- Insurance 150

- Posts

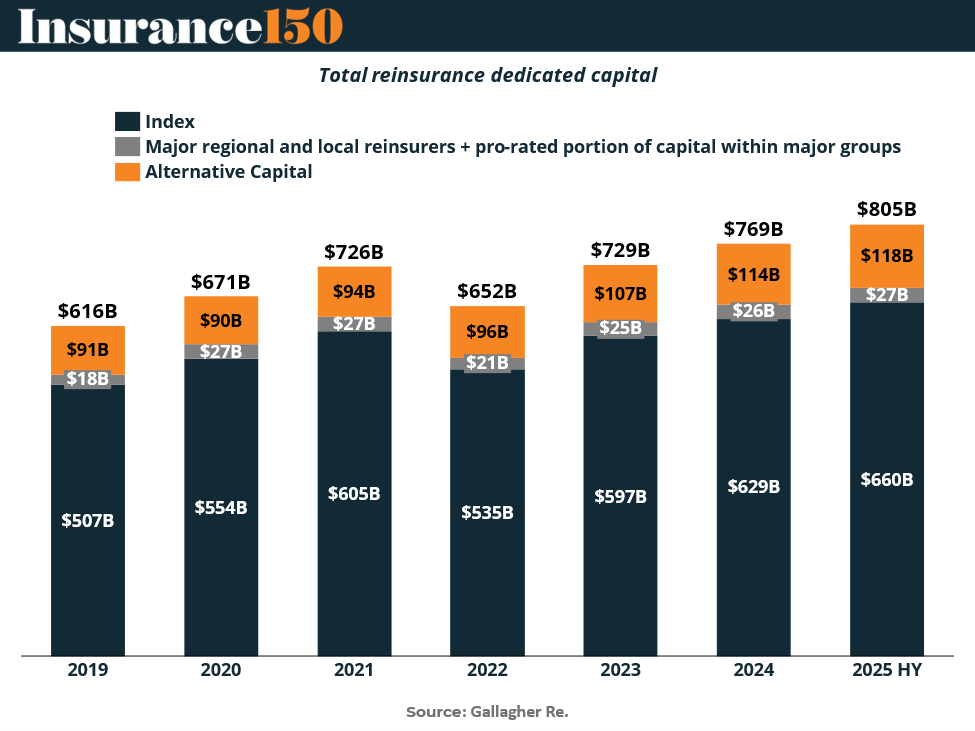

- 805B and Counting: Reinsurers Make Chaos Look Profitable

805B and Counting: Reinsurers Make Chaos Look Profitable

Reinsurers start 2025 with record capital and double-digit returns, proving that even chaos can be profitable when managed with discipline.

Good morning, ! This week we’re tracking the reinsurance sector, value that Insurtechs bring to business, total insurance premiums growth in India, and U.S private health insurance regulatory tightening.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Reinsurance’s $800B Cushion

The reinsurance sector is entering 2025 with a balance sheet that looks more like a fortress than a shock absorber. Dedicated capital hit USD 805 billion, a record high, with retained earnings doing the heavy lifting. Traditional capital sits around USD 660 billion, while alternative capital—from cat bonds to ILS funds—adds another USD 118 billion. Despite $60 billion in Q1 catastrophe losses, reinsurers still posted an 11.4% ROE, their third straight year in double digits. Even as pricing normalizes and IFRS 17 reshapes the reporting landscape, expense ratios remain lean near 28%. Translation: the industry’s getting more efficient at making money from chaos. The challenge now? Capital discipline—because when every reinsurer’s flush, underwriting judgment becomes the true differentiator.

TREND OF THE WEEK

India's Insurance Growth—More Engine, Less Drag

India’s life insurance sector stumbled through 2023 (+0.4% growth), but 2024 looks like a rebound year, with real growth forecast at 5.1%. Why the U-turn? Regulatory hangovers are easing, digital infra is maturing, and India’s middle class keeps expanding. Investment products—90% of the life pie—are back in demand. Over the next five years, life premiums are set to outpace their historical run rate by 80%. Meanwhile, non-life insurance holds its own, buoyed by health, motor, and some regulatory tailwinds (plus a cameo from cyber and surety). Just don’t expect miracles: price competition is still the buzzkill in group health and crop lines. (More)

PRESENTED BY SURF LAKES

Final Days to Invest: Every City’s a Potential Surf Destination

Topgolf revolutionized golf by turning it into a social, tech-driven game for anyone. And they’ve made billions in annual revenue doing it. Surf Lakes is applying that same model to surfing, and investors can still join them until 10/30 at 11:59 PM PT.

Their patented tech creates 2,000 ocean-quality rides per hour, anywhere in the world, across all skill levels.

It’s a $65B surf tourism market opportunity. They’ve already sold 8 tech licenses, plus their own commercial parks are underway.

3x world champ Tom Curren and surf icon Mark Occhilupo have joined as ambassadors and shareholders. Even actor Chris Hemsworth has praised Surf Lakes.

You have until October 30th at 11:59 PM PT to invest in Surf Lakes.

This is a paid advertisement for Surf Lakes’ Regulation CF offering. Please read the offering circular at https://invest.surflakes.com

MICROSURVEY

We’d like to know which aspect of climate risk is most pressing for your organization today — where do you see the greatest exposure emerging? |

DEAL OF THE WEEK

EQT’s $3.4B Bid Targets Aussie Broking Giant

Private equity giant EQT has tabled a $3.41B cash offer for AUB Group, Australia’s second-largest insurance broker, in a move that underscores the sector’s accelerating consolidation. The offer—A$45/share, a 25.1% premium—follows a previous A$43 bid and has secured a six-week exclusivity window for due diligence.

The announcement sent AUB shares up 11%, though still below the offer price—signaling either skepticism on deal closure or room for negotiation. EQT’s interest aligns with its broader push into Asia-Pacific financial services, including a recent look at Perpetual’s trust unit.

AUB, underperforming local rival Steadfast, has seen PE turnover before—Odyssey Investment Partners partially exited last year. Now, the company’s strong cash generation and stable premium flows are drawing fresh suitors amid a wave of private equity activity in ANZ financials.

Why it matters: With deal size, exclusivity, and timing all aligned, this could become 2024’s largest insurance broking buyout in the region—and a harbinger of more PE-fueled consolidation plays across global intermediaries. (More)

INSURTECH CORNER

Insurtech’s Value Equation: From Efficiency to Experience

Insurtechs have officially moved from peripheral disruptors to core enablers. According to the Insurtech Global Outlook Survey 2025, 58% of insurance leaders say improved customer experience is the top value Insurtechs deliver — signaling a clear shift from cost-cutting to client-centricity. Behind that, 49% cite new product development, and 44% highlight operational efficiency, a sign that innovation and execution are finally aligned. Interestingly, only 23% point to cost reduction, confirming that Insurtech ROI is about transformation, not trimming. The verdict: the winners won’t be the ones dabbling in digital—they’ll be the ones embedding it into the value chain from underwriting to retention. (More)

TOGETHER WITH MONEY.COM

Prepare your pet for the unexpected

Accidents and illnesses happen when you least expect them. Pet insurance makes sure you’re prepared, with coverage for emergencies, chronic conditions, and wellness visits. Enroll today and give your pet the care they deserve.

MACROECONOMICS

America's Balance Sheet Just Got Heavier

The U.S. Net International Investment Position hit –$26.14T in Q2 2025—yet another reminder that America is the world’s favorite investment asset… and borrower. What happened? Liabilities grew $4.16T, outpacing the $2.68T boost in U.S. foreign assets, driven by a rising dollar and booming U.S. equities. Blame it on equity market outperformance, exchange-rate shifts, and a big helping of foreign appetite for U.S. debt.

Foreigners keep buying; Americans keep spending. But with investment income turning negative in 4 of the last 5 quarters, the check may be coming.

A widening NIIP isn’t inherently a red flag—but it’s a flashing yellow. The deeper the U.S. relies on foreign capital, the more it needs fiscal guardrails that don’t wobble every election cycle. (More)

COMPLIANCE CORNER

Private Health Coverage: One System, Fifty States, and One Big Exception

U.S. private health insurance is a dual-regulated beast. States remain the primary enforcers, setting licensing and solvency standards, while the federal government layers on consumer protections via landmark legislation like HIPAA, ACA, and the No Surprises Act. But one statute—ERISA—quietly reorders the regulatory pecking order.

ERISA preempts state regulation for self-insured employer plans, which now cover the majority of working-age Americans. That means many federal protections don’t apply unless Congress explicitly says so. Even major ACA reforms like essential health benefits and premium rating restrictions don’t touch these self-funded plans.

Why it matters: For insurers, TPAs, and benefits consultants, regulatory exposure depends more on plan funding than state lines. Employers with multi-state workforces often choose self-insurance for uniformity and cost control—but at the cost of federal oversight gaps. Meanwhile, state regulators are left regulating fully insured group plans and individual market products—unless the federal government steps in to enforce.

Expect continued legal tension, especially as value-based care models and tax-based incentives like HSAs and ICHRAs further blur the regulatory lines. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

The size of the U.S. economy likely insulate us — that and our geographic reach — but good luck Florida.

Florida now likely bears more liability from propping up its homeowners insurance market than it carries in state debt.

— Sheldon Whitehouse (@SenWhitehouse)

9:18 PM • Oct 27, 2025

"The first step toward success is taken when you refuse to be a captive of the environment in which you first find yourself."

Mark Caine