- Insurance 150

- Posts

- Spoilage’s $940B Price Tag: The Upside Of Food Insurance

Spoilage’s $940B Price Tag: The Upside Of Food Insurance

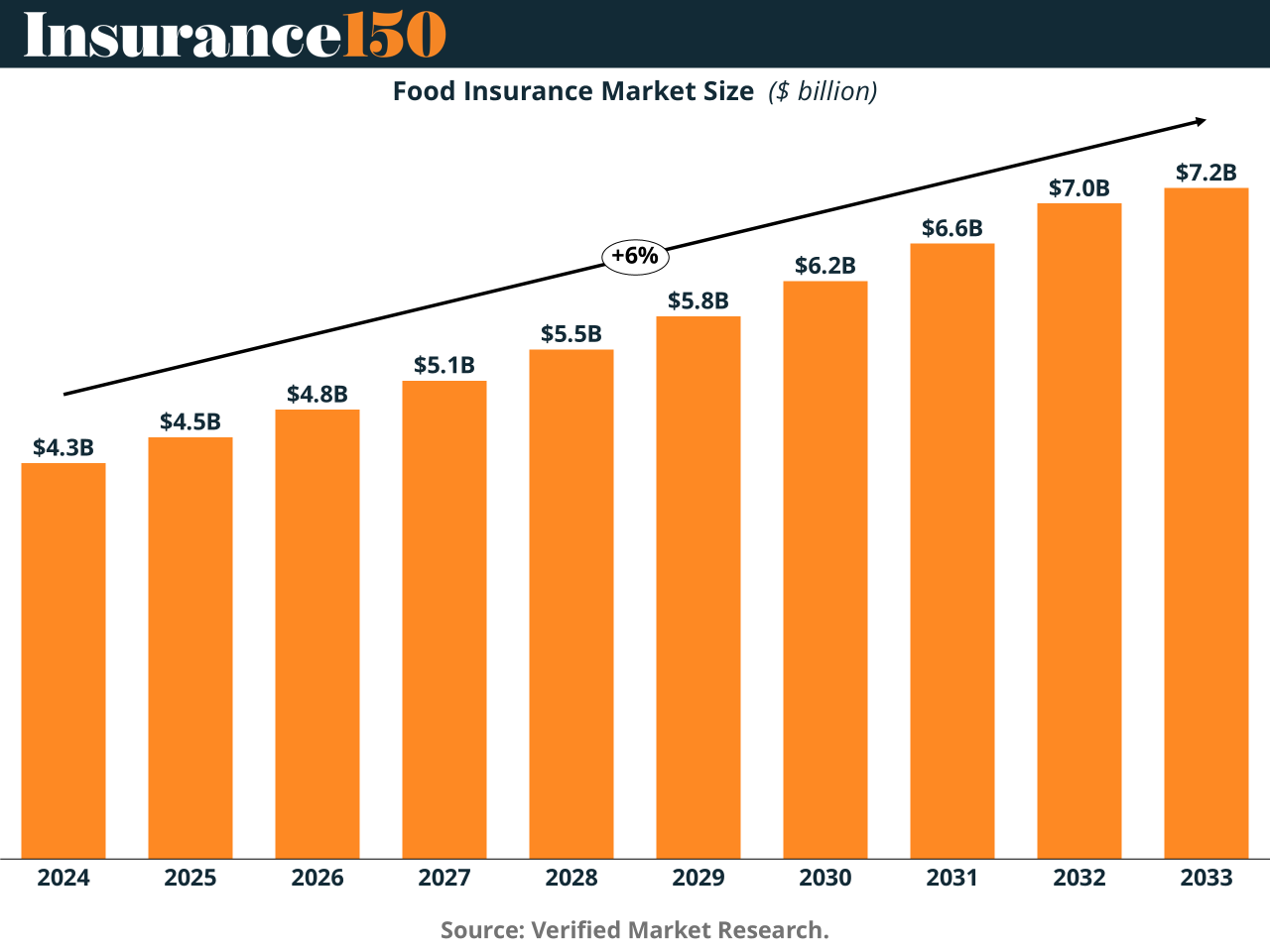

$940 B in spoilage riding a $12.5 T supply chain turns food insurance into the most overlooked $7.2 B premium pool.

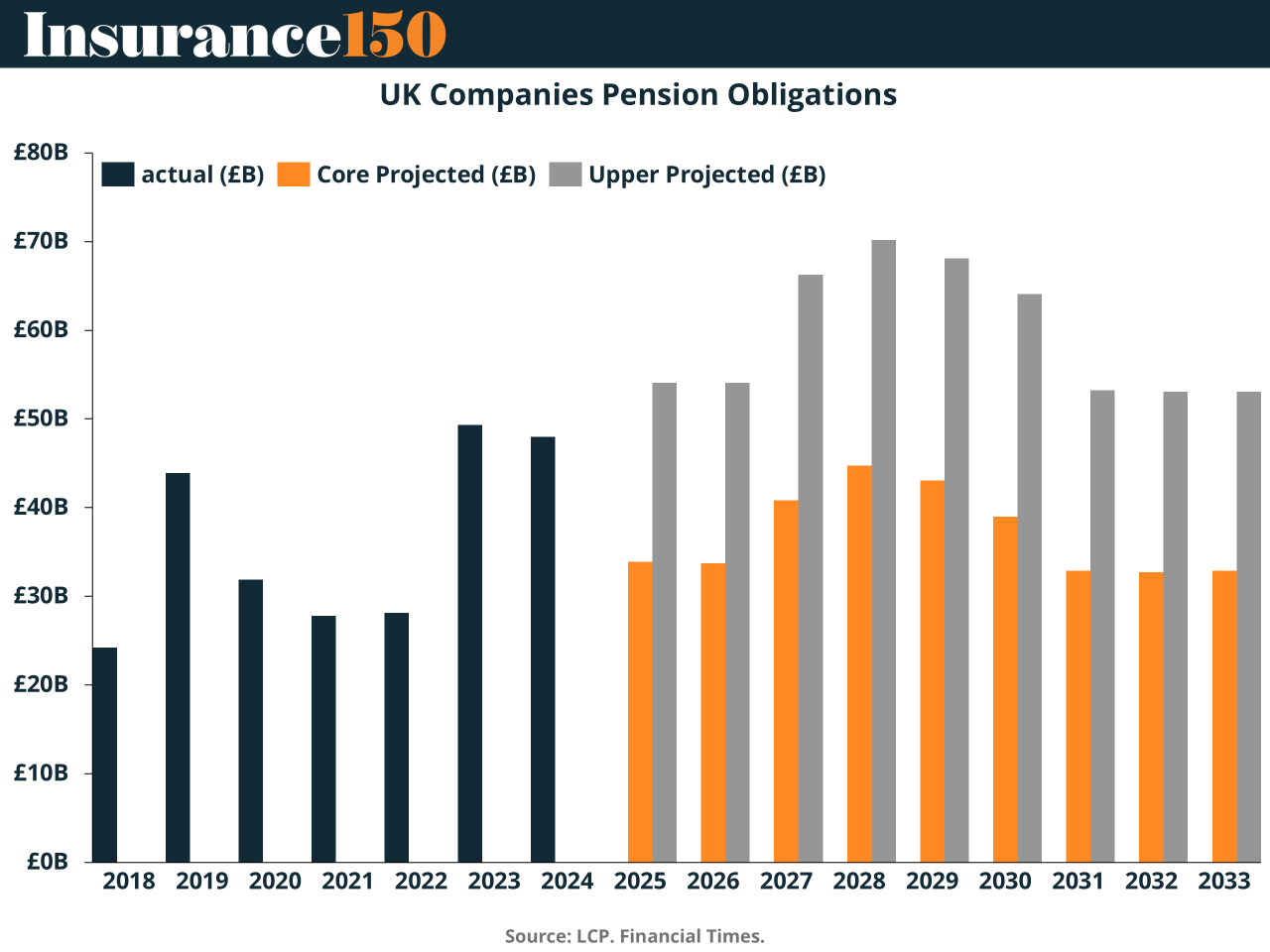

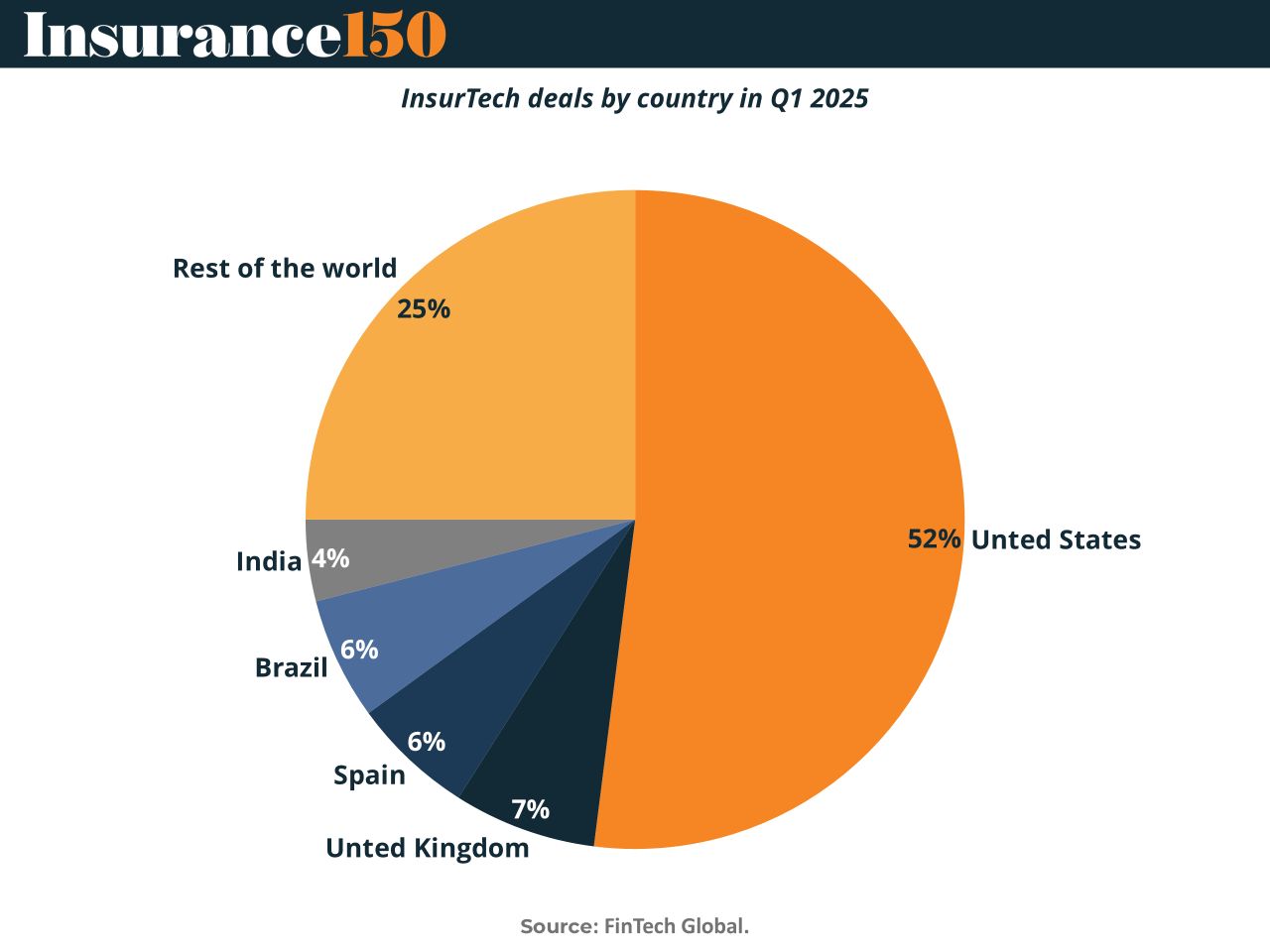

Good morning, ! This week we’re covering the $4.5B global food insurance market, a Q1 2025 insurtech deals rundown, and the UK companies pension obligations.

Join 50+ private markets advertisers who reach our 450,000 investors and executives: Start Here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Spoilage Happens. So Does $940B in Annual Waste.

Food insurance is moving from back-office formality to frontline strategy. As the global food industry balloons to $12.5T by 2029, the insurance market tied to it is expected to hit $7.2B by 2033—a 6% CAGR powered by recalls, cyber risks, and climate volatility. Why? Because margin-crushing spoilage, reputational hits, and cargo delays aren't risks anymore—they're certainties. This isn’t just about protection. In a world of razor-thin margins, insurance is the margin. Whether it’s parametric policies, cold-chain failures, or ESG-linked pricing, insurers are becoming the essential ingredient in food’s global recipe.

TREND OF THE WEEK

The British DB Dance: Accounting Gains Mask De-risking Pain

Defined benefit (DB) pension schemes are posting healthier balance sheets—but not for the reasons sponsors might like. A sharp rise in AA corporate bond yields has cut liabilities, fueling a £60bn funding surplus. But buy-in/buy-out (BIBO) deal volumes are actually down 25% YoY, per PwC. Why? The discount rate rally has pushed prices higher, making insurers more selective. Translation: sponsors need to rethink de-risking timelines and price expectations, especially for smaller deals. (More)

PRESENTED BY TIMEPLAST

“Big Plastic” Hates Them

From water bottles to shrink wrap, Timeplast has a $1.3T market opportunity with its patented plastic that dissolves in water. But the clock is ticking to invest. You have until midnight, July 31 to become a Timeplast shareholder as they expand globally.

This is a paid advertisement for Timeplast’s Regulation CF Offering. Please read the offering circular at invest.timeplast.com.

MARKET MOVERS

INSURTECH CORNER

InsurTech’s Back—but Only the Strong Get Funded

InsurTech funding surged to $1.1B in Q1 2025, up 59% YoY, even as deal count fell 22%. Translation: fewer experiments, more conviction.

The U.S. still dominates, pulling in 52% of all deals (37 in total), though that's a step down from 45 a year ago. The standout? HDVI’s $40M raise, signaling appetite for narrow, data-rich platforms—especially in specialty lines.

Global shake-up: Spain and Brazil each punched in with 6% of deals, overtaking the usual suspects like Germany and Canada. Investors want scale-ready tech, not science projects.

The TLDR: This isn’t a funding frenzy—it’s a strategic reallocation to mature, vertical-specific InsurTechs with actual underwritable edge. (More)

DEAL OF THE WEEK

Deal of the Week: Verisk Buys SuranceBay for $162.5M

Verisk is doubling down on life and annuities. The data analytics giant signed a definitive agreement to acquire SuranceBay for $162.5M in cash, folding its agent onboarding and compliance tools into Verisk’s FAST platform. The move signals Verisk’s deeper commitment to digitizing and automating life insurance distribution—from producer licensing to claims.

SuranceBay’s flagship solution, SureLC™, will now become a core asset within FAST, which already ranks as a leading life and annuity platform. This integration sharpens Verisk’s value proposition to carriers and MGAs looking to reduce friction with their sales networks.

Why it matters: This deal is less about expanding product lines and more about strengthening infrastructure. As life insurers chase efficiency and scale, the battle is increasingly being fought in back-end systems. With SuranceBay, Verisk is securing more of the insurance lifecycle—and potentially locking in more clients across the L&A vertical. (More)

TOGETHER WITH ELITE TRADE CLUB

What Every Investor Reads Before the Bell

Every morning, Elitetrade.club delivers fast, smart, no-fluff market insights straight to your inbox. Join thousands of investors who don’t miss a beat.

MACROECONOMICS

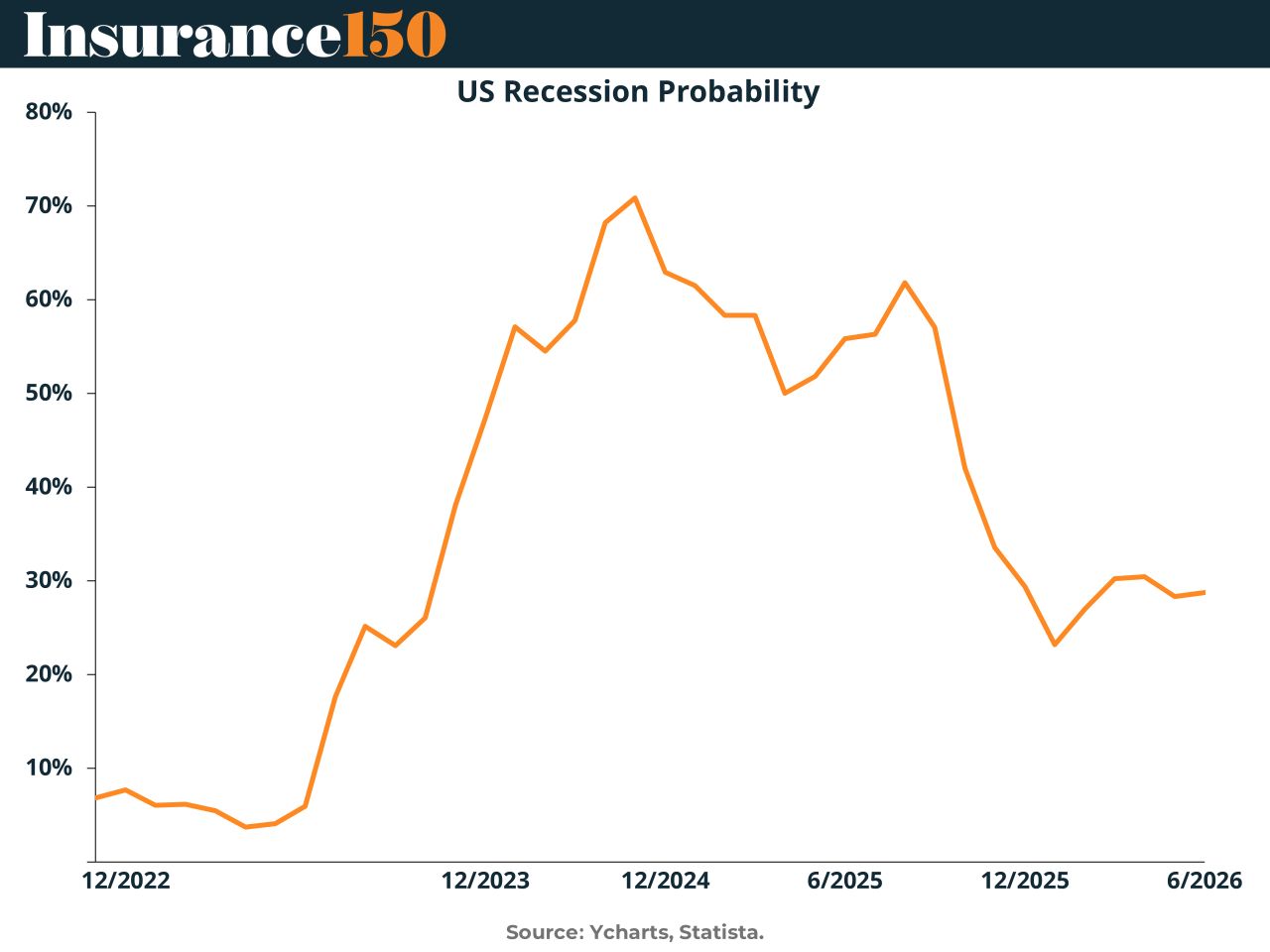

Sentiment Shift = Capex is Back

The recession probability chart is doing a solid impression of your last disappointing deal exit — steep drop, sharp regrets. From 70% in early 2024 to 30% mid-2025, fears of a downturn are cooling fast. That matters because sentiment drives spending, and businesses are finally starting to unpause capex. With policy risks receding, CEOs are flipping from doomsday prep to cautiously optimistic — and that’s big for PE firms sitting on record dry powder.

Bonus depreciation is back. Intellectual property capex is sticky. Tariffs are (mostly) untangled. Expect investment momentum to build into 2026, especially in sectors less interest rate-sensitive. The Fed is eyeing a December cut, and that guidance alone is catalyzing deferred capital deployment.

Translation: Q4 might be the beginning of an M&A reawakening — not because fundamentals are better, but because expectations are less terrible. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

.@FinancialCmte's Housing & Insurance Subcommittee is focused on finding real solutions to America’s housing crisis.

The HOME Investment Partnership Program can be a key tool to boost local supply.

It's time to realize this potential. More from my opening remarks today 👇

— Rep. Mike Flood (@USRepMikeFlood)

10:23 PM • Jul 16, 2025

"In the middle of every difficulty lies opportunity."

Albert Einstein