- Insurance 150

- Posts

- Inside the $139.7B Microinsurance Boom — Are You Missing Out?

Inside the $139.7B Microinsurance Boom — Are You Missing Out?

Microinsurance has evolved from niche to global force, powered by digital access and financial inclusion. A fast-growing market redefining economic protection worldwide.

Good morning, ! This week we’re diving into the $139.7B space of Microinsurance, 43% of Insurance senior management believe that Reputational Risk is the biggest exposure in climate risk-related pressure, Philadelphia Insurance Companies Acquires Ignyte’s Collector Vehicle Division in $615 Million Deal.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

From Pennies to Protection

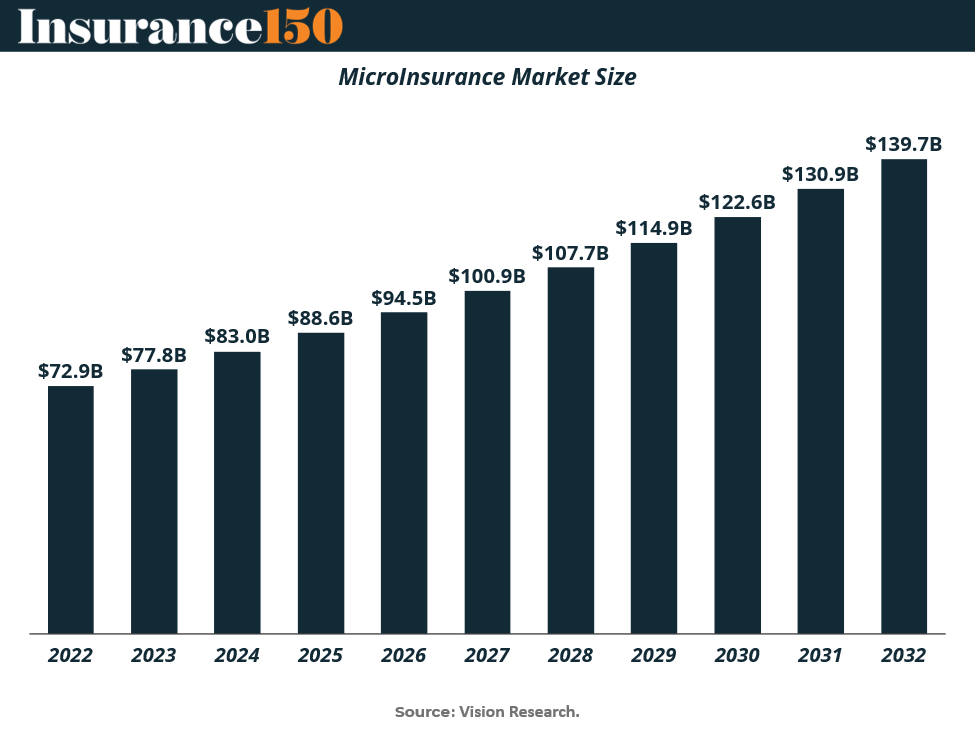

Microinsurance has quietly become the insurance world’s best-kept growth story. Once a niche product for low-income households, it’s now a $77.8B global market projected to reach $139.7B by 2032. The acceleration comes from a perfect storm: digital onboarding, mobile wallets, and regulator-backed platforms like India’s Bima Sugam, where every policy lives in a single digital vault.

The partner–agent model dominates — local cooperatives and microfinance institutions act as trusted bridges for customers who don’t trust traditional banks. Meanwhile, parametric insurance is rewriting the payout playbook: no paperwork, no delays, just a trigger and a transfer. In a world where a flood or hospital visit can upend livelihoods, microinsurance isn’t small at all — it’s the biggest thing to happen to small policies.

TREND OF THE WEEK

Rate Relief Arrives — But at What Cost?

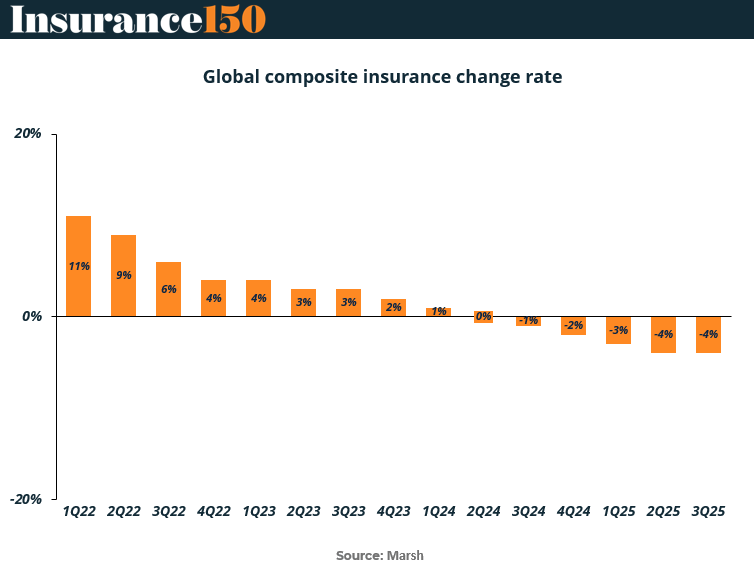

After three years of steep premium hikes, the commercial insurance market is officially softening. According to Marsh’s Global Insurance Market Index, global commercial renewal rates flipped negative in Q3 2024 (-1%), and the decline accelerated to -4% by Q3 2025. The shift follows a steady deceleration: from +11% in Q1 2022 to flat by mid-2024, before turning into outright rate compression.

The driver? Surging insurer capacity and intensified competition among underwriters. A benign CAT season and favorable reinsurance pricing have also added fuel, making insurers more willing to negotiate on both pricing and terms.

But don’t mistake softness for safety. Margins are tightening, especially in long-tail lines. And while global property and D&O saw meaningful rate drops, casualty lines remain stubbornly hard in key regions, with insurers pricing in legal system risk and social inflation.

For PE owners and CFOs, this is an opportune window to revisit captive strategies or negotiate multi-year renewals. For insurers, it’s a signal: the days of riding rate momentum are over. Profit will now hinge on precision, not pricing power. (More)

PRESENTED BY RAD INTEL

From MGM to F1 — This AI Runs It All (and It’s Still Early). RAD Intel at Just $0.81/Share.

Trillions are wasted on ads every year that no one ever sees. The truth is, most brands vanish in the noise. A new AI disruptor is helping Fortune 1000 companies break through and connect with the audiences that actually drive growth.

RAD Intel is an AI intelligent platform that:

Features award-winning technology driving 4,900% valuation growth in just four years*.

Has attracted 10,000+ investors, including insiders from Google, Amazon, Meta, and YouTube.

Delivers results through a proprietary AI platform trusted by a who’s-who roster of Fortune 1000 clients and agency partners across brands like F1, P&G, Porsche, L’Oréal, Sephora, the World Cup, Nissan & more.

Has doubled sales contracts in 2025 vs. 2024, demonstrating clear, measurable traction. Recently reserved a Nasdaq ticker ($RADI), signaling commitment to the next stage of growth. Investors can still buy in at $0.81/share—but not for long. Don’t miss your chance to own the AI-decision layer powering the world’s biggest brands.

MICROSURVEY

Transition Risk Takes the Throne

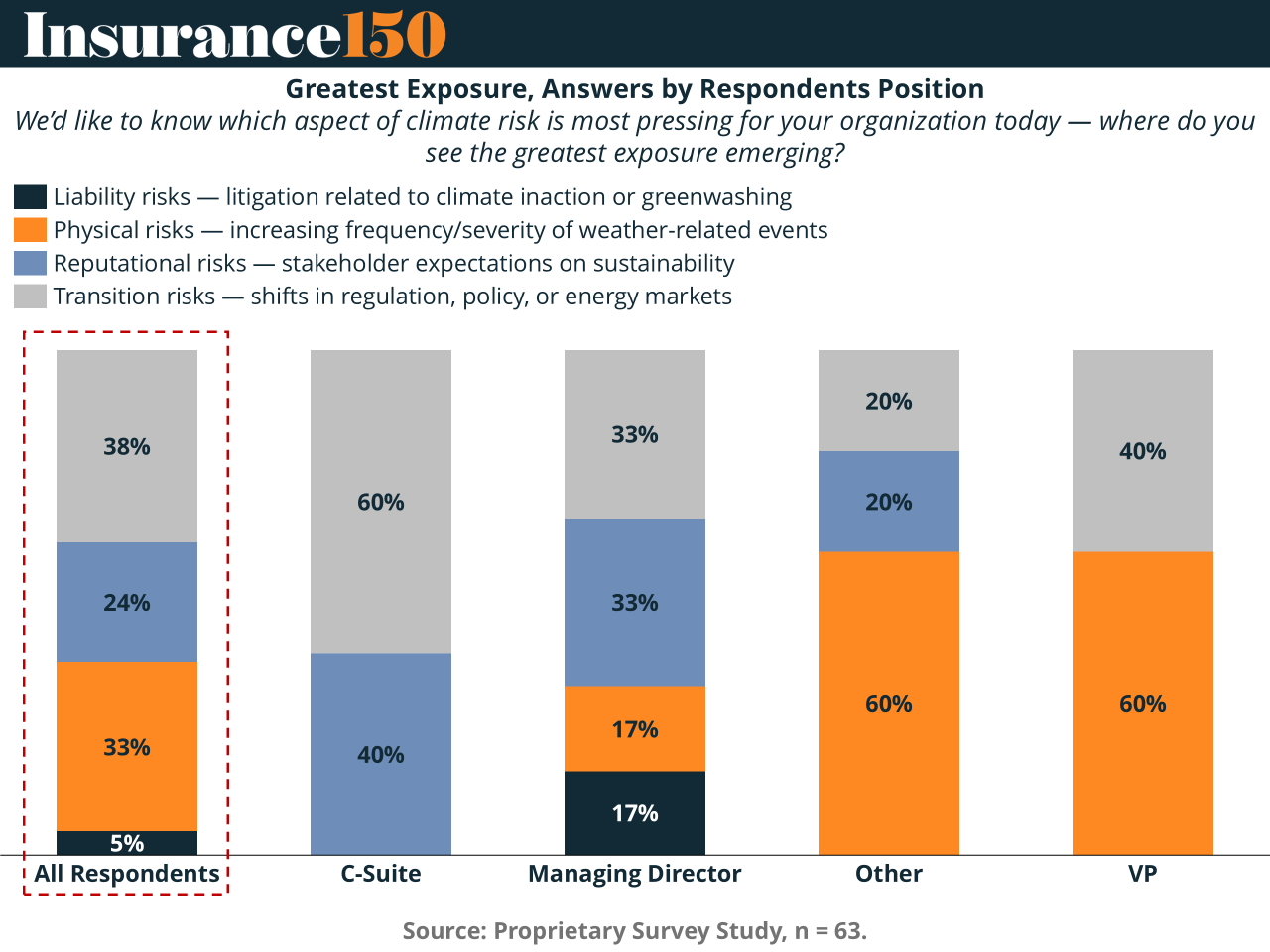

Insiders aren't sweating floods. They're sweating frameworks. Our latest microsurvey shows 60% of C-Suite leaders see transition risk—the regulatory, policy, and market shifts around decarbonization—as their biggest climate exposure. Meanwhile, VPs worry most about getting literally stormed: 60% flagged physical risk. Insurers leaned into reputation, investors hedged with physical, and bankers split the bill down the middle. Only 5% named liability risk, which suggests litigation is still seen as background noise. But don’t get comfortable. As we move deeper into mandatory disclosures (IFRS S2, CSRD), transition planning is becoming existential, not optional. TLDR: The storm is strategic, not meteorological. (More)

DEAL OF THE WEEK

Philadelphia Insurance’s $615M Collector Car Coup

Philadelphia Insurance Companies (PHLY) just parked a $615 million collector’s item in its portfolio: the Collector Vehicle Division of Ignyte Insurance, including four leading brands like J.C. Taylor and Heacock Classic. The move revs up PHLY’s footprint in specialty and vintage auto coverage, while also adding 250 employees and a coast-to-coast client base. Ignyte, backed by Carlyle, is ditching chrome for clicks—now laser-focused on D2C and embedded insurance plays. Call it the graceful trade-in: nostalgia on wheels for a future running on APIs. For PHLY, this isn’t just a bolt-on—it’s a full engine swap. (More)

INSURTECH CORNER

Property InsurTech’s 200x Decade: From Storms to Sustainability

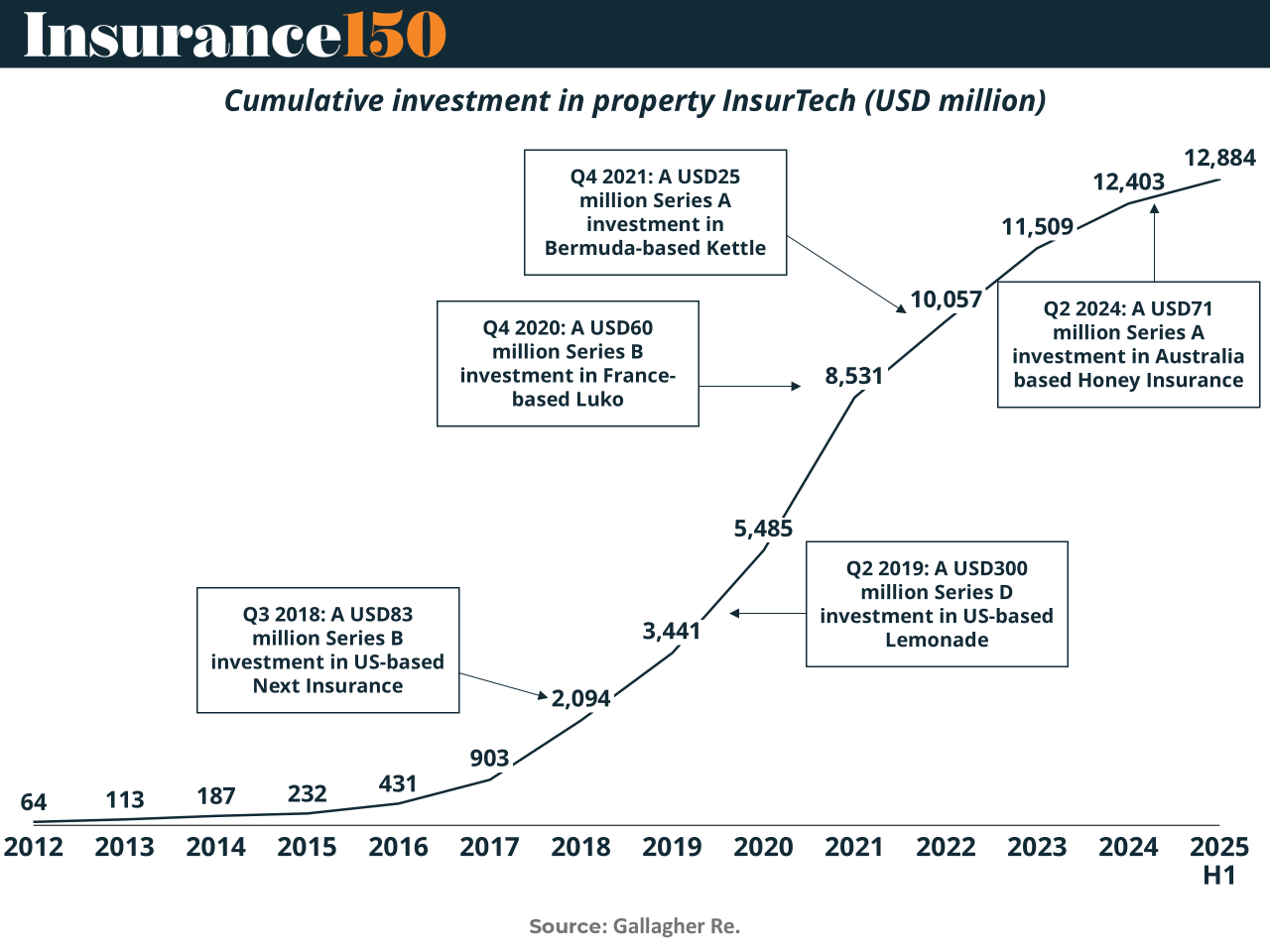

In 2012, Property InsurTech was barely a blip at $64M in funding. By mid-2025, it’s a $12.9B juggernaut. The journey—spanning digitized underwriting, global expansion, and AI-fueled risk modeling—reads like a Silicon Valley startup script with actuarial tables.

After a 2021 funding peak, investors pivoted from “growth” to grit, backing firms like Honey Insurance and Kettle focused on climate resilience and embedded distribution.

The sector’s new KPI? Sustainable value creation. With climate volatility rising, the winners will be those who use data, IoT, and parametric models to predict—not just insure—disaster. (More)

TOGETHER WITH MONEY.COM

Get in on the markets before tech stocks keep rising

Online stockbrokers have become the go-to way for most people to invest, especially as markets remain volatile and tech stocks keep driving headlines. With just a few taps on an app, everyday investors can trade stocks, ETFs, or even fractional shares—something that used to be limited to Wall Street pros. Check out Money’s list of top-rated online stock brokerages and start investing today!

MACROECONOMICS

Rate Cuts and Trade Truces: Macro’s Mixed Signals

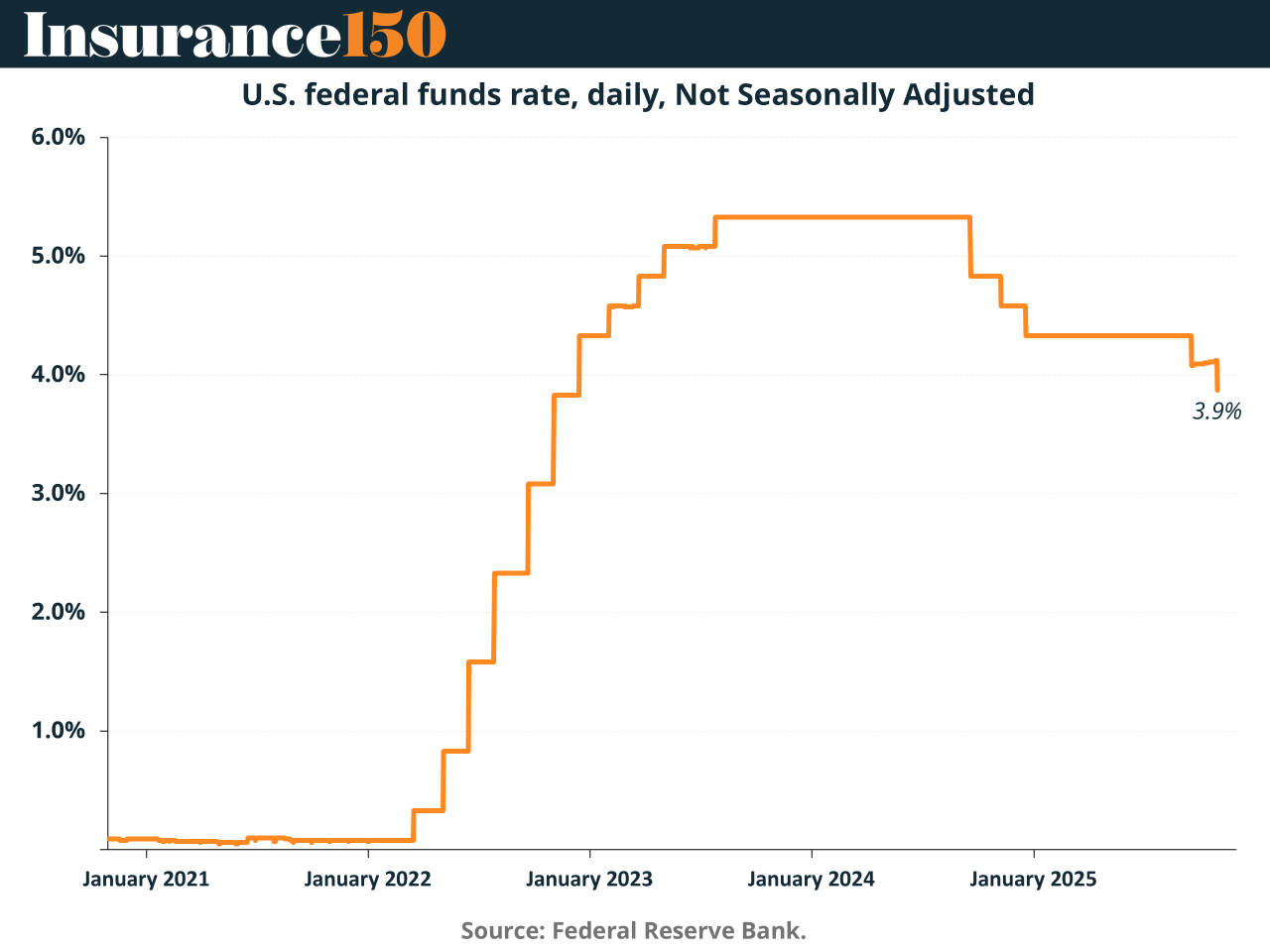

Two moves, one theme: strategic ambiguity. The Federal Reserve just cut rates to 3.75–4.00%, but Chair Powell admits they’re “flying blind” thanks to a data drought from the shutdown. Meanwhile, the U.S.–China truce looks more like détente than resolution. Both are classic game-theory plays: the Fed signaling without full information; China and the U.S. entering a fragile Nash equilibrium that could collapse with one misstep. For PE investors, this is borrowed time—rate relief may not last, and trade calm is temporary. Credibility is the new currency. Misread the signal, and you're pricing deals in the fog. (More)

COMPLIANCE CORNER

Climate Disclosure Rules Go from Reporting to Liability

Climate transparency is no longer a branding exercise — it’s a compliance obligation. With the SEC’s Climate Disclosure Rule and the EU’s CSRD entering enforcement, insurers face a new reality: every emissions figure and climate-risk statement now carries legal exposure.

Climate reporting has effectively become financial reporting. Incomplete data or weak methodologies can trigger audit issues, shareholder suits, or regulatory penalties. The challenge: aligning actuarial, investment, and underwriting data under assurance-grade standards.

What once sat with sustainability teams is now owned by finance and risk. Regulators are clear — if you disclose, you’re accountable. For insurers managing climate-exposed portfolios, even small gaps in Scope 3 data or catastrophe modeling can become liabilities.

Bottom line: In 2026, compliance means proof, not promises. Insurers that embed climate disclosure into their governance and control systems will set the standard — everyone else will be playing defense. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

JUST IN: 🇺🇸 Federal Reserve cuts interest rates by 25 bps, signals to end quantitative tightening on December 1st.

Fed Chair Jerome Powell says President Trump's (tantrum) tariffs are causing "higher overall inflation."

— Megh Updates 🚨™ (@MeghUpdates)

7:21 PM • Oct 29, 2025

"To be successful, you have to have your heart in your business, and your business in your heart."

Thomas Watson, Sr.