- Insurance 150

- Posts

- Zurich’s £8bn Buyout, 73% AI Adoption, and Why Solvency Is Wobbling

Zurich’s £8bn Buyout, 73% AI Adoption, and Why Solvency Is Wobbling

Zurich pays a 60% premium for Beazley and 73% of insurers prioritize AI, while solvency ratios take a hit in the Americas.

Good morning, ! This week we’re diving into ROI on insurance investments for 2026, solvency ratios continue to steady across the globe, and insurtech investment priorities for the next 12 months

Want to advertise in Insurance 150? Check out our ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Where Insurers Are Actually Placing Their Bets

Insurance leaders heading into 2026 aren’t pulling back — they’re getting selective. The data shows Data & Analytics leading budget growth overall (44%), but priorities diverge sharply by role. C-suites are zeroing in on Underwriting Technology (50%) as a margin defense play, while VPs and Directors favor distribution tools and claims automation for faster execution and visible wins.

Cost pressure is fragmenting. Executives are fixated on reinsurance economics, while operational leaders feel the heat from technology spend tied to multi-year modernization programs. That divergence helps explain ROI expectations: Fraud detection, claims automation, and customer experience consistently top the list for fastest payback.

Bottom line: Insurers aren’t abandoning transformation. They’re sequencing it — prioritizing initiatives with clear attribution, lower execution risk, and defensible ROI before taking bigger swings.

TREND TO WATCH

Solvency: Still Standing, But Wobbling

Solvency ratios across the globe are holding steady—just don’t look too closely. Life insurers in Asia and Oceania are quietly trending downward, even as their ratios remain high. Non-life solvency is a mixed bag: up in Europe and Africa, but slipping in Asia and EMDEs. Meanwhile, the Americas’ life insurers posted the sharpest YoY drop in asset surpluses, marking a reversal after years of growth.

What’s driving the volatility? A cocktail of NatCat losses, interest rate swings, and rising reinsurance premiums. Add longevity risk and ALM complexity, and it’s no wonder boards are sweating capital adequacy models. (More)

MICROSURVEY

Which types of assets are most likely to be divested by insurers over the next 24 months?We would like to better understand which types of insurance assets the market expects to see coming to market next. |

DEAL OF THE WEEK

Zurich Pays Up for Specialty Edge

Zurich Insurance Group has agreed an £8bn takeover of Beazley, offering a near 60% premium to secure one of the London market’s most strategically valuable specialty platforms. The deal values Beazley at £13.35 per share, combining £13.10 cash with a 25p dividend, after an initial bid was rebuffed.

This is not a scale grab. It is a capability buy. Beazley brings deep underwriting muscle in cyber, specialty property, fine art, yachts, and reinsurance, plus a prized Lloyd’s footprint. Zurich plans to fold its own specialty book into Beazley, creating a global specialty carrier with roughly $15bn in gross written premiums, anchored in the UK.

The premium tells the story. Public markets have consistently undervalued specialty underwriting franchises relative to private control value. Zurich simply decided not to wait.

Why it matters for insurance leaders: specialty talent, data, and Lloyd’s access are now strategic assets worth paying for. For the UK market, it is another reminder that global carriers are shopping London’s crown jewels faster than public markets can reprice them. (More)

INSURTECH CORNER

AI Moves From Pilot to Priority

Insurers have made their call: AI is no longer an experiment. According to the latest survey data, 73% of insurers plan to invest in AI-related technology over the next 12 months — more than any other category. That’s not curiosity spending. That’s execution.

What’s driving it is practical impact. AI now sits at the center of automation, predictive analytics, fraud detection, and claims efficiency. In short, it touches money, risk, and customers — the three places budgets still flow freely.

Close behind, portfolio and risk management platforms (70%) and analytics tools (56%) reinforce the same theme: better decisions under pressure. Even data platforms continue to draw investment as insurers work to modernize fragmented infrastructure.

Bottom line: Insurtechs that combine AI + data + risk intelligence are aligned with real budgets. Everything else is optional. (More)

MACROECONOMICS

Rates on Hold, Power in Flux

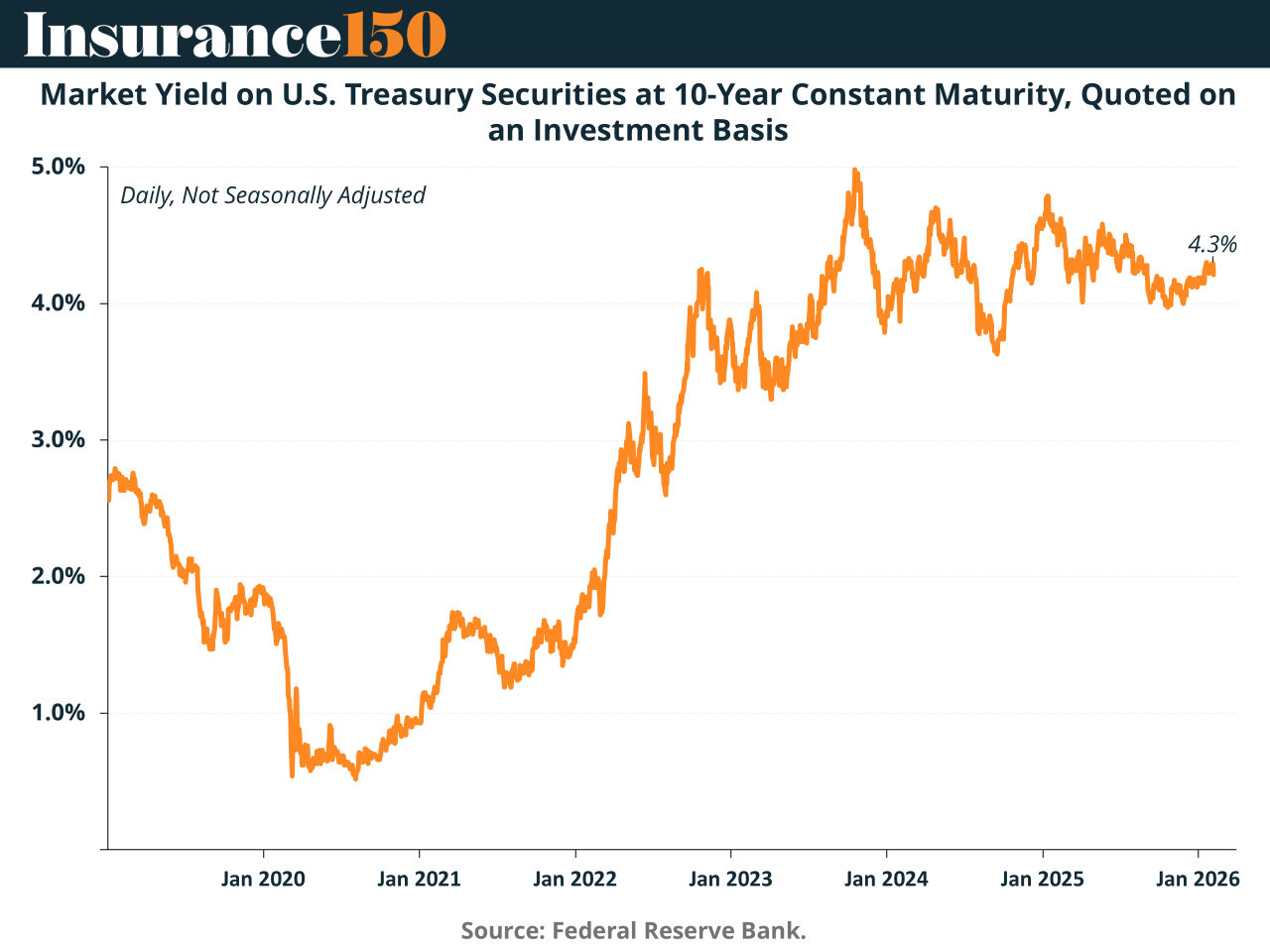

The Federal Reserve kept rates on hold at 3.5–3.75%, reinforcing a higher-for-longer message as inflation remains above target and productivity-driven growth continues to surprise. For private equity, this implies no imminent relief on financing costs and sustained pressure on leverage-heavy strategies.

Long-term yields near 4.3% signal markets still price persistent nominal growth and fiscal risk, favoring operational value creation, pricing power, and capital discipline over multiple expansion. Meanwhile, the U.S. dollar remains structurally strong, despite recent volatility linked more to political signaling than fundamentals.

The bigger shift may be institutional. President Trump’s nomination of Kevin Warsh as next Fed Chair revives questions around central bank independence and the Fed’s expanded discretionary powers. While often labeled a hawk, Warsh has recently emphasized productivity gains as a rationale for measured easing, suggesting policy flexibility, not dogma.

For sponsors, the key risk is not a 25 bp cut, but credibility. A stable, independent Fed remains critical for valuation, exit timing, and long-duration capital deployment. (More)

COMPLIANCE CORNER

Privacy Is Now an Insurance Risk

Insurance compliance is entering a new phase — and it’s built around data. California’s emerging Insurance Consumer Privacy Protection Act (ICPPA) signals a sharper regulatory stance on how insurers collect, store, and share consumer information. This isn’t just GDPR-lite. It’s insurance-specific, and enforcement risk is real.

Layered onto that are expanded rights under California privacy law allowing consumers to challenge automated profiling, directly implicating AI-driven underwriting and pricing models. Regulators are increasingly focused on bias, transparency, and explainability, not just cybersecurity hygiene.

At the national level, the NAIC Insurance Data Security Model Law raises expectations around risk-based cybersecurity programs and third-party vendor oversight — a growing pain point for carriers and MGAs alike.

Bottom line: Privacy-by-design, vendor governance, and AI impact assessments are no longer optional. Data compliance is now a core insurance risk. (More)

INTERESTING ARTICLES

PUBLISHER PODCAST

No Off Button: He Built North America's Largest AI Conference (& Had A Winning Exit)

Champions don’t quit when the plan breaks—they adapt. No Off Button is Aram’s publisher-led podcast honoring founders, executives, and creators who don’t have an off switch. Each episode spotlights operators who keep building through pivots, pressure, and imperfect conditions.

This week’s guest is Michael Weiss, co-founder of Ai4, the largest AI conference in North America. Michael walks through the pivot that changed everything—from an ambitious attempt to revive the 1893 Chicago World’s Fair to identifying AI as the defining opportunity of the decade before the boom. The conversation unpacks the realities of the event business, the discipline behind timing a market, and why surviving the compounding phase matters more than chasing early wins.

Why it matters: this episode is a blueprint for founders and investors alike—niche selection, execution, and resilience are what turn failed ideas into category-defining outcomes.

"You'll never do a whole lot unless you're brave enough to try."

Dolly Parton