- Insurance 150

- Posts

- The Life Pyramid Is Inverting, Are Your Products Ready?

The Life Pyramid Is Inverting, Are Your Products Ready?

AUB doubles down on the UK and the AI divide widens, while inflation risks shift toward fiscal dominance.

Good morning, ! This week we’re diving into the US inflation evolution and its fiscal dominance root problem, the inversion of the life pyramid and its impact in the life insurance space, and the widening AI divide among insurers.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

TREND OF THE WEEK

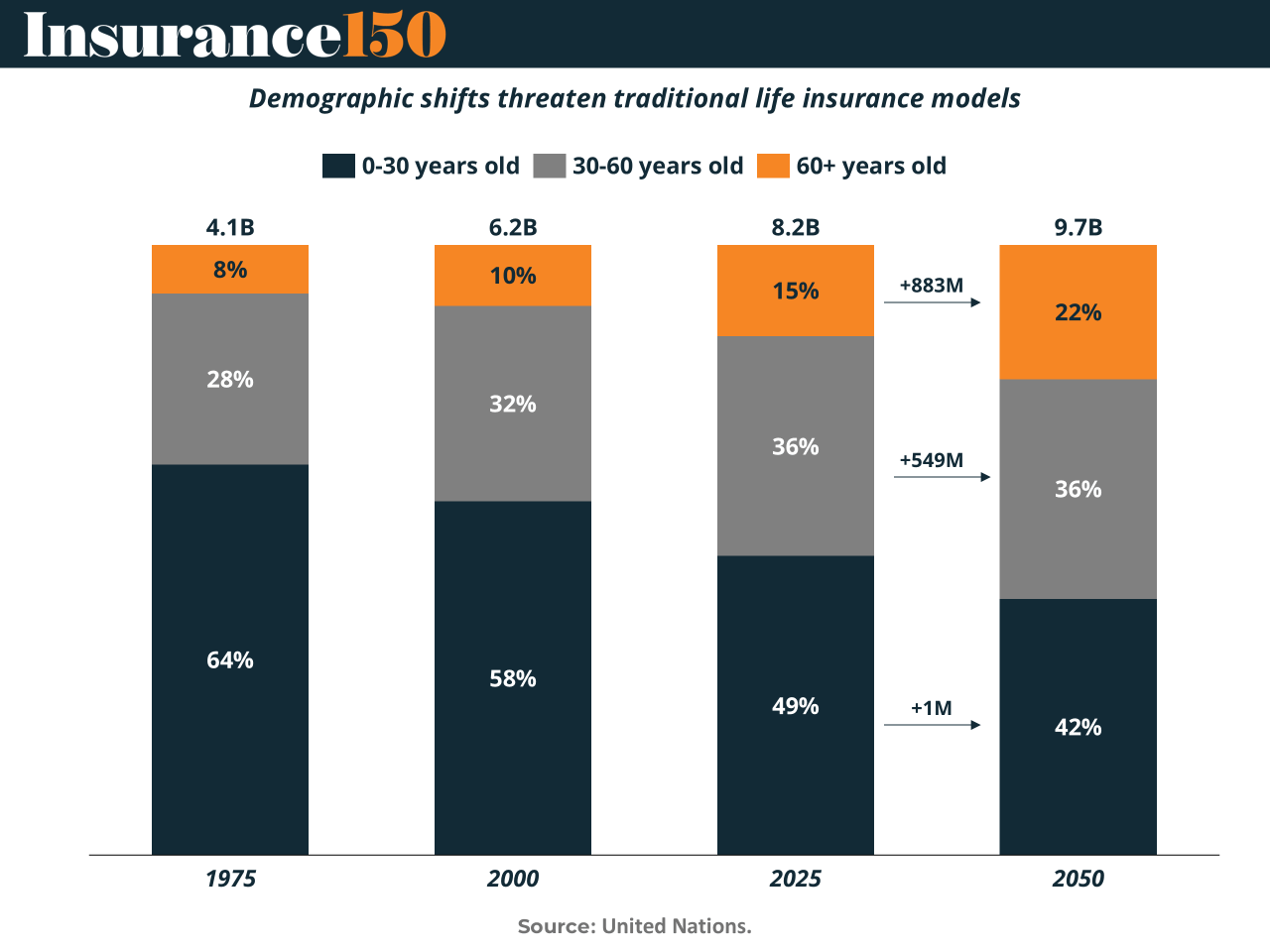

The Life Insurance Pyramid Is Inverting

For decades, life insurers quietly depended on a simple math trick: lots of young policyholders at the bottom, fewer retirees at the top. That population pyramid is now flipping.

By 2050, people aged 60+ will make up 22% of the global population, while the under-30 cohort shrinks to 42% and stops growing altogether—an unprecedented milestone. Translation: longer-duration payouts meet a thinner pipeline of new premiums.

The stress shows up everywhere: reserve assumptions, pricing models, and customer acquisition economics were built for a younger world. Slower growth doesn’t help, with global GDP expected to expand just 2.2% CAGR through 2050—the weakest stretch since the Great Depression.

Executives see it coming. In a 2025 survey, aging populations, longevity risk, and delayed life milestones topped strategic concerns. The takeaway is blunt: incremental tweaks won’t save legacy life models. (More)

MICROSURVEY

In your opinion, what is currently the primary driver of portfolio reshaping among insurers?We would like to understand what is most actively pushing insurers to rethink and reshape their portfolios today. |

DEAL OF THE WEEK

AUB Plants Its Flag in UK Retail Insurance

AUB Group has struck a decisive UK expansion play, agreeing to acquire a majority stake in Prestige Insurance, positioning it as the group’s flagship UK retail platform. The transaction, expected to close before 30 June 2026, marks a sharp pivot toward organic scale after AUB’s $5.25B private equity sale collapsed late last year.

Prestige brings real heft. The group writes £170m+ of retail GWP across 18 branches, runs £140m of MGA capacity, and operates Covernet, an insurtech platform servicing £330m of GWP. Just as important, it offers a rare three legged model combining broking, MGA, and technology under one roof. AUB plans to consolidate Tysers’ retail portfolios into Prestige, reinforcing distribution density while keeping the business operationally independent under CEO Trevor Shaw.

Why it matters. This is not financial engineering. It is platform construction. AUB is doubling down on the UK as a long term growth market, prioritizing control, capability, and embedded technology over fragmented bolt ons. For FIG leaders, the signal is clear. In a softer M&A tape, scaled intermediaries with integrated MGA and tech assets are becoming the most defensible growth bets in global insurance distribution. (More)

INSURTECH CORNER

The Great AI Divide Is Here

Capgemini’s latest insurance outlook draws a hard line between trailblazers and tourists. While 70% of insurers plan to scale AI deployments in customer service, underwriting, and claims, most remain trapped in pilot purgatory. The real leaders? They’re redesigning workflows, not just retrofitting tech into legacy processes.

The urgency is mounting. Risk is clustering, both physically (urban density) and digitally (a few GenAI providers powering billions of business processes). That’s creating systemic exposures insurers aren’t yet pricing for.

Capgemini flags two structural shifts:

AI-enabled workflows, like a Google Cloud–powered underwriting engine now handling 15–20 specialty risk proposals per day at 98% accuracy.

Advisor augmentation, where AI tools streamline agent tasks and deepen customer engagement. Younger consumers (67% of <40s) want both digital access and human support—only 16% of insurers deliver that today.

Bottom line: The gap between insurers who digitize and those who redesign is growing—and by 2027, the latter will be 18 months ahead on performance metrics. (More)

MACROECONOMICS

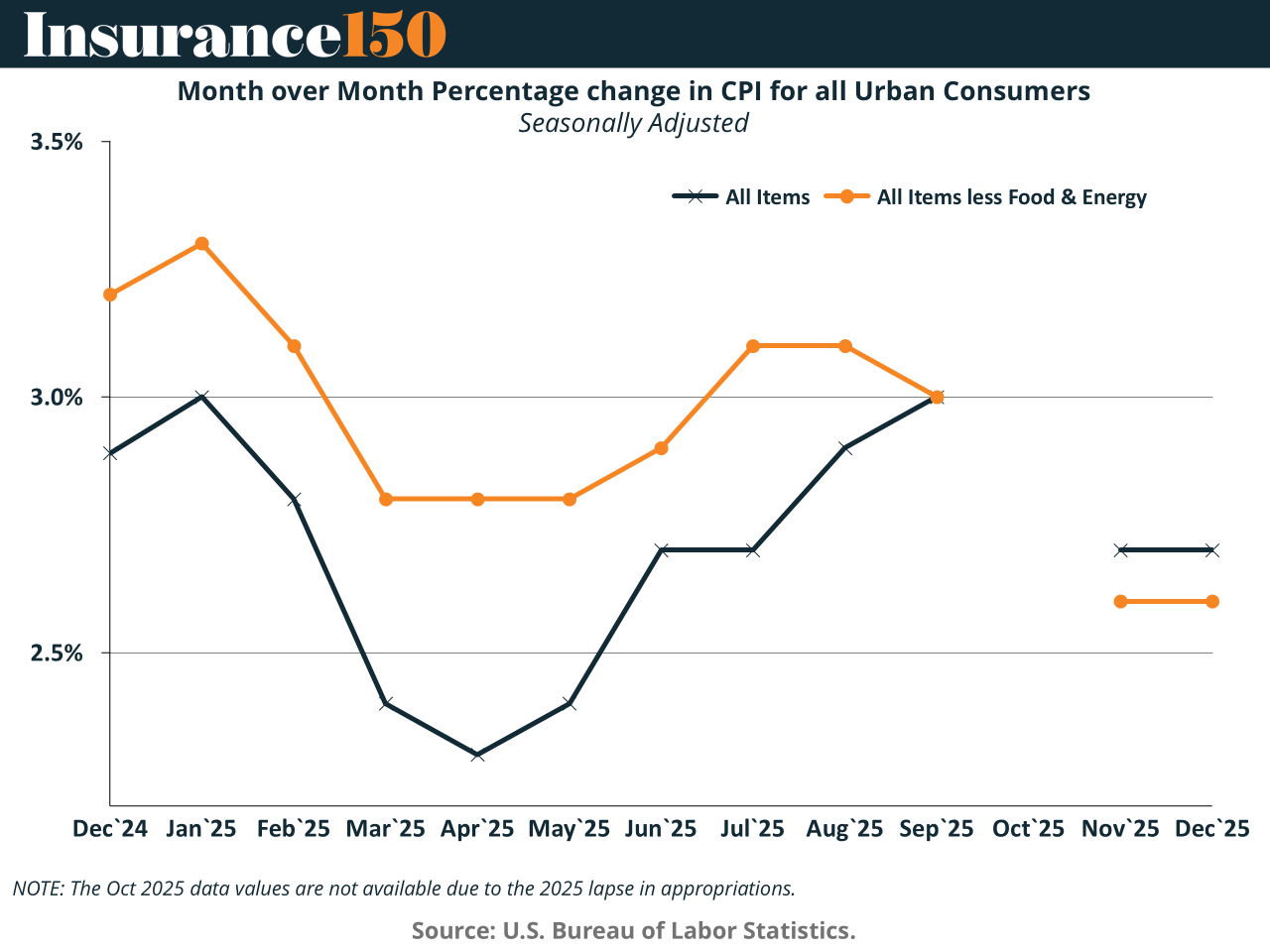

Inflation Is Calm — But the Risks Are Shifting

US inflation has cooled markedly since its 2022 peak and now sits just below 3 percent. By itself, this looks reassuring. Yet inflation remains above the Federal Reserve’s 2 percent target, and the sources of price pressure have shifted in ways that complicate the policy outlook.

Goods prices have largely normalized, but services inflation — especially shelter and healthcare — remains sticky. This makes further disinflation harder to achieve through interest rates alone. At the same time, inflation risks are no longer purely economic. Growing political pressure on the Federal Reserve to cut rates in order to lower government borrowing costs raises concerns about fiscal dominance, where monetary policy becomes subordinate to fiscal needs.

That would be dangerous: if investors doubt the Fed’s independence, inflation expectations could rise even while current inflation looks contained.

The bottom line: today’s inflation is calm, but preserving credibility and institutional independence may matter more for future price stability than any single data release. (More)

COMPLIANCE CORNER

Solvency Gets a Tighter Grip

Regulators spent 2024 doing what markets didn’t: slowing insurers down. The NAIC and state regulators tightened solvency oversight with a clear focus on capital adequacy, investment quality, and group transparency.

The most pointed move hit risk-based capital (RBC). Higher factors on CLO residual tranches—assets disproportionately held by private equity–owned insurers—send an unmistakable message: riskier yield now requires more surplus. At the same time, statutory accounting changes reduced reliance on external credit ratings, forcing insurers to own their cash-flow and reserve assumptions.

Beyond assets, regulators pushed harder on structure. A new offshore reinsurance worksheet standardizes collateral audits, while enhanced group supervision expands visibility across holding-company ecosystems.

Even AI-driven underwriting isn’t immune. While no new capital rules target InsurTech directly, scrutiny around model governance and operational resilience is quickly becoming a solvency issue. (More)

INTERESTING ARTICLES

PUBLISHER PODCAST

No Off Button: Work/Life Lessons To Reach 700,000 Subscribers And #1 In Your Niche

Champions don’t slow down. They don’t wait for shortcuts. And they definitely don’t have an off switch. No Off Button is where Aram sits down with founders and creators who treat their craft like a long game—obsessive execution, high standards, and zero excuses.

This week’s guest is Rocky Xu, a finance filmmaker who built a 700,000+ subscriber audience and became #1 in his niche by skipping the creator playbook entirely. From day one, Rocky approached YouTube like a media company—producing Netflix-level documentaries from his bedroom and focusing on assets that compound, not viral hits.

The conversation digs into lessons PE minds will recognize instantly: why consistency beats hacks, why distribution is power, why AI is a tool—not a replacement for judgment—and why real value is built by owning evergreen catalogs, not chasing weekly spikes.

Why it matters: this is capital allocation and brand-building logic applied to media. Long-term thinking, defensible taste, and doing the work when no one’s watching.

"Always bear in mind that your own resolution to succeed is more important than any other."

Abraham Lincoln