- The Deal Brief - Insurance

- Posts

- No Hype, Just Premiums: Energy Insurance’s $8B Upside by 2030

No Hype, Just Premiums: Energy Insurance’s $8B Upside by 2030

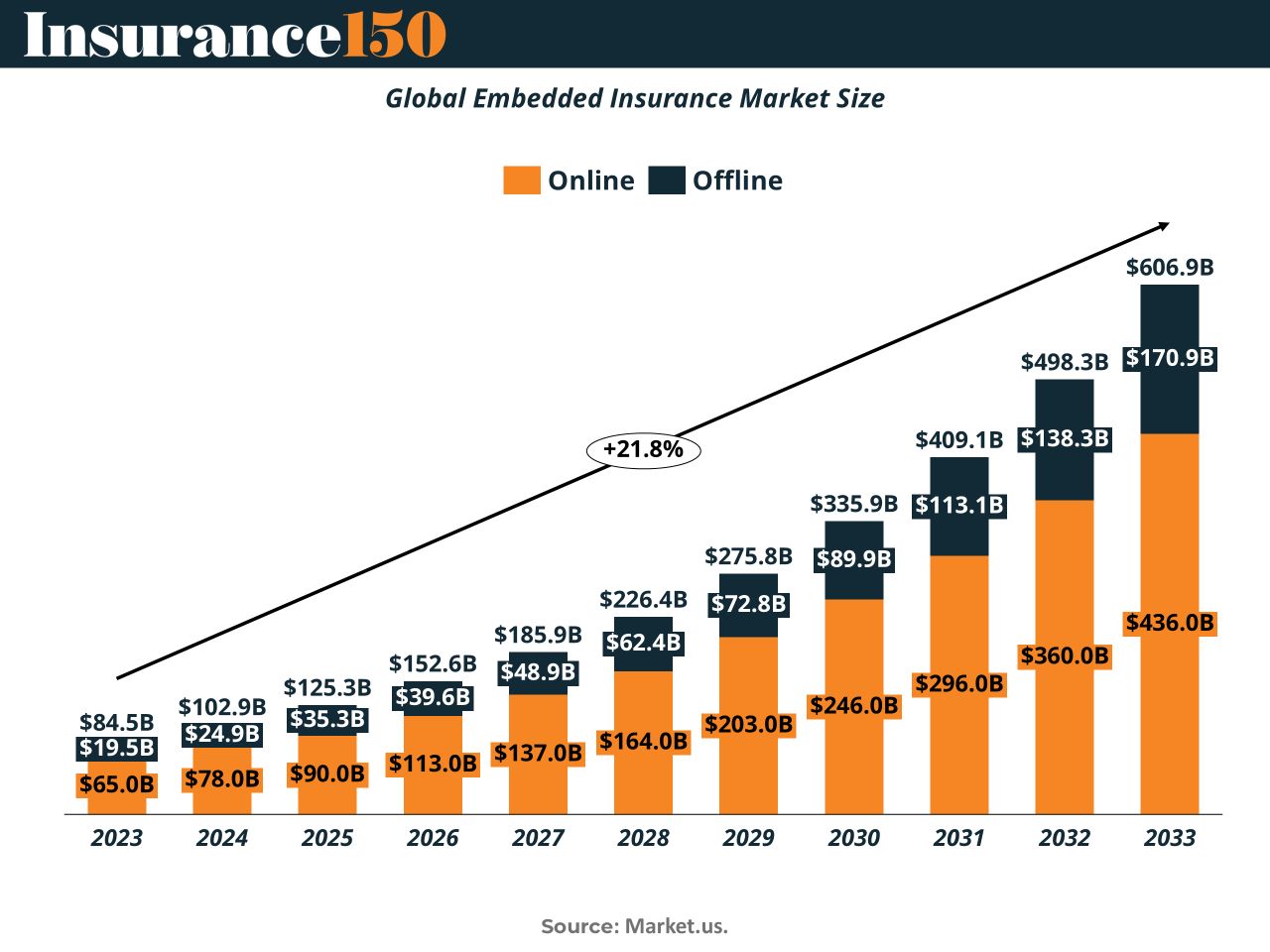

From $84 B today to $607 B by 2033, one-click coverage is turning checkout flows into the insurance industry’s fastest-growing premium pipeline.

Good morning, ! This week we’re covering the global embedded insurance market, the $18.8B energy insurance landscape, and the quarterly insurtech transaction by target country. Plus, the US potential tariff on investment prices.

Join 50+ private markets advertisers who reach our 450,000 investors and executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Embedded Insurance Hits Prime Time

Once a novelty, embedded insurance is now going mainstream—with the market expected to balloon from $84.5B in 2023 to $606.9B by 2033. What’s driving this? Think seamless checkout flows, rising mobile penetration, and a growing demand for contextual coverage—from smartphones to SaaS subscriptions. Asia-Pacific leads the charge (35.7% of global revenue), but the U.S. is catching up fast with $70B in P&C premiums expected to flow through embedded models by 2030. In short: insurance is no longer sold—it’s selected, suggested, and slipped into your cart.

TREND OF THE WEEK

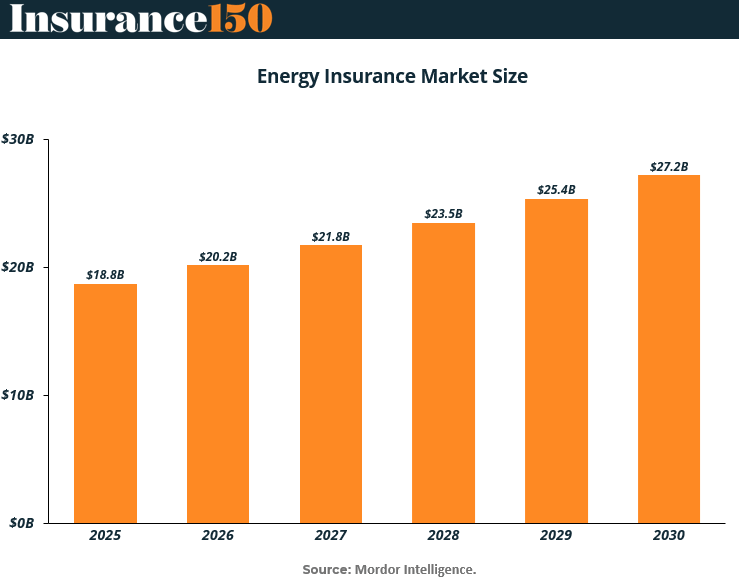

Energy Insurance: A $27B Market by 2030

Energy insurance is quietly becoming a heavyweight. The market is set to grow from $18.8B in 2025 to $27.2B by 2030, expanding at a steady CAGR of 7.7%. That’s not hype—it’s momentum.

Driving this surge? A global energy transition that’s anything but smooth. On one end, aging fossil fuel infrastructure still demands traditional risk coverage. On the other, renewables like offshore wind and grid-scale batteries introduce complex new exposures—intermittency, cyber risk, and catastrophic weather dependencies. The result: broader risk appetites and deeper policy layers.

For insurers, this growth isn’t just about more premiums—it’s about smarter risk engineering, multi-line structuring, and geopolitical adaptability. For reinsurers and brokers, expect demand for tailored capacity and cross-border expertise to climb.

Why it matters: The path to net zero will be volatile, and coverage demand is following the volatility. Energy insurance is no longer niche—it’s foundational. (More)

The Private Markets Intelligence Summit of the Year

📍 October 15, 2025 | Well& by Durst, NYC

Insurance M&A (formerly Insurance 150) is proud to announce it’s exclusive joint venture with CapLink Group!

In it’s first major event partnership, we cordially invite Insurance M&A readers to join 300+ private markets leaders—GPs, LPs, operating partners, and advisors—for a single day of insights, strategy, and dealmaking at the New York Private Capital Summit.

This isn’t another networking event. It’s where strategy meets substance:

→ Keynotes from HarbourVest, Bloomberg, Australian Super

→ Deep-dives on secondaries, direct lending, GenAI, and ESG

→ Practical panels on fund formation, human capital, and tax strategy

→ A spotlight on emerging liquidity tools and NAV-based financing

With over 50 senior speakers from firms like Apollo, KKR, Carlyle, Neuberger Berman, and Warburg Pincus, the Summit is designed for decision-makers driving the next decade of private capital.

Reserve your seat before it sells out: First Release Access

MARKET MOVERS

Company (Ticker) | Last Price | 5D |

UnitedHealth Group Incorporated (UNH) | $ 300.58 | -1.03% |

Ping An Insurance (Group), (2318. HK) | $ 6.70 | 3.75% |

Elevance Health (ELV) | $ 340.07 | -1.96% |

Chubb Limited (CB) | $ 280.20 | 0.08% |

Allianz SE (ALV. DE) | $ 400.06 | -2.20% |

INSURTECH CORNER

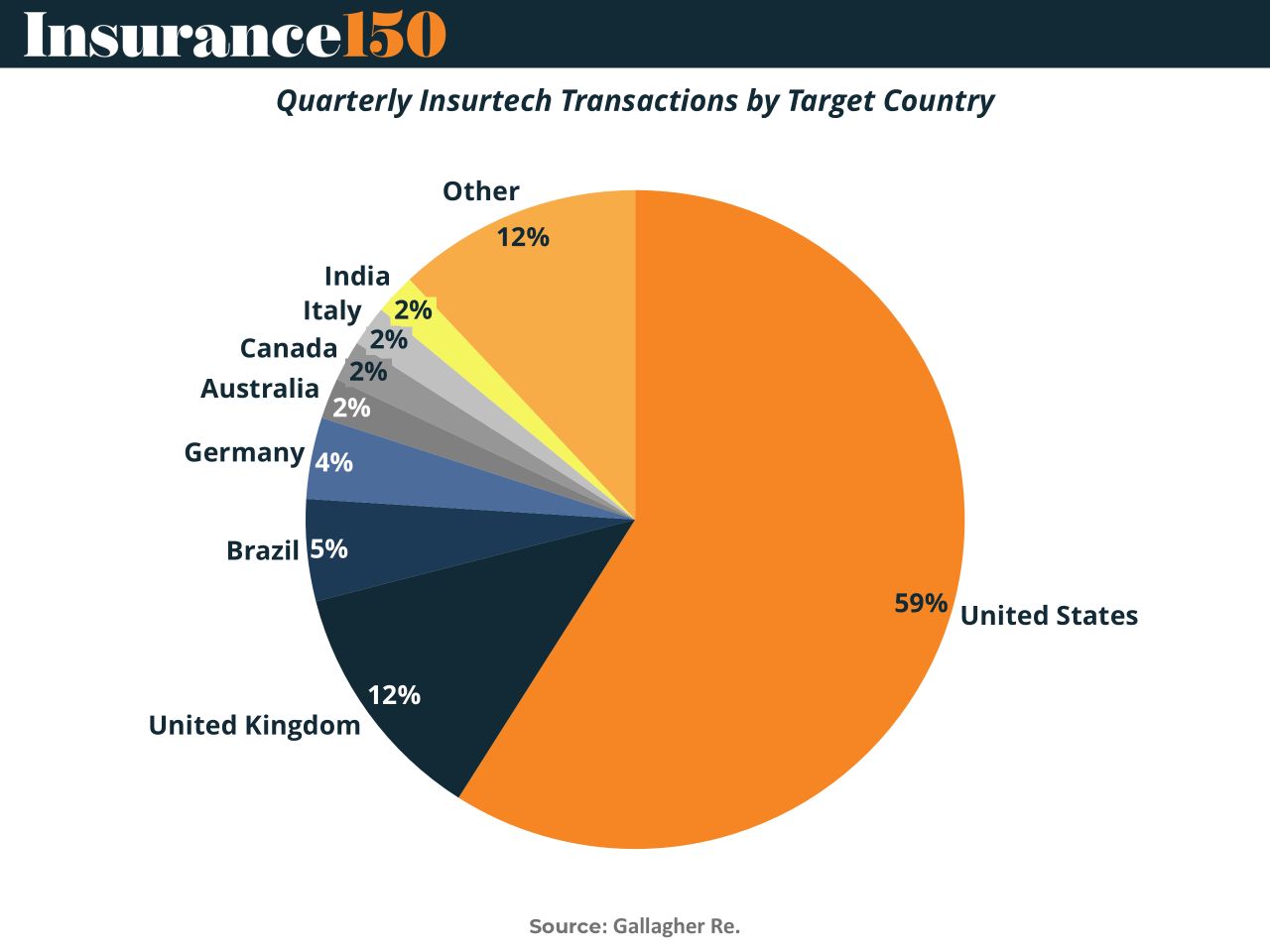

Still an American Game

Insurtech’s center of gravity hasn’t shifted much. In Q1 2025, 59% of global transactions targeted U.S. startups, reaffirming America's dominance in digital insurance. Deep capital markets, seasoned founders, and regulators who (mostly) get it help explain the staying power. The U.K. and “Other” markets tied for second at 12% each, with Europe’s fintech darling still pulling its weight—and everyone else fighting over scraps. The rest? Brazil (5%), Germany (4%), and a global sampling of 2%ers (India, Canada, Italy, Australia). Geographic diversity is growing—but slowly. (More)

DEAL OF THE WEEK

L&G Taps Blackstone for a $20B Credit Play

Legal & General (L&G) is making a $20 billion bet on private credit, partnering with Blackstone to deploy capital into one of the fastest-growing corners of alternative finance. It’s part of a broader pivot among European insurers: swap government bonds for higher-yield, illiquid debt. Think less gilt, more grit. With Blackstone’s deep bench in private credit and L&G’s appetite for yield, the play isn’t just diversification — it’s a structural shift.

In a world where insurers are becoming quasi-asset managers, this move is textbook: match long-dated liabilities with juicier returns, minus the public market noise. If this is the new baseline, expect more insurers to follow — especially the ones still pretending that 2% bonds are a viable strategy in 2025. (More)

From a $120M Acquisition to a $1.3T Market

The wealthiest companies target the biggest markets. For example, NVIDIA skyrocketed ~200% higher last year with the $214B AI market’s tailwind. That’s why investors like Maveron backed Pacaso.

Created by a founder who sold his last venture for $120M, Pacaso’s digital marketplace offers easy purchase, ownership, and enjoyment of luxury vacation homes. And their target market is worth a whopping $1.3T.

No wonder Pacaso has earned $110M+ in gross profits to date, including 41% YoY growth last year alone. Now, with new homes planned in Milan, Rome, and Florence, they’re really hitting their stride. They even reserved the Nasdaq ticker PCSO.

And you can join well-known firms like Greycroft today. Lock in your Pacaso investment now for $2.90/share.

*This is a paid advertisement for Pacaso's Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving the ticker symbol is not a guarantee that the company will go public.Listing on the Nasdaq is subject to approvals.

MACROECONOMICS

Inflation’s Trojan Horse: Tariffs

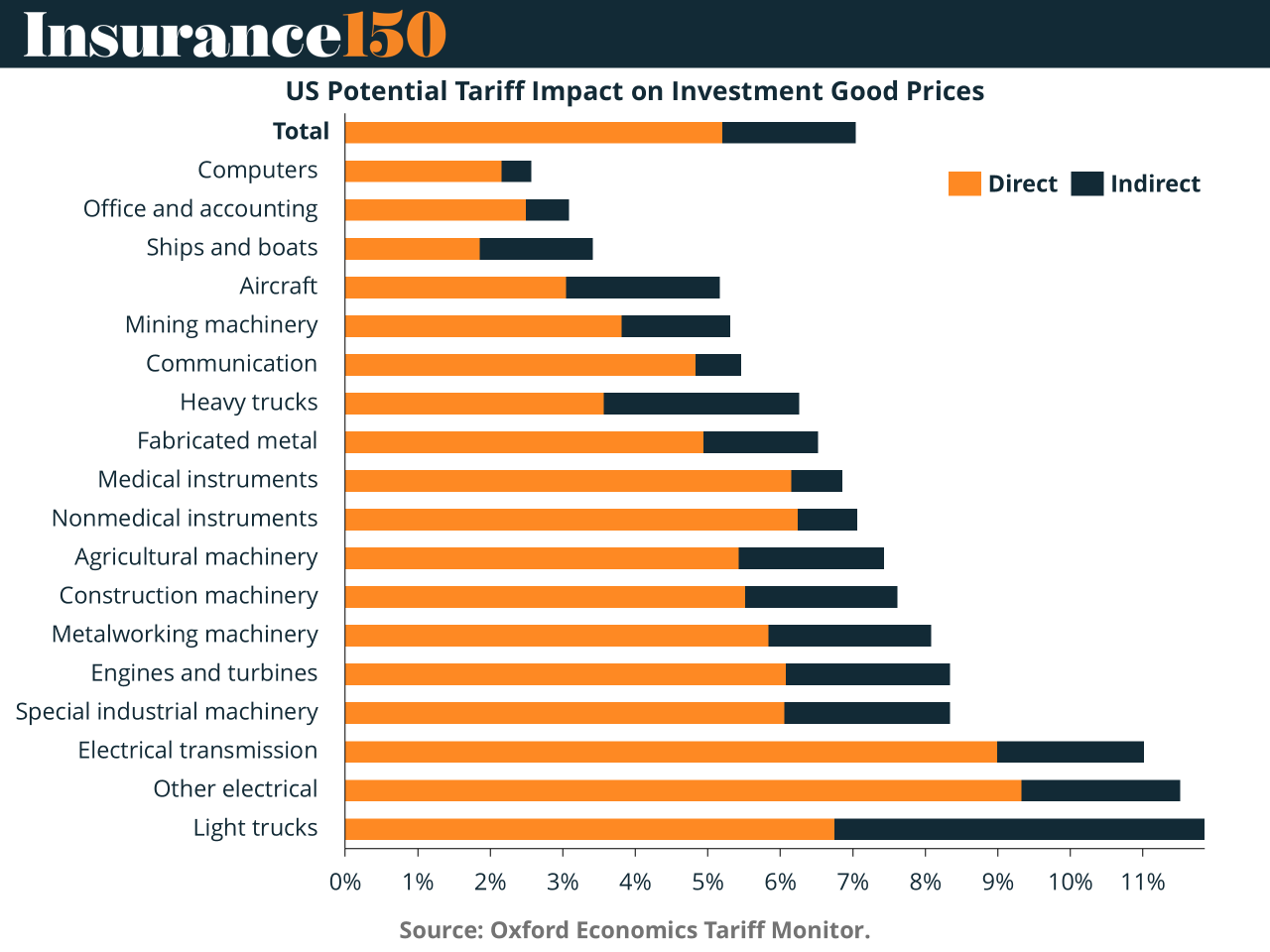

Consumer optimism on inflation might be misplaced. The NY Fed says expectations for one-year-ahead inflation have cooled to 3%, echoing pre-trade war calm. But Donald Trump is cueing up another tariff offensive—10% universal import tax, and a 60% hit on Chinese goods. Oxford Economics estimates the last trade spat lifted consumer prices by up to 1.5 percentage points. This time, corporate buffers are thinner. That means quicker pass-through to consumers. For investors? Tariffs are a stealth inflation engine—sticky, regressive, and Fed-proof. Rate cuts can’t fix container detours. Add spillover risks to supply chains, capex, and cross-border M&A, and suddenly, the "soft landing" looks less certain. (More)

PRESENTED BY STOCKS & INCOME

Financial News Keeps You Poor. Here's Why.

The scandalous truth: Most market news is designed to inform you about what already happened, not help you profit from what's coming next.

When CNBC reports "Stock XYZ surges 287%"—you missed it.

What you actually need:

Tomorrow's IPO calendar (not yesterday's launches)

Crowdfunding deals opening this week (not closed rounds)

What real traders are positioning for (not TV talking heads)

Economic data that moves markets (before it's released)

The financial media industrial complex profits from keeping you one step behind.

Stocks & Income flips this backwards. We focus entirely on forward-looking intel that helps you get positioned before the crowd, not informed after the move.

Stop chasing trades that happened already.

Start prepping for the next one.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

INTERESTING ARTICLES

TWEET OF THE WEEK

@JonathanJLevin@nirkaissar@AllisonSchrager CPI Day 🚗🚘

“The pressure on transportation had been coming from things like auto insurance, and that’s been cooling in the market,” says @JonathanJLevin

— Bloomberg Opinion (@opinion)

12:41 PM • Jul 15, 2025

"The only place where success comes before work is in the dictionary."

Vidal Sassoon