- Insurance 150

- Posts

- End of Year Special Issue: A 2025 Review and Key Topics for 2026 in the Insurance Industry

End of Year Special Issue: A 2025 Review and Key Topics for 2026 in the Insurance Industry

EV charging opens a $114B market and AI targets $160B in savings, while 68% of dealmakers prioritize tech over territory.

Good morning, ! As we head into the holidays—with Christmas just behind us and New Year’s Eve closing out the year—this special end-of-year issue looks at the moments that truly shaped Insurance in 2025. From Electric Vehicles Charging Infrastructure and Artificial Intelligence, we break down where value is being unlocked in the Insurance Industry.

2026 comes with more AI integration and new niche playbooks for this technology in the Insurance industry. Insurance M&A pipelines are now tech-focused, more than geo-focused.

Wishing you a happy holidays.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

Top Topics of 2025

I. Charged Assets, Charged Risks

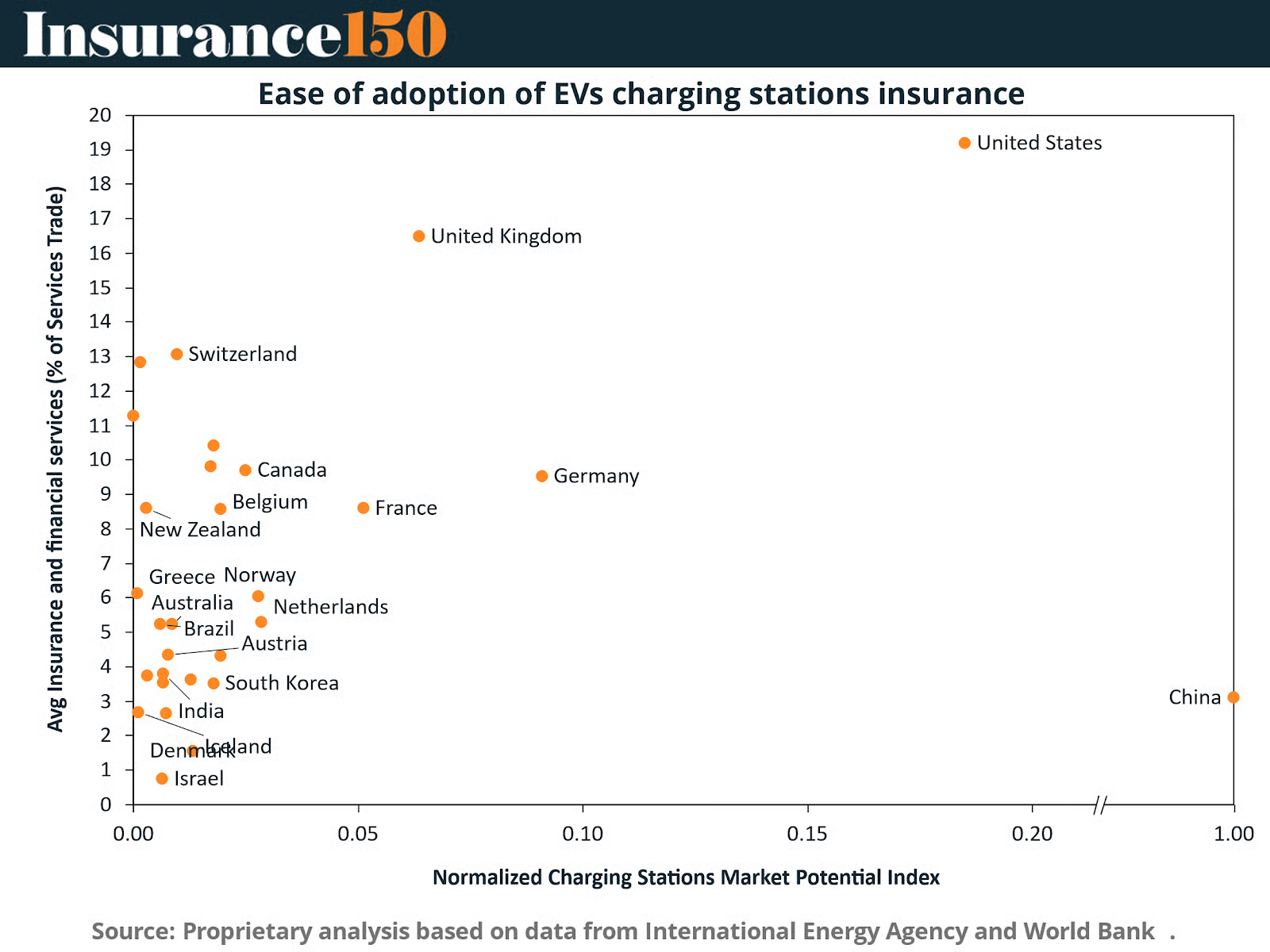

The EV charging station boom isn’t just an infrastructure story — it’s a growing insurance minefield. With 17M EVs sold globally in 2024, every new plug-in port adds layers of insurable exposure: property damage, cyber risk, liability, and business interruption. And insurers aren’t just spectators.

The U.S. market alone is projected to grow from $7.5B to $114B by 2040, converting physical assets into underwriting gold. For underwriters, the real action lies in high-adoption, insurance-mature countries — the top of the insurer-tailored Charging Station Index includes the U.S., Germany, and Japan. Bottom line: coverage isn’t catching up — it’s racing to keep pace. (More)

II. Specialty > Scale. Precision > Volume.

The insurance M&A market is no longer about buying bulk — it’s about buying better. 43% of dealmakers now prioritize specialty underwriting platforms, while 48% favor insurtech bolt-ons for operational edge. Only 10% still back horizontal consolidation, confirming that scale-for-scale’s-sake is out. Driving this shift? A lethal combo of reinsurance volatility, capital scarcity, and investor scrutiny.

The top deal blockers? Financing/strategic Misalignment (40%), Valuation Gaps (30%), and Regulatory Friction (30%). The only consistency? Disagreement on what’s “worth it.” Expect more earn-outs, carve-outs, and targeted plays — not mega-mergers. (More)

III. AI’s Value Chain Is No Longer Optional

The AI-in-insurance market is projected to explode from $6.1B in 2023 to $141B by 2034 — a CAGR north of 30%. That’s not transformation; that’s detonation. Cost pressures, digital-native customers, and a wave of insurtech competition are forcing legacy players to embed machine learning, NLP, and LLMs across the stack. North America leads in adoption (41%), but Asia-Pacific is closing in with rapid gains in fraud detection and mobile distribution.

The shift from "considering AI" to "actively using it" will jump 65% year-over-year in 2025. For underwriters, actuaries, and CIOs, the takeaway is simple: AI isn’t an edge — it’s table stakes. (More)

IV. Underserved, Not Unattractive

SMEs make up 99.9% of U.S. businesses and employ 62M people — yet the $82B insurance market serving them remains fragmented, low-margin, and underpenetrated. But that’s changing. Digital underwriting, embedded distribution, and automation are reducing friction and unlocking profitability. With 35% satisfaction rates and 41% ready to switch providers, insurers have a rare shot at grabbing market share — if they can deliver simplicity, transparency, and personalization. Distribution is also shifting: 85% of SMEs are open to buying insurance through banks, tech firms, and platforms. The future is digital, modular, and relationship-driven. (More)

V. Risk on Both Sides of the Balance Sheet

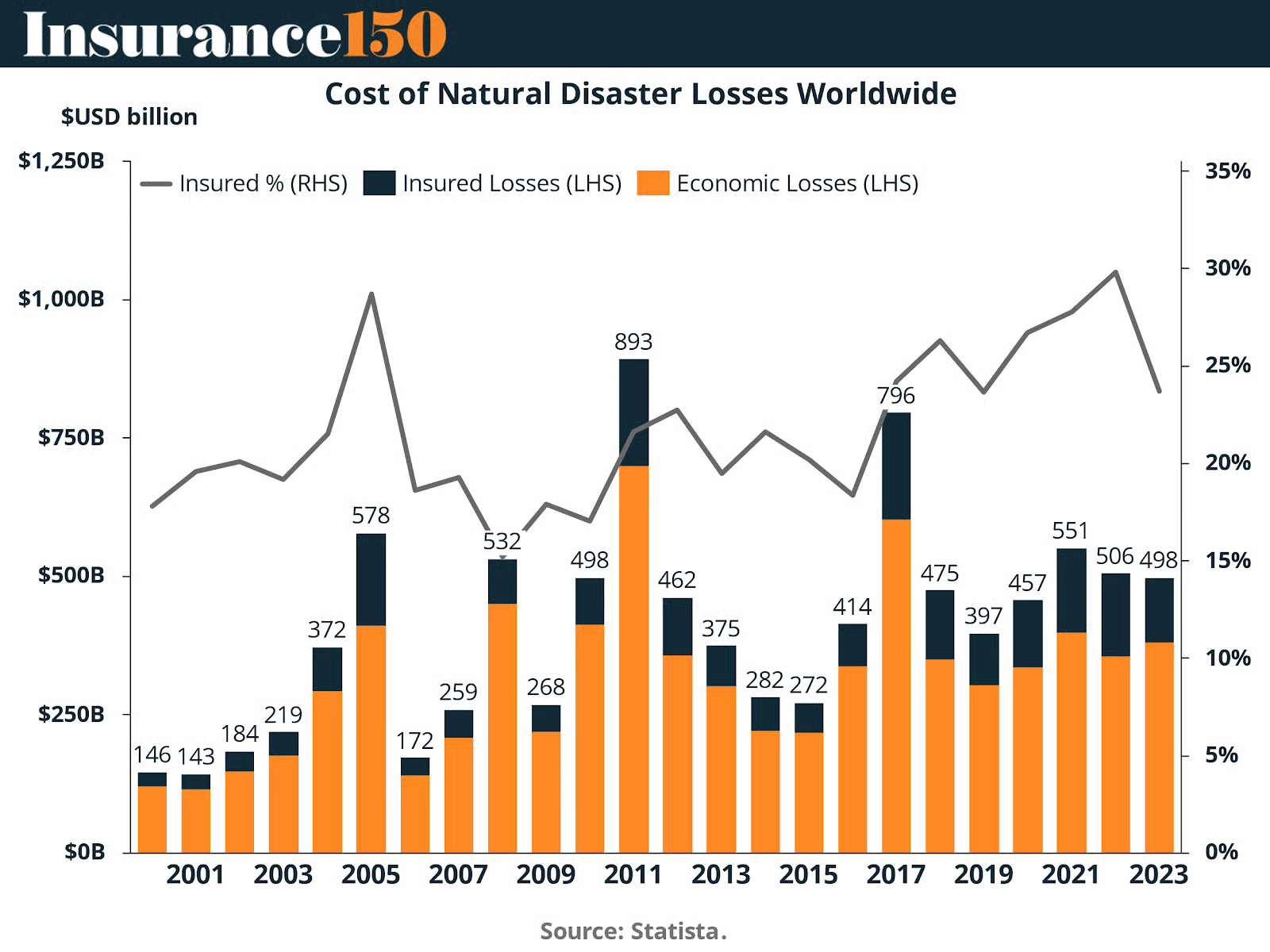

Climate transition risk is no longer theoretical — it’s being priced. Europe’s EIOPA is proposing +17% capital charges on fossil-fuel equities and up to +40% on related bonds, fundamentally shifting how insurers underwrite risk and allocate capital. Yet only 5.7% of corporate bond books are green, and 46% of global climate-related losses remain uninsured, leaving a $71B protection gap.

The play? Insurers must de-risk portfolios, ramp impact underwriting, and embrace transition-linked products — from renewable construction guarantees to parametric covers. It’s no longer about ESG optics. It’s about solvency. (More)

Topics for 2026

I. Premium Growth Outlook: 2026 Signals a Slower, More Selective Expansion

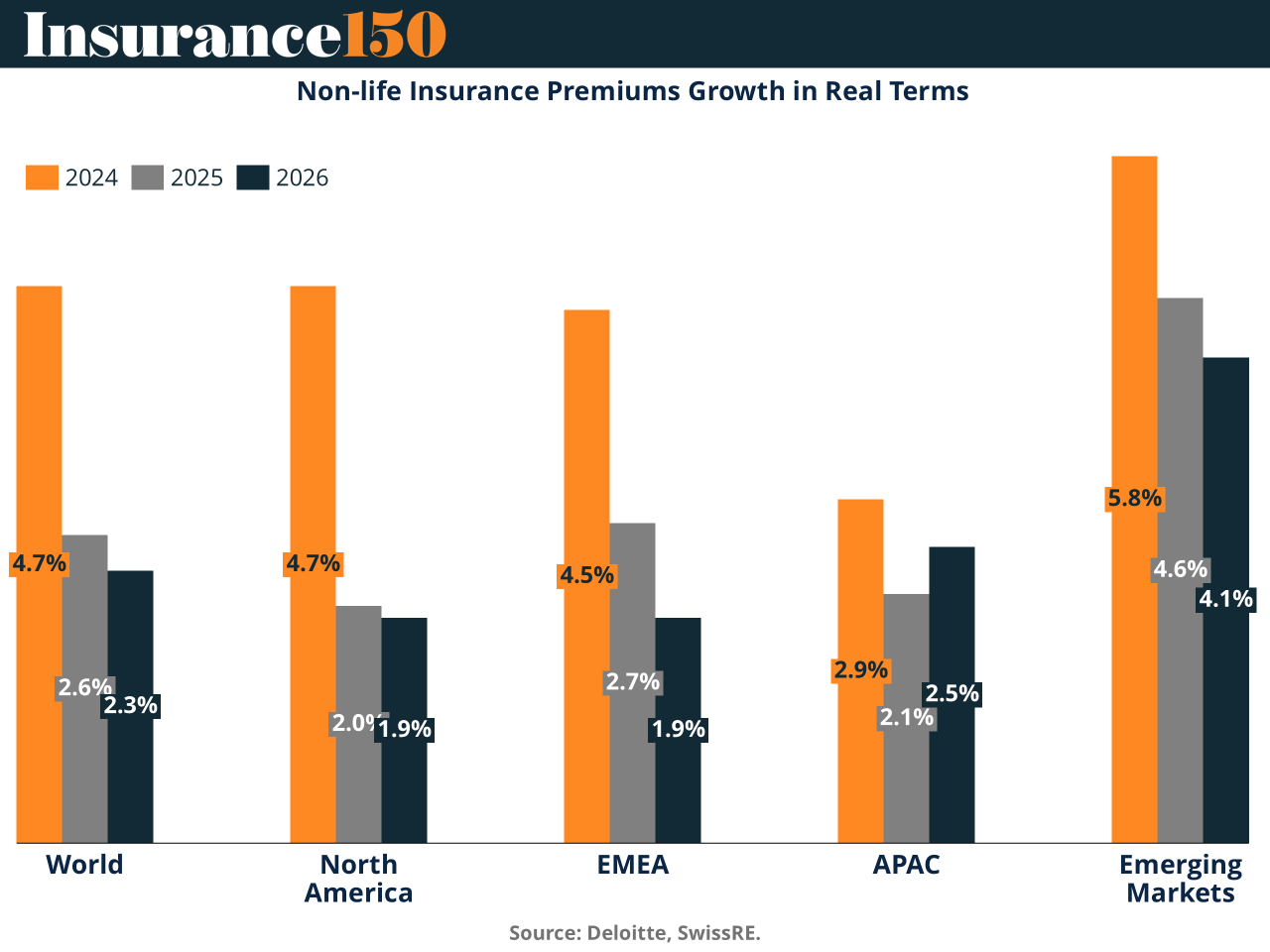

By 2026, real premium growth in non-life insurance is expected to slow across all regions, underscoring the sector’s shift from a prolonged hard market to one defined by margin compression, capital discipline, and slower rate momentum. Global non-life growth is forecast at approximately 2.3% in real terms, reflecting heightened competition, waning pricing power, and rising cost pressures. Tariffs, supply-chain disruptions, labor shortages, and escalating catastrophe losses are driving claims severity higher, while underwriting margins deteriorate across both personal and commercial lines.

In the United States, combined ratios are projected to worsen through 2026, despite still-supportive investment yields, reinforcing the need for underwriting precision and alternative revenue streams. Emerging markets continue to outperform advanced economies, but growth moderates as China’s economic slowdown weighs on regional momentum.

In response, P&C insurers are accelerating investments in advanced analytics, AI-enabled underwriting, geospatial data, and technology-driven loss prevention. At the same time, carriers are adopting more agile capital models, expanding use of reinsurance optimization, insurance-linked securities, cat bonds, and fee-based risk services to manage volatility and sustain returns in a lower-growth environment.

Life insurance premium growth is also expected to decelerate in 2026, particularly in advanced markets where consumer caution and policy uncertainty constrain demand. Emerging markets remain the primary growth engine, supported by low penetration and expanding middle-class wealth. While traditional life growth softens, annuities continue to provide a meaningful earnings tailwind, and unit-linked products are gaining traction in Europe. To counter structural headwinds, life and annuity carriers are increasingly pursuing strategic alliances, digital engagement, and product innovation to protect profitability and capital efficiency.

II. AI Moves From Experimentation to Execution

By 2026, AI adoption in insurance is shifting decisively from pilots and proofs of concept to production-scale deployment, with leaders focusing on clear ROI, operational resilience, and manageable risk. Competitive advantage will be determined by execution capability, not experimentation.

Where AI Is Delivering Tangible Value

Fraud detection is one of the highest-impact use cases. AI-driven, real-time analytics could unlock up to US$160 billion in P&C savings by 2032, while improving loss ratios and protecting honest policyholders.

Underwriting efficiency is accelerating through agentic AI. Tools like AIG’s gen AI underwriting assistant enable 5x productivity gains by prioritizing submissions and freeing underwriters to focus on complex risk judgment.

Claims automation and triage are improving speed and accuracy, particularly in Asia, where insurers are deploying gen AI in lower-risk use cases under supportive regulatory regimes.

Personalized customer engagement is evolving beyond chatbots to predictive service, optimized interactions, and AI-augmented advisors—while preserving human involvement in emotionally complex moments.

Fix the Plumbing Before Scaling AI

Data infrastructure is foundational. AI success depends on data quality, integration, and master data management, not perfect hygiene but sufficient standardization to ensure trust and consistency.

Legacy system modernization remains critical. Insurers are balancing cloud migration with flexible architectures that allow AI layers without locking into obsolete platforms.

Hardware matters too. Some life insurers are leveraging GPU computing for both AI workloads and high-performance actuarial modeling.

Trust, Security, and Regulation

Expanding use of cloud, APIs, IoT, and AI increases the attack surface, making cybersecurity, third-party risk management, and data stewardship non-negotiable.

Regulatory environments shape pace. Asia is accelerating through sandboxes and grants, Europe remains more cautious, and Brazil’s Open Insurance model is enabling data-driven innovation.

Human + AI = Competitive Advantage

Human-AI collaboration is the real differentiator. AI augments—not replaces—human judgment, especially in high-stakes and emotionally sensitive interactions.

A critical gap remains: 90% of executives see the urgency of reskilling for AI, but only 25% have taken action.

Winners will redesign roles, workflows, and workforce models to enable humans to move into judgment-intensive, trust-based work.

Bottom line: In 2026, AI leaders will separate from laggards not by adopting more tools—but by building the right data foundations, scaling proven use cases, securing trust, and keeping humans at the center of execution.

III. M&A Becomes a Technology Strategy, Not a Geography Play

As 2026 unfolds, Insurance M&A is increasingly leveraged to buy technology, not territory. 68% of dealmakers now cite technology and insurtech capabilities as critical to post-deal value creation, reflecting a structural shift in how transactions are sourced, valued, and executed.

What’s Driving the Shift

Investor appetite remains strong for resilient insurance segments that demonstrate consistent profitability and digital transformation success, creating clear winners and laggards.

Consolidation is accelerating as carriers with modern technology platforms and operational efficiency acquire peers constrained by legacy systems.

Private equity and strategic buyers are increasingly acquiring for digital capabilities, not geographic expansion.

Cross-sector convergence is gaining traction, particularly wealth management and insurance integration, as firms build end-to-end financial services platforms.

Carve-outs are multiplying as large carriers divest non-core assets to sharpen focus on high-performing segments.

From Deal-Making to Modernization: A 2026 To-Do List

Align M&A with modernization

Evaluate targets based on technology readiness, not just premium volume or market share.

Prioritize acquisitions that accelerate digital transformation, rather than simply adding scale.

Assess integration complexity and system compatibility upfront—technology misalignment destroys value faster than synergies create it.

Treat technology integration as a strategic differentiator, not a post-deal afterthought.

Use digital maturity as a value lever

Digital capabilities increasingly drive valuation multiples—for buyers and sellers alike.

Demonstrate how technology translates into better combined ratios, faster claims resolution, and higher retention.

Build platform ecosystems and partnerships that enhance strategic attractiveness and defensibility.

Look beyond traditional acquisitions

Target carve-outs, insurtech partnerships, and adjacent plays that deliver proven technology and new revenue streams.

Explore wealth, retirement, and protection convergence, where lifecycle-based platforms are emerging.

Build capability before scale

In a consolidating market, technology readiness enables speed, efficiency, and insight from day one.

M&A isn’t about who grows fastest—it’s about who is equipped to keep growing.

Bottom line: In 2026, the line between M&A and modernization will blur. Technology capability is now the currency of consolidation.

"Get busy living or get busy dying."

Stephen King