- Insurance 150

- Posts

- Soft Landing, No Landing, or Recession? Scenarios That Matter for Deal Pipelines

Soft Landing, No Landing, or Recession? Scenarios That Matter for Deal Pipelines

Deal Pipelines Meet the Macroeconomic Blender.

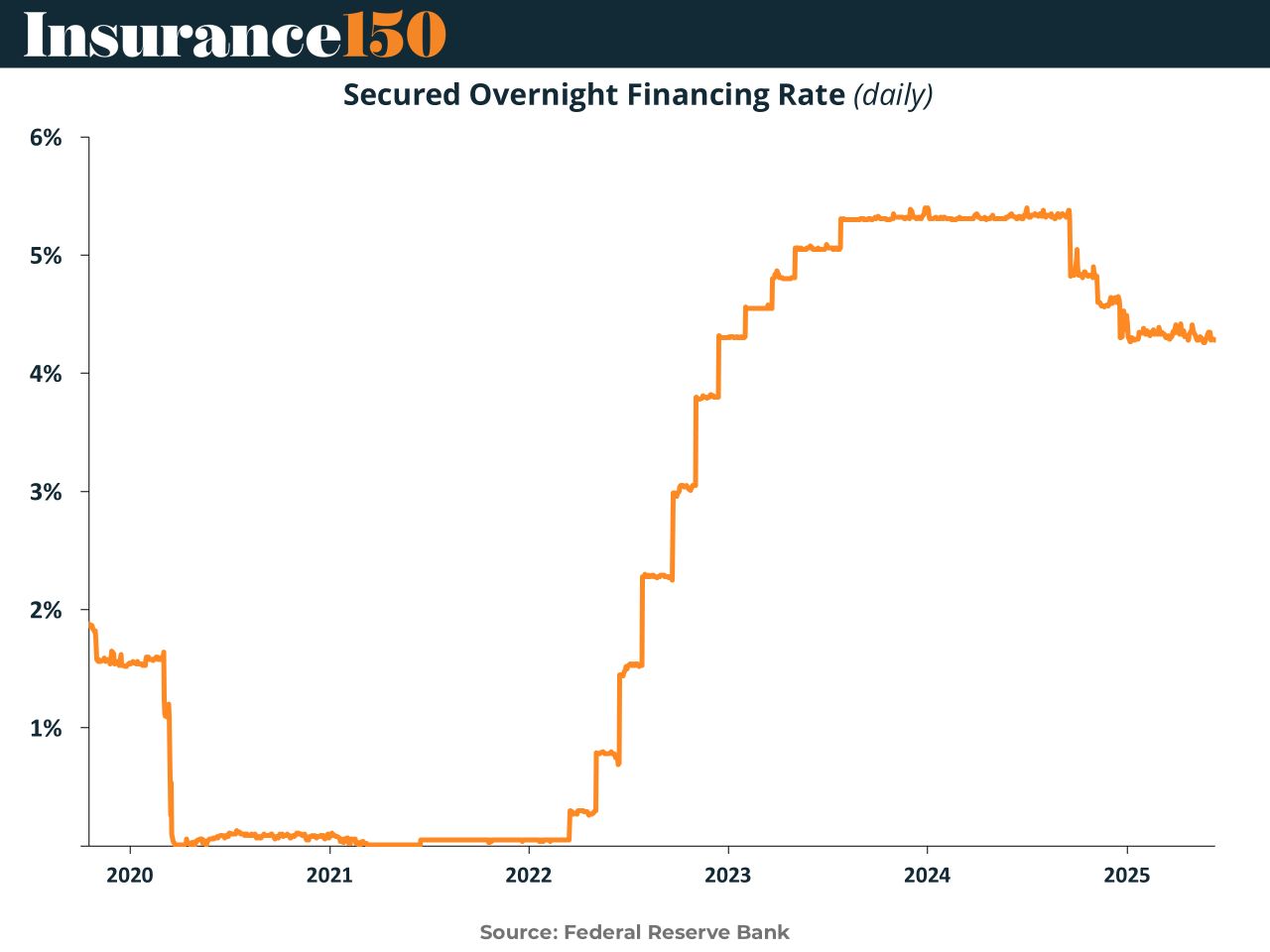

As we move deeper into 2025, dealmakers face one of the most uncertain macroeconomic backdrops in recent memory. The US economy remains resilient on the surface, but inflation progress has stalled, rates remain elevated, and global growth looks fragile. In this environment, private equity sponsors, corporate development teams, and bankers are actively debating three scenarios — soft landing, no landing, or recession — each with very different implications for the deal pipeline.

In a soft landing scenario, inflation cools gradually and the economy avoids outright contraction. While this is still the official narrative among many market participants, it is increasingly contested. Consumer spending remains strong and unemployment is low, but sectors like manufacturing and freight have begun to show signs of stress. If a soft landing materializes, it would likely support steady M&A activity. Valuations would stabilize or even rise in certain sectors, financing costs would plateau, and lenders would remain willing to support well-structured transactions. Sectors such as healthcare and software could see particularly robust deal flow, as sponsors seek platforms with long-term defensibility.

A no landing scenario — where inflation stays elevated and growth grinds sideways — presents a trickier picture. In this case, the economy avoids a sharp downturn but fails to regain solid momentum. For dealmakers, this environment would favor defensive strategies. Many sponsors would likely pivot toward margin-enhancing value creation, delay aggressive growth bets, and focus on operational improvements within portfolio companies. On the financing side, banks could pull back selectively, pushing more sponsors to tap private credit markets where spreads and terms have adjusted to reflect higher uncertainty. Underwriting models in a no landing world would increasingly incorporate downside stress tests and multiple exit paths.

The most concerning scenario, of course, is a recession. Interestingly, our recent survey on PE150 shows that nearly half of private equity sponsors already see signs of a recession in motion — 45.5% report observing early indicators such as weaker cash flows, tighter credit, and reduced hiring appetite. In contrast, bankers remain somewhat more sanguine, with 43.2% expecting only a mild recession. Corporate development teams are split, reflecting the sector-specific nature of the slowdown. Should a full recession take hold, deal volumes would likely contract sharply. Buyers would shift toward distressed and opportunistic transactions, and leverage would become harder to obtain on favorable terms. Sponsors would need to get creative with structuring, using earn-outs, seller financing, and hybrid debt to navigate the tighter environment. Valuations, especially in cyclical sectors, would face downward pressure, though this would also present entry opportunities for patient capital.

What is clear from both macro data and sentiment surveys is that the outlook is fragmented. The divergence in views between sponsors, bankers, and corporate strategists underscores the need for flexible deal planning. Sponsors should not rely on any single macro assumption. Instead, stress-testing transactions across multiple scenarios — from benign soft landing to a severe recession — will be critical to safeguarding returns. Deal structuring, sector selection, and financing strategy all need to reflect this uncertainty. While no one can predict the precise path of the economy, those who build this flexibility into their pipelines will be best positioned to execute effectively in 2025’s complex market landscape.

Sources & References

ABC. (2025). Will Trump's tariffs threaten the Fed's soft landing? Experts weigh in. https://abcnews.go.com/Business/trumps-tariffs-threaten-feds-soft-landing-experts-weigh/story?id=119906069

Bloomberg. (2025). Fed’s Goolsbee Says Inflation Improving, Hopeful of Soft Landing. https://www.bloomberg.com/news/articles/2025-01-15/fed-s-goolsbee-says-inflation-improving-hopeful-of-soft-landing

Federal Reserve Bank. (2025). Interest Rates. https://fred.stlouisfed.org/graph/?g=1wm2q

PE 150. (2025). Is the Soft Landing Still Intact? Survey Shows Cracks in Outlook. https://www.pe150.com/p/what-our-survey-reveals-about-the-soft-landing-narrative-and-what-it-means-going-forward