- Insurance 150

- Posts

- Reinsurance Hits $1.7T, Howard Hughes’ $2.1B Bet, and the 40% AI Drop

Reinsurance Hits $1.7T, Howard Hughes’ $2.1B Bet, and the 40% AI Drop

Howard Hughes acquires Vantage for $2.1B and reinsurance premiums hit $1.7T, while 40% of agentic AI projects face cancellation.

Good morning, ! This week we’re tracking reinsurance premiums surging past ~$1.7T, oil bouncing off key technical% levels on geopolitical risk, and AI shifting from hype to oversight as 40% of agentic projects face cancellation and regulators tighten controls.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

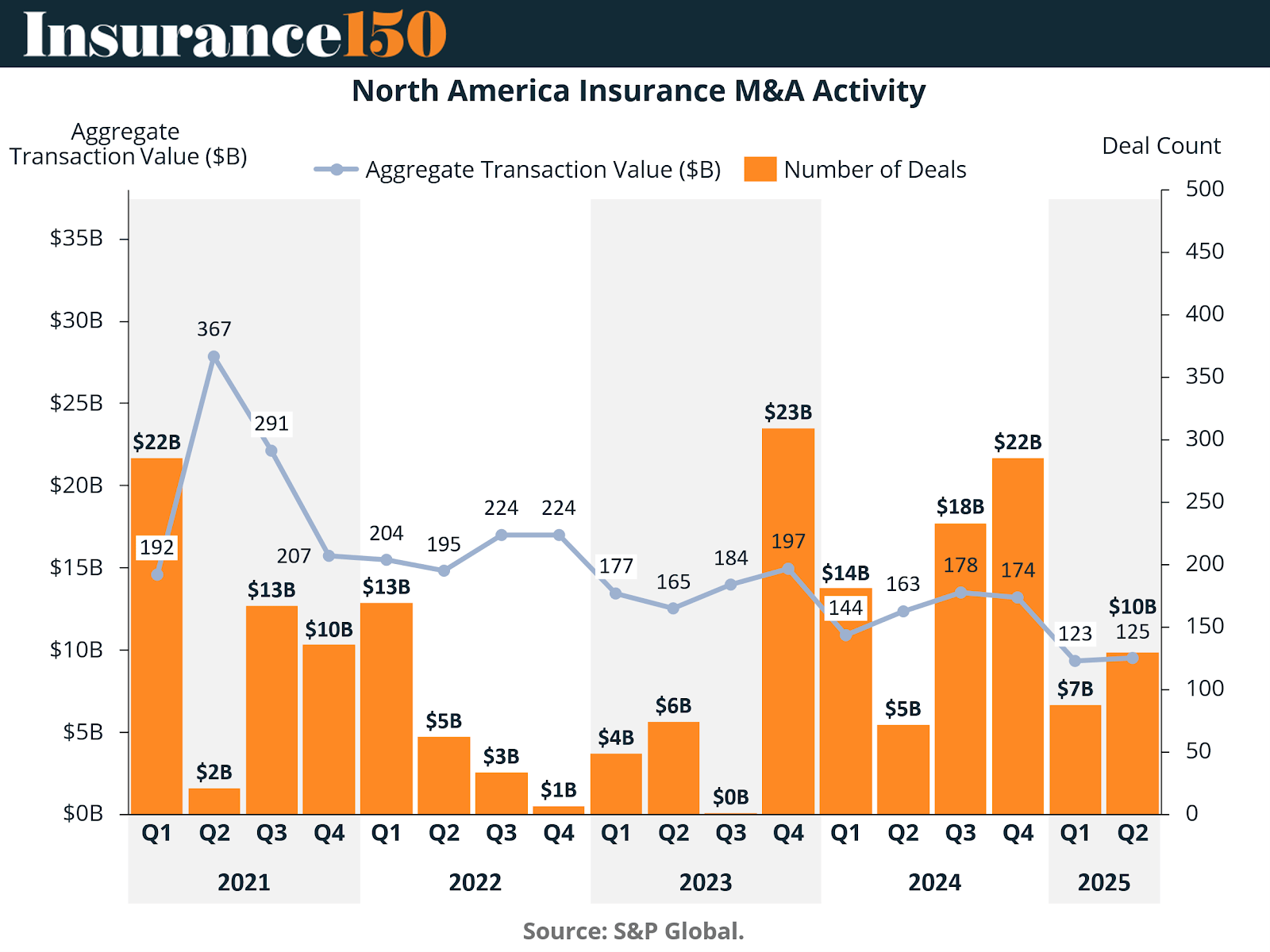

From Roll-Ups to Razor Blades

Insurance M&A has officially ditched its “size matters” era. The game now? Strategic precision. Forget broad geographic plays—today’s buyers want specialty underwriting, digital enablement, and capital-light assets that actually do something. Even private equity has sobered up, skipping bloated roll-ups in favor of niche, defensible bets. And while deal count holds steady, headline valuations are driven by a few outsized broker transactions masking a very cautious middle-market reality. It’s no longer about who can swallow the most agencies; it’s about who can extract the most margin per byte of data or underwriting edge.

TREND OF THE WEEK

Reinsurance Gets Bigger—Not Looser

Reinsurance demand is exploding, but insurers aren’t giving up control. Global gross reinsurance premiums written climbed from roughly $545B in 2019 to ~$885B in 2023, before an estimated leap to $1.74T in 2024—effectively doubling the market in five years.

What’s notable isn’t just the growth, but the discipline. Despite aggressive limit buying, insurers still retained about 69% of risk in 2024, only modestly below the 71% peak in 2023. Even in 2020, retention never collapsed.

Translation: this isn’t panic buying. Cedents are using reinsurance as capital management, not as an excuse to outsource underwriting. NatCat volatility, inflation-adjusted losses, and regulatory capital pressure are driving demand—but insurers still want skin in the game. Expect more premium flow, not a surrender of risk. (More)

PRESENTED BY FISHER INVESTMENTS

7 Ways to Take Control of Your Legacy

Planning your estate might not sound like the most exciting thing on your to-do list, but trust us, it’s worth it. And with The Investor’s Guide to Estate Planning, preparing isn’t as daunting as it may seem.

Inside, you’ll find {straightforward advice} on tackling key documents to clearly spell out your wishes.

Plus, there’s help for having those all-important family conversations about your financial legacy to make sure everyone’s on the same page (and avoid negative future surprises).

Why leave things to chance when you can take control? Explore ways to start, review or refine your estate plan today with The Investor’s Guide to Estate Planning.

MICROSURVEY

What is your organization’s biggest cost pressure heading into 2026?As insurers rebalance expense ratios in a higher-volatility market, cost containment is becoming as critical as growth. |

DEAL OF THE WEEK

Howard Hughes Bets Big on Specialty Risk

In a bold pivot from real estate to risk, Howard Hughes Holdings is acquiring Vantage Group Holdings for $2.1B in cash, marking one of the most strategic transformations in the holding company’s history. The deal, expected to close by mid-2026, values Vantage at 1.5x 2025 book and accelerates Howard Hughes’ shift into a diversified conglomerate with long-term insurance ambitions.

Vantage, launched in 2020 with backing from Carlyle and Hellman & Friedman, quickly built a modern, analytics-driven specialty re/insurer platform. The transaction includes up to $1B in preferred equity from Pershing Square Holdings—Howard Hughes’ largest shareholder—which will manage Vantage’s investment assets fee-free. Over time, Pershing may fully exit as Howard Hughes builds full economic control of the insurer.

Why it matters: This is more than financial engineering. It’s a statement: owning an underwriting platform with permanent capital, long-tailed risk, and asset float could be Howard Hughes’ path to Berkshire-like reinvention. And for the insurance market, it signals growing interest from non-traditional strategic buyers who see insurance not just as risk—but as return. (More)

INSURTECH CORNER

Agentic AI: Hype Now, Headaches Later

Agentic AI may be the buzzword du jour, but according to Gartner, it’s headed for a brutal reality check: over 40% of agentic AI projects will be canceled by 2027 due to high costs, vague ROI, and weak risk controls.

Insurtechs flirting with autonomous agents should take note. A January 2025 Gartner poll showed only 19% of enterprises have made significant investments in agentic AI—while 31% remain on the sidelines. The reason? Vendor “agent-washing” is rampant, with firms rebranding legacy automation tools as next-gen AI agents.

Gartner sees real promise in agentic AI—predicting 15% of daily work decisions will be made autonomously by 2028, and a third of enterprise software will embed agents. But for now, the tech lacks maturity to reliably handle nuanced decisions at scale.

Why it matters: For insurers chasing AI-led operational gains, the real edge may lie not in flashy agent deployments, but in workflow reinvention. Insurtechs that can clearly tie agentic AI to underwriting productivity or claims automation—not just chatbot upgrades—may be the ones to watch. (More)

TOGETHER WITH MONEY.COM

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to find the coverage you actually need.

MACROECONOMICS

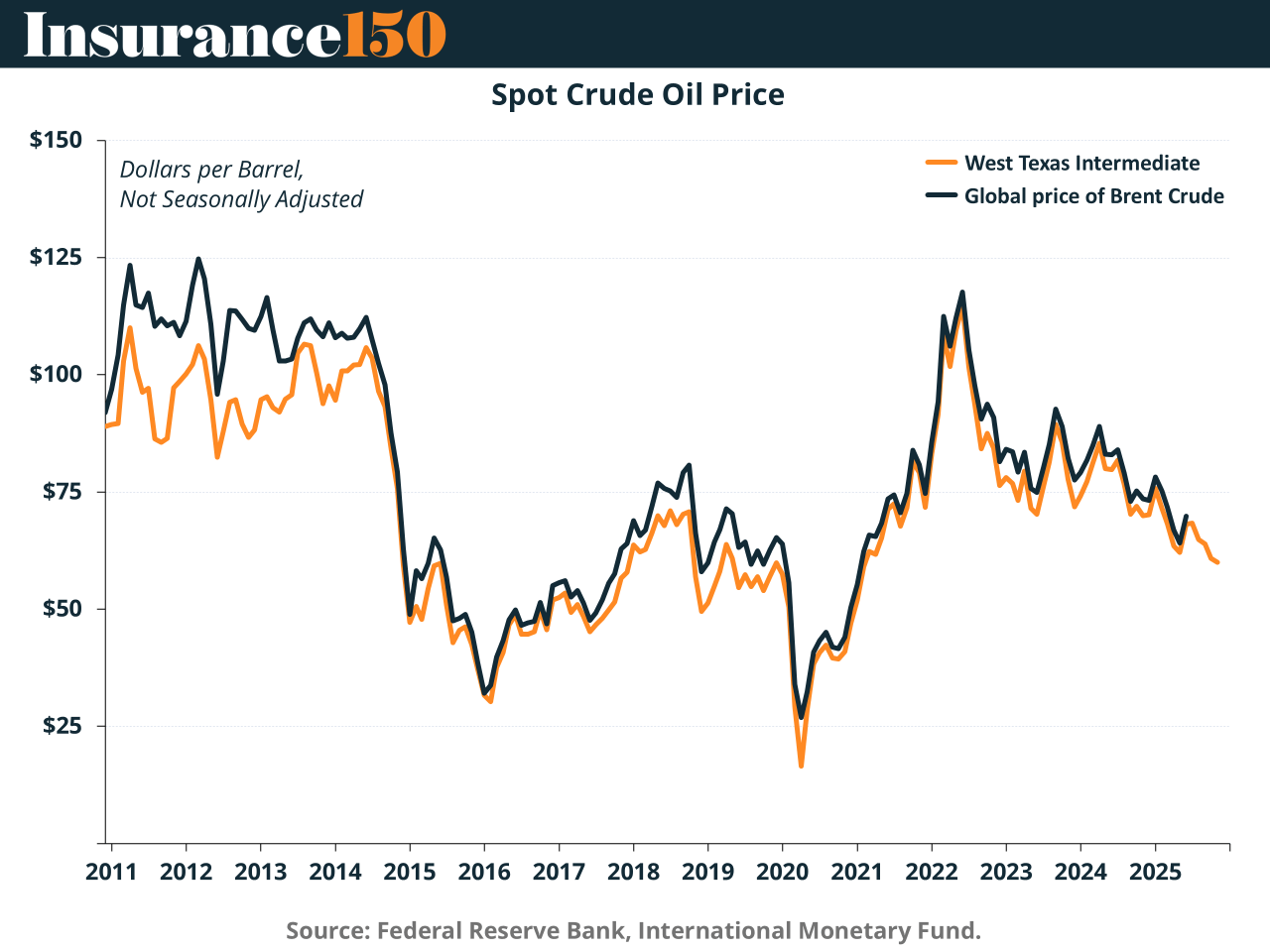

Geopolitical Risk Lights a Match Under Oil Prices

Crude oil markets are doing their best impression of a fire alarm test—blaring at even the whiff of U.S.-Venezuela tension. Despite ample U.S. production and OPEC+ steadiness, Brent and WTI are rising on geopolitical fumes alone. Venezuela’s ~600K barrels/day sounds minor—until you remember oil markets run on margins, not magnitude. Futures markets have already baked in risk premiums, with WTI bouncing off multi-month lows thanks to short-covering.

A U.S. military incursion could push WTI through technical ceilings near $58.59, reinforcing a self-fulfilling upward spiral. Past crises—from Ukraine to mid-2010s supply shocks—show that prices don’t just rise, they overshoot. Oil doesn’t care that it’s just 1% of global supply—political risk is king when spare capacity is tight and traders are trigger-happy. (More)

COMPLIANCE CORNER

AI Governance Isn’t Optional

As insurers double down on AI-driven underwriting, pricing, and claims, regulators are making one thing clear: innovation without oversight won’t cut it. The NAIC Model Bulletin on the Use of AI by Insurers, now adopted by 24 states, signals a rising baseline for documented governance, risk controls, and bias testing.

Insurers must now stand up formal AI Governance Programs—complete with audit trails, data lineage, and internal controls—that can survive regulatory scrutiny. That includes third-party models. If your vendor’s AI causes discriminatory outcomes, your name is still on the door.

Action items: Run a gap assessment against the NAIC bulletin, revise compliance policies to include AI-specific risk frameworks, and ensure contracts with tech providers include regulatory compliance provisions. And yes, your risk and tech teams need training too.

Why it matters: The window for regulatory grace is closing. As AI adoption in regulated insurance functions accelerates, regulators are shifting from principles to enforcement. Treat AI oversight like you would solvency or data privacy: core to your license to operate. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Get busy living or get busy dying."

Stephen King