- Insurance 150

- Posts

- 8.2% Uninsured: Cracks in America’s Coverage Map

8.2% Uninsured: Cracks in America’s Coverage Map

The U.S. health insurance landscape is showing visible cracks as uninsured rates climb and coverage patterns shift. The map isn’t collapsing—but it’s being redrawn under economic and regulatory pressure.

Good morning, ! This week we’re tracking insurance’s long-awaited rebound—advanced markets are back to growth, regulators are tightening the screws, and AI-focused InsurTechs are rewriting the rules of distribution.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Cracks in the Coverage Mosaic

The U.S. healthcare coverage landscape is showing signs of instability, despite strong macroeconomic tailwinds. Medicaid unwinding, employer-sponsored plateauing, and ACA price pressures are reshaping the coverage mix in ways that matter deeply to payers, providers, and investors.

Medicaid disenrollments—driven by eligibility redeterminations—have pushed uninsured rates up from 7.6% to 8.2%, but the ripple effects go deeper. Pediatric coverage erosion (from 3.9% to 5.1% uninsured) suggests administrative churn is outpacing re-enrollment mechanisms. Meanwhile, ACA small group insurers are filing for 5–15% premium hikes in 2026, citing inflation and utilization pressures.

Employer coverage isn’t offering a buffer. Growth has plateaued, with affordability and job churn weakening retention—especially among working-age adults, whose uninsured rate climbed to 11.6%.

Why it matters: The shifting payer mix alters revenue predictability. Providers overexposed to commercial or self-pay segments face heightened risk. Conversely, Medicaid MCOs and ACA-exchange incumbents could gain share. Strategic capital should follow coverage resiliency—not volume.

Bottom line: The U.S. health insurance map isn’t collapsing, but it’s redrawing. Watch the margins, not the headlines.

TREND OF THE WEEK

Advanced Markets Find Their Groove Again

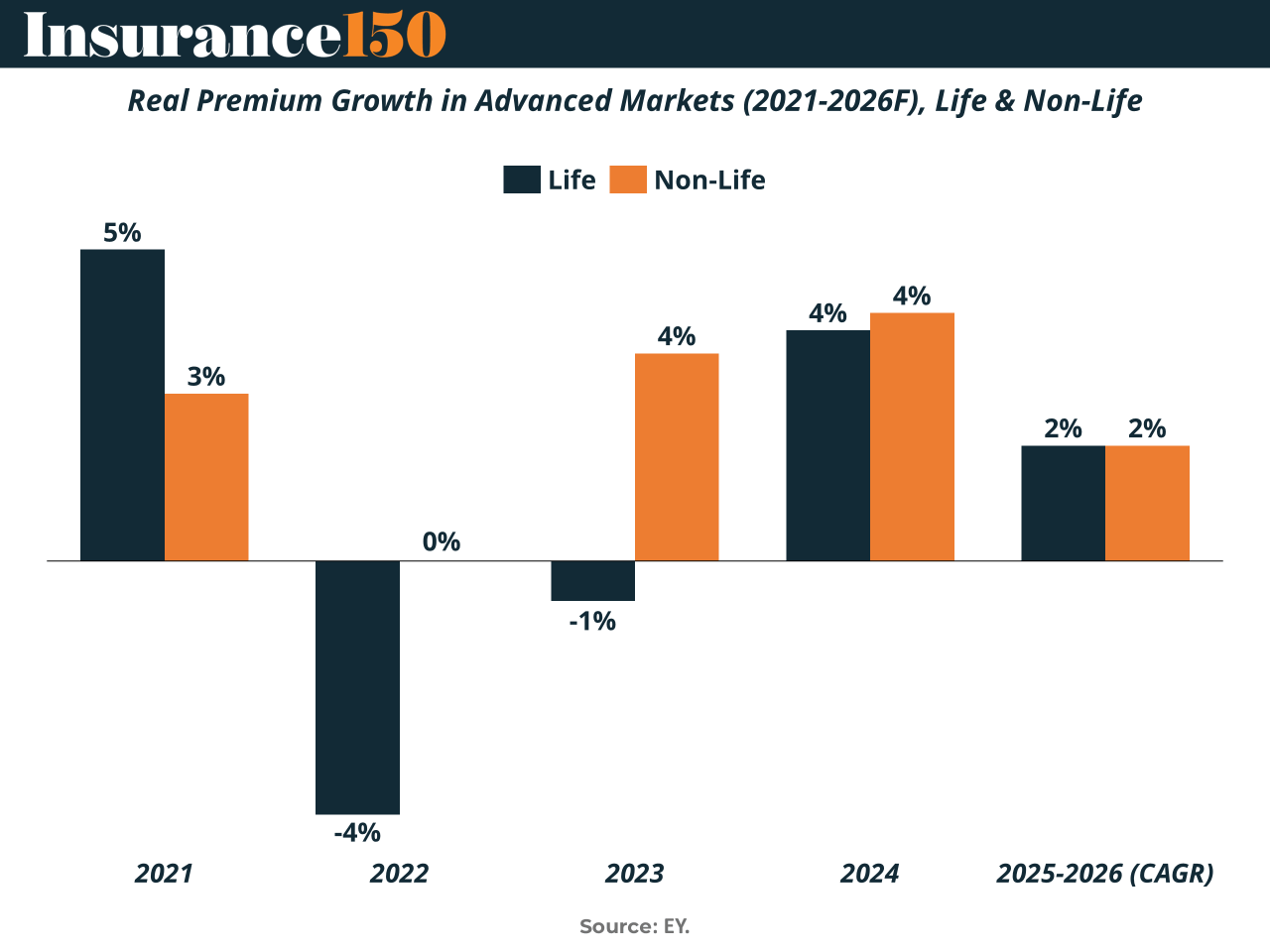

After a turbulent few years, advanced markets are showing signs of life again — and not just a pulse. Following a 4.4% contraction in 2022 and flat growth in 2023, real premium growth is set to jump +4.0% in 2024, split between life (+4.3%) and non-life (+3.6%) segments. Translation: the industry’s long-awaited comeback tour has begun.

What’s driving it? A cocktail of cooling inflation, monetary easing, and wage growth, giving insurers breathing room to rebuild margins and pricing power. The rebound won’t turn into a boom, though — forecasts suggest a steady ~2% CAGR for 2025–26, marking a shift from survival mode to sustainable normalization.

The bottom line: advanced markets are finally shaking off the pandemic and inflation hangover. Less chaos, more rhythm — and, for once, stability might just be the new sexy in insurance. (More)

PRESENTED BY ALTINDEX

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

MICROSURVEY

C-Suites Want Niche. VPs Want Tech.

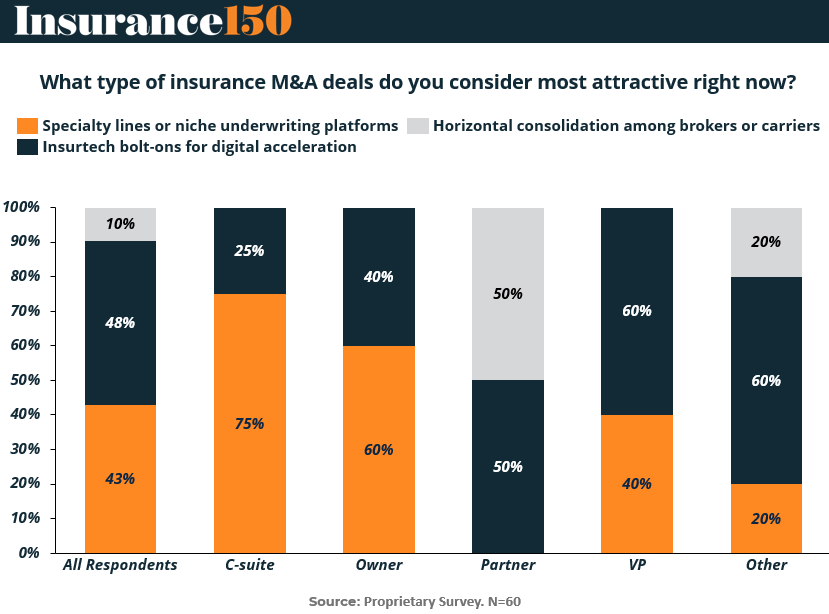

In our proprietary survey of 60 insurance execs, the most attractive M&A target varies—sharply—by role. 75% of C-suite leaders are chasing specialty or niche underwriting platforms, signaling a clear appetite for margin-rich, vertical expertise. Meanwhile, 60% of VPs and those in "Other" roles favor Insurtech bolt-ons, prioritizing digital acceleration over distribution or risk books.

Interestingly, horizontal consolidation—a once-dominant strategy—ranks lowest across all groups, except for Partners, where it ties for top billing at 50%. It’s a split that reflects not just preference, but power dynamics. Owners and execs are hunting earnings accretion; mid-levels are focused on tech enablement.

Why it matters: The internal tug-of-war over M&A strategy is real—and relevant. If you're selling a specialty MGA, start at the top. If you're peddling tech, target ops-heavy leaders. And if you’re planning a broker roll-up? You might be five years too late. (More)

DEAL OF THE WEEK

Reinsurance Megablock: Fortitude Re & Carlyle Build a $700M Sidecar for Asia

Fortitude Re and Carlyle just launched FCA Re, a $700M reinsurance sidecar purpose-built to unlock Asian life and annuity markets. It's not just another Bermuda-based reinsurer; this one's turbocharged by third-party capital from T&D Insurance, AllianceBernstein, Shinhan Life, and even Korea’s National Pension Service.

Fortitude sponsors the insurance; Carlyle steers the assets. Once fully deployed, Carlyle adds $10B in fee-earning AUM—proof that reinsurance is becoming the next frontier for asset managers. For a region driven by aging populations and capital optimization, FCA Re is a bet on a demographic dividend—and a signal that sidecars are no longer just for hurricanes. (More)

INSURTECH CORNER

AI Eats Distribution

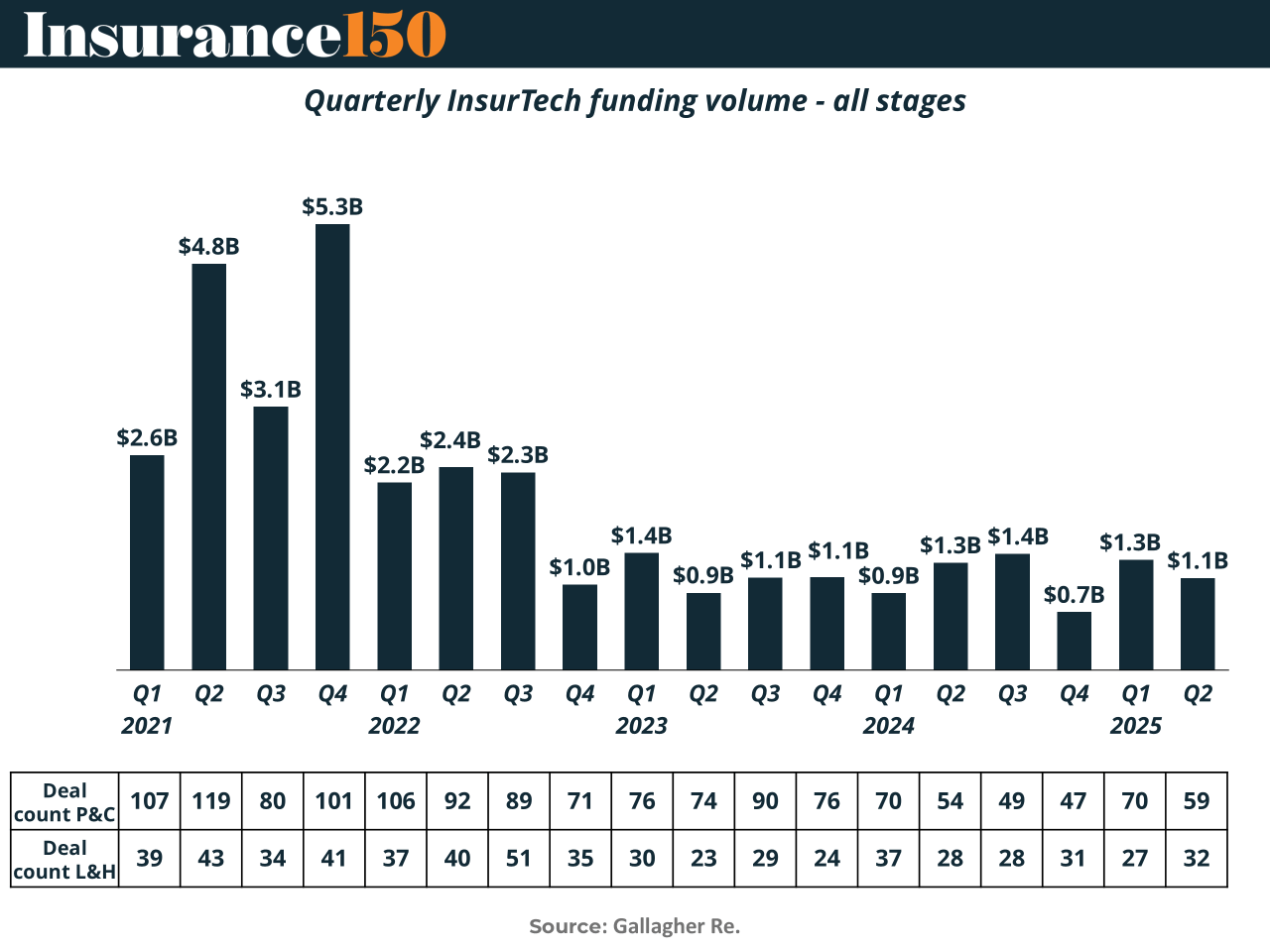

Global InsurTech funding is finally finding its footing — but the balance between segments couldn’t be starker. Total investment slid 16.7% in Q2 2025 to $1.09B, yet beneath the slowdown, Life & Health (L&H) techs are thriving while Property & Casualty (P&C) players hit their weakest streak since 2018.

P&C funding collapsed 68% QoQ to $362M, as investors turned cold on traditional underwriting and distribution models. Meanwhile, L&H InsurTechs nearly tripled funding to $728M, with Gravie, Bestow, and Empathy leading a rebound that pushed average deal size to $26M.

The big picture: AI-focused InsurTechs now represent 57% of activity, underscoring that the next growth cycle will be driven by data and intelligent automation, not digital brokers. The gold rush for distribution is over — the new frontier is smarter underwriting. (More)

TOGETHER WITH MASTERWORKS

Where to Invest $100,000 According to Experts

Investors face a dilemma. Headlines everywhere say tariffs and AI hype are distorting public markets.

Now, the S&P is trading at over 30x earnings—a level historically linked to crashes.

And the Fed is lowering rates, potentially adding fuel to the fire.

Bloomberg asked where experts would personally invest $100,000 for their September edition. One surprising answer? Art.

It’s what billionaires like Bezos, Gates, and the Rockefellers have used to diversify for decades.

Why?

Contemporary art prices have appreciated 11.2% annually on average

…And with one of the lowest correlations to stocks of any major asset class (Masterworks data, 1995-2024).

Ultra-high net worth collectors (>$50M) allocated 25% of their portfolios to art on average. (UBS, 2024)

Thanks to the world’s premiere art investing platform, now anyone can access works by legends like Banksy, Basquiat, and Picasso—without needing millions. Want in? Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

MACROECONOMICS

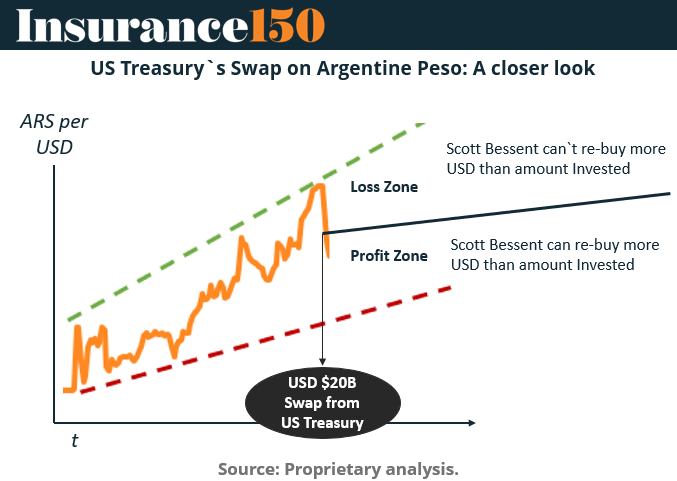

Scott Bessent’s $20 Billion Bet on Argentina

Argentina just pulled off something that hasn't happened in over 100 years: a fiscal surplus. Under President Javier Milei, the country is stabilizing via fiscal discipline, floating exchange bands, and a $20B currency-swap lifeline from the U.S. Treasury. The peso is holding, reserves are up 60%, and inflation is trending down — cautiously optimistic signals for a country notorious for default cycles. But Washington’s cash comes with political strings: lose midterms, lose support. A private-sector follow-on facility could double the war chest to $40B. The macro thesis? This isn’t cosmetic reform — it’s monetary orthodoxy with real teeth. But in Argentina, politics—not policy—usually ruins the ending. (More)

COMPLIANCE CORNER

DFS Put Everyone on the Clock

Regulation 60 isn’t new. But NY DFS just gave it teeth—and a timer. Starting December 13, 2024, life insurers and fraternal orgs must not only have internal procedures for replacements… they must file them. Enter Section 51.6(e): Your replacement policies are now a regulatory filing. Any material updates? You’ve got 30 days to re-file. Also new: a “File and Use” system—DFS can review at any time, so don't get cute. Still need pre-approval for alternate procedures or custom forms. Submissions must go to DFS via email or SERFF. No exceptions. And yes, 12-point font is now a compliance matter. DFS also urges adherence to its Best Practices: think 60-day free looks, accurate Disclosure Statements, and form signature hygiene.

Bottom line: Whether you're updating e-apps or tightening telesales, the margin for sloppiness is officially closed. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

Insurer stocks have outperformed the S&P 500 by 106 percentage points since 2014, with shares rising 172% in the first 4 years of Obamacare - due to subsidy-backed revenues. Molina saw a 1,000%+ stock gain.

Operational waste tripled.

— The Questionable Gardner (@T_Q_Gardner)

1:54 PM • Oct 14, 2025

"To succeed in business, to reach the top, an individual must know all it is possible to know about that business."

J. Paul Getty