- The Deal Brief - Insurance

- Posts

- The Global Jewelry Insurance Market in 2025

The Global Jewelry Insurance Market in 2025

How Technology, Emotion, and Trust Are Redefining Value Protection in the Modern Luxury Landscape

Jewelry occupies a singular place in the hierarchy of personal possessions. It is both adornment and investment, a store of value that blends emotional significance with tangible worth. Unlike most consumer goods, jewelry carries a story — of heritage, love, achievement, or identity — making its protection a deeply personal matter. This duality has long positioned jewelry insurance at the crossroads of sentiment and finance, and in 2025, that intersection is more dynamic than ever.

Once confined to specialized personal property clauses or rider policies, jewelry insurance has grown into a distinct, high-touch line of coverage. Its relevance expands each time a consumer buys an engagement ring online, inherits a vintage timepiece, or invests in a rare gemstone. Modern policyholders no longer see coverage as a luxury; they see it as an extension of ownership — a means to preserve not just monetary value but also the emotional continuity embedded in each piece.

The industry’s transformation reflects broader forces shaping the luxury and insurance ecosystems. Jewelry ownership itself is changing: digital marketplaces have democratized access to fine pieces, while the rise of resale platforms and authentication technologies has blurred traditional boundaries between primary and secondary markets. Consumers are increasingly comfortable acquiring high-value items online, often across borders, and expect immediate, transparent coverage that mirrors the digital ease of the buying experience. This has pushed insurers to innovate in both product design and service delivery.

At the same time, risk profiles have grown more complex. The most common claims — theft, accidental loss, and damage — remain central, but new categories have emerged: fraudulent resales, valuation disputes, and cyber-enabled thefts tied to digital payments or counterfeit listings. Jewelry insurers today must assess not only physical risk but also the integrity of digital provenance. This has made technology integration and data accuracy core pillars of underwriting strategy.

Leading providers and emerging insurtechs alike are reshaping the customer experience through AI-based valuation, image recognition for loss verification, and blockchain authentication systems that track a jewel’s journey from creation to ownership. These tools are not merely operational upgrades; they represent a shift in trust infrastructure. For consumers, transparency has become as valuable as compensation — knowing their insurer can validate authenticity, trace value, and settle claims efficiently has become part of the brand promise.

Yet beyond automation and risk analytics lies the human dimension that defines this category. Jewelry insurance is ultimately a business of empathy: it serves clients in moments of vulnerability, when personal symbols of love or legacy are lost. The emotional texture of such claims differentiates this line from broader property insurance and demands a refined balance between efficiency and sensitivity. Insurers that succeed in this space blend data precision with emotional intelligence, turning protection into reassurance.

II. Jewelry Insurance Market Size

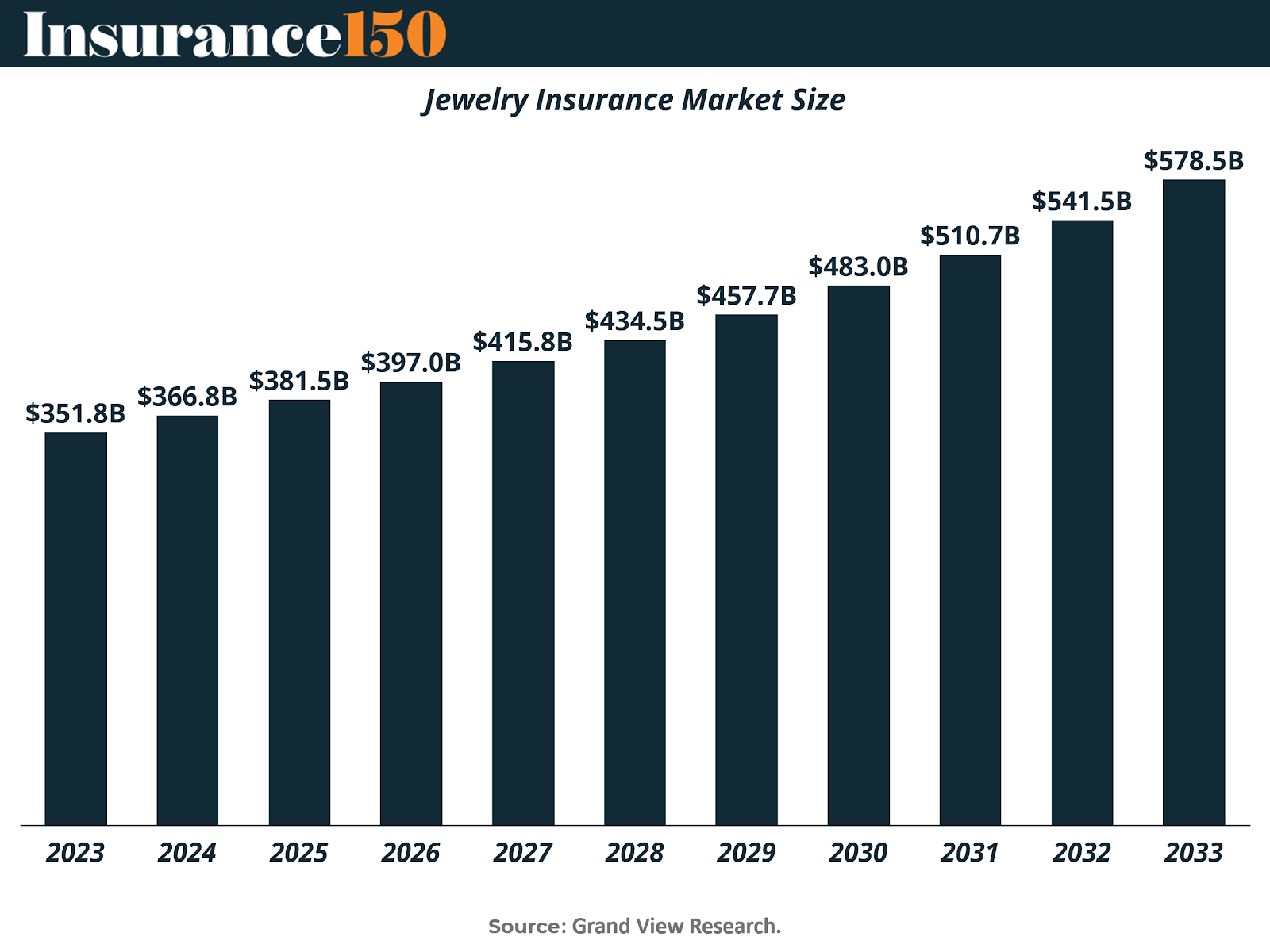

The global jewelry insurance market is projected to grow steadily from $351.8 billion in 2023 to $578.5 billion by 2033, reflecting a compound annual growth rate (CAGR) of approximately 5.0%. This sustained expansion is closely linked to broader trends within the jewelry industry, which continues to evolve amid shifting consumer behaviors, technological innovation, and a growing emphasis on sustainability.

The jewelry market’s growth is driven by rising consumer demand for luxury and personalized items, underpinned by increasing disposable incomes and the aspirational value associated with fine jewelry. Consumers are seeking products that blend exclusivity, craftsmanship, and modern design. Technological advancements—notably in 3D printing and smart jewelry—are redefining product innovation and offering new dimensions of customization and functionality. For example, in June 2025, Platinum Guild International introduced its first 3D printed platinum jewelry collection, “Tùsaire,” featuring platinum and titanium necklaces, bracelets, rings, and earrings, showcasing how technology is enhancing creative expression in jewelry design.

Furthermore, collaborations between established designers and global fashion houses are amplifying brand value and expanding market visibility. Social media platforms and influencer marketing continue to shape consumer preferences, driving online jewelry purchases and expanding reach among younger demographics.

As a result, the jewelry insurance market benefits from the increasing volume and value of insured jewelry assets. With consumers investing more in premium, customized, and collectible pieces, demand for comprehensive protection against loss, theft, or damage is expected to rise proportionally. Moreover, digital insurance platforms are making policy issuance, claims processing, and valuation more seamless, improving accessibility and customer experience.

In addition, leading jewelry and insurance companies are adopting sustainable sourcing practices and data-driven underwriting tools to align with evolving consumer expectations and regulatory standards. The convergence of luxury, technology, and risk management is thus shaping a robust growth trajectory for the jewelry insurance market through 2033.

III. Jewelry Insurance Market by End User

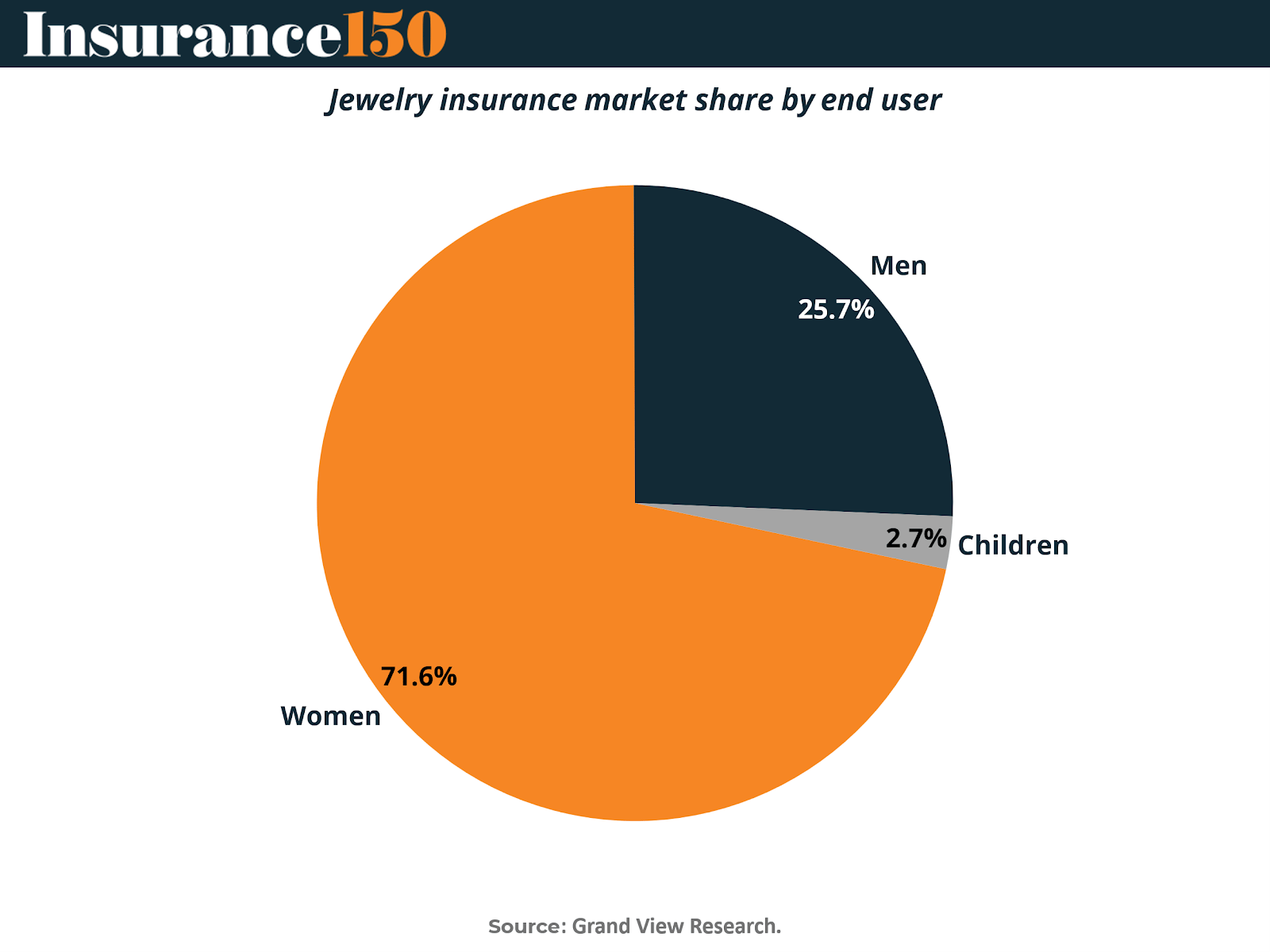

The jewelry insurance market demonstrates clear segmentation by end user, with women accounting for the largest share at 71.6%, followed by men at 25.7%, and children at 2.7%, according to Grand View Research. This distribution reflects long-standing trends in jewelry ownership and purchasing behavior, where women remain the dominant consumer base for both fine and fashion jewelry. However, the men’s jewelry segment is emerging as a key growth driver over the forecast period.

The men’s jewelry market is projected to grow at the fastest CAGR of 4.6% between 2025 and 2033, driven by shifting cultural norms and the growing acceptance of jewelry as a form of self-expression among men. Modern male consumers are increasingly incorporating jewelry into their daily attire, embracing items such as rings, bracelets, necklaces, cufflinks, and chains. Designs now span a broad aesthetic spectrum—from minimalist pieces that complement professional wear to bold, statement-driven styles that reflect individuality and confidence.

This transformation is being fueled by influences from streetwear culture, music, sports, and social media, which collectively shape perceptions of masculinity and style. Younger demographics, in particular, are playing a central role in redefining jewelry as a lifestyle accessory rather than a purely decorative item. Supporting this trend, a May 2024 survey of 1,002 U.S. men revealed that 78% believe men’s jewelry is becoming increasingly mainstream, underscoring a strong shift in consumer attitudes and purchase intentions.

The evolving consumer landscape is also creating new opportunities for jewelry insurers, as the rising diversity of product types and price points expands the insured jewelry base. Men’s jewelry, often incorporating high-value materials like gold, platinum, and diamonds, contributes to the increased need for tailored insurance coverage addressing theft, loss, or damage. As gender-neutral and men’s collections gain traction globally, insurers are expected to adapt their offerings to better reflect the changing profile of jewelry ownership.

IV. Regional Insights: Global Jewelry Insurance Market

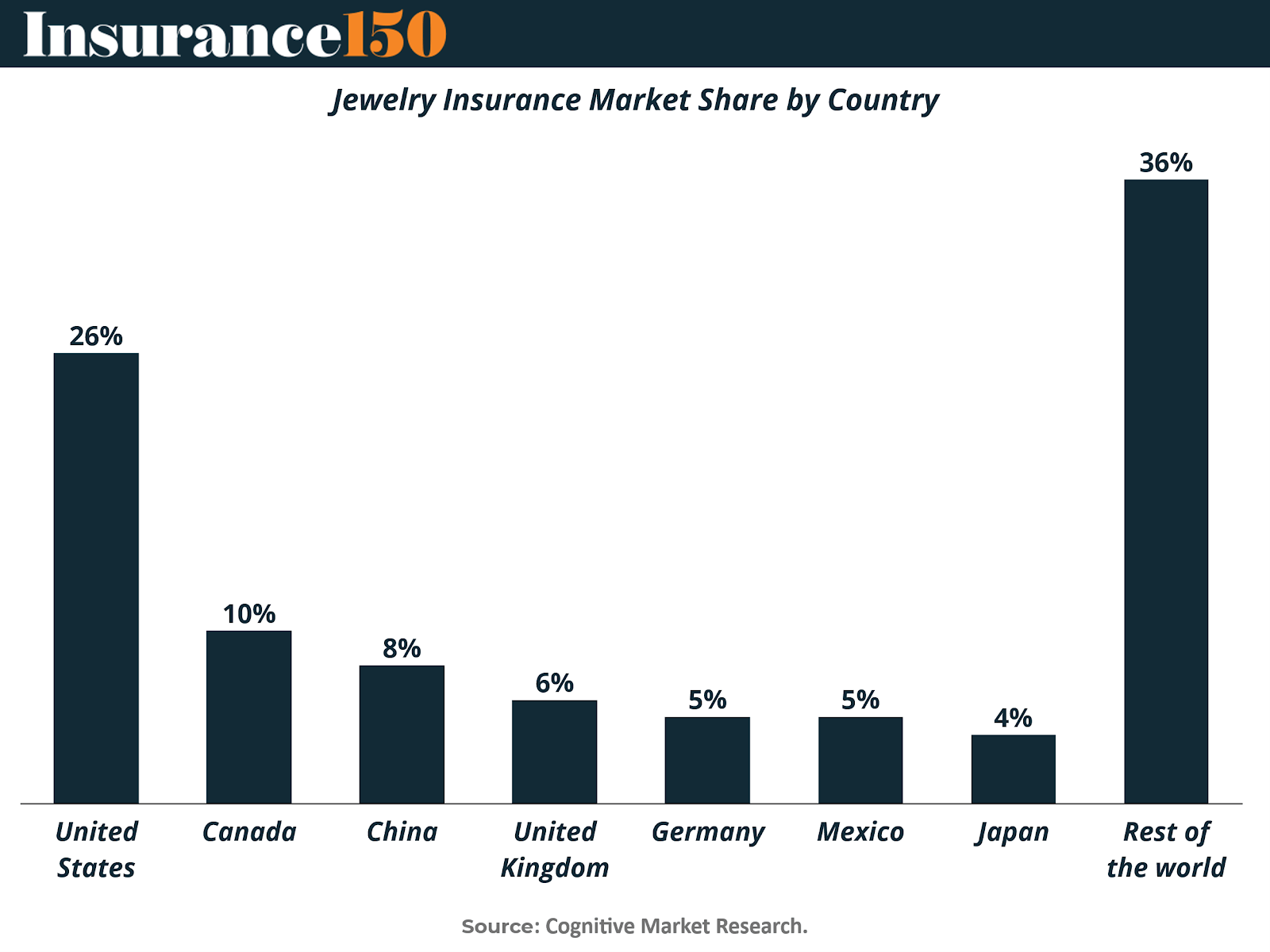

The global jewelry insurance market exhibits notable regional diversity, driven by varying cultural attitudes toward jewelry ownership, economic conditions, and insurance penetration levels. According to Cognitive Market Research, the United States holds a commanding 26% share, followed by Canada (10%), China (8%), and major European economies such as the United Kingdom (6%) and Germany (5%). The Rest of the World segment collectively represents 36%, underscoring the market’s broad international footprint and growth potential.

North America Jewelry Insurance Market Analysis

North America remains the largest regional market, accounting for approximately 38% of the global share. This dominance is underpinned by an affluent consumer base, a mature jewelry industry, and strong cultural traditions surrounding jewelry ownership—particularly in engagement rings, luxury watches, and gemstone pieces.

The United States, contributing the majority share within the region, continues to drive market expansion through its advanced insurance infrastructure and high-value jewelry consumption. The market is primarily segmented into personal jewelry insurance, catering to individual owners, and commercial jewelry insurance, serving retailers, designers, and collectors. Robust consumer awareness, combined with the widespread practice of insuring personal valuables, ensures sustained growth in this region.

Europe Jewelry Insurance Market Analysis

Europe holds a significant position in the global jewelry insurance landscape, representing around 33% of the total market. The region’s deep-rooted craftsmanship traditions—spanning from Italy’s artisanal jewelry houses to the U.K.’s timeless luxury brands—fuel continuous demand for insurance coverage. European consumers place high value on safeguarding inherited heirlooms and fine jewelry, prompting the adoption of comprehensive protection policies.

As digital transformation reshapes the insurance sector, many European insurers are transitioning to online platforms offering seamless policy management and expedited claims handling. Growing awareness of jewelry protection and higher disposable incomes are further stimulating market growth, while customer-centric innovations in policy design and digital underwriting are enhancing the consumer experience.

Asia Pacific Jewelry Insurance Market Analysis

The Asia Pacific (APAC) region is emerging as the fastest-growing jewelry insurance market, capturing 20% of global share. The region’s growth is fueled by rising middle-class affluence, expanding urbanization, and a strong cultural attachment to jewelry as both a symbol of tradition and status.

Major contributors such as China, India, Japan, and South Korea are witnessing heightened demand for jewelry insurance, paralleling rapid developments in their domestic jewelry sectors. Consumers are increasingly seeking protection for valuable possessions, while insurers are tailoring offerings to local markets. The region’s economic dynamism and evolving consumer behaviors make Asia Pacific a key driver of future industry expansion.

South America Jewelry Insurance Market Analysis

Latin America, encompassing culturally rich markets like Mexico, Brazil, and Argentina, represents approximately 5% of the global jewelry insurance market. The region’s jewelry sector blends indigenous artistry with modern luxury trends, creating a diverse consumer landscape.

Rising disposable incomes and growing appreciation for fine jewelry have prompted increased adoption of insurance coverage. Insurers are focusing on customized policies that address local risks such as theft and travel-related loss. As awareness of jewelry protection spreads and economic conditions strengthen, Latin America is poised for steady, long-term growth in jewelry insurance adoption.

Middle East & Africa Jewelry Insurance Market Analysis

The Middle East and Africa account for around 4% of global share, driven by the region’s deep-rooted affinity for gold, gemstones, and ornate jewelry designs. Markets such as the UAE, Saudi Arabia, and South Africa are home to affluent consumers and thriving jewelry trade hubs.

High-net-worth individuals are key clients in this region, often seeking bespoke insurance coverage for extensive jewelry collections. Insurers are emphasizing personalized service and trust-based relationships, offering protection that extends to travel, exhibitions, and luxury events. As wealth concentration increases and luxury consumption expands, the Middle East and Africa are expected to remain vital contributors to the global jewelry insurance market.

V. Jewelry Insurance Market by Product

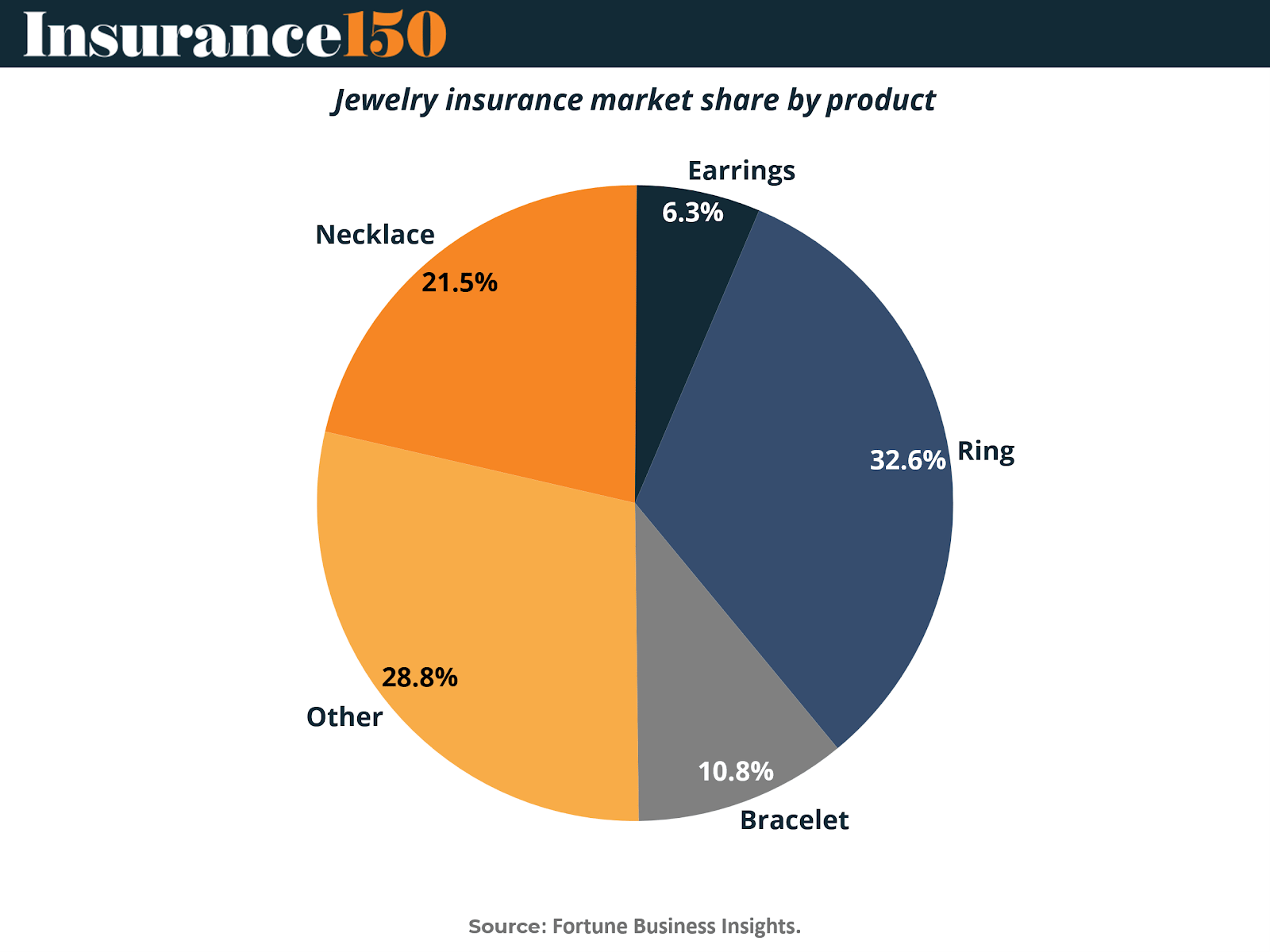

The jewelry insurance market is segmented by product type, with rings accounting for the largest share at 32.6%, followed by other jewelry items (28.8%), necklaces (21.5%), bracelets (10.8%), and earrings (6.3%), according to Fortune Business Insights. This distribution reflects the strong emotional and financial value attached to certain jewelry categories—particularly rings and necklaces—which are among the most commonly insured items worldwide.

Rings: The Leading Segment

Rings dominate the jewelry insurance market due to their high sentimental and monetary value, often representing major life milestones such as engagements, weddings, and anniversaries. The prevalence of diamond and precious gemstone rings significantly elevates their insured worth. Furthermore, custom-designed rings and those incorporating rare stones have contributed to higher average claim values. Insurers are responding with specialized coverage options tailored to high-value engagement and wedding rings, offering protection against loss, theft, and accidental damage.

Necklaces and Bracelets

Necklaces, holding 21.5% of the market share, remain a key jewelry category due to their widespread popularity across demographics. They often feature gold, platinum, or gemstone components that make them both fashionable and investment-worthy. Bracelets, with a 10.8% share, have seen rising demand amid evolving fashion trends and the increasing adoption of smart jewelry—such as connected or sensor-enabled pieces—requiring insurance coverage for both material and technological components.

Earrings and Other Jewelry

Earrings represent 6.3% of the market, with insurers noting frequent claims related to accidental loss or mismatched pairs. Despite their smaller size, high-value earrings featuring diamonds or luxury brand designs contribute significantly to the overall insured value.

The “other” category, comprising 28.8%, includes watches, brooches, pendants, and heirloom pieces. Luxury watches, in particular, have become a substantial subsegment due to their investment potential and brand prestige. High-net-worth individuals and collectors are increasingly opting for comprehensive jewelry and watch insurance, which often includes coverage for storage, international travel, and exhibitions.

Market Outlook

Overall, the dominance of rings and necklaces underscores the market’s emotional and financial duality—balancing sentiment with asset protection. As consumer purchasing patterns shift toward premium, customized, and sustainable jewelry, insurers are enhancing policy flexibility and digital accessibility. With growing online sales of high-value jewelry items, digital-first insurance models are gaining traction, offering instant valuation and claims processing. This trend is expected to strengthen insurers’ ability to cater to the evolving protection needs of modern jewelry consumers.

VI. Conclusion: Protecting Value, Preserving Meaning

The jewelry insurance industry stands at a pivotal moment—where technology, emotion, and economics converge to redefine how value is protected and perceived. What began as a niche extension of personal property coverage has matured into a sophisticated ecosystem, reflecting both the emotional gravity and financial magnitude of modern jewelry ownership.

Across markets, the story is consistent: consumers are investing more deeply in jewelry that symbolizes individuality, legacy, and achievement, while simultaneously demanding protection that mirrors the precision, transparency, and immediacy of the digital age. This shift has transformed insurance from a reactive safeguard into an integrated component of the ownership experience—one that begins at the point of purchase and extends through the life of the piece.

The industry’s evolution is fueled by technology and trust in equal measure. Innovations in AI-driven valuation, blockchain authentication, and digital claims management are revolutionizing how insurers assess and protect assets. Yet, the true differentiator remains empathy—the understanding that jewelry represents not just capital, but connection. The ability to blend analytical rigor with emotional sensitivity will determine which insurers thrive in an increasingly competitive landscape.

Regionally, mature markets such as North America and Europe continue to lead through established infrastructures and high-value collections, while emerging markets in Asia Pacific and Latin America are driving the next phase of expansion through cultural affinity and rising affluence. Product segmentation further reinforces the depth of the category, as rings and necklaces dominate both financial and sentimental value, while watches and smart jewelry redefine what “insurable” means in an era of hybrid luxury.

Looking ahead, jewelry insurance is poised for sustained growth—supported by rising global wealth, expanding digital distribution, and consumer demand for personalized, tech-enabled coverage. But beyond the numbers lies a deeper narrative: the enduring human desire to protect what carries both meaning and memory. In safeguarding jewelry, the industry ultimately safeguards stories—each gem, ring, and heirloom becoming a vessel of trust, sentiment, and continuity across generations.

Sources & References

Cognitive Market Research – Global Jewelry Insurance Market Report

Fortune Business Insights – Jewelry Market Size, Share, and Industry Analysis

Grand View Research – Global Jewelry Market Analysis and Forecast