- Insurance 150

- Posts

- The Fed’s 25 bp cut: a careful step into an uncertain fall

The Fed’s 25 bp cut: a careful step into an uncertain fall

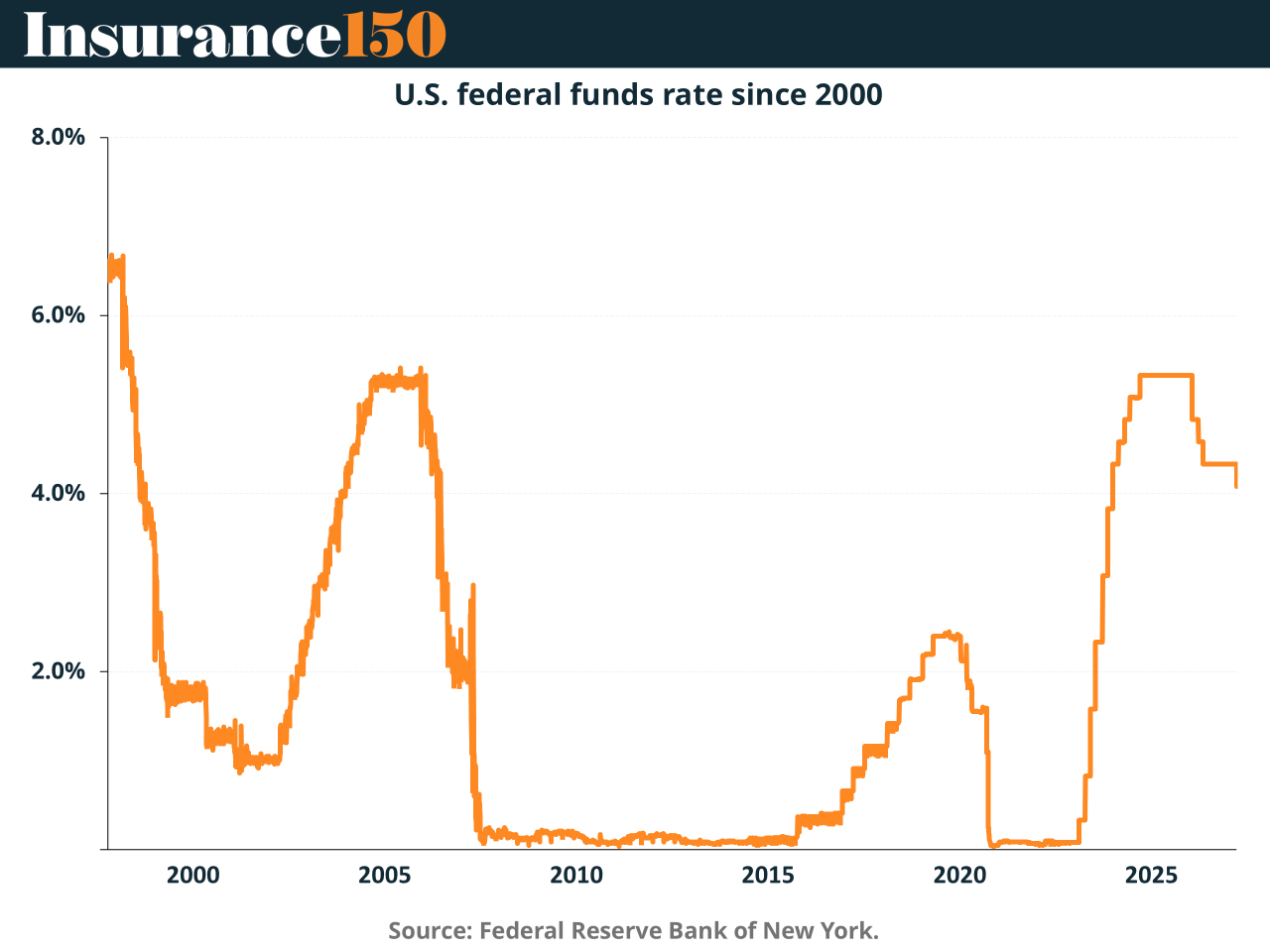

The Federal Reserve trimmed its benchmark rate by 25 basis points at its latest meeting, lowering the federal funds target range to 4.00%–4.25%, its first reduction since December.

Policymakers framed the move as a bid to “manage risks” as evidence mounts that the once‐hot labor market is cooling even while inflation has turned sticky again.

The decision was 11–1, with newly installed Governor Stephen Miran dissenting in favor of a larger half-point cut. Chair Jerome Powell said job gains have “slowed,” and the committee now judges that downside risks to employment have risen. In his words, the cut places policy in a more “neutral” stance—less restrictive than earlier this year but far from anything that looks like emergency easing.

Why now? Labor is flashing yellow, not red

Over the summer, payroll revisions erased a sizable chunk of previously reported job growth, and unemployment ticked up to 4.3%, the highest since 2021. Powell described a “marked slowing in both the supply of and demand for workers,” an unusual balance that can deteriorate quickly if firms pivot from slower hiring to outright layoffs. That risk loomed large in the Fed’s calculus. Economists at Wells Fargo captured the logic: when the jobs market turns, it can turn fast, so policymakers don’t want to be pressing the brakes as momentum fades.

At the same time, inflation has moved up to 2.9% year-over-year—above the 2% goal—with some of the latest pressure tied to tariff-driven price increases. Powell called the tariff impact “reasonable” as a potential one-time level shift, but he acknowledged it could prove more persistent, a risk the Fed will “assess and manage”. The nightmare scenario would be stagflation—rising unemployment and stubborn prices—so the committee is trying to cushion labor without re-accelerating inflation.

What comes next? Guidance with plenty of caveats

The Fed’s projections point to two additional cuts this year, with only one penciled in for 2026. But the distribution of views is unusually wide. Some officials see no need to move again this year, while at least one participant (widely assumed to be Miran) would cut far more aggressively—down toward 3% or lower—arguing that policy is still too tight for a softening economy (Articles 2–3). Powell underscored that “there are no risk-free paths right now,” so future moves will be data-dependent.

Politics in the air—but independence still matters

The rate debate has unfolded amid intense political crosswinds. President Donald Trump has publicly hammered the Fed for moving “too late” and urged bigger cuts, while his allies pressed personnel changes ahead of the meeting. Miran, temporarily away from his White House role, joined the Board in time to cast the sole dissent; the administration has also fought to remove Governor Lisa Cook, a move currently tied up in the courts (Articles 1–3). Powell declined to engage on the politics, reiterating that the committee’s decisions reflect its dual mandate, not the White House timeline.

How markets digested the move

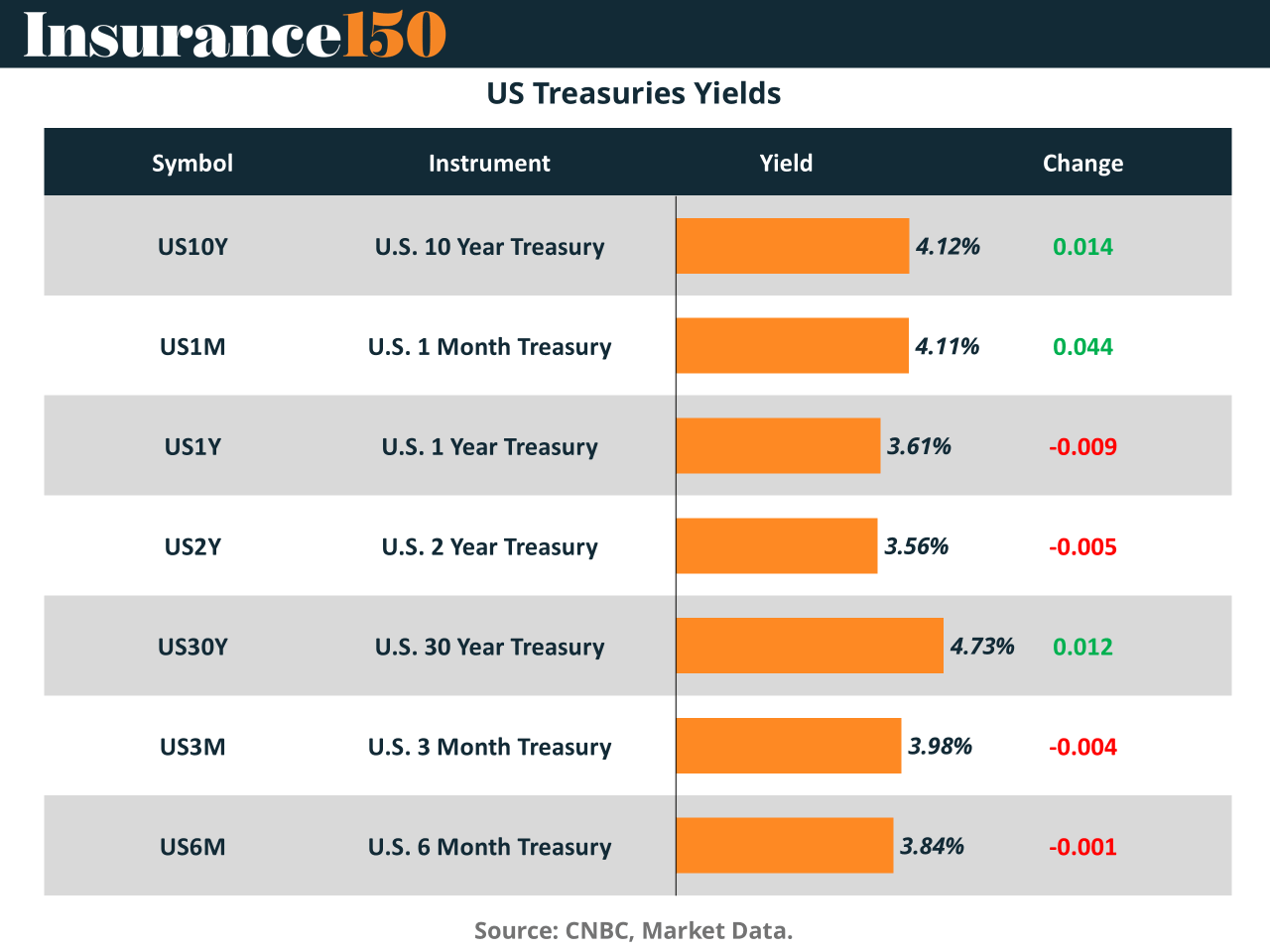

Initially, yields dipped on the announcement, then rebounded as investors interpreted Powell’s “risk management” framing as measured easing, not a rapid-fire cutting cycle. The next day, jobless claims fell to 231,000, reversing a prior week’s spike that had stoked layoff fears; the Labor Department said the earlier jump largely reflected an aberration in Texas. With recession odds perceived a touch lower, Treasury yields rose: the 10-year moved to ~4.11%, the 2-year to ~3.57%, and the 30-year to ~4.73%.

Those levels line up with the broader curve shown in Chart B, where longer maturities hover around 4.1%–4.7% and shorter bills sit just under 4%–4.1%. The curve remains relatively flat, reflecting a market caught between softer growth ahead and the possibility that inflation proves slower to recede.

What it means for households, businesses, and investors

For consumers and businesses, the immediate impact is incrementally lower borrowing costs: adjustable-rate loans, some credit cards, and new corporate issuance should price a touch cheaper. Mortgage rates, tied more to long-term yields than to the fed funds rate, may not fall in lockstep—especially if incoming data, like the claims report, nudges the 10-year higher. Still, a gentle easing path should help the housing market avoid further downdrafts, one reason political voices are pushing for faster cuts.

For markets, the message is that this is not a pivot to rapid stimulus. The Fed is easing gradually into ambiguity: inflation is no longer collapsing, yet the labor engine is sputtering. That’s a delicate mix for risk assets. Equities may cheer any sign that growth holds up while rates glide lower, but disappointments on payrolls—or a fresh flare-up in prices linked to tariffs—could quickly tighten financial conditions again.

What to watch from here

Labor: Do payrolls stabilize and does unemployment stop drifting up? Another soft print would validate the Fed’s caution.

Inflation mix: Are recent price pressures a one-time tariff shock or the start of renewed persistence?

Fed rhetoric and the dots: Unity versus dissent will matter for the trajectory into October and December.

Market plumbing: If longer yields keep rising, financial conditions could tighten even as the Fed trims, blunting the cut’s support.

One quarter-point cut won’t settle the debate. But it signals a central bank leaning against labor-market downside while refusing to chase a growth slowdown at the cost of rekindling inflation. In a year short on risk-free choices, “measured” is the policy word of the moment—and this week’s 25 bp step fits that script.

Sources & References

BBC. (2025). Fed Reserve cuts interest rates but cautions over stalling job market. https://www.bbc.com/news/articles/c3e75y90pw0o

CNBC. (2025). 10-year Treasury yield rises after jobless claims signal labor market in OK shape. https://www.cnbc.com/2025/09/18/us-treasury-yields-feds-latest-interest-rate-decision.html

CNBC. (2025). Fed approves quarter-point interest rate cut and sees two more coming this year. https://www.cnbc.com/2025/09/17/fed-rate-decision-september-2025.html

Insurance150. (2025). Signaling Games in Monetary Policy. https://insights150.com/p/signaling-games-in-monetary-policy-how-the-fed-markets-and-investment-banks-strategize-around-intere

New York FED. (2025). Effective Federal Funds Rate. https://www.newyorkfed.org/markets/reference-rates/effr

The Guardian. (2025). Federal Reserve cuts US interest rates for first time since December. https://www.theguardian.com/business/2025/sep/17/us-federal-reserve-interest-rates-jerome-powell