- Insurance 150

- Posts

- Pet Insurance: A Large Market Opportunity for US Insurers

Pet Insurance: A Large Market Opportunity for US Insurers

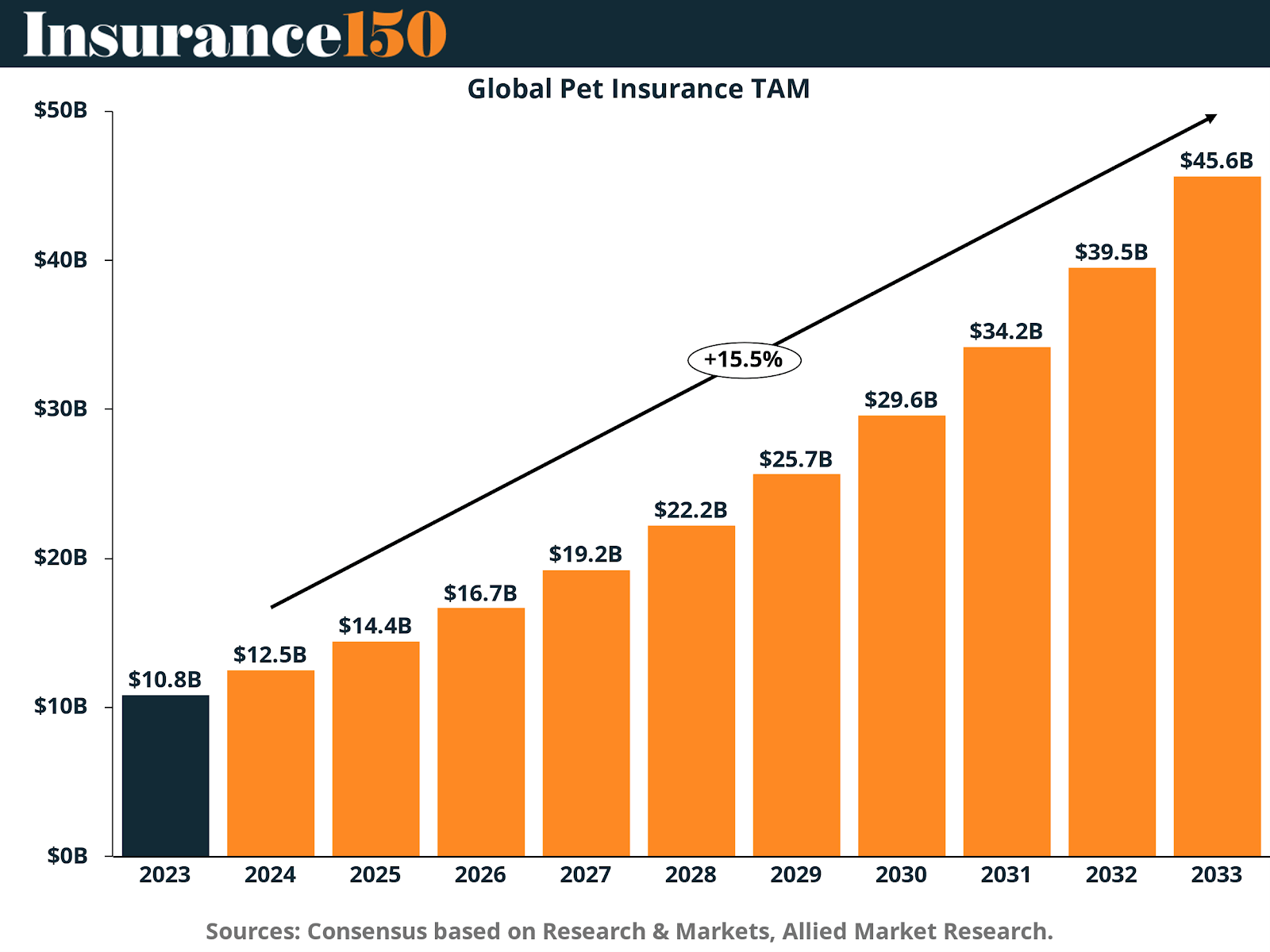

The global pet insurance market, valued at $10.84 billion in 2023, is projected to grow at a 15.5% CAGR to reach $45.64 billion by 2033.

Global Pet Insurance TAM

According our consensus between Research & Markets and Allied Market Research estimates, Global Pet Insurance Market was valued at $10.84 billion as of 2023, and it is expected to reach a value of $45.64 billion by 2033, growing at a CAGR of 15.5%, presenting itself as a stable and high growing market.

Pet Insurance Market is being driven by many factors, where we can highlight the following:

Rising Veterinary Costs: The increasing costs of veterinary care, including surgeries, medications, and specialized treatments, are encouraging pet owners to seek insurance to manage expenses and ensure they can afford high-quality care for their pets.

Growing Pet Ownership and Humanization: More households consider pets as family members, leading to increased spending on their health and well-being. This "humanization" trend drives demand for pet insurance as owners seek comprehensive health coverage similar to human health insurance.

Increased Awareness and Availability: Greater awareness of pet insurance, coupled with more providers entering the market and offering a variety of plans, has made it easier for pet owners to find policies that suit their needs and budgets.

Technological Advancements in Pet Care: Innovations such as telemedicine for pets, wearable health trackers, and advanced diagnostic tools have increased the scope of services covered by pet insurance, making it more appealing to pet owners looking for holistic care options.

Rise in Chronic Pet Health Conditions: There is an increasing incidence of chronic conditions like obesity, diabetes, and allergies in pets, which require ongoing treatment and management. Pet insurance helps cover these long-term costs, driving adoption among pet owners concerned about managing such expenses.

North America Pet Insurance Market

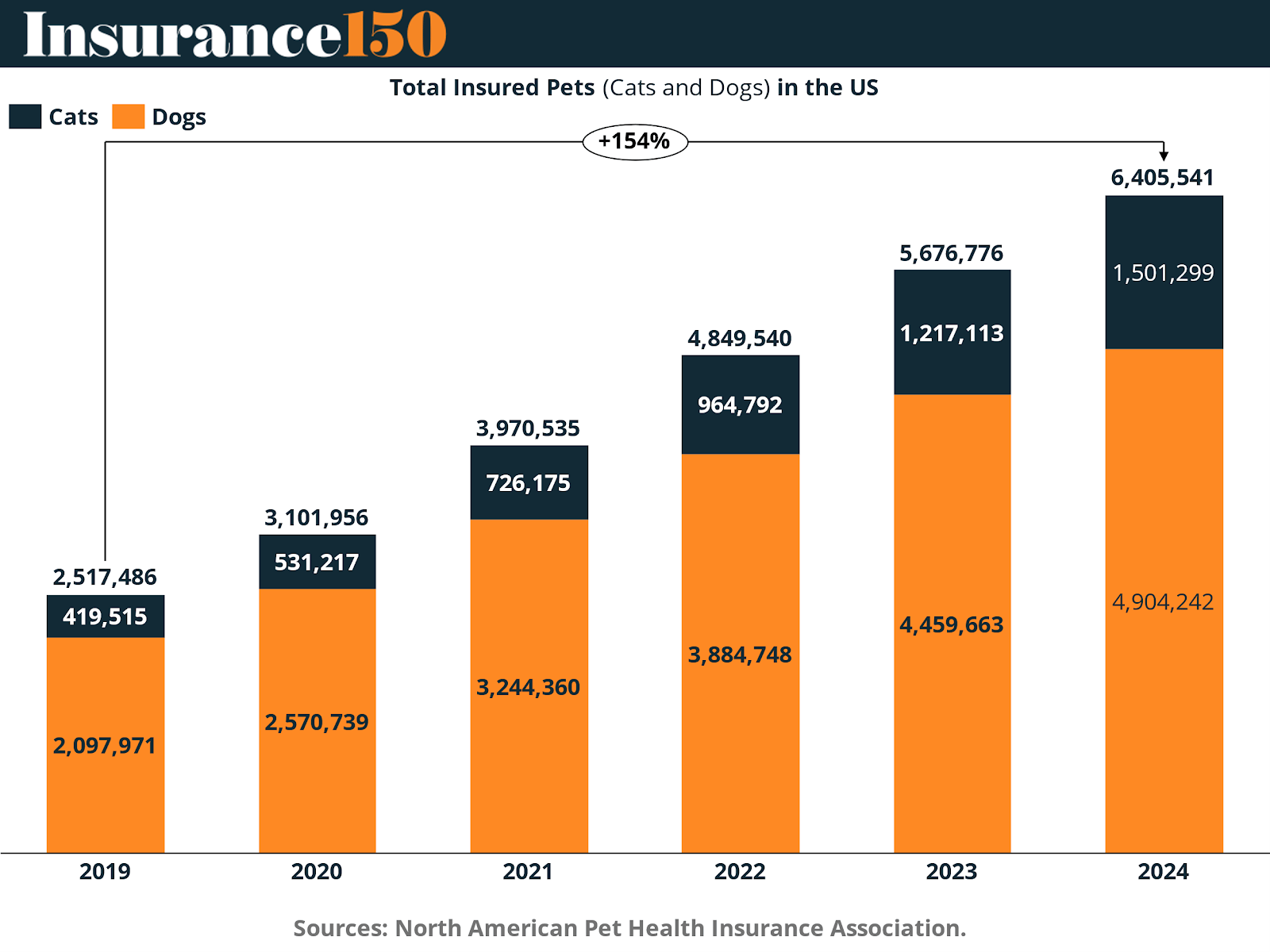

Total Pets Insured in US

According to NAPHIA (North American Pet Health Insurance Association), there are 6,405,541 insured pets (Cats + Dogs) in United States, as of 2024 (+154% vs 2019).

Among those 6,405,541 insured pets, 4,904,242 correspond to Dogs and 1,501,299 to Cats.

Additionally, NAPHIA (North American Pet Health Insurance Association) estimates that there are 619,303 insured pets (Cats + Dogs) in Canada (+105% vs 2019), with 462,302 insured Dogs and 157,001 insured cats, as of 2024.

These numbers combined, result in a large Pet population in North America of 7,024,844 pets (Cats + Dogs) as of 2024, which represents an increase of +149% vs 2019 values.

TAM Modelling: P*Q

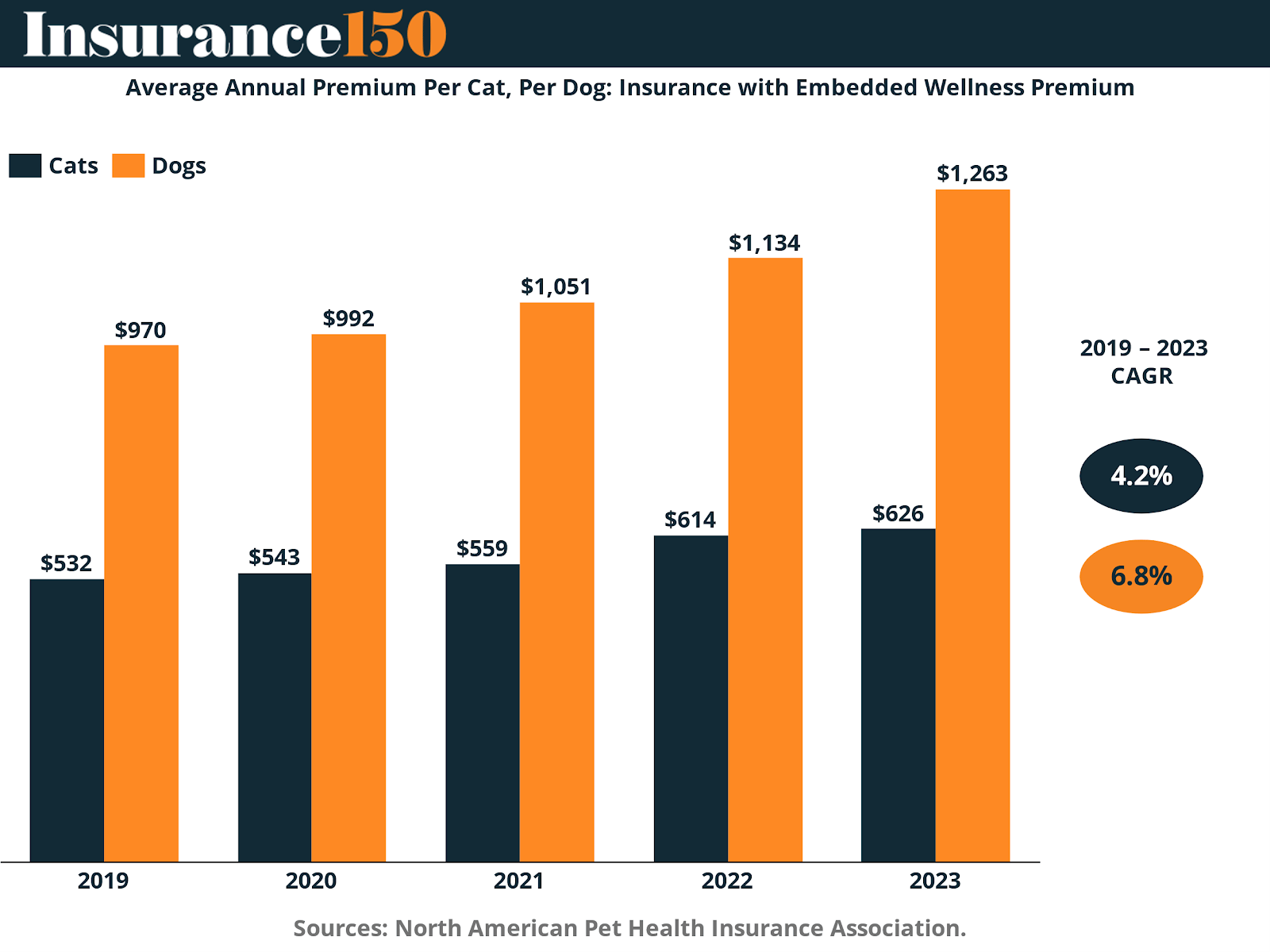

To understand the Market Value, it is important to triangulate Quantity (Q) data with Pricing (P) data. In our TAM modelling, Pricing point in Pet Insurance is composed of the Average Annual Premium both for Cats and Dogs. We apply our model for the US.

Average Annual Premium Per Cat, Per Dog

Insurance with Embedded Wellness Average Annual Premium per Cat in 2019 was $531.73, and reached a value of $625.99 in 2023, growing at a CAGR of 4.2%. While Dog`s Premium grew from $969.65 in 2019 to $1,263.39 in 2023, at a CAGR of 6.8%.

Multiplying the number of Insured pets in North America with it`s Embedded Wellness Average Annual Premium, the estimated US Market Value is $6.4 billion as of 2023.

Assuming that the North American Market will grow at the same CAGR of the Global Market (15.5%) and that the penetration rate remains constant at it`s current level of 3.2%, we estimated that US Pet Insurance Market will reach $26.02 billion by 2033.

As mentioned, this Market Value is the forecasted value for North America, assuming a constant penetration rate (5.7%). The penetration rate is the result of the ratio between the number of Insured Pets and total number of Pets in the Region.

US Pet Owners Survey Stats

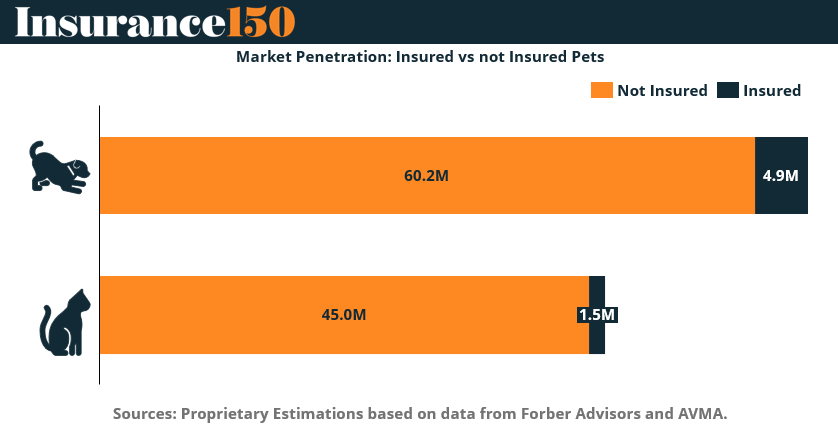

According to Forbes Advisor, there are 65.1 million households that own a Dog and 46.5 million households that own a Cat in the US. Crossing these data points with the average number of dogs (1.46) per household that owns a dog and the average number of cats (1.78) per household that owns a cat, we estimate that in the US there is a total number of 95 million Dogs and 83 million Cats owned as pets.

Considering that there are 95 million Dogs and 83 million Cats (estimated) but only 4.9 million of those Dogs are insured and only 1.5 million of those cats are insured, there is a large opportunity for Pet Insurers to capture market unlocked value.

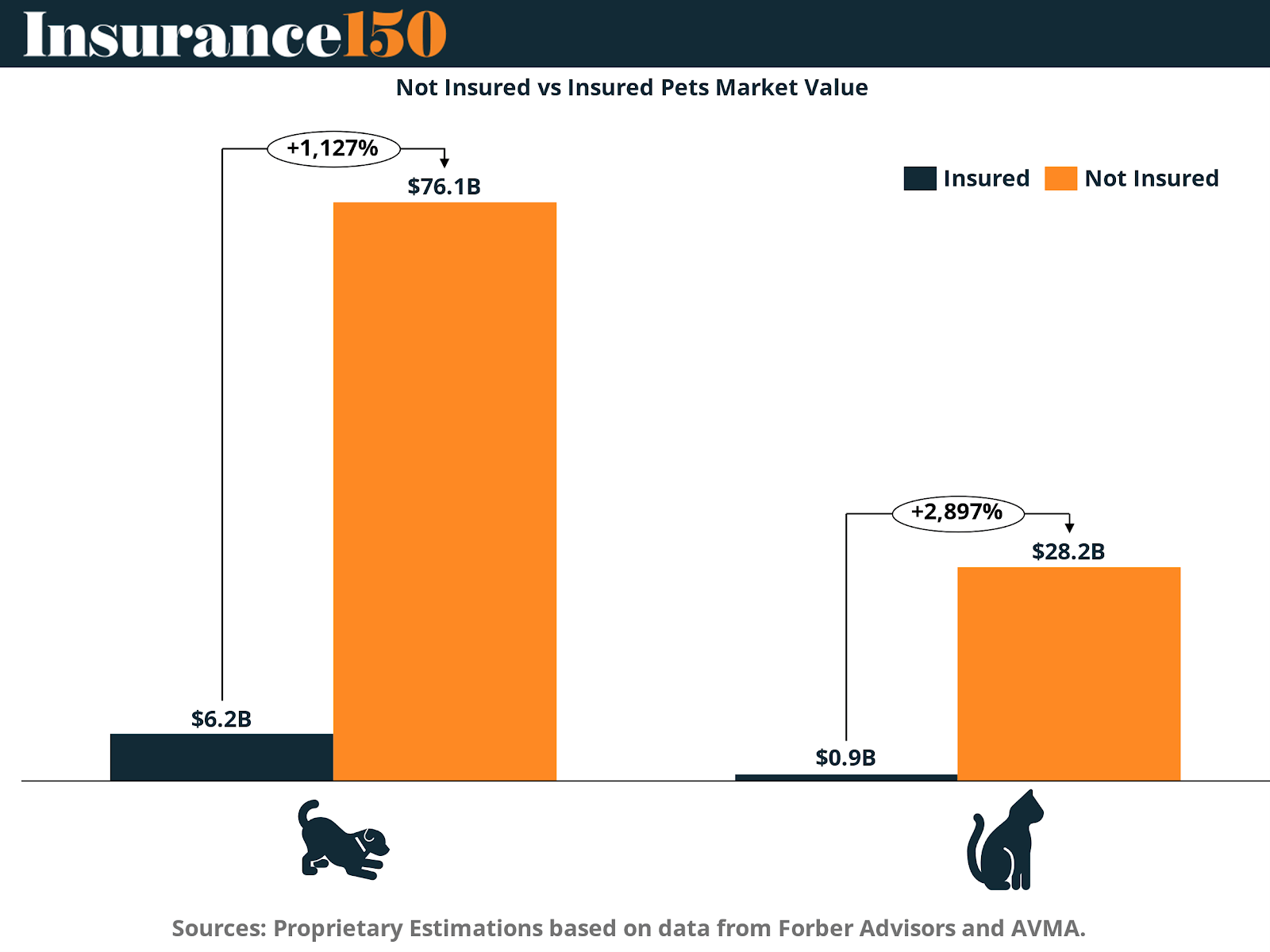

Not Insured vs Insured Pets Market Value

Pet Insurers can make 13.61x if they are able to capture an optimistic 100% of the Potential Market. In the Dogs segment, the Market can add $76.05 billion if Insurers are able to capture it entirely, and $28.17 billion in the Cats segment.

Pet Ownership Evolution in US

According to Statista, Cats and Dogs ownership numbers are growing in US, driving further growth for Pet Insurance. Between 2011 and 2019, the number of households that own a Dog grew at a CAGR of 2.9%, while the number of households that own a Cat grew at a CAGR of 1.5%.

These CAGRs are used to linearly project the US Pet Population for the forecasted period (2024 – 2034E), and then multiplying the estimated Pet (Cats and Dogs) population by the Embedded Wellness Average Annual Premium (assumed constant) for each type of animal, we estimated the market opportunity that Insurers can tackle for the upcoming years if they can penetrate this market.

Investment Thesis

Pet Population is Growing in the US: Dogs at a CAGR of 2.9%, Cats at a CAGR of 1.5%

Pets Humanization is Growing: A growing number of households view pets as family members, resulting in higher spending on their health and well-being.

Pet Insurance is an under penetrated Market: Pet Insurance penetration rate is very low, showing a big opportunity and market value to be unlocked by Insurers, promising juicy future cash flows that can be captured and transformed into shareholders and company value.

Sources & References

AVMA. (2022). PET OWNERSHIP AND DEMOGRAPHICS SOURCEBOOK. https://ebusiness.avma.org/files/ProductDownloads/eco-pet-demographic-report-22-low-res.pdf

Forbes Advisors. (2024). Pet Ownership Statistics 2025. https://www.forbes.com/advisor/pet-insurance/pet-ownership-statistics/#:~:text=Pet%20ownership%20in%20the%20U.S.,part%20of%20their%20owners'%20lives.

North American Pet Health Insurance Association. (2025). Section #2: Total Pets Insured. https://naphia.org/industry-data/section-2-total-pets-insured/

Statista. (2024). Number of pet owning households in the United States in 2024, by species. https://www.statista.com/statistics/198095/pets-in-the-united-states-by-type-in-2008/

Yahoo Finance. (2024). Pet Insurance Industry Analysis Report 2024-2030. https://finance.yahoo.com/news/pet-insurance-industry-analysis-report-095700190.html?guccounter=1

Yahoo Finance. (2024). Pet Insurance Market to Reach $38.3 billion, Globally, by 2033 at 14.5% CAGR. https://finance.yahoo.com/news/pet-insurance-market-reach-38-062700513.html?guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAADhdRsWK8hfwogtKPjAhoFqGiKuXAsgiGb-6i1BuGhjrQVJ11SfZAID2l-tWGWfVlD6tNDYUwS61D5SNr5Q7x2n4PnhoNAqICpzXWIdjlxCmSj3B11n5Er7NUPuybcKYTBOoipt8rTkjTuNWvWUrwEW7mgEKRcPpzC5lQgw7LC0L&guccounter=2

Premium Perks

Since you are an Executive Subscriber, you get access to all the full length reports our research team makes every week. Interested in learning all the hard data behind the article? If so, this report is just for you.

|

Want to check the other reports? Access the Report Repository here.