- The Deal Brief - Insurance

- Posts

- From -36% to +24%: The Great Divergence in Insurance Stocks

From -36% to +24%: The Great Divergence in Insurance Stocks

Insurance is splitting fast—property rises, health stumbles, and AI-driven precision reshapes how risk, capital, and deals get done.

Good morning, ! This week we’re unpacking the great divide across insurance markets—as health and insurtech names slump, property players quietly rally. Deal-making friction is emerging inside leadership teams, the EU tightens distribution rules, and parametric insurance races toward a $40 B market. Meanwhile, AI accuracy has become the industry’s new currency, and one deal—White Mountains’ $1.75 B Bamboo flip—shows that speed and precision still pay off.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

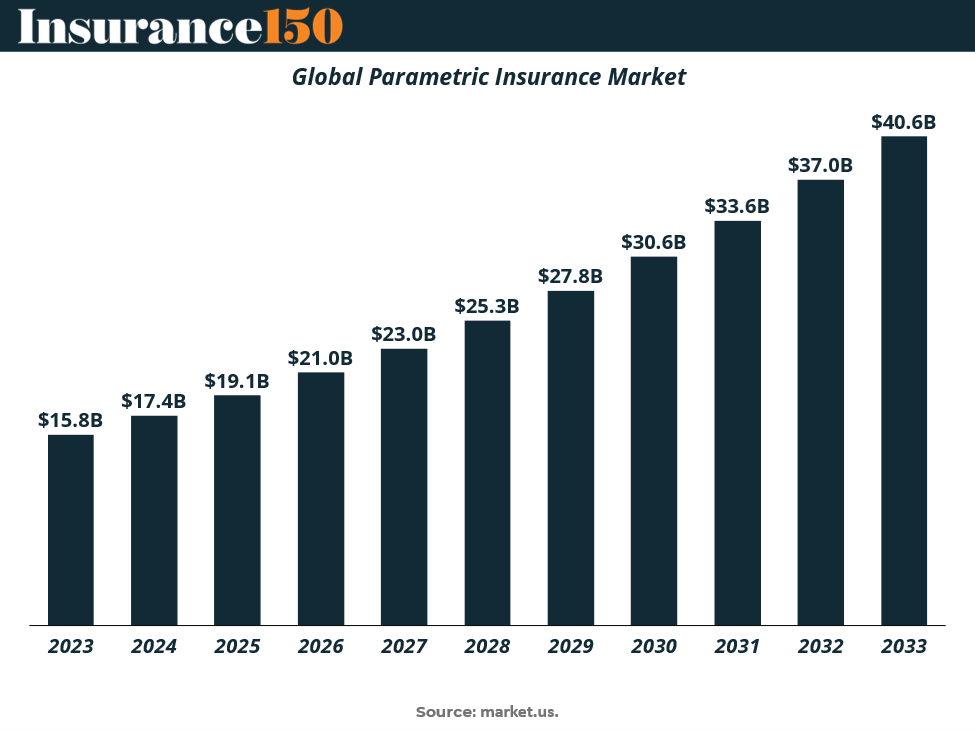

The $40B Trigger

Parametric insurance is moving from quirky pilot projects to a $40.6B global market by 2033. Unlike traditional indemnity models, parametric products don’t waste time arguing over damage assessments—they just measure the trigger (wind speed, rainfall, quake magnitude) and pay out. That speed is proving irresistible to governments (40% of buyers) and corporates (50%) who need instant liquidity after climate shocks. The biggest hurdle? Basis risk—when payouts don’t quite match real-world losses. But with smart contracts on blockchain expected to hit $25.6B by 2034, automation is shrinking both delays and disputes. In short: insurers aren’t just hedging risk anymore—they’re coding it.

TREND OF THE WEEK

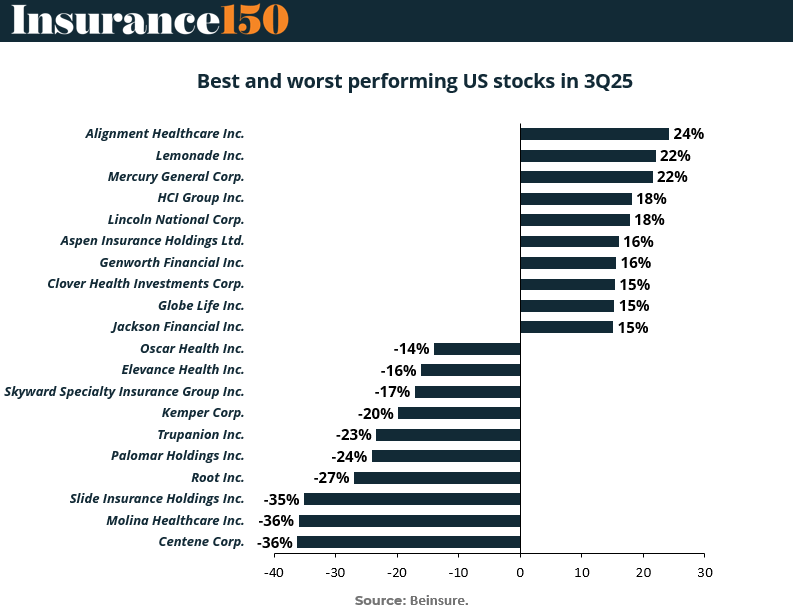

The Great Divergence: Health vs. Property Insurers

Q3 delivered a stark split in insurance equities. Health and tech-driven insurers took a beating—Centene (-36.2%), Molina (-36.0%), and Slide Insurance (-35.1%) led the bottom tier, while insurtechs like Trupanion (-23.4%) and Root (-27.0%) weren’t spared either.

On the flip side? Mid-cap property and specialty players staged a quiet rally. Alignment Healthcare (+24.2%), Mercury General (+21.5%), and HCI Group (+18.1%) all posted double-digit gains. Even legacy life insurer Lincoln National (+17.8%) clawed back relevance.

What’s driving the divide? A cocktail of rising claims costs, regulatory noise, and earnings resets are haunting health names. Meanwhile, property insurers are riding premium hikes, cleaner balance sheets, and a relatively quiet hurricane season (so far).

For PE and strategic investors, the signal is clear: underwriting volatility is back in fashion—and Q4 could widen the gap. (More)

PRESENTED BY MISO ROBOTICS

Jeff Bezos Says This New Breakthrough is Like “Science Fiction”

He called it a “renaissance.” No wonder ~40,000 people backed Amazon partner Miso Robotics. Miso’s kitchen robots fried 4M food baskets for brands like White Castle. In a $1T industry with 144% employee turnover, that’s big. So are Miso’s partnerships with NVIDIA and Uber. Initial units of its newest robot sold out in one week. Invest before Miso’s bonus shares change on 10/9.

This is a paid advertisement for Miso Robotics’ Regulation A offering. Please read the offering circular at invest.misorobotics.com.

MICROSURVEY

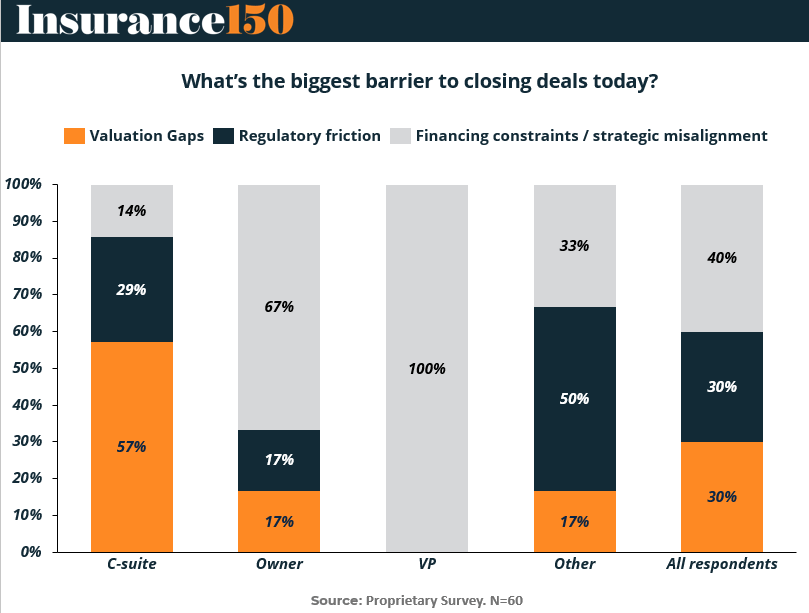

Deal‑making’s Blockers — What Executives Say

A recent proprietary micro‑survey of 60 industry leaders reveals sharp divergence in how deal impediments are perceived across the leadership hierarchy. The biggest surprise: financing constraints / strategic misalignment dominate for senior VPs, while valuation gaps loom largest for C‑suite respondents.

Why it matters

Deals don’t die for the same reasons at every level. Insurtech CEOs and C‑suite executives blame valuation arbitrage most — 57 % of them place it at the top. But among VPs, 100 % point to financing or alignment issues. That signals a breakdown not in deal structure, but in execution. The senior team is pushing for premium multiples; those two or three steps down see no way to bridge financial or strategic gulf. Without telling the ground team how to operationalize, deals stall.

What to watch

Bridging the valuation-to‑execution gap will require tools and playbooks, especially around earnouts, milestone-based payments, or de‑risking instruments

Strategic alignment must be iterated downward — explaining how deal targets slot into execution realities

Governance and diligence frameworks may need recalibration so that VPs feel empowered rather than hand‑tied

This split in perceptions is a red flag: either the leadership is insulated from how deals are closed in reality, or junior levels lack visibility into strategic value drivers. Either way, meaningful friction is built into the hierarchy. (More)

DEAL OF THE WEEK

Bamboo Bombshell: White Mountains Flips a $300M Bet into $1.75B Payday

White Mountains Insurance pulled off a classic private equity-style flip—just nine months after buying Bamboo Insurance for ~$300M, it’s selling a controlling stake to CVC Capital Partners at a $1.75B valuation. The move nets White Mountains $840M in cash and a $310/share book value bump, while still retaining a 15% stake worth $250M. Bamboo, founded in 2018 by John Chu, rode California's wildfire chaos into national expansion. Premiums doubled under White Mountains’ brief watch, hitting $484M in 2024. For CVC, it’s recurring revenue gold. For everyone else, it’s a masterclass in short-hold alpha. (More)

INSURTECH CORNER

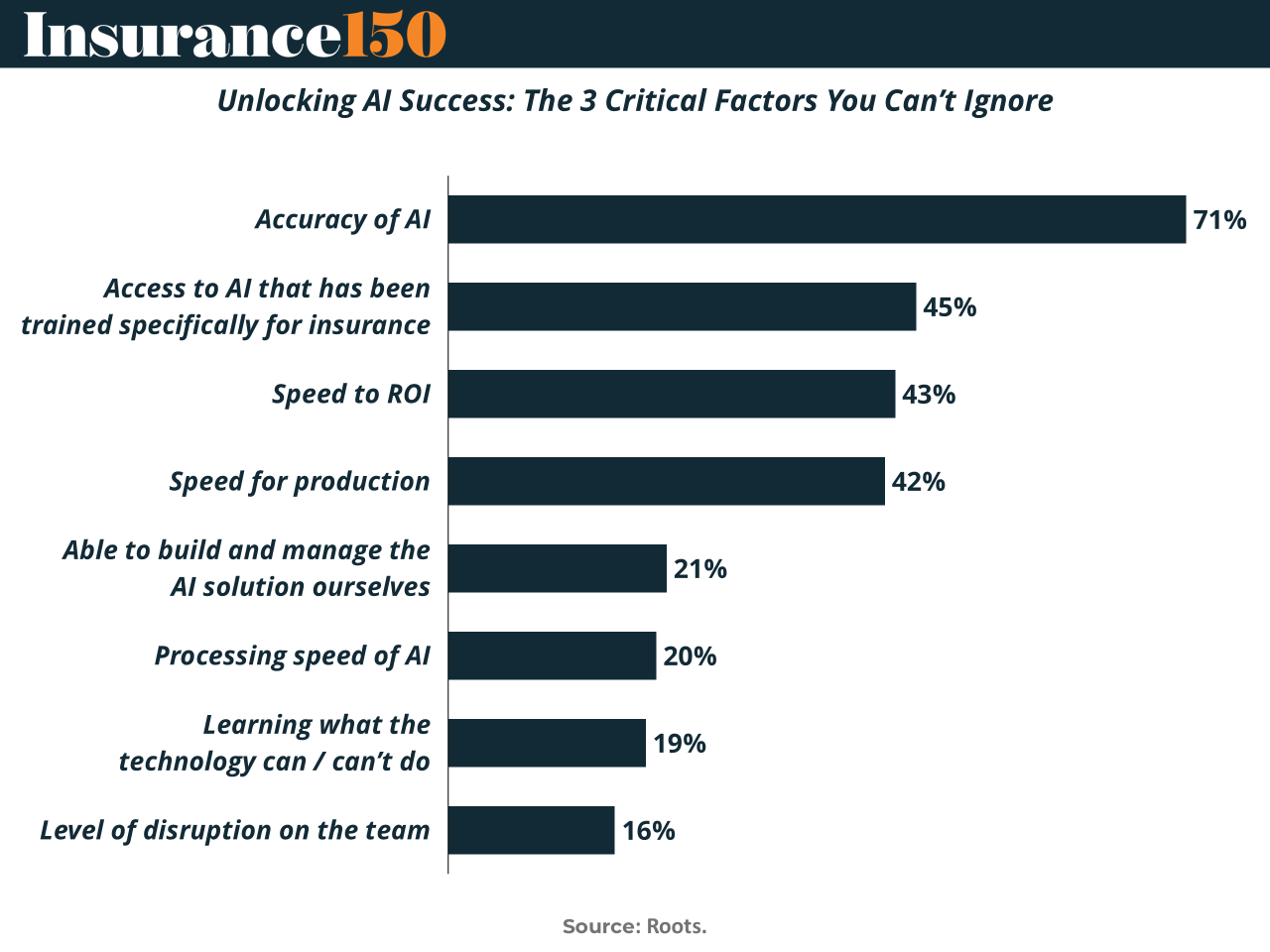

Accuracy is the Killer App

In insurance, AI accuracy isn’t just table stakes—it’s the whole casino. A recent survey shows 71% of industry leaders put accuracy as the top driver of AI success. No surprise: miss the mark in underwriting or claims, and you’re not just losing money—you’re losing trust. Next up, insurance-trained AI (45%), because generic models are like hiring a general contractor to do heart surgery. Other factors—speed to ROI (43%) and speed to production (42%)—matter too, but mostly in the “how fast can I show my CFO this isn’t vaporware?” category. Interestingly, internal capabilities (21%) trail behind, showing insurers are still leaning on outside vendors. The takeaway: those who marry accuracy, domain expertise, and rapid deployment will be the real winners of InsurTech’s AI wave. (More)

TOGETHER WITH COW SWAP

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

MACROECONOMICS

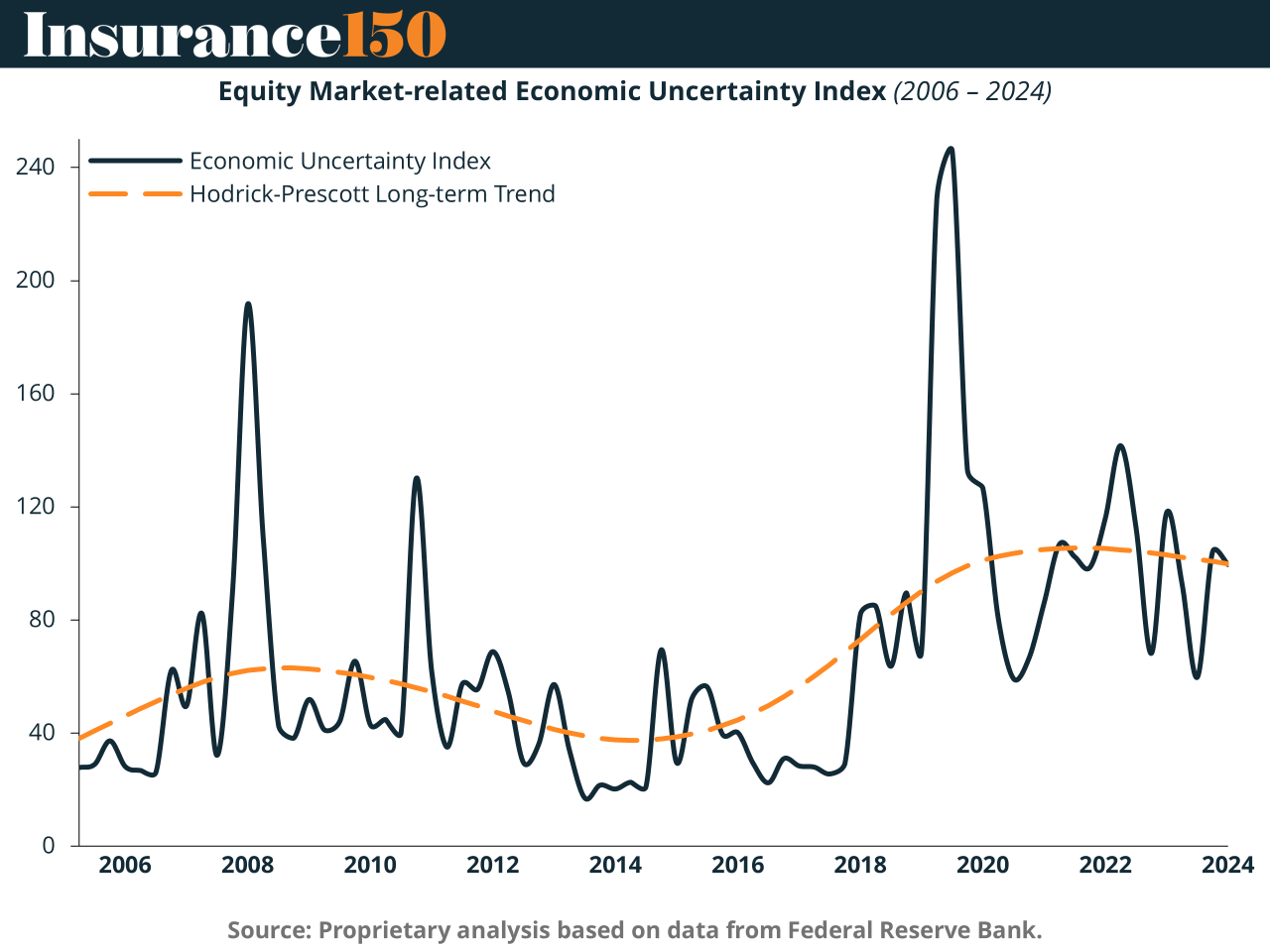

Macro Volatility: The Silent Killer in Your IRR

Volatility isn't just a market mood—it’s a wealth destroyer, quietly compounding losses across portfolios. The latest data show that public markets, with their liquidity and transparency, react violently to shifts in the 10Y yield—with the NASDAQ 100 clocking a sensitivity of −0.5706. In contrast, middle-market private equity is only half as reactive, with a coefficient of −0.2307. That’s not just insulation—it’s armor. Structural illiquidity, long holding periods, and negotiated valuations allow PE to ride out macro chaos without panic selling. As uncertainty grows, so does the case for capital staying private. The message? In this market, patience beats panic—and structure beats sentiment. (More)

COMPLIANCE CORNER

IDD: The EU’s Rulebook for Selling Insurance

The Insurance Distribution Directive (IDD) isn’t just Eurocratic alphabet soup—it’s the operating manual for selling insurance across the EU. In force since 2018, this minimum harmonizing directive sets a baseline for how insurance products are sold, focusing on consumer protection and cross-border clarity. Think: mandatory disclosures, product governance, and yes, sanctions if you mess up.

Of note: The Insurance Product Information Document (IPID) is now standard for non-life policies, bringing summary boxes and clear language to an industry long known for dense legalese. And while EIOPA doesn’t hand out gold stars, it does publish market structure evaluations and annual reports on administrative penalties.

Bottom line: If you’re distributing insurance in the EU and haven’t refreshed your IDD playbook recently, you might already be noncompliant. And in Brussels, ignorance isn’t bliss—it’s a sanctionable offense. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Insurance is all about data", this is what one can hear from incumbents.

→ linkedin.com/posts/florian-…

A few days , ideas were raised to remove tech giants from FIDA (a European framework to shape data sharing in Financial Services).

— Florian Graillot (@FGraillot)

8:02 AM • Sep 29, 2025

"The secret of business is to know something that nobody else knows."

Aristotle Onassis