- The Deal Brief - Insurance

- Posts

- 65% of SMEs Are Ready to Switch Carriers. Here’s Why.

65% of SMEs Are Ready to Switch Carriers. Here’s Why.

SMEs are growing fast, but most feel underserved by their current carriers. Digital speed, flexibility, and better service are now the deciding factors driving the shift.

Good morning, ! This week we’re breaking down China’s outsized 7.6% premium growth, the new regulatory pressure from whistleblowers, and a market where 65% of SMEs are unhappy with their carrier and ready to switch.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

The Satisfaction Gap

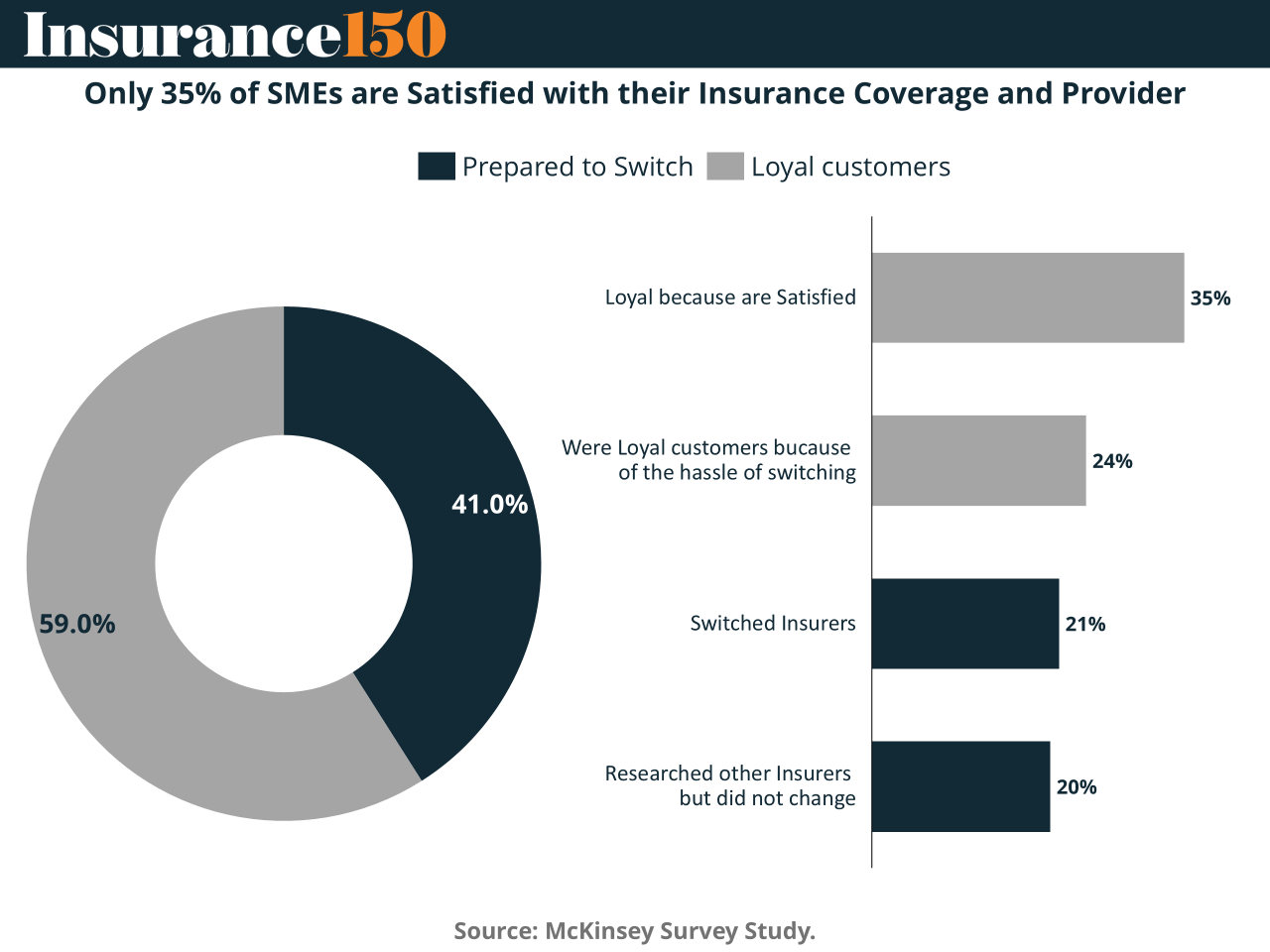

Only 35% of SMEs are happy with their insurance provider. The other 65%? Either stuck or shopping. It’s not just price; it's the complexity, rigidity, and lack of transparency in coverage. Yet the market is booming, projected to grow from $82B to $141B by 2033. 85% of SMEs are willing to buy insurance from nontraditional channels—think banks, Amazon, even social platforms. Add the rising demand for automated advisory tools (cost comparison, coverage clarity), and it’s clear: legacy carriers are on notice. If the industry wants to keep the SME market, it has to make insurance intuitive, not impenetrable.

PRESENTED BY MODE MOBILE

Apple just secretly added Starlink satellite support to iPhones through iOS 18.3.

One of the biggest potential winners? Mode Mobile.

Mode’s EarnPhone already reaches 50M+ users that have earned over $325M, and that’s before global satellite coverage. With SpaceX eliminating "dead zones," Mode's earning technology can now reach billions more in unbanked and rural populations worldwide.

Their global expansion is perfectly timed, and accredited investors still have a chance to invest in their pre-IPO offering at $0.50/share.

With their recent 32,481% revenue growth and newly reserved Nasdaq ticker, Mode is one step closer to a potential IPO.

-

Disclosures

Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

This offer is only open to accredited investors.

TREND OF THE WEEK

China’s Insurance Engine Is Outpacing the World

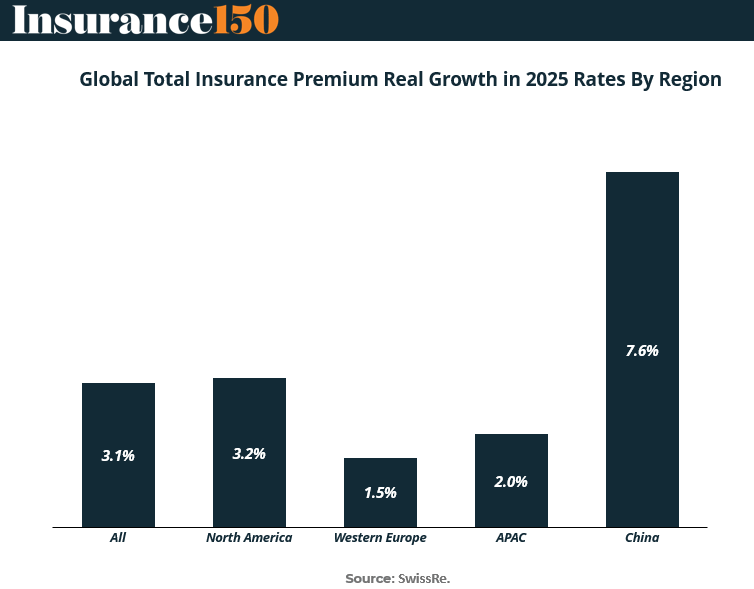

Global insurance premiums are expected to grow 3.1% in real terms in 2025, but that average hides a sharp divergence: China is projected to grow 7.6%, more than double North America (3.2%) and nearly 5x Western Europe (1.5%), according to Swiss Re.

What’s driving the surge? A mix of regulatory reforms, rising middle-class demand for health and life coverage, and digital distribution at scale. China’s state-driven financial modernization has also funneled capital into insurance as a long-term risk pooler—especially in retirement, property, and catastrophe lines.

Meanwhile, developed markets face sluggish growth amid demographic drag and mature saturation. Western Europe, in particular, is showing anemic premium expansion despite rising risks.

Why it matters: For global insurers and asset managers, China isn’t just a growth story—it’s becoming the growth story. FIG players without a China strategy (or at least an Asia hedge) risk being anchored in low-yield geographies while the insurance market rebalances eastward. (More)

MICROSURVEY

We’d like to know how your organization is adapting to the realities of climate change — which strategies are proving most effective in strengthening resilience? |

DEAL OF THE WEEK

Majesco Acquires Vitech, Creating a Next-Gen Insurance Core Tech Giant

In a major consolidation play in insurance technology, Majesco (backed by Thoma Bravo) is acquiring Vitech (backed by CVC) to form one of the largest global players in insurance core systems. The combined entity will serve 375+ insurers, spanning P&C, Life & Annuity, Health, and Pension & Retirement, with deep footprints in the U.S., Canada, and U.K.

Why this matters: Majesco is already a force in cloud-native, AI-powered core platforms. Vitech brings scale in pension and retirement, a growing market under pressure to modernize. The resulting portfolio offers AI-native capabilities across underwriting, sales, policy admin, and customer engagement—precisely where legacy insurers are feeling the most pain.

CVC will retain a minority stake, signaling long-term conviction in the platform’s upside. Both firms are betting on AI acceleration across insurance and the urgency of SaaS transitions.

For insurers and PE observers: This isn’t just a tuck-in. It’s a clear sign that core systems—once slow, rigid, and under-invested—are now ground zero for AI-driven transformation and dealmaking. (More)

INSURTECH CORNER

The Great InsurTech Recalibration

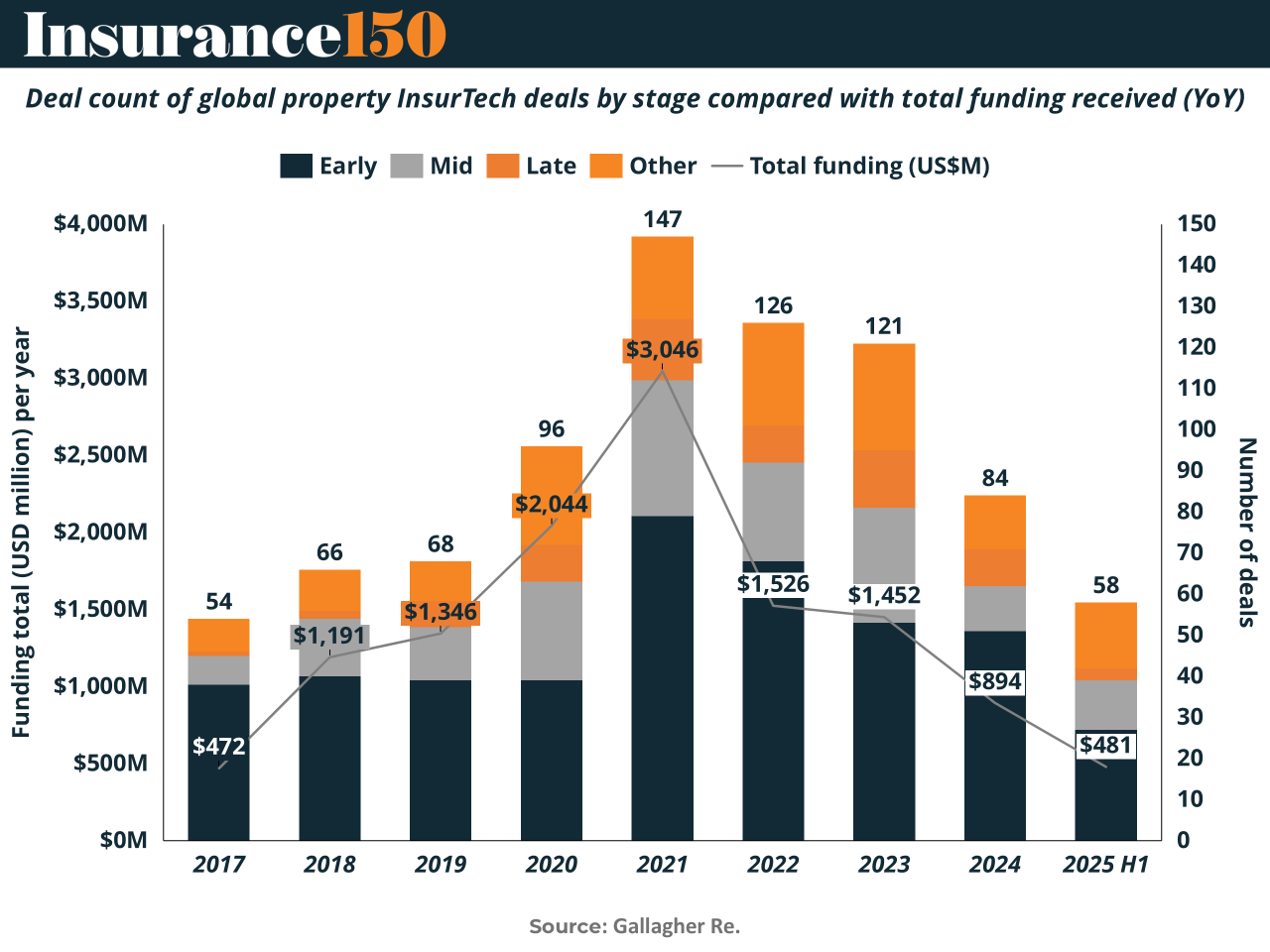

Property InsurTech continues to retrace from its 2021 peak, when funding hit $3.0B across 147 deals. Since then, the market has eased into a discipline-first cycle: 2022 dropped to roughly $2.0B, 2023 to $1.45B, and 1H 2025 sits at just $481M. Behind the decline is a wholesale reset of valuations, capital intensity, and enthusiasm for unprofitable underwriting models. But the most important shift is the quiet rise of early-stage dominance, climbing to 46% of deals in 2025. Investors are rediscovering the value of workflow automation, analytics, and IoT-driven risk tools, while mid- and late-stage rounds compress under tighter multiples. The 2021 spike now looks like a liquidity-driven outlier—today’s builders are leaner, smarter, and far more unit-economic aware. (More)

PRESENTED BY FINANCE BUZZ

Put Interest On Ice Until 2027

Pay no interest until 2027 with some of the best hand-picked credit cards this year. They are perfect for anyone looking to pay down their debt, and not add to it!

Click here to see what all of the hype is about.

MACROECONOMICS

The Two-Speed Economy

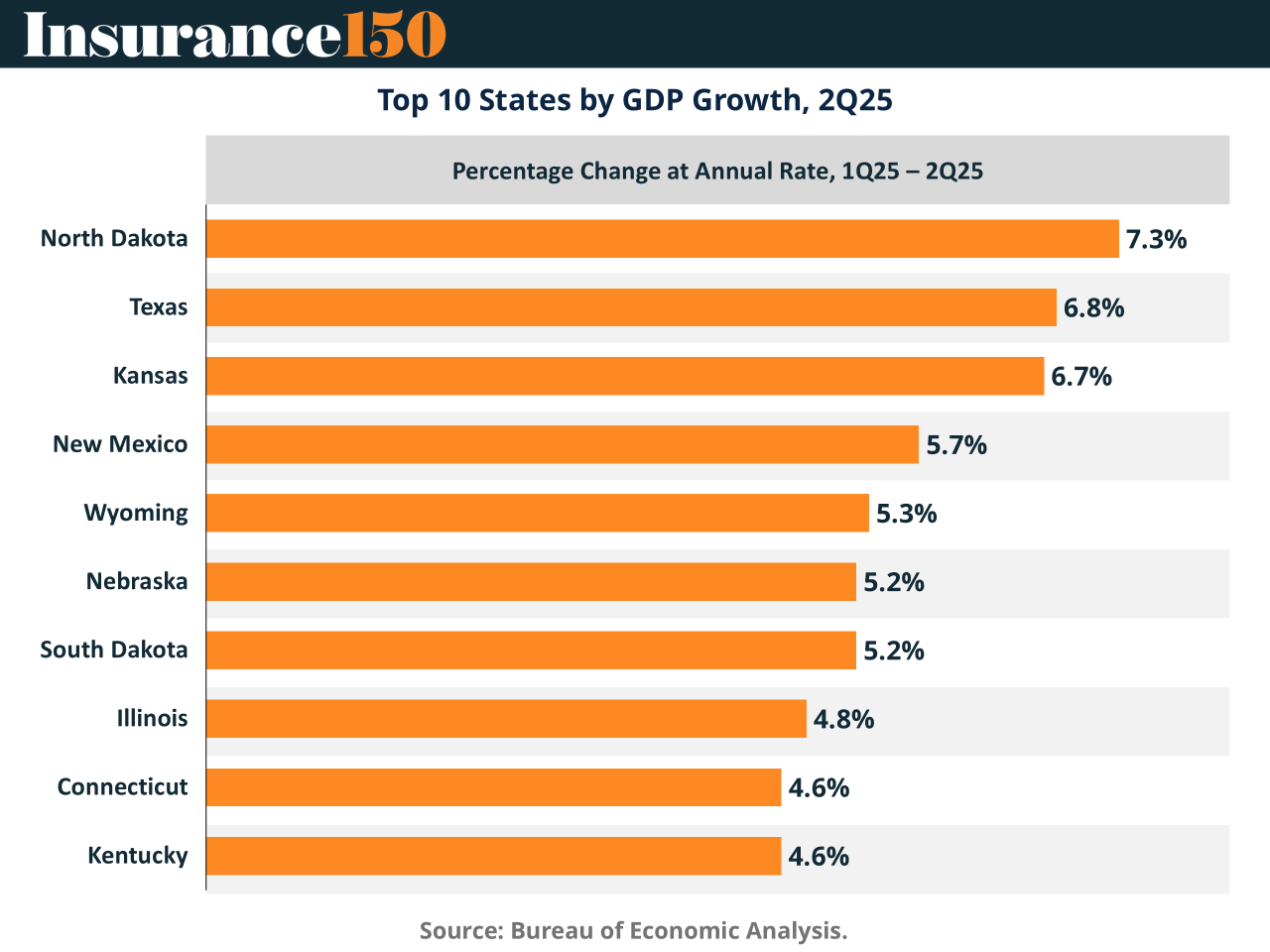

U.S. GDP rose 3.8% in Q2 2025, but this isn’t your grandpa’s recovery — it’s a bifurcated grind. North Dakota, Texas, and New Mexico are booming thanks to energy and mining, while Arkansas shrank, and the District of Columbia flatlined. The top performers? Resource hubs flush with capital and commodity tailwinds. Manufacturing led nationally, with 1.1 percentage points of growth, driven by demand for durables, reshoring, and tech upgrades. Meanwhile, retail and government lagged — a drag on portfolios tied to consumer credit, municipal debt, and small business. (More)

COMPLIANCE CORNER

Whistleblowers: InsurTech’s Surprise Regulators

Whistleblowers have quietly become one of the most potent compliance risks for insurance and InsurTech firms. With the SEC Whistleblower Program offering 10–30% awards, insiders now have strong financial incentives to escalate concerns beyond internal channels. Regulators increasingly expect robust internal reporting frameworks, especially across distributed models with MGAs, brokers, and platform partners. Meanwhile, insurance-adjacent claims are rising, including disputes over whether SOX whistleblower actions fall under D&O coverage, and a surge in ESG-related allegations tied to greenwashing. For insurers, the threat isn’t just enforcement—it’s the reputational and cross-regulatory fallout triggered by a single tip. The compliance mandate is clear: strengthen internal systems, align governance and HR, and ensure product teams understand the shifting whistleblower-driven liability landscape. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Never let the fear of striking out keep you from playing the game."

Babe Ruth