- Insurance 150

- Posts

- Potential Impacts of a U.S. Military Incursion in Venezuela on Crude Oil Prices and Futures

Potential Impacts of a U.S. Military Incursion in Venezuela on Crude Oil Prices and Futures

Crude oil markets have begun to price in elevated geopolitical risk as tensions between the United States and Venezuela intensify, raising concerns over potential supply disruptions.

Even without a confirmed military incursion, recent enforcement actions against Venezuelan oil shipments have already produced measurable price reactions in both Brent and WTI futures, underscoring how sensitive the market remains to geopolitical escalation.

At the start of the week, February Brent crude futures traded at $60.99 per barrel, up 0.86%, while February WTI futures rose 0.88% to $57.02 per barrel. These gains occurred despite a broadly bearish macro backdrop characterized by ample U.S. production and steady OPEC+ output, suggesting that geopolitical risk—not fundamentals—was the dominant short-term price driver. In India, January crude futures on the MCX climbed 0.86% to ₹5,149, reinforcing the global nature of the response.

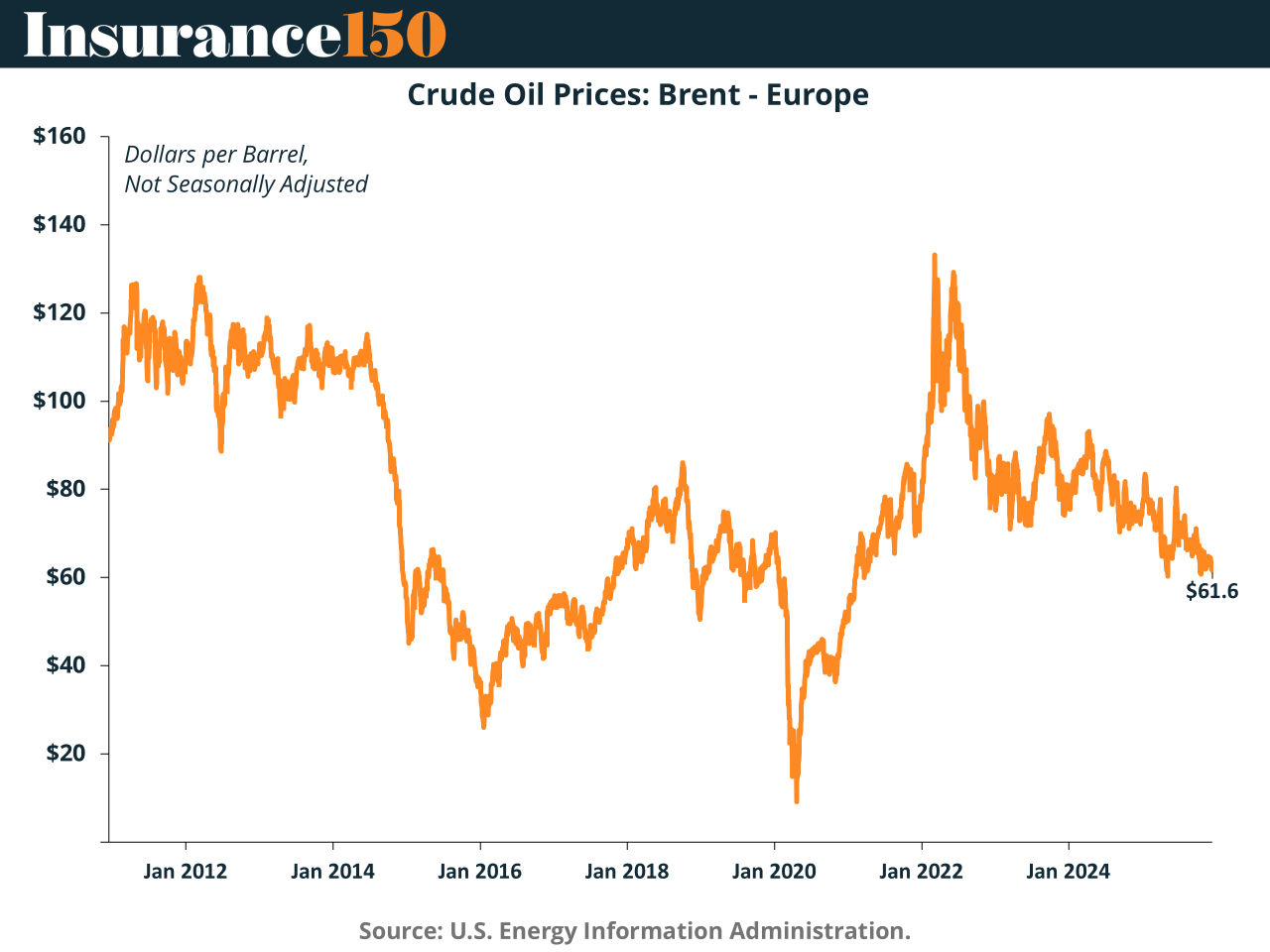

The historical context shown in the Brent price chart highlights why markets react so forcefully to such developments. Over the past decade, Brent has repeatedly exhibited sharp price swings during periods of geopolitical stress, including supply shocks in the mid-2010s, the 2020 collapse to near $20 per barrel, and the 2022 surge above $120 per barrel following Russia’s invasion of Ukraine. These episodes demonstrate that oil prices tend to overshoot when supply risk emerges, particularly when spare capacity and inventories are perceived as insufficient buffers.

Venezuela currently exports approximately 600,000 barrels per day, with the majority of shipments directed to China. While this represents only about 1% of global oil supply, the marginal nature of oil market balances means that even partial disruption can have an outsized impact on prices. A U.S. military incursion—or a more aggressive enforcement of sanctions through naval action—would significantly increase the probability that these barrels are removed from the market, at least temporarily.

Futures Market Sensitivity and Technical Levels

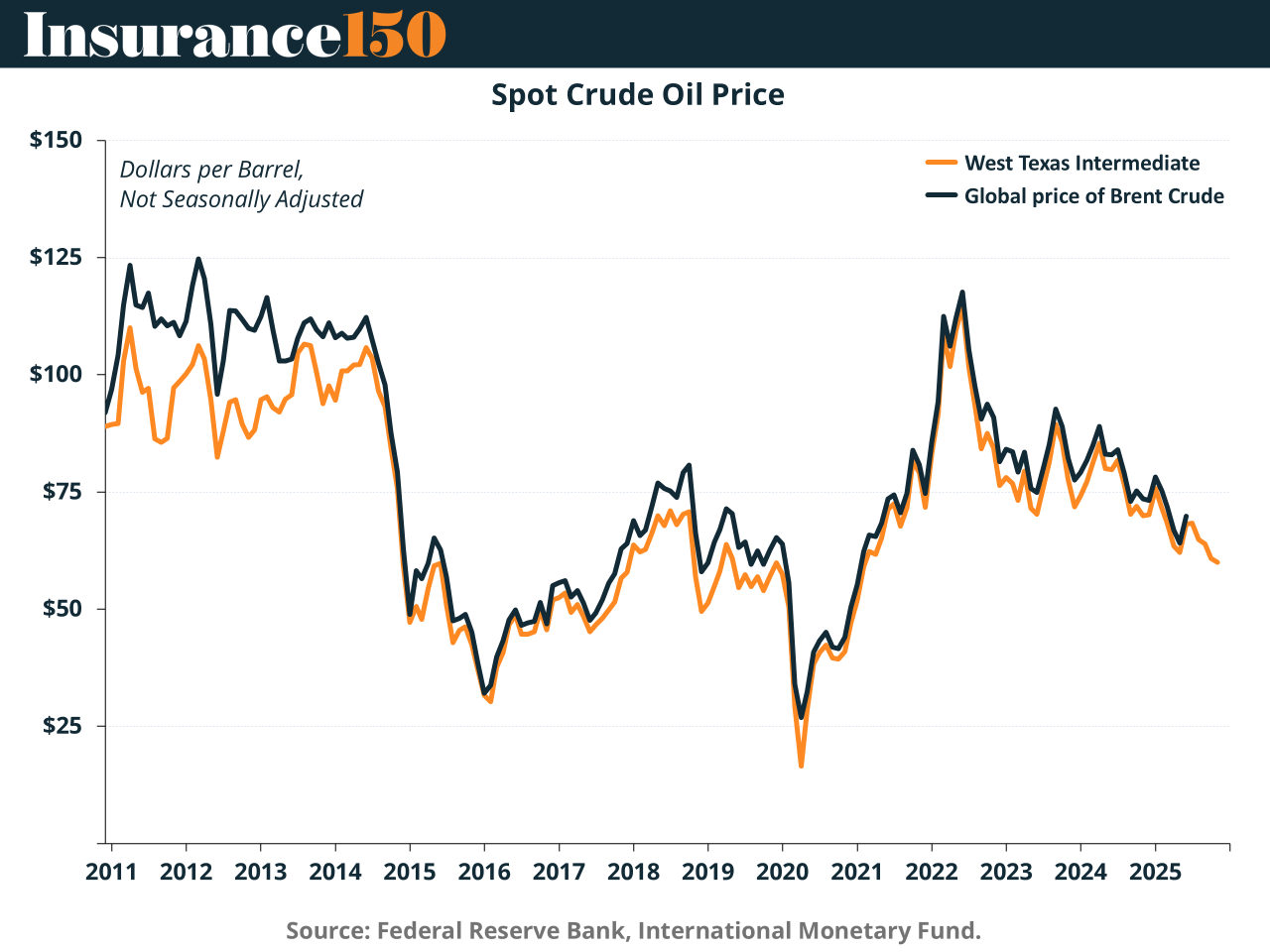

The spot price comparison between Brent and WTI illustrates how closely the two benchmarks move during periods of stress, with geopolitical risk rapidly transmitted across regions. While Brent tends to carry a premium during international supply disruptions, WTI futures often respond just as quickly due to speculative positioning and arbitrage flows.

Recent price action shows that WTI rebounded from a multi-month low of $54.89, driven largely by short-covering once geopolitical headlines emerged. The contract pushed decisively above the $55.87 short-term pivot level and advanced toward the next key resistance at $57.51. A sustained move through this level would open the door to $58.07, with the 50-day moving average near $58.59 acting as a major technical ceiling.

These levels matter because futures markets are currently positioned cautiously after weeks of declining prices. A military incursion would likely force traders to rapidly reassess downside exposure, triggering additional short-covering and momentum buying. In such an environment, price moves can become self-reinforcing, particularly in the front months of the futures curve.

Oil prices reflect not only current supply and demand but also expectations about future disruptions. The threat of military action introduces a geopolitical risk premium that can push prices above levels justified by physical balances alone. This effect is magnified by the short-run inelasticity of both supply and demand. Oil production capacity cannot be expanded quickly, and consumers cannot easily reduce consumption in response to rising prices, requiring larger price moves to rebalance the market.

Although global supply remains ample on paper, spare capacity is unevenly distributed and politically constrained. U.S. shale production, while substantial, cannot respond immediately to a sudden external shock. OPEC+ producers may have the capacity to offset some losses, but willingness to do so is uncertain, particularly if higher prices align with fiscal or strategic objectives.

Duration and Severity as Key Variables

The ultimate impact on crude prices would depend heavily on the duration and severity of a U.S. incursion. A brief, contained operation with limited export disruption could result in a short-lived spike similar to previous geopolitical scares, with prices retreating once clarity emerges. In contrast, a prolonged conflict, expanded sanctions enforcement, or repeated interdictions of Venezuelan tankers would likely keep Brent and WTI futures elevated for an extended period.

Under a prolonged disruption scenario, front-month futures would likely rise faster than longer-dated contracts, steepening backwardation as traders price immediate scarcity. This structure would signal tight near-term conditions even if long-term supply expectations remain relatively stable.

Conclusion

Current price movements—sub-1% daily gains, a rebound from $54.89 in WTI, and renewed tests of key technical resistance levels—suggest that markets are already assigning value to Venezuela-related risk. A confirmed U.S. military incursion would likely amplify these dynamics, pushing crude prices higher through risk premiums, technical momentum, and futures repositioning. Even though Venezuela’s output is modest in global terms, the combination of geopolitical uncertainty, limited short-term flexibility, and historically volatile price behavior makes crude oil particularly vulnerable to further escalation.

Sources & References

Businessline. (2025). Crude oil futures rise as US-Venezuela tensions fuel supply concerns. https://www.thehindubusinessline.com/markets/commodities/crude-oil-futures-rise-as-us-venezuela-tensions-fuel-supply-concerns/article70424799.ece

EIA. (2025). Energy & Financial Markets. WHAT DRIVES CRUDE OIL PRICES? https://www.eia.gov/finance/markets/crudeoil/spot_prices.php

Federal Reserve Bank of St. Louis, Spot Crude Oil Price: West Texas Intermediate (WTI) [WTISPLC], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/WTISPLC, December 22, 2025.

FX Empire. (2025). Oil News: Crude Oil Futures Jump on Supply Risk as Venezuela Tensions Push WTI Higher. https://www.fxempire.com/forecasts/article/oil-news-crude-oil-futures-jump-on-supply-risk-as-venezuela-tensions-push-wti-higher-1568954

International Monetary Fund, Global price of Brent Crude [POILBREUSDM], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/POILBREUSDM, December 22, 2025.

U.S. Energy Information Administration, Crude Oil Prices: Brent - Europe [DCOILBRENTEU], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/DCOILBRENTEU, December 22, 2025.