- Insurance 150

- Posts

- Where Leaders Expect the Fastest ROI From New Investments

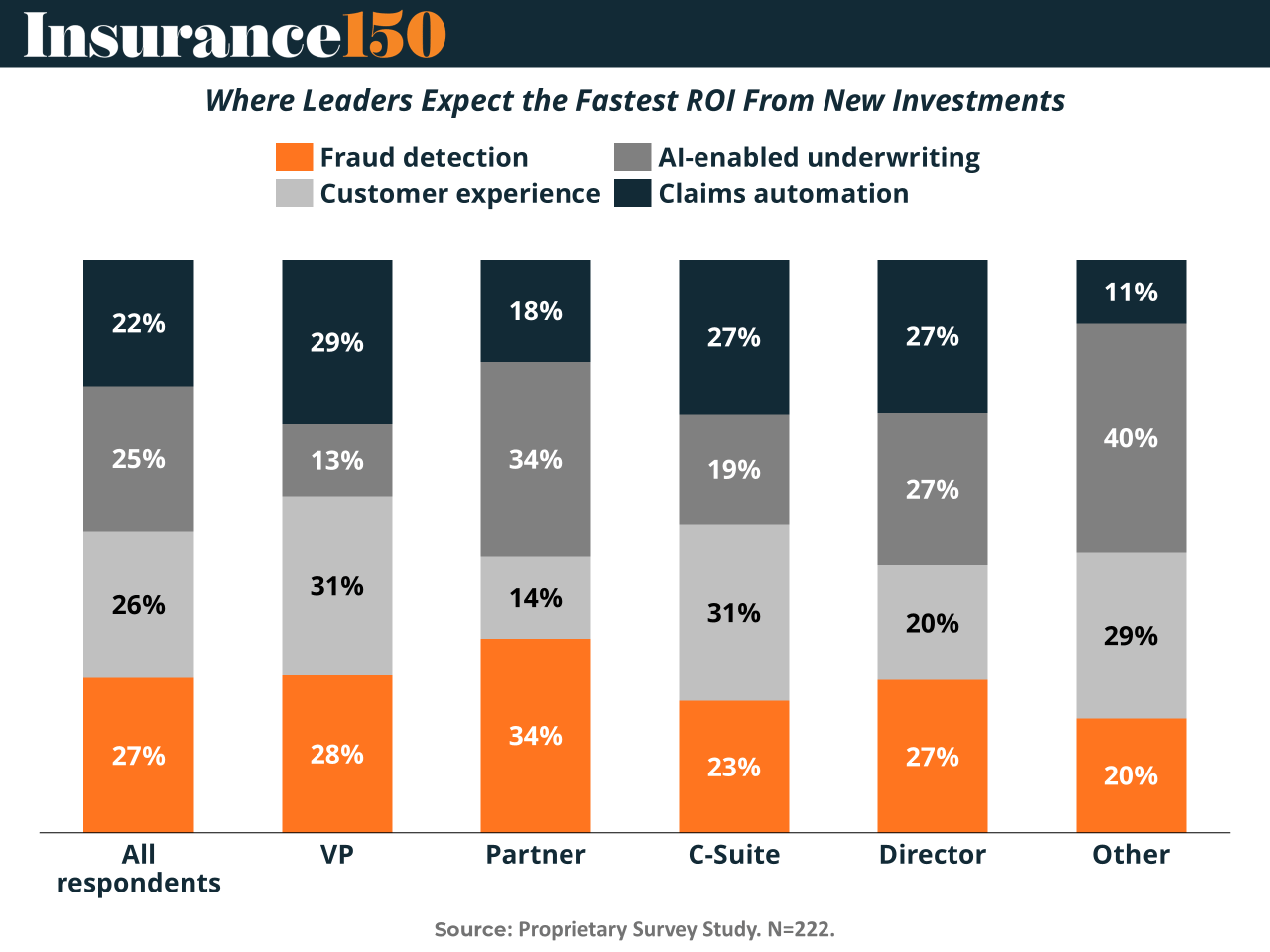

Where Leaders Expect the Fastest ROI From New Investments

In today’s insurance environment, ROI isn’t just about returns—it’s about speed, certainty, and defensibility.

With loss ratios under pressure, claims costs rising, and regulatory scrutiny intensifying, insurance leaders are no longer asking whether to invest in technology. They’re asking where capital works fastest.

The data tells a clear story: near-term ROI is expected from operational technologies that touch money and customers first.

Across all respondents, Fraud Detection (27%) and Customer Experience (26%) lead as the areas most likely to deliver fast returns. These are not experimental bets. Fraud tools directly protect margin by reducing leakage, while customer experience investments show impact through faster claims resolution, higher retention, and lower servicing costs. In a sector where outcomes are closely tracked, both categories offer clean attribution between investment and result.

But the more revealing insight emerges when we look at how expectations shift by seniority.

Different Seats, Different ROI Math

Partners stand out with the strongest conviction in Fraud Detection and AI-enabled Underwriting (both at 34%). This group often operates closest to portfolio performance and long-term profitability, making them acutely sensitive to loss prevention and risk selection. Their confidence in underwriting AI suggests belief in its upside—but also comfort with longer implementation cycles and model maturity.

At the C-suite level, priorities shift. Customer Experience leads at 31%, followed closely by Claims Automation (27%). This reflects a strategic reality: senior executives are under pressure to show visible progress to boards, regulators, and customers alike. Faster claims, fewer complaints, and smoother digital journeys deliver reputational ROI alongside financial impact—and often within reporting cycles that matter most.

VPs and Directors sit in the middle, favoring Claims Automation (29% and 27%) as a proven, execution-ready lever. For these leaders, success is measured in throughput, cycle times, and operational efficiency. Claims automation offers tangible gains without the organizational disruption that often accompanies underwriting transformation.

Why Fraud and Claims Keep Winning the ROI Race

What’s striking is how consistently Fraud Detection and Claims Automation perform across roles. These areas share three characteristics insurers increasingly prioritize:

Immediate cost visibility – savings are measurable and defensible

Lower regulatory friction – compared to core pricing or underwriting changes

Operational readiness – data, workflows, and use cases already exist

By contrast, AI-enabled underwriting, while viewed as high-upside, appears more polarized. It commands strong confidence among Partners and “Other” roles (40%), yet lower expectations among the C-suite. This gap likely reflects the reality of underwriting modernization: powerful in theory, complex in practice, and often slower to scale.

The Bigger Signal: Pragmatic AI Is Winning

Taken together, the data highlights a broader shift in insurance technology strategy. Leaders are prioritizing pragmatic AI—tools that reduce leakage, accelerate decisions, and improve customer outcomes—before fully rearchitecting core risk models.

This isn’t a retreat from innovation. It’s sequencing.

Insurers are building ROI momentum where it’s fastest and most defensible, creating the financial and organizational room to tackle more transformative bets later.

In today’s market, the fastest ROI doesn’t come from the boldest idea—it comes from the clearest line between investment and impact.