- Insurance 150

- Posts

- The Inflation–Insurance Feedback Loop

The Inflation–Insurance Feedback Loop

The infinite loop between Inflation and Insurance industry.

The Inflation–Insurance Feedback Loop

Overview

In 2025, inflation continues to exert pressure on the insurance industry. While global CPI inflation is projected to decline to an average of 3.3% in 2025, down from 5.1% in 2024, the residual effects of past inflationary periods linger. This persistent inflation impacts claim costs, especially in sectors like auto and property insurance, where the cost of repairs and replacements has risen.

Regarding US, the consumer price inflation surged dramatically from early 2021 through mid-2022, peaking near 9% year-over-year before steadily declining throughout 2023 and into early 2025. Core inflation, which excludes volatile food and energy prices, also rose significantly during this period but remained more stable and declined at a slower pace.

This persistent inflationary environment has posed notable challenges for the insurance industry, as rising costs have eroded profit margins, increased claims expenses, and complicated long-term risk pricing models. The lag in core inflation's decline suggests ongoing pressure on insurers' operating costs and emphasizes the importance of adaptive pricing strategies and underwriting discipline.

In this context, the credibility of the Federal Reserve's inflation-targeting policy plays a central role in anchoring inflation expectations, which is essential for macroeconomic stability. For the insurance sector, such an anchor provides critical predictability, enabling more robust forecasting, actuarial planning, and long-term contract design, all of which rely heavily on stable nominal environments.

Insurance Implications

Premium Adjustments: Insurers are compelled to adjust premiums more frequently to keep pace with rising claim costs.

Underwriting Challenges: Accurate risk assessment becomes more complex in an inflationary environment, necessitating more sophisticated underwriting models.

Customer Retention: Frequent premium hikes can lead to customer dissatisfaction and increased policy lapses.

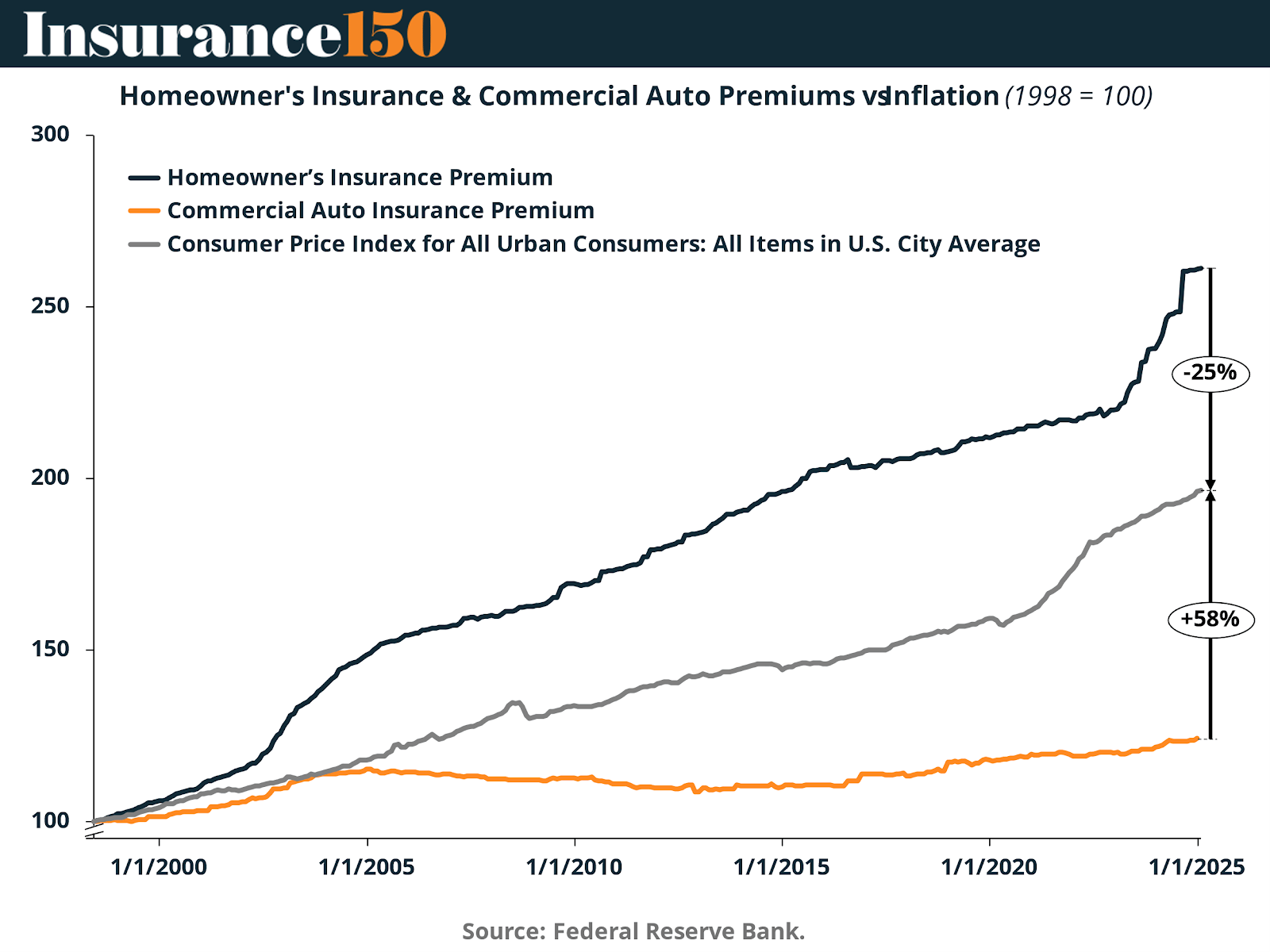

Over the long term, trends in insurance premiums have diverged markedly across lines, with homeowner’s insurance premiums rising far more rapidly than general inflation, while commercial auto insurance premiums have remained comparatively stable. Since 1998, homeowner’s insurance premiums have increased by nearly 200%, substantially outpacing the 58% cumulative rise in the Consumer Price Index (CPI) for all urban consumers. In contrast, commercial auto premiums have shown minimal growth over the same period, only beginning to rise more noticeably in recent years. This disparity reflects differences in risk exposure, regulatory dynamics, and cost structures between the two segments. The sharp escalation in homeowner’s premiums—particularly post-2020—highlights systemic pressures such as climate-driven catastrophe losses, surging repair and replacement costs, and tightening reinsurance markets.

Inflation and the Housing Problem in the US

In the context of the broader inflationary pressures impacting the insurance industry, the U.S. housing market stands out as a sector facing acute affordability challenges. Homeowners are increasingly squeezed not just by rising mortgage rates and home prices, but also by non-mortgage housing costs—particularly property taxes and insurance premiums.

Between 1998 and 2025, homeowner’s insurance premiums rose by nearly 200%, vastly outpacing general inflation, which increased by only 58% over the same period. This trend, visualized in the next Chart, underscores how the cumulative burden of insurance is diverging from the overall cost of living.

Howeveren the steep rise in homeowner’s premiums pales in comparison to the growth in housing prices. As shown in the following, the Case-Shiller U.S. National Home Price Index has surged 48% since 2010—far exceeding the growth in average annual homeowners insurance premiums, which rose more modestly over the same period.

This widening gap reflects a deeper structural issue: while inflation affects all goods and services, housing-related costs are compounding disproportionately due to systemic factors. These include:

Demographic pressures from first-time homebuyers entering the market,

Constrained housing supply, and

Rising climate risks that drive up insurance claims and premiums.

Additionally, state-level disparities in insurance hikes—some exceeding 20% year-over-year in states like Nebraska and Iowa—are further straining household budgets.

Looking forward, projections show housing-related costs (insurance + property tax) rising from $4,000 in 2019 to nearly $12,000 by 2035, with a sharp +6.2% spike expected around 2024 alone. These non-mortgage costs will continue to erode housing affordability, especially for renters and low-income households.

In sum, inflation has not only distorted baseline affordability but is now embedded in the very structure of housing costs. The combined effect of rising premiums, home prices, and stagnant wage growth suggests that the U.S. housing affordability crisis is set to persist—if not intensify—over the coming decade.

Real Growth Rates and Forecasts

Despite persistent macroeconomic uncertainty and geopolitical volatility, the global insurance industry is poised for a period of renewed real growth. According to SwissRE, global insurance premiums are projected to grow at a CAGR of 2.5% in 2025 and 2026, outpacing the compound annual growth rate (CAGR) of 1.6% between 2019 and 2023. This rebound is largely driven by emerging markets—especially China, which is forecast to register a CAGR of 5.5% in 2025 to 2026.

Looking further ahead, growth in 2025–2026 is forecast to moderate but remain positive across all regions, reflecting an improving inflation outlook and steady demand for risk protection. Importantly, while the 2025–2026 CAGR projections remain highest for emerging markets, advanced economies may face structural headwinds such as aging populations and market saturation. As SwissRE highlights, insurers must navigate this uneven recovery with region-specific strategies, balancing premium expansion with disciplined underwriting and product innovation.

Conclusion

The insurance industry in 2025 finds itself at the intersection of macroeconomic volatility, inflationary aftershocks, and mounting structural pressures. Persistent inflation, though easing, continues to weigh on underwriting margins and pricing strategies, particularly in property and casualty lines. As demonstrated throughout this report, homeowners’ insurance premiums have outpaced general inflation by a wide margin—nearly 200% since 1998—underscoring the sector’s acute exposure to climate-related losses, escalating rebuild costs, and tighter reinsurance capacity.

Simultaneously, the broader U.S. housing market faces a compounding affordability crisis. While insurance costs are rising sharply, housing prices have grown even faster, driven by demographic shifts, constrained supply, and financial barriers to ownership. With property taxes and insurance projected to triple by 2035, non-mortgage housing expenses are emerging as a critical threat to long-term affordability—especially for low-income households and renters.

On the global front, recovery is underway. Insurance premium growth is rebounding in 2024, particularly in emerging markets like China, where SwissRE forecasts real growth rates above 7%. However, advanced markets continue to face demographic stagnation and saturated risk pools, requiring more nuanced strategies focused on underwriting discipline, innovation, and digital transformation.

As the industry moves forward, navigating inflation, affordability challenges, and uneven growth dynamics will be essential. Success will depend not just on pricing agility, but on insurers’ ability to adapt to new risk landscapes, regulatory shifts, and the evolving needs of both policyholders and investors in a more volatile global economy.

Sources & References

CNBC. (2025). Here’s the inflation breakdown for March 2025. https://www.cnbc.com/2025/04/10/heres-the-inflation-breakdown-for-march-2025-in-one-chart.html

CNBC. (2025). Homeowners insurance has risen over 50% in these states. https://www.cnbc.com/select/homeowners-insurance-has-skyrocketed-over-50percent-in-these-states/

Insurance150. (2025). The U.S. Homebuying Affordability Crisis: Why It’s Not Going Away Anytime Soon. https://insights150.com/p/the-u-s-homebuying-affordability-crisis-why-it-s-not-going-away-anytime-soon

Joint Center of Housing Studies, Harvard University. (2024). The Insurance Crisis Continues to Weigh on Homeowners. https://www.jchs.harvard.edu/blog/insurance-crisis-continues-weigh-homeowners

JP Morgan. (2025). Insurance: Weathering the storm of inflation, climate change and market-distorting state regulation. https://www.jpmorgan.com/content/dam/jpm/cib/documents/Weathering_the_storm.pdf

SwissRe. (2024). Global economic and insurance market outlook 2025-26. https://www.swissre.com/institute/research/sigma-research/sigma-2024-05-global-economic-insurance-outlook-growth-geopolitics.html

Yahoo Finance. (2025). NEXT Insurance Survey: Inflation, labor shortages top concerns for small business owners. https://finance.yahoo.com/news/next-insurance-survey-inflation-labor-130000525.html