- Insurance 150

- Posts

- The Future of Home Insurance: Growth Drivers, Regional Dynamics, and Market Opportunities

The Future of Home Insurance: Growth Drivers, Regional Dynamics, and Market Opportunities

Home insurance stands as one of the most essential pillars of the global insurance industry, safeguarding individuals, families, and financial institutions against risks tied to one of the most valuable assets people own: their homes.

Introduction

Home insurance stands as one of the most essential pillars of the global insurance industry, safeguarding individuals, families, and financial institutions against risks tied to one of the most valuable assets people own: their homes. More than a contractual product, home insurance plays a critical role in economic resilience, enabling households to recover from unexpected losses while providing stability to mortgage markets, real estate ecosystems, and broader financial systems.

The importance of home insurance has grown substantially in recent years. Rising property values, the increased frequency and severity of climate-related catastrophes, and heightened consumer awareness of risk have all accelerated demand for coverage. At the same time, the sector is undergoing profound transformation. Insurers are leveraging technologies such as artificial intelligence, aerial imagery, and Internet of Things (IoT) devices to improve underwriting, streamline claims processes, and incentivize loss prevention. Meanwhile, new distribution models, including embedded insurance and digital-first platforms, are reshaping how consumers access and engage with protection products.

Despite its growth trajectory, the market faces mounting challenges. Affordability concerns, widening protection gaps in disaster-prone regions, and the pressure of reinsurance costs are testing the balance between risk coverage and financial sustainability. Regulatory scrutiny is also intensifying as policymakers seek to ensure transparency, fairness, and resilience in the face of increasing systemic risks.

This report provides an overview of the global home insurance market, covering market size and growth outlook, regional dynamics, end-use segments (landlords and tenants), and a focused analysis of the U.S. market. It highlights the key drivers of demand, the challenges of affordability and reinsurance costs, and the role of technological innovation and climate risks in shaping the industry’s trajectory through 2034.

Home Insurance Market Size

The global home insurance market is experiencing robust growth, reflecting rising property values, climate-related risks, and increased consumer awareness of financial protection. According to Precedence Research (2024), the market was valued at USD 269.92 billion in 2024 and is projected to expand steadily at a compound annual growth rate (CAGR) of 8.82% between 2025 and 2034. By the end of the forecast period, the market is expected to nearly double, reaching approximately USD 628.52 billion by 2034.

This expansion highlights the growing necessity of home insurance in both developed and emerging markets. On one hand, established economies such as North America and Europe are seeing increased demand due to rising natural catastrophe exposures, particularly floods, hurricanes, and wildfires. On the other, emerging economies in Asia-Pacific and Latin America are witnessing accelerated adoption driven by rapid urbanization, increasing home ownership, and government efforts to promote insurance literacy.

The chart below illustrates the projected market growth from 2025 to 2034. The data shows a consistent upward trend, with annual premiums expected to climb from USD 293.72 billion in 2025 to USD 577.58 billion in 2034, underscoring the sector’s resilience and long-term potential.

Beyond the topline growth, this expansion reflects structural drivers such as:

Higher property values: Global housing prices are rising, pushing up insured values and policy premiums.

Climate change risks: Increased severity of extreme weather events is elevating both risk awareness and demand for protection.

Digital transformation: Easier access to policies via online platforms and embedded models is widening penetration.

Regulatory and policy initiatives: Governments are actively promoting financial literacy and insurance adoption as part of economic resilience strategies.

The strong growth trajectory indicates that home insurance will remain a cornerstone of the global insurance industry, with significant opportunities for innovation, diversification, and market penetration across regions.

Regional Market Analysis

The global home insurance market demonstrates distinct dynamics across regions, shaped by differences in housing structures, regulatory environments, consumer behavior, and exposure to natural disasters. In 2024, North America led the global market with a 31% share, followed closely by Europe (29%) and Asia Pacific (23%). Latin America (7%) and the Middle East & Africa (3%) remain smaller but promising markets with long-term growth potential.

Asia-Pacific

The Asia-Pacific region is expected to post the strongest growth between 2025 and 2034. Rising disposable incomes, a growing middle class, and greater awareness of insurance benefits are driving higher penetration rates. Additionally, the integration of digital insurance platforms and smart technologies has made policy acquisition and claims processing more accessible.

Japan: Japan dominates the regional home insurance market, supported by its mature property and casualty insurance sector. Key growth drivers include natural disaster preparedness, an aging population, and government regulations that encourage financial resilience. Companies are also heavily investing in digital platforms to improve transparency and customer engagement.

In March 2025, Aon plc strengthened its presence in Japan by acquiring the in-house insurance agency business of Mitsubishi Chemical Group (MCG), reinforcing its Risk Capital and Human Capital capabilities.

China: With an urban homeownership rate of 96% (People’s Bank of China), China presents a massive market opportunity. Rising household wealth — with average urban household assets reaching CNY 3.18 million (USD 449,200) — has created a fertile environment for long-term financial commitments, including home insurance policies.

Europe

The European home insurance market is forecast to grow steadily, underpinned by robust regulatory frameworks and rising adoption of smart home technologies. Governments across the region are increasingly mandating or incentivizing home insurance to strengthen financial protection against disasters.

United Kingdom: The UK stands out as a key driver of regional growth, supported by rapid digital transformation and evolving consumer preferences. The government has introduced digital platforms to streamline policy management and improve customer experience.

Smart home integration is a defining trend, with insurers offering policies that cover not only physical damage but also cyber risks such as hacking, identity theft, and data breaches.

Sky Protect Smart Home Insurance has emerged as a leading provider in this segment, offering comprehensive protection for connected households.

According to the Allianz Global Insurance Report 2024, Europe’s property and casualty (P&C) segment recorded 7.0% growth in 2023, highlighting strong momentum for the home insurance sector in the years ahead.

North America, Latin America, and MEA

North America (31% share in 2024) remains the largest market, driven by high insurance penetration, rising housing costs, and exposure to catastrophic events such as hurricanes and wildfires in the United States.

Latin America (7%) is witnessing growth from increasing urbanization and greater awareness of financial risk protection. However, penetration remains low compared to global averages.

Middle East & Africa (3%) represent emerging markets with significant untapped potential, particularly as governments push for stronger financial inclusion policies and insurance literacy campaigns.

End Use Insights

The global home insurance market shows distinct variations by end use, primarily divided between landlords and tenants. In 2024, landlords dominated the market, accounting for 73% of the total share, while tenants represented the remaining 27%.

Landlords

The landlords segment held the largest share of the home insurance market in 2024. Rapid urbanization, population growth, and the expansion of new residential properties have significantly increased property leasing activity worldwide. As a result, landlords are increasingly opting for comprehensive home insurance policies that provide protection against risks such as:

Structural damages caused by fire, natural disasters, or accidents.

Theft or vandalism within rental properties.

Liability coverage in cases where tenants or visitors are injured on the premises.

With the rental housing sector expanding, landlord insurance has become a vital financial safeguard, ensuring both property preservation and income protection.

Tenants

The tenants segment, while smaller in 2024, is projected to be the fastest-growing category between 2025 and 2034. Several structural shifts are driving this trend:

Rising housing costs in urban centers are making homeownership increasingly unaffordable, leading more consumers to rent instead of buy.

Delayed homeownership among younger demographics, who often prioritize financial flexibility.

Greater awareness of insurance benefits, with tenants recognizing the importance of liability coverage and protection for personal belongings.

As city populations continue to rise and cost-of-living pressures grow, tenant-focused insurance products are expected to expand rapidly. Insurers are increasingly tailoring policies to meet the needs of renters, offering flexible, low-cost coverage options to capture this growing customer base.

U.S. Home Insurance Market Analysis

The U.S. home insurance market was valued at USD 62.76 billion in 2024 and is projected to reach approximately USD 149.48 billion by 2034, growing at a CAGR of 9.07% during the forecast period (2025–2034). This strong expansion reflects increasing homeownership rates, rising property values, and greater awareness of the importance of comprehensive home coverage.

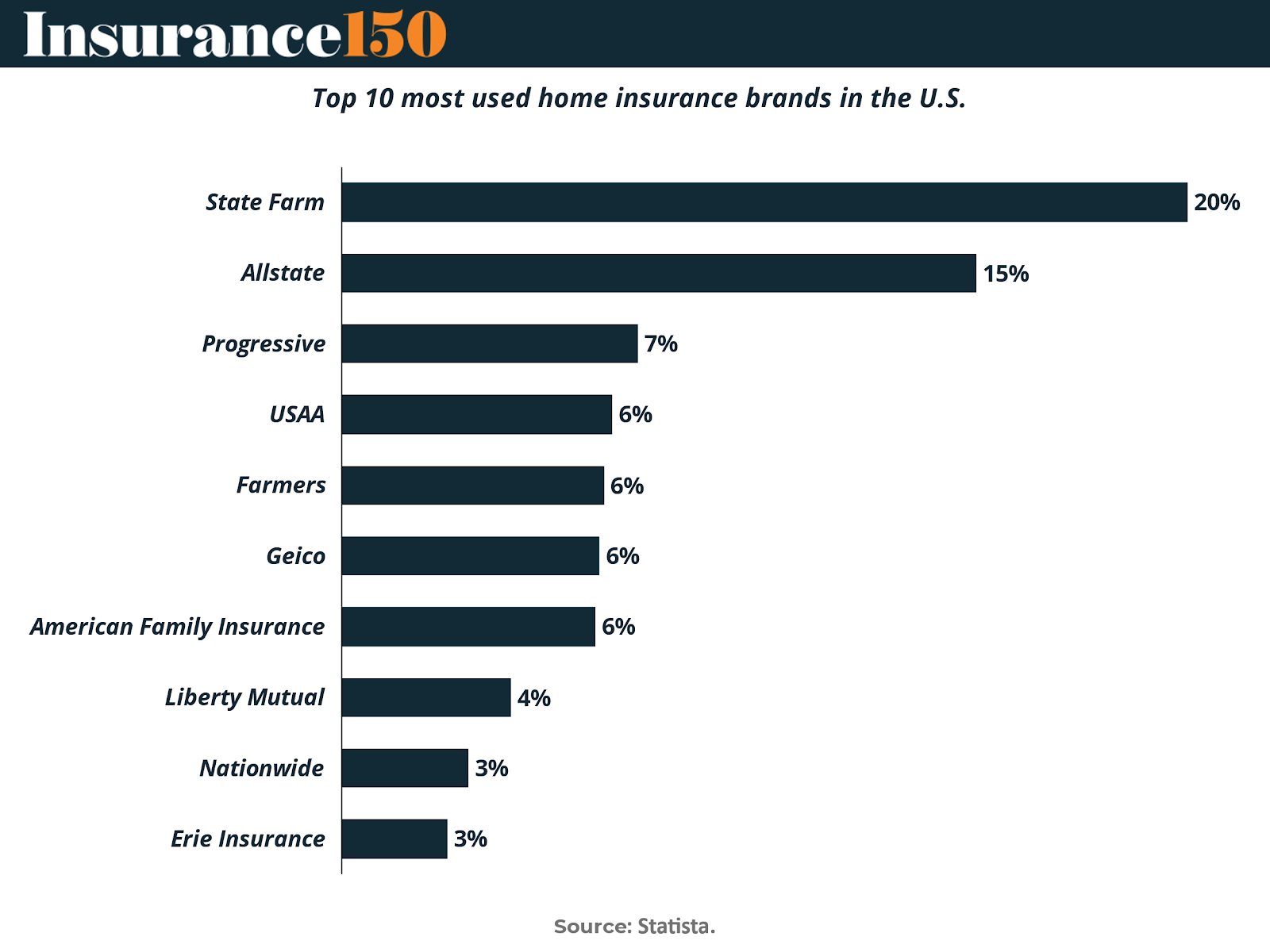

State Farm and Allstate dominate the competitive landscape, holding 20% and 15% of the market share, respectively. Other notable players include Progressive (7%), USAA (6%), and Farmers (6%). While smaller in comparison, insurers such as Liberty Mutual, Nationwide, and Erie Insurance still play a crucial role in diversifying offerings and serving niche customer needs.

The market’s growth trajectory is also influenced by external factors, such as inflationary pressures, climate-related risks, and increasing demand for digital insurance platforms that streamline policy management and claims processing. The high concentration of established players combined with rapid technological adoption makes the U.S. one of the most dynamic home insurance markets globally.

Conclusion

The home insurance market is entering a pivotal decade, defined by both accelerated growth and heightened complexity. Rising property values, intensifying climate risks, and evolving consumer expectations are pushing insurers to rethink traditional models while embracing digital transformation and resilience-focused strategies. At the same time, challenges such as affordability constraints, protection gaps, and mounting reinsurance costs underscore the need for balance between financial sustainability and comprehensive coverage.

Regionally, the market reflects both maturity and opportunity: developed economies in North America and Europe continue to lead in penetration and innovation, while Asia-Pacific and other emerging markets hold vast untapped potential fueled by urbanization and expanding middle-class households. Within end-use segments, landlords maintain dominance, but tenant-focused products are rapidly emerging as a critical growth driver, reflecting demographic and housing trends worldwide.

The U.S. market exemplifies the sector’s dynamism, with established players leveraging scale and technology to strengthen market share while responding to regulatory pressures and shifting risk landscapes. Globally, the industry’s long-term success will depend on its ability to align innovation with inclusivity—developing flexible, accessible, and sustainable insurance solutions that protect both individuals and economies.

As the market expands toward 2034 and beyond, insurers, policymakers, and investors alike must adopt forward-looking strategies. By addressing systemic risks, closing protection gaps, and capitalizing on technological advancements, the home insurance sector can reinforce its role as a cornerstone of global financial stability and household security.

Sources & References

Home Insurance Market

Home Insurance Market Report

Statista (2025). Home insurance: USAA customers in the United States

https://www.statista.com/study/93231/home-insurance-usaa-customers-in-the-united-states/Want to check the other reports? Access the Report Repository here.