- Insurance 150

- Posts

- The Anatomy of Today’s M&A Decisions

The Anatomy of Today’s M&A Decisions

The insurance M&A market is back in the spotlight—only this time, it’s not the same old story of scale, roll-ups, and consolidation land grabs.

Think less “sprawling mega-merger” and more “precision-engineered dealmaking with laser-focused strategic intent.” The industry is stepping into a new era where differentiation beats size, capital discipline trumps momentum, and value creation isn’t measured in raw premium volume, but in specialty expertise and digital edge.

With reinsurance pressure still rewriting risk appetites, capital not nearly as cheap as it used to be, and investors hunting harder than ever for defensible returns, the temperature around insurance deals is rising quickly. Competition for high-quality assets is heating up, and dry powder is burning a hole in private equity pockets—creating a race to deploy capital where it counts most.

But even with the energy building, closing transactions is no easy sprint. Bid-ask spreads have stretched, financing clarity is harder to come by, and regulatory complexity is adding friction at the worst possible moments. It’s a market full of opportunity—if you can thread the needle.

This microsurvey takes the pulse of decision-makers across the industry, surfacing what types of deals buyers want most, what forces will drive activity next, and what’s stopping transactions from getting over the finish line. The signal is clear: the deals are out there, the urgency is real, and success will belong to those who can align strategy, pricing, and conviction.

Insurance M&A Deals heating up

M&A activity in the insurance sector continues to evolve as market participants reassess where value creation is most achievable in the current environment. Pricing discipline, capacity constraints, rising loss costs, and heightened scrutiny on deployment of capital are driving acquirers to prioritize strategic fit and differentiated capabilities rather than scale alone. As a result, the competitive landscape for attractive acquisition targets is shifting, with a growing emphasis on platforms that can accelerate underwriting performance or modernize digital operating models.

The results of this microsurvey illustrate a clear directional preference for capability-enhancing acquisitions, especially across senior leadership decision-makers. A majority of respondents favor either specialty underwriting platforms or technology-driven bolt-ons that can improve efficiency, analytics, or distribution. This signals that acquirers believe differentiation and specialty expertise are key levers for sustaining profitability in a market still defined by volatility and tightening reinsurance dynamics.

While horizontal consolidation has historically been a major theme in insurance M&A, the data suggests that broad roll-ups among brokers or carriers are now seen as less compelling by most respondents. The fact that only 10% of the total response base selected horizontal consolidation as the most attractive strategy indicates a shift from scale for scale’s sake to more selective, value-based consolidation tied to synergy certainty and integration feasibility.

Differences by seniority level further reinforce how strategic focus varies within organizations. C-suite respondents overwhelmingly favor specialty platforms, emphasizing long-term strategic positioning, while mid-level leaders, such as VPs, prioritize digital acceleration, reflecting direct operational pressure to improve efficiency. Partners — often closest to deal execution — are more open to horizontal roll-ups, suggesting tactical interest where valuation dynamics or network effects may still make consolidation attractive.

Detailed Analysis

Overall market preference

43% of all respondents favor specialty lines or niche underwriting platforms, indicating strong interest in differentiated, high-margin segments.

48% selected insurtech bolt-ons for digital acceleration, showing buyers are prioritizing modernization and operational improvement.

Only 10% prefer horizontal consolidation, signaling reduced enthusiasm for large roll-ups amid integration and valuation challenges.

Differences by seniority

C-suite: 75% specialty platform preference — strong focus on long-term strategic differentiation and exposure to attractive specialty risk pools.

Owners: Split between specialty (60%) and digital bolt-ons (40%), aligning with modernization demands and capital-deployment ROI pressures.

Partners: 50% horizontal consolidation — most supportive of roll-ups, likely reflecting deal-sourcing realities and synergy visibility.

VPs: 60% prioritize digitization — aligned with performance and efficiency drivers in operational roles.

Other respondents: Even split between specialty (20%) and digital (60%), suggesting broad-based emphasis on capability upgrade.

Strategic implications

Market signals favor specialization, capability expansion, and digital transformation over scale.

Specialty platforms are viewed as critical for accessing profitable niches and mitigating volatility.

Digital bolt-ons are increasingly seen as essential to cost competitiveness, speed, and customer experience.

Horizontal consolidation remains opportunistic rather than a dominant thesis.

Takeaway

The market narrative has shifted decisively from scale to specialization, and from premium growth to value-enhancing capabilities, shaping acquisition priorities for the year ahead.

What Will Drive Insurance M&A in the Next 12 Months?

As insurance dealmakers look ahead to the coming year, the forces shaping M&A strategy appear to be shifting from growth-at-any-cost toward more selective and financially disciplined acquisition rationales. Persistent macroeconomic uncertainty, continued volatility in reinsurance capacity, and higher capital costs are driving organizations to sharpen their investment theses. Against this backdrop, the motivations behind pursuing transactions are becoming increasingly tied to structural efficiency and capital deployment, rather than broad consolidation momentum.

Survey results show that private equity dry powder remains a central engine for deal activity, with a plurality of respondents identifying it as the most influential driver of M&A in the next 12 months. The combination of record fundraising levels, pressure to deploy capital, and a deep pipeline of potential assets—particularly in specialty distribution and technology-enabled service models—continues to support competitive bidding dynamics. In a market where valuations have recalibrated and performance differentiation is widening, private equity remains positioned to move aggressively.

At the same time, regulatory or capital pressure is expected to play a meaningful role in catalyzing transactions, especially among carriers facing balance-sheet strain, reserve uncertainty, or ratings sensitivity. For management teams navigating changing capital frameworks or sharpening underwriting focus, divestitures and strategic restructurings may become increasingly common tools for optimizing risk and releasing capital. This signals the potential for more complex carve-outs and portfolio realignments in the year ahead.

Less attention is being placed on cost synergies and scale, although this theme resurfaces strongly among certain seniority segments. While roll-ups and consolidation strategies remain viable in pockets of the market, they appear to be secondary to capital deployment and regulatory dynamics as near-term catalysts. The variation in responses across seniority levels underscores differing perspectives between strategic leadership, financial sponsors, and operational teams on where the most compelling value creation opportunities lie.

Detailed Analysis and Takeaways from Charts

Overall respondent signal

Private equity dry powder is the leading expected driver of M&A activity, cited by 44% of all respondents.

Regulatory or capital pressure follows closely at 33%, underscoring balance-sheet and capital adequacy considerations.

Only 22% selected cost synergies and scale, indicating that consolidation benefits are currently less compelling overall.

Differences by seniority

C-suite respondents are evenly split (50% PE capital vs. 50% regulatory pressure), highlighting a dual-focus agenda on financing conditions and capital optimization.

Partners report the same 50/50 distribution, likely reflecting visibility into investor demand and distressed or motivated sellers.

VPs overwhelmingly identify private equity dry powder (67%) as the dominant catalyst, which may reflect deal-level funding realities and current buyer aggressiveness.

Owners lean toward cost synergies and scale (50%), consistent with value expectations tied to integration efficiency and asset consolidation.

Strategic implications

Expect strong competition for high-quality assets, particularly from PE-backed platforms under pressure to deploy capital.

Carrier restructurings, capital-motivated divestitures, and block transactions may increase as regulatory pressures intensify.

Cost synergy-driven roll-ups may be more selective, surfacing where integration certainty and valuation resets justify the thesis.

Capital scarcity and macroeconomic volatility are likely to test deal conviction, increasing emphasis on underwriting discipline and post-close execution certainty.

Key takeaway

Insurance M&A in the next year is likely to be shaped primarily by financial sponsor activity and capital-related restructuring, rather than broad consolidation or pure scale plays.

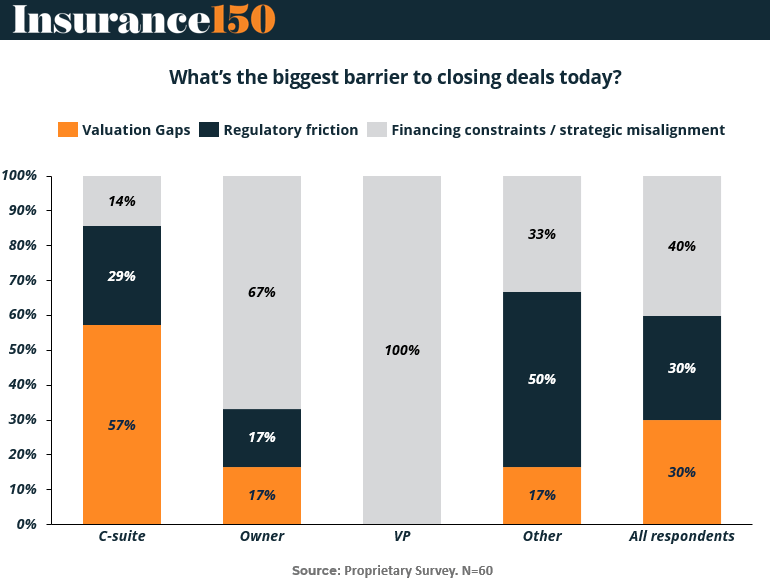

What Is the Biggest Barrier to Closing Insurance M&A Deals Today?

As insurance M&A participants work through a complex macroeconomic and capital environment, deal execution challenges have become more pronounced, and the path to closing has grown more fragmented by stakeholder group. This microsurvey sheds light on the most significant barriers impeding deal closure today and reveals meaningful differences in perception across respondent seniority. The result is a picture of a market where the urgency to transact is high, but alignment on valuation, structure, and expectations remains difficult to achieve.

Across all respondents, financing constraints and strategic misalignment emerged as the top obstacle, cited by 40%, indicating that uncertainty around capital availability, forward performance assumptions, and integration strategy continues to slow deal momentum. With borrowing costs elevated and more selective capital allocation, buyers are demanding clearer business cases and more confidence in post-close value realization. This shift places increased pressure on both valuation discipline and strategic clarity.

The survey also highlights that valuation gaps remain a major barrier, selected by 30% of respondents overall. Bid-ask spreads have widened as buyers adjust expectations to reflect tighter capacity, higher loss costs, and more conservative investment performance assumptions, while sellers continue to anchor to 2021–2022 peak multiples. In this environment, transactions are increasingly dependent on creative structures such as contingent consideration, partial divestitures, and profit-share mechanisms to bridge expectations.

Notably, the perceived role of regulatory friction varies materially by seniority. While the C-suite and other respondents cite regulatory complexity or review timelines as a meaningful obstacle, VPs overwhelmingly view strategic misalignment and financing constraints (100%) as the core impediment. This disparity underscores differing vantage points: leadership teams are navigating oversight and structural considerations, while execution-level participants are struggling most with capital certainty and pricing alignment.

Detailed Analysis and Takeaways from Chart

Overall respondent signal

Financing constraints / strategic misalignment is the largest barrier overall (40%), reflecting uncertainty around capital deployment and integration conviction.

Valuation gaps remain a significant challenge (30%), demonstrating persistent bid-ask spread friction.

Regulatory friction is cited by 30%, indicating that approval timing, compliance expectations, and rating considerations still influence deal feasibility.

Differences by seniority

C-suite: Majority selects valuation gaps (57%), highlighting macro-cycle-driven pricing disconnects as the core impediment.

Owners: Split primarily toward financing/strategy misalignment (67%), consistent with sensitivity to buyer discipline and capital availability.

VPs: 100% cite financing constraints / strategic misalignment, suggesting execution teams are most impacted by uncertainty in structure and capital sources.

Other respondents: Balanced between regulatory friction (50%) and strategic misalignment (33%), showing process-level friction across the spectrum.

Implications for deal strategy

Increased use of earn-outs, seller notes, and contingent pricing structures likely required to bridge valuation gaps.

Enhanced emphasis on strategic fit, post-close integration plans, and clear ROI modeling necessary to unlock financing.

Carve-outs and restructuring transactions may accelerate as capital pressure and regulatory oversight intensify.

Deal teams may need to prioritize early alignment across financial sponsors, management teams, and boards to avoid late-stage breakdown.

Key takeaway

The greatest execution risk in today’s insurance M&A market is not deal volume demand, but agreement on valuation and conviction around strategy, requiring more sophisticated structuring and deeper diligence.

Conclusion

If one message rings loudest from these findings, it’s this: the future of insurance M&A belongs to the bold—but not the reckless. Buyers are demanding sharper strategy, sellers are demanding fair value, and investors are demanding credible growth pathways backed by real capability, not just scale. Gone are the days when piling on premium volume guaranteed competitive advantage. Today, differentiation, data, and specialty know-how define who wins.

Private equity’s continued firepower will keep the market active, but capital pressure and regulatory oversight will shape the pace and character of transactions. Expect more carve-outs, targeted platform expansion, and disruptive bolt-on innovation, while broad consolidation plays evolve into more selective, defensible moves.

The challenge? Closing the gap between buyer conviction and seller expectation. Those who master creative structuring, earn-out engineering, and early alignment across stakeholders will unlock the best deals. Those who cling to yesterday’s multiples or generic synergy stories may watch opportunities pass them by.

To put it simply: demand is not the problem—execution is. The firms that navigate complexity with clarity, agility, and discipline won’t just survive this cycle—they’ll define the next generation of leaders in insurance M&A.

Sources & References

Media150 Microsurvey M&A Next 12 Months. https://insights150.com/p/m-a-divergence-what-62-insurance-executives-told-us-about-the-next-12-months

Media150. Niche Over Scale: How Insurance M&A Preferences Are Splitting by Role. https://insights150.com/p/niche-over-scale-how-insurance-m-a-preferences-are-splitting-by-role

Media150. What’s the Real Deal‐Killer in Insurance M&A? It Depends Who You Ask. https://insights150.com/p/what-s-the-real-deal-killer-in-insurance-m-a-it-depends-who-you-ask