- Insurance 150

- Posts

- Metal Markets on the Tariff Treadmill

Metal Markets on the Tariff Treadmill

Tariffs Reshape Global Metals Markets, Driving Price Volatility and Production Shifts.

In recent years, tariffs have become a powerful tool in shaping the dynamics of the global metals market, with wide-reaching effects on production, prices, and trade patterns. The latest round of tariffs on steel and aluminum announced in early 2025 highlights this evolving landscape.

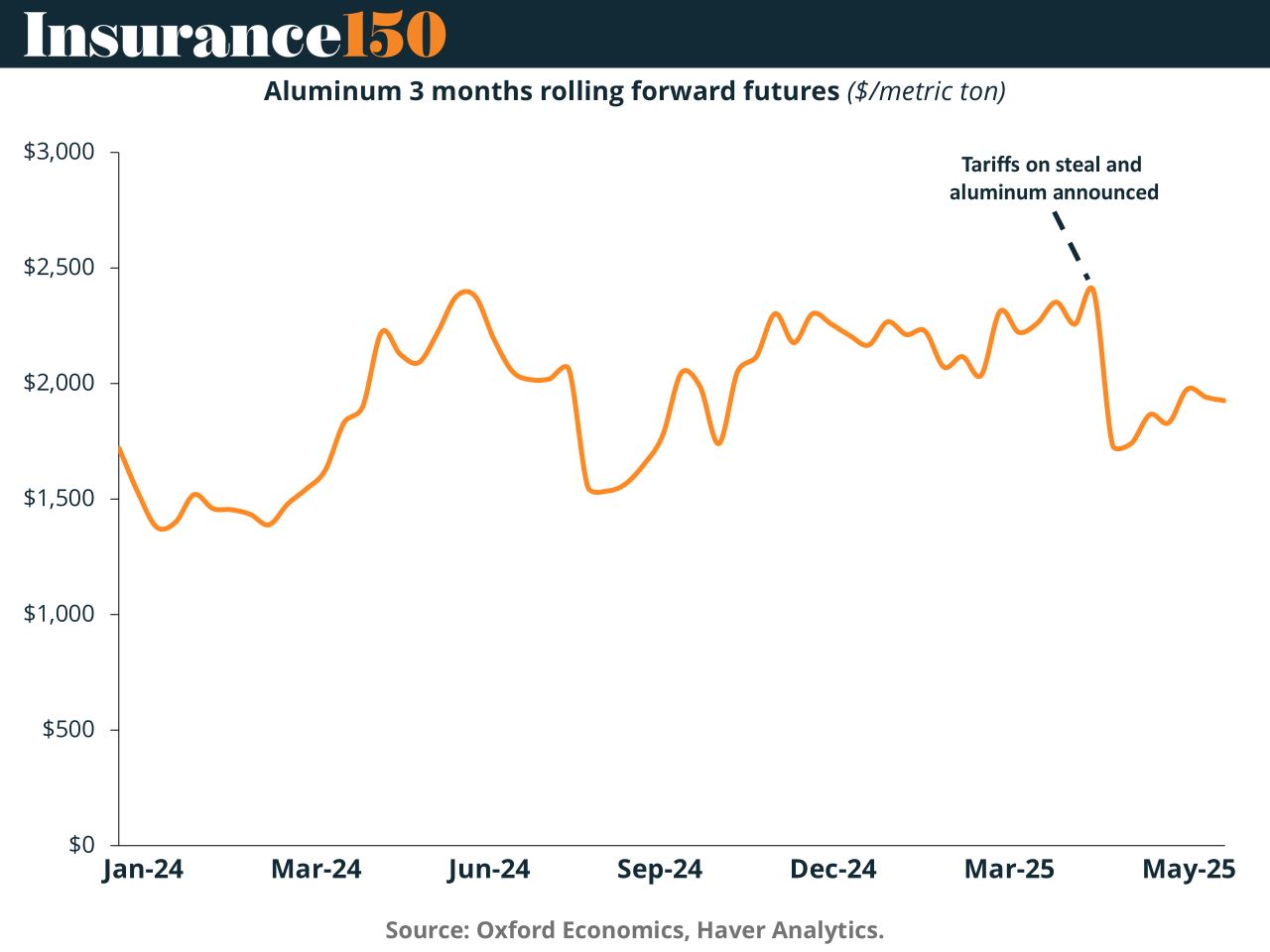

The imposition of tariffs has caused notable price disruptions. As the first chart illustrates, aluminum futures spiked ahead of the 2025 tariffs announcement but quickly dropped as markets absorbed the news and recalibrated expectations. The volatility reflects the uncertainty surrounding how long tariffs will remain in place, as exemptions and trade negotiations continue to evolve. According to the latest Oxford Economics report, aluminum prices are projected to remain elevated due to constrained domestic supply and higher import costs.

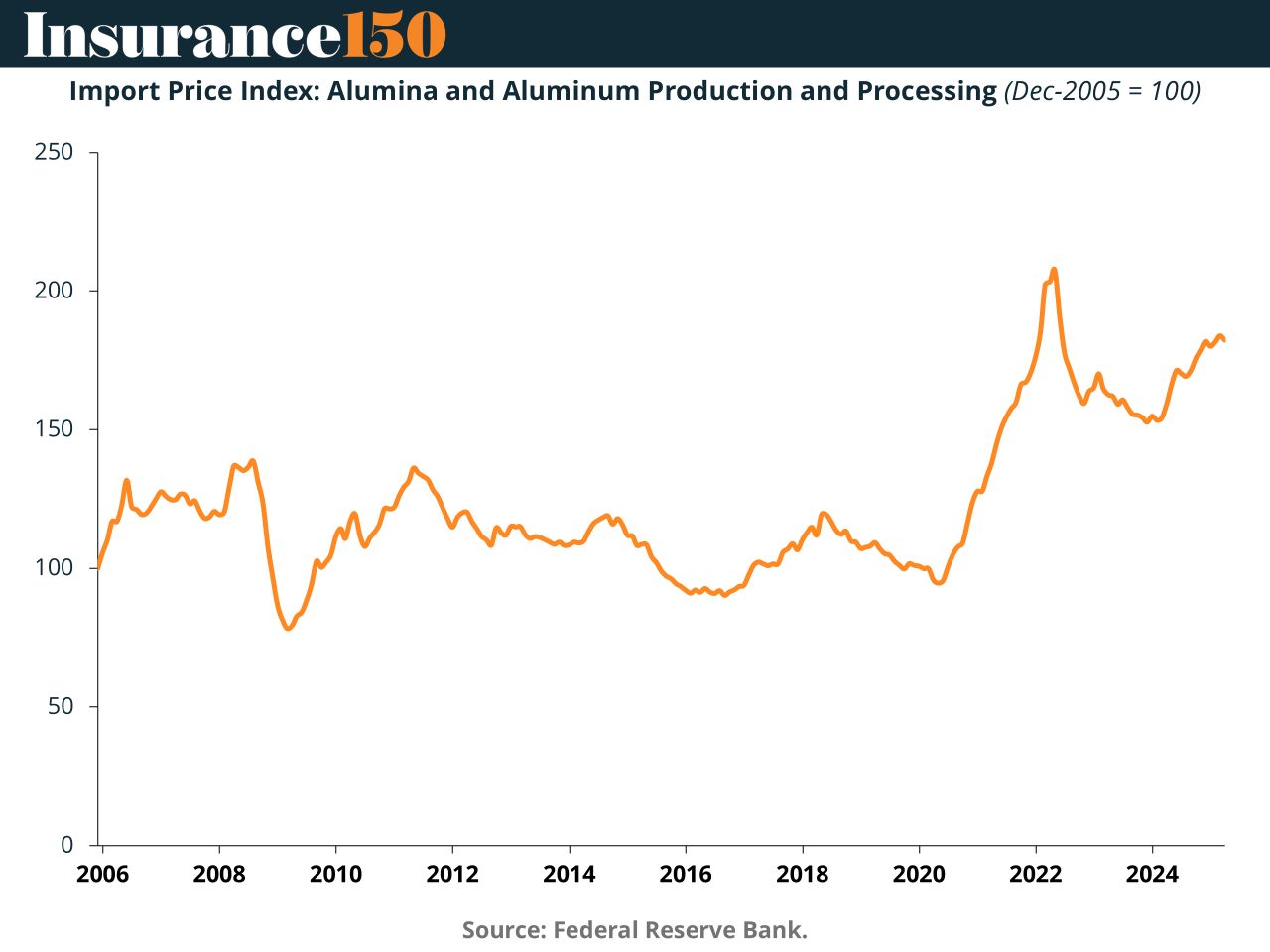

The second chart underscores the structural shift in aluminum prices. The Import Price Index shows a sharp climb since 2020, driven by post-pandemic demand recovery and more recently, by trade barriers. J.P. Morgan notes that U.S. aluminum premiums could increase further as tariffs compound existing supply chain frictions. The bank forecasts a supply-demand gap of around 200k metric tons in 2025, pushing prices higher even as consumption softens.

Meanwhile, U.S. production dynamics are changing unevenly across metals. Oxford Economics forecasts that basic metals production will grow modestly (+0.7%) in 2025, with aluminum declining by 1.9% before rebounding by 3.0% in 2026. The resilience of the aluminum market stems from the fact that only four domestic smelters remain, limiting capacity to substitute for lost imports.

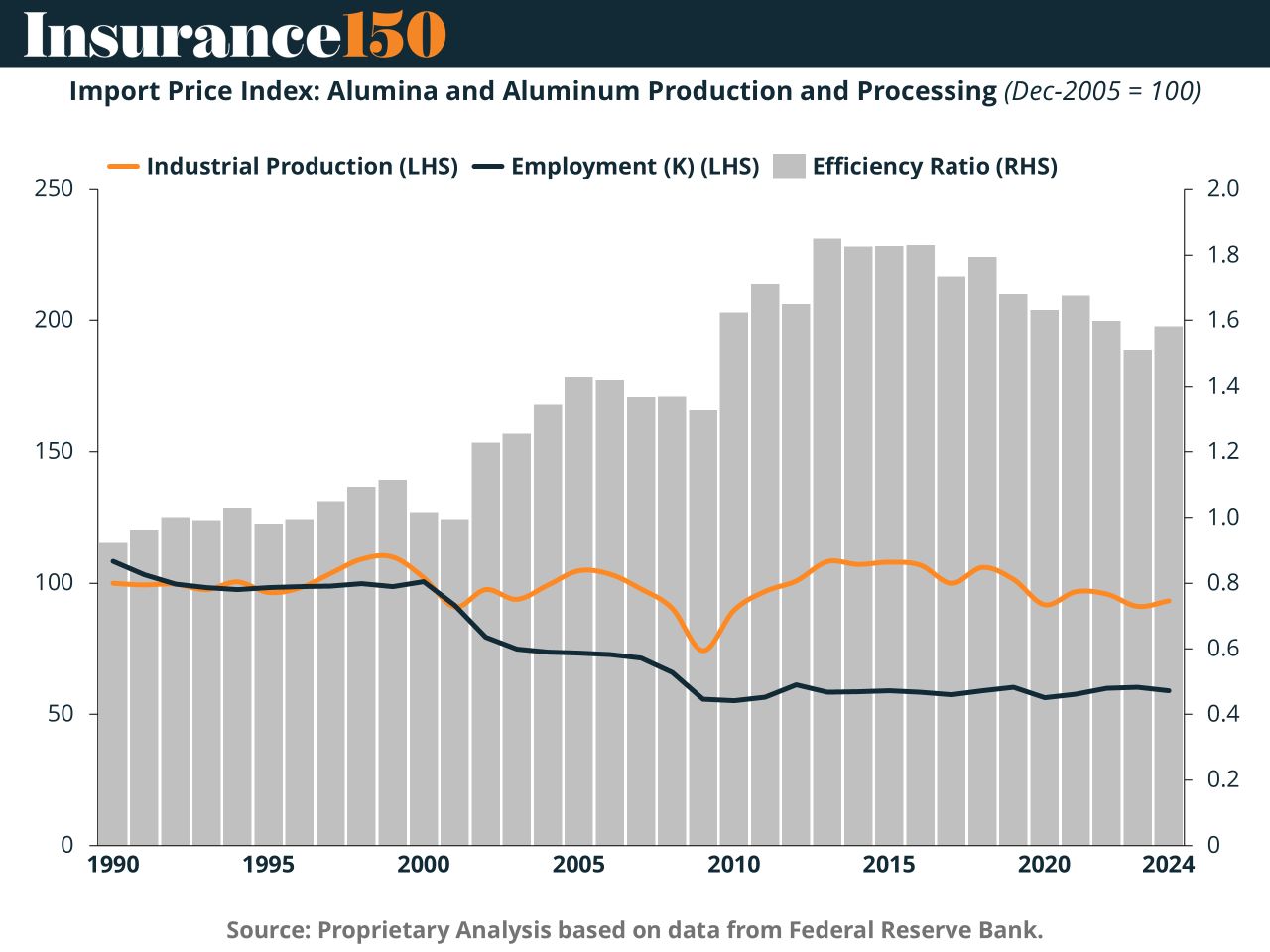

Structural inefficiencies further complicate the picture. The third chart illustrates that despite price gains, U.S. aluminum industrial production and employment remain below historical norms. The efficiency ratio suggests that productivity gains have plateaued, making it difficult for domestic producers to ramp up quickly in response to tariffs.

Steel markets are similarly impacted. The 25% blanket tariff on steel imports is forecast to drive prices higher, as U.S. reliance on imported steel (around 75% of Q4 2024 consumption) leaves limited room for domestic substitution. Iron and steel production is expected to decline slightly in 2025 (-0.7%) before rebounding (+5.5%) in 2026, as higher prices incentivize investment in domestic capacity.

However, uncertainty remains a key constraint. The Oxford Economics report stresses that tariff unpredictability discourages long-term investment in new production facilities. J.P. Morgan also highlights the risk that tariffs could be rolled back or modified, deterring firms from committing capital to an uncertain policy regime.

In sum, tariffs are reshaping the global metals landscape by driving price volatility, shifting production incentives, and disrupting trade flows. U.S. producers may enjoy temporary gains, but consumers face higher costs and supply risks. Long-term stability will depend on policy clarity and strategic investments in production efficiency.

Sources & References

Board of Governors of the Federal Reserve System (US), Industrial Production: Manufacturing: Durable Goods: Alumina and Aluminum Production and Processing (NAICS = 3313) [IPG3313S], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IPG3313S, June 6, 2025.

J.P. Morgan (2025). How are tariffs impacting the metals and mining sector? https://www.jpmorgan.com/insights/global-research/commodities/aluminum-steel-copper-prices#:~:text=Strategy%2C%20J.P.%20Morgan-,Aluminum%20prices,around%20200%20kmt%20in%202025.

Oxford Economics. (2025). Metal Prices. https://www.oxfordeconomics.com/resource/tag/metal-prices/

U.S. Bureau of Labor Statistics, Employment for Manufacturing: Alumina and Aluminum Production and Processing (NAICS 3313) in the United States [IPUEN3313W200000000], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IPUEN3313W200000000, June 6, 2025.

U.S. Bureau of Labor Statistics, Import Price Index (NAICS): Alumina and Aluminum Production and Processing [IZ3313], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/IZ3313, June 6, 2025.