- Insurance 150

- Posts

- The $71B Climate Gap, WTW’s $1.3B Bet, and GenAI Priorities

The $71B Climate Gap, WTW’s $1.3B Bet, and GenAI Priorities

WTW acquires Newfront for $1.3B and the protection gap hits $71B, while global insurance penetration drops to 6.2% of GDP.

Good morning, ! This week we’re diving into the Global NatCat landscape, insurance penetration as a percentage of GDP, and primary motivators to implement GenAI technologies

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

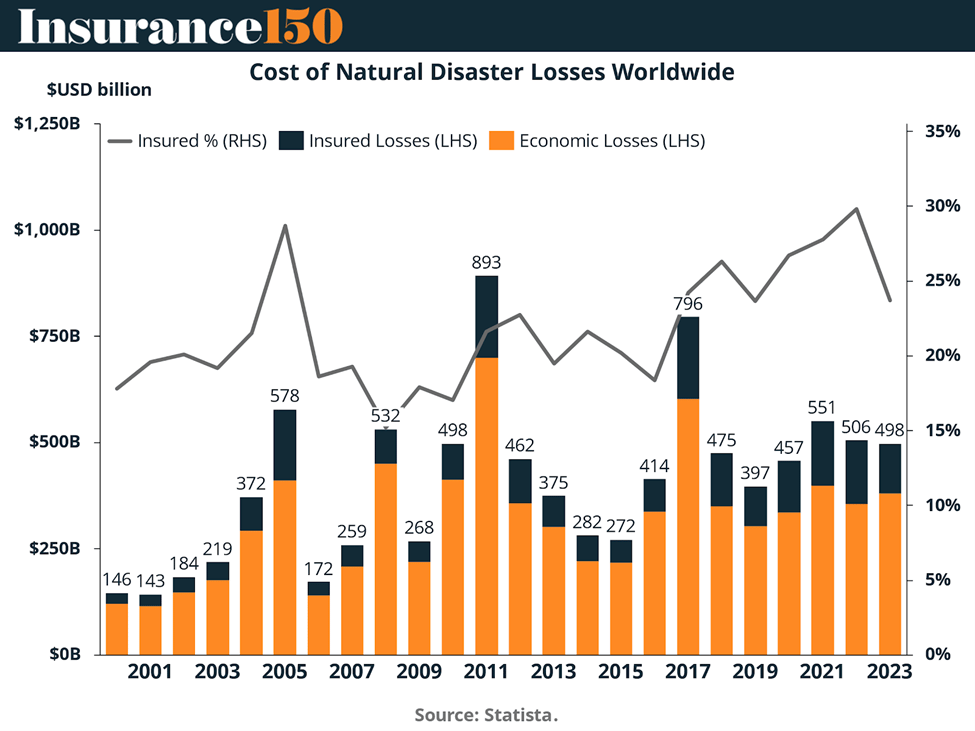

The $71B Gap That’s Not Going Away

Insurers are facing a climate-induced profitability squeeze, and the old playbook—exclusions, rate hikes, retreat—no longer works. Physical risks are rising, transition risks are accelerating, and the protection gap now yawns at over $71B annually. That’s not just a coverage problem—it’s a balance-sheet liability and a growth opportunity rolled into one. Insurers know it too: the focus is shifting to data harmonization, pricing innovation, and governance upgrades. Translation? Climate adaptation has gone from “side panel” to “dashboard.” The boardroom is finally in sync with the boiler room.

TREND OF THE WEEK

Insurance Penetration Slips Again

Insurance penetration—measured as total premiums as a percentage of GDP—has been quietly eroding over the past decade. After peaking at 6.6% in 2014, the ratio has fallen to 6.2% in 2024, according to the OECD.

That 40bps drop might seem small, but for an industry designed to grow with the economy, it’s a warning light. The downward trend reflects both macro and micro pressures: slowing life insurance demand in developed markets, underpenetration in emerging ones, and cyclical hits to premium growth (e.g. COVID, inflation lag, pricing corrections in P&C).

Notably, penetration has flatlined around 6.0–6.3% for most of the past six years, underscoring structural stagnation. It also signals that as GDP grows, insurance isn’t keeping pace—a red flag for investors banking on secular tailwinds.

Bottom line: Insurers can’t count on rising GDP to lift premiums. Growth will have to come from new products, tech-driven distribution, and underserved segments. Penetration isn’t dead—but it’s not doing the heavy lifting anymore. (More)

PRESENTED BY FISHER INVESTMENTS

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

MICROSURVEY

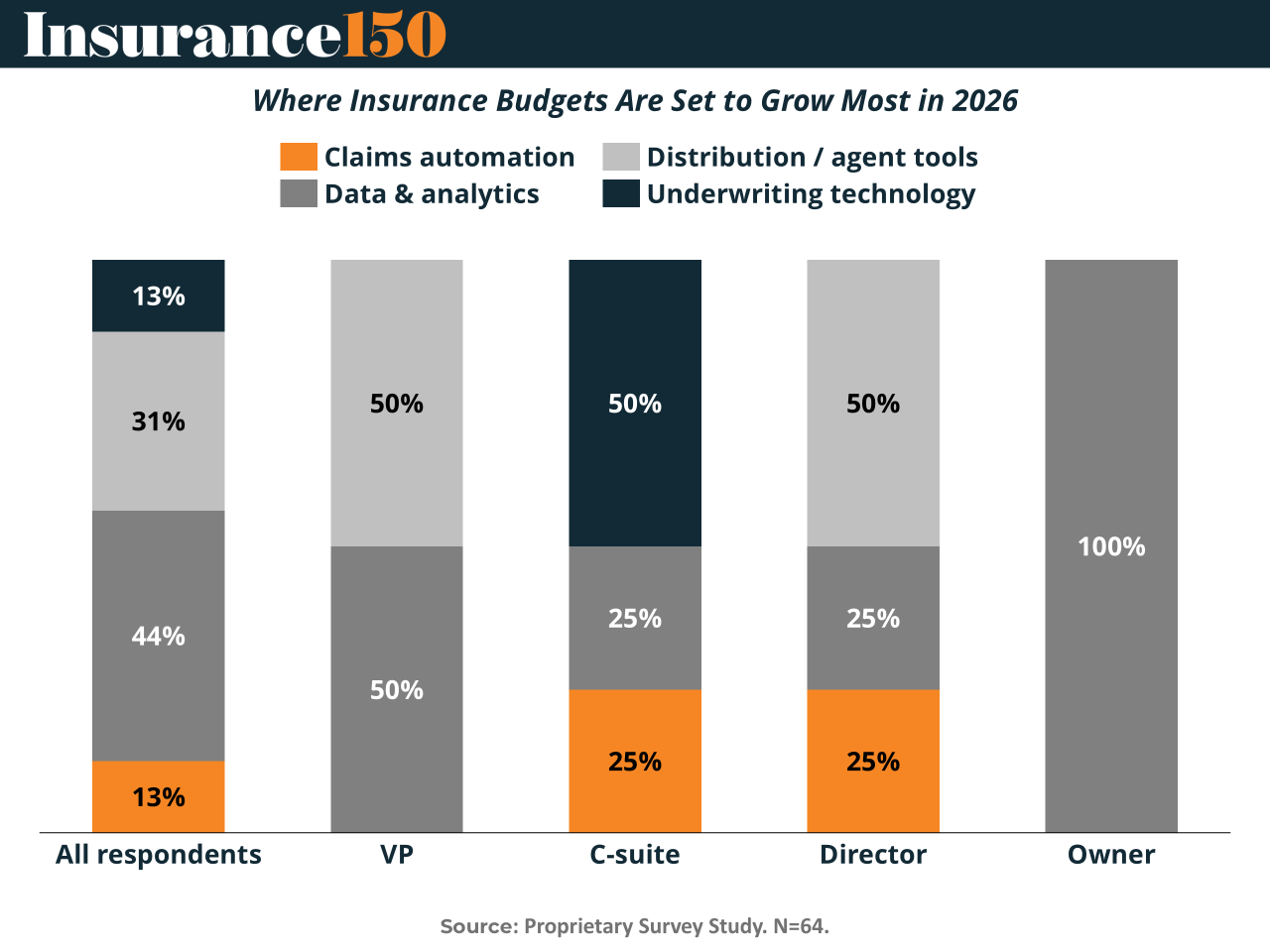

Budget Priorities for 2026: Where Insurers Are Investing

As insurers finalize 2026 plans, technology budgets are becoming more focused and strategic. Insights from our latest microsurvey show Data & Analytics leading overall budget growth, reflecting its growing importance in pricing discipline, risk selection, and portfolio management.

At the senior level, priorities shift. Underwriting technology stands out among C-suite leaders, highlighting increased investment in automation and AI-enabled decisioning to protect margins. Distribution and agent tools continue to attract spend among operators focused on growth and execution, while claims automation remains a targeted lever for efficiency and customer experience improvements.

The takeaway for 2026 is clear: technology spend is increasingly about alignment—connecting data, underwriting, claims, and distribution into a more integrated insurance operating model. (More)

DEAL OF THE WEEK

WTW’s $1.3B Tech Bet on the Middle Market

WTW just made its biggest U.S. middle market move in years, agreeing to acquire San Francisco-based broker Newfront for up to $1.3 billion. The deal includes $1.05B upfront—mostly cash—and $250M contingent on performance, plus another $150M tied to outperformance triggers and $100M in retention equity through 2031.

Why it matters: This is less about buying market share and more about absorbing next-gen tech. Newfront’s AI-powered interface (Navigator) and placement automation are designed for scale—aligning neatly with WTW’s Neuron platform and digital ambitions.

The integration brings Newfront’s 120+ producers and 20% organic growth engine under WTW’s umbrella, targeting tech, fintech, and life sciences verticals. The synergy play: $35M in cost savings by 2028 through tech efficiencies and overhead cuts.

This is a blueprint for what mid-market M&A in insurance broking looks like post-2024: part distribution grab, part tech leapfrog. And with U.S. broking still highly fragmented, it won’t be the last. (More)

INSURTECH CORNER

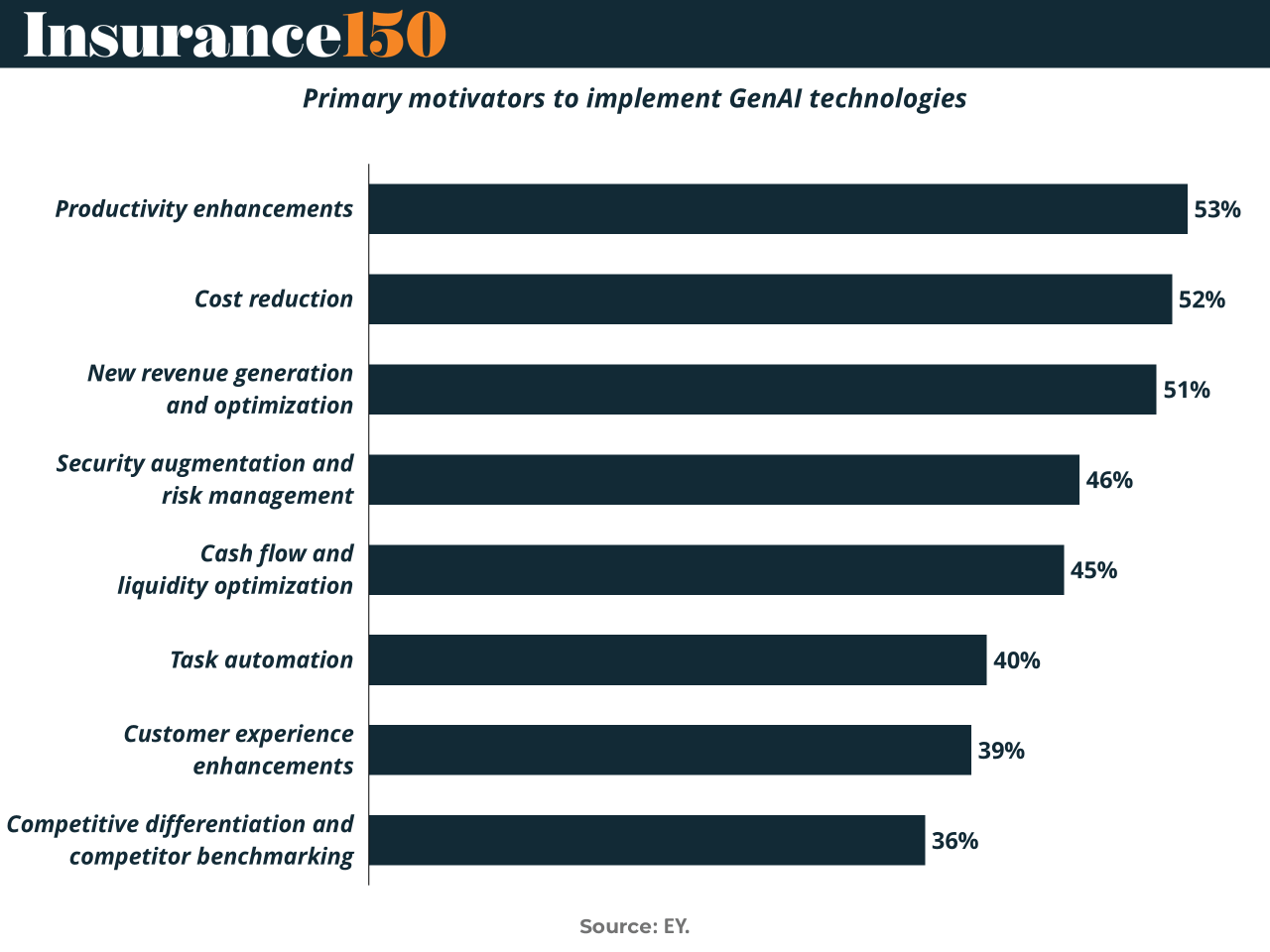

GenAI Becomes Insurance’s New Operating System

Insurers aren’t dabbling in GenAI anymore—they’re institutionalizing it. Nearly every carrier is either investing or planning to invest, and the motivations are remarkably aligned. Productivity enhancements lead at 53%, followed closely by cost reduction and new revenue generation, creating a value stack too compelling to ignore. Large carriers feel it most, with up to 82% citing productivity as the primary driver. The broader motivators—security, liquidity optimization, task automation, and customer experience—signal that GenAI isn’t just a tools upgrade but a structural evolution. As operating ratios tighten and underwriting margin compression persists, carriers that scale GenAI into claims, underwriting, and risk modeling will define the industry’s next efficiency frontier. (More)

TOGETHER WITH COMPARE

Compare Car Insurance Rates in Minutes

Stop overpaying for car insurance. Compare.com lets you check real quotes from top carriers in minutes—fast, simple, and free. See personalized rates side by side and find the best price for your coverage needs today.

This is an advertisement. You are receiving this message because you opted-in to receive emails from a third-party publisher. This email was delivered by a third-party, on behalf of Compare.com. To stop receiving email advertisements from Compare.com affiliates please click here or write to us at 201 Broadway, 6th Floor, Cambridge MA 02139.

MACROECONOMICS

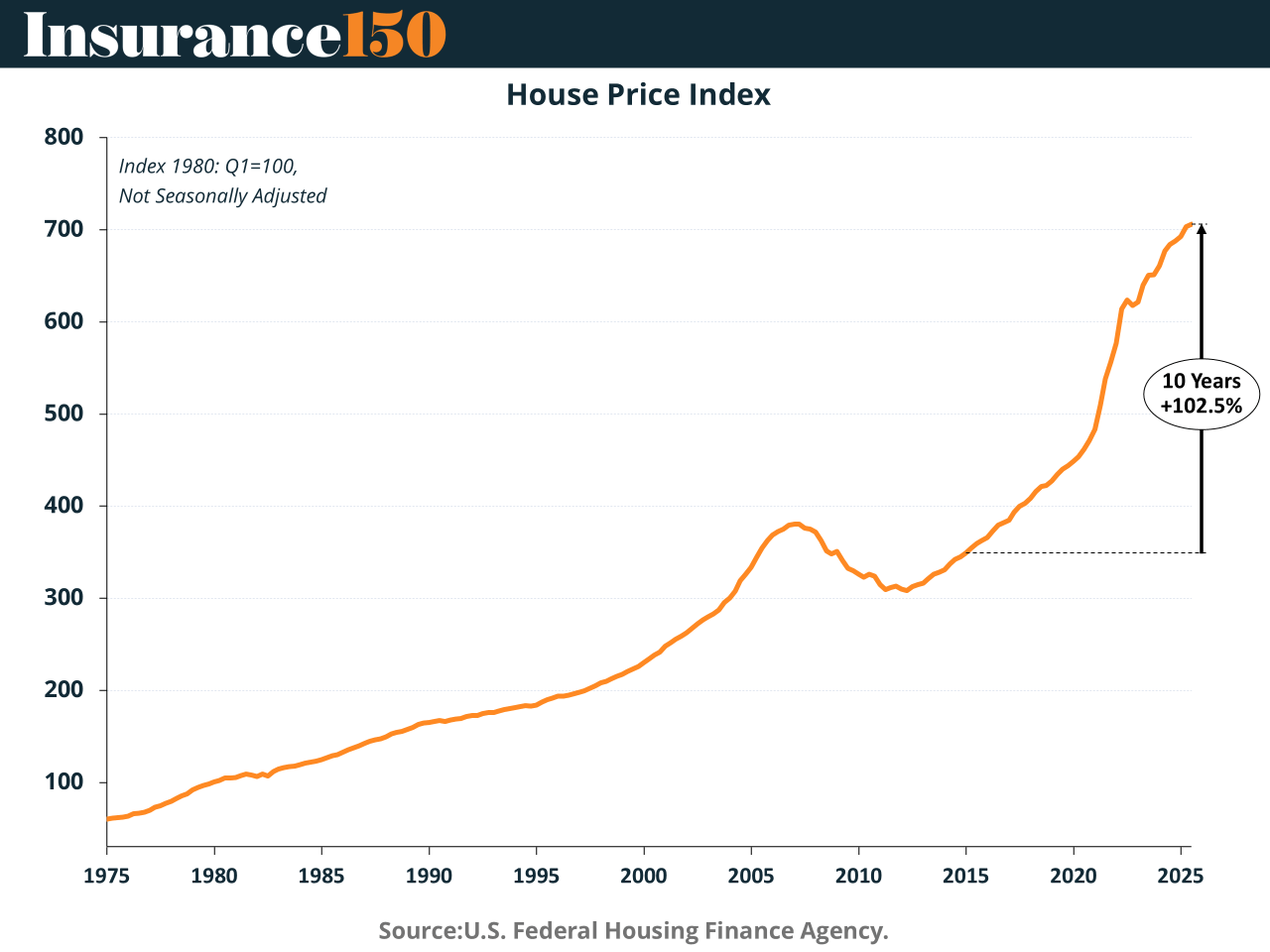

The Economy’s New Normal Is Still Expensive

The Fed may be easing, but households still feel broke. That’s the paradox of today’s economy: disinflation has brought CPI back to ~3%, but consumer price levels are ~25% higher than five years ago. For most households, that means pain is sticky—especially when shelter, childcare, and insurance keep climbing. Meanwhile, rate cuts help wealthier borrowers and asset holders, not renters or those locked into high mortgages. The Fed’s shift toward neutrality won’t fix structural issues like housing shortages and supply constraints. Bottom line: macro stability has returned, but micro-level pain persists. Private equity investors betting on the consumer need to read between the economic lines—GDP isn’t the same as discretionary income. (More)

COMPLIANCE CORNER

SPVs—Not a Set-and-Forget Tool

Risk transfers to Special Purpose Vehicles (SPVs) aren’t a regulatory blind spot—especially not for the UK’s Bank of England PRA. The regulator expects cedants to actively monitor SPV funding levels, grace periods, and basis risk like they're managing a balance-sheet proxy. Limited recourse clauses? They can flip risk right back onto your books if SPV assets underperform. And grace periods? Only permissible under PRA Rulebook 2.1A/B, ideally not during hurricane season.

The PRA is especially wary of long-tail and annuity risk transfers, where market and credit exposures can spiral. Offshore structures don’t escape scrutiny either—cedants must prove the SPV setup delivers genuine, sustainable, and prudentially sound risk mitigation. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Nothing is impossible. The word itself says 'I'm possible!"

Audrey Hepburn