- Insurance 150

- Posts

- Premium Growth Enters Its Selective Era

Premium Growth Enters Its Selective Era

As insurers stare down a future defined by volatility, the path to premium growth is narrowing—but not disappearing.

Deloitte’s 2026 Global Insurance Outlook makes one thing clear: profitable, strategic premium growth is not only possible, it’s becoming the new competitive edge.

Premium growth in insurance is no longer the blunt instrument it once was. From North America to Asia Pacific, insurers are retooling strategies around underwriting discipline, targeted pricing, and selective market participation. Broad-based expansion is being replaced by margin-conscious growth, driven by underwriting precision, capital efficiency, and smart deployment of tech like GenAI.

This trajectory is especially visible in the global slowdown in premium acceleration. Deloitte notes a steep deceleration in average premium growth across all regions from 2024 to 2025, with only marginal recovery expected in 2026.

World average falls from ~5.3% in 2024 to ~1.8% in 2025

North America plunges below 1% in 2025 before ticking back up

Asia Pacific holds steadier, reflecting stronger regional demand and digital expansion

This reversion isn’t just cyclical—it’s structural. Insurers are repricing risk in the face of rising CAT losses, tighter reinsurance markets, and a global economic baseline that has reset to “volatile.” Premium growth that doesn’t deliver underwriting profitability is increasingly viewed as risk—not opportunity.

P&C: Price-Driven Growth, Not Volume

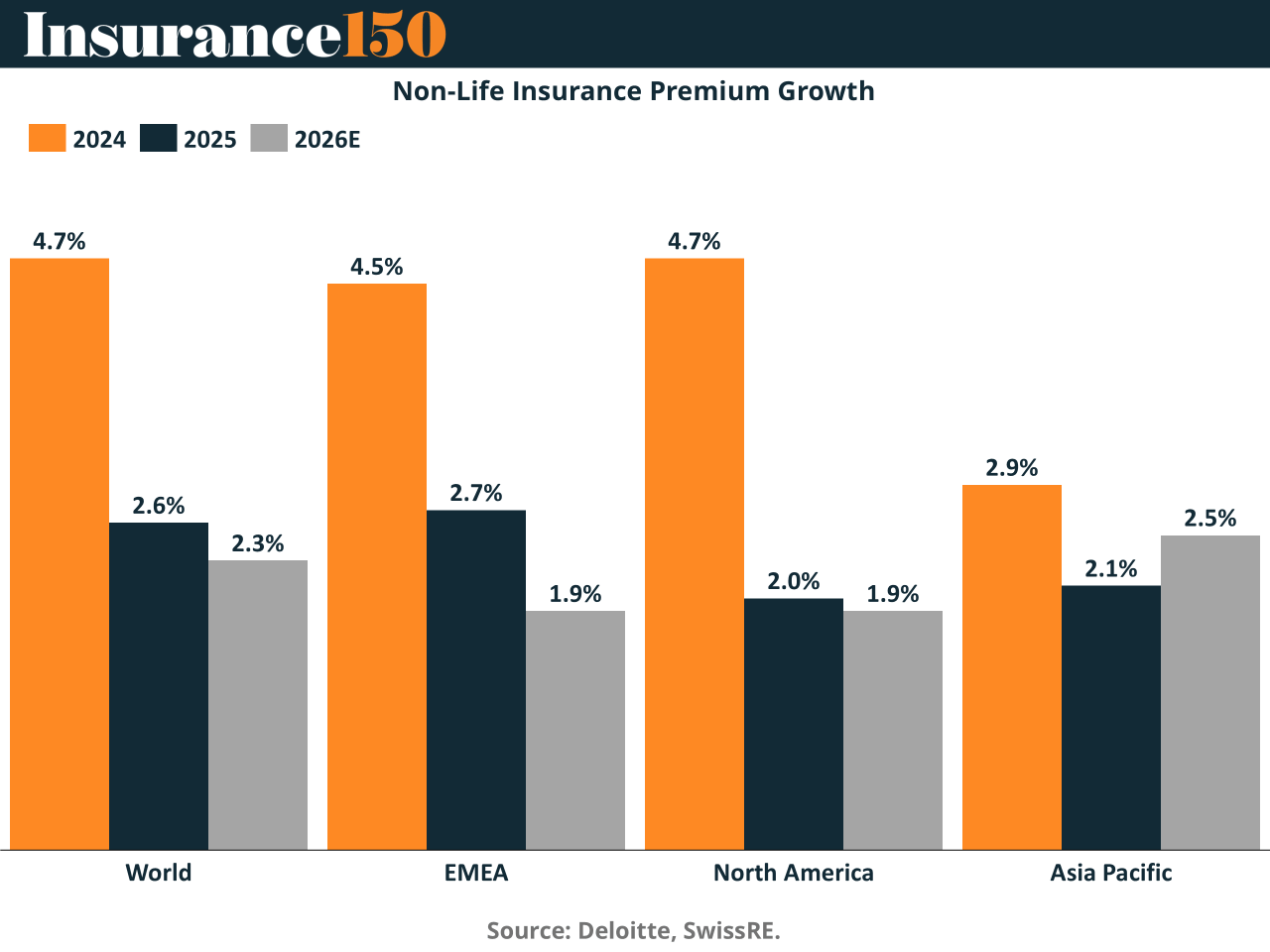

In non-life insurance, premium growth remains positive—but the drivers are different. As shown in the chart below, most of the momentum in 2024 stems from rate increases, not new policies or expanded distribution.

The data shows:

World non-life premiums rise +4.7% in 2024, but taper to +2.3% by 2026E

North America and EMEA mirror this pattern, with growth falling by more than half

Asia Pacific is the only region with a moderate rebound by 2026

This reflects deliberate recalibration. Insurers are shedding unprofitable lines—especially in CAT-prone geographies—and focusing on portfolios that can sustain both higher rates and acceptable loss ratios. Reinsurers, facing the same pressures, are tightening capacity, forcing primary carriers to pass on higher costs.

As Deloitte puts it: “Insurers are engineering profitability before scale.” Growth is being channeled toward specialty, commercial, and mid-market P&C, where underwriting innovation and pricing power remain strongest.

Life Insurance: Volatile, Regional, and Demographic-Driven

In life insurance, the picture is more complex. The premium surge in 2024—+6.1% globally—is largely driven by pent-up demand and favorable interest rate dynamics. But this quickly dissipates into low or even negative growth across regions in 2025, before stabilizing modestly.

Notably:

North America experiences -1.4% shrinkage in 2025 before rebounding in 2026

Asia Pacific flatlines, with only +0.4% to +1.1% projected

EMEA shows relative resilience, but still decelerates sharply after 2024

The challenge? Life insurers are squeezed between consumer demand uncertainty, especially among younger demographics, and capital cost pressure that makes traditional products less viable. To grow profitably, carriers are retooling portfolios—shifting from guaranteed-return offerings to hybrid or investment-linked structures, often via digital channels in APAC and EMEA.

Strategic Growth ≠ Fast Growth

What unites both life and non-life markets is the strategic recalibration of what “growth” means. Growth without margin is being discarded. In its place:

Modular product launches tailored to local demand

AI-augmented pricing and underwriting to improve loss ratios

Selective re-entry into markets where digital distribution offers scale without capex

This is reflected in how insurers are building “polycrisis-resilient” business models, as Deloitte describes them. Volatility is now the norm, and with it comes the need for smarter growth—not faster.

Implications for Insurance Execs

For executives in insurance and financial services, the message is clear:

Don’t chase top-line growth—interrogate whether it earns its cost of capital

Expect premium rate hardening to persist selectively in 2025–26, particularly in commercial P&C and life segments with investment sensitivity

Regional strategies matter: Asia’s digital demand, EMEA’s regulatory shifts, and North America’s CAT exposure all demand tailored premium growth plays