- Insurance 150

- Posts

- Insurance M&A: From Scale to Precision

Insurance M&A: From Scale to Precision

The insurance mergers and acquisitions market is once again commanding attention, but the forces shaping today’s deal environment bear little resemblance to those that defined prior cycles.

1. Introduction

Where earlier waves of insurance M&A were dominated by scale-driven rollups, geographic expansion, and premium accumulation, the current market is marked by a far more selective and strategically fragmented approach. Buyers are no longer pursuing growth for growth’s sake. Instead, transactions are increasingly driven by targeted capability acquisition, underwriting specialization, digital enablement, and capital optimization.

This shift reflects the cumulative impact of several years of structural change within the insurance sector. Loss cost inflation, reinsurance volatility, persistent capital scrutiny, and evolving regulatory regimes have fundamentally altered how insurers evaluate risk and growth. At the same time, rising interest rates and tighter financing conditions have introduced a new level of discipline into dealmaking, forcing buyers and sellers alike to reassess valuation expectations, integration feasibility, and post-close execution certainty. The result is an M&A market that is active, but far more deliberate.

Insurance companies today operate in an environment where differentiation matters more than size. Specialty underwriting expertise, proprietary data, distribution efficiency, and technology-enabled operating leverage have become critical determinants of long-term value creation. These realities are reshaping acquisition strategies across carriers, brokers, managing general agents (MGAs), and insurtech platforms. Rather than pursuing broad horizontal consolidation, many acquirers are selectively targeting assets that strengthen specific lines of business, enhance digital infrastructure, or improve capital efficiency.

Private equity continues to play a central role in this evolution. While sponsor activity moderated during periods of heightened rate volatility, financial investors remain highly active in insurance, drawn by its durable cash flows, fragmentation, and opportunities for operational improvement. With substantial dry powder still available and increasing pressure to deploy capital, financial sponsors are exerting meaningful influence on deal structures, valuation discipline, and competitive dynamics. However, PE-driven transactions are increasingly focused on defensible niches rather than broad roll-ups, reinforcing the market’s pivot toward precision.

Importantly, the insurance M&A landscape is no longer unified around a single dominant thesis. Instead, it is characterized by internal divergence within organizations. Executive leadership, operational teams, financial sponsors, and founders often approach transactions from fundamentally different vantage points, prioritizing different objectives and perceiving different risks. These internal misalignments have meaningful implications for deal execution, valuation negotiations, and integration outcomes.

This report examines the current state of insurance M&A through multiple lenses: macroeconomic and market conditions, recent transaction activity, leadership sentiment, and forward-looking expectations. Drawing on proprietary Microsurveys, observed deal trends, and recent market developments, it explores how insurance dealmaking is evolving from a scale-centric model to one defined by strategic precision. As the industry enters its next phase of consolidation, success will belong not to the biggest acquirers, but to those with the clearest strategic intent and the discipline to execute against it.

2. Current Environment: Macro Conditions and Market Activity

The broader macroeconomic backdrop continues to exert a powerful influence on insurance M&A. While inflationary pressures have moderated from their recent peaks, interest rates remain elevated relative to the ultra-low environments that fueled prior deal cycles. This has materially altered acquisition economics, increasing the cost of leverage and placing greater emphasis on free cash flow generation, underwriting profitability, and capital efficiency. Buyers are increasingly focused on assets that can deliver near-term earnings accretion or structural improvements rather than speculative growth.

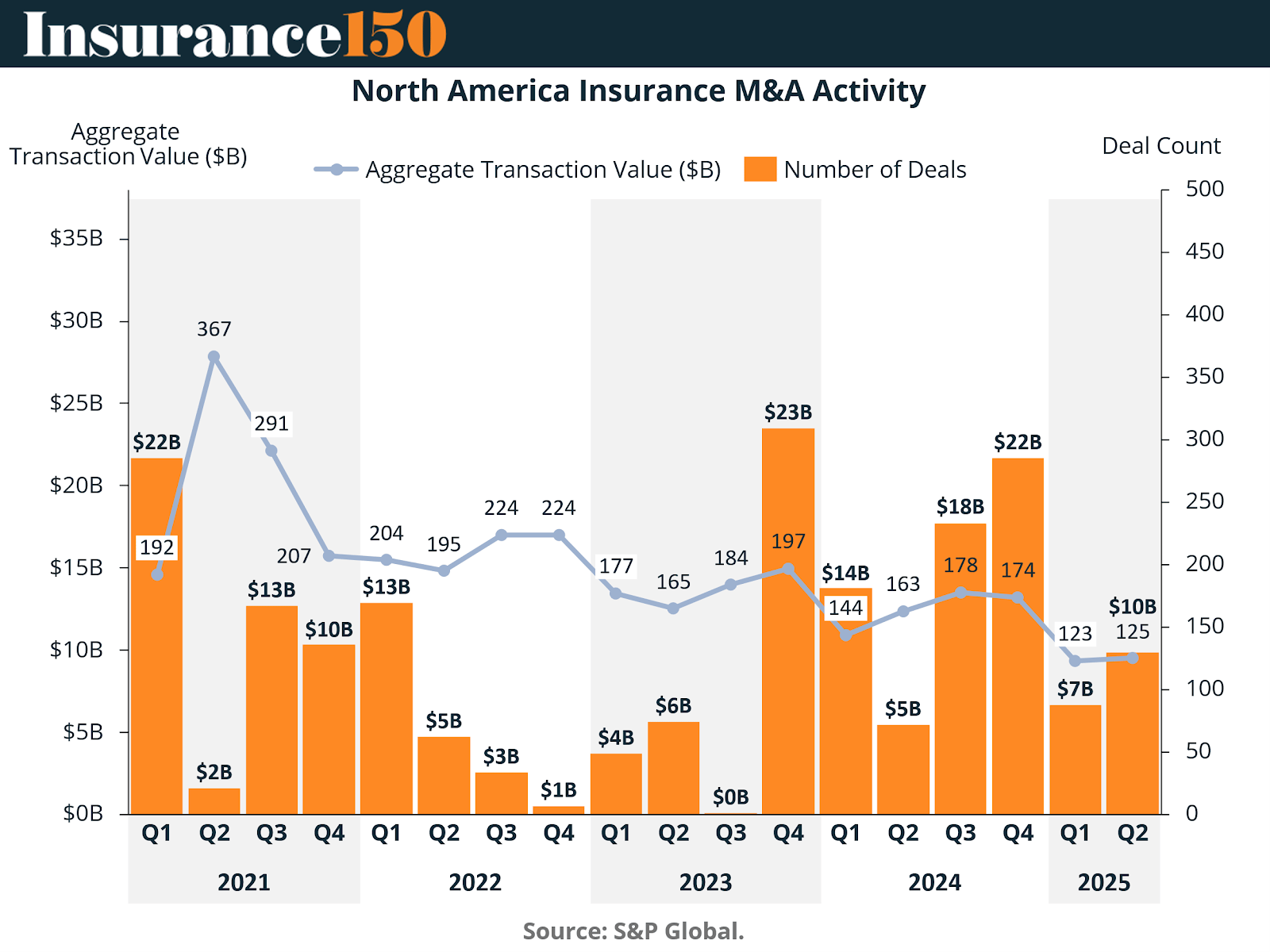

Despite these headwinds, insurance M&A has demonstrated relative resilience compared to other sectors. Deal activity has remained stable, even as broader corporate M&A markets have experienced periods of contraction. This stability reflects the defensive characteristics of insurance businesses and the sector’s attractiveness to long-term capital. However, stability does not imply uniformity. Aggregate deal values have been increasingly skewed by a small number of large transactions, while underlying deal counts suggest a market that is active but cautious.

Recent North American activity illustrates this dynamic clearly. Transaction volumes have remained broadly consistent quarter-over-quarter, but aggregate deal values have fluctuated significantly based on the presence or absence of large, transformative deals. In particular, high-value broker transactions have had an outsized impact on total deal value, masking a more moderate level of activity beneath the surface. This pattern underscores the bifurcation between headline transactions and the steady flow of middle-market deals that continue to define the sector.

Brokerage remains the most active segment by deal count, reflecting its fragmented structure and ongoing consolidation opportunities. However, even within brokerage, the rationale for acquisitions has evolved. Rather than pure geographic expansion, buyers are increasingly focused on specialty distribution capabilities, program administration, and niche vertical expertise. These assets offer differentiated revenue streams and stronger pricing power, making them more attractive in a disciplined capital environment.

Underwriter activity tells a similar story. While the number of transactions has declined modestly, aggregate deal values have increased, driven by fewer but larger and more strategic acquisitions. Life and annuity transactions, in particular, have been shaped by balance sheet considerations, capital optimization, and interest rate sensitivity. In property and casualty, specialty carriers and MGAs continue to attract interest due to their focused underwriting models and ability to operate effectively in volatile risk environments.

Taken together, the current environment can best be described as selectively active. Capital is available, strategic intent is strong, and high-quality assets remain in demand. However, valuation discipline, execution risk, and regulatory complexity have introduced meaningful friction into the dealmaking process. Transactions that align clearly with strategic priorities are moving forward, while marginal or opportunistic deals are increasingly sidelined.

3. Leaders’ Thoughts: What Executives Are Really Signaling

3.1 Deal Type Preferences: Specialization Over Scale

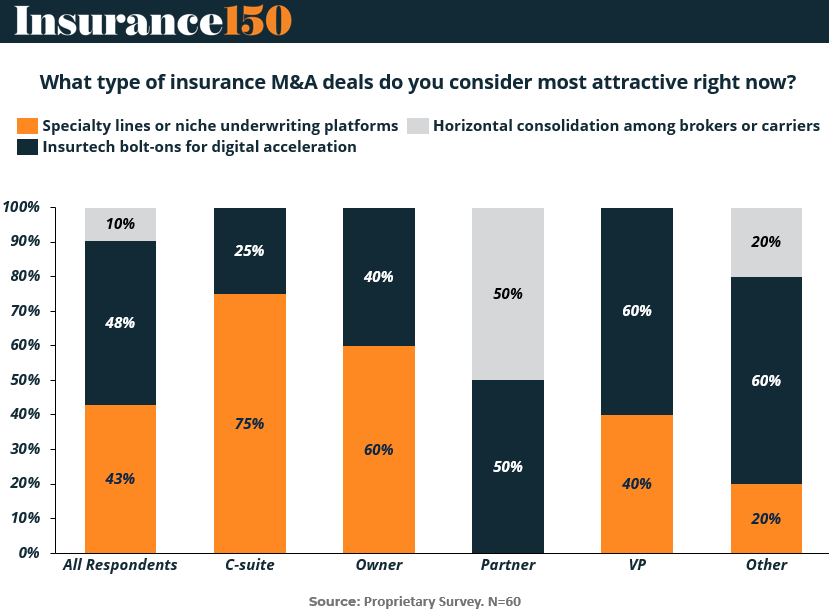

Leadership sentiment reveals a market that is deeply divided—not between companies, but within them. When asked what types of insurance M&A deals are most attractive, respondents showed a clear preference for specialization and digital capability over traditional consolidation. Specialty lines and niche underwriting platforms emerged as a leading priority, closely followed by insurtech bolt-ons designed to accelerate digital transformation. Horizontal consolidation ranked a distant third.

This divergence becomes more pronounced when viewed by role. C-suite executives overwhelmingly favor specialty underwriting platforms, reflecting a strategic focus on margin resilience, pricing power, and defensible market positions. For senior leadership, specialization represents a long-term hedge against commoditization and volatility, particularly in lines where expertise and data confer meaningful competitive advantages.

Operational leaders, by contrast, display a strong preference for insurtech bolt-ons. Vice presidents and similar roles are closest to execution challenges and process inefficiencies, making them more attuned to the immediate value of automation, analytics, and workflow optimization. For these stakeholders, digital acquisitions offer tangible improvements without the integration burden of full-scale platform combinations.

The waning enthusiasm for horizontal consolidation is equally telling. Once the backbone of insurance M&A strategy, roll-ups are now viewed with skepticism due to integration fatigue, diminishing returns on scale, and increased regulatory scrutiny. Consolidation is no longer dismissed outright, but it is increasingly opportunistic rather than foundational.

3.2 Barriers to Closing Deals: A Question of Perspective

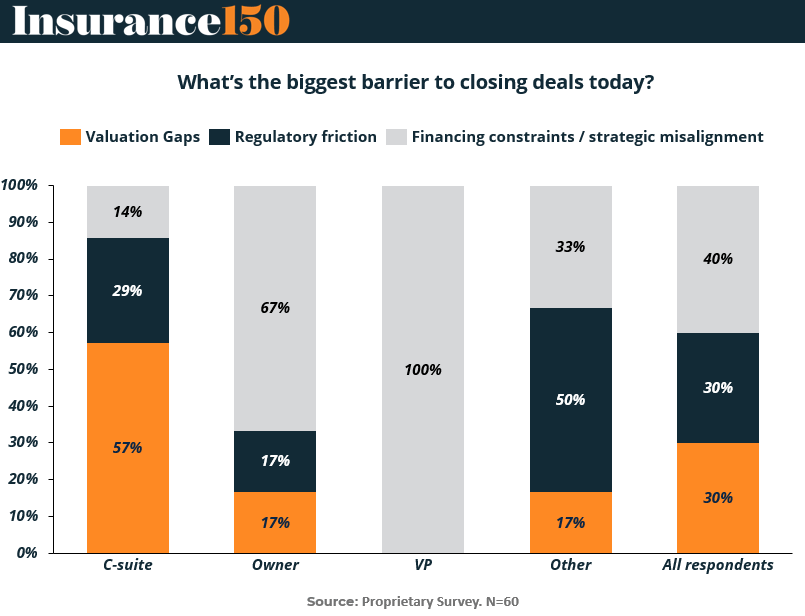

When deals stall, the reasons depend heavily on who is asked. Senior executives overwhelmingly point to valuation gaps as the primary obstacle, reflecting the persistent disconnect between seller expectations and buyer underwriting assumptions. Boards and CEOs remain disciplined, unwilling to stretch on price without clear line of sight to value creation.

Operational leaders see a different risk. Financing constraints and strategic misalignment dominate their concerns, underscoring the challenge of translating deal rationale into executable plans. Even when price is agreed, uncertainty around capital structure, integration sequencing, and performance delivery can derail transactions late in the process.

Regulatory friction occupies a middle ground, cited most frequently by legal, compliance, and operational stakeholders. Approval timelines, capital requirements, and regulatory interpretation continue to inject uncertainty into deal execution, particularly for cross-border or structurally complex transactions.

These differing perspectives highlight a critical reality: deals do not fail for a single reason. They fail when organizations are misaligned internally. Successful acquirers are increasingly those that surface and reconcile these differing viewpoints early in the process.

3.3 Where Leaders See Opportunity Next

Looking ahead, leadership consensus is notably absent. Digital insurtech platforms, life and annuity consolidation, and specialty insurers and MGAs all attract meaningful support, but none emerges as a dominant theme. Instead, preferences vary sharply by role.

C-suite leaders lean toward digital platforms and specialty businesses, reflecting a dual mandate to modernize operations while enhancing underwriting differentiation. Financial sponsors, particularly partners, show a strong preference for life and annuity consolidation, viewing it as a defensive strategy anchored in long-duration cash flows and balance sheet optimization.

Owners and mid-level leaders remain broadly distributed across segments, signaling optionality rather than conviction. This posture reflects uncertainty around valuations, timing, and execution risk, reinforcing the idea that the next phase of insurance M&A will be segmented rather than thematic.

3.4 What Will Drive the Next Wave of Deals

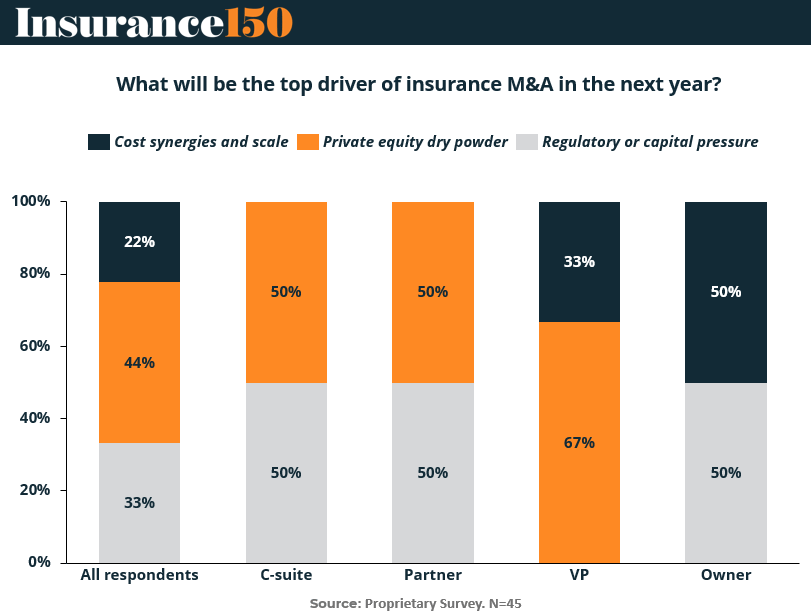

Private equity dry powder stands out as the most frequently cited driver of future M&A activity. With significant unallocated capital and mounting pressure to deploy, financial sponsors are expected to remain aggressive buyers, particularly in specialty, distribution, and capital-light businesses.

Regulatory and capital pressures follow closely, especially among senior executives and owners. For many insurers, M&A is becoming a mechanism to address solvency constraints, rating agency expectations, and reserve adequacy challenges.

Traditional cost synergies, while still relevant, have receded in importance relative to these structural forces.

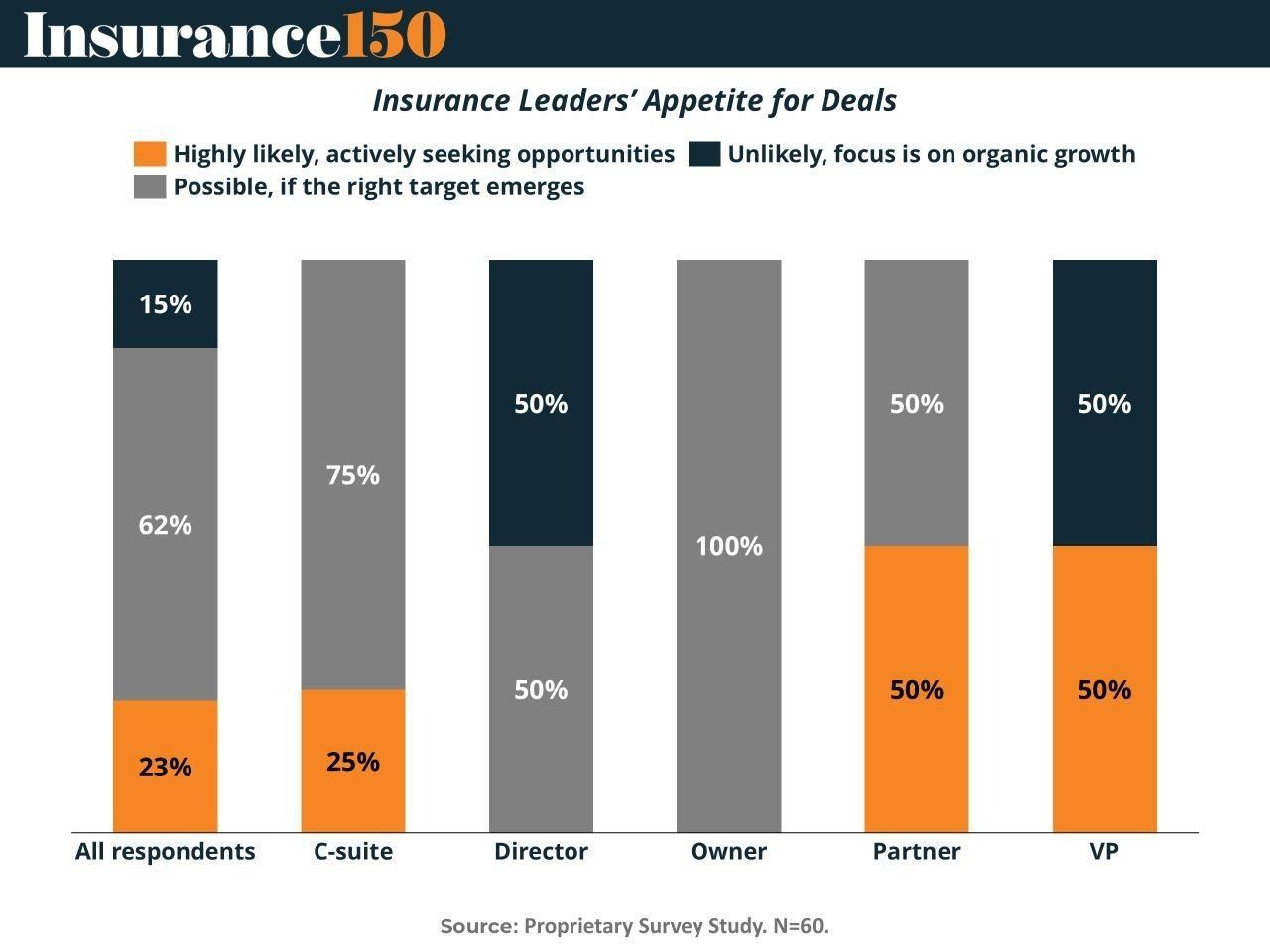

3.5 Appetite for Deals: Cautious, But Growing

Despite persistent uncertainty, appetite for M&A is clearly rising. A majority of respondents indicate openness to transactions if the right opportunity emerges, and a meaningful minority are actively seeking deals. The most aggressive postures are found among partners and vice presidents, while C-suite leaders remain measured, emphasizing discipline over urgency.

This pattern suggests a market that is warming, but not overheated. Deal flow is likely to increase, but transactions will remain targeted, strategic, and highly scrutinized.

4. Outlook

Looking forward, insurance M&A is poised to remain active but uneven. The era of broad-based consolidation is giving way to a more nuanced landscape defined by specialization, digital enablement, and capital rationalization. Private equity will continue to play a central role, but sponsor-led deals will increasingly mirror strategic priorities rather than purely financial engineering.

Regulatory and capital considerations will shape deal timing and structure, particularly for mid-sized carriers and specialty players. At the same time, digital capabilities will remain a critical acquisition driver as insurers seek to improve efficiency and responsiveness in an increasingly competitive market.

Perhaps most importantly, successful dealmaking will hinge on internal alignment. As this report’s findings make clear, different stakeholders perceive different risks and rewards. Bridging these perspectives—between strategy and execution, valuation and integration—will be essential to converting opportunity into outcome.

5. Conclusion

Insurance M&A is no longer a monolithic market driven by a single thesis. It is a complex, multi-track environment where strategy, capital, regulation, and capability intersect. Scale alone is no longer sufficient. Precision, discipline, and alignment are the new prerequisites for success.

As the sector moves forward, the winners will be those who understand not just where to buy, but why—and who can execute with clarity in a market that increasingly rewards focus over breadth.

Sources & References

Deloitte. (2025). 2025 Insurance M&A Outlook. file:///C:/Users/gasto/Downloads/us-2025-insurance-m-and-a-outlook.pdf

Gallagher. (2025). Global M&A Insurance. https://assets.foleon.com/eu-central-1/de-uploads-7e3kk3/48649/gallagher_specialty_ma_global_report_0125_.7fb55aa33fda.pdf

Insurance150. (2025). Insurance Leaders Warm to M&A. https://insights150.com/p/insurance-leaders-warm-to-m-a-cdfe

Insurance150. (2025). M&A Divergence: What 62 Insurance Executives Told Us About the Next 12 Months. https://insights150.com/p/m-a-divergence-what-62-insurance-executives-told-us-about-the-next-12-months

Insurance150. (2025). Niche Over Scale: How Insurance M&A Preferences Are Splitting by Role. https://insights150.com/p/niche-over-scale-how-insurance-m-a-preferences-are-splitting-by-role

Insurance150. (2025). The Shifting Drivers of Insurance M&A: Scale, Dry Powder, and Regulatory Pressures. https://insights150.com/p/the-shifting-drivers-of-insurance-m-a-scale-dry-powder-and-regulatory-pressures

Insurance150. (2025). What’s the Real Deal‐Killer in Insurance M&A? It Depends Who You Ask. https://insights150.com/p/what-s-the-real-deal-killer-in-insurance-m-a-it-depends-who-you-ask

S&P Global. (2025). North American insurance M&A activity stable in Q2 2025. https://www.spglobal.com/market-intelligence/en/news-insights/articles/2025/8/north-american-insurance-ma-activity-stable-in-q2-2025-91721618