- The Deal Brief - Insurance

- Posts

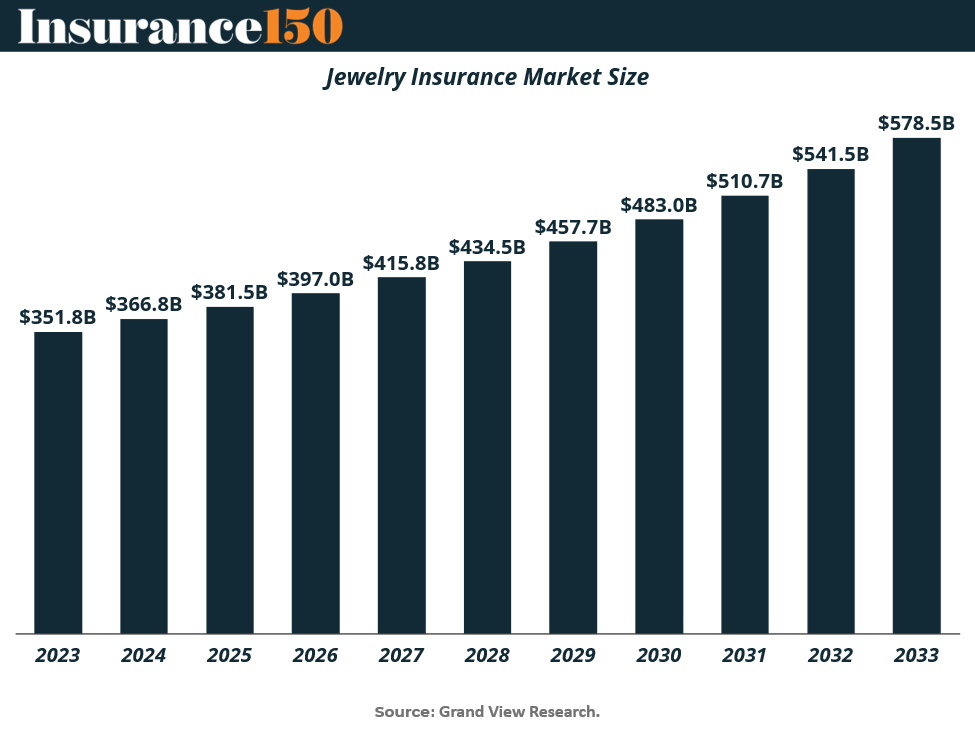

- The $578.5B Opportunity Insurers Can’t Afford to Ignore

The $578.5B Opportunity Insurers Can’t Afford to Ignore

A look at the $578.5B jewelry insurance boom, Q2’s $3.6B InsurTech surge, and why 39% of leaders now prioritize harmonized climate-risk data standards.

Good morning, ! This week we’re diving into the $578.5B space of Jewelry Insurance, InsurTech Funding rocketed to $3.6 billion in Q2, and 39% of respondents of our survey picked harmonized climate-risk data standards as the most effective resilience strategy.

Want to advertise in Insurance 150? Check out our self-serve ad platform, here.

Know someone who would love this? Pass it along—they’ll thank you later. Here’s the link.

DATA DIVE

Jewelry Insurance’s Quiet Boom

The global Jewelry Insurance market is growing faster than most lines insurers actually talk about. The industry is set to climb from $351.8B in 2023 to $578.5B by 2033, powered by digital buying habits, rising disposable income, and a shift toward customized and sustainable luxury. Women still drive demand at 71.6%, but the fastest growth is coming from men, whose jewelry spend is scaling alongside evolving style norms. Rings remain the heavyweight at 32.6% of insured items, followed by necklaces and a fast-growing category of luxury watches. Behind the scenes, insurers are leaning heavily on AI valuation, image recognition, and blockchain authentication to manage risk and speed up claims. The headline: jewelry isn’t just sentimental — it’s becoming one of personal lines’ most data-rich, tech-enabled, and globally expanding segments.

TREND OF THE WEEK

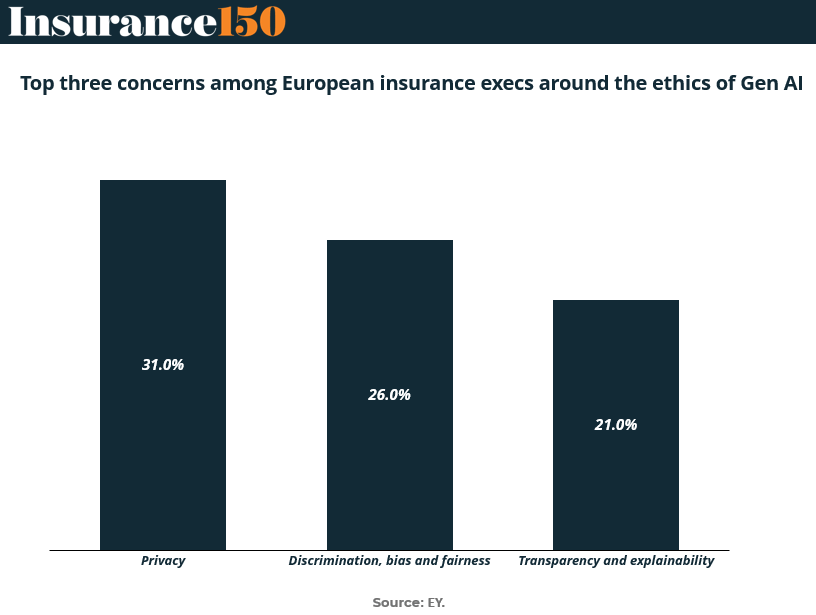

GenAI Is Here. Ethics Are Lagging.

As European insurers ramp up GenAI deployment, the ethical fog around its use is getting harder to ignore. According to EY, 31% of executives cite privacy as their top concern, followed by bias and fairness (26%), and transparency (21%).

These concerns go beyond compliance. For insurers, opaque or biased models can lead to regulatory blowback, reputational damage, and underwriting errors—especially in life and health lines where fairness and explainability aren’t optional. Unlike other industries, insurance doesn't just use data—it depends on trust. And GenAI is testing that relationship.

Expect a growing push for AI governance frameworks, third-party audits, and regulatory clarity in Europe and beyond. Until then, ethical AI won't just be a tech problem—it'll be a boardroom one. (More)

PRESENTED BY CLIMATIZE

Are You Ready to Climatize?

Climatize is an investment platform focused on renewable energy projects across America.

You can explore vetted clean energy offerings, with past projects including solar on farms in Tennessee, grid-scale battery storage in New York, and EV chargers in California.

Each project is reviewed for transparency and offers people access to fund development and construction loans for renewable energy in local communities.

As of November 2025, more than $13.2 million has been invested through the platform across 28 renewable energy projects. To date, over $3.6 million has already been returned to our growing investor base. Returns are not guaranteed, and past performance does not predict future results.

Check out Climatize to explore clean energy projects raising capital. Minimum investments start with as little as $10.

Climatize is an SEC-registered & FINRA member funding portal. Crowdfunding carries risk, including loss.

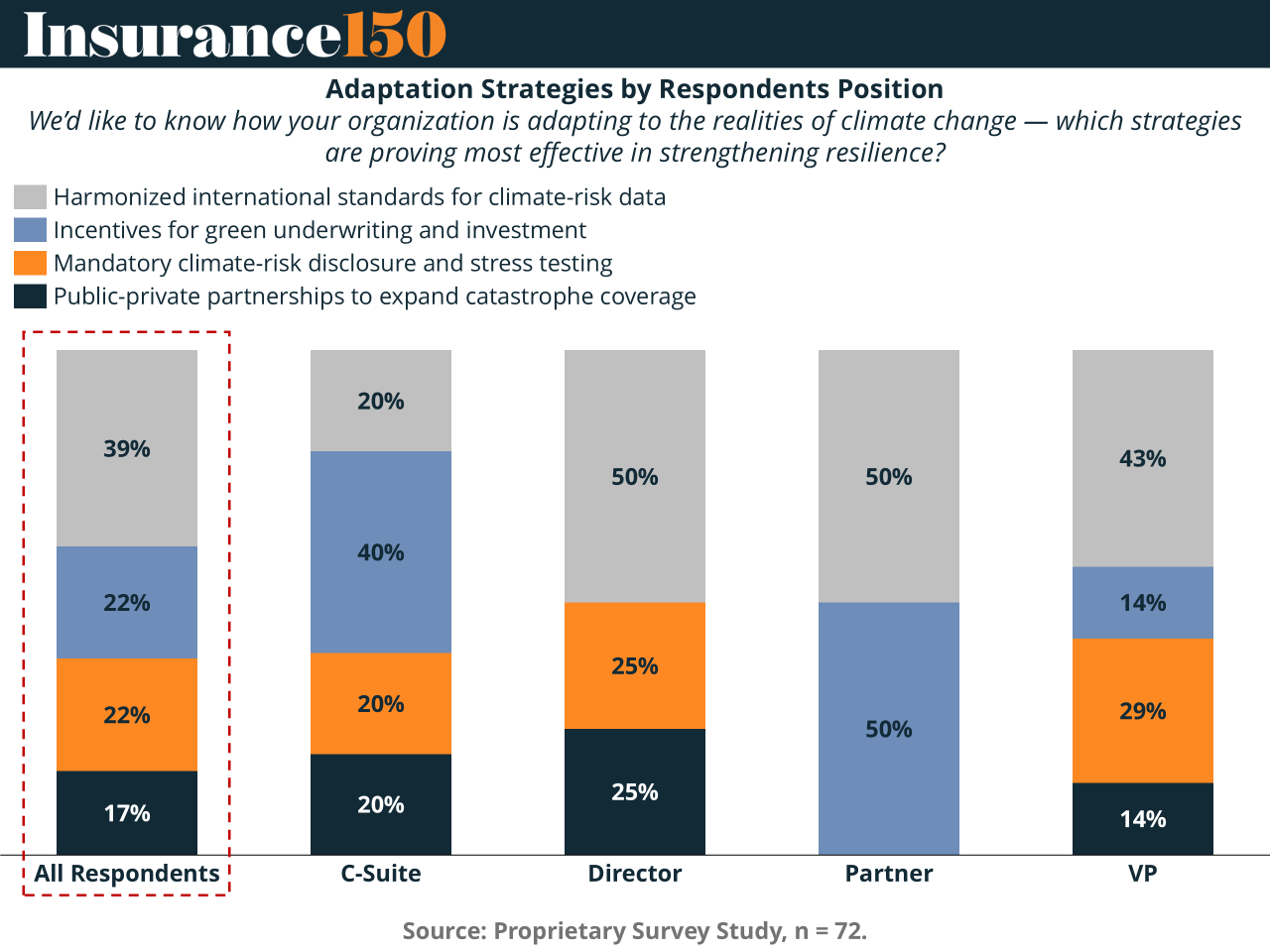

MICROSURVEY

Climate Strategies Get a Reality Check

Consensus is rare in insurance—unless it’s about needing better data. In our latest microsurvey, 39% of respondents picked harmonized climate-risk data standards as the most effective resilience strategy. Directors and Partners pushed that even higher at 50%, while the C-suite went scattershot across all options (par for the enterprise course).

Meanwhile, mandatory climate disclosures clocked in at 22%, boosted by VP-level operational angst. Consultants loved green underwriting incentives (43%), and bankers went all-in on public-private partnerships (50%).

The big picture? Everyone’s coping differently, but clarity and coordination are climbing the priority list. Think: less noise, more signals. (More)

DEAL OF THE WEEK

Piraeus Bets Big on Insurance

Piraeus Bank just pulled the trigger on its biggest insurance move yet, acquiring 100% of Ethniki Insurance from CVC Capital Partners and National Bank of Greece for €0.6bn in cash. The deal boosts Piraeus’ capital ratio to ~19% and adds a top-tier insurer with 1.8m customers, €850m in GWP, and a 188% Solvency II ratio. For Piraeus, the play is simple: diversify revenue and build an integrated bank–insurance–investment ecosystem. Ethniki brings scale, market share (14.6% overall), and growing profitability — with 2025 PBT already above €30m in ten months. Advisors included UBS, Milliman, and Milbank. A tidy outcome for CVC — and a strategic milestone for Piraeus before its 2026 investor reset. (More)

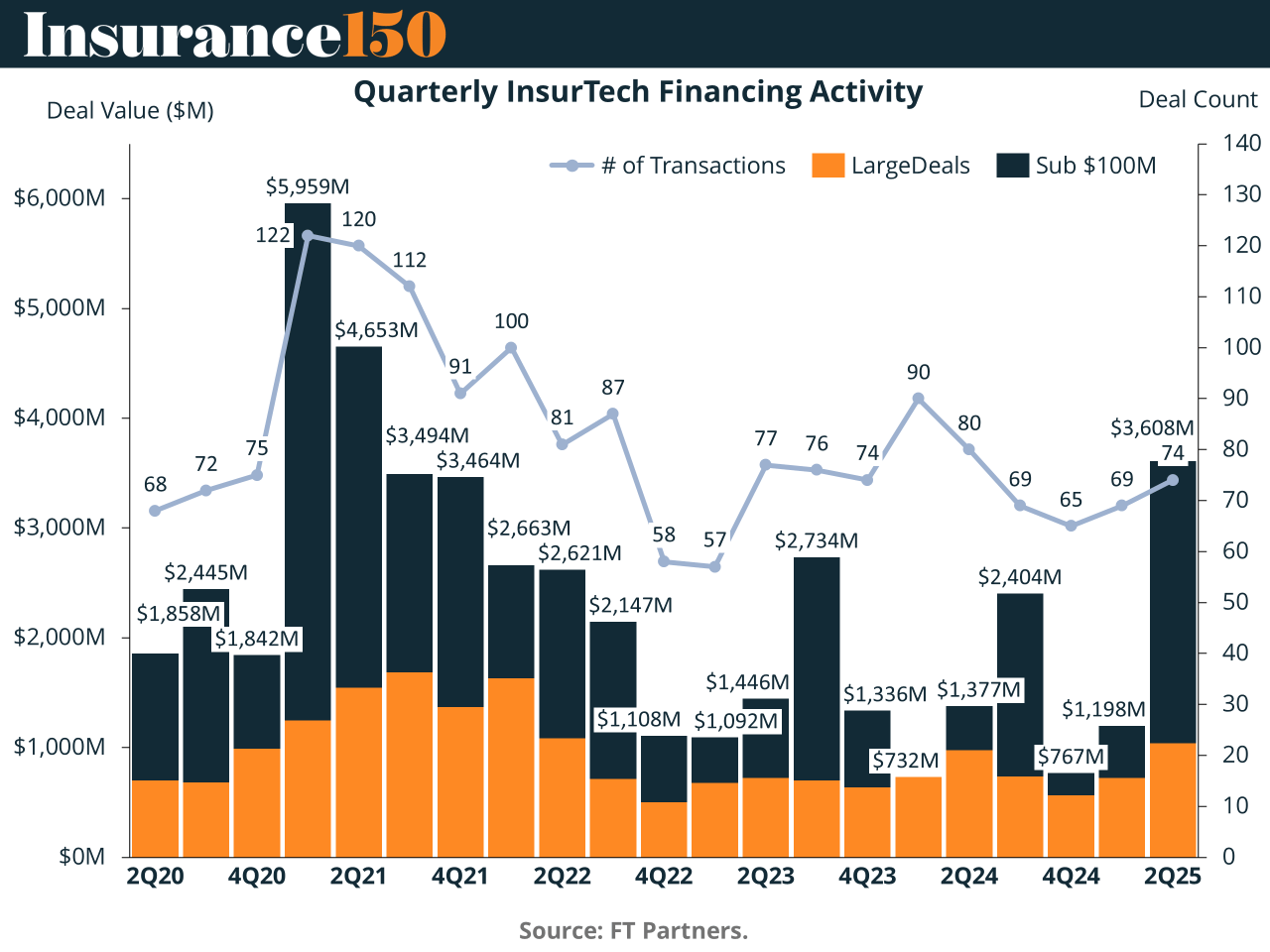

INSURTECH CORNER

InsurTech’s Q2 Comeback: Big Dollars, Bigger Signals

After a tepid Q1, InsurTech funding rocketed to $3.6 billion in Q2—the highest since 2021. Leading the charge: Acrisure’s $2.1B raise, which tripled total volume vs. last quarter. Even without that outlier, funding still ticked up ~10% QoQ. Meanwhile, M&A hit a record pace, with 50+ acquisitions, and Slide Insurance brought the IPO market back from the dead, raising $469M (though it’s since slid ~15%).

Most telling: sub-$100M financings surged past $1B—a first since early 2022—thanks to a 55% jump in $50M+ rounds. (More)

TOGETHER WITH MONEY.COM

Does your car insurance cover what really matters?

Not all car insurance is created equal. Minimum liability coverage may keep you legal on the road, but it often won’t be enough to cover the full cost of an accident. Without proper limits, you could be left paying thousands out of pocket. The right policy ensures you and your finances are protected. Check out Money’s car insurance tool to find the coverage you actually need.

MACROECONOMICS

Black Friday’s $11.8B Illusion: When Fear Fuels Consumption

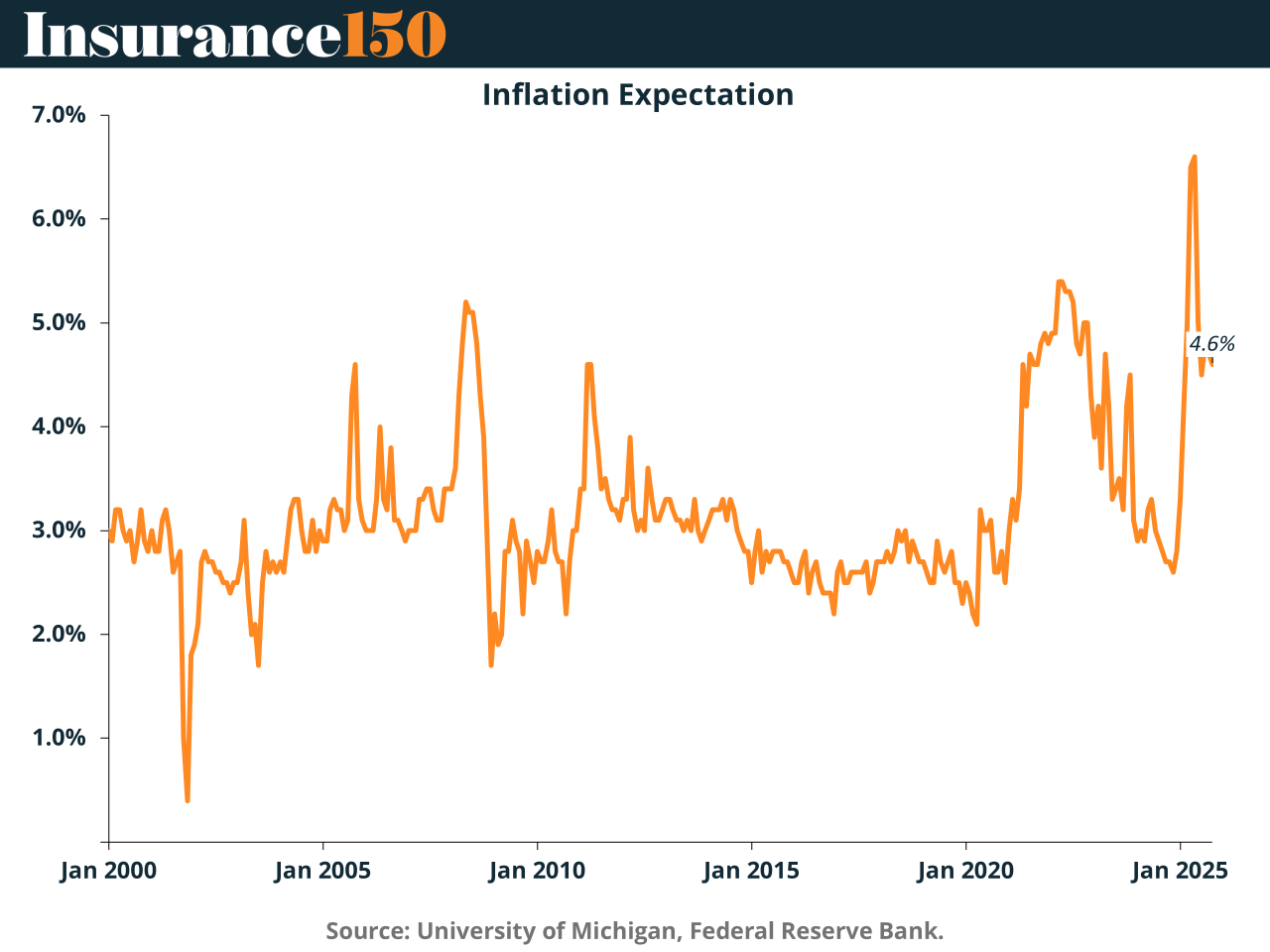

This year’s Black Friday was a blockbuster — on paper. A record $11.8B in online sales looks like strength… until you zoom in. Order volume fell, while prices jumped 7%, confirming what economists already suspected: inflation, not confidence, is driving the numbers. Consumers aren’t shopping out of joy — they’re hedging against future pain. With inflation expectations back near 4.6%, intertemporal substitution is back in fashion: spend now, worry later. Add AI-assisted shopping and Buy Now, Pay Later (BNPL) to the mix, and the picture looks more like tactical consumption than economic strength. Affluent households are carrying the retail headline, while middle- and lower-income groups are barely keeping up. The Fed will read this as resilience. But private equity and retail operators should read between the lines: this economy’s façade is holding up thanks to psychology and short-term credit. (More)

COMPLIANCE CORNER

Cybersecurity Gets Serious: New York Closes the Loopholes

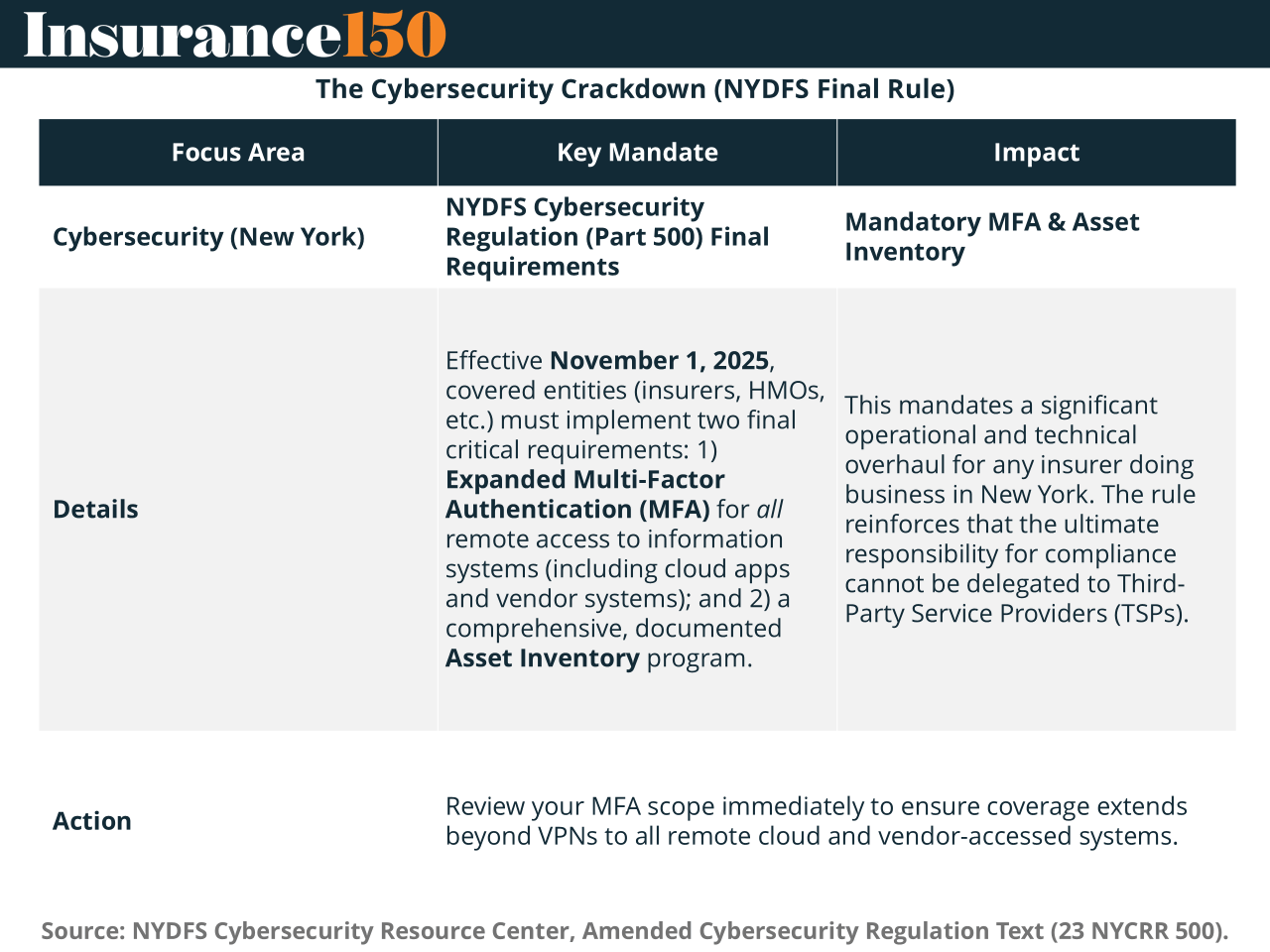

Effective November 1, 2025, the NYDFS Cybersecurity Regulation (Part 500) final rule brings two words to the top of every CISO’s worry list: MFA and Inventory. New York now requires universal Multi-Factor Authentication—no exceptions for agents, vendors, or lazy push notifications. Think phishing-resistant or get ready for fines.

Also required: a comprehensive Asset Inventory, complete with asset owners, recovery times, and classification metadata. Incomplete spreadsheets won’t cut it. Annual compliance certification is due April 15, 2026, and insurers are on the hook—not their vendors. The age of “outsourcing responsibility” is over. (More)

INTERESTING ARTICLES

TWEET OF THE WEEK

"Whether you think you can or think you can't, you're right."

Henry Ford