- Insurance 150

- Posts

- AI's 30% CAGR in Insurance | North America M&A Trends

AI's 30% CAGR in Insurance | North America M&A Trends

Artificial Intelligence is reshaping efficiency and processes in the insurance industry — but are we still in the early stages, or have we already seen significant gains?

Good morning, ! This week we’re diving into the 30% annual growth of AI in the insurance Industry, 23% of Insurtech financing rounds are sized between $10 and $25M, and floating exchange markets work as a life jacket for macroeconomic storms.

Join 50+ advertisers who reach our 400,000 executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

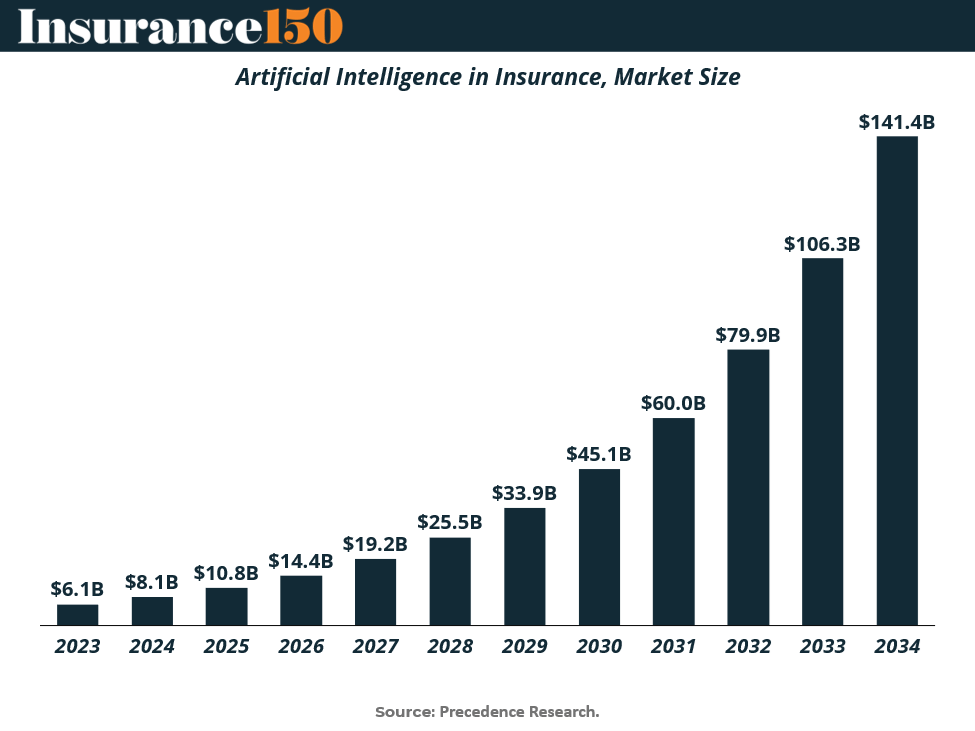

The $141B Algorithm Bet

The insurance sector isn’t experimenting with AI anymore—it’s building entire operating models around it. Valued at $6.1B in 2023, the AI in insurance market is forecasted to hit $141.4B by 2034, with North America holding a 41% share and the rest playing catch-up. Adoption is moving fast: 48% of insurers expect to actively use AI by 2025 (up from 29% in 2024). That’s not a trend—it’s table stakes.

So where’s the money going? Infrastructure first, software second. The Americas are also betting big on AI-related energy infrastructure—a subtle nod to the compute-heavy reality of generative AI. The kicker: only 10% of insurers plan to stay AI-free by next year. Translation? If AI isn’t in your 2025 budget, someone else is underwriting your clients faster.

TREND OF THE WEEK

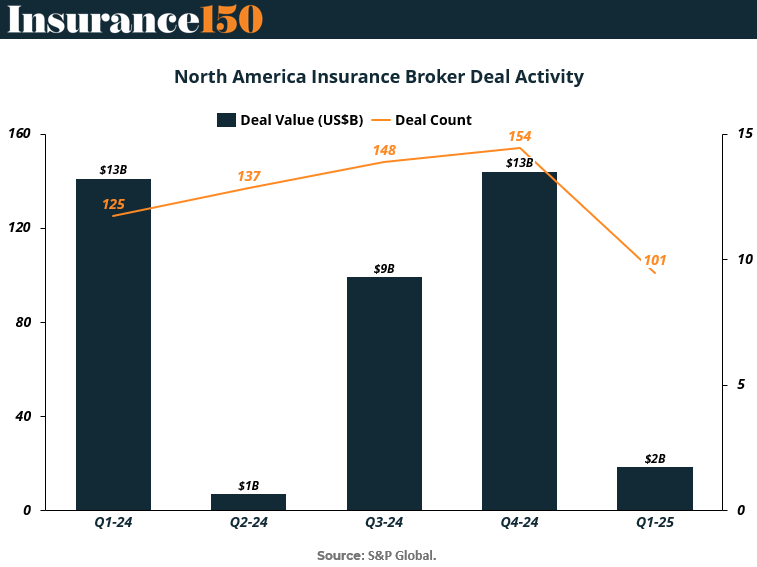

North America Insurance Broker Deal Activity

This quarter’s chart—covering Q1‑24 through Q1‑25—puts a spotlight on North America’s insurance broker M&A momentum.

Deal volume climbed steadily through 2024—from 125 deals in Q1‑24 to a peak of 154 in Q4‑24—while dollar value fluctuated, with spikes at $13 B in both Q1‑24 and Q4‑24, and a low of $9 B in Q3‑24.

In Q1‑25, both deal count and value cooled sharply: only 101 transactions, and deal value fell to just $2 B—an 84% drop from the prior quarter’s $13 B. (More)

Why it matters:

The flat-high deal value in Q1 and Q4 of last year highlights concentrated mega-deals, rather than steady mid‑market activity.

The sharp slowdown in Q1‑25 may reflect elevated interest rates, tighter capital deployment, or integration fatigue post‑2024 M&A push.

For insurers and FIG executives, this suggests a cautionary call in near-term valuation expectations—and a turning point where sellers may need to recalibrate forecasts or incentives to attract bidders.

PRESENTED BY TIMEPLAST

Former PepsiCo Exec Invented A Plastic That Dissolves in Water

If anyone knows a thing about plastic’s impact on the planet, it’s Manuel Rendon. The former PepsiCo executive and environmental engineer is using his 20 years of expertise to solve one of the world’s biggest problems with Timeplast.

Up to 450 million metric tons of plastic are wasted each year. Microplastics seep into our bodies, and mountains of bottles pile up in the ocean. But Timeplast has patented a water-soluble, time-programmable plastic that vanishes without harming the environment.

Major players are already partnering with Timeplast for its patented technology—their sales grew 6,000% in the first month.

You have just a few days left to invest as Timeplast scales in its $1.3T plastic market, from packaging to 3D printing. Become a Timeplast shareholder by midnight, 7/31.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

MARKET MOVERS

INSURTECH CORNER

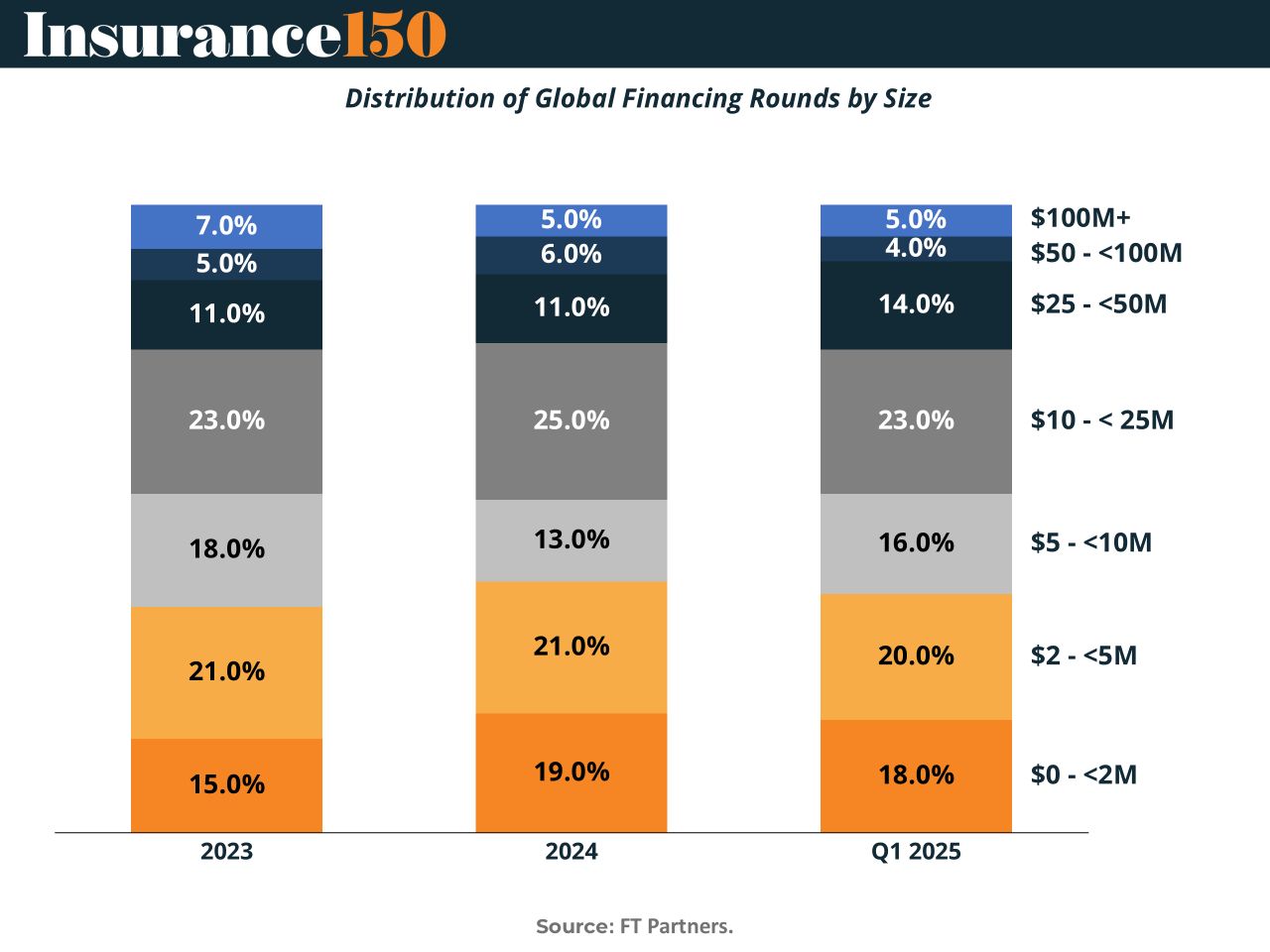

Mid-Sized Rounds Are the New Black

The $25M–$50M deal bracket is having a moment. According to FT Partners, it’s now 14% of global insurtech financings in Q1 2025 — a jump from 11% in both 2023 and 2024.

Sure, early-stage rounds (<$10M) still make up half the market. And yes, $100M+ mega-deals are rare (just 5%). But the middle tier is where the real shift’s happening.

Why it matters: Investors are signaling stronger conviction in startups that have survived the sandbox and are now proving unit economics, distribution, and defensibility.

For founders: the bar is higher, but the capital’s more available — if you can show traction.

For PE and carriers: this cohort is becoming ripe for platform tuck-ins or scale-stage bets.

Bottom line: We’re past the spray-and-pray era. Insurtech’s grown up, and the check sizes are following suit. (More)

DEAL OF THE WEEK

Insignia’s New Identity: Private & Proud

Insignia Financial, the 180-year-old Aussie wealth manager and owner of MLC, is going private via an implied enterprise value of A$3.9B (US$2.5B) acquisition by CC Capital and OneIM. The deal offers a 56.9% premium and ends a bidding brawl with Bain Capital and Brookfield, both casualties of tighter debt markets. Insignia CEO Scott Hartley—who unveiled “Vision 2030” shortly after taking the reins—calls private ownership a tactical advantage for consolidation plays. Advisors? Deutsche Bank, Macquarie, and Ashurst for CC Capital, with Citigroup, Gresham, and King & Wood Mallesons backing Insignia. If approved, this deal gives CC Capital its first major Australian foothold—and a front-row seat to the A$4.1T superannuation game. (More)

TOGETHER WITH LONG ANGLE

A Private Circle for High-Net-Worth Peers

Long Angle is a private, vetted community for high-net-worth entrepreneurs, executives, and professionals across multiple industries. No membership fees.

Connect with primarily self-made, 30-55-year-olds ($5M-$100M net worth) in confidential discussions, peer advisory groups, and live meetups.

Access curated alternative investments like private equity and private credit. With $100M+ invested annually, leverage collective expertise and scale to capture unique opportunities.

MACROECONOMICS

Floating Isn’t a Luxury—It’s Lifesaving

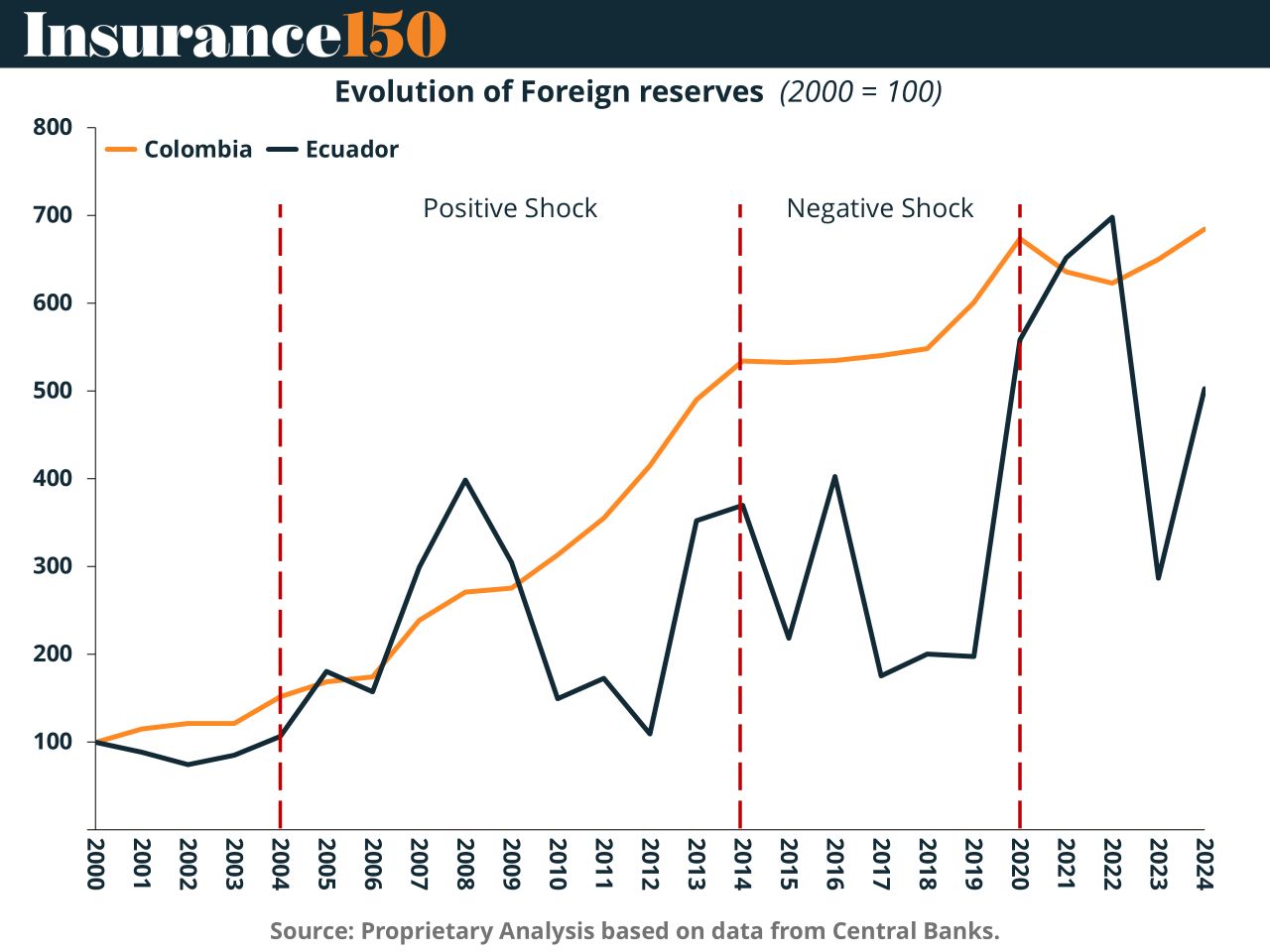

Economists love models. But Colombia and Ecuador just gave us a real-world exhibit. Two oil-heavy economies. One (Colombia) floats. The other (Ecuador) doesn’t. When oil crashed, Colombia let its currency adjust. Ecuador had to torch reserves, jobs, and long-term productivity. The data’s blunt: Fixed regimes push pain into the real economy. Floating? It absorbs the impact of the shock. The bottom line: the world is unpredictable and volatile, so you better be importing flexibility. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

🚨Update: President Trump says that the interest rate should be lower to 1%

— The Calvin Coolidge Project (@TheCalvinCooli1)

10:41 PM • Jul 23, 2025

"The more I lose, the more they believe they can beat me. But believing is not enough, you still have to beat me."

Roger Federer