- The Deal Brief - Insurance

- Posts

- Small and Medium Enterprises Insurance

Small and Medium Enterprises Insurance

Small and medium enterprises (SMEs) form the structural backbone of modern economies, acting as catalysts of employment, innovation, and regional development.

1) Introduction

In the United States and across major markets, SMEs account for nearly all business entities, employing close to half of the private-sector workforce. Despite this massive economic footprint, their access to, and experience with, insurance remains fragmented, inefficient, and often misaligned with evolving risk dynamics. As digitalization reshapes financial services and risk management paradigms, the SME insurance sector is poised for profound transformation over the next decade.

SMEs operate under distinct structural and behavioral realities compared to large enterprises. Their limited financial buffers, concentrated revenue bases, and high exposure to external shocks make them particularly vulnerable to market volatility, inflationary pressures, and climate-related disruptions. Yet, paradoxically, these same vulnerabilities make them the most promising target for insurers seeking sustainable growth. A new generation of technology-driven carriers, underwriters, and brokers is emerging to address the underpenetration of coverage in this market, developing products that integrate automation, analytics, and personalization into previously static offerings.

Globally, the insurance industry is entering an inflection point. Traditional distribution channels are giving way to digital-first engagement models, while data integration, artificial intelligence, and modular underwriting are reconfiguring how carriers assess and price risk. The convergence of these technological and behavioral shifts creates an unprecedented opportunity for insurers to expand their presence in the SME market. In parallel, macroeconomic conditions—marked by sustained business formation rates, strong employment contributions, and steady recovery in post-pandemic sectors—are fueling renewed demand for comprehensive, flexible, and transparent insurance solutions.

The decade ahead will test insurers’ ability to balance profitability with accessibility. Winning strategies will hinge on three critical competencies: the capacity to understand diverse SME segments, the agility to embed digital-first experiences, and the foresight to integrate advisory and automation services that add tangible value beyond risk transfer. The following report explores the evolving SME insurance landscape through market trends, customer satisfaction patterns, purchasing behaviors, and emerging innovation levers that are redefining how coverage is designed and delivered.

2) Market Overview

Market Size

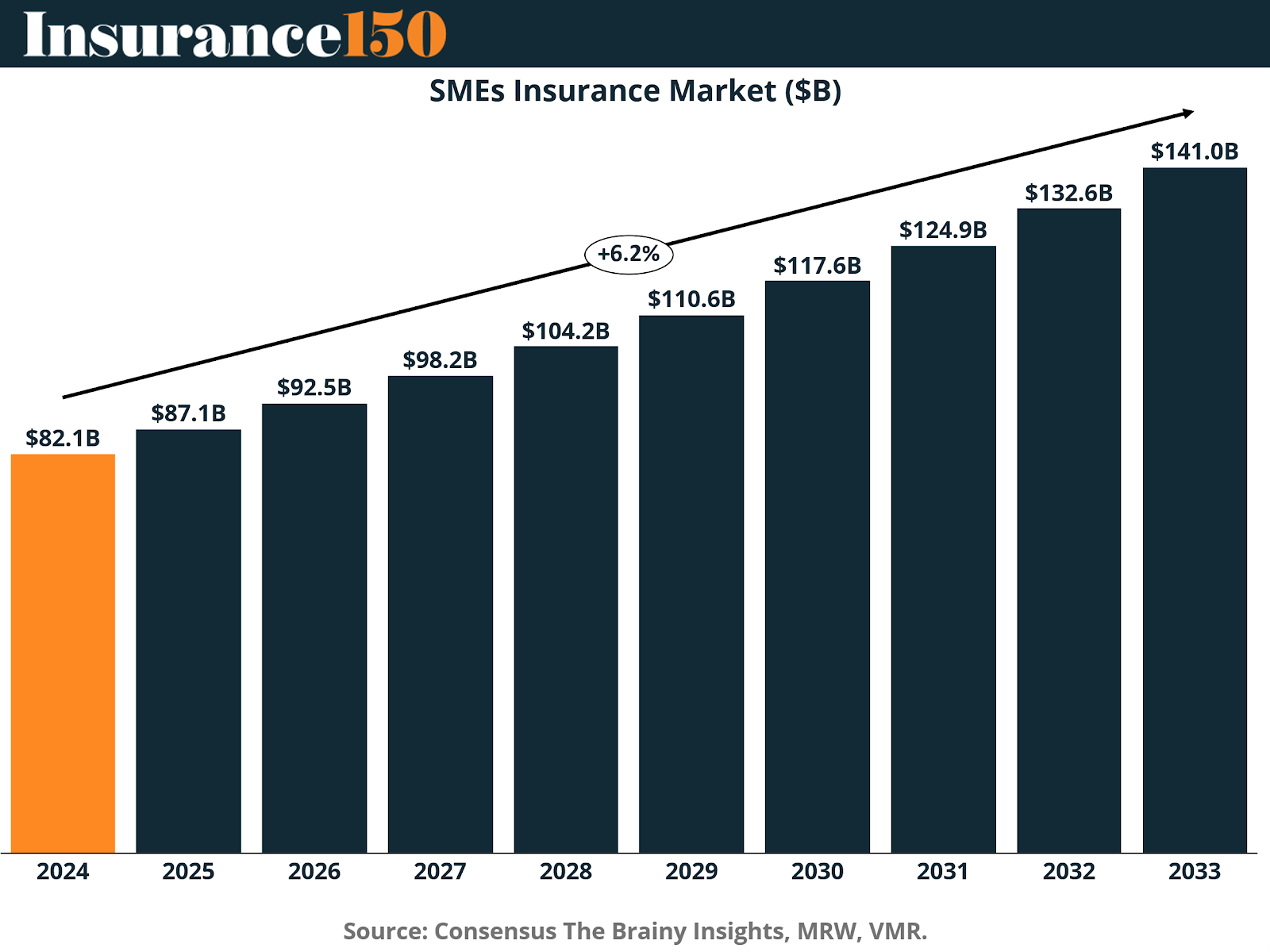

The global SME insurance market is on a trajectory of sustained expansion, reflecting both the rising number of small enterprises and the increasing awareness of risk mitigation as a strategic priority. In 2024, the SME insurance market was valued at approximately $82.1 billion, with projections indicating consistent annual growth of around 6.2%, reaching nearly $141 billion by 2033. This steady compounding growth is underpinned by three intersecting forces: digital enablement, evolving regulatory frameworks, and heightened risk exposure driven by economic volatility and climate impacts.

Traditional carriers have historically underestimated the potential of the SME segment, viewing it as administratively costly and operationally complex. However, as automation and straight-through processing technologies reduce underwriting friction and improve efficiency, insurers are increasingly recognizing the scale and profitability of this segment.

Moreover, the competitive dynamics of the market—where no single player commands more than a 10% share—suggest a wide-open field for differentiation based on digital experience, customer intimacy, and data-driven pricing innovation.

Number of SMEs

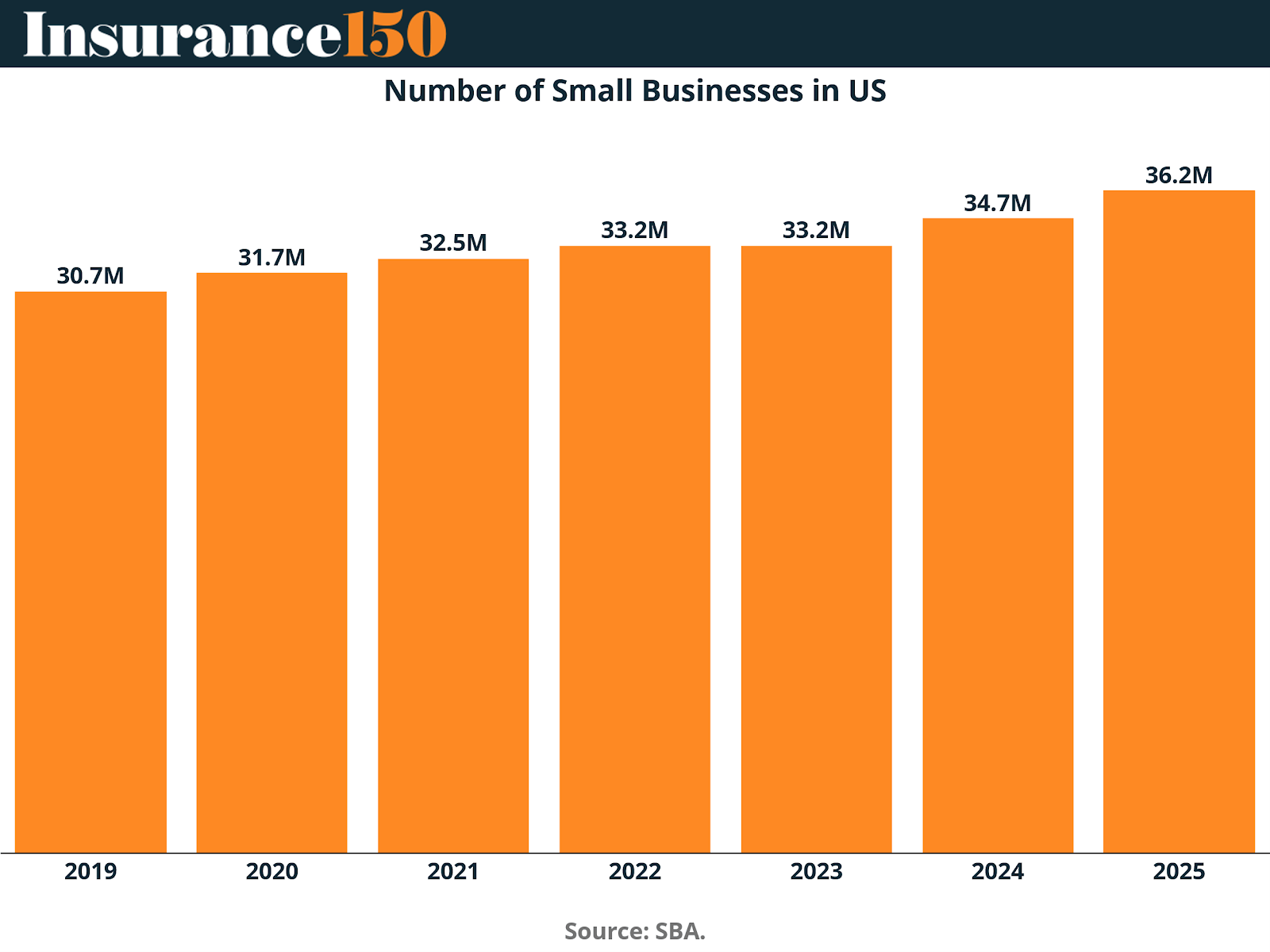

The demand base for SME insurance continues to expand alongside the proliferation of new enterprises. In the United States alone, the number of small businesses grew from 30.7 million in 2019 to 36.2 million in 2025, illustrating both entrepreneurial dynamism and the sector’s resilience despite macroeconomic headwinds. SMEs now represent 99.9% of all U.S. businesses and employ over 62 million Americans, underscoring their systemic importance to national economic stability.

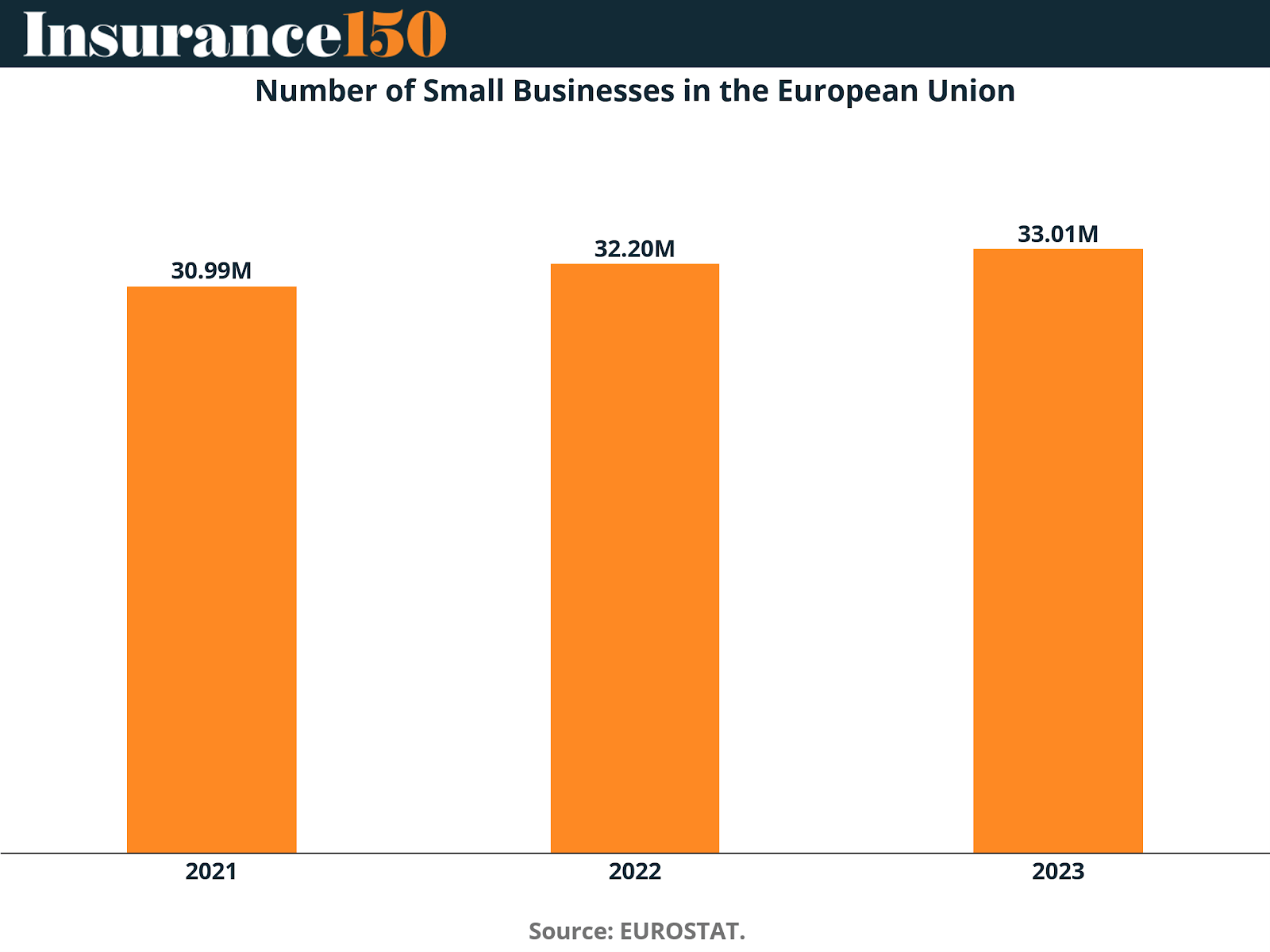

In the European Union, a parallel expansion has occurred. Between 2021 and 2023, the number of SMEs rose from 30.99 million to 33.01 million, reinforcing the sector’s central role in employment and value creation across the continent.

European SMEs are particularly concentrated in retail, construction, tourism, and digital services—industries that exhibit a high dependency on tailored risk protection and coverage flexibility.

Market Drivers and Challenges

The acceleration of SME insurance demand is shaped by both enabling and constraining factors. Among the strongest drivers are the digital transformation of underwriting processes, improved data accessibility, and the emergence of embedded insurance solutions that integrate coverage directly into business platforms and payment systems. These innovations are lowering distribution costs while enhancing accessibility for underserved micro and small enterprises.

Conversely, the sector continues to face challenges related to product complexity, low customer literacy, and affordability constraints. Many SME owners still perceive insurance as a burdensome administrative expense rather than a strategic safeguard. Inflationary pressures, higher reinsurance costs, and increased frequency of weather-related losses have also pushed premiums upward, particularly in property and casualty lines. As a result, coverage gaps persist—especially among smaller firms in high-risk geographies or labor-intensive sectors such as food services, construction, and hospitality.

3) Insurance

Satisfaction

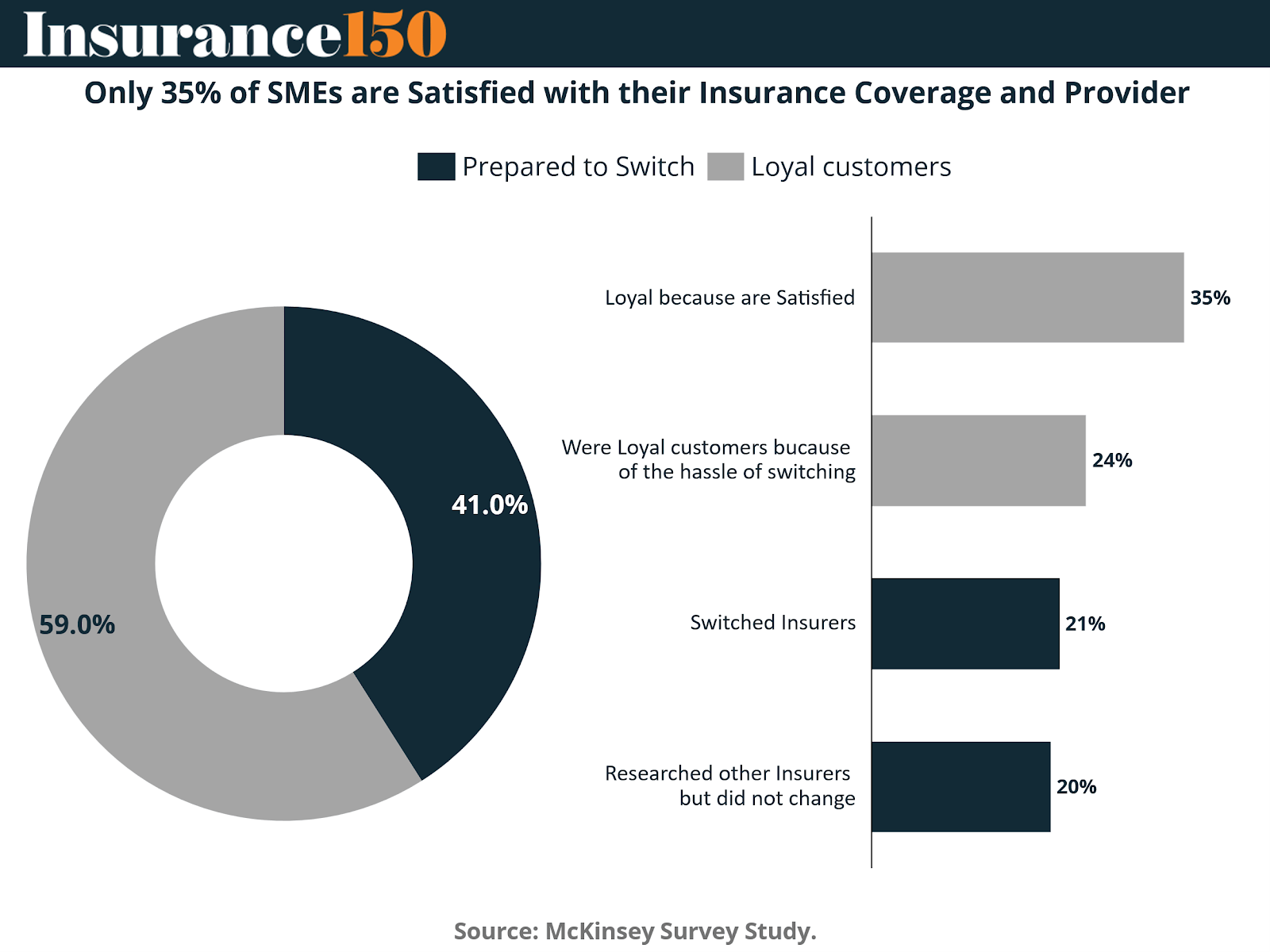

Customer satisfaction remains a central issue within the SME insurance segment. According to recent market research, only 35% of SMEs express genuine satisfaction with their current insurance coverage and provider. A significant 41% are prepared to switch insurers, citing reasons such as lack of product transparency, rigid policy structures, and slow claims processes. Notably, 24% of policyholders maintain loyalty primarily due to the perceived hassle of switching rather than brand affinity or service excellence.

This dissatisfaction underscores the industry’s ongoing misalignment between customer expectations and product design. Small business owners seek simplicity, clarity, and personal engagement—attributes often missing from legacy insurance experiences dominated by intermediaries and complex policy documents. In many cases, traditional carriers have failed to translate digital progress into user-centric journeys. As a result, policyholders remain disengaged, and opportunities for cross-selling or upselling remain unrealized.

Future growth will hinge on reimagining customer experience through three lenses: personalization, transparency, and proactive service. Insurers that integrate behavioral analytics and modular coverage configurations can enhance perceived value, while digital tools—such as self-service dashboards and AI-driven claim status updates—can significantly improve retention and advocacy.

Purchasing Channels

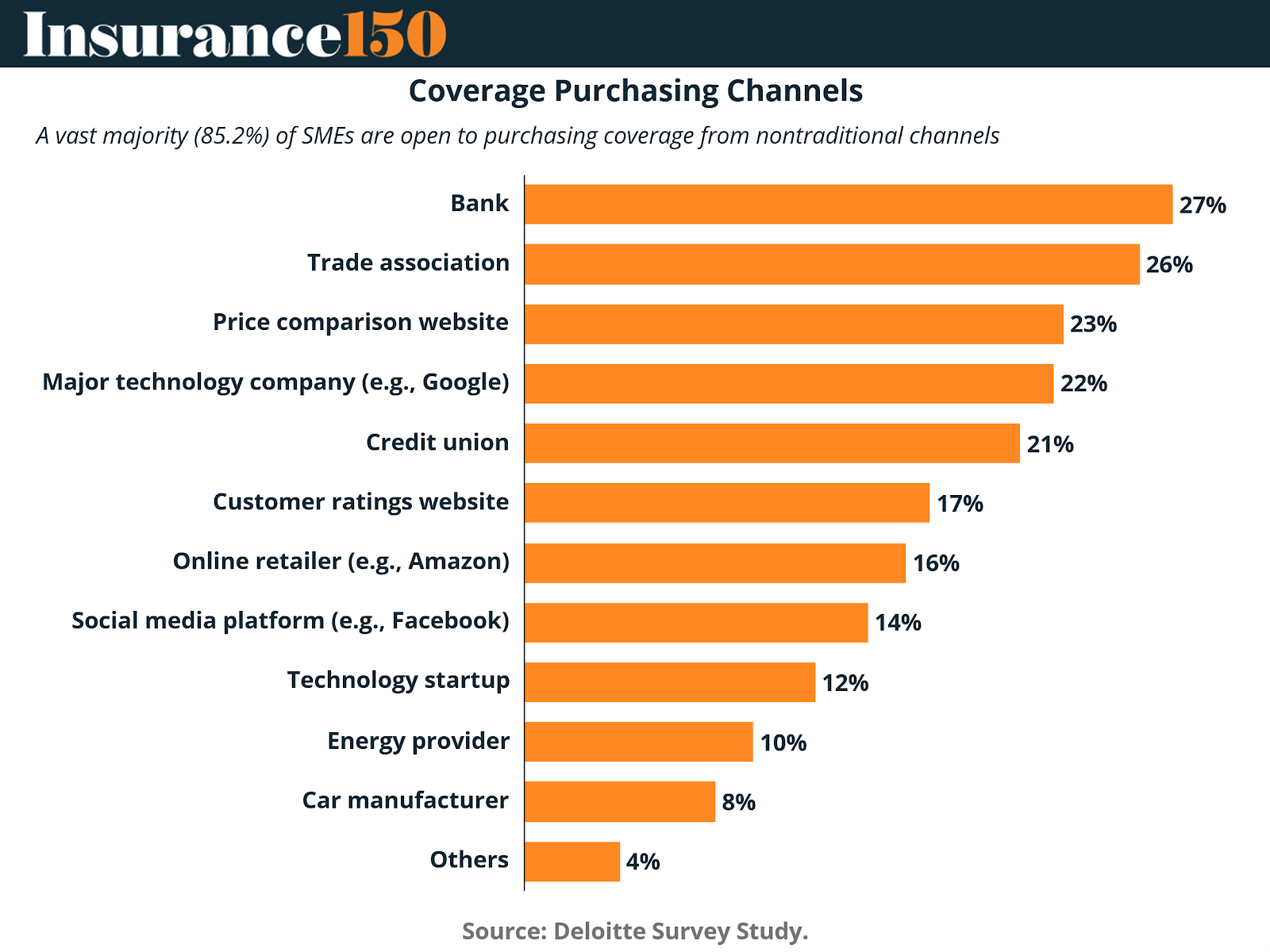

The SME insurance purchasing ecosystem is undergoing a rapid diversification, with small business owners increasingly open to nontraditional distribution channels. Nearly 85% of SMEs indicate willingness to purchase insurance through alternative avenues such as banks, trade associations, or major technology companies. This marks a fundamental shift away from the exclusive dominance of brokers and agents toward a multi-channel, ecosystem-driven marketplace.

Banks and trade associations lead the nontraditional distribution spectrum, preferred by 27% and 26% of SMEs respectively, followed closely by price comparison websites (23%) and technology firms (22%). The appeal of these platforms lies in their ability to offer integrated financial services, streamlined onboarding, and greater price transparency. In parallel, online retailers and social media platforms are emerging as viable embedded insurance partners, capitalizing on customer trust and digital traffic.

This evolution in purchasing behavior presents insurers with both opportunities and competitive threats. Those that successfully form partnerships with fintechs, e-commerce platforms, and neobanks can achieve unprecedented scale and data access. Conversely, carriers slow to adapt risk disintermediation and loss of brand relevance as distribution becomes increasingly platform-based.

Automation Needs

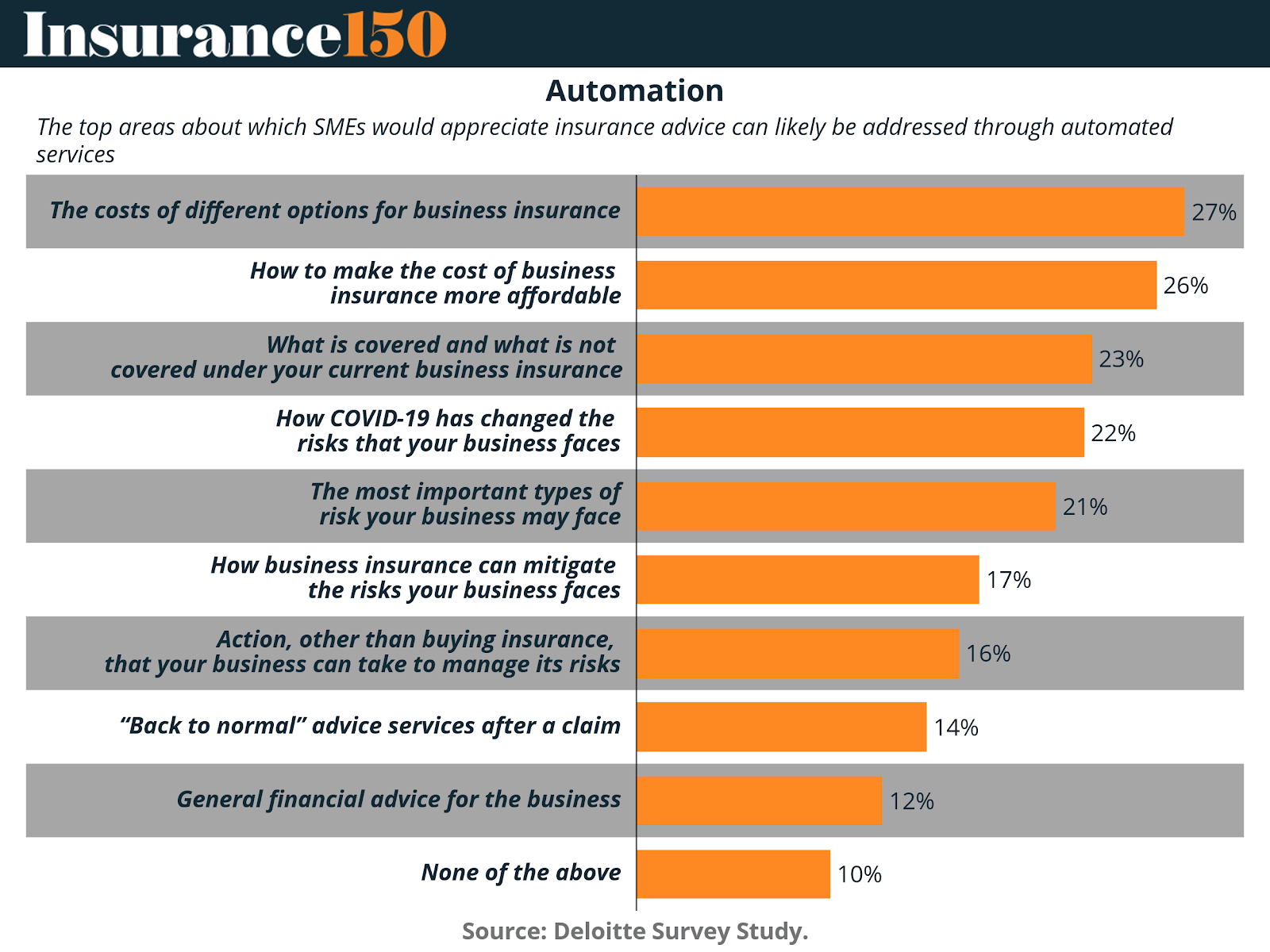

The rising complexity of risks faced by SMEs, combined with limited internal risk management capacity, is driving strong demand for automated advisory and support solutions. Businesses seek tools that simplify coverage selection, monitor exposures, and deliver actionable insights in real time. Surveys indicate that the most valued automated insurance services among SMEs relate to cost comparison (27%), affordability optimization (26%), and clarity around coverage inclusions and exclusions (23%).

Furthermore, SMEs express interest in automated guidance on how macro events—such as pandemics, inflationary cycles, or supply chain disruptions—affect their risk profiles. This reflects a shift in customer expectations from transactional insurance toward continuous, data-informed risk management partnerships.

Automation thus represents more than an efficiency lever; it is becoming a core differentiator in SME insurance. Insurers that leverage AI-driven advisory models can deepen engagement, increase trust, and reduce the perceived complexity of insurance. For small business owners who often lack dedicated financial expertise, the ability to receive dynamic, automated insights on cost control, coverage adequacy, and claim prevention could redefine their perception of insurance value.

4) Conclusion

The small and medium enterprise insurance segment is entering a new phase of strategic relevance and structural transformation. As global SME populations continue to grow and diversify, insurers face both immense opportunity and elevated expectations. The convergence of digital technology, data-driven pricing, and ecosystem-based distribution is reshaping the industry’s economic logic, turning an historically underserved market into a pivotal growth engine for the next decade.

Future winners in this space will be those carriers that pivot from transactional protection to relational engagement—blending automation, personalization, and education into seamless experiences. Beyond product design, success will depend on trust-building and empathy: understanding that SME owners value simplicity, transparency, and reliability above all.

In the long term, the insurers that thrive will not merely sell policies—they will become integral partners in business continuity, resilience, and growth. By aligning digital innovation with customer-centricity, the industry can unlock the full potential of a market exceeding $140 billion by 2033, ensuring that SMEs, the backbone of global economies, are not only protected but empowered to flourish in an increasingly uncertain world.

Sources & References

European Commission. (2025). Annual Report on European SMEs 2024/2025, SME performance review. https://publications.jrc.ec.europa.eu/repository/handle/JRC142263

Eurostat. (2025). Enterprise statistics by size class and NACE Rev. 2 activity (from 2021 onwards). https://ec.europa.eu/eurostat/databrowser/view/SBS_SC_OVW/default/table?lang=en

Deloitte. (2022). How to reinvent the small-business insurance market for a digital economy. https://www.deloitte.com/us/en/insights/industry/financial-services/small-business-insurance-market-survey.html

Insurance Business. (2024). What's key for SMB insurance coverage? https://www.insurancebusinessmag.com/us/news/sme/whats-key-for-smb-insurance-coverage-481598.aspx

Market Reports World. (2024). SME Insurance Market Size. https://www.marketreportsworld.com/market-reports/sme-insurance-market-14717768#:~:text=SME%20Insurance%20Market%20Overview,of%20the%20SME%20insurance%20market.

McKinsey. (2022). Small and medium-size commercial insurance: The big opportunity. https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/small%20and%20midsize%20commercial%20insurance%20the%20big%20opportunity/small-and-medium-size-commercial-insurance-the-big-opportunity-vf.pdf?shouldIndex=false

Oliver Wyman. (2025). Win In The Small And Medium-Size Commercial Insurance Market. 10 profitable opportunities for insurers. https://www.oliverwyman.com/content/dam/oliver-wyman/v2/publications/2023/september/Oliver_Wyman_Opportunities_for_insurers_in_the_small_and_medium_commercial_market_article_1.pdf

SBA. (2025). New Advocacy Report Shows the Number of Small Businesses in the U.S. Exceeds 36 million. https://advocacy.sba.gov/2025/06/30/new-advocacy-report-shows-the-number-of-small-businesses-in-the-u-s-exceeds-36-million/

Sellers Commerce. (2025). United States Small Business Statistics (2025 Data). https://www.sellerscommerce.com/blog/small-business-statistics/

The Brainy Insight. (2023). SME Insurance Market Size. https://www.thebrainyinsights.com/report/sme-insurance-market-14540

The Kaplan Group. (2025). 54 Small Business Statistics for 2025. https://www.kaplancollectionagency.com/business-advice/54-small-business-statistics-for-2025/

Virtue Market Research. (2024). Global SME Insurance Market Research Report. https://virtuemarketresearch.com/report/sme-insurance-market