- Insurance 150

- Posts

- The Insurance Wake-Up Call: M&A, Fraud ROI, and AI Dominance

The Insurance Wake-Up Call: M&A, Fraud ROI, and AI Dominance

Megadeals dominate M&A and AIG commits $3.5B to CVC, while leaders target Fraud Detection for fast ROI.

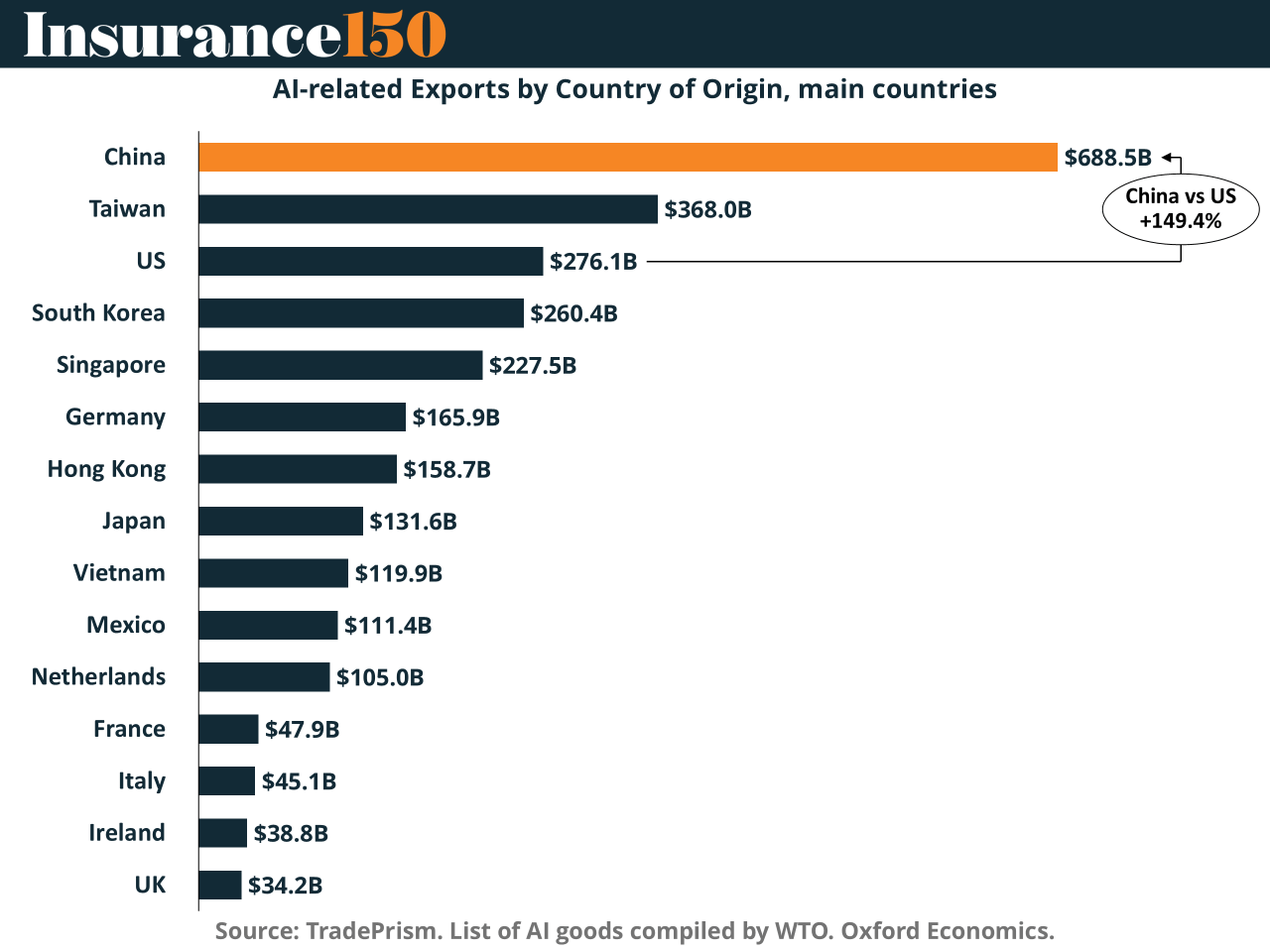

Good morning, ! This week we’re diving into the 2025 Insurance M&A story, lessons learned and the path ahead. Fraud detection is expected to be the fastest ROI source for Insurance investments; and China more than doubles US AI-related exports, marking clear dominance in today`s race.

Sponsor spotlight: In Affinity’s survey of nearly 300 private capital professionals, deal sourcing is still priority #1 for 2026—but bandwidth is the constraint. The 2026 Predictions report shows how firms are tightening data ecosystems and automating sourcing workflows to surface better opportunities faster. Read the Report →

DATA DIVE

Megadeals or Bust

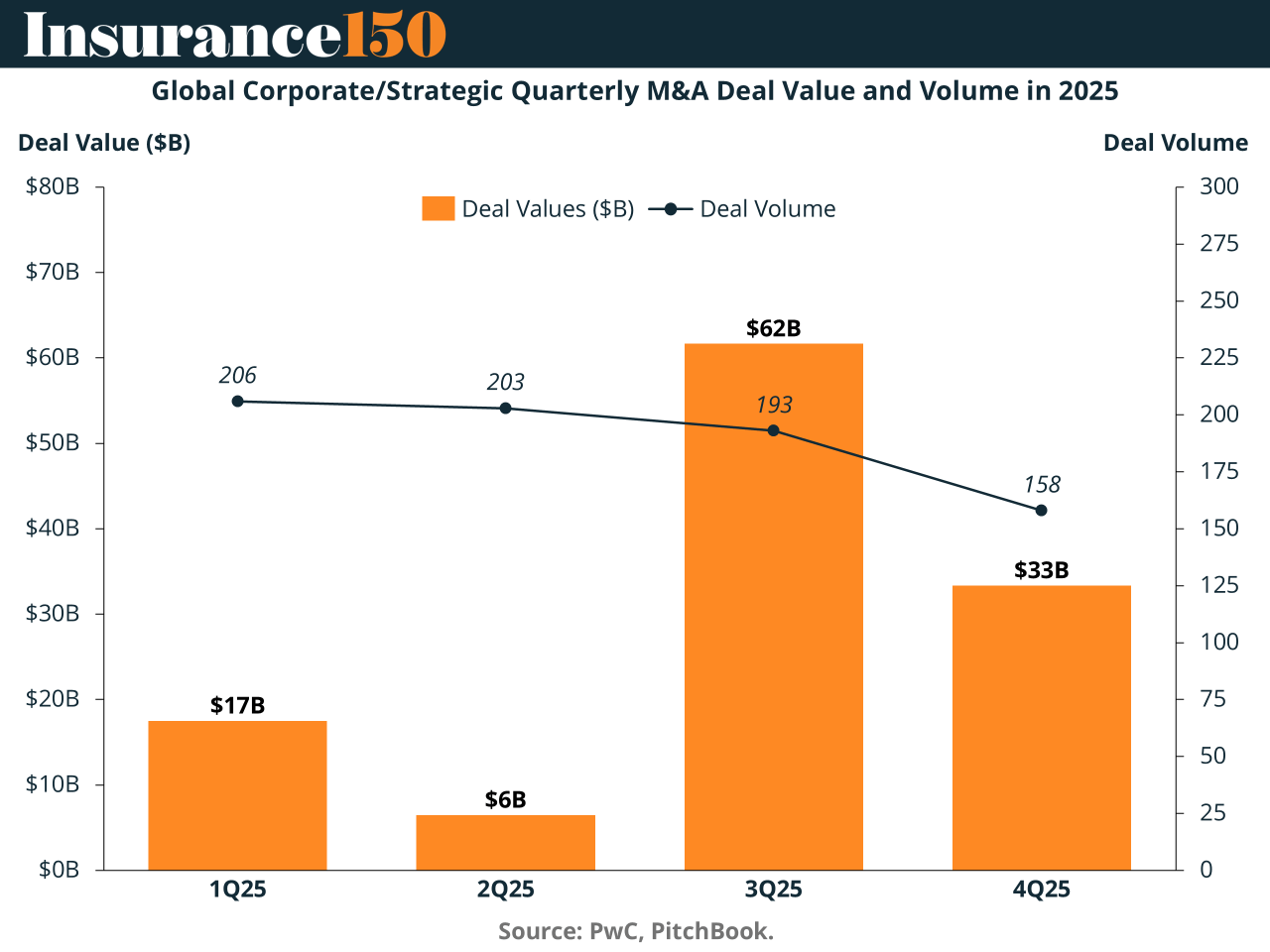

Insurance M&A in 2025 isn't about quantity—it’s about conviction. Despite a decline in overall deal volume, the U.S. market still clocked $13B in deal value through just 62 transactions. The math is simple: fewer deals, bigger bets.

Over 90% of H2’25 deal value came from megadeals, which now dominate the sector like never before. Strategic buyers and PE sponsors aren’t window shopping—they’re buying platforms with distribution control, specialty underwriting, and fee-based revenue. Sub-scale players? They're running out of time—and options.

TREND OF THE WEEK

Personal Lines Is a Scale Game Again

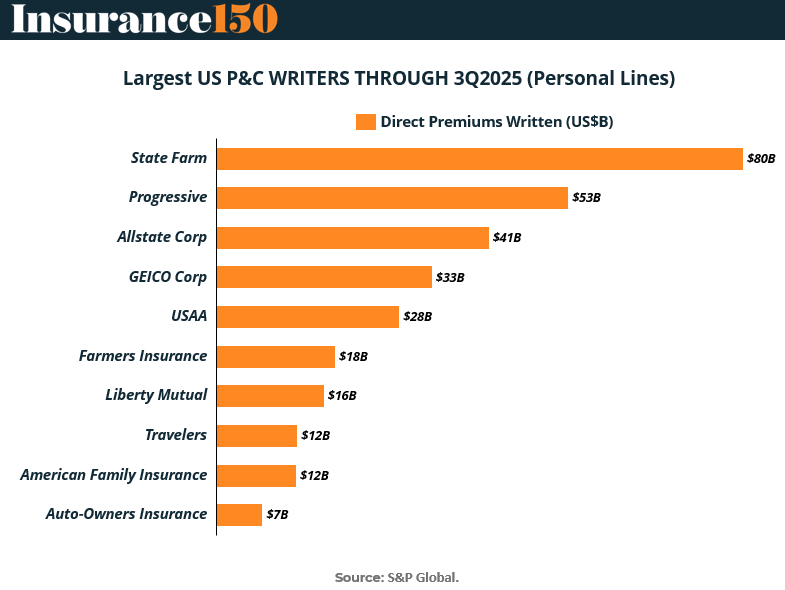

The personal lines leaderboard through 3Q2025 tells a familiar but newly reinforced story: scale is reasserting itself as the primary competitive weapon. State Farm’s ~$80B in direct premiums written now exceeds the combined personal lines book of the bottom five carriers on the list. The gap is widening, not narrowing.

The real signal sits just below. Progressive at ~$53B continues to outpace peers through disciplined rate action, telematics driven underwriting, and faster loss cost repricing. Allstate (~$41B) and GEICO (~$33B) remain formidable, but the distance to the leaders underscores how hard it is to recover share once momentum is lost in personal auto.

Mid tier carriers are effectively capped. The drop from USAA (~$28B) to Farmers (~$18B) marks the line where brand strength and distribution density start to matter more than marginal pricing or product tweaks. Below that, personal lines becomes a capital intensive grind with limited operating leverage.

Why it matters for insurance executives: personal lines profitability in the next cycle will favor carriers that can spread technology, claims, and reinsurance costs over massive premium bases. For boards and investors, this chart argues that organic scale is now more valuable than incremental M&A. The leaders are pulling. (More)

PRESENTED BY AFFINITY

One-third of dealmakers are now spending 21–40 hours every week just researching companies. That's half a full-time job before a single conversation happens.

In Affinity's survey of nearly 300 private capital professionals, deal sourcing remains their top priority for 2026. But the real bottleneck is having the bandwidth to evaluate opportunities before competitors do.

The firms pulling ahead are automating the manual research work, surfacing higher-quality targets faster, and protecting their teams from drowning in data.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

MICROSURVEY

Where Leaders Expect the Fastest ROI From New Investments

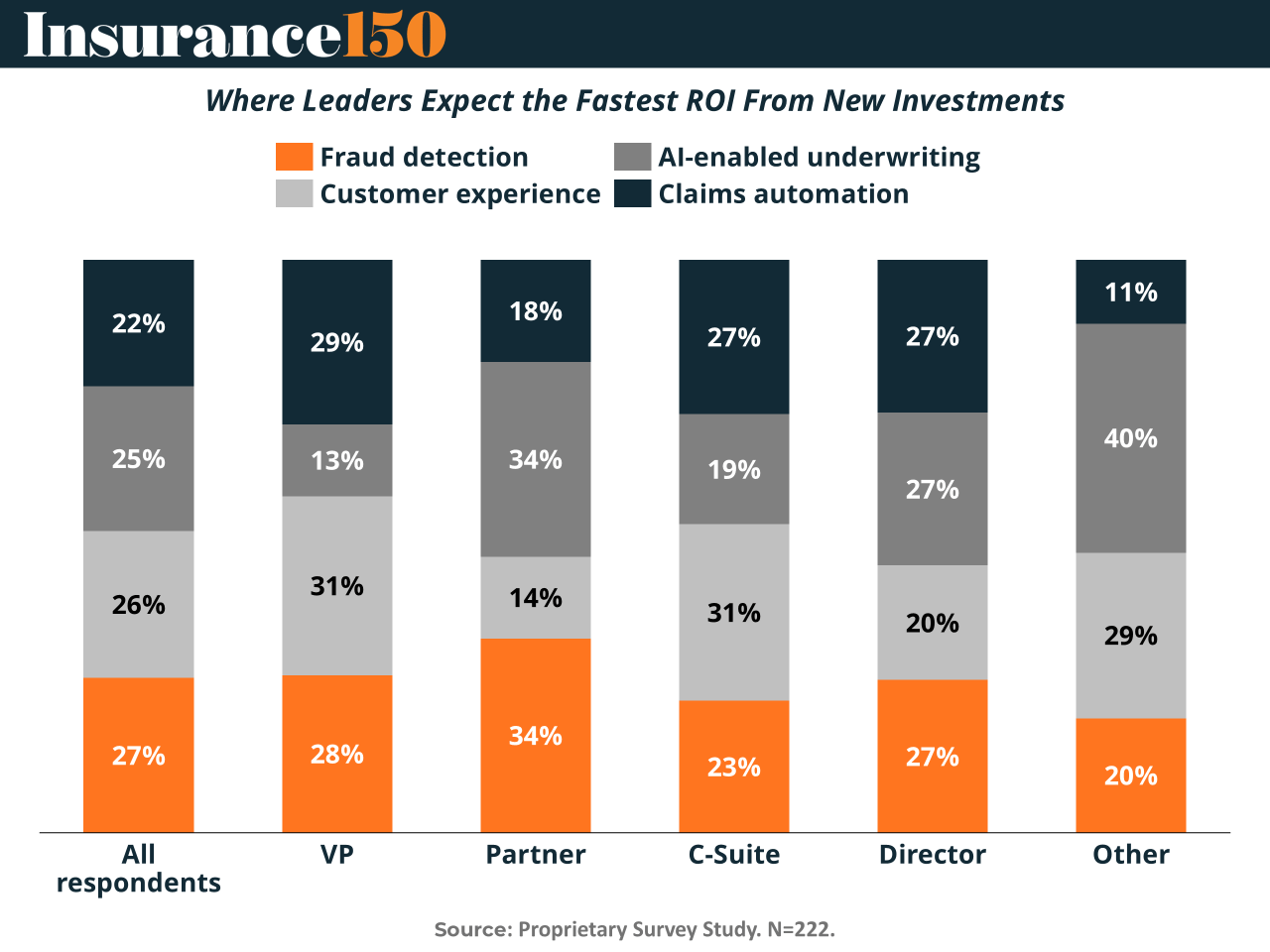

In today’s insurance market, ROI is no longer about ambition—it’s about speed, certainty, and proof. Our latest survey shows leaders gravitating toward technologies that deliver fast, measurable impact—rather than long-horizon transformation.

Across all respondents, Fraud Detection (27%) and Customer Experience (26%) top the list for fastest expected ROI, reflecting a focus on margin protection and retention. But priorities diverge by seniority. Partners show the strongest confidence in Fraud Detection and AI-enabled underwriting (both 34%), signaling belief in long-term risk and pricing upside. Meanwhile, the C-suite prioritizes Customer Experience (31%) and Claims Automation (27%), where improvements are highly visible to boards, regulators, and customers.

The common thread? Pragmatic AI is winning—tools that reduce leakage, accelerate claims, and improve service before deeper underwriting transformation. (More)

DEAL OF THE WEEK

AIG Hands the Keys to CVC

American International Group is outsourcing more than just asset selection. It is outsourcing conviction.

The insurer has entered a long term strategic investment partnership with CVC Capital Partners, committing nearly $3.5B across private credit and private equity secondaries. The structure matters. This is not a one off allocation but a set of scalable, multi year mandates, including $1.5B as a cornerstone investor in CVC’s evergreen secondaries platform and ~$2B via tailored SMAs focused on private and liquid credit.

For AIG, the move is a balance sheet recalibration. With trailing twelve month ROE at 9.09% versus a 15.14% industry average, management is clearly leaning on alternatives to close the return gap without taking underwriting risk. Private credit and secondaries offer duration, yield, and smoother mark to market behavior in a higher rate but volatile macro.

For CVC, the prize is sticky insurance capital. With €201B in AUM, locking in a global carrier as a long term partner strengthens fee visibility and reinforces its institutional credibility.

Why it matters: insurers are no longer dabbling in alternatives. They are industrializing them. (More)

INSURTECH CORNER

When AI Hits the Scaling Wall

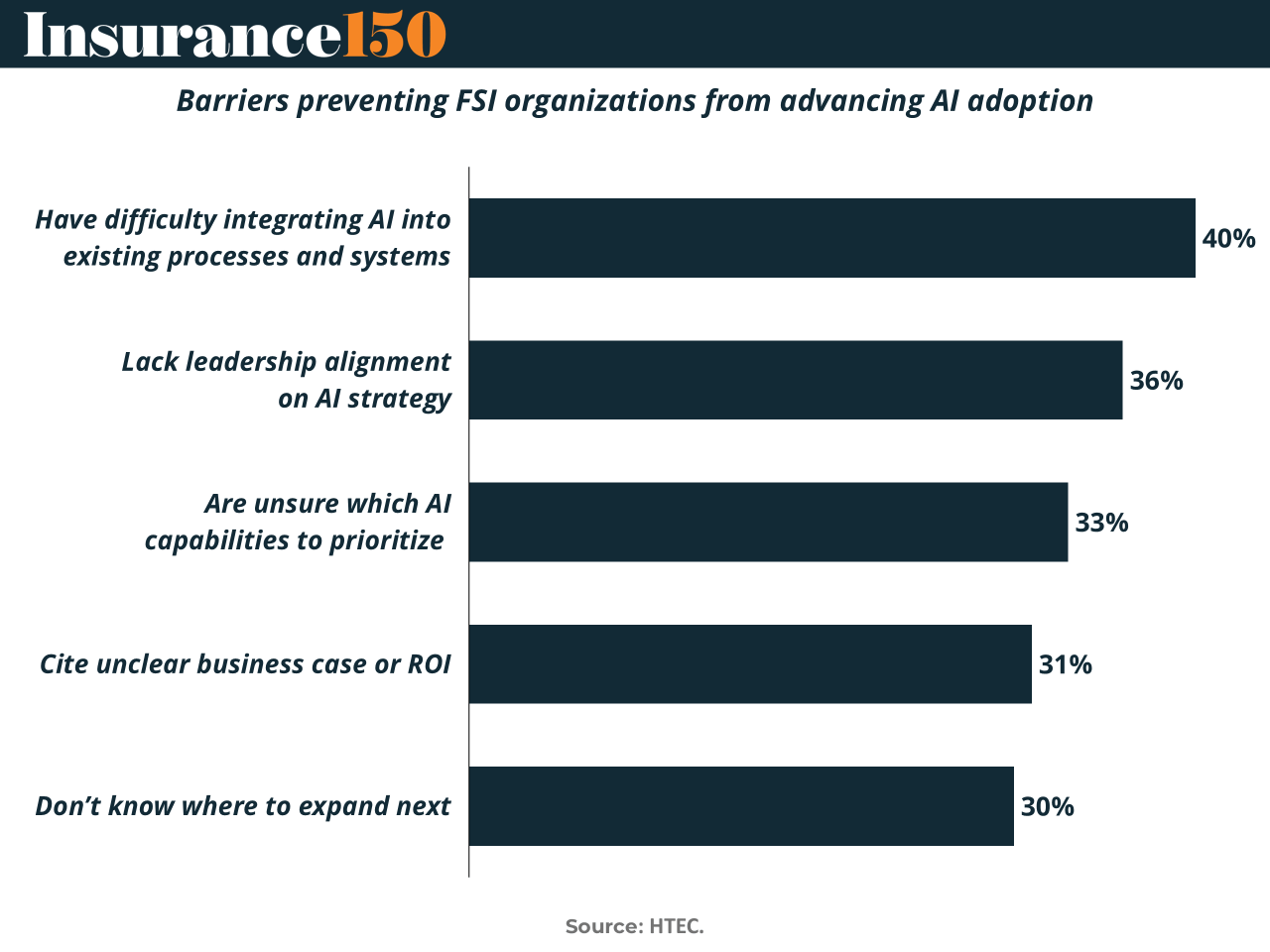

AI is no longer a novelty in insurance. It’s embedded across underwriting, claims, fraud, and customer service. And yet, progress is stalling right when insurers expect real enterprise value.

The biggest blocker is technical integration. Roughly 40% of financial institutions struggle to embed AI into core systems—a familiar story of legacy platforms, fragmented data, and duct-taped architectures. Close behind is leadership misalignment, cited by 36% of organizations. That’s not a tech failure; it’s a governance one.

Add growing strategy gaps—unclear priorities, fuzzy ROI, and uncertainty around where to scale—and AI remains stuck in pilot mode.

The takeaway: insurers don’t need more models. They need executive ownership, clear use cases, and operating models built for AI at scale. (More)

MACROECONOMICS

The Macroeconomics of Artificial Intelligence in 2026

AI trade has quietly become a macro shock absorber. AI related goods now account for roughly 11% of global exports, and the geography matters more than the headline growth. China exports nearly $690B of AI related hardware, more than 2.5x the United States at $276B, with Taiwan and South Korea filling out the semiconductor spine of global trade.

This is not a consumer tech story. It is an infrastructure cycle. Semiconductors, processors, memory, and networking gear dominate flows, pulling capital toward fabs, data centers, power grids, and logistics. While tariffs and protectionism continue to suppress non AI goods, AI linked trade is growing roughly twice as fast, offsetting a meaningful share of global trade drag.

The strategic wrinkle is concentration risk. Asia captures the export dividend, while Western economies import the capex. As a result, growth increasingly shows up in industrial production and fixed investment, not wages or consumption.

Why it matters for PE: macro growth driven by AI is capex heavy, debt financed, and regionally uneven. Returns will favor sponsors positioned in infrastructure, power, supply chain relocation, and second order industrial beneficiaries, not just software narratives. (More)

COMPLIANCE CORNER

ERM Moves From Policy to Practice

Insurance regulators are raising the bar on governance, and in 2025 the focus is squarely on ERM and internal controls that actually work. State departments, backed by the NAIC, are expanding expectations well beyond underwriting and credit risk to include cybersecurity, AI, climate exposure, and liquidity management.

Boards are now expected to show active oversight, not passive sign-off. That means clearer management accountability, tighter risk reporting, and the ability to respond to increasingly granular regulatory data calls. California’s reinforced Long-Term Solvency Regulation and ongoing updates to RBC formulas underscore the shift toward continuous risk surveillance.

Add a 13% increase in regulatory interventions year-over-year, and the message is clear: insurers need scalable compliance infrastructures and independent internal audit functions to keep pace. (More)

INTERESTING ARTICLES

PUBLISHERS PODCAST

No Off Button: Real leadership shows up after the frameworks fail.

In this episode, Aram sits down with Konstantinos Papakonstantinou to unpack the uncomfortable gap between formal education and real-world execution. They get into why degrees, playbooks, and neat frameworks tend to break down when capital is at risk—and how judgment is actually forged through ownership and consequence.

The conversation zeroes in on decision-making under pressure, accountability, and the kind of lessons teams only learn when outcomes are real and reversible mistakes are gone.

Why PE should care: returns aren’t driven by credentials—they’re driven by operators who can make clear calls with imperfect information, carry responsibility, and execute when it counts.

Watch the full conversation and see what holds up when theory meets reality.

Affinity helps PE deal teams capture relationship activity automatically and see firm-wide connections — so you move faster with less manual work.

Supporting our sponsors supports our free newsletters. Please support our sponsors!

"If you don't like something, change it. If you can't change it, change your attitude."

Maya Angelou