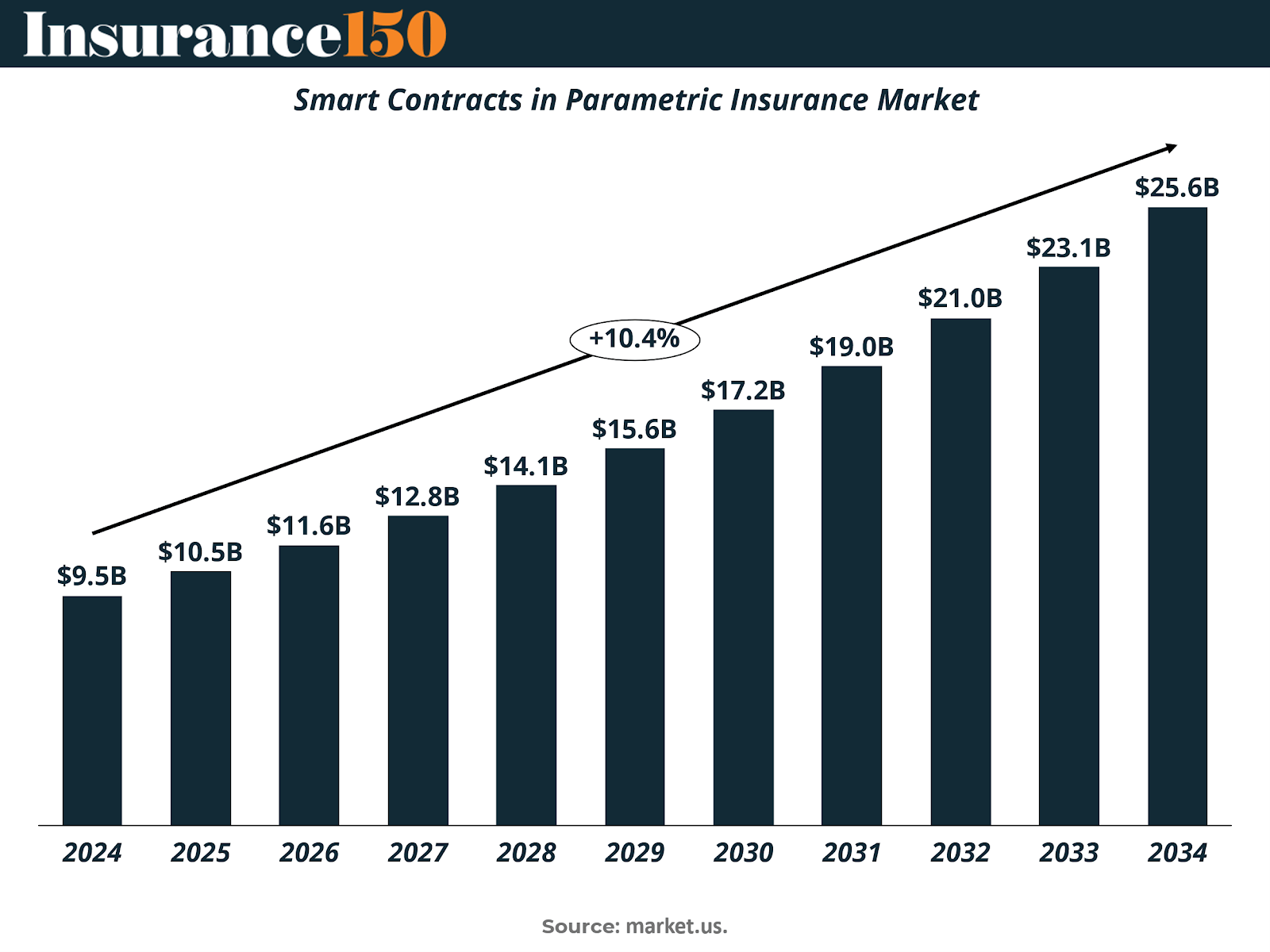

According to recent forecasts, the market for smart contract-based parametric insurance is expected to grow from USD 10.5 billion in 2025 to USD 25.6 billion by 2034, representing a compound annual growth rate (CAGR) of 10.4%. Natural catastrophe policies account for the largest share, followed by specialty and other niche insurance products, highlighting the areas where automation and digitalization are most impactful.

The growth trajectory underscores how technology-driven parametric solutions are moving beyond pilot programs, reinforcing their role as a strategic complement to traditional policies. For insurers, smart contracts not only streamline claims but also open new possibilities for product innovation, risk diversification, and access to previously underserved markets. This technological evolution aligns closely with the broader market trends outlined above, illustrating how parametric insurance continues to evolve at the intersection of risk management and digital innovation.

Conclusion

Parametric insurance represents more than a new product type—it signals a fundamental shift in how the industry approaches risk, capital efficiency, and resilience. Its rise underscores the growing recognition that traditional insurance frameworks are insufficient for a world defined by climate volatility, operational complexity, and rapidly evolving stakeholder expectations. The adoption of parametric solutions highlights a broader trend: insurers, governments, and businesses are increasingly prioritizing speed, transparency, and predictability over conventional risk transfer mechanisms.

Looking ahead, the trajectory of parametric insurance suggests that innovation will be the defining differentiator for market leaders. Integrating smart contracts, blockchain, and data-driven analytics will not only enhance operational efficiency but also create opportunities for new partnerships, product structures, and market expansion—particularly in regions and sectors historically underserved by traditional insurance. At the same time, the industry must navigate basis risk, regulatory complexities, and consumer trust barriers, balancing rapid deployment with robustness and credibility.

Ultimately, parametric insurance is a catalyst for strategic evolution, enabling stakeholders to respond more effectively to uncertainty while unlocking value and resilience across the ecosystem. Its continued growth will likely redefine industry norms, fostering an insurance landscape where agility, precision, and technological integration are no longer optional but essential for sustained success.

Sources & References

Arbol — Parametric Insurance: What It Is and How It Enables Climate Resilience

CoinLaw — Parametric Insurance Industry Statistics

Market.us — Parametric Insurance Market Report

Market.us — Smart Contracts in Parametric Insurance Market Report

UNDP / Generali — Parametric Insurance to Build Financial Resilience (2025)