- Insurance 150

- Posts

- U.S. International Investment Position, Q2 2025: Trends, Shifts, and Outlook

U.S. International Investment Position, Q2 2025: Trends, Shifts, and Outlook

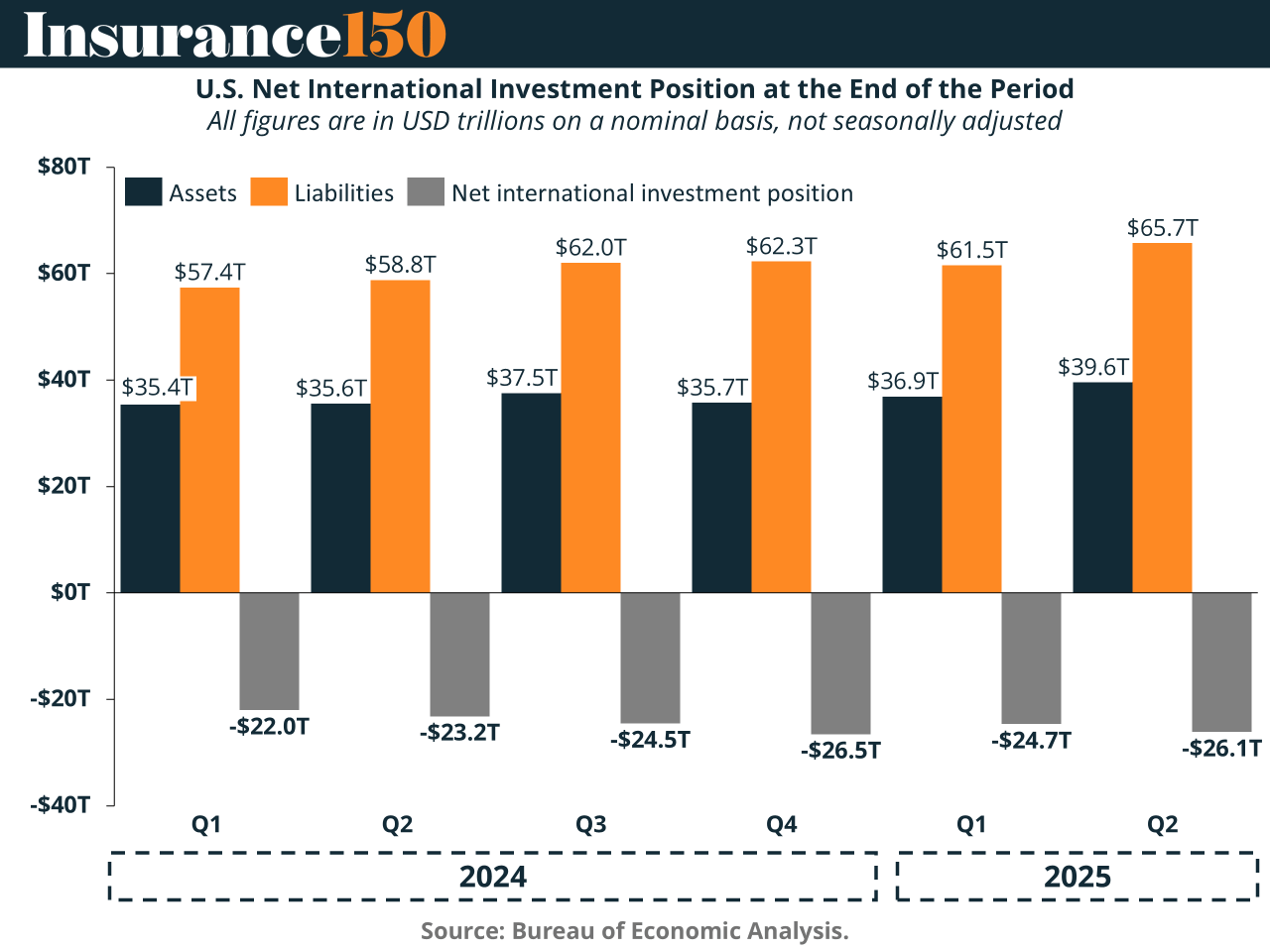

The U.S. net international investment position (NIIP)—the difference between what U.S. residents own abroad and what foreigners own in the United States—stood at –$26.14 trillion at the end of the second quarter of 2025.

Overview

This figure reflects a $1.49 trillion decline from the previous quarter, underscoring how global financial conditions, price movements, and exchange-rate shifts continue to shape the nation’s external balance sheet.

The Numbers Behind the Decline

At the end of the second quarter, U.S. assets totaled $39.56 trillion, while liabilities reached $65.71 trillion. The resulting negative position highlights the extent to which foreign investors continue to hold U.S. assets at a faster pace than Americans invest abroad.

The change from the first to the second quarter of 2025 was driven by:

Net financial transactions: –$428.1 billion.

Price changes: –$2.23 trillion, as U.S. equity prices outperformed foreign markets, raising the value of U.S. liabilities more than assets.

Exchange-rate changes: +$1.17 trillion, due to foreign currency appreciation against the dollar, which lifted the dollar value of U.S. assets.

U.S. assets grew by $2.68 trillion over the quarter, supported by favorable currency effects and higher foreign stock prices. Liabilities rose even faster—by $4.16 trillion—as rising U.S. equity markets increased the market value of securities held by foreign investors.

All major categories of both assets and liabilities increased. On the asset side, portfolio investment and direct investment led the gains, while on the liability side, foreign purchases of U.S. equity and long-term debt securities were the key contributors.

Composition of U.S. Assets

As of early 2025, U.S. residents held roughly $36.9 trillion in foreign assets. The composition illustrates how diversified American investments abroad have become, spanning corporate ownership, bonds, bank claims, and reserve holdings.

Breakdown of total foreign assets:

Portfolio investment: 44% (~$16.3 trillion)

Direct investment at market value: 31% (~$11.5 trillion)

Other investment: 16% (~$6 trillion)

Financial derivatives (other than reserves): 6% (~$2 trillion)

Reserve assets: 3% (~$1 trillion)

The data show that portfolio and direct investments remain the foundation of U.S. external wealth. This distribution also explains why valuation changes in equity and bond markets have such a strong impact on the overall net position.

Key Drivers in 2025

Three broad factors shaped the movement in the NIIP through mid-2025:

Equity Market Performance – U.S. stock prices continued to climb, pushing up the market value of foreign holdings of American securities.

Exchange Rates – A softer dollar increased the dollar value of U.S. investments abroad, offsetting part of the rise in liabilities.

Cross-Border Financial Flows – Foreign purchases of U.S. equities and bonds remained strong, widening the gap between U.S. liabilities and assets.

The result is a financial picture characterized by rising cross-border exposure on both sides of the ledger, with valuation swings playing an increasingly large role.

Policy Uncertainty and Market Volatility

The economic environment in 2025 has been marked by elevated policy uncertainty, shifts in fiscal priorities, and a more cautious global growth outlook. These forces have contributed to episodes of volatility in the dollar and in global equity markets.

The depreciation of the dollar over the past year has provided a modest boost to the value of U.S. assets abroad, yet it also reflects unease about the fiscal trajectory of the United States and the sustainability of large-scale borrowing.

At the same time, foreign demand for U.S. financial instruments remains strong. Treasury securities and corporate bonds continue to be seen as among the most secure and liquid investments available, even as investors weigh the implications of higher debt levels and shifting monetary policy.

A Double-Edged Indicator

The persistent negative NIIP can be interpreted in two ways. On one hand, it highlights the global confidence in U.S. markets—foreign investors are willing to commit trillions of dollars to American equities and debt instruments. On the other hand, it reflects the growing dependence of the U.S. on foreign capital to finance investment and public spending.

The widening gap between liabilities and assets is not necessarily a sign of weakness, but it does underscore the importance of maintaining fiscal credibility and stable policy frameworks. As debt service costs rise, the ability to attract foreign investment on favorable terms may depend increasingly on perceptions of long-term economic discipline.

Structural Trends

Over the past five years, U.S. liabilities have grown at an average annual rate of 8.9%, compared with 4.5% growth in U.S. assets abroad. This differential expansion has been closely tied to sustained trade deficits, the depth of U.S. capital markets, and the global role of the dollar.

Foreign investors continue to favor U.S. assets for their liquidity, transparency, and legal protections. In return, American investors have diversified across advanced and emerging markets but at a slower pace, partly because of relative market performance and exchange-rate dynamics.

Geographic Distribution of Investment

Investment flows into the U.S. are dominated by advanced economies. Financial centers in Europe and Asia remain major holders of U.S. debt and equity securities. European investors have significantly increased their purchases of U.S. bonds in recent years, while institutions in Japan and other developed markets maintain substantial long-term holdings.

These flows highlight the strong interconnectedness of advanced economies and the continued dominance of U.S. financial assets as the cornerstone of global portfolios. Even as emerging markets expand, the largest pools of international savings remain concentrated in developed countries that view U.S. markets as both stable and profitable.

The Role of Non-Bank Institutions

One defining feature of modern international finance is the growing role of non-bank financial institutions—such as pension funds, insurance companies, and asset managers—in shaping global capital flows. Their portfolios increasingly determine the direction and magnitude of cross-border investment.

This shift has coincided with the rise of the foreign-exchange swap market, which allows investors to hedge currency risk and access dollar-denominated bonds. The market now exceeds $100 trillion in outstanding contracts, most of which involve the dollar. While this supports global liquidity, it also creates new channels through which market stress can spread quickly.

The Income Balance Shift

For decades, the U.S. enjoyed a net positive investment income—earning more from its holdings abroad than it paid to foreign investors in the U.S. That advantage is now eroding. In four of the past five quarters, investment income has turned negative, meaning foreign investors are earning more on their U.S. holdings than Americans receive on theirs.

This change stems partly from the dollar’s recent decline: returns from foreign assets translate into fewer dollars, while payments to foreign investors remain denominated in dollars. The result is a narrowing income surplus that could eventually turn into a structural deficit if current trends persist.

Interconnected Financial Conditions

Global financial markets have become deeply interconnected. When monetary policy tightens in one major economy, the effects ripple outward through exchange rates, bond yields, and portfolio adjustments.

High levels of cross-border investment mean that changes in investor sentiment can lead to rapid asset re-pricing. If risk appetite weakens, the same mechanisms that support liquidity and credit expansion can amplify downturns through simultaneous sell-offs across markets.

Regulators and policymakers face the challenge of ensuring that oversight keeps pace with the complexity of this financial web. The focus is no longer just on banks, but on a vast ecosystem of funds and institutions that hold diversified global portfolios.

Historical Perspective

The current situation has historical echoes. In earlier eras, global financial leadership shifted gradually as economies evolved and financial centers adapted. The United States remains the central node in today’s system—its markets are still the deepest, and its currency remains the primary medium for global transactions.

However, maintaining that position requires continued trust in the stability of U.S. governance, fiscal management, and economic openness. Growing public debt and policy volatility could, over time, erode some of that trust, prompting investors to diversify more aggressively toward other advanced economies.

The Takeaway

The negative U.S. net international investment position is both a reflection of strength and a signal of vulnerability. It demonstrates the world’s continued willingness to invest in American assets, but it also highlights the scale of external obligations that accompany that confidence.

As of mid-2025, the trends point toward further expansion of U.S. liabilities, modest gains in foreign assets, and continued dependence on global capital inflows.

The challenge ahead is to manage these dynamics responsibly—sustaining growth and innovation while maintaining the financial stability that has long underpinned global confidence in the U.S. economy.

Sources & References

Bureau of Economic Analysis. (2025). U.S. International Investment Position, 2nd Quarter 2025. https://www.bea.gov/news/2025/us-international-investment-position-2nd-quarter-2025

Federal Reserve Bank of St. Louis. (2025). Understanding the Net International Investment Position. https://www.stlouisfed.org/on-the-economy/2025/may/understanding-net-international-investment-position

RSM. (2025). Policy uncertainty putting U.S. international investment position at risk. https://realeconomy.rsmus.com/the-deteriorating-u-s-international-investment-position/